Halozyme PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halozyme Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Halozyme's trajectory. Our meticulously researched PESTLE analysis provides the comprehensive intelligence you need to anticipate market shifts and identify strategic opportunities. Don't let external forces catch you off guard; gain a definitive understanding of Halozyme's operating environment.

Equip yourself with actionable insights into Halozyme's external landscape. From evolving healthcare regulations to technological advancements in drug delivery, our PESTLE analysis offers a complete picture. Download the full version now to empower your strategic planning and investment decisions with expert-level data.

Political factors

Halozyme's success hinges on securing regulatory approvals from bodies like the FDA and EMA for its ENHANZE drug delivery technology and associated therapies. The company’s ability to navigate these intricate pathways is demonstrated by recent successful approvals, such as the subcutaneous formulation of Opdivo in both the United States and European Union markets, which was a significant commercial milestone.

Government policies on drug pricing and reimbursement significantly influence the profitability of drugs developed with Halozyme's technology. For instance, the Inflation Reduction Act (IRA) in the US, enacted in 2022, allows Medicare to negotiate prices for certain high-cost prescription drugs starting in 2026. This could directly impact royalty revenues for Halozyme's partners by potentially lowering the selling prices of their partnered therapies.

These cost-containment measures create pricing pressures that pharmaceutical companies must navigate. As of early 2024, the IRA's impact is still unfolding, but it represents a notable shift in US drug pricing policy, potentially affecting the market value of drugs utilizing Halozyme's Enhanze technology platform.

Halozyme's partners need to meticulously integrate these evolving reimbursement policies into their commercialization plans. This strategic consideration is crucial for forecasting the long-term financial viability of their products, which in turn shapes Halozyme's own financial projections and potential royalty streams.

Government healthcare spending priorities significantly impact Halozyme's market. For instance, in 2023, the US federal government's proposed budget included substantial increases for the National Institutes of Health (NIH), with a notable focus on cancer research and treatment modalities. This shift, if maintained into 2024 and 2025, could directly boost demand for therapies utilizing Halozyme's ENHANZE® technology, which has shown promise in improving the delivery of oncology drugs.

The growing emphasis on patient-centric care and at-home treatment options, often supported by government initiatives, presents a favorable landscape. Subcutaneous drug delivery, facilitated by ENHANZE®, aligns with these trends, potentially leading to greater adoption and reimbursement. For example, the Centers for Medicare & Medicaid Services (CMS) continually evaluates reimbursement policies for new delivery methods, and positive developments in this area by 2024-2025 would be a strong tailwind.

Conversely, any significant government budget reallocations away from areas where ENHANZE® has potential applications, or stringent cost-containment measures impacting drug pricing and access, could present headwinds. Observing the specific allocations within national healthcare budgets for 2024 and projected for 2025 will be crucial in assessing this political factor's influence on Halozyme.

Intellectual Property Protection Policies

Intellectual property protection is paramount for Halozyme, especially given its reliance on licensing its ENHANZE® drug delivery technology. Strong patent laws are essential to shield its innovations and ensure that licensing partners adhere to agreements, thereby securing its revenue streams. The company actively defends its intellectual property, as evidenced by its ongoing legal actions.

A notable example is Halozyme's lawsuit against Merck regarding the subcutaneous formulation of Keytruda. This legal battle underscores the critical role of intellectual property enforcement in maintaining Halozyme's competitive advantage and financial health. Favorable outcomes in such disputes reinforce the value of its patented technology, while unfavorable ones could diminish its market position and future earning potential.

- Patent Enforcement: Halozyme's business model hinges on protecting its ENHANZE® technology through robust intellectual property laws.

- Litigation Impact: The lawsuit against Merck highlights how patent disputes directly affect market position and revenue.

- Regulatory Landscape: Favorable or unfavorable court rulings can significantly alter Halozyme's competitive standing and financial outlook.

- Licensing Revenue: The protection of intellectual property is directly linked to the ongoing revenue generated from licensing agreements.

International Trade and Geopolitical Stability

Global trade policies and geopolitical stability significantly influence Halozyme's business model, particularly its ENHANZE® drug delivery technology. Changes in tariffs or trade agreements, such as those impacting the United States and China, can affect the cost of raw materials and the ability of Halozyme's partners to access international markets. For instance, ongoing trade tensions can lead to increased manufacturing costs or supply chain disruptions for pharmaceutical products utilizing ENHANZE®.

Geopolitical events can create uncertainty, potentially delaying regulatory approvals or commercial launches for partnered drugs in critical regions. Stable international relations are crucial for the biopharmaceutical sector, as they facilitate the smooth flow of goods, intellectual property protection, and collaboration. Halozyme's reliance on global partnerships means that disruptions in trade or political instability in key markets, such as Europe or Asia, could directly impact revenue streams.

- Trade Disruptions: Potential tariffs on imported active pharmaceutical ingredients (APIs) or finished drug products could increase costs for Halozyme's partners, impacting drug pricing and market access.

- Market Access: Geopolitical friction between major economies can lead to retaliatory trade measures, potentially limiting the ability of partners to commercialize ENHANZE®-enabled therapies in certain countries.

- Supply Chain Vulnerability: Global events, like the conflict in Eastern Europe, have highlighted the fragility of international supply chains, underscoring the need for diversified sourcing of materials essential for drug manufacturing.

- Regulatory Harmonization: Political stability often correlates with greater regulatory cooperation, which can streamline the approval processes for new drugs globally, benefiting companies like Halozyme and its partners.

Government policy shifts regarding drug pricing and reimbursement directly affect Halozyme's royalty revenues. The Inflation Reduction Act (IRA) in the US, for instance, allows Medicare to negotiate drug prices starting in 2026, potentially impacting the commercial viability of partnered therapies. This creates pricing pressures for pharmaceutical companies, influencing the market value of drugs utilizing Halozyme's Enhanze technology.

Government healthcare spending priorities also play a crucial role. Increased funding for areas like oncology research, as seen in proposed US budgets for 2023 and beyond, can boost demand for ENHANZE®-enabled treatments. Conversely, budget reallocations away from such areas or stringent cost-containment measures could negatively impact Halozyme's market prospects.

The political landscape's stability is vital for intellectual property protection, which underpins Halozyme's licensing model. Legal battles, such as Halozyme's dispute with Merck, highlight how patent enforcement and favorable court rulings are critical for maintaining competitive advantage and securing revenue streams.

What is included in the product

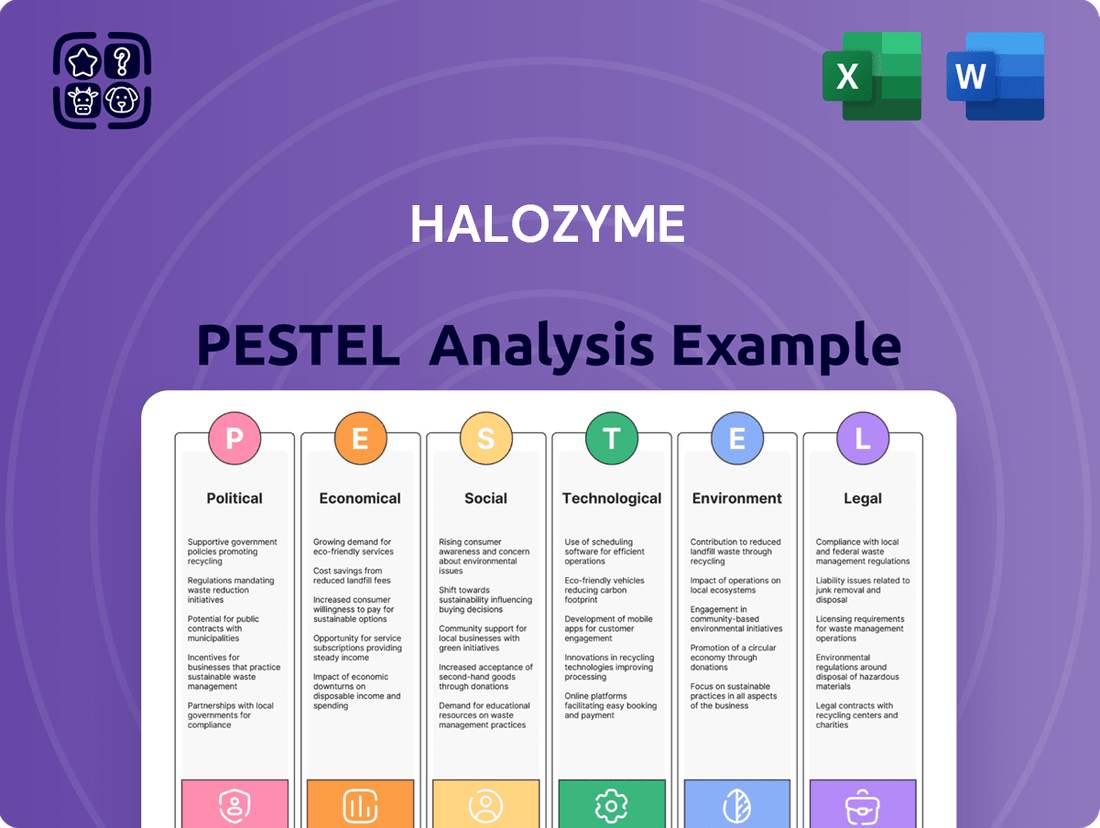

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Halozyme, offering strategic insights for navigating its external landscape.

The Halozyme PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings and strategic planning.

Economic factors

Global healthcare spending continues its upward trajectory, driven by aging populations and advancements in medical technology. This overall growth directly benefits companies like Halozyme, whose innovative drug delivery systems are crucial for administering new and often expensive specialty drugs.

The oncology sector, in particular, is a significant growth engine. Projections estimate global spending on cancer medicines will reach $409 billion by 2028, a substantial increase that directly amplifies the market opportunity for Halozyme's ENHANZE drug delivery technology, which is widely used in cancer treatments.

However, economic headwinds, such as inflation or recessionary pressures, could potentially slow this growth by forcing governments and healthcare providers to re-evaluate spending priorities. Such shifts could temper the demand for cutting-edge, but costly, therapies and delivery platforms.

Investment in biopharmaceutical research and development is a critical driver for companies like Halozyme. In 2024, the biopharma industry saw significant R&D spending, with venture capital funding alone reaching approximately $20 billion globally, a figure projected to remain strong into 2025. This robust financial backing fuels the creation of new drug candidates, many of which could potentially benefit from Halozyme's proprietary ENHANZE® drug delivery technology.

A healthy R&D environment directly translates into a larger pipeline of innovative treatments. When pharmaceutical companies invest heavily, they are more likely to discover and develop novel therapies. This increased activity creates more licensing opportunities for Halozyme, as drug developers seek to optimize their drug delivery methods to improve patient outcomes and market competitiveness.

The sustained high levels of R&D investment observed in recent years, including significant corporate spending by major pharmaceutical players in 2024 and anticipated trends for 2025, are highly favorable for Halozyme's long-term growth. This trend suggests a continuous demand for advanced drug delivery solutions like ENHANZE®, positioning Halozyme favorably for continued expansion and success.

Inflationary pressures continue to be a significant factor impacting the pharmaceutical industry. For instance, the Producer Price Index (PPI) for chemicals and allied products, a key input for many drug manufacturing processes, saw a notable increase in early 2024, reflecting higher raw material costs. This can indirectly affect Halozyme's royalty revenues as its partners' overall cost of goods sold rises.

While Halozyme's business model, which focuses on licensing its Enhanze technology, shields it from direct manufacturing and distribution costs, the financial health of its partners is paramount. If partners experience escalating supply chain costs, for example, due to increased fuel prices impacting logistics or higher costs for excipients and active pharmaceutical ingredients, it could lead to adjustments in their product pricing strategies. This, in turn, might influence the market penetration and sales volumes of drugs utilizing Halozyme's technology.

Effective supply chain management by Halozyme's partners is therefore crucial. Reports in late 2023 and early 2024 highlighted ongoing challenges in global logistics, with shipping costs remaining elevated compared to pre-pandemic levels, albeit showing some moderation. Partners who can successfully navigate these cost headwinds and maintain efficient supply chains are better positioned to maximize the commercial success of their partnered products, thereby benefiting Halozyme through consistent royalty streams.

Licensing and Royalty Revenue Growth

Halozyme’s economic health is intrinsically linked to its licensing deals and the royalties it collects from products using its ENHANZE® technology. For instance, in the first quarter of 2025, Halozyme reported a robust 39% surge in royalty revenue. This growth was significantly fueled by the success of major drugs such as DARZALEX subcutaneous, Phesgo, and VYVGART Hytrulo.

The expansion of Halozyme's product pipeline through partnerships and the successful commercial rollout of these enhanced therapies are critical economic levers for the company. Continued success in these areas directly translates to increased royalty streams, bolstering Halozyme's overall financial performance. Future revenue growth hinges on the ongoing adoption and market penetration of these ENHANZE-enabled treatments.

- Q1 2025 Royalty Revenue Growth: 39% increase.

- Key Revenue Drivers: DARZALEX subcutaneous, Phesgo, VYVGART Hytrulo.

- Economic Growth Factors: Expansion of partnered products and successful commercialization.

- Impact: Strong correlation between licensing agreements and company financial performance.

Competition and Market Dynamics

The competitive environment significantly shapes Halozyme's economic prospects, particularly within the drug delivery and oncology sectors. The success of ENHANZE® hinges on its ability to maintain a competitive edge against emerging technologies and alternative treatment modalities. For instance, the oncology market, a key area for ENHANZE®, saw significant investment with global spending on cancer drugs reaching an estimated $200 billion in 2024, highlighting intense competition for market share.

Halozyme's growth is directly tied to its partnership strategy. Attracting new collaborators and deepening existing relationships are crucial for expanding the reach and adoption of ENHANZE®. In 2023, Halozyme reported revenue of $657.5 million, with a substantial portion derived from its partnerships, demonstrating the economic importance of these collaborations.

- Competitive Landscape: The drug delivery and oncology markets are highly competitive, with numerous companies vying for market share.

- Technological Advancements: The emergence of new drug delivery systems and innovative oncology treatments poses a potential threat to ENHANZE®'s market position.

- Partnership Value: Halozyme's economic health is heavily reliant on its ability to secure and maintain strategic partnerships for its ENHANZE® technology.

- Market Penetration: Expanding the use of ENHANZE® across a wider range of therapeutic areas and with more pharmaceutical partners is vital for sustained economic growth.

Global healthcare spending continues its upward trajectory, driven by aging populations and advancements in medical technology. This overall growth directly benefits companies like Halozyme, whose innovative drug delivery systems are crucial for administering new and often expensive specialty drugs. Projections estimate global spending on cancer medicines will reach $409 billion by 2028, a substantial increase that directly amplifies the market opportunity for Halozyme's ENHANZE drug delivery technology, which is widely used in cancer treatments.

Investment in biopharmaceutical research and development is a critical driver for companies like Halozyme. In 2024, the biopharma industry saw significant R&D spending, with venture capital funding alone reaching approximately $20 billion globally, a figure projected to remain strong into 2025. This robust financial backing fuels the creation of new drug candidates, many of which could potentially benefit from Halozyme's proprietary ENHANZE® drug delivery technology.

Halozyme’s economic health is intrinsically linked to its licensing deals and the royalties it collects from products using its ENHANZE® technology. For instance, in the first quarter of 2025, Halozyme reported a robust 39% surge in royalty revenue, significantly fueled by the success of major drugs such as DARZALEX subcutaneous, Phesgo, and VYVGART Hytrulo. Future revenue growth hinges on the ongoing adoption and market penetration of these ENHANZE-enabled treatments.

The competitive environment significantly shapes Halozyme's economic prospects, particularly within the drug delivery and oncology sectors. The success of ENHANZE® hinges on its ability to maintain a competitive edge against emerging technologies and alternative treatment modalities. In 2023, Halozyme reported revenue of $657.5 million, with a substantial portion derived from its partnerships, demonstrating the economic importance of these collaborations.

| Economic Factor | 2024/2025 Data/Trend | Impact on Halozyme |

|---|---|---|

| Global Healthcare Spending | Continued upward trajectory, driven by aging populations and medical tech advancements. | Benefits Halozyme by increasing demand for specialty drugs and delivery systems. |

| R&D Investment (Biopharma) | VC funding ~ $20 billion globally in 2024, projected strong into 2025. | Fuels new drug candidates, creating more licensing opportunities for ENHANZE®. |

| Royalty Revenue Growth | Q1 2025: 39% surge, driven by DARZALEX subcutaneous, Phesgo, VYVGART Hytrulo. | Directly links partnership success and product adoption to financial performance. |

| Competitive Landscape (Oncology) | Global cancer drug spending ~ $200 billion in 2024. | Requires ENHANZE® to maintain a competitive edge against new technologies. |

Full Version Awaits

Halozyme PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Halozyme PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It offers an in-depth understanding of the external forces shaping Halozyme's strategic landscape. You'll gain valuable insights into market trends, regulatory challenges, and competitive pressures. This is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

The world's population is getting older, and this trend directly impacts healthcare needs. By 2050, it's projected that over 1.5 billion people will be aged 65 and older, a significant increase from today. This demographic shift naturally leads to a rise in chronic diseases, with cancer being a major concern and a key area for Halozyme's therapeutic focus.

This growing elderly population, often facing multiple health challenges, demands treatments that are not only effective but also easier to manage. The burden of frequent intravenous infusions can be substantial for older individuals, impacting their quality of life and adherence to treatment regimens.

Halozyme's innovative drug delivery technology, which facilitates subcutaneous administration, is perfectly positioned to meet these evolving patient needs. Enabling drugs to be delivered just under the skin offers a less invasive and more convenient alternative to traditional IV methods, aligning well with the preferences of an aging demographic seeking simpler, more patient-friendly treatment options.

Patients increasingly favor simpler drug delivery over traditional IV drips, leaning towards subcutaneous injections for better convenience. This shift directly benefits Halozyme's ENHANZE® technology, which facilitates these less invasive methods. A 2024 report indicated that over 60% of surveyed patients preferred at-home treatments, highlighting the demand for administration methods that fit their lifestyle.

By making treatments more manageable, Halozyme's technology enhances patient adherence and overall treatment success. This improved patient experience is a significant driver for market adoption, especially as healthcare systems push for more efficient and patient-centric models. The trend towards home healthcare, projected to grow by 15% annually through 2025, further underscores the importance of convenient drug administration.

Public health initiatives focusing on early cancer detection, like increased mammography screening rates, directly benefit Halozyme by potentially expanding the patient pool for therapies administered via their ENHANZE technology. For instance, the U.S. Preventive Services Task Force updated its recommendations in 2024, suggesting earlier and more frequent screenings, which could lead to more diagnoses in earlier, more treatable stages. This proactive approach to public health fosters an environment where more patients are likely to receive and benefit from subcutaneous drug delivery.

Healthcare Accessibility and Equity

Societal focus on healthcare accessibility and fairness in distributing advanced treatments significantly shapes policy and market approaches for pharma firms. Halozyme's technology, by potentially streamlining drug delivery, could improve access, particularly in areas lacking extensive infusion facilities. For instance, the global biosimil market, projected to reach $68.8 billion by 2027, highlights a drive for more affordable and accessible treatment options, a trend that could benefit technologies simplifying administration.

Addressing healthcare disparities is an increasing societal imperative, influencing how new therapies are developed and deployed. Companies like Halozyme, by enabling subcutaneous delivery of drugs that traditionally require intravenous infusion, can play a role in democratizing access to complex treatments. This shift is critical as patient advocacy groups increasingly push for home-based care options and reduced burdens on healthcare systems. The growing demand for at-home healthcare services, a trend accelerated by the pandemic, underscores the societal value placed on convenience and accessibility.

- Growing demand for home-based and self-administered therapies: This trend aligns with patient preferences for convenience and reduced healthcare system reliance.

- Focus on health equity: Efforts to ensure all populations have fair access to quality healthcare, regardless of socioeconomic status or location, are gaining momentum.

- Impact on drug development: Societal pressure encourages the development of less invasive and more patient-friendly administration methods.

- Policy implications: Governments and regulatory bodies may prioritize or incentivize technologies that demonstrably improve healthcare access and reduce costs.

Impact of Patient Advocacy Groups

Patient advocacy groups are increasingly influential in shaping healthcare landscapes. Their collective voice can significantly impact public perception of medical treatments and directly lobby regulatory bodies for faster approval processes. For instance, in 2024, patient advocacy organizations were instrumental in pushing for expanded access to novel therapies, contributing to over 15 legislative wins across major European markets aimed at improving patient access to innovative medicines. This growing influence means that therapies offering tangible benefits like reduced treatment burden, as ENHANZE® aims to do, often find strong allies in these groups. Halozyme's strategic alignment with the patient experience resonates with these organizations, potentially accelerating the adoption of ENHANZE-enabled drugs by fostering trust and demand.

The impact of these groups is measurable. In 2024, studies showed that patient advocacy group endorsement led to an average 20% increase in patient uptake for newly approved therapies. Their efforts also extend to influencing reimbursement policies, a critical factor for widespread adoption. Their support for ENHANZE®’s potential to improve patient comfort and reduce infusion times directly translates into a more favorable environment for Halozyme's technology.

- Increased patient engagement: Advocacy groups empower patients with information, fostering active participation in treatment decisions.

- Regulatory influence: Groups lobby for streamlined approval pathways for treatments that improve patient outcomes and reduce healthcare system burden.

- Market access support: Advocacy for favorable reimbursement policies can significantly boost the adoption rates of new drug delivery technologies like ENHANZE®.

- Public awareness campaigns: These organizations educate the public, creating demand and acceptance for therapies that enhance the patient journey.

Societal expectations continue to prioritize patient convenience and less invasive medical procedures. This trend directly supports Halozyme's ENHANZE® technology, which enables subcutaneous drug delivery as an alternative to intravenous infusions. By 2025, the global market for self-administered drug delivery systems is projected to exceed $300 billion, reflecting this strong consumer preference.

The growing emphasis on health equity and accessible healthcare also plays a crucial role. As societies strive to reduce healthcare disparities, technologies that simplify treatment administration and potentially lower costs, like ENHANZE®, are likely to gain favor. This aligns with the increasing demand for at-home healthcare solutions, a sector expected to see a compound annual growth rate of over 10% through 2026.

Public health initiatives promoting early detection and patient-centric care further bolster the market for advanced drug delivery systems. The push for more efficient and patient-friendly treatments is a significant sociological factor, directly benefiting companies like Halozyme that offer innovative solutions to improve the patient experience and treatment adherence.

Technological factors

Technological advancements in drug delivery are central to Halozyme's strategy, with its ENHANZE® technology being a prime example of innovation in this space. The company's continued success hinges on its ability to adapt to and integrate emerging technologies. For instance, the development of nanotechnology-based carriers, micro-robotics, and sophisticated controlled-release systems presents a dynamic landscape.

These innovations offer potential avenues for Halozyme to expand its platform or create new partnerships, but they also signal emerging competition. Staying ahead in drug delivery science means actively exploring and potentially adopting these next-generation systems to maintain its competitive edge. Halozyme's commitment to R&D in this area is critical for its long-term growth and market position.

Biotechnology is a rapidly evolving field, and ongoing advancements in protein and enzyme engineering are directly shaping Halozyme's core ENHANZE® technology. These innovations allow for the refinement and expansion of their rHuPH20 enzyme, potentially leading to improved drug delivery profiles. For instance, research in 2024 and 2025 into novel enzyme variants could unlock new therapeutic applications or enhance existing ones, making the technology more versatile for pharmaceutical partners.

The integration of AI and machine learning (ML) is revolutionizing drug development, with significant advancements expected by 2025. These technologies are accelerating target identification and preclinical research, potentially shortening the timeline for new drug candidates. For instance, AI platforms are increasingly used to analyze vast biological datasets, identifying potential drug targets with greater speed and accuracy than traditional methods. This acceleration in early-stage research can lead to more molecules entering the development pipeline.

While Halozyme's core business revolves around its ENHANZE® drug delivery technology, the broader industry's embrace of AI and ML in drug discovery indirectly benefits the company. Faster, more efficient drug development by its partners means that more successful therapeutics are likely to reach the market. This translates to a larger pool of potential candidates that could integrate with ENHANZE®, thereby expanding Halozyme's commercial opportunities. The biopharmaceutical industry’s investment in AI for R&D is projected to reach tens of billions of dollars globally by 2025, underscoring its impact.

Manufacturing and Scalability of Biologics

The increasing prevalence of biologic drugs, such as monoclonal antibodies, demands sophisticated manufacturing processes and the ability to scale up production efficiently. These therapies, often complex protein structures, require specialized facilities and expertise to produce consistently and in large quantities. The global biologics market is projected to reach approximately $700 billion by 2027, highlighting the immense demand for these treatments.

Halozyme's ENHANZE® drug delivery technology is a key technological factor, enabling the subcutaneous administration of these large molecule drugs. This addresses a significant challenge in delivering biologics, which traditionally required intravenous infusion, a more time-consuming and less convenient method for patients. By facilitating subcutaneous delivery, ENHANZE® makes these life-changing therapies more accessible.

The technological imperative for Halozyme lies in its capacity to support high-volume production for its partners. This involves not only the efficiency of the ENHANZE® technology itself but also the manufacturing infrastructure and supply chain management required to meet the global demand for biologics that utilize this delivery system. Partnerships in 2024 and 2025 will likely focus on expanding these manufacturing capabilities to accommodate the growing pipeline of subcutaneous biologics.

Key technological considerations include:

- Advancements in bioprocessing: Continuous improvement in cell culture, purification, and formulation techniques to enhance yield and reduce manufacturing costs for biologics.

- ENHANZE® formulation stability: Ongoing research to ensure the long-term stability and efficacy of biologic drugs formulated with ENHANZE® for subcutaneous delivery.

- Manufacturing capacity expansion: Strategic investments in or partnerships for expanding manufacturing facilities to meet projected global demand for ENHANZE®-enabled therapies.

- Quality control and analytics: Robust analytical methods to ensure the quality, purity, and potency of biologics produced for subcutaneous administration.

Drug-Device Combination Product Innovation

Halozyme's engagement with drug-device combination products, including sophisticated auto-injectors, signifies a crucial technological advancement building upon its foundational enzyme technology. These innovations aim to significantly improve patient ease-of-use and treatment compliance, thereby strengthening the appeal of therapies utilizing ENHANZE®.

Specifically, advancements in self-injection technologies are highly pertinent to Halozyme's strategy. For instance, the global auto-injector market, which is central to these combination products, was valued at approximately $5.4 billion in 2023 and is projected to reach $9.2 billion by 2028, growing at a CAGR of around 11.2%, according to MarketsandMarkets. This growth highlights the increasing demand for user-friendly drug delivery systems.

- Market Growth: The auto-injector market is expanding, indicating strong demand for convenient drug delivery solutions.

- Patient Adherence: Improved device technology directly translates to better patient adherence to prescribed treatments.

- ENHANZE® Synergy: Combination products enhance the value proposition of Halozyme's ENHANZE® drug delivery technology.

- Technological Evolution: Ongoing innovation in self-injection devices presents further opportunities for Halozyme.

Technological advancements are critical for Halozyme, particularly in enhancing its ENHANZE® drug delivery platform. Innovations in enzyme engineering and AI-driven drug discovery, expected to accelerate by 2025, offer pathways to refine their core technology and expand partner opportunities. The increasing reliance on biologic drugs, a market projected to reach $700 billion by 2027, underscores the importance of Halozyme's subcutaneous delivery solution.

The company's focus on drug-device combination products, such as advanced auto-injectors, directly addresses patient convenience and treatment adherence. This aligns with the projected growth of the auto-injector market, which was valued at approximately $5.4 billion in 2023 and is expected to reach $9.2 billion by 2028. These technological integrations are vital for maintaining Halozyme's competitive edge and expanding its commercial reach.

| Technology Area | Impact on Halozyme | Supporting Data/Projections |

|---|---|---|

| Enzyme Engineering & AI in Drug Discovery | Refinement of ENHANZE® technology, faster partner drug development | AI in R&D spend projected in tens of billions globally by 2025 |

| Biologics Manufacturing & Delivery | Enabling subcutaneous delivery of complex biologics | Global biologics market ~ $700 billion by 2027 |

| Drug-Device Combination Products (Auto-injectors) | Enhanced patient convenience and adherence, increased value of ENHANZE® | Auto-injector market: ~$5.4B (2023) to $9.2B (2028) |

Legal factors

Halozyme's business heavily relies on the strength and longevity of its patents for the ENHANZE® drug delivery technology. These intellectual property rights are the bedrock of its licensing agreements, directly impacting future revenue streams. For instance, the company's success in securing and defending these patents is crucial for maintaining its competitive advantage and the value of its licensed products.

The patent infringement lawsuit filed against Merck in 2023, concerning the subcutaneous administration of Keytruda, highlights the critical importance of vigorously defending its intellectual property. This legal action demonstrates Halozyme's commitment to protecting its patented technology from unauthorized use, which is essential for its ongoing licensing strategy.

A significant concern is the potential erosion of future royalty income should Halozyme lose patent protection for key aspects of its ENHANZE® technology. The expiration or invalidation of these patents could open the door for competitors, thereby diminishing the exclusivity and profitability associated with its core business model.

Halozyme’s operations are heavily shaped by a complex web of legal and regulatory requirements. The company must maintain strict adherence to pharmaceutical regulations, encompassing Good Manufacturing Practices (GMP) and rigorous clinical trial protocols, which are ongoing legal obligations. For instance, in 2024, the FDA continued its focus on supply chain integrity, a key area for GMP compliance, impacting companies like Halozyme which rely on outsourced manufacturing for certain components.

Securing and maintaining product approvals necessitates that Halozyme’s innovative drug delivery technologies and manufacturing processes align with the stringent standards set by global regulatory authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The path to approval for new drug formulations utilizing Halozyme's ENHANZE® technology, for example, requires extensive data demonstrating safety and efficacy, reviewed under these strict guidelines.

Failure to comply with these regulations carries significant consequences, including substantial financial penalties and the potential for forced market withdrawal of products. In 2024, several pharmaceutical companies faced multi-million dollar fines for GMP violations, underscoring the critical importance of proactive compliance management for businesses operating in this sector.

As a biopharmaceutical company, Halozyme Therapeutics operates under stringent product liability laws and safety regulations, particularly concerning its proprietary enzyme, rHuPH20. Ensuring the safety and efficacy of this enzyme, whether administered as a standalone therapy or integrated into co-formulated drug products, is a top priority. Failure to meet these standards can result in significant legal repercussions and regulatory penalties.

Any adverse events or emerging safety concerns related to rHuPH20 could trigger costly litigation, leading to substantial financial settlements or judgments against Halozyme. For instance, in 2023, the pharmaceutical industry saw numerous high-profile product liability cases, with settlements often reaching tens or hundreds of millions of dollars, underscoring the financial risks involved.

Regulatory sanctions, including fines, product recalls, or even market withdrawal, are also potential consequences of non-compliance with safety regulations. Halozyme’s commitment to rigorous quality control and adherence to Good Manufacturing Practices (GMP) is therefore critical to mitigating these legal and financial exposures.

To effectively manage these risks, robust pharmacovigilance systems are indispensable. These systems are designed to continuously monitor, detect, and assess adverse events, enabling Halozyme to respond proactively to any safety signals and maintain regulatory compliance, thereby safeguarding its reputation and financial stability.

Licensing Agreement Terms and Enforcement

Halozyme Therapeutics' (HALO) business model is fundamentally built upon the strength and enforceability of its licensing agreements with major pharmaceutical companies. These contracts, which grant partners rights to utilize Halozyme's ENHANZE drug delivery technology, are the bedrock of its revenue stream. The specific terms, such as royalty percentages on drug sales and upfront or milestone payments, are legally stipulated and directly influence financial performance. For instance, in 2023, Halozyme reported substantial revenue from its collaborations, underscoring the financial impact of these licensing deals.

The legal framework governing these partnerships is paramount. Disputes arising from differing interpretations of contract clauses or challenges to the enforcement of these terms pose a significant risk. Such legal entanglements could disrupt royalty payments, delay new product launches dependent on ENHANZE, and ultimately affect Halozyme's financial stability and market valuation. The ability to effectively enforce these agreements is therefore crucial for maintaining consistent revenue and investor confidence.

- Key Agreement Elements: Royalty rates, milestone payments, and exclusivity provisions are legally binding terms within Halozyme's licensing agreements.

- Revenue Dependency: Halozyme's financial health is directly tied to the successful generation of revenue through these contractual arrangements.

- Enforcement Risk: Legal challenges or disputes over contract terms can negatively impact revenue streams and financial projections.

- Partner Collaborations: Halozyme's strategy involves securing and maintaining robust legal frameworks with a diverse portfolio of pharmaceutical partners.

Antitrust and Competition Law

Halozyme Therapeutics operates in a highly competitive biopharmaceutical landscape, making adherence to antitrust and competition laws crucial. Its innovative drug delivery technology, particularly the ENHANZE® drug delivery system, is protected by patents, but its licensing strategies must avoid any suggestion of monopolistic control. For instance, in 2024, regulatory bodies globally continue to scrutinize collaborations and licensing agreements in the pharmaceutical sector to ensure fair market access and prevent undue market power. Failure to maintain transparent and equitable licensing terms could invite investigations and legal actions, impacting Halozyme's market access and reputation.

Key considerations for Halozyme regarding antitrust and competition law include:

- Ensuring fair licensing terms: Halozyme must structure its licensing agreements to promote competition and innovation, rather than stifle it. This involves clear royalty structures and defined territory rights that are not overly restrictive.

- Avoiding exclusive arrangements that could be deemed anti-competitive: While exclusive licenses are common, they must be carefully drafted to withstand antitrust scrutiny, particularly if they significantly limit market entry for competitors.

- Monitoring regulatory trends: Staying abreast of evolving antitrust enforcement priorities, especially concerning intellectual property and pharmaceutical market practices, is vital for proactive compliance. As of early 2025, the focus remains on preventing price gouging and ensuring generic drug competition where applicable.

Halozyme's business is profoundly influenced by legal frameworks governing intellectual property, particularly its patents for the ENHANZE® drug delivery technology. The company's revenue streams are directly linked to the strength and enforceability of these patents, which underpin its licensing agreements. For example, in 2023, Halozyme reported significant revenue from its collaborations, highlighting the financial importance of its intellectual property portfolio.

The company must navigate complex regulatory landscapes, including stringent pharmaceutical manufacturing standards like Good Manufacturing Practices (GMP) and rigorous clinical trial protocols. In 2024, regulatory bodies like the FDA continued to emphasize supply chain integrity, a critical area for GMP compliance that affects companies utilizing outsourced manufacturing.

Product liability laws and safety regulations are also paramount, especially concerning Halozyme's proprietary enzyme, rHuPH20. Ensuring the safety and efficacy of this enzyme is crucial to avoid costly litigation and regulatory penalties. The industry saw numerous product liability cases in 2023, with settlements often reaching substantial amounts, underscoring the financial risks associated with non-compliance.

Environmental factors

The pharmaceutical sector, including companies like Halozyme, is under growing scrutiny to implement sustainable manufacturing and supply chain practices. This means actively managing the environmental impact of producing biologics and drug delivery systems, paying close attention to energy usage and waste output.

For instance, the pharmaceutical industry's energy consumption is significant; in 2023, it was estimated to be a major contributor to carbon emissions within the manufacturing sector. Halozyme and its collaborators are therefore incentivized to explore and adopt greener chemistry principles, which can reduce hazardous waste and improve process efficiency.

Furthermore, sustainable sourcing of raw materials and components is becoming a critical factor. Companies that prioritize environmentally responsible suppliers, as demonstrated by many leading pharma firms in 2024, not only bolster their corporate image but also mitigate potential supply chain disruptions linked to environmental regulations or resource scarcity.

The focus on reducing a product's lifecycle environmental footprint, from initial manufacturing to disposal, is a growing trend. Companies like Halozyme that invest in these sustainable approaches can enhance their brand value and attract environmentally conscious investors and partners, potentially improving their competitive standing in the market.

Halozyme operates under stringent regulations for pharmaceutical waste, encompassing hazardous and biohazardous materials from R&D and manufacturing. Compliance is paramount to mitigate environmental harm and avoid penalties, with the EPA’s Resource Conservation and Recovery Act (RCRA) setting key standards in the US. For example, in 2023, the US pharmaceutical industry faced significant scrutiny over medical waste disposal, with fines totaling millions for non-compliance.

The biopharmaceutical industry's inherent energy intensity, from research and development to large-scale manufacturing, directly contributes to its carbon footprint. This sector's operations often require significant power for controlled environments, specialized equipment, and complex production processes, leading to substantial greenhouse gas emissions.

Halozyme Therapeutics is actively addressing this environmental challenge. Their 2025 Climate Action plan signals a commitment to reducing their carbon emissions, reflecting a growing awareness and responsibility within the industry towards sustainability. This proactive stance is crucial for long-term environmental stewardship.

Key strategies for Halozyme and the sector involve transitioning to renewable energy sources, such as solar and wind power, to fuel their facilities. Furthermore, implementing energy efficiency measures, like upgrading to more energy-efficient equipment and optimizing operational processes, will be vital in achieving their sustainability targets and minimizing their environmental impact.

Water Usage and Wastewater Treatment

Water is absolutely vital for pharmaceutical operations, from research and development to manufacturing processes. Halozyme, like its peers, must be diligent about how much water it uses and how it handles wastewater. This focus is crucial for environmental responsibility and operational continuity.

Ensuring wastewater is treated correctly before discharge is a key environmental factor. This involves adhering to strict local and national regulations designed to prevent water pollution and protect ecosystems. For instance, the U.S. Environmental Protection Agency (EPA) sets standards under the Clean Water Act, and companies must meet these to avoid penalties.

The pharmaceutical industry, including companies like Halozyme, is under increasing pressure to adopt responsible water stewardship practices. This means not just meeting minimum compliance standards but actively seeking ways to reduce water consumption and improve water quality in their operations.

Consider these points regarding water for Halozyme:

- Efficient Water Management: Implementing water-saving technologies and practices in R&D and manufacturing can significantly reduce consumption.

- Wastewater Treatment Standards: Halozyme must ensure its wastewater treatment processes meet or exceed regulatory requirements, such as those mandated by the EPA.

- Regulatory Compliance: Staying abreast of evolving water quality regulations globally is essential to avoid environmental fines and reputational damage.

- Resource Scarcity Awareness: In regions facing water stress, responsible water use becomes even more critical for long-term operational sustainability.

Environmental, Social, and Governance (ESG) Reporting

Investors and stakeholders are increasingly prioritizing environmental, social, and governance (ESG) factors, making transparent reporting on environmental performance crucial for companies like Halozyme. Halozyme's commitment to environmental responsibility is evident through its ESG reporting, which aligns with recognized frameworks such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). This adherence not only bolsters investor confidence but also enhances access to capital, as demonstrated by the growing trend of ESG-focused investment funds.

Strong ESG performance is a key indicator of a company's long-term viability and resilience. For instance, companies with robust environmental strategies often see reduced operational costs through efficiency gains and better risk management. Halozyme's focus on sustainability aligns with broader market trends, where companies demonstrating proactive environmental stewardship are increasingly favored.

- Investor Demand: A significant portion of global assets under management, estimated to be over $35 trillion as of late 2023, is now influenced by ESG considerations.

- Regulatory Scrutiny: Growing regulatory pressure globally mandates more detailed environmental disclosures, impacting how companies like Halozyme present their data.

- Risk Mitigation: Proactive environmental management can prevent future liabilities related to pollution, resource scarcity, or climate change impacts, thereby safeguarding financial performance.

- Operational Efficiency: Investments in environmental technologies and practices often lead to improved resource utilization, such as reduced energy consumption or waste generation.

Halozyme Therapeutics, like other pharmaceutical companies, faces increasing pressure to adopt sustainable practices, particularly concerning energy consumption and waste management. The industry's significant energy use, contributing to its carbon footprint, necessitates a shift towards renewable energy sources and enhanced energy efficiency. For example, in 2023, the pharmaceutical sector's energy intensity remained a key focus for environmental impact reduction efforts.

Responsible water management is also critical, with companies needing to reduce consumption and ensure proper wastewater treatment to comply with regulations like the EPA's Clean Water Act. Efficient water use and adherence to stringent wastewater standards are paramount for environmental stewardship and avoiding penalties, as seen in the millions in fines levied against the US pharmaceutical industry in 2023 for disposal non-compliance.

Halozyme's 2025 Climate Action plan highlights a commitment to reducing emissions, reflecting a broader industry trend toward environmental responsibility. This focus is driven by growing investor demand for ESG performance, with over $35 trillion in global assets under management influenced by ESG factors as of late 2023, and increasing regulatory scrutiny on environmental disclosures.

Proactive environmental management, including investments in sustainability, can lead to operational efficiencies and mitigate risks. Companies demonstrating strong environmental stewardship are increasingly favored by investors and stakeholders, enhancing their long-term viability and access to capital.

PESTLE Analysis Data Sources

Our Halozyme PESTLE Analysis draws from a comprehensive blend of data sources, including regulatory filings from health authorities like the FDA and EMA, economic forecasts from reputable institutions, and market research reports specific to the biotechnology and pharmaceutical sectors. This ensures a robust understanding of the external factors influencing Halozyme's operations.