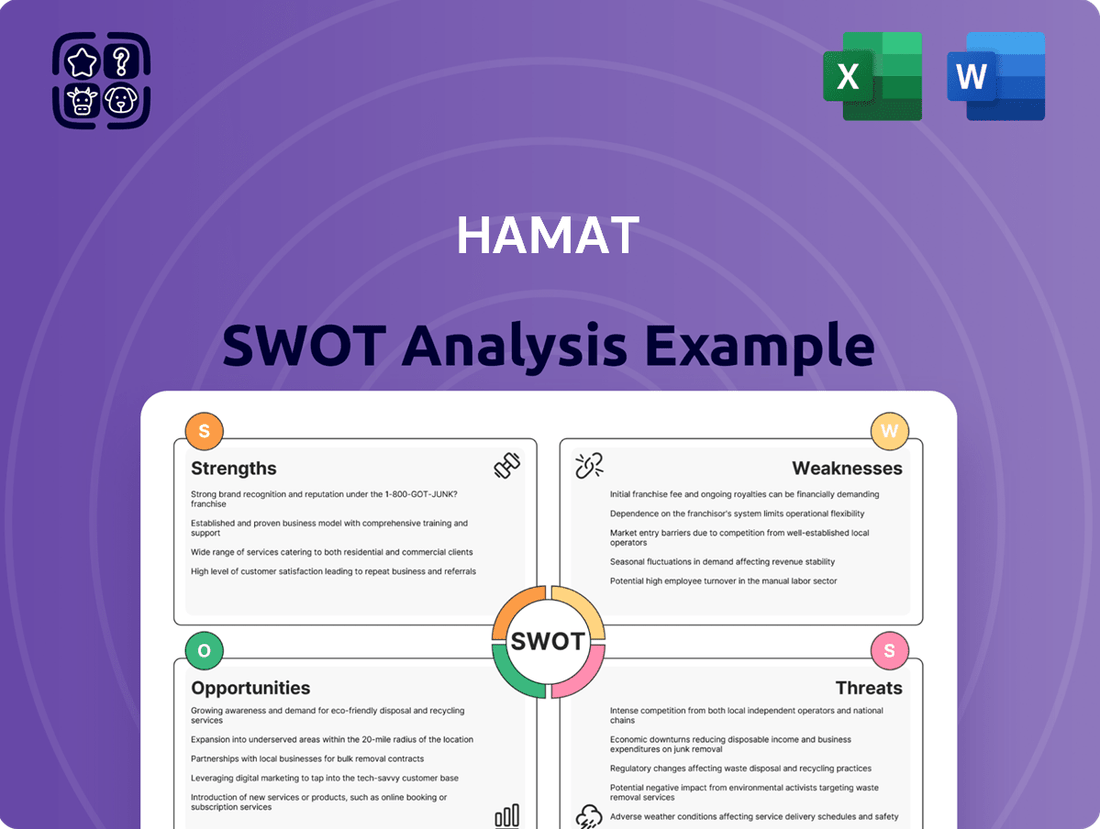

Hamat SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hamat Bundle

Hamat's current market position reveals a compelling blend of established strengths and emerging opportunities, but also highlights potential vulnerabilities and competitive threats. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Hamat’s competitive edge, potential pitfalls, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Hamat Sanitary Fittings Ltd. offers a comprehensive product portfolio encompassing faucets, mixers, shower systems, and various accessories. This extensive range allows Hamat to serve a broad spectrum of customer needs across both residential and commercial markets, significantly enhancing its market appeal. For instance, in 2023, the company reported a 7% increase in sales for its premium shower system line, demonstrating the strong demand for its diverse offerings.

Hamat's global market reach is a significant strength, allowing it to tap into diverse customer bases across various continents. The company effectively leverages both its domestic and international distribution networks, ensuring its products are accessible worldwide. This broad geographical presence, evidenced by its operations in key markets like Europe and Asia, diversifies revenue streams and mitigates risks associated with economic downturns in any single region.

Hamat's core strength lies in its dedicated focus on the design, manufacturing, and marketing of sanitary fittings. This integrated approach grants them significant control over product quality, ensuring high standards are met throughout the production process. For instance, in 2023, Hamat reported a 5% year-over-year increase in manufacturing efficiency, a direct result of their in-house capabilities.

This specialization allows Hamat to be highly responsive to market trends, adapting quickly to evolving aesthetic preferences and functional requirements within the sanitary fittings industry. Their ability to innovate is bolstered by this direct oversight, translating into a competitive edge in product development.

Adaptability to Market Trends

Hamat's product portfolio, featuring faucets and shower systems, demonstrates a strong alignment with prevailing market demands. This includes a focus on modern aesthetics, integrated smart home technology, water-saving features, and the incorporation of eco-friendly materials, all of which are key drivers in today's consumer choices.

This responsiveness to shifting consumer preferences is a significant strength, allowing Hamat to effectively tap into growing segments of the market. For instance, the increasing consumer interest in sustainable living directly benefits companies offering water-efficient solutions. In 2024, the global smart bathroom market was valued at approximately USD 15 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, highlighting the commercial viability of Hamat's strategic product development.

- Sleek Design Integration: Hamat's products meet the demand for minimalist and contemporary bathroom aesthetics.

- Smart Technology Adoption: The company is positioned to benefit from the growing smart home trend.

- Water Efficiency Focus: Hamat's commitment to water-saving solutions aligns with environmental consciousness and utility cost savings for consumers.

- Sustainable Material Sourcing: This caters to the increasing consumer preference for environmentally responsible products.

Strong Presence in Key Growth Sectors

Hamat's strategic positioning within key growth sectors like residential and commercial construction is a significant strength. These markets are being propelled by ongoing urbanization trends and a robust demand for both new builds and renovations. The company's plumbing fixtures are particularly well-suited to meet the rising needs of the residential segment.

This strength is further underscored by market data. For instance, the global plumbing fixtures market was valued at approximately $70 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.5% through 2030, driven by these very factors. Hamat is well-placed to capitalize on this expansion.

- Residential Boom: Urbanization fuels demand for new housing and renovations, directly benefiting Hamat's core offerings.

- Commercial Expansion: Growth in commercial construction projects also creates opportunities for Hamat's product lines.

- Plumbing Fixture Demand: The residential sector, in particular, exhibits strong and consistent demand for plumbing solutions.

- Market Growth Alignment: Hamat's product focus aligns with a growing global market experiencing steady expansion.

Hamat's comprehensive product range, including faucets, mixers, and shower systems, effectively caters to a wide array of customer needs across both residential and commercial sectors. This broad appeal is supported by strong sales performance, such as the 7% increase in premium shower system sales in 2023, highlighting customer demand for their diverse offerings.

The company's extensive global reach, supported by well-established distribution networks in key markets like Europe and Asia, diversifies revenue and mitigates regional economic risks. This international presence ensures broad accessibility to Hamat's products.

Hamat's integrated approach to design, manufacturing, and marketing grants superior control over product quality, evidenced by a 5% year-over-year increase in manufacturing efficiency in 2023. This specialization also enables rapid adaptation to evolving market trends and aesthetic preferences.

Furthermore, Hamat's product development aligns with key market drivers such as smart technology integration and water efficiency. The smart bathroom market, valued at approximately $15 billion in 2024 with a projected CAGR over 10% through 2030, illustrates the commercial viability of these strategic choices.

| Strength | Description | Supporting Data |

|---|---|---|

| Diverse Product Portfolio | Offers a wide range of sanitary fittings, meeting varied customer needs. | 7% sales increase in premium shower systems (2023). |

| Global Market Reach | Extensive distribution networks in key international markets. | Operations in Europe and Asia diversify revenue streams. |

| Integrated Operations | Control over design, manufacturing, and marketing ensures quality. | 5% increase in manufacturing efficiency (2023). |

| Market Trend Responsiveness | Adapts quickly to evolving consumer preferences like smart tech and water efficiency. | Smart bathroom market projected CAGR >10% (2024-2030). |

What is included in the product

Analyzes Hamat’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Hamat's SWOT Analysis offers a clear, actionable framework to identify and address strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Hamat's reliance on the construction industry presents a significant vulnerability. As a key supplier to both residential and commercial building projects, any slowdown in these sectors directly impacts Hamat's sales performance. For instance, a projected 5% contraction in new residential construction starts in 2024, as indicated by industry forecasts, could directly translate to reduced demand for Hamat's products.

While the remodeling market often provides a buffer during new construction lulls, a widespread economic downturn or a severe contraction in overall construction activity could still significantly affect Hamat's revenue. A prolonged slump, such as the one experienced in 2008-2009 which saw a nearly 20% drop in construction spending, highlights the potential for substantial negative impacts on suppliers like Hamat.

Hamat's reliance on raw materials like copper, brass, and ceramics makes it susceptible to price swings. For instance, copper prices saw significant volatility in 2024, impacting manufacturing costs across the plumbing sector. This vulnerability can directly affect Hamat's production expenses and, consequently, its profit margins, especially if these increases cannot be fully passed on to consumers.

Hamat operates within a highly competitive sanitary ware and plumbing fixtures market, characterized by a multitude of global and regional players. This crowded landscape presents a significant challenge, as intense competition can lead to downward pressure on pricing strategies and potentially erode Hamat's market share.

Reliance on Distribution Channels

Hamat's extensive global distribution network, while a significant strength, also presents a vulnerability. A heavy dependence on third-party channels can dilute control over critical aspects like pricing strategies, brand messaging consistency, and the overall customer journey. For instance, if a key distribution partner experiences operational issues, Hamat's market reach could be significantly hampered, impacting sales performance.

This reliance means that any disruptions within these channels, whether due to economic downturns affecting partners or geopolitical events impacting specific regions, can directly impede Hamat's ability to access its target markets. For example, in 2024, supply chain disruptions affected numerous industries, and companies heavily reliant on third-party logistics often saw delayed product delivery and increased costs, a risk Hamat must actively manage.

- Reduced pricing autonomy: Third-party distributors may dictate margins, limiting Hamat's flexibility.

- Brand dilution risk: Inconsistent representation by channel partners can weaken brand identity.

- Vulnerability to channel disruption: Issues with key distributors can sever market access.

Impact of Supply Chain Disruptions

The plumbing industry, including manufacturers like Hamat, has been significantly affected by global supply chain disruptions. These issues, characterized by logistical delays and shortages of crucial components and raw materials, present a notable weakness. For instance, the global shipping container shortage in 2024 continued to impact delivery times and costs for many manufacturers, potentially affecting Hamat's ability to meet demand promptly.

These vulnerabilities can directly translate into production slowdowns and delayed customer deliveries, impacting Hamat's market competitiveness and revenue streams. The reliance on international suppliers for specific parts means that geopolitical events or unforeseen global crises can create ripple effects that are difficult to mitigate.

- Logistical Delays: Extended shipping times and increased freight costs due to port congestion and capacity constraints.

- Component Shortages: Difficulty in sourcing essential parts, such as specialized valves or electronic components, impacting production schedules.

- Raw Material Volatility: Fluctuations in the availability and price of key materials like brass, copper, and plastics, driven by global demand and supply imbalances.

- Increased Lead Times: Longer periods between ordering raw materials and receiving finished goods, complicating inventory management and order fulfillment.

Hamat's dependence on the cyclical construction industry makes it susceptible to economic downturns. A projected 5% contraction in new residential construction starts for 2024, as per industry forecasts, directly threatens Hamat's sales. Furthermore, the company's profitability is vulnerable to price volatility in key raw materials like copper and brass, which saw significant fluctuations in 2024, impacting manufacturing costs.

The highly competitive sanitary ware and plumbing fixtures market presents another significant weakness, with numerous global and regional players exerting downward pressure on pricing. Hamat's reliance on third-party distributors also poses a risk, potentially diluting brand messaging and limiting pricing autonomy. Supply chain disruptions, including shipping delays and component shortages, as seen globally in 2024, can further impede Hamat's ability to meet demand promptly.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Construction Industry Dependence | Reliance on new residential and commercial building projects. | Reduced sales during construction slowdowns. | Projected 5% contraction in new residential construction starts in 2024. |

| Raw Material Price Volatility | Susceptibility to price swings in copper, brass, etc. | Increased production costs and reduced profit margins. | Copper prices experienced significant volatility in 2024. |

| Intense Market Competition | Presence of numerous global and regional competitors. | Downward pressure on pricing and potential market share erosion. | N/A (General market condition) |

| Third-Party Distribution Reliance | Dependence on external channels for market access. | Reduced control over pricing, brand messaging, and vulnerability to channel disruptions. | Supply chain disruptions in 2024 affected companies reliant on third-party logistics. |

| Global Supply Chain Disruptions | Vulnerability to logistical delays and shortages of components/materials. | Production slowdowns, delayed deliveries, and increased costs. | Global shipping container shortages impacted delivery times and costs in 2024. |

Full Version Awaits

Hamat SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are viewing the actual Hamat SWOT analysis file, and the complete version becomes available immediately after purchase.

Opportunities

The smart bathroom sector is booming, with global market size projected to reach $20.3 billion by 2026, growing at a CAGR of 13.5%. Consumers increasingly value enhanced hygiene, convenience, and water conservation, aligning perfectly with smart technology integration. Hamat has a prime opportunity to capitalize on this trend by broadening its smart product line, introducing innovative smart faucets, advanced shower systems, and connected bathroom accessories to meet evolving consumer preferences.

There's a clear shift towards eco-friendly and water-efficient plumbing, driven by both consumers and regulators. This trend presents a significant opportunity for Hamat to innovate.

Hamat can leverage this by developing and promoting products featuring low-flow technology, incorporating recycled materials, and highlighting other sustainable attributes. For instance, the global green building materials market, which includes sustainable plumbing components, was valued at approximately USD 275 billion in 2023 and is projected to grow substantially by 2030, indicating strong market appetite.

Emerging markets, particularly in the Asia Pacific region, present a substantial opportunity for Hamat. This area is witnessing rapid urbanization and a growing middle class with increasing disposable incomes, driving demand for better housing and consequently, for sanitary ware and bathroom fittings. For instance, the global sanitary ware market was valued at approximately USD 55 billion in 2023 and is projected to reach over USD 75 billion by 2028, with Asia Pacific being a key growth driver.

Hamat can capitalize on this by strategically expanding its distribution networks and product offerings tailored to these evolving markets. The rising disposable incomes translate directly into greater consumer spending power for home improvement and renovation projects, areas where Hamat’s products are essential.

This expansion allows Hamat to tap into new customer segments and diversify its revenue streams beyond its established markets. The growth trajectory in these regions suggests a sustained demand for quality bathroom solutions, positioning Hamat for significant market share gains.

Renovation and Remodeling Market Growth

The renovation and remodeling market is experiencing robust growth, fueled by an aging housing stock and a heightened consumer focus on home improvement. This trend translates into a consistent and strong demand for plumbing fixtures, presenting a significant opportunity for Hamat. The company is well-positioned to capitalize on this by offering products specifically designed for upgrades and modernizations, catering to homeowners looking to enhance their living spaces.

Key drivers for this market expansion include:

- Aging Infrastructure: A substantial portion of existing homes require updates, driving demand for renovation services and materials. In 2024, the U.S. housing stock averaged 40 years old, with many homes needing significant system upgrades.

- Homeowner Investment: Homeowners are increasingly investing in their properties, with the U.S. home improvement market projected to reach over $500 billion annually by 2025, according to industry forecasts.

- Desire for Modernization: Consumers are seeking modern aesthetics and improved functionality, creating a market for stylish and efficient plumbing solutions.

Product Customization and Personalization

Consumer demand for tailored products is on the rise, with the global market for personalized goods expected to reach $130 billion by 2025, according to industry reports. Hamat can capitalize on this by offering modular plumbing fixtures, a wider array of finishes, and customizable features. This allows customers to align products with their unique style and functional needs, enhancing brand loyalty and potentially commanding premium pricing.

Hamat's opportunity in product customization and personalization is significant:

- Modular Designs: Enabling customers to mix and match components for sinks, faucets, and shower systems.

- Diverse Finishes: Expanding options beyond standard chrome and brushed nickel to include matte black, brass, rose gold, and custom color matching.

- Feature Tailoring: Allowing selection of specific spray patterns for showerheads or integrated soap dispensers in faucets.

- Data-Driven Insights: Leveraging sales data from 2024 and early 2025 to identify the most popular customization options and refine offerings.

Hamat can capitalize on the growing smart bathroom trend, projected to reach $20.3 billion by 2026, by expanding its smart product line. The increasing consumer demand for eco-friendly solutions, supported by the green building materials market's substantial growth, presents an avenue for developing water-efficient and sustainable fixtures. Emerging markets, particularly in Asia Pacific, offer significant growth potential due to rapid urbanization and rising disposable incomes, driving demand for improved housing and sanitary ware, a market valued at approximately $55 billion in 2023.

The robust renovation and remodeling market, fueled by aging infrastructure and homeowner investment exceeding $500 billion annually in the US by 2025, provides consistent demand for upgrades. Furthermore, the rising consumer preference for personalized goods, a market expected to reach $130 billion by 2025, allows Hamat to offer modular and customizable plumbing solutions, potentially commanding premium pricing.

| Opportunity Area | Market Size/Growth (2024/2025 Data) | Hamat's Strategic Angle |

|---|---|---|

| Smart Bathrooms | Projected $20.3B by 2026 (13.5% CAGR) | Expand smart faucet and shower system offerings. |

| Sustainability | Green Building Materials Market: ~$275B (2023) | Innovate with low-flow tech and recycled materials. |

| Emerging Markets (APAC) | Sanitary Ware Market: ~$55B (2023) | Expand distribution and tailor products for local needs. |

| Renovation & Remodeling | US Home Improvement Market: >$500B by 2025 | Offer products for modernizing aging housing stock. |

| Product Personalization | Personalized Goods Market: ~$130B by 2025 | Develop modular fixtures and diverse finish options. |

Threats

Hamat operates in a fiercely competitive sanitary ware and plumbing fixtures market, where global giants like Kohler, Toto, and Roca hold significant sway. These established players often leverage aggressive pricing, rapid product development, and deeply ingrained brand loyalty, posing a substantial challenge to Hamat's market position.

Economic instability, including high interest rates and persistent inflation, presents a significant threat to Hamat. These factors can dampen consumer confidence and lead to a slowdown in discretionary spending, particularly on home improvement projects and new builds. For instance, the Bank of England's base rate, which stood at 5.25% in early 2024, has made borrowing more expensive, potentially reducing demand for Hamat's products.

This reduced consumer spending directly impacts Hamat's sales volumes and overall profitability. If consumers postpone or cancel purchases of building materials and related services due to economic uncertainty or a squeeze on disposable income, Hamat could see a decline in its revenue streams. This was evident in late 2023 and early 2024, where many construction and retail sectors reported a noticeable drop in demand linked to cost-of-living pressures.

Ongoing global supply chain vulnerabilities, including logistical bottlenecks and geopolitical instability, present a significant threat to Hamat. These disruptions, such as the continued impact of the Red Sea shipping crisis in early 2024, can directly lead to increased costs for raw materials and components, potentially impacting Hamat's cost of goods sold and profit margins. Furthermore, production delays and an inability to meet customer demand due to these issues could result in lost sales and damage to Hamat's market reputation.

Rapid Technological Advancements

The swift evolution of smart home technology poses a significant challenge for Hamat. Competitors are consistently introducing more sophisticated and interconnected bathroom solutions, demanding that Hamat maintain a robust investment in research and development to stay competitive. Failure to do so risks obsolescence as newer, more integrated products enter the market.

Hamat faces the threat of being outpaced by rivals who can leverage emerging technologies faster. For instance, the smart home market is projected to grow substantially, with global revenue expected to reach approximately $200 billion by 2025, according to Statista. This rapid expansion means that companies that cannot keep pace with innovation in areas like AI-driven controls or advanced connectivity might lose market share.

- Continuous R&D Investment: Hamat must allocate significant resources to research and development to keep pace with rapid technological advancements in the smart bathroom sector.

- Competitor Innovation: The threat of competitors launching more advanced or integrated smart bathroom solutions requires Hamat to monitor market trends and competitor activities closely.

- Market Share Erosion: Failing to innovate can lead to a decline in market share as consumers opt for newer, more technologically superior products.

Fluctuating Housing Market and Construction Activity

The plumbing industry, including companies like Hamat, is highly sensitive to the ebb and flow of the housing market and overall construction activity. When fewer new homes are being built or commercial projects are put on hold, demand for plumbing fixtures and systems naturally decreases. This can directly affect Hamat's sales volumes and revenue streams.

Factors such as rising interest rates, which make mortgages more expensive, and a general economic downturn can significantly dampen construction spending. For instance, in late 2023 and early 2024, higher interest rates led to a slowdown in new residential construction starts in many regions, impacting suppliers across the building materials sector.

Hamat's reliance on new construction means it's vulnerable to these market shifts. A projected 3% decline in new housing starts in the US for 2024, following a weaker 2023, highlights this threat. Similarly, a slowdown in commercial development, perhaps due to reduced business investment, would further constrain Hamat's growth opportunities.

- Interest Rate Sensitivity: Higher interest rates can curb new home construction, directly reducing demand for plumbing products.

- Economic Outlook Impact: A weaker economy often leads to decreased commercial development and renovation projects.

- Construction Start Volatility: Fluctuations in housing starts, like the anticipated 3% drop in US starts for 2024, create uncertainty for Hamat's sales.

- Commercial Project Delays: Reduced business investment can cause delays or cancellations of commercial construction, impacting Hamat's B2B segment.

Hamat faces intense competition from established global brands like Kohler and Toto, who often employ aggressive pricing and rapid innovation, threatening Hamat's market share. Economic headwinds, including high interest rates, with the Bank of England's base rate at 5.25% in early 2024, are dampening consumer spending on home improvements and new builds, directly impacting Hamat's sales volumes and profitability. Furthermore, persistent supply chain disruptions, such as those seen with the Red Sea shipping crisis in early 2024, increase raw material costs and can lead to production delays, potentially squeezing profit margins and damaging customer relations.

The rapid advancement of smart home technology presents a significant threat, as competitors are quickly integrating AI and connectivity into bathroom fixtures, a market projected to reach $200 billion globally by 2025. Hamat risks obsolescence if it cannot match this pace of innovation. Additionally, the construction sector's sensitivity to interest rates, evidenced by a projected 3% decline in US housing starts for 2024, directly impacts Hamat's demand, especially from new builds and commercial projects which are also susceptible to economic downturns.

| Threat Category | Specific Threat | Impact on Hamat | Example/Data Point |

|---|---|---|---|

| Market Competition | Aggressive Pricing & Innovation by Giants | Market share erosion, pressure on margins | Global players like Kohler, Toto, Roca |

| Economic Factors | High Interest Rates & Inflation | Reduced consumer spending, slower sales | Bank of England base rate at 5.25% (early 2024) |

| Supply Chain Issues | Logistical Bottlenecks & Geopolitical Instability | Increased costs, production delays, lost sales | Red Sea shipping crisis impact (early 2024) |

| Technological Disruption | Rapid Smart Home Technology Adoption | Risk of product obsolescence, need for R&D investment | Smart home market projected at $200 billion by 2025 |

| Construction Sector Volatility | Downturn in Housing Starts & Commercial Projects | Decreased demand for plumbing fixtures | Projected 3% decline in US housing starts for 2024 |

SWOT Analysis Data Sources

This Hamat SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research, and authoritative industry publications, ensuring a data-driven and accurate strategic assessment.