Halozyme Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halozyme Bundle

Unlock the strategic potential of Halozyme's product portfolio with a glance at its BCG Matrix. This powerful framework categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a crucial snapshot of market performance and potential. Imagine knowing precisely which innovations are poised for explosive growth and which are quietly generating consistent revenue.

Don't let this limited view hold back your strategic planning. Dive deeper into Halozyme's BCG Matrix to gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

VYVGART Hytrulo, powered by Halozyme's ENHANZE technology, is experiencing robust growth in treating conditions such as generalized myasthenia gravis (gMG) and chronic inflammatory demyelinating polyneuropathy (CIDP). This product's increasing market acceptance is a significant factor in its success.

The company anticipates substantial royalty income from VYVGART Hytrulo in 2025, highlighting its role as a primary revenue generator. This financial projection underscores the product's strong market performance and future potential.

Furthermore, the subcutaneous administration enabled by ENHANZE significantly improves patient convenience and experience. This user-friendly aspect is a key driver of its expanding market penetration.

DARZALEX SC, enhanced by ENHANZE technology, is a powerhouse in the multiple myeloma market. Its subcutaneous formulation has captured a leading share in the U.S. and shows robust global sales momentum. This means it’s a major contributor to Halozyme’s royalty income.

The product’s strong performance is further solidified by its established presence and ongoing expansion within Europe. With patent protection providing a crucial safeguard, DARZALEX SC is positioned as a consistently high-performing asset for Halozyme. For instance, in 2023, Halozyme reported significant royalty revenue growth driven by key partnerships, with subcutaneous daratumumab being a primary driver.

Phesgo, a subcutaneous formulation of pertuzumab and trastuzumab utilizing Halozyme's ENHANZE technology, has demonstrated impressive growth. In 2023, Phesgo sales reached $180 million, a significant increase from the previous year, showcasing strong market penetration. This success is driven by its convenience and efficacy in treating HER2-positive breast cancer.

The widespread adoption of Phesgo, particularly its subcutaneous administration, has solidified its position in the oncology market. This innovation offers patients a less invasive treatment option compared to traditional intravenous infusions, contributing to its rapid uptake. Halozyme's royalty revenue from Phesgo is expected to continue its upward trajectory.

Tecentriq Hybreza with ENHANZE (Emerging Star)

Tecentriq Hybreza, powered by Halozyme's ENHANZE technology, recently secured approvals in both the U.S. and EU. This signifies its transition from development to the early phases of commercialization. While its direct impact on Halozyme's 2024 financials will be minimal, its market entry, especially in the competitive oncology space for conditions like triple-negative breast cancer, sets a strong foundation for future growth. Analysts project significant revenue contributions from 2026 onwards, positioning it as a key emerging Star in Halozyme's portfolio.

The drug's potential is amplified by its application in a high-growth oncology segment. For instance, the global triple-negative breast cancer market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030. Early patient uptake and successful navigation of further regulatory pathways will be critical in confirming Tecentriq Hybreza's trajectory towards becoming a dominant player and solidifying its Star status.

- Early Commercialization: Tecentriq Hybreza, utilizing ENHANZE, has recently gained U.S. and EU approval, marking its initial market presence.

- Future Growth Driver: Expected to significantly contribute to Halozyme's revenue from 2026, it is poised to become a key growth engine.

- Oncology Market Entry: Targeting indications like triple-negative breast cancer places it within a robust and expanding oncology sector.

- Potential Star Status: Positive initial uptake and successful regulatory milestones are anticipated to elevate its position to a future Star.

Opdivo Qvantig with ENHANZE (Emerging Star)

Opdivo Qvantig, a subcutaneous formulation of nivolumab leveraging Halozyme's ENHANZE technology, has secured U.S. approval and is under review in the European Union for a range of solid tumors, including non-small cell lung cancer.

This represents a significant advancement, offering a potentially more convenient administration route for patients. The oncology market, particularly for checkpoint inhibitors, is experiencing robust growth, with global sales of PD-1/PD-L1 inhibitors projected to reach over $60 billion by 2025.

While Opdivo Qvantig is in its nascent stages of commercialization, its connection to a well-established and highly effective therapy positions it for substantial future growth. Early adoption and successful expansion into new indications will be crucial for its trajectory.

- Market Potential: The oncology market for immunotherapy continues its rapid expansion.

- Technological Advantage: ENHANZE technology offers a distinct patient convenience benefit.

- Regulatory Progress: U.S. approval and EU filing signal strong commercialization prospects.

- Growth Drivers: Expanded indications and successful market penetration are key to its Star status.

Tecentriq Hybreza, recently approved in the U.S. and EU, is poised to become a significant future revenue driver for Halozyme. Its entry into the growing oncology market, specifically for indications like triple-negative breast cancer, positions it as a strong contender for Star status. Analysts project substantial contributions from 2026 onwards, with the global triple-negative breast cancer market valued at approximately USD 2.5 billion in 2023 and expected to grow at a CAGR exceeding 7% through 2030.

Opdivo Qvantig, leveraging ENHANZE technology, has received U.S. approval and is under review in the EU for various solid tumors, including non-small cell lung cancer. This product benefits from the robust growth in the immunotherapy market, with global sales of PD-1/PD-L1 inhibitors projected to surpass $60 billion by 2025. Its early-stage commercialization and potential for expanded indications signal a promising future for this asset.

These products, while in their early commercial stages, represent significant future growth opportunities for Halozyme. Their strategic positioning within expanding therapeutic areas and their reliance on the proven ENHANZE technology are key indicators of their potential to achieve Star status within the company's portfolio.

| Product | Technology | Status | Key Market | 2023 Revenue Contribution (Halozyme Royalties) | Projected Impact |

| Tecentriq Hybreza | ENHANZE | Early Commercialization | Triple-Negative Breast Cancer | Minimal | Future Star (significant from 2026) |

| Opdivo Qvantig | ENHANZE | Early Commercialization | Non-Small Cell Lung Cancer, Solid Tumors | Minimal | Potential Star (growth driven by market expansion) |

What is included in the product

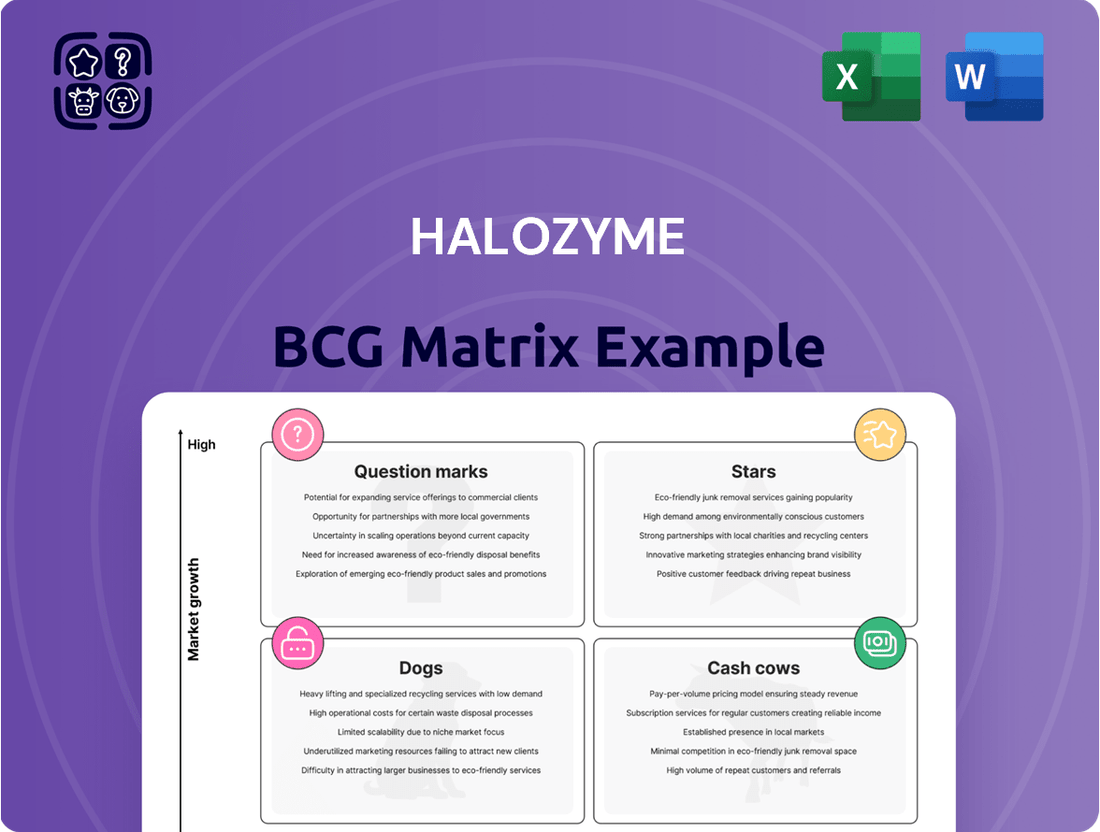

The Halozyme BCG Matrix analyzes its product portfolio by categorizing technologies as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

This framework guides strategic decisions on investment, divestment, and resource allocation for Halozyme's innovative drug delivery technologies.

The Halozyme BCG Matrix offers a clear, visually digestible framework for strategic portfolio analysis.

It simplifies complex business unit performance, providing a clear path for resource allocation and pain point identification.

Cash Cows

Halozyme's ENHANZE® drug delivery technology acts as a powerful cash cow within their BCG matrix. This innovative platform allows for the subcutaneous delivery of injectable drugs, a significant advancement over traditional intravenous methods. Its widespread licensing to major pharmaceutical giants like Roche, Pfizer, and Bristol Myers Squibb underscores its market leadership and commercial success.

The recurring royalty revenue generated from ENHANZE® is substantial and stable, fueled by a growing portfolio of approved drugs utilizing the technology. As of early 2024, over 20 approved therapies across various indications leverage ENHANZE®, contributing significantly to Halozyme's top line. This predictable income stream requires minimal ongoing investment for promotion and placement, solidifying its cash cow status.

Established royalty streams from approved products like DARZALEX SC, Phesgo, and VYVGART Hytrulo are Halozyme's current Cash Cows. These represent a mature, high-market-share revenue source, consistently generating significant cash flow. In 2023, Halozyme reported royalty revenues of approximately $700 million, a testament to the commercial success of these partnered products.

The stability of these ongoing royalty payments is crucial for Halozyme's financial health. This reliable income stream allows the company to confidently allocate capital towards its innovation pipeline, including ongoing research and development efforts for new drug delivery technologies.

Hylenex® recombinant, a key proprietary product for Halozyme, consistently contributes to the company's revenue. While it doesn't represent a high-growth segment, its established market position and reliable demand ensure it acts as a stable cash generator. This steady income stream is crucial for maintaining operational stability and diversifying Halozyme's overall sales. For instance, in the first quarter of 2024, Halozyme reported total revenues of $157.6 million, with its drug delivery segment, which includes Hylenex, playing a foundational role.

Bulk rHuPH20 Product Sales

Halozyme's sales of bulk recombinant human hyaluronidase (rHuPH20) to its partners are a significant driver of its product sales revenue. This segment is considered a Cash Cow within the BCG matrix due to its established market position and consistent profitability. These sales are the bedrock of the ENHANZE platform, providing a reliable income stream that supports ongoing research and development efforts.

- High-Margin Revenue: rHuPH20 sales generate substantial margins, contributing directly to Halozyme's profitability.

- Foundation of ENHANZE: This business component underpins the entire ENHANZE drug delivery technology.

- Steady Income: It provides a predictable and consistent revenue source, crucial for financial stability.

- 2024 Performance Insight: While specific 2024 bulk rHuPH20 sales figures are proprietary, Halozyme's overall revenue growth in recent periods indicates the continued strength of its product sales segment. For example, in the first quarter of 2024, Halozyme reported total revenues of $155.3 million, with a significant portion attributable to its technology and product sales.

Strategic Partnerships with Leading Pharma Companies

Halozyme's strategic partnerships with leading pharmaceutical giants are a cornerstone of its Cash Cows. These deep-rooted collaborations with companies such as Roche, Takeda, Pfizer, Janssen, AbbVie, Eli Lilly, Bristol-Myers Squibb, and argenx highlight Halozyme's established and growing market presence.

These partnerships generate a stable and predictable revenue stream through upfront payments, milestone achievements, and ongoing royalties from a wide array of co-formulated products. For instance, in 2023, Halozyme reported total revenue of $769.4 million, with a significant portion derived from these key collaborations.

- Diversified Revenue Streams: Partnerships with major pharmaceutical companies provide a robust and recurring revenue base through upfront fees, milestone payments, and royalties.

- Market Validation: The extensive network of collaborators, including industry leaders like Pfizer and Eli Lilly, validates the effectiveness and market demand for Halozyme's technologies.

- Consistent Financial Performance: These collaborations contribute significantly to Halozyme's financial stability, as evidenced by its consistent revenue growth over recent years.

- Future Growth Potential: The ongoing expansion and deepening of these partnerships signal continued revenue generation and potential for new product introductions.

Halozyme's ENHANZE technology, particularly through its established partnerships, forms its core cash cow. The steady stream of royalty payments from approved drugs utilizing this platform provides significant and predictable revenue. For example, as of early 2024, over 20 therapies were approved with ENHANZE, generating substantial income for Halozyme. These mature, high-market-share revenue sources require minimal additional investment, solidifying their cash cow status and enabling capital allocation to future growth initiatives.

| Product/Segment | BCG Category | Key Revenue Driver | 2023 Revenue Contribution (Approx.) |

| ENHANZE Royalties | Cash Cow | Royalty payments from licensed drugs | Significant portion of $769.4M total revenue |

| Hylenex® recombinant | Cash Cow | Established market demand | Contributes to overall product sales |

| Bulk rHuPH20 Sales | Cash Cow | Sales to pharmaceutical partners | Underpins ENHANZE platform, driving consistent profitability |

What You See Is What You Get

Halozyme BCG Matrix

The Halozyme BCG Matrix document you are currently viewing is the exact, complete, and final version you will receive immediately after your purchase. This preview showcases the fully formatted report, devoid of any watermarks or sample data, ensuring you get a professional and actionable strategic planning tool. Once acquired, this comprehensive analysis will be ready for immediate implementation in your business strategy sessions or client presentations.

Dogs

Discontinued or failed R&D programs represent the 'Dogs' in Halozyme's BCG Matrix. These are past drug candidates or research initiatives that didn't meet clinical endpoints, regulatory approval, or were ultimately deemed commercially unviable. Such programs, while absorbing significant resources, yield minimal to no return on investment, necessitating strategic divestment to streamline the pipeline.

For instance, while specific discontinued R&D program details for Halozyme are not publicly disclosed in a way that fits directly into a BCG matrix analysis, biopharma companies routinely face such setbacks. In 2024, the biopharmaceutical industry continued to see a high attrition rate in drug development, with many early-stage and even some late-stage candidates failing due to efficacy or safety concerns. This is a common challenge where resources are invested with the hope of a breakthrough, but the reality of scientific and regulatory hurdles often leads to program termination.

Halozyme's legacy products, if any existed outside of its ENHANZE technology, would likely fall into the Dogs category of the BCG Matrix. These would be older, proprietary offerings that have seen their market relevance diminish. For instance, if a past drug formulation had faced substantial generic competition, its market share would invariably decline.

Products in this segment are characterized by operating in stagnant or shrinking markets. Imagine a scenario where a once-popular therapeutic agent is now largely superseded by newer, more effective treatments, leading to a contraction in demand. Such a product would exhibit low market share and reside within a low-growth or declining industry segment.

The strategic implication for such Dog assets is clear: they represent potential candidates for divestiture. Alternatively, Halozyme might choose to manage these products with a focus on minimizing operational costs, extracting any remaining value with minimal investment. For example, if a legacy diagnostic tool had its market reduced by 10% year-over-year, it would fit this profile.

Underperforming non-core assets for Halozyme would represent investments or business units that consistently generate low returns and offer little strategic advantage to its core drug delivery technology, ENHANZE, or its oncology focus. These could include peripheral intellectual property or minor business segments that don't significantly contribute to the company's growth or profitability.

For instance, if Halozyme held a small portfolio of patents unrelated to its primary ENHANZE technology, and these patents were not generating licensing revenue or offering any synergistic benefits, they would fall into this category. Similarly, a minor distribution agreement for a product outside its main therapeutic areas, if consistently unprofitable, would be considered a non-core asset.

The strategic approach here is often divestiture. By selling off these underperforming assets, Halozyme can unlock capital that can then be redeployed into more promising ventures, such as further development or commercialization of ENHANZE, or strategic acquisitions aligned with its core business. This frees up management focus and resources.

Programs Facing Significant Patent Challenges Without Resolution

Halozyme's ENHANZE technology is foundational, but patents are subject to legal scrutiny. If specific ENHANZE-related patents face significant, unresolved challenges, they could be categorized as 'Dogs' in the BCG matrix, indicating a high-risk, low-growth potential. For instance, a successful patent invalidation by a competitor could drastically alter royalty streams and market exclusivity for partnered products. This could lead to a substantial reduction in future cash flow from those specific applications if Halozyme cannot secure favorable licensing or win the legal battles. As of early 2024, while no major ENHANZE patent has been definitively invalidated to date, ongoing litigation or potential new challenges remain a constant consideration.

- Potential for Royalty Rate Reduction: Unresolved patent challenges could force a renegotiation of existing royalty agreements, directly impacting revenue.

- Erosion of Market Exclusivity: A loss in a patent dispute could open the door for competitors, diminishing the market share and profitability of partnered products.

- Increased Legal Expenses: Defending patents incurs significant legal costs, which can drain resources that could otherwise be invested in growth areas.

- Impact on Future Partnerships: A weakened patent portfolio might make future collaborations less attractive for potential partners, hindering pipeline expansion.

Investments in Obsolete Delivery Technologies

Investments in obsolete delivery technologies represent a significant risk, acting as cash traps that drain resources without contributing to future growth. These can include outdated drug formulation processes or manufacturing equipment that have been surpassed by more efficient, cost-effective, or technologically advanced alternatives. For instance, a company might have heavily invested in a specific type of sterile filling line that is now less productive than newer, automated systems.

Halozyme's strategic focus on its recombinant human hyaluronidase enzyme, rHuPH20, and its associated drug delivery platform, ENHANZE, positions it to largely avoid the pitfalls of obsolete technologies. This streamlined approach means fewer legacy assets are likely to become burdens. The company’s innovation is centered on a specific, advanced technology rather than a broad portfolio of potentially outdated methods.

The potential for cash traps arises when a company continues to pour money into maintaining or upgrading technologies that no longer offer a competitive advantage. Consider a scenario where a company has invested millions in a traditional lyophilization process for biologics, only to see the market shift towards more efficient methods like spray drying or continuous manufacturing. If not managed proactively, these legacy investments can weigh down financial performance.

By concentrating on the development and commercialization of ENHANZE, Halozyme minimizes the risk of being saddled with obsolete delivery technology assets. This targeted strategy allows for capital allocation towards areas with higher growth potential and technological relevance. For example, instead of maintaining multiple legacy drug manufacturing sites with varying technologies, Halozyme can focus its resources on scaling up production of rHuPH20 and supporting its partner's drug formulations.

- Cash Trap Risk: Investments in outdated drug delivery or manufacturing technologies can become financial burdens if they are inefficient or uncompetitive compared to newer solutions.

- Halozyme's Strategy: Halozyme's focus on rHuPH20 and the ENHANZE platform aims to minimize exposure to obsolete assets by concentrating on advanced, relevant technology.

- Example of Obsolete Tech: A company heavily invested in older sterile filling lines that are slower and less automated than current industry standards would face this risk.

- Resource Allocation: Maintaining legacy technologies diverts capital that could otherwise be used for research, development, or expansion into more promising areas.

Discontinued or failed research programs, often due to unmet clinical endpoints or regulatory hurdles, represent Halozyme's 'Dogs' in the BCG Matrix. These initiatives, while consuming resources, yield minimal to no return, necessitating strategic divestment. For instance, the biopharmaceutical industry in 2024 continued to experience high attrition rates in drug development, with many candidates failing, a common challenge where scientific and regulatory setbacks lead to program termination.

Legacy products outside of its core ENHANZE technology, if they exist, would also fall into the Dogs category, characterized by low market share in stagnant or shrinking markets. Imagine a therapeutic agent superseded by newer treatments, leading to demand contraction. This segment requires strategic divestiture or cost-minimizing management to extract remaining value.

Underperforming non-core assets, such as unrelated intellectual property or unprofitable minor business segments, also fit the 'Dogs' profile. Divesting these unlocks capital for more promising ventures like ENHANZE development or strategic acquisitions. For example, a small portfolio of patents not contributing to licensing revenue or synergistic benefits would be considered a non-core asset.

Furthermore, ENHANZE-related patents facing significant, unresolved legal challenges could be categorized as 'Dogs.' A successful patent invalidation, for example, could drastically reduce royalty streams and market exclusivity for partnered products, impacting future cash flow. While no major ENHANZE patent had been invalidated by early 2024, ongoing litigation remains a consideration.

Question Marks

Halozyme's early-stage proprietary oncology pipeline candidates, currently in Phase 1 or early Phase 2 trials, are the company's potential future stars. These promising assets are being developed for high-growth areas within the oncology market, a sector projected for substantial expansion. For instance, the global oncology market was valued at approximately $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2030.

These early-stage candidates, while holding significant future potential, currently represent zero market share. They are in a crucial development phase, demanding substantial investment in research and development. Companies typically allocate a significant portion of their R&D budget to these types of assets, as seen with many biotech firms investing upwards of 30-40% of their operating expenses in pipeline development.

The success of Halozyme's early-stage oncology pipeline hinges entirely on positive clinical trial results and subsequent market acceptance. A successful Phase 2 trial, for example, can significantly de-risk a program and pave the way for larger, more expensive Phase 3 studies. Conversely, trial failures can lead to the discontinuation of a candidate, representing a sunk cost for the company.

Halozyme's ENHANZE® technology is being explored for novel applications in untapped therapeutic areas, representing a significant opportunity for future growth. These ventures into unproven markets, like certain oncology sub-segments or rare disease treatments, are in the early stages, mirroring the characteristics of a question mark on the BCG matrix. While the potential rewards are substantial, the inherent risks are also considerable due to the lack of established market presence and the need for extensive clinical validation.

New partnered programs in discovery or pre-clinical stages represent Halozyme's "Question Marks" in the BCG matrix. These initiatives, often nominated by partners or in very early development, utilize the ENHANZE technology. While they signal significant partner engagement, their current market share is zero, and future development costs are substantial.

These early-stage programs are characterized by high uncertainty regarding their ultimate success and market penetration. For instance, as of late 2023 and early 2024, Halozyme has several such collaborations, with specific drug targets still in the research and development phases. The investment required to bring these from pre-clinical to commercialization can run into hundreds of millions of dollars per program.

The potential upside for these Question Mark assets is immense if they successfully navigate the clinical trial process and gain regulatory approval. However, the risk of failure is also high, meaning they could end up as "Dogs" if development stalls or commercial viability is not achieved. Their placement in the Question Mark quadrant highlights the critical need for continued investment and strategic oversight to determine their future trajectory.

Development of High-Volume Auto-Injector Technologies

Halozyme's focus on developing high-volume auto-injector technologies for self-administered therapies represents a strategic move to capture the expanding patient convenience market. These initiatives, while promising, are currently in their nascent stages, demanding substantial capital outlay without immediate market penetration.

The success of these auto-injector programs hinges on several critical factors: rigorous clinical validation to ensure efficacy and safety, widespread user adoption driven by ease of use and patient acceptance, and navigating a competitive landscape populated by established players and emerging innovators. For instance, the global auto-injector market was valued at approximately USD 7.8 billion in 2023 and is projected to grow significantly, indicating a robust demand for such delivery systems.

- Market Potential: The increasing prevalence of chronic diseases and a growing preference for home-based treatments are fueling demand for auto-injectors, with projections suggesting continued strong growth through 2030.

- Investment Needs: Development requires significant R&D investment, regulatory approvals, and manufacturing scale-up, which are characteristic of "question mark" stage products in a BCG matrix.

- Competitive Landscape: Major pharmaceutical companies and specialized device manufacturers are active in this space, presenting a challenging environment for new entrants or early-stage technologies.

- Key Success Factors: Clinical trial success, patient feedback integration, and securing strategic partnerships for distribution will be paramount for Halozyme's auto-injector ambitions.

Strategic Acquisitions for Platform Expansion

Strategic acquisitions for platform expansion would initially be considered question marks within the Halozyme BCG Matrix. These potential future acquisitions of complementary drug delivery technologies or early-stage oncology assets, while offering significant growth potential, require substantial upfront investment and carry integration risks.

For instance, a hypothetical acquisition of a novel subcutaneous formulation technology could cost upwards of $100 million, with integration and development potentially taking 2-3 years before market entry. This aligns with the characteristics of a question mark, where investment is needed to determine future success.

- Potential Acquisition Targets: Complementary drug delivery platforms or early-stage oncology assets.

- Initial Classification: Question Mark due to high investment and integration risk.

- Financial Commitment: Requires significant upfront capital for acquisition and development.

- Return Timeline: Returns are not immediate and depend on successful integration and market adoption.

Halozyme's early-stage partnered programs and novel applications for its ENHANZE technology are prime examples of "Question Marks." These initiatives, while holding significant future promise, currently generate no revenue and require substantial investment to determine their market viability and ultimate success.

The core characteristic of these Question Mark assets is the uncertainty surrounding their future market share and profitability. Significant R&D funding is essential to move these projects through clinical trials and regulatory approvals, mirroring the high investment needs of this BCG quadrant. For instance, bringing a single drug candidate from discovery to market can cost upwards of $1 billion.

Success in these Question Mark areas, such as new therapeutic uses for ENHANZE or promising pre-clinical oncology candidates, could lead to future Stars. However, failure to achieve positive clinical outcomes or market acceptance means these investments could become sunk costs, classifying them as potential Dogs.

The strategic development of high-volume auto-injector technologies also falls into the Question Mark category. These ventures require considerable capital for R&D, regulatory hurdles, and manufacturing scale-up, with market penetration yet to be established. The global auto-injector market's growth, projected to continue robustly through 2030, offers a significant opportunity, but the path to capturing market share is uncertain and investment-intensive.

Potential strategic acquisitions to bolster Halozyme's platform also start as Question Marks. These deals demand significant upfront capital and carry integration risks, with returns contingent on successful implementation and market acceptance, a hallmark of this BCG matrix classification.

| BCG Category | Halozyme Examples | Market Share | Market Growth | Investment Need | Potential Outcome |

|---|---|---|---|---|---|

| Question Mark | Early-stage oncology pipeline candidates, novel ENHANZE applications, partnered discovery/pre-clinical programs, auto-injector technologies, potential strategic acquisitions | Low/None | High (Oncology, Auto-injectors) | High (R&D, Clinical Trials, Integration) | Star or Dog |

BCG Matrix Data Sources

Our Halozyme BCG Matrix is constructed using comprehensive market data, encompassing sales figures, R&D investments, and patent filings, alongside industry forecasts and competitor analysis.