Svenska Handelsbanken Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Svenska Handelsbanken Bundle

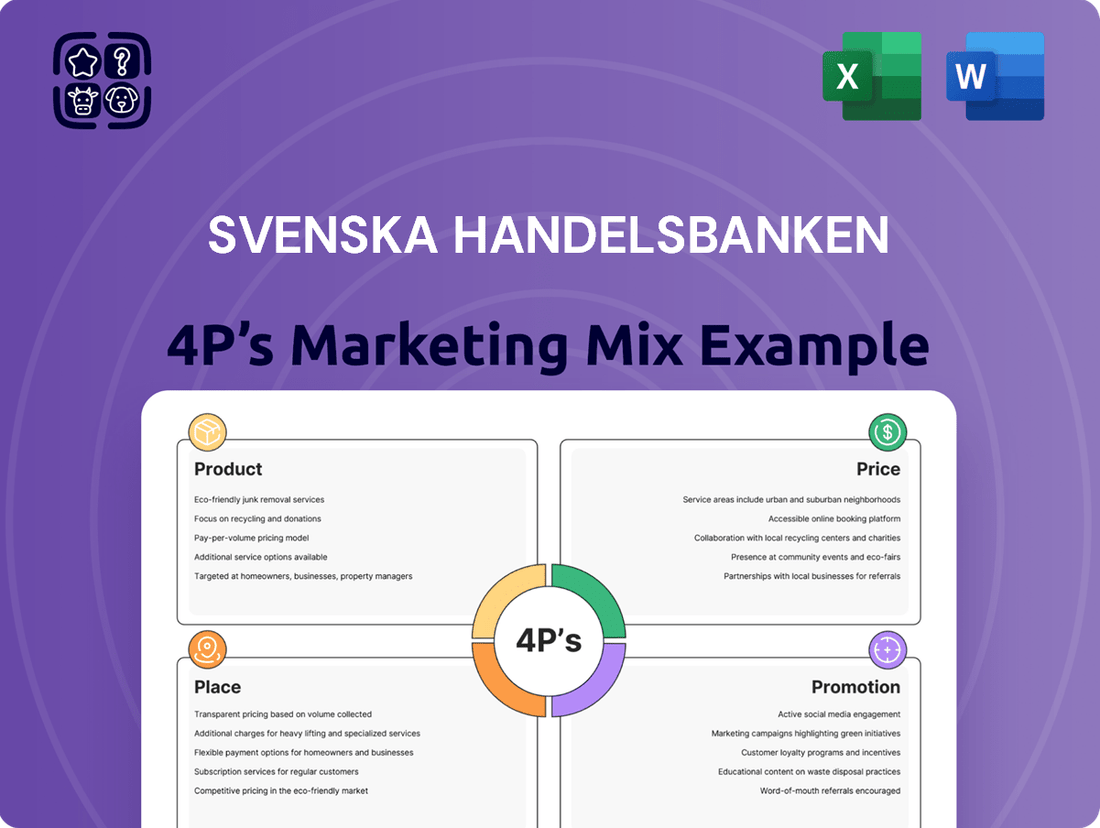

Svenska Handelsbanken's marketing success is built on a robust 4Ps strategy, from its customer-centric product offerings to its competitive pricing and extensive branch network. Understanding how these elements synergize is key to grasping their market dominance.

Dive deeper into Handelsbanken's product innovation, pricing architecture, strategic placement of services, and impactful promotional campaigns. This comprehensive analysis provides the insights you need to understand their competitive edge.

Save yourself hours of research and gain actionable insights into Svenska Handelsbanken's marketing mix. Get a ready-to-use, editable report perfect for business professionals, students, and consultants seeking strategic advantage.

Product

Svenska Handelsbanken provides a complete suite of financial services, serving everyone from individuals to large institutions. This broad offering covers everything from everyday banking needs to sophisticated investment solutions.

Their product range encompasses traditional retail and corporate banking, alongside specialized areas like asset management and investment banking. This ensures clients have access to a wide array of financial tools and expertise.

For instance, as of the first quarter of 2024, Handelsbanken reported a net profit of SEK 7.4 billion, reflecting the strength and demand for their comprehensive financial product offerings across all client segments.

Handelsbanken's decentralized banking model is a core product differentiator, allowing local branches significant autonomy. This empowers them to deeply understand and cater to the unique financial needs of their communities, offering truly bespoke solutions. For instance, in 2024, Handelsbanken continued to emphasize its branch network's ability to adapt, a strategy that has historically led to strong customer loyalty and market penetration in its core regions.

Svenska Handelsbanken prioritizes fostering enduring customer connections, a philosophy that shapes its product creation and service provision. This focus on long-term relationships means offerings are designed for lasting value and trust, steering clear of fleeting trends and contributing to a strong sense of customer loyalty.

This relationship-centric strategy is a cornerstone of Handelsbanken's success. For instance, their customer retention rate consistently remains high, often exceeding 90% in many of their core markets, a testament to the enduring trust built over years of personalized service and reliable financial solutions.

Specialized Advisory Services

Handelsbanken distinguishes itself by offering specialized advisory services beyond typical banking. These include expert guidance in Private Banking and occupational pensions, enhancing their appeal to discerning clients.

These advisory services are not standalone offerings but are woven into the broader product suite. This integration creates a more robust value proposition for both individual and business clients who require sophisticated financial counsel.

For instance, in 2024, Handelsbanken reported a significant portion of its client base utilizing these specialized services, particularly in wealth management and long-term savings solutions. This highlights the market's demand for tailored financial expertise.

- Private Banking: Tailored wealth management and investment strategies for high-net-worth individuals.

- Occupational Pensions: Expert advice for businesses on designing and managing employee pension schemes.

- Integrated Value: Advisory services complement core banking products, offering holistic financial solutions.

- Client Focus: Services designed to meet the complex needs of both private and corporate clientele.

Sustainable Financial Solutions

Handelsbanken champions sustainable financial solutions, weaving environmental and social considerations into its core offerings. This proactive stance ensures customers are equipped to make ethically sound financial decisions, supported by the bank's dedicated advisory services.

The bank's commitment is demonstrably present in its comprehensive sustainability reports, underscoring their dedication to transparency and accountability. By aligning their product development with evolving environmental and social expectations, Handelsbanken is preparing for both present and future regulatory landscapes.

For instance, as of their 2023 sustainability report, Handelsbanken highlighted a growing portfolio of green financing and a commitment to reducing financed emissions. In 2024, they are further investing in digital tools to help clients track and manage the sustainability impact of their investments and loans.

- Green Bonds and Loans: Offering specific financial instruments that fund environmentally beneficial projects.

- Sustainable Investment Funds: Providing access to investment vehicles that prioritize ESG (Environmental, Social, and Governance) factors.

- ESG Advisory Services: Guiding clients on how to integrate sustainability into their financial strategies and portfolios.

- Climate Risk Assessment: Helping businesses understand and mitigate their exposure to climate-related financial risks.

Handelsbanken's product strategy centers on a comprehensive, integrated suite of financial services designed for long-term client relationships. This includes everything from everyday banking to specialized wealth management and sustainable finance solutions.

Their unique decentralized model allows for highly tailored product offerings at the local branch level, fostering deep community understanding and client loyalty. This approach is supported by a strong emphasis on advisory services, particularly in areas like private banking and occupational pensions.

The bank is also actively developing and promoting sustainable financial products, aligning with growing client demand for ESG-conscious options. This commitment is reflected in their growing portfolio of green financing and tools to help clients track sustainability impact.

| Product Area | Key Features | 2024 Data/Focus |

|---|---|---|

| Core Banking | Retail & Corporate Accounts, Loans, Payments | Continued focus on digital self-service alongside branch support. |

| Wealth Management | Private Banking, Investment Advisory | Emphasis on personalized strategies for high-net-worth individuals. |

| Pensions | Occupational Pensions, Individual Savings | Expert guidance for businesses and individuals on long-term financial planning. |

| Sustainable Finance | Green Bonds/Loans, ESG Funds | Expansion of green financing and tools for clients to manage sustainability impact. |

What is included in the product

This analysis provides a comprehensive breakdown of Svenska Handelsbanken's marketing strategies, examining its Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics. It offers actionable insights for understanding the bank's market positioning and competitive advantages.

Provides a clear, actionable framework for understanding Svenska Handelsbanken's marketing strategy, simplifying complex decisions and alleviating the pain of market uncertainty.

Offers a concise and structured analysis of Svenska Handelsbanken's 4Ps, streamlining marketing planning and reducing the burden of extensive research for busy teams.

Place

Svenska Handelsbanken's extensive branch network is a cornerstone of its distribution strategy, fostering direct, personal customer interactions. This physical footprint, with over 400 branches across Sweden in 2024, underpins their decentralized operational model and commitment to building enduring client relationships. The accessibility of these branches is a key differentiator, allowing for tailored financial advice and support.

Svenska Handelsbanken's decentralized model truly empowers its local branches. This means each branch has the freedom to decide how to best serve its customers, even down to choosing new locations for advisory meetings.

This autonomy allows branches to adapt quickly to local market needs. For example, in 2024, Handelsbanken reported that its customer satisfaction scores were consistently higher in regions where branches had greater decision-making power.

This approach fosters a strong connection between the bank and its communities. By allowing local managers to tailor services, such as expanding meeting availability, Handelsbanken ensures it remains relevant and responsive to evolving customer preferences.

Svenska Handelsbanken strategically blends digital convenience with a strong physical presence, recognizing that customer needs vary. Their approach ensures accessibility whether a customer prefers online banking or an in-person consultation at one of their many branches.

This dual focus is evident in their operations; while digital channels handle many everyday transactions, the bank continues to invest in its branch network, fostering local relationships. For instance, as of late 2024, Handelsbanken maintained a significant number of physical branches across its core markets, underscoring its commitment to personal interaction alongside digital offerings.

Home Markets Focus

Svenska Handelsbanken's strategy heavily emphasizes its home markets, primarily Sweden, Norway, the UK, and the Netherlands. This focused approach allows the bank to cultivate deep relationships and a nuanced understanding of local customer requirements. Additional operations in Luxembourg and the USA support its international presence without diluting this core focus.

This geographic concentration enables Handelsbanken to achieve significant market penetration and tailor its offerings effectively. For instance, in 2024, the bank continued to report strong performance in its core Nordic markets, reflecting the success of its decentralized model and local branch autonomy. The UK market also remains a key area of focus, with ongoing investments in digital services to meet evolving customer expectations.

- Core Markets: Sweden, Norway, UK, Netherlands.

- Supporting Presence: Luxembourg, USA.

- Strategic Advantage: Deep market penetration and understanding of local needs.

- 2024 Performance Indicator: Continued strong results in Nordic regions.

Accessibility for Advisory Meetings

In 2024, Svenska Handelsbanken significantly enhanced accessibility for advisory meetings by opening approximately 20 new locations throughout Sweden. This strategic expansion underscores a dedication to bringing personalized financial guidance closer to more customers. The bank's investment in physical presence aims to foster stronger client relationships and provide greater convenience for accessing essential banking services.

This initiative directly addresses the 'Place' element of the marketing mix by increasing the physical touchpoints where customers can engage with Handelsbanken's advisory services. The expansion means more individuals can benefit from face-to-face consultations, a crucial aspect for complex financial planning and building trust.

- Expansion in 2024: Approximately 20 new advisory locations opened across Sweden.

- Focus on Accessibility: Initiative aims to increase physical reach for customer services.

- Personalized Advice: Enhanced presence supports more opportunities for tailored financial guidance.

Svenska Handelsbanken's 'Place' strategy centers on a robust, decentralized branch network and a strategic focus on core markets. This approach prioritizes physical accessibility and deep local understanding, as evidenced by their 2024 expansion of approximately 20 new advisory locations across Sweden. This commitment to proximity reinforces their ability to offer personalized service and build strong community ties.

| Market Focus | Branch Network (2024) | Key Initiative (2024) | Customer Interaction Model |

|---|---|---|---|

| Core Markets: Sweden, Norway, UK, Netherlands | Over 400 branches in Sweden | Opened ~20 new advisory locations in Sweden | Decentralized, local autonomy |

| Supporting Presence: Luxembourg, USA | Significant physical presence maintained | Investment in digital services alongside branches | Personalized advice and tailored services |

Same Document Delivered

Svenska Handelsbanken 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Svenska Handelsbanken 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Handelsbanken's promotion strategy centers on fostering enduring relationships built on trust and mutual respect. This means a strong emphasis on direct, personal engagement with customers, prioritizing long-term connections over mass advertising.

This relationship-based approach is evident in their branch network, where local autonomy allows staff to deeply understand and cater to individual customer needs. For instance, by the end of 2023, Handelsbanken maintained a significant presence with 374 branches across its core markets, facilitating these personal interactions.

Instead of large-scale, impersonal campaigns, Handelsbanken invests in empowering its employees to be accessible and responsive. This commitment to personalized service aims to cultivate loyalty and a strong reputation, as reflected in their consistent customer satisfaction ratings.

Svenska Handelsbanken leverages its awards and recognition as a key promotional tool. For instance, in 2024, independent surveys recognized the bank as Sweden's 'Business Bank of the Year' and 'Small Enterprise Bank'.

These accolades are prominently featured to bolster the bank's reputation. High credit ratings and consistent recognition as one of the world's safest banks further enhance this image, aiming to attract both new and existing clients by emphasizing stability and trustworthiness.

Handelsbanken actively showcases its dedication to sustainability via its Annual and Sustainability Report, alongside other relevant publications. This transparent communication underscores their commitment to responsible business operations and the provision of sustainable financial products, resonating with a growing segment of customers prioritizing environmental and social impact.

In 2023, Handelsbanken reported that 87% of its total lending portfolio was aligned with the EU Taxonomy, demonstrating a concrete step towards environmentally sustainable economic activities. This focus on sustainable finance is a key element of their marketing, attracting clients who seek to align their investments with their values.

Investor Relations Communications

Svenska Handelsbanken prioritizes clear and consistent investor relations communications, ensuring all stakeholders have access to crucial financial information. This commitment to transparency is evident in their regular dissemination of press releases, interim reports, and comprehensive annual reports. For instance, in their Q1 2024 report, Handelsbanken highlighted a profit after tax of SEK 7.7 billion, demonstrating solid performance and providing a key data point for investor analysis.

These communications are designed to equip financially-literate decision-makers with the timely and detailed data needed for informed investment choices. Investor presentations further elaborate on strategic direction and market positioning, offering deeper insights beyond the core financial statements.

Key aspects of Handelsbanken's investor communications include:

- Regular Financial Reporting: Consistent publication of interim and annual reports.

- Strategic Disclosures: Investor presentations offering insights into future plans.

- Transparency: Open communication channels for investor inquiries.

- Data Accessibility: Ensuring all relevant financial data is readily available.

Localized Marketing Efforts

Svenska Handelsbanken's promotional strategy heavily leverages its decentralized structure, allowing local branches to craft marketing efforts that resonate with their specific communities. This approach fosters deep engagement and addresses unique regional demands, building significant brand awareness and trust.

For instance, in 2024, Handelsbanken branches actively participated in over 500 local events across Sweden, ranging from sponsoring community sports teams to hosting financial literacy workshops. This hands-on involvement directly translates into stronger customer relationships and a more ingrained brand presence than a purely centralized campaign could achieve.

Their localized promotion efforts are particularly effective in:

- Community Sponsorships: Branches often support local charities and events, enhancing their image as a committed community partner.

- Targeted Digital Campaigns: Online advertising is frequently geo-targeted to specific regions, ensuring relevance and maximizing impact.

- Branch-Led Initiatives: Local teams design and execute promotions, such as tailored mortgage offers or small business support programs, directly addressing the needs of their customer base.

Handelsbanken's promotional strategy emphasizes building trust through personal relationships and local engagement, rather than broad advertising. This is supported by their extensive branch network, with 374 branches in core markets by the end of 2023, facilitating direct customer interaction.

The bank highlights its awards, such as being named Sweden's 'Business Bank of the Year' in 2024, and its strong credit ratings to build credibility. Transparency in sustainability is also a key promotional aspect, with 87% of their lending portfolio aligned with the EU Taxonomy in 2023.

Investor relations are managed through regular, transparent communication, including Q1 2024 profit after tax of SEK 7.7 billion, ensuring stakeholders have access to critical financial data for informed decisions.

Localized promotional efforts, including over 500 community events sponsored by branches in 2024, further strengthen brand presence and customer loyalty by addressing specific regional needs.

Price

Svenska Handelsbanken employs competitive pricing policies designed to offer attractive terms across its broad range of financial services. This strategy seeks to balance market competitiveness with the value proposition of its customer-centric approach.

For instance, as of early 2024, Handelsbanken's mortgage rates in Sweden were often positioned competitively within the market, aiming to attract new customers while retaining existing ones. Their approach prioritizes long-term customer relationships over aggressive short-term pricing.

The bank’s fee structures for various accounts and transactions are also benchmarked against competitors, ensuring they remain accessible and perceived as fair value. This careful calibration supports their decentralized model, allowing local branches some flexibility in pricing to meet specific market needs.

Net interest income is a cornerstone of Handelsbanken's profitability, reflecting the core banking business of lending and borrowing. In the first quarter of 2024, the bank reported net interest income of SEK 13.1 billion, a slight increase from the previous year, demonstrating its ability to manage this vital revenue stream amidst evolving market conditions.

While central bank policies, such as interest rate adjustments, can influence net interest margins by compressing the spread between lending and deposit rates, Handelsbanken's strategic approach to pricing its loan and deposit products plays a crucial role in safeguarding this income. The bank's focus on building strong customer relationships and offering competitive, yet profitable, rates allows it to navigate these margin pressures effectively.

Svenska Handelsbanken actively drives fee and commission income by emphasizing its advisory services and mutual fund offerings. This strategy diversifies revenue beyond traditional interest income, showcasing a pricing approach that incorporates fees for specialized financial guidance and investment products.

Dividend Policy Reflecting Financial Strength

Svenska Handelsbanken’s dividend policy is a direct reflection of its robust financial strength and consistent profitability. The bank's commitment to returning value to shareholders through both ordinary and special dividends underscores its healthy financial position, which is intrinsically linked to its effective pricing strategies and overall operational efficiency.

The proposed dividends, including any potential special dividends, signal a strong financial performance and a confidence in future earnings. Handelsbanken consistently aims for a healthy return on equity, a key metric demonstrating how effectively the company generates profits from its shareholders' investments. This focus on profitability directly supports its ability to offer attractive dividends.

- Proposed Dividend Per Share (2024): SEK 7.00 (Ordinary)

- Dividend Yield (as of mid-2024): Approximately 4.5%

- Return on Equity (Q1 2024): 12.8%

- Net Profit Margin (2023): 22.5%

Cost Efficiency Impact on Pricing

Svenska Handelsbanken's dedication to cost efficiency is a cornerstone of its pricing strategy. By diligently managing operational expenses, the bank can present competitive pricing to its customers.

This focus on efficiency directly translates into a stronger cost-to-income ratio, a key indicator of financial health. For instance, in Q1 2024, Handelsbanken reported a cost-to-income ratio of 43%, demonstrating effective cost management.

- Lower Operational Costs: Continued investment in digital transformation and process optimization aims to further reduce overheads.

- Competitive Pricing: Cost savings allow for more attractive interest rates on loans and competitive fees for services.

- Profitability Maintenance: Efficient operations ensure that attractive pricing does not compromise the bank's ability to generate profits.

- Strong Cost-to-Income Ratio: As of Q1 2024, the ratio stood at 43%, highlighting robust cost control measures.

Handelsbanken's pricing strategy is deeply intertwined with its commitment to value and long-term customer relationships. The bank aims for competitive positioning, particularly in core offerings like mortgages, where rates in early 2024 were often aligned with market averages to foster customer loyalty rather than pursuing aggressive acquisition through price alone. This approach extends to its fee structures, which are benchmarked for fairness and accessibility, supporting its decentralized model that allows for local pricing adjustments.

| Metric | Value (Q1 2024/2024) | Significance |

|---|---|---|

| Net Interest Income | SEK 13.1 billion | Demonstrates effective management of core lending and borrowing spreads. |

| Cost-to-Income Ratio | 43% | Indicates strong operational efficiency, enabling competitive pricing. |

| Proposed Dividend Per Share (Ordinary) | SEK 7.00 | Reflects robust financial health and profitability. |

| Return on Equity | 12.8% | Shows effective generation of profits from shareholder investments. |

4P's Marketing Mix Analysis Data Sources

Our Svenska Handelsbanken 4P's analysis is built upon a foundation of publicly available financial reports, investor relations materials, and official company announcements. We also incorporate insights from reputable industry analyses and market research to ensure a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.