Hallmark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hallmark Bundle

Hallmark navigates a complex retail landscape shaped by intense rivalry and the ever-present threat of new entrants disrupting traditional greeting card sales. Understanding the bargaining power of both buyers and suppliers is crucial for maintaining market share in this evolving industry.

The complete report reveals the real forces shaping Hallmark’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hallmark's supplier bargaining power is significantly influenced by the concentration of its input sources. For common materials like paper, a broad supplier base generally limits individual supplier leverage. However, for specialized printing technologies or unique artistic components required for certain card lines or Crayola products, fewer suppliers might exist, granting them greater influence.

Hallmark's strategic push towards sustainability, aiming to reduce emissions and increase renewable electricity usage, as reported in their 2024 environmental progress updates, could further concentrate power among suppliers who meet these stringent criteria. This focus may necessitate partnerships with a smaller, more specialized group of providers, potentially increasing their bargaining strength.

Hallmark experiences a spectrum of switching costs with its suppliers. For common raw materials like paper or ink, the cost and complexity of switching suppliers are generally low, allowing Hallmark to leverage competitive pricing.

However, when it comes to specialized components, such as unique art supplies for their greeting cards or proprietary software and content creation tools used by Hallmark Media, the switching costs can be substantial. These costs include not only the direct expense of finding and vetting new suppliers but also the indirect costs of retooling manufacturing processes or retraining staff to adapt to new systems and materials.

Hallmark's strategic investments in digital transformation and supply chain modernization, as indicated by their focus on enhancing operational efficiency, aim to mitigate these higher switching costs and foster more stable, cost-effective supplier relationships over the long term.

The presence of readily available substitute inputs significantly diminishes a supplier's bargaining power. If a company can easily switch to alternative raw materials or components without incurring substantial costs or compromising quality, suppliers have less leverage. For example, if a manufacturer of consumer electronics can source microchips from multiple vendors offering similar specifications and pricing, no single chip supplier can dictate terms.

Conversely, when substitute inputs are scarce or nonexistent, suppliers gain considerable power. This is particularly true for specialized components or unique resources. Consider the automotive industry; if a specific advanced sensor is only produced by one or two companies, those suppliers can command higher prices and more favorable terms from car manufacturers. This dynamic was evident in 2024 with ongoing supply chain disruptions for certain semiconductor components, leading to increased negotiation power for the few available suppliers.

For companies like Hallmark, the availability of substitutes for their creative talent is a key factor. While many actors can be cast in television movies, highly recognizable and popular stars, such as those with established fan bases and multi-picture deals, represent a more concentrated pool of talent. In 2024, the demand for such established talent in the streaming wars remained high, limiting the substitutes and thereby increasing the bargaining power of these key performers.

Importance of Hallmark to Suppliers

Hallmark's immense scale as a premier manufacturer of greeting cards and personal expression items, coupled with its ownership of brands like Crayola and Hallmark Media, positions it as a crucial customer for its suppliers. This substantial purchasing volume inherently diminishes the bargaining power of these suppliers, as the loss of Hallmark as a client would represent a significant financial setback for many.

This dynamic is especially pronounced for smaller or niche suppliers whose revenue streams may be disproportionately dependent on Hallmark's business. For instance, a specialized paper mill or a unique ink manufacturer could find its operational viability threatened if Hallmark were to shift its procurement elsewhere. In 2023, Hallmark reported revenues exceeding $3.5 billion, underscoring the sheer scale of its operations and its impact on the supply chain.

- Hallmark's Market Dominance: As a leader in the greeting card industry, Hallmark's purchasing decisions significantly influence supplier demand.

- Supplier Dependence: Many suppliers, particularly those catering to specialized materials or manufacturing processes, rely heavily on Hallmark's consistent orders.

- Reduced Supplier Leverage: The potential loss of Hallmark's business can deter suppliers from demanding higher prices or more favorable terms.

- Crayola and Hallmark Media Synergies: The inclusion of Crayola and Hallmark Media further diversifies Hallmark's supplier needs, potentially consolidating purchasing power.

Threat of Forward Integration by Suppliers

The threat of suppliers moving into Hallmark's core business, known as forward integration, appears minimal across most of its operations. For instance, a company that supplies paper for greeting cards or the raw materials for Hallmark's art supplies is highly unlikely to start manufacturing and selling greeting cards or art kits themselves. This lack of forward integration threat is a positive for Hallmark's established market position.

However, the landscape shifts somewhat within Hallmark's media and content creation segments. Here, there's a greater potential for suppliers, such as independent content creators or smaller production studios, to develop more direct distribution channels. This could bypass traditional media companies like Hallmark Media, thereby diminishing Hallmark's bargaining power over these content providers.

- Low Threat in Traditional Supply Chains: Suppliers of paper, ink, and other physical materials for greeting cards or craft supplies generally lack the inclination or capability to enter Hallmark's direct retail or manufacturing operations.

- Emerging Threat in Media: Content creators and production houses supplying content to Hallmark Media might increasingly leverage digital platforms for direct distribution, reducing their reliance on Hallmark's channels.

- Impact on Leverage: This shift in the media segment could potentially weaken Hallmark Media's negotiation leverage with its content suppliers as these suppliers gain alternative avenues to reach audiences.

Hallmark's bargaining power with suppliers is generally strong due to its significant purchasing volume and market dominance. However, this can be challenged by suppliers of specialized inputs or unique creative talent where substitutes are limited, as seen in the high demand for established actors in 2024. The threat of forward integration by suppliers is low in traditional product lines but presents a growing concern in Hallmark Media's content segment.

| Factor | Impact on Hallmark's Supplier Bargaining Power | Supporting Data/Trend (as of 2024) |

|---|---|---|

| Supplier Concentration | Low for common materials, High for specialized inputs | Limited suppliers for unique art supplies or printing tech can increase their leverage. |

| Switching Costs | Low for raw materials, High for specialized components/software | Retooling or retraining staff for new systems represents substantial indirect costs. |

| Availability of Substitutes | High for basic inputs, Low for key creative talent | High demand for popular actors in 2024 limited substitutes, increasing their power. |

| Customer Importance | Low supplier power due to Hallmark's scale | Hallmark's 2023 revenues exceeding $3.5 billion makes it a critical client for many suppliers. |

| Forward Integration Threat | Minimal in traditional, Moderate in media | Content creators potentially bypassing Hallmark Media via direct digital platforms. |

What is included in the product

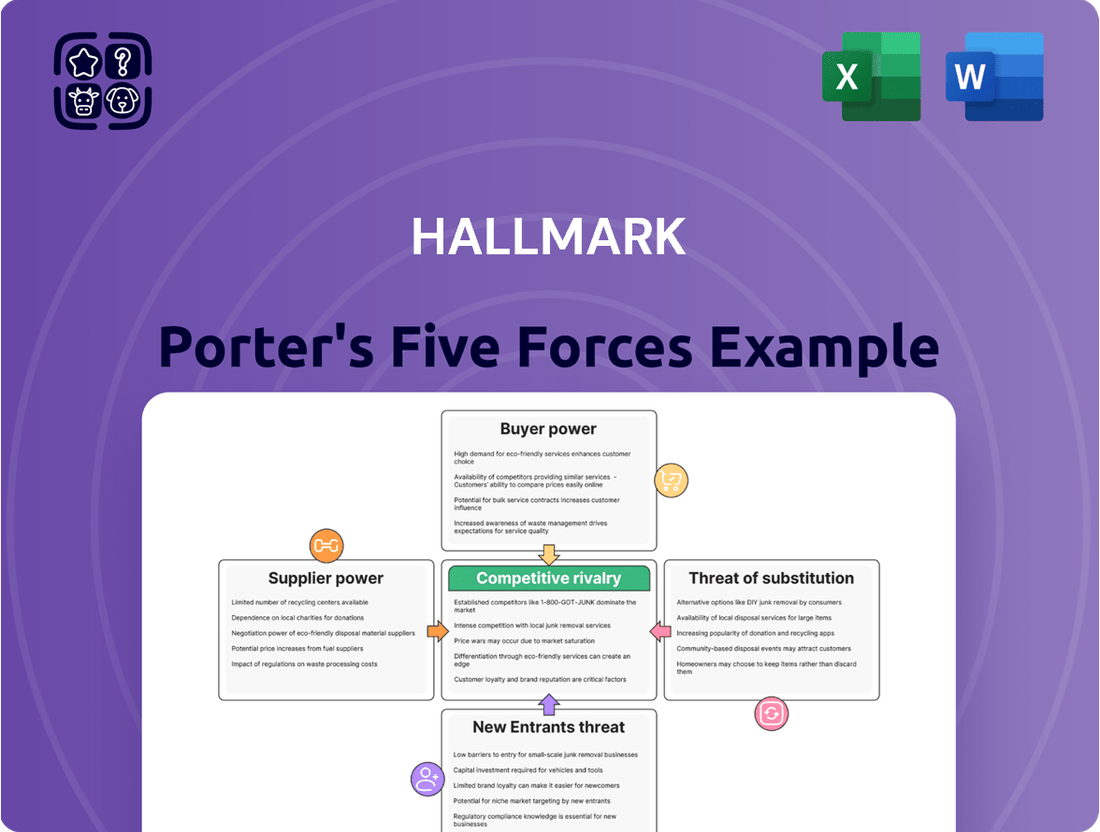

This Porter's Five Forces analysis delves into the competitive intensity and profitability potential within Hallmark's industry, examining threats from new entrants, the power of buyers and suppliers, the availability of substitutes, and the rivalry among existing competitors.

Quickly identify and mitigate competitive threats with a visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Hallmark customers, particularly for greeting cards and art supplies, often exhibit significant price sensitivity. This is largely due to the abundance of readily available alternatives and the growing transparency of pricing, especially through online channels. For instance, the average price for a premium greeting card can range from $5 to $7, making consumers more inclined to seek out deals or less expensive options when faced with multiple choices.

The proliferation of e-commerce and digital platforms has dramatically increased the information consumers have at their fingertips. This allows them to effortlessly compare prices, product features, and customer reviews across a wide array of brands and retailers. In 2024, online retail sales are projected to continue their upward trend, further solidifying the customer's ability to shop around and find the best value, thereby amplifying their bargaining power.

The availability of numerous substitute products and services for Hallmark's core offerings, such as digital greeting cards, social media messages, and various entertainment streaming options, significantly amplifies customer bargaining power. Consumers can readily shift their spending to alternatives if Hallmark's prices, quality, or perceived value do not align with their preferences.

Hallmark's customer base is quite varied, encompassing everyday shoppers, various retail partners, and even viewers of Hallmark Media. While individual customers don't hold much sway, major retailers that carry Hallmark's goods possess significant bargaining power because of the sheer volume of products they purchase and their crucial role in getting those products to market.

Switching Costs for Customers

For consumers, the bargaining power of customers is amplified by low switching costs. When it comes to greeting cards or art supplies, there's typically minimal penalty for choosing a competitor, allowing customers to easily shift their purchases based on price or preference. This low barrier to entry for competitors means customers can exert significant pressure on pricing and product innovation.

In the realm of Hallmark Media, while subscribers might feel an emotional connection to specific content, the financial switching costs between streaming services remain relatively low. This ease of transition, often involving simple cancellation and subscription to another platform, contributes to customer churn. For instance, in 2024, the average consumer subscribed to 3.7 streaming services, indicating a willingness to experiment and switch based on content availability and cost, further empowering the customer.

- Low Switching Costs: Customers face minimal financial or practical hurdles when moving between Hallmark's greeting card brands or art supply offerings and those of competitors.

- Ease of Churn in Media: For Hallmark Media subscribers, the ability to easily cancel and switch to other streaming services, driven by content and price, reduces customer loyalty.

- Consumer Choice: The low switching costs across Hallmark's product lines give customers considerable leverage to seek better value or different products elsewhere.

- 2024 Data: The average consumer subscribed to 3.7 streaming services in 2024, highlighting the fluidity of the market and customer willingness to switch.

Hallmark's Brand Loyalty and Differentiation

Hallmark, despite a market with many alternatives and minimal costs to switch, commands significant customer loyalty. This is largely due to its deeply ingrained brand recognition and the emotional connection consumers have with its products, especially greeting cards and its family-oriented media. This loyalty helps to temper the bargaining power of customers.

This strong brand equity translates into a reduced sensitivity to price among a core customer base. For instance, in 2024, Hallmark continued to be a go-to brand for consumers seeking specific sentiments and a perceived level of quality in their celebratory communications, even when faced with more generic or lower-priced options.

- Brand Recognition: Hallmark is consistently cited as a top-of-mind brand for greeting cards in consumer surveys.

- Emotional Resonance: The brand's association with family, holidays, and heartfelt messages fosters a unique customer bond.

- Differentiation: Hallmark's curated selection and consistent quality offer a perceived value that generic substitutes often lack.

While Hallmark benefits from strong brand loyalty, the bargaining power of its customers remains a significant factor. This power is amplified by the ease with which consumers can access alternatives, both for physical products like greeting cards and for media content. The ability to compare prices and switch providers with minimal effort gives customers considerable leverage.

The digital age has further empowered consumers, providing them with readily available information and a vast marketplace to explore. In 2024, the continued growth of e-commerce means customers can effortlessly compare Hallmark's offerings against a multitude of competitors, driving a need for competitive pricing and value propositions.

| Factor | Impact on Hallmark | Customer Leverage |

|---|---|---|

| Availability of Substitutes | High | Customers can easily opt for digital greetings or alternative entertainment. |

| Switching Costs | Low | Minimal barriers to changing brands or subscription services. |

| Price Sensitivity | Moderate to High | Consumers actively seek deals and compare prices, especially online. |

Preview Before You Purchase

Hallmark Porter's Five Forces Analysis

This preview showcases the complete Hallmark Porter's Five Forces Analysis, offering a thorough examination of competitive and market forces impacting the company. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently expect to download this fully formatted and professionally written analysis, ready for immediate application to your strategic planning.

Rivalry Among Competitors

Hallmark faces intense competition across its diverse business segments. In the traditional greeting card market, it contends with giants like American Greetings, alongside a vibrant ecosystem of independent and niche card designers, many of whom leverage online platforms for direct-to-consumer sales. This fragmented landscape, while offering variety to consumers, means Hallmark must continually innovate to capture market share.

For its Crayola brand, the competitive arena is equally crowded. Major players such as Faber-Castell and Stabilo International offer a wide range of art supplies, directly challenging Crayola's dominance. The global art supplies market, valued at approximately $24.9 billion in 2023, is characterized by both established brands and emerging companies focusing on eco-friendly or specialized products.

Hallmark Media operates within the highly competitive entertainment industry, where it competes with a vast array of traditional cable networks and a rapidly growing number of streaming services. The streaming market alone, projected to reach over $200 billion globally by 2024, includes major players like Netflix, Disney+, and Max, alongside numerous smaller, specialized platforms, all vying for viewer attention and subscription revenue.

The greeting card industry, Hallmark's traditional stronghold, is mature and faces fierce competition as consumers increasingly opt for digital alternatives. This maturity intensifies the rivalry for market share among existing players.

In contrast, the crayons market, where Crayola operates, shows promising growth. Rising demand from educational institutions and a surge in arts and crafts participation are key drivers, potentially softening the competitive intensity for Crayola in this segment.

Hallmark Media, meanwhile, carves out a niche in family-friendly content, demonstrating robust viewership numbers. However, the broader media landscape remains highly dynamic, with constant shifts in consumer preferences and emerging digital platforms contributing to a competitive environment.

Hallmark's competitive edge is significantly bolstered by its robust product differentiation and deeply ingrained brand identity. The company leverages its strong brand recognition, coupled with emotionally resonant messaging, to connect with consumers. This is further amplified by its extensive retail footprint, notably its dedicated Gold Crown stores, which provide a unique and immersive brand experience.

Crayola, a key player in a related segment, also thrives on a powerful brand image, focusing on high-quality art supplies tailored for children and artists alike. This consistent emphasis on quality and creative expression solidifies its market position.

Hallmark Media contributes to this differentiation through its distinct niche in feel-good, family-friendly programming. Its highly successful holiday movie franchises, for instance, have cultivated a loyal viewership, demonstrating the power of specialized content to maintain a strong presence in a competitive media landscape.

High Fixed Costs and Exit Barriers

Hallmark operates in industries characterized by substantial fixed costs, particularly in media production and large-scale manufacturing of greeting cards and art supplies. These investments in production facilities, extensive distribution networks, and content creation represent significant upfront capital. For instance, maintaining a global distribution network for physical goods requires substantial ongoing expenditure.

The presence of high fixed costs intensifies competitive rivalry. Companies are incentivized to maximize their operational capacity to spread these costs over a larger output, leading to aggressive pricing strategies or increased marketing efforts to capture market share. This pressure to utilize capacity can make it difficult for firms to scale back or exit the market, even during periods of low demand.

Exit barriers in such industries are also considerable. The specialized nature of manufacturing equipment, established brand recognition, and the cost of winding down operations mean that exiting the market is often financially punitive. This can trap companies in competitive battles, further fueling rivalry as they fight to remain viable.

- High Fixed Costs: Industries like media and greeting cards require significant investment in physical assets and content development.

- Capacity Utilization Pressure: Companies aim to maximize output to offset high fixed costs, leading to intensified competition.

- Substantial Exit Barriers: Specialized assets and operational complexities make exiting the market financially challenging, prolonging competitive struggles.

Competitive Strategies and Innovation

Hallmark faces intense competition across its diverse business segments, with rivals continually pushing innovation. In the greeting card market, competitors are increasingly focusing on personalized offerings, integrating digital elements, and developing eco-friendly product lines to meet evolving consumer demands.

For its Crayola brand, the challenge lies in adapting to the digital landscape while preserving the tactile appeal and quality of its core art supplies. This means exploring digital art tools and educational platforms that complement physical products.

Hallmark Media, meanwhile, is actively diversifying its content strategy to capture a broader audience. This includes venturing into new genres such as unscripted series and reality competition shows, aiming to attract and retain viewers in a crowded entertainment market.

- Personalization: Competitors are leveraging technology to offer customized greeting cards, a trend that saw significant growth in the early 2020s.

- Digital Integration: The inclusion of QR codes or augmented reality features in cards is becoming a competitive differentiator.

- Eco-Friendly Options: A growing segment of consumers prefers sustainable products, pushing competitors to offer recycled or biodegradable card options.

- Content Diversification: Hallmark Media's expansion into unscripted content aims to tap into viewer interest in reality television, a genre that has shown consistent audience engagement.

Hallmark faces intense rivalry from established players and emerging niche brands across its core segments. In greeting cards, competitors like American Greetings and numerous online direct-to-consumer sellers vie for market share, pushing for innovation in personalization and digital integration. The global greeting card market is projected to grow, indicating ongoing competitive pressure.

Crayola competes with brands such as Faber-Castell and Stabilo in the art supplies sector, where differentiation often comes from eco-friendly materials and specialized product lines. The art supplies market is robust, with global sales reaching approximately $24.9 billion in 2023, underscoring the need for continuous product development.

Hallmark Media navigates a highly competitive entertainment landscape, contending with major streaming services like Netflix and Disney+, alongside traditional networks. The streaming market is expected to exceed $200 billion globally by 2024, highlighting the intense battle for viewer attention and subscription revenue.

| Industry Segment | Key Competitors | Competitive Factors |

| Greeting Cards | American Greetings, Online DTC Brands | Personalization, Digital Integration, Eco-Friendly Options |

| Art Supplies (Crayola) | Faber-Castell, Stabilo International | Product Quality, Eco-Friendly Materials, Niche Offerings |

| Media (Hallmark Media) | Netflix, Disney+, Cable Networks | Content Diversification, Streaming Exclusives, Family-Friendly Niche |

SSubstitutes Threaten

The most significant substitute for traditional greeting cards comes from digital alternatives like e-cards, personalized videos, and messages sent through social media or messaging apps. These digital options provide convenience, instant delivery, and often a lower cost, directly impacting the demand for physical cards. For instance, in 2023, the global digital greeting card market was valued at approximately $700 million and is projected to grow, indicating a clear shift in consumer preference towards these more immediate and cost-effective communication methods.

Platforms like Facebook, Instagram, and LinkedIn have become powerful substitutes for traditional greeting cards. In 2024, billions of users actively engage with these platforms for personal communication, sharing greetings and well-wishes instantly. This digital convenience directly erodes the demand for physical cards for many everyday occasions.

The sheer accessibility and low cost of social media and direct messaging present a significant threat. For instance, a quick birthday message on Instagram or a Facebook wall post requires no purchase and reaches the recipient immediately, making it a compelling alternative to buying and mailing a card. This trend is particularly pronounced among younger demographics who are digital natives.

Digital art applications and creative software present a significant threat of substitutes for traditional art supplies, particularly impacting segments like older children and adults. These platforms offer an expansive palette of colors, diverse brushes, and advanced effects, negating the need for physical materials and thereby challenging the established art supply market. For instance, the global digital art market was valued at approximately USD 3.5 billion in 2023 and is projected to grow substantially, indicating a strong shift in consumer preference towards digital mediums.

Alternative Entertainment Platforms

The threat of substitutes for Hallmark Media is significant due to the sheer volume of entertainment options available to consumers. Platforms like Netflix, Disney+, and Amazon Prime Video offer a wide range of family-friendly and general entertainment content, directly competing for viewer attention and subscription dollars. In 2024, the streaming market continues to be highly competitive, with major players investing heavily in original programming designed to attract and retain subscribers.

Beyond dedicated streaming services, traditional broadcast television and video-on-demand services also present viable alternatives. Furthermore, the rise of user-generated content platforms, such as YouTube, provides a free and often highly personalized entertainment experience that can draw audiences away from more curated content. This diverse landscape means consumers can easily switch to a different form of entertainment if Hallmark's offerings do not meet their expectations or if a more appealing substitute emerges.

Consider these key substitutes:

- Streaming Services: Netflix, Disney+, Max, Paramount+, Peacock, Apple TV+.

- Broadcast and Cable Television: Traditional networks and cable channels offering diverse programming.

- Video-on-Demand (VOD): Rental and purchase options for movies and TV shows.

- User-Generated Content: Platforms like YouTube and TikTok offering a vast array of free, often niche, content.

DIY and Handmade Alternatives

The threat of substitutes for Hallmark's core products, particularly greeting cards and art supplies, is significant due to the rise of DIY and handmade alternatives. Consumers increasingly opt to create their own cards or artwork using readily available materials, often citing a desire for greater personalization and cost savings. This trend is amplified by a growing appreciation for handmade crafts, which can be perceived as more authentic and unique than mass-produced items.

This shift towards DIY impacts both segments of Hallmark's business. For greeting cards, individuals can purchase inexpensive paper, embellishments, and stamps to craft personalized messages, bypassing the need to buy pre-made cards. Similarly, the art supply market sees consumers opting for individual components rather than curated kits, especially with the accessibility of online tutorials and communities dedicated to crafting.

The economic aspect is also a driver. For example, the cost of basic card-making supplies can be substantially lower than purchasing premium greeting cards, especially for frequent senders. In 2023, the global arts and crafts market was valued at approximately $50 billion, with a notable portion attributed to DIY segments, indicating a substantial consumer base actively engaging in creating their own goods.

- DIY Greeting Cards: Consumers can purchase basic cardstock, envelopes, and decorative elements for a fraction of the cost of a store-bought card.

- Handmade Art: The appeal of unique, personalized art created by individuals offers a distinct alternative to mass-produced prints or decor.

- Cost-Effectiveness: For many, crafting their own items provides a more budget-friendly option, especially when compared to premium or specialty cards and art pieces.

- Personalization and Uniqueness: Handmade items inherently offer a level of personalization and uniqueness that manufactured goods often struggle to replicate.

The threat of substitutes for Hallmark's traditional greeting cards is substantial, primarily driven by the convenience and cost-effectiveness of digital alternatives. E-cards, personalized videos, and messages via social media platforms offer instant delivery and often a lower price point, directly impacting the demand for physical cards. In 2024, billions of users actively communicate through platforms like Facebook and Instagram, making quick digital greetings a common practice, especially among younger demographics.

Furthermore, the rise of DIY and handmade crafts presents another significant substitute. Consumers increasingly create their own cards and artwork, citing personalization and cost savings as key motivators. The global arts and crafts market, valued at approximately $50 billion in 2023, highlights a substantial consumer base actively engaging in creating their own goods, further challenging the market for pre-made items.

Hallmark also faces competition from a vast array of entertainment options, including streaming services like Netflix and Disney+, traditional television, and user-generated content platforms like YouTube. These alternatives vie for consumer attention and leisure time, directly impacting the demand for Hallmark's media offerings. The streaming market in 2024 remains highly competitive, with major players investing heavily in original content.

| Substitute Category | Examples | Key Advantages | Market Trend (2024) |

|---|---|---|---|

| Digital Communications | E-cards, Social Media Messages, Videos | Convenience, Speed, Low Cost | Growing adoption, especially among younger demographics |

| DIY & Handmade | Handcrafted Cards, Personalized Artwork | Uniqueness, Personalization, Cost Savings | Increasing popularity, driven by craft communities |

| Entertainment Alternatives | Streaming Services, Broadcast TV, User-Generated Content | Variety, Accessibility, On-Demand Viewing | Dominant consumer choice for leisure time |

Entrants Threaten

Entering industries like greeting cards, art supplies, or media at a scale matching Hallmark necessitates significant upfront capital. This includes building or acquiring manufacturing plants, establishing widespread distribution channels, stocking substantial inventory, and investing heavily in content creation and intellectual property. For instance, the global greeting card market, valued at approximately $1.5 billion in 2024, requires considerable investment in design, printing, and logistics to compete effectively.

Hallmark and Crayola have cultivated deep brand loyalty over many decades, making it a significant barrier for new competitors. For instance, Hallmark's brand recognition is exceptionally high, with a 2023 survey indicating over 90% of consumers are familiar with the brand. This established trust means newcomers must commit substantial resources to marketing and brand development to even begin to erode the loyalty enjoyed by these incumbents.

Hallmark's established and expansive distribution network presents a significant barrier to new entrants. This includes its proprietary Gold Crown stores, which offer direct customer engagement, and a vast array of partnerships with retailers globally. In 2024, securing comparable shelf space and access to these crucial channels would require substantial investment and strategic maneuvering.

Economies of Scale

Established companies like Hallmark leverage significant economies of scale, particularly in manufacturing and procurement. This allows them to spread fixed costs over a larger production volume, resulting in a lower cost per unit. For instance, in 2023, Hallmark Cards reported a robust revenue, enabling substantial purchasing power for paper, printing, and distribution services, which new entrants would struggle to match.

Newcomers would likely face considerably higher initial per-unit costs. Without the established infrastructure and high-volume contracts, their production expenses would be elevated. This cost disadvantage makes it challenging to compete on price with incumbents like Hallmark, who can absorb lower margins due to their scale, without severely impacting profitability from the outset.

- Economies of Scale in Manufacturing: Hallmark’s large-scale production facilities reduce per-unit manufacturing costs.

- Procurement Advantages: Bulk purchasing of raw materials like paper and ink leads to lower input costs.

- Marketing Cost Efficiency: Established brand recognition allows for more cost-effective marketing campaigns compared to new entrants.

- Distribution Network: Hallmark’s extensive distribution network further lowers per-unit shipping and logistics expenses.

Regulatory Hurdles and Intellectual Property

The media industry, unlike greeting cards or art supplies, presents significant barriers to entry due to intricate regulatory landscapes and substantial intellectual property (IP) concerns. New players must contend with complex content rights, licensing agreements, and evolving data privacy laws, which can demand considerable investment in legal and compliance resources.

Navigating these regulatory hurdles and securing necessary IP rights can be a lengthy and expensive undertaking for potential entrants. For instance, in 2024, the global media and entertainment market, valued at over $2.5 trillion, saw substantial investment directed towards IP acquisition and regulatory compliance, particularly in areas like streaming rights and digital content distribution.

- Regulatory Complexity: Media companies must comply with diverse regulations concerning content, broadcasting, and digital platforms, often varying by region.

- Intellectual Property Costs: Acquiring and protecting IP, such as copyrights and licenses for content, represents a significant upfront and ongoing expense.

- Time and Resource Investment: Successfully entering the media market requires substantial time and financial resources dedicated to legal counsel, compliance efforts, and IP management.

The threat of new entrants for Hallmark is generally low due to substantial capital requirements, strong brand loyalty, and established distribution networks. Significant upfront investment is needed for manufacturing, inventory, and marketing, especially in a market like greeting cards, valued at approximately $1.5 billion in 2024. Hallmark's brand recognition, exceeding 90% in 2023 surveys, and its extensive retail partnerships further solidify its position, making it difficult for newcomers to gain traction without considerable resources.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for manufacturing, distribution, and marketing. | Substantial financial resources needed to compete. |

| Brand Loyalty | Decades of established trust and recognition. | New entrants must invest heavily in marketing to build awareness. |

| Distribution Channels | Proprietary stores and extensive retail partnerships. | Securing comparable shelf space and access is challenging and costly. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants face higher initial production costs, impacting pricing. |

| Regulatory & IP (Media) | Complex laws and IP acquisition costs in media. | Significant investment in legal and compliance resources is required. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hallmark leverages data from industry-specific market research reports, financial statements of key players, and consumer trend surveys. We also incorporate information from trade publications and economic indicators to provide a comprehensive view of the competitive landscape.