Hamat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hamat Bundle

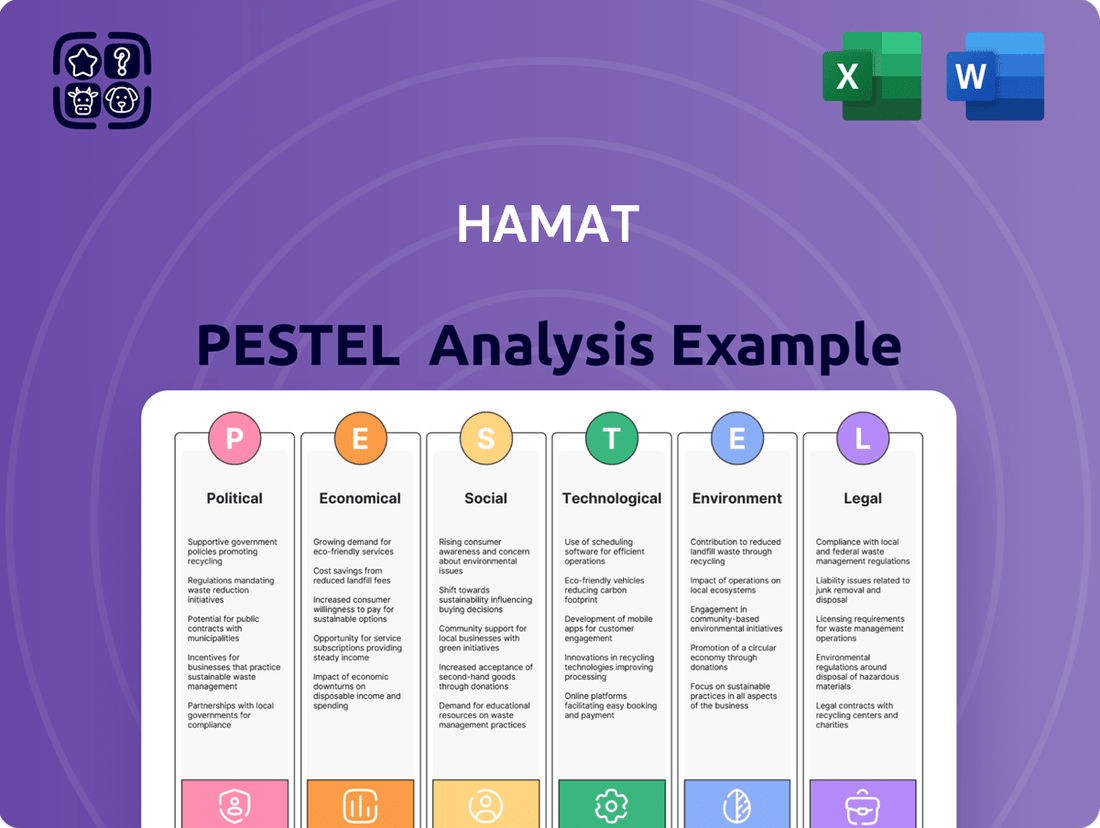

Navigate the complex external forces impacting Hamat with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its market. Gain critical insights to inform your strategy and investment decisions. Download the full report now for actionable intelligence.

Political factors

Government infrastructure investments, like the US Infrastructure Investment and Jobs Act (IIJA), are injecting billions into projects, fueling demand for construction materials. For instance, the IIJA allocated $1.2 trillion, with a significant portion directed towards transportation and utilities, sectors that heavily rely on robust plumbing systems. This surge in construction activity, including manufacturing facilities and data centers, directly benefits companies like Hamat by creating a strong market for their sanitary fittings and plumbing products.

Changes in international trade policies and tariffs, especially from major economies like the US on building materials, directly affect Hamat's supply chain and pricing structures. For instance, the US imposed tariffs on steel and aluminum imports, which can escalate Hamat's raw material expenses.

Tariffs on essential components, including those sourced from China, can inflate production costs, potentially squeezing profit margins or necessitating price increases for consumers. Hamat needs to closely track these trade shifts to optimize its import-export strategies and ensure competitive pricing in the global marketplace.

The impact of these policies on Hamat's cost of goods sold and its ability to access international markets is a critical consideration. For example, if tariffs on key inputs rise by 10%, Hamat's cost of goods sold could see a proportional increase, influencing its overall financial performance.

Political stability in Hamat's key operating markets, such as Israel, is crucial for maintaining investor confidence and ensuring the smooth progression of construction projects. Recent political developments in Israel throughout 2024 have presented some volatility, which can impact the predictability of large-scale infrastructure and real estate investments.

Election cycles, both domestically and in potential international expansion territories, can introduce uncertainty. For instance, a change in government could lead to reviews or alterations of public sector investment programs, potentially delaying the commencement of new construction projects that Hamat might bid on. This necessitates a proactive approach to understanding political shifts.

Hamat must continuously monitor the political landscape to anticipate potential changes in demand for its services or new regulatory frameworks. A stable political environment, characterized by consistent policy implementation, generally provides a more favorable and predictable business climate, supporting Hamat's long-term strategic planning and capital investments.

Public Health and Sanitation Initiatives

Global and national efforts to boost public hygiene and sanitation are directly fueling demand for advanced sanitary fixtures. The World Health Organization's ongoing advocacy for universal access to safe sanitation, a critical component of public health, significantly shapes both consumer preferences and governmental policy. This focus is expected to drive greater adoption of sophisticated sanitary solutions, such as those incorporating antimicrobial technologies or sensor-based, touchless operation, aligning with Hamat's product development and marketing strategies.

The increasing emphasis on public health is translating into tangible market growth. For instance, the global sanitation market was valued at approximately $60 billion in 2023 and is projected to reach over $90 billion by 2030, demonstrating a strong compound annual growth rate (CAGR) of around 6%. This expansion is largely driven by government investments in infrastructure and public awareness campaigns promoting hygiene.

- Growing Demand: Public health initiatives are creating a sustained demand for modern, hygienic sanitary fixtures.

- Policy Influence: Organizations like the WHO are influencing policy and consumer behavior towards better sanitation.

- Product Innovation: Campaigns encourage adoption of advanced features like antimicrobial properties and touchless operations.

- Market Opportunity: The global sanitation market is projected for significant growth, offering opportunities for companies like Hamat.

Regional Policy Divergence

Regional policy divergence presents a complex landscape for Hamat. For example, in 2024, the European Union continued to harmonize water efficiency standards, potentially simplifying compliance for Hamat's irrigation technologies across member states. However, emerging markets like India are also strengthening their water management policies, with the Jal Jeevan Mission aiming to provide tap water to all rural households by 2024, creating specific demand for localized solutions.

These varying regulatory frameworks directly impact Hamat's product development and market entry strategies. Differences in water conservation mandates, for instance, mean that a one-size-fits-all approach to irrigation solutions is not viable. Hamat must tailor its offerings to meet distinct regional requirements, such as specific water usage limits or allowed irrigation methods, to ensure market acceptance and compliance.

Hamat's international distribution network highlights the need for adaptability. By 2025, Hamat anticipates that over 60% of its revenue will come from outside its primary market. This necessitates a keen understanding of how policies in key growth regions, like Southeast Asia where several countries are investing heavily in agricultural modernization, will shape demand for smart irrigation and water-saving technologies.

- Varying Water Conservation Laws: Regulations on water usage can differ significantly, impacting the design and marketing of Hamat's irrigation systems.

- Investment Priorities in Agriculture: Government initiatives to boost agricultural output and efficiency, such as those seen in Latin America in 2024, influence the adoption of advanced farming technologies.

- Product Compliance Standards: Different countries have unique certification and safety standards that Hamat must meet for its products to be legally sold and used.

- Trade Agreements and Tariffs: Regional trade blocs and bilateral agreements can affect the cost and accessibility of Hamat's products in various international markets.

Political stability in key markets, such as Israel, directly impacts Hamat's operational continuity and investor confidence, with 2024 showing some volatility. Election cycles in Hamat's operating regions can introduce policy uncertainty, potentially affecting public infrastructure spending and project timelines. Government infrastructure investments, like the US Infrastructure Investment and Jobs Act, are creating demand for Hamat's products by boosting construction activity.

Changes in international trade policies and tariffs, such as those on steel and aluminum, directly influence Hamat's raw material costs and pricing strategies. Global and national public health initiatives are increasing demand for advanced sanitary fixtures, aligning with Hamat's product offerings. Regional policy divergence, especially concerning water conservation, necessitates tailored product development and market entry strategies for Hamat.

| Factor | Impact on Hamat | 2024/2025 Data/Trend |

|---|---|---|

| Infrastructure Spending | Increased demand for plumbing and sanitary fittings. | US IIJA allocated $1.2 trillion, driving construction. |

| Trade Tariffs | Higher raw material costs, potential price increases. | US tariffs on steel/aluminum impacting import costs. |

| Political Stability | Affects investor confidence and project predictability. | Some political volatility noted in Israel in 2024. |

| Public Health Initiatives | Growing demand for hygienic and advanced sanitary solutions. | Global sanitation market projected to reach over $90 billion by 2030. |

| Water Conservation Policies | Requires adaptation of irrigation technologies for regional needs. | EU harmonizing water efficiency standards; India's Jal Jeevan Mission. |

What is included in the product

The Hamat PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework that demystifies complex external factors, enabling teams to proactively address potential challenges and seize opportunities.

Economic factors

Despite facing some headwinds in 2024, the global construction market is showing promising signs of recovery, with projections indicating growth in both residential and commercial sectors for 2025. This uptick in construction activity, spurred by improving economic conditions, directly translates to increased demand for essential components like sanitary fittings.

The global plumbing fixtures market, a key segment for Hamat, is anticipated to experience substantial expansion in the coming years. Analysts forecast the market to reach approximately $75 billion by 2027, growing at a compound annual growth rate (CAGR) of around 5.5% from 2023 to 2027.

Hamat is well-positioned to capitalize on this renewed momentum, benefiting from the increased activity in both new construction projects and the ongoing trend of renovations and upgrades.

High interest rates and persistent inflation have indeed put a squeeze on private sector investment and the housing market, which directly affects industries like construction and plumbing. For instance, in early 2024, many construction projects faced higher borrowing costs, leading to a slowdown. Hamat, as a supplier to these sectors, would have felt this constraint.

Looking ahead, there's an expectation of a gradual decrease in interest rates. This easing is projected to lower financing costs, making it more attractive for businesses to invest in construction. This could translate into more public infrastructure projects and private developments, ultimately boosting demand for Hamat's plumbing solutions.

For example, if central banks begin cutting rates in late 2024 or early 2025, as some forecasts suggest, this could unlock new project pipelines. Hamat should closely track these macroeconomic shifts, like the projected inflation rate for 2025 which is expected to moderate, to accurately adjust its production and sales strategies to meet anticipated demand changes.

The cost of essential raw materials like copper, zinc, and chromium, critical for producing sanitary fittings, has seen considerable swings. While there have been some positive signs regarding supply chain improvements and moderating raw material costs in late 2024 and early 2025, these expenses continue to be a major consideration for companies such as Hamat.

Effectively managing these fluctuating input costs and the capacity to pass them on to customers are key to Hamat's sustained profitability. For instance, copper prices, after reaching highs in early 2024, have shown some stabilization, but remain sensitive to global demand and geopolitical events, impacting manufacturing overheads.

Hamat's procurement approach needs to be robust enough to navigate this potential price volatility, ensuring the maintenance of stable profit margins. A proactive strategy in sourcing and hedging against price increases will be crucial for financial stability throughout 2025.

Consumer Spending and Disposable Income

Consumer spending is a major driver for companies like Hamat. As consumer confidence improves and wages rise, people tend to spend more. For instance, in the US, personal consumption expenditures increased at an annual rate of 3.1% in the first quarter of 2024, according to the Bureau of Economic Analysis. This uptick in spending directly benefits sectors like home improvement.

With higher disposable incomes, consumers are more likely to invest in their homes. This includes upgrades to bathrooms, with a growing preference for higher-quality and design-focused fixtures. Data from Statista suggests the global bathroom fixtures market is projected to reach over $100 billion by 2027, indicating strong demand for premium products.

This trend creates a demand for premium and luxury sanitary products that blend functionality with aesthetic appeal. Hamat can capitalize on this by ensuring its product range reflects these evolving consumer tastes, offering a variety of options to suit different budgets and design preferences.

- Consumer Confidence: Rising consumer confidence fuels increased household spending.

- Disposable Income: Growth in disposable income allows for discretionary spending on home improvements.

- Demand for Premium Products: Consumers are increasingly seeking high-quality, design-oriented bathroom fixtures.

- Market Growth: The global bathroom fixtures market shows robust growth, indicating strong consumer interest.

Housing Market Dynamics

The residential housing market, a crucial sector for Hamat, has experienced challenges due to elevated interest rates, which have slowed down new housing construction. However, a modest rebound in project starts is projected for 2024 and 2025, driven by improving housing affordability and a boost in buyer confidence.

This recovery is supported by strong underlying demand for housing in numerous regions and the ongoing need to address the aging stock of existing homes. Consequently, repair and remodeling activities are on the rise.

This trend translates into sustained demand for the replacement and upgrading of plumbing systems and fixtures. For instance, in 2024, the US housing market saw a notable increase in renovation spending, with projections indicating continued growth into 2025, particularly in the repair and remodeling segment.

- Interest Rate Impact: High interest rates have historically dampened new housing starts, as seen in late 2023 and early 2024 data.

- Projected Recovery: Forecasts for 2024-2025 suggest a partial recovery in housing project starts, aided by increased affordability.

- Repair and Remodeling Demand: Strong demand for housing upgrades and the aging of existing homes are fueling consistent activity in the repair and remodeling sector.

- Plumbing System Needs: This sustained demand directly benefits companies like Hamat through increased sales of plumbing systems and fixtures for both replacement and new installations.

Economic factors significantly influence Hamat's performance. While high interest rates and inflation presented challenges in early 2024, dampening construction investment, projections for late 2024 and 2025 indicate a more favorable environment with moderating inflation and potential interest rate cuts. This easing of financial conditions is expected to stimulate both new construction projects and renovations, directly boosting demand for plumbing fixtures.

Consumer spending trends are also a key economic driver. Improved consumer confidence and rising disposable incomes, exemplified by a 3.1% annual increase in US personal consumption expenditures in Q1 2024, translate into greater spending on home improvements. This surge in discretionary spending benefits sectors like bathroom fixtures, with a growing consumer preference for premium, design-oriented products.

The global plumbing fixtures market is robust, projected to reach approximately $75 billion by 2027, with a CAGR of around 5.5% from 2023-2027. This growth trajectory, coupled with a projected over $100 billion market for global bathroom fixtures by 2027, highlights the substantial opportunities for Hamat. The company is well-positioned to benefit from increased activity in both new builds and the substantial repair and remodeling segment, which saw notable growth in 2024 and is expected to continue into 2025.

| Economic Factor | 2024 Impact | 2025 Outlook | Hamat Relevance |

|---|---|---|---|

| Interest Rates | High rates slowed construction investment | Projected gradual decrease, lowering financing costs | Increased project viability, boosting demand |

| Inflation | Persistent inflation increased raw material costs | Expected moderation, potentially stabilizing input costs | Improved profit margins if costs are managed |

| Consumer Spending | 3.1% annual increase in US PCE (Q1 2024) | Continued growth driven by confidence and income | Higher demand for home improvements and premium fixtures |

| Raw Material Costs | Volatile, with copper prices sensitive to demand | Stabilization signs, but continued sensitivity | Strategic sourcing and hedging are crucial for profitability |

Full Version Awaits

Hamat PESTLE Analysis

The preview you see here is the exact Hamat PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Hamat's external environment.

The content and structure shown in the preview is the same Hamat PESTLE Analysis document you’ll download after payment, giving you immediate access to valuable insights.

Sociological factors

Rapid urbanization is a significant force propelling the sanitary ware market, especially in developing nations. This trend directly fuels demand for new homes and essential urban infrastructure, creating a robust customer base for companies like Hamat. As cities expand, the need for contemporary and efficient sanitary fittings in both residential and commercial buildings escalates.

The global population is projected to reach over 8.1 billion by 2025, a figure that amplifies the requirement for more housing. This demographic expansion translates into a consistent and growing market for Hamat's diverse product offerings, ensuring sustained demand for their sanitary ware solutions.

Consumers are placing a higher value on hygiene, leading to increased demand for sanitary fittings with features like touchless operation and antimicrobial surfaces. This shift is driven by a greater awareness of health and cleanliness, particularly in shared spaces. For instance, the global smart bathroom market, which includes many of these advanced features, was projected to reach over $20 billion by 2024, indicating a strong consumer appetite for such innovations.

Alongside hygiene, there's a significant trend towards more aesthetically pleasing and luxurious bathroom designs. This means consumers are seeking high-quality, design-forward fixtures that contribute to a spa-like atmosphere. The luxury bathroom segment, valued at billions globally, continues to grow, demonstrating a willingness to invest in both form and function.

Hamat can capitalize on these converging trends by developing and marketing products that seamlessly integrate advanced hygiene technologies with contemporary, stylish aesthetics. This approach aligns with the broader wellness movement, where consumers are increasingly viewing their bathrooms as personal sanctuaries.

A significant portion of existing housing stock, with an average age of over 40 years in many developed nations, necessitates continuous repair and remodeling, fueling a robust market for plumbing system upgrades. This aging infrastructure, a common sociological factor, directly translates into sustained demand for Hamat's solutions.

The imperative to modernize and extend the lifespan of older homes and buildings, coupled with the critical replacement of deteriorating public infrastructure, consistently drives demand for Hamat's products. For instance, in the United States, the American Society of Civil Engineers' 2021 report card highlighted that over 45% of the nation's water mains and sewer pipes are nearing or have exceeded their design life, underscoring the urgency for replacements.

Commercial plumbers are also experiencing escalating demand to retrofit older structures with sustainable and contemporary plumbing systems. This focus on renovation and upgrades provides Hamat with a stable and predictable revenue stream, less susceptible to the cyclical nature of new construction projects.

Rise of DIY and Home Improvement Culture

The do-it-yourself (DIY) and home improvement culture is booming, particularly among younger demographics like Millennials. This surge means more people are tackling projects themselves, directly impacting how companies like Hamat sell their products. For instance, a 2024 report indicated that over 60% of homeowners under 40 undertook at least one home improvement project in the past year, often relying on online platforms for research and purchasing.

This shift necessitates a multi-channel approach for Hamat, ensuring products are readily available online and in traditional retail settings. Clear, easy-to-follow installation guides and tutorials are becoming crucial selling points, as consumers increasingly expect to be self-sufficient. Hamat’s strategy must therefore prioritize accessible e-commerce options and robust digital content to support this growing DIY segment.

- Millennial Homeownership: Millennials, a key demographic for DIY, saw their homeownership rate reach approximately 44% by late 2024, fueling demand for home improvement.

- Online Research Dominance: Over 75% of DIYers now begin their project planning with online research, highlighting the importance of Hamat's digital presence.

- E-commerce Growth: The online home improvement retail sector experienced a 15% year-over-year growth in 2024, underscoring the need for strong e-commerce capabilities.

Demand for Smart and Connected Home Solutions

Consumers increasingly desire convenience and efficiency in their homes, fueling the demand for smart and connected solutions. This trend is particularly evident in the growing interest in smart sanitary fittings that offer remote control and data monitoring. For instance, a 2024 report indicated that the global smart home market, which includes smart bathroom fixtures, is projected to reach over $200 billion by 2028, demonstrating significant growth potential.

The drive for energy savings and sustainability is also a major catalyst for adopting smart home technologies. Homeowners are actively seeking products that can optimize water usage and reduce utility bills. Hamat can capitalize on this by integrating smart features into its faucets, mixers, and shower systems, offering consumers greater control and insight into their consumption patterns.

There's a clear societal shift towards technologically advanced and interconnected living spaces. Consumers are looking for products that seamlessly integrate into existing smart home ecosystems, allowing for unified control and enhanced functionality. This growing interest in data collection and remote access presents a prime opportunity for Hamat to innovate and capture market share in the smart sanitary ware segment.

Hamat's strategic move into smart sanitary solutions aligns with these evolving consumer preferences. By offering products with features like:

- Remote temperature and flow control for faucets and showers.

- Water usage tracking and reporting via a mobile app.

- Integration with popular smart home platforms like Google Home and Amazon Alexa.

- Personalized user profiles for customized settings.

The company can effectively tap into this expanding market, catering to the modern consumer's demand for intelligent and sustainable home environments.

Societal trends significantly influence the sanitary ware market, with a growing emphasis on health and hygiene driving demand for advanced features like touchless operation. This is further amplified by a desire for aesthetically pleasing, luxurious bathroom designs, pushing consumers towards high-quality, design-forward fixtures. The increasing adoption of smart home technology also fuels demand for integrated sanitary solutions, offering convenience and energy efficiency.

The aging of existing housing stock in developed nations necessitates continuous repair and remodeling, creating a steady market for plumbing upgrades. This is compounded by the critical need to replace deteriorating public infrastructure, as highlighted by reports indicating a substantial percentage of water mains and sewer pipes exceeding their design life. Furthermore, the burgeoning DIY culture, particularly among younger demographics, is reshaping product distribution and marketing strategies, emphasizing accessible online platforms and clear installation guidance.

The global smart home market, encompassing smart bathroom fixtures, is projected for significant expansion, with a 2024 forecast suggesting it could surpass $200 billion by 2028. This growth is underpinned by consumer demand for energy savings and sustainability, leading to a preference for products that optimize water usage. For instance, the smart bathroom market alone was anticipated to exceed $20 billion by 2024, reflecting a strong consumer interest in technologically advanced sanitary solutions.

| Sociological Factor | Trend | Market Impact | 2024/2025 Data Point |

| Health & Hygiene Awareness | Increased demand for touchless and antimicrobial features | Drives innovation in product design and materials | Global smart bathroom market projected over $20 billion by 2024 |

| Urbanization & Housing Needs | Growing demand for new residential and commercial sanitary ware | Supports consistent market growth, especially in developing economies | Global population expected to exceed 8.1 billion by 2025 |

| Aging Infrastructure | Need for replacement and upgrade of plumbing systems | Creates sustained demand for sanitary ware and related components | Over 45% of US water mains and sewer pipes nearing or exceeding design life (ASCE 2021) |

| DIY & Home Improvement Culture | Increased consumer engagement in self-installation and renovation | Requires multi-channel sales strategies and robust digital content | Over 60% of homeowners under 40 undertook home improvement projects in the past year (2024 report) |

Technological factors

The sanitary fittings market is rapidly evolving, with a strong push towards smart, touchless, and energy-efficient products. Consumers are increasingly valuing hygiene and convenience, fueling demand for innovations like smart faucets, toilets, and shower systems. These advanced fixtures offer features such as remote control, voice activation, and even data tracking for usage patterns.

This technological integration is not just a niche trend; over 60% of new homes in developed nations are now incorporating smart home technology. This widespread adoption signifies a robust and expanding market for connected plumbing solutions. For Hamat, this presents a clear imperative to invest in or collaborate on developing smart product lines to effectively tap into this growing consumer and construction demand.

Innovations in water-saving technologies are a significant technological factor, spurred by growing awareness of water conservation and stricter environmental rules. This includes advancements like low-flow fixtures, smart sensor-activated faucets, and sophisticated greywater recycling systems, all designed to reduce water usage efficiently. Consumers and governments alike are increasingly favoring products that offer water efficiency without sacrificing performance.

For companies like Hamat, this presents a clear opportunity to boost their product offerings by investing in research and development for highly water-efficient designs and cutting-edge technologies. This strategic move directly supports the global trend towards more responsible and sustainable water management practices.

The home improvement sector has experienced a substantial digital transformation, with consumers increasingly relying on online channels for everything from initial product research to final purchase. This trend is underscored by data showing a significant portion of home improvement purchases initiated online, even if finalized in-store. For instance, in 2024, reports indicated that over 60% of consumers researched home improvement products online before visiting a physical store, demonstrating the critical role of digital touchpoints.

E-commerce continues to be a vital component of sales strategies, even with the resurgence of physical retail spaces. This necessitates a robust omnichannel approach, seamlessly integrating online and offline experiences. Hamat's competitive edge will depend on its ability to cultivate a strong digital presence, offering intuitive online platforms and exploring innovative technologies like augmented reality to enhance product visualization and customer engagement, thereby bridging the digital-physical divide.

Innovative Manufacturing Techniques

The integration of advanced manufacturing techniques, like prefabricated plumbing systems, is a significant technological factor impacting the construction and plumbing industries. These methods are designed to cut down on installation time, minimize material waste, and reduce errors on-site. This is particularly beneficial for companies like Hamat, operating in an environment where labor shortages are a persistent challenge and the demand for quicker project completion is high.

Hamat has an opportunity to enhance its operational efficiency and product quality by exploring the adoption of these innovative techniques. This could involve directly incorporating them into their own manufacturing processes or forming strategic alliances with suppliers and contractors who already leverage such advancements. The potential benefits include greater consistency in product output, improved cost-effectiveness, and a more streamlined approach to delivering plumbing solutions.

The global construction market, a key sector for plumbing products, is increasingly embracing off-site construction and prefabrication. For instance, the global prefabrication construction market was valued at approximately $170 billion in 2023 and is projected to grow significantly in the coming years, with a compound annual growth rate (CAGR) estimated between 6% and 8% through 2030. This trend underscores the growing demand for manufacturing processes that offer speed, precision, and reduced on-site labor requirements.

- Reduced Installation Time: Prefabricated components can decrease on-site labor needs by up to 30-50%, accelerating project timelines.

- Material Waste Reduction: Factory-controlled environments and precise cutting can lower material waste by as much as 25%.

- Enhanced Quality Control: Off-site manufacturing allows for stricter quality checks, leading to fewer installation errors and improved product reliability.

- Addressing Labor Shortages: By shifting tasks to a controlled factory setting, companies can mitigate the impact of on-site skilled labor scarcity.

Material Science Innovations

Ongoing advancements in material science are significantly impacting the plumbing industry, with new, more durable, and sustainable materials continually emerging. These innovations offer alternatives to traditional materials like copper, with options such as PEX and PVG gaining traction due to their flexibility and corrosion resistance. For instance, the global PEX pipes market was valued at approximately USD 7.5 billion in 2023 and is projected to grow substantially through 2030, indicating strong adoption rates.

Hamat can leverage these material science breakthroughs to enhance its product offerings. By incorporating innovative materials like recycled plastics or advanced composites, the company can improve product longevity and reduce its environmental footprint. For example, the use of recycled materials in manufacturing can lead to cost savings; a 2024 report by the European Environment Agency highlighted that using recycled plastics can reduce manufacturing energy consumption by up to 70% compared to virgin materials.

The development of eco-friendly materials, such as glass foam aggregate, also presents opportunities for Hamat. These materials can offer superior insulation properties and a lower embodied carbon footprint. Staying informed about these evolving material technologies is crucial for Hamat to drive product innovation and meet its sustainability targets, potentially differentiating itself in a competitive market. The global market for sustainable building materials is expected to reach over USD 400 billion by 2027, underscoring the growing demand for environmentally conscious products.

Key material science innovations relevant to Hamat include:

- Development of advanced polymers: Offering greater flexibility, chemical resistance, and longer lifespans than traditional materials.

- Use of recycled and bio-based materials: Reducing environmental impact and potentially lowering production costs.

- Emergence of smart materials: Materials that can self-heal or change properties in response to environmental stimuli, enhancing product durability and functionality.

- Nanomaterials: Incorporation of nanoparticles to improve strength, antimicrobial properties, and surface characteristics of plumbing components.

The integration of smart technology in sanitary fittings is a major technological driver, with consumers increasingly seeking touchless, energy-efficient, and connected bathroom experiences. This trend is supported by the fact that over 60% of new homes in developed nations now incorporate smart home technology, creating a strong demand for advanced plumbing solutions.

Innovations in water-saving technologies are also paramount, driven by environmental concerns and regulations. Products like low-flow fixtures and smart sensor-activated faucets are gaining popularity, reflecting a broader societal shift towards sustainable water management practices.

The digital transformation of the home improvement sector means consumers heavily rely on online research and purchasing. Over 60% of consumers researched home improvement products online in 2024 before buying, highlighting the need for Hamat to maintain a strong digital presence and omnichannel strategy.

Advanced manufacturing techniques, such as prefabrication, are streamlining construction processes, reducing waste by up to 25% and installation time by 30-50%. This efficiency is crucial given labor shortages in the construction industry, making off-site construction a key trend with the global prefabrication market valued at approximately $170 billion in 2023.

Legal factors

Global water conservation regulations are intensifying, directly affecting sanitary fitting design and performance. For instance, California's updated water use objectives, effective January 1, 2025, mandate specific usage targets for water suppliers, which will likely boost consumer demand for low-flow fixtures. Hamat needs to ensure its product portfolio aligns with these increasingly stringent regional and national water efficiency standards to avoid penalties and maintain market appeal.

Hamat must strictly adhere to national and international building codes and construction standards, a crucial factor particularly when older buildings are upgraded with contemporary plumbing. These regulations often specify exact material requirements, installation techniques, and performance benchmarks for sanitary fittings, directly impacting product design and manufacturing. For instance, the Uniform Plumbing Code (UPC) sees regular revisions, demanding ongoing evaluation and adjustments to Hamat's product lines and production methods to maintain compliance and market relevance.

Hamat's sanitary fittings must comply with stringent safety and quality standards to protect consumers and guarantee product longevity. These regulations often dictate acceptable material composition, such as limits on lead content, and performance metrics like pressure resistance, ensuring hygienic operation. For instance, in the European Union, the Construction Products Regulation (CPR) and specific harmonized standards like EN 817 for faucets are critical for CE marking, a mandatory requirement for market access.

Adherence to these benchmarks is paramount for Hamat to build consumer trust and mitigate legal risks, including potential product recalls or lawsuits stemming from safety failures. In 2024, regulatory bodies globally continue to emphasize material safety, with ongoing scrutiny on heavy metals in plumbing components. Maintaining up-to-date certifications, such as WRAS approval in the UK or NSF certification in North America, is therefore vital for Hamat's ability to operate and compete effectively across various international markets.

International Trade Regulations and Agreements

Hamat's international trade operations are significantly influenced by a web of global regulations and agreements. For instance, changes in trade policies, such as the United States' imposition of tariffs on goods from various countries, can directly impact Hamat's cost structure for both sourcing materials and selling its products abroad. Navigating these evolving trade landscapes is essential for maintaining competitiveness and ensuring a robust supply chain.

Key factors impacting Hamat's global distribution include:

- Trade Agreements: Hamat must monitor and adapt to agreements like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or regional trade blocs, which can alter market access and duty rates.

- Tariffs and Quotas: The potential for increased import tariffs, as seen in recent trade disputes impacting global manufacturing, directly affects the landed cost of Hamat's products in key markets.

- Geopolitical Risks: Evolving geopolitical situations can lead to sudden trade restrictions or sanctions, necessitating agile adjustments to Hamat's distribution strategies and supplier diversification.

- Regulatory Compliance: Adherence to diverse import/export documentation requirements and product standards across different nations is critical to avoid delays and penalties.

Environmental Certifications and Green Building Mandates

Environmental certifications and green building mandates are increasingly shaping the construction industry, directly impacting plumbing product manufacturers like Hamat. These regulations often stipulate requirements for water efficiency, sustainable material sourcing, and the overall lifecycle impact of building components. For instance, the U.S. Green Building Council's LEED (Leadership in Energy and Environmental Design) certification, a widely recognized standard, often includes credits for water-efficient fixtures, which can directly influence demand for Hamat's products.

Hamat can leverage this trend by proactively developing and marketing plumbing solutions that meet or exceed these green building standards. Products achieving certifications like WaterSense in the United States or similar regional eco-labels can provide a significant competitive edge, attracting environmentally conscious consumers and large-scale developers committed to sustainable projects. The global green building market was valued at approximately $297.5 billion in 2023 and is projected to grow substantially, indicating a strong and expanding market for eco-friendly building materials.

- LEED Certification: Projects seeking LEED certification often prioritize water-saving plumbing fixtures, driving demand for efficient products.

- WaterSense Program: Products meeting the EPA's WaterSense criteria demonstrate water efficiency, appealing to environmentally aware buyers.

- Global Green Building Market Growth: The expanding green building sector, projected for significant growth through 2030, presents a lucrative opportunity for sustainable plumbing solutions.

- Lifecycle Impact: Mandates increasingly consider the environmental footprint of products throughout their lifespan, from manufacturing to disposal.

Hamat must navigate evolving international trade regulations and agreements, which significantly impact its global operations. For instance, the potential for increased tariffs, as seen in ongoing trade policy adjustments, can directly affect product costs and market competitiveness. Staying abreast of trade pacts, geopolitical shifts, and import/export compliance is crucial for maintaining a stable supply chain and market access.

Environmental factors

Consumers increasingly favor plumbing products that are sustainable and eco-friendly, a trend bolstered by government regulations. This growing preference translates into a significant market opportunity for companies like Hamat. For instance, the global green building market, which heavily influences demand for sustainable fixtures, was valued at over $300 billion in 2023 and is projected to grow substantially through 2030.

Hamat can tap into this demand by expanding its offerings to include water-saving fixtures, such as low-flow toilets and showerheads, and systems for greywater recycling. Products manufactured using recycled materials or rapidly renewable resources also resonate strongly with environmentally conscious buyers. This strategic pivot aligns with the broader societal movement towards greener lifestyles and construction methods, creating a competitive advantage.

Global concerns over water scarcity are intensifying, prompting a surge in water conservation initiatives worldwide. This translates into more rigorous water usage regulations and a growing incentive structure for adopting water-saving technologies. For instance, by 2025, several regions are projected to face severe water stress, impacting industries reliant on substantial water consumption.

These trends directly fuel demand for products designed to minimize water waste. Think smart faucets offering precise flow control or advanced leak detection systems. Hamat can leverage this by positioning its sanitary fittings as leaders in water efficiency, appealing to both eco-conscious consumers and regulatory compliance needs.

The construction sector's growing preference for recycled and renewable materials, driven by environmental concerns and circular economy principles, presents a significant opportunity. Materials such as recycled glass, plastic composites, and bamboo are gaining traction, with the global recycled construction materials market projected to reach $67.2 billion by 2027, growing at a CAGR of 5.8%.

Hamat can capitalize on this trend by integrating these sustainable materials into its sanitary fittings and packaging. This strategic move not only supports Hamat's sustainability objectives but also enhances its brand image, making it more attractive to the burgeoning green building sector, which is expected to account for 20-30% of new construction in major markets by 2025.

Energy Efficiency in Plumbing Systems

The push for energy efficiency in plumbing is gaining serious momentum. Beyond just saving water, consumers and regulators are increasingly focused on reducing the energy used to heat and move water. This trend is fueled by rising utility costs and government incentives aimed at promoting greener living. For instance, in 2024, the US Department of Energy's ENERGY STAR program continued to highlight water heaters that use at least 10% less energy than standard models, a key benchmark for efficiency.

Hamat can capitalize on this by innovating in areas like faucets that reach the desired temperature faster, thereby cutting down on wasted energy from running water. This not only aligns with environmental goals but also directly addresses consumer demand for lower utility bills. By developing products that contribute to a home's overall energy efficiency, Hamat can broaden its appeal and enhance the environmental credentials of its offerings.

- Growing Demand: Consumers and regulators are prioritizing plumbing systems that reduce energy consumption, driven by cost savings and environmental concerns.

- Technological Advancements: Innovations like tankless water heaters and smart flow optimization systems are becoming more prevalent.

- Hamat's Opportunity: Developing faucets that quickly deliver desired water temperatures can significantly contribute to home energy efficiency.

- Market Impact: In 2024, ENERGY STAR certified water heaters demonstrated significant energy savings, setting a benchmark for the industry.

Reducing Carbon Footprint of Manufacturing and Supply Chain

The construction industry faces growing demands to lower its carbon footprint, a trend that extends to manufacturers of sanitary fittings like Hamat. This pressure necessitates optimizing manufacturing processes to cut emissions, ensuring responsible material sourcing, and minimizing waste generation throughout the production cycle.

Hamat can bolster its environmental standing by adopting more sustainable production methods and investigating options for carbon-neutral shipping or prioritizing local material suppliers. For instance, the global construction sector's carbon emissions were estimated to be around 37% of total energy-related CO2 emissions in 2022, highlighting the significant impact of this industry.

- Industry Pressure: The construction sector, a key market for Hamat, is increasingly focused on reducing its environmental impact.

- Operational Improvements: Hamat can optimize manufacturing for lower emissions and explore sustainable logistics.

- Supply Chain Focus: Responsible sourcing of materials and waste reduction are critical components of this environmental strategy.

- Market Advantage: Demonstrating commitment to sustainability enhances corporate social responsibility and market appeal, especially as consumers and regulators prioritize eco-friendly products.

Environmental factors significantly influence consumer preferences and regulatory landscapes for plumbing products. Hamat can leverage the growing demand for sustainable and water-saving fixtures, driven by global water scarcity concerns and a push for greener construction practices. By integrating recycled materials and focusing on energy-efficient designs, Hamat can enhance its market position and appeal to environmentally conscious stakeholders.

PESTLE Analysis Data Sources

Our Hamat PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable international organizations, and leading industry research firms. This ensures that every aspect of the analysis, from political stability to technological advancements, is grounded in verified and current information.