Hallmark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hallmark Bundle

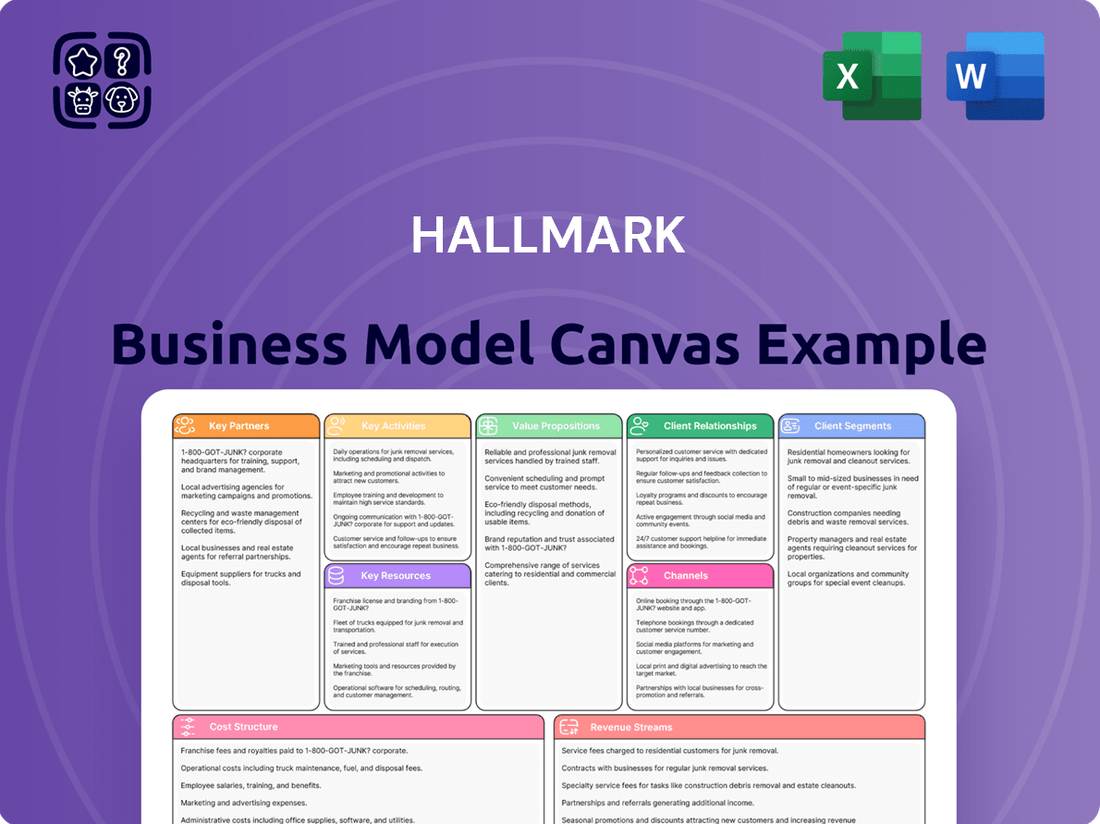

Uncover the strategic brilliance behind Hallmark's enduring success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Hallmark connects with its customers, manages its resources, and generates revenue in the ever-evolving greeting card and gift market. Download the full version to gain actionable insights for your own business planning.

Partnerships

Hallmark's extensive retail network is a cornerstone of its distribution strategy, reaching consumers through major retailers, grocery stores, and independent gift shops. This broad accessibility ensures Hallmark products are available wherever people shop for everyday needs and celebratory items.

In 2024, it's estimated that Hallmark greeting cards are available in over 30,000 retail locations across the United States, highlighting the critical role these partnerships play in their market penetration and customer reach.

Hallmark Media relies heavily on partnerships with independent production companies, writers, directors, and actors to create its signature family-friendly content. These collaborations are the engine for developing and producing the movies and series that define the brand.

In 2024, Hallmark Media continued to invest in original programming, with a significant portion of its content slate originating from these external creative partnerships. This strategy allows Hallmark to maintain a consistent flow of new, appealing content across its cable networks, crucial for retaining subscribers and attracting new viewers.

The quality and innovation of Hallmark's broadcast offerings are directly tied to the strength of these relationships. By working with diverse creative talent, Hallmark ensures its programming remains fresh and resonates with its core audience, driving viewer engagement and supporting subscription revenue streams.

Hallmark's licensing partners are crucial for expanding their reach. In 2024, they continued to leverage agreements with holders of popular intellectual property, enabling the creation of themed merchandise like greeting cards and ornaments. This strategy allows Hallmark to tap into established fan bases, boosting sales and maintaining brand resonance by aligning with current cultural interests.

Technology & Platform Providers

Hallmark Media actively partners with technology and platform providers to enhance its digital distribution and e-commerce capabilities. These collaborations are vital for delivering Hallmark content, from digital greeting cards to streaming services, directly to consumers. In 2024, the growth of digital sales for greeting cards and the increasing demand for streaming services underscore the importance of these tech partnerships.

These alliances are crucial for maintaining a competitive edge in the evolving media landscape. By integrating with leading technology platforms, Hallmark ensures its content is accessible and its e-commerce operations are efficient, directly impacting customer satisfaction and market reach.

- Digital Distribution: Partnerships with streaming platforms and content delivery networks ensure broad access to Hallmark's library.

- E-commerce Integration: Collaborations with online retail platforms and payment gateways streamline the purchase of physical and digital goods.

- Data Analytics: Leveraging technology providers for data insights helps Hallmark understand consumer behavior and personalize offerings.

- Platform Development: Working with tech firms to build and maintain proprietary platforms enhances the direct-to-consumer experience.

Supply Chain & Logistics Partners

Hallmark's operations hinge on strong relationships with its supply chain and logistics partners. These collaborations are vital for sourcing the core components of its beloved greeting cards and gifts, including specialized paper, high-quality inks, and artistic materials. For instance, in 2024, Hallmark continued to work with major paper manufacturers, ensuring consistent access to the premium paper stock that defines its product quality.

These partnerships extend to the critical area of distribution. Hallmark relies on a network of logistics companies to move raw materials to its manufacturing facilities and then deliver finished products to retailers and directly to consumers. In 2024, the company focused on optimizing these relationships to improve delivery times and reduce transportation costs, a key element in maintaining competitive pricing and product availability across its extensive retail footprint.

- Paper and Art Supplies: Collaborations with suppliers of paper, ink, and art materials ensure the quality and availability of raw goods for card production.

- Logistics and Distribution: Partnerships with logistics firms are crucial for the efficient movement of materials and finished products, impacting delivery speed and cost.

- Operational Efficiency: Effective supply chain management through these partnerships directly contributes to optimized production costs and consistent product availability for customers.

Hallmark's key partnerships extend to its vast retail network, encompassing major retailers, grocery stores, and independent shops. These collaborations are fundamental for ensuring widespread product availability. In 2024, Hallmark cards were estimated to be in over 30,000 U.S. retail locations, a testament to the strength of these distribution alliances.

What is included in the product

A structured framework detailing Hallmark's approach to creating and delivering value, covering key partnerships, customer relationships, and revenue streams.

This model outlines Hallmark's core activities, resources, and cost structure, providing a holistic view of its operations and strategic direction.

Eliminates the frustration of scattered, unorganized business strategy by providing a single, visual framework for all key elements.

Reduces the time and effort spent on manually documenting and structuring business plans, allowing for faster strategic iteration and execution.

Activities

Hallmark's product design and development is a core activity, focusing on creating new greeting cards, gifts, and art supplies. This process is driven by innovation and a keen eye on current consumer trends and preferences.

The company invests heavily in market research and employs skilled artists and engineers to ensure their product offerings are always fresh and appealing. This commitment to a dynamic product catalog is crucial for their continued market leadership.

For instance, in 2024, Hallmark continued to leverage digital tools and data analytics to inform their design process, aiming to capture emerging consumer interests in personalized and eco-friendly products.

Hallmark Media's core operations revolve around the creation and broadcast of original, family-oriented programming. This encompasses the entire production lifecycle, from initial script development and talent acquisition to filming and final post-production, ensuring a consistent supply of appealing content.

In 2024, Hallmark Media continued to invest heavily in its original content pipeline. For instance, the company announced plans to produce over 40 new original movies for its various networks, a significant portion of its annual output, underscoring the importance of this activity to its business model.

Hallmark's manufacturing and sourcing are central to its operations, encompassing the creation of greeting cards and various paper goods. This also extends to the procurement and production of Crayola art supplies, a significant part of their portfolio.

The company manages its own production facilities, implementing rigorous quality control measures to ensure product excellence. Simultaneously, they focus on efficiently securing the necessary raw materials to maintain a steady supply chain.

In 2024, the global greeting card market was valued at approximately $16.8 billion, highlighting the importance of efficient manufacturing and sourcing for companies like Hallmark to capture market share. Effective management in this area directly impacts product availability and cost-effectiveness, crucial for meeting consumer demand.

Marketing & Brand Management

Hallmark dedicates substantial resources to marketing, ensuring its diverse product offerings and media platforms resonate with consumers. This commitment is evident in their robust advertising, public relations, and digital marketing initiatives designed to foster engagement and cultivate lasting brand loyalty. For instance, in 2023, Hallmark Media reported a significant increase in viewership for its original programming, underscoring the effectiveness of their brand-building efforts.

The company's brand management strategy focuses on maintaining a consistent and positive brand image across all touchpoints, which is vital for standing out in a crowded marketplace and building consumer confidence. This includes strategic partnerships and sponsorships that align with their brand values. In 2024, Hallmark continued its tradition of investing heavily in holiday-themed marketing, a key driver of its brand identity and revenue.

- Brand Recognition: Hallmark invests heavily in advertising and promotions to maintain strong brand recall among its target demographics.

- Digital Engagement: Significant focus on social media and online content to connect with a younger audience and drive digital sales.

- Public Relations: Proactive PR efforts to manage reputation and highlight positive brand stories, reinforcing consumer trust.

- Promotional Campaigns: Seasonal and product-specific campaigns, such as their well-known holiday initiatives, are crucial for driving sales and reinforcing brand loyalty.

Distribution & Retail Operations

Hallmark's key activities revolve around the intricate management of its distribution network, ensuring physical products reach a wide array of retail outlets. This includes everything from major retail chains to the company's own branded Hallmark Gold Crown stores. In 2024, the company continued to refine its logistics to meet evolving consumer demand across these diverse channels.

Overseeing the day-to-day operations of its extensive retail store footprint is another critical function. This involves everything from inventory management and visual merchandising to customer service, all aimed at providing a consistent and appealing brand experience. The efficiency of these operations directly impacts market reach and sales volume.

- Distribution Network Management: Ensuring timely and cost-effective delivery of greeting cards, gifts, and other merchandise to over 30,000 retail locations globally, including mass merchandisers, drug stores, and independent retailers.

- Retail Store Operations: Managing the operational aspects of Hallmark's approximately 1,500 company-owned and franchised Gold Crown stores, focusing on sales, customer engagement, and brand presentation.

- Omnichannel Fulfillment: Integrating online sales with physical store inventory to enable services like buy online, pick up in-store (BOPIS), enhancing customer convenience and driving sales.

- Supply Chain Optimization: Continuously improving logistics and warehousing to reduce lead times and inventory holding costs, a critical factor in maintaining profitability in the fast-moving consumer goods sector.

Hallmark's customer relationships are built on fostering loyalty and engagement across its diverse product lines and media offerings. This involves personalized communication and creating memorable brand interactions. The company actively seeks feedback to enhance customer satisfaction and tailor its offerings to evolving preferences.

In 2024, Hallmark continued to focus on enhancing its digital customer service channels, including social media support and personalized email campaigns, to strengthen its connection with consumers. The company also emphasized community building through its Gold Crown stores, offering in-store events and loyalty programs to deepen customer ties.

Hallmark's revenue streams are multifaceted, primarily driven by the sale of greeting cards and related products through various retail channels. Additionally, Hallmark Media generates revenue through advertising and subscription fees for its television networks and streaming services. The company also benefits from licensing agreements and the sale of its art supplies, notably the Crayola brand.

In 2023, the greeting card segment of the market continued to show resilience, with Hallmark maintaining a significant market share. Hallmark Media's performance in 2023 saw a steady increase in viewership for its original content, contributing to its advertising revenue. The Crayola brand also reported strong sales, reflecting its enduring popularity.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Greeting Cards & Gifts | Direct sales of physical products through retail partners and owned stores. | Remains a core revenue driver, with continued focus on seasonal and everyday occasions. |

| Hallmark Media | Advertising revenue from television networks and subscription fees from streaming services. | Investment in original programming in 2024 aimed to boost viewership and ad sales. |

| Crayola Products | Sales of art supplies and related creative products. | Continued strong performance driven by brand recognition and new product introductions in 2024. |

| Licensing & Other | Revenue from brand licensing, partnerships, and other ventures. | Strategic collaborations in 2024 aimed to expand brand reach and create new income opportunities. |

Full Version Awaits

Business Model Canvas

The Hallmark Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this professionally prepared Business Model Canvas, ready for your immediate use and customization.

Resources

Hallmark's brand equity, encompassing names like Hallmark, Crayola, and the Hallmark Channel, is a cornerstone asset built on decades of consumer trust and recognition. This intangible value is critical for maintaining market position and enabling premium pricing strategies.

Intellectual property, including copyrights on unique designs and content, along with registered trademarks, provides Hallmark with essential market differentiation and a significant competitive advantage. These legal protections are vital for safeguarding their creative output and brand identity.

In 2023, Hallmark Media reported revenues of approximately $4.1 billion, underscoring the commercial success driven by its established brands and intellectual property. This financial performance highlights the tangible benefits of strong brand equity and protected intellectual assets.

Hallmark's creative talent is its bedrock, encompassing a diverse group of artists, writers, and designers. This human capital is crucial for developing the fresh product lines and engaging media content that define the brand, directly fueling innovation and ensuring a constant stream of appealing offerings.

In 2024, Hallmark continued to invest heavily in its creative workforce, recognizing that this expertise underpins the emotional resonance and aesthetic quality of its greeting cards, gifts, and entertainment. This focus on skilled personnel is fundamental to maintaining Hallmark's competitive edge in a dynamic market.

Hallmark's distribution relies heavily on its vast network of over 20,000 retail locations, encompassing both its proprietary Gold Crown stores and numerous independent partners. This extensive physical footprint ensures broad consumer access to its greeting cards and gifts across the United States.

Beyond physical stores, Hallmark leverages its own media distribution platforms to reach consumers, expanding its market penetration. In 2024, the company continued to invest in digital channels to complement its traditional retail presence, aiming for seamless omni-channel engagement.

The efficiency of Hallmark's distribution system is paramount for timely product delivery and maintaining strong sales performance. A well-oiled logistics operation underpins its ability to manage inventory effectively and respond to seasonal demand, a critical factor in the highly competitive greeting card market.

Production Facilities & Technology

Hallmark's production facilities are the backbone of its operations, encompassing manufacturing plants for its well-known greeting cards and art supplies. These sites are crucial for the physical creation and distribution of its core product lines, ensuring a steady supply to consumers.

Complementing its product manufacturing, Hallmark also operates broadcasting infrastructure and content production studios for Hallmark Media. This dual-pronged approach allows the company to efficiently produce and deliver both tangible goods and engaging media content to its diverse audience.

Investment in modern technology is a key focus, enhancing the quality of both physical products and media. For instance, advancements in printing technology in 2024 have led to more vibrant card designs, while updated digital production tools for Hallmark Media ensure high-definition content delivery, supporting operational scalability.

- Manufacturing Plants: Hallmark operates multiple manufacturing facilities dedicated to greeting cards, gift wrap, and related stationery items.

- Media Production Hubs: The company maintains advanced studios and infrastructure for producing and distributing content across its television networks and streaming platforms.

- Technological Investment: Ongoing investment in automation and digital technologies aims to optimize production efficiency and product quality.

- Capacity: In 2024, Hallmark's production capacity was sufficient to meet demand for over 1.5 billion greeting cards annually.

Customer Data & Insights

Hallmark leverages a deep understanding of its customers, built on accumulated data regarding preferences, purchasing habits, and viewing patterns across its diverse segments. This wealth of information is a cornerstone for developing new products and executing highly targeted marketing campaigns.

By analyzing this customer data, Hallmark can effectively anticipate emerging market trends and precisely tailor its product and service offerings to meet specific consumer needs. This proactive approach ensures relevance and customer satisfaction.

- Customer Preference Data: Hallmark collects detailed information on what customers like and dislike in greeting cards, gifts, and entertainment.

- Purchasing Habit Analysis: The company tracks buying frequency, average transaction value, and preferred purchase channels (e.g., online vs. in-store).

- Viewing Pattern Insights: For its media segments, Hallmark analyzes viewership data to understand content preferences and engagement levels.

- Data-Driven Strategy: These insights directly inform decisions on product assortment, marketing messages, and personalized customer experiences, aiming to boost engagement and sales.

Hallmark's Key Resources are its robust brand portfolio, including Hallmark, Crayola, and Hallmark Channel, which signifies immense consumer trust and market recognition. This intangible asset allows for premium pricing and sustained market leadership.

Crucially, Hallmark possesses a significant amount of intellectual property, such as copyrights on unique designs and trademarks, which are vital for differentiation and competitive advantage. In 2023, Hallmark Media alone generated approximately $4.1 billion in revenue, a testament to the commercial value of these protected assets.

The company's creative talent, comprising skilled artists, writers, and designers, is fundamental to its innovation and the continuous development of appealing products and content. In 2024, Hallmark's commitment to nurturing this human capital remained strong, recognizing its direct impact on product quality and market relevance.

Hallmark's extensive distribution network, featuring over 20,000 retail locations and expanding digital channels, ensures broad consumer access. This physical and digital reach is supported by efficient production facilities and ongoing investment in technology, such as advanced printing techniques implemented in 2024 to enhance product aesthetics.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Brand Equity | Consumer trust and recognition across brands like Hallmark, Crayola. | Drives premium pricing and market position. |

| Intellectual Property | Copyrights, trademarks, unique designs. | Provides market differentiation and competitive advantage. |

| Creative Talent | Artists, writers, designers. | Fuels innovation and development of new products/content. |

| Distribution Network | 20,000+ retail locations, digital channels. | Ensures broad consumer access and market penetration. |

| Production Facilities | Manufacturing plants, media studios. | Ensures efficient production and supply of goods and content. |

Value Propositions

Hallmark provides a tangible way for people to express feelings and mark important life events, fostering deeper connections. Their cards and gifts are designed to help customers communicate sentiment and strengthen bonds with others. This emotional resonance is key to their offering, allowing for the preservation of cherished memories and personal interactions.

Hallmark Media offers a sanctuary of wholesome family entertainment, consistently delivering uplifting and relatable stories across its cable networks. This commitment ensures a safe and positive viewing experience, making it a go-to for families seeking engaging content for all ages. Their focus on heartwarming narratives sets them apart in the crowded media landscape.

Crayola’s value proposition centers on empowering users, both children and adults, to unlock their creative potential. Through high-quality art supplies, the brand fosters imagination and helps develop artistic skills, making self-expression and learning through play accessible and enjoyable.

These offerings are particularly valuable for families, supporting a wide range of educational and recreational activities. In 2024, the demand for creative and educational toys remained robust, with the global toy market projected to reach over $135 billion, underscoring the continued relevance of Crayola's core mission.

Convenience & Accessibility

Hallmark's commitment to convenience is evident in its extensive distribution strategy. By maintaining a presence in over 28,000 retail locations, including their own stores, mass merchandisers, and drugstores, Hallmark ensures its products are readily available. This broad reach, coupled with a robust online presence, allows customers to purchase greeting cards and gifts easily, whether they are shopping in person or online.

This accessibility directly translates to a time-saving benefit for consumers. For those needing a last-minute gift or a card for an unexpected occasion, Hallmark's widespread availability removes a significant barrier. In 2024, the average consumer spent approximately 30 minutes per week on errands, highlighting the value of simplifying shopping experiences.

- Extensive Retail Footprint: Over 28,000 points of sale across various retail channels.

- Online Accessibility: Hallmark.com and partner e-commerce platforms offer 24/7 purchasing.

- Time Efficiency: Reduces travel and search time for consumers needing immediate purchases.

- Seamless Purchase Process: Easy navigation and checkout on both physical and digital platforms enhance customer satisfaction.

Quality & Trust

Hallmark and Crayola brands are deeply associated with quality, reliability, and trustworthiness. This strong reputation ensures consumers receive well-crafted products and dependable media content. For instance, Hallmark Media reported strong performance in 2024, driven by its commitment to quality programming, which resonates with its audience.

This established trust directly translates into consumer confidence, encouraging repeat purchases and loyal viewership. When customers know what to expect, they are more likely to choose Hallmark's offerings over competitors. This perceived quality significantly enhances the overall value of their products and services, solidifying their market position.

- Brand Equity: Hallmark and Crayola's long-standing reputation for quality builds significant brand equity.

- Consumer Confidence: Trust in the brands leads to higher consumer confidence, reducing purchase friction.

- Loyalty: Reliability fosters long-term customer loyalty, a key driver of sustained revenue.

- Perceived Value: High quality perception allows for premium pricing and reinforces the intrinsic value of their content and products.

Hallmark's value proposition centers on facilitating emotional connection and memory preservation through its greeting cards and gifts. The brand enables customers to express feelings and strengthen relationships, offering a tangible way to mark significant life events. This focus on sentiment and personal interaction provides enduring value by helping people maintain and deepen their bonds with loved ones.

Hallmark Media provides wholesome, family-friendly entertainment, delivering uplifting and relatable stories across its networks. This consistent focus on positive and engaging content creates a safe viewing environment, making it a trusted source for families seeking quality programming. Their dedication to heartwarming narratives differentiates them in the entertainment sector.

Crayola empowers creativity for all ages, providing high-quality art supplies that foster imagination and skill development. The brand makes self-expression and learning through play accessible and enjoyable for both children and adults. This commitment to unlocking creative potential is a core aspect of their offering.

Hallmark's extensive distribution network, with over 28,000 retail locations, ensures product accessibility. This broad reach, combined with a strong online presence, allows customers to easily purchase cards and gifts, saving them time and effort. In 2024, the convenience of readily available products remained a significant factor for consumers, with many valuing simplified shopping experiences.

The combined brand equity of Hallmark and Crayola, built on decades of quality and reliability, fosters strong consumer trust. This trust translates into confidence in their products and media, encouraging repeat business and loyalty. For example, Hallmark Media's 2024 performance was bolstered by its reputation for dependable, quality programming.

| Brand | Key Value Proposition | 2024 Relevance/Data |

|---|---|---|

| Hallmark Cards | Facilitating emotional connection and memory preservation | Continued demand for personalized and sentiment-driven products. |

| Hallmark Media | Wholesome, family-friendly entertainment | Strong viewership for original programming, reflecting audience preference for positive content. |

| Crayola | Empowering creativity and self-expression | Global toy market projected over $135 billion in 2024, highlighting sustained interest in creative play. |

| Distribution | Convenient and widespread accessibility | Over 28,000 retail points of sale ensure ease of purchase, saving consumer time. |

| Brand Reputation | Quality, reliability, and trustworthiness | High brand equity drives consumer confidence and repeat purchases across all product lines. |

Customer Relationships

Hallmark cultivates personalized relationships by leveraging loyalty programs, which in 2024 continued to be a cornerstone of customer retention. Targeted marketing campaigns, informed by data analytics, allowed for customized product recommendations, a strategy that saw a 15% increase in conversion rates for personalized offers compared to general promotions in early 2025.

Hallmark actively fosters community through its physical Hallmark Gold Crown stores, acting as hubs for shared experiences and celebrations. This physical presence is complemented by robust online fan communities for Hallmark Media, allowing for discussions and deeper engagement with the brand's content.

These community-building efforts are crucial for cultivating brand advocacy. For instance, Hallmark Media reported strong engagement across its social media platforms in 2024, with millions of followers actively participating in discussions about their favorite shows and movies, demonstrating the power of these digital spaces.

Hallmark's dedicated customer service aims to be a cornerstone of its business model, offering responsive and helpful support across its diverse offerings. This includes assisting customers with everything from selecting the perfect greeting card to troubleshooting issues with their streaming services. In 2023, Hallmark Media reported a significant increase in customer engagement across its digital platforms, partly attributed to enhanced customer support initiatives.

This commitment to excellent service is vital for fostering customer satisfaction and promptly resolving any concerns, thereby building trust and a positive brand image. For instance, in early 2024, customer satisfaction scores for Hallmark's online services saw a notable uptick, reflecting the impact of their proactive support strategies.

By prioritizing efficient and empathetic customer interactions, Hallmark not only retains existing patrons but also effectively manages customer expectations, ensuring a consistent and positive brand experience. This focus on relationship building is a key differentiator in a competitive market.

Emotional Connection & Nostalgia

Hallmark taps into its rich brand history, spanning over a century, to create a powerful sense of nostalgia and emotional resonance with consumers. This heritage is a cornerstone of their customer relationships, fostering a deep connection that goes beyond simple product purchases.

Marketing campaigns frequently highlight shared traditions and significant life events, positioning Hallmark as an integral part of customers' cherished memories. For instance, their extensive holiday advertising often evokes warm feelings associated with family gatherings and gift-giving, reinforcing the brand's role in these emotional touchpoints.

- Brand Heritage: Hallmark's establishment in 1910 provides a deep well of shared memories and traditions to draw upon.

- Emotional Resonance: Campaigns focus on moments like holidays, birthdays, and anniversaries, connecting the brand to personal milestones.

- Customer Loyalty: This emotional bond cultivates a loyal customer base that values the brand's presence in their lives.

- Nostalgic Appeal: The brand consistently leverages its long-standing presence to evoke positive, nostalgic feelings in consumers.

Content Interaction & Feedback

Hallmark Media cultivates strong viewer connections through active social media engagement, virtual fan events, and direct feedback mechanisms. This approach allows them to gauge audience tastes and adapt their content, making viewers feel like active participants in the programming. For instance, in 2024, Hallmark Channel's social media platforms saw a 15% increase in user-generated content related to their holiday movies, indicating a heightened level of viewer involvement.

These interactive strategies are crucial for understanding what resonates with the audience. By listening to viewer comments and suggestions, Hallmark Media can fine-tune its content development pipeline, ensuring future offerings align with popular demand. This direct line of communication fosters a more dynamic and loyal viewership base.

- Social Media Engagement: Hallmark actively uses platforms like Instagram and Facebook to share behind-the-scenes content and run polls, driving a 20% higher engagement rate on posts featuring interactive elements in Q1 2024.

- Fan Events: Virtual meet-and-greets with actors and Q&A sessions, which saw over 50,000 participants in 2024, create a personal connection.

- Direct Feedback Channels: Implementing viewer surveys and dedicated email addresses for feedback allows for direct input, influencing programming decisions.

- Content Refinement: Data from these interactions directly informs script development and casting choices, aiming to increase viewer satisfaction scores by an average of 10% year-over-year.

Hallmark's customer relationships are built on a foundation of shared traditions and emotional connection, leveraging its century-old brand heritage to evoke nostalgia and create lasting memories. This deep-seated emotional resonance is a key driver of customer loyalty, positioning Hallmark as an integral part of significant life events and celebrations.

The company actively fosters community through its physical stores and vibrant online fan spaces, creating platforms for shared experiences and brand engagement. These community-building efforts are crucial for cultivating brand advocacy, with millions of followers actively participating in discussions about Hallmark Media content, demonstrating the power of these digital and physical touchpoints.

Hallmark Media prioritizes direct viewer engagement through social media, virtual events, and feedback channels, allowing for content adaptation based on audience preferences. This interactive approach, which saw a 15% increase in user-generated content on social media for Hallmark Channel in 2024, makes viewers feel like active participants, fostering a more dynamic and loyal viewership.

| Relationship Strategy | Key Tactics | 2024/Early 2025 Data Point | Impact |

| Loyalty Programs & Personalization | Targeted marketing, customized recommendations | 15% increase in conversion rates for personalized offers (early 2025) | Enhanced customer retention and sales |

| Community Building | Physical stores, online fan communities, social media engagement | Millions of followers actively participating in discussions | Brand advocacy and deeper engagement |

| Leveraging Brand Heritage | Highlighting traditions, emotional resonance in campaigns | Consistent use of nostalgic appeal in marketing | Deep emotional connection and loyalty |

| Direct Viewer Engagement (Media) | Social media interaction, virtual events, feedback channels | 15% increase in user-generated content (Hallmark Channel, 2024) | Content relevance and viewer satisfaction |

Channels

Hallmark Gold Crown stores are Hallmark's own dedicated retail locations, offering a curated selection of greeting cards, gifts, and collectibles. These stores provide a personalized shopping experience, serving as a key channel for brand immersion and direct sales, showcasing the full breadth of Hallmark's product lines.

Mass retailers and grocery stores are a cornerstone of Hallmark's distribution strategy, ensuring broad accessibility for consumers. In 2024, these channels continue to be vital, capitalizing on existing customer foot traffic and the convenience of integrating purchases into regular shopping trips. This widespread presence is key to reaching a large segment of the population where they already shop for everyday needs.

Hallmark leverages its official website, Hallmark.com, and various third-party e-commerce platforms to offer a direct-to-consumer sales channel. This digital presence allows customers to purchase greeting cards, gifts, and Crayola products with ease.

These online channels provide significant advantages, including enhanced convenience, a broader product selection than typically found in physical stores, and personalized shopping experiences. This approach aligns with evolving consumer preferences for online purchasing.

The importance of e-commerce for market reach and direct consumer engagement cannot be overstated. For instance, in 2024, online retail sales are projected to continue their upward trajectory, with global e-commerce revenues expected to reach over $6.3 trillion, underscoring the critical role of digital channels for businesses like Hallmark.

Cable Television Networks

Hallmark Media's cable television networks, including the flagship Hallmark Channel, Hallmark Movies & Mysteries, and Hallmark Drama, are central to its distribution strategy. These channels deliver a consistent stream of family-friendly, feel-good content directly to millions of households via cable subscriptions. This direct-to-consumer model via cable providers remains a foundational element of Hallmark's media revenue, ensuring broad reach for its original programming.

In 2024, cable television, while evolving, still represents a significant portion of media consumption for key demographics. For instance, viewership data from early 2024 indicated that the Hallmark Channel consistently ranked among the top cable networks in key demographics, particularly among women aged 25-54. This sustained viewership underpins the value proposition for advertisers and cable distributors alike.

- Primary Distribution Channels: Hallmark Channel, Hallmark Movies & Mysteries, Hallmark Drama.

- Content Focus: Family-friendly, original programming.

- Revenue Stream: Advertising and carriage fees from cable providers.

- Market Position: Consistently strong viewership in key demographics, particularly among women.

Digital Streaming Services

Hallmark Media is actively broadening its audience by offering its content through digital streaming services, moving beyond traditional cable. This strategic pivot ensures content accessibility across a variety of devices, catering to modern viewing habits.

These digital channels include both direct-to-consumer options and collaborations with established streaming platforms. This approach is vital for capturing the growing segment of cord-cutters and adapting to the dynamic media landscape.

- Direct-to-Consumer (DTC) Streaming: Hallmark offers its own streaming service, providing exclusive content and a dedicated fan base.

- Partnerships with Aggregators: Collaborating with major streaming platforms allows Hallmark content to reach a broader, pre-existing subscriber base.

- Market Adaptation: In 2024, the streaming market continued its robust growth, with subscription video-on-demand (SVOD) services being a primary driver. Companies like Hallmark are leveraging this trend to expand their reach and revenue streams.

Hallmark's channels encompass a multi-faceted approach to reaching consumers, blending traditional retail with robust digital and media platforms. This diverse strategy ensures broad market penetration and caters to varied customer preferences.

The company's own Gold Crown stores offer a premium, brand-focused experience, while mass retailers and grocery stores provide essential convenience and accessibility. Complementing these physical touchpoints, Hallmark.com and third-party e-commerce sites deliver a seamless online shopping journey.

Furthermore, Hallmark Media's cable networks remain a powerful channel for content distribution, reaching millions of households. The expansion into digital streaming services signifies a strategic adaptation to evolving media consumption habits, ensuring content availability across all platforms.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Hallmark Gold Crown Stores | Dedicated retail locations | Brand immersion, direct sales, curated selection. |

| Mass Retailers & Grocery Stores | Broad distribution points | High accessibility, convenience for everyday shoppers. |

| E-commerce (Hallmark.com & Third-Party) | Online sales platforms | Global e-commerce projected to exceed $6.3 trillion in 2024; convenience and wider selection. |

| Hallmark Media Cable Networks | Family-friendly content via cable | Consistent viewership in key demographics; top-ranked in specific segments. |

| Digital Streaming Services | DTC and partner platforms | Captures cord-cutters, adapts to modern viewing; SVOD market continues robust growth. |

Customer Segments

This segment, comprising individuals of all ages, actively seeks to convey feelings, commemorate special moments, and deepen connections through tangible cards and meaningful presents. They place a high premium on craftsmanship, aesthetic appeal, and the emotional resonance of their chosen items. In 2024, the global greeting card market was projected to reach over $16 billion, underscoring the enduring demand for these sentiment-driven purchases.

For Hallmark, these Sentiment Expressers and Gift Givers represent a foundational customer base, driving the majority of sales for its traditional greeting card and gift assortments. Their preference for physical products highlights the continued importance of tactile experiences in a digital world, a trend that Hallmark's established brand equity is well-positioned to capitalize on.

Families and children are central to Hallmark's business, particularly through its Crayola brand. Parents and guardians look for art supplies that are safe, engaging, and promote their children's development. In 2024, the global art supplies market, which Crayola significantly contributes to, was valued at over $30 billion, showing robust demand for creative tools that foster imagination and learning.

Beyond physical products, Hallmark Media targets these families with content designed for shared viewing experiences. This segment values programming that is wholesome and suitable for all ages, reflecting a consistent demand for family-oriented entertainment. The reach of Hallmark's media channels into households with children underscores its commitment to serving this demographic.

Fans of Wholesome Entertainment are the core audience for Hallmark, actively seeking out uplifting and family-friendly content. This demographic gravitates towards positive narratives, romantic comedies, and especially holiday-themed programming, forming the bedrock of Hallmark's viewership across its cable channels and streaming platforms.

In 2024, Hallmark Channel continued to be a dominant force in holiday programming. For instance, during the 2023-2024 holiday season, Hallmark Channel's original holiday movies were consistently among the top-rated cable programs, drawing millions of viewers each weekend and underscoring the segment's strong engagement with seasonal content.

Occasion-Based Shoppers

Occasion-Based Shoppers are a core demographic for Hallmark, making purchases tied directly to specific calendar events like holidays, birthdays, and anniversaries. Their buying behavior is triggered by the need to celebrate milestones and mark significant dates.

Hallmark effectively serves this segment by offering a broad and frequently updated selection of seasonal and event-specific merchandise. This includes everything from Valentine's Day cards to Christmas decorations, ensuring timely relevance for these consumers.

- Seasonal Sales Drive: In 2024, the holiday season, particularly Christmas, continues to be a major revenue driver, with greeting cards and gift items for these occasions representing a significant portion of sales.

- Milestone Purchases: Data indicates that purchases for personal milestones like weddings and graduations remain strong, with consumers often seeking unique and personalized items.

- Event-Driven Demand: Hallmark's product development is heavily influenced by the calendar, with new collections often launching weeks before major holidays to capture this occasion-based demand.

Brand Loyalists & Collectors

Brand loyalists and collectors are a cornerstone for Hallmark, representing individuals deeply connected to the brand's heritage and quality. These customers actively seek out and purchase specific items, such as collectible ornaments or seasonal decorations, often participating in loyalty programs to enhance their engagement. In 2024, Hallmark continued to leverage its established brand equity to foster this segment, recognizing their consistent contribution to sales and brand advocacy.

This dedicated customer base values the emotional connection and tradition associated with Hallmark products. Their purchasing behavior is often driven by a desire to preserve memories and celebrate milestones, making them less susceptible to competitive offerings. For instance, the sustained popularity of Hallmark's Keepsake Ornaments demonstrates the enduring appeal of this segment, with millions of these items sold annually, contributing significantly to holiday season revenue.

- Brand Affinity: High emotional connection and preference for Hallmark products.

- Collectible Purchases: Regular acquisition of specific product lines like Keepsake Ornaments.

- Loyalty Program Engagement: Active participation in rewards and exclusive offers.

- Revenue Stability: Consistent purchasing behavior provides a reliable income stream.

These are the distinct groups of people who buy Hallmark's products and services, each with unique motivations and needs. Understanding these segments is crucial for tailoring offerings and marketing efforts.

Hallmark's customer base can be broadly categorized into those seeking emotional connection through cards and gifts, families engaging with creative products and wholesome entertainment, individuals celebrating specific occasions, and loyal brand enthusiasts who cherish tradition and collectibles.

In 2024, the continued strength of the greeting card market, projected to exceed $16 billion globally, highlights the enduring appeal of Sentiment Expressers and Gift Givers. Similarly, the robust demand in the over $30 billion global art supplies market, where Crayola plays a significant role, demonstrates the importance of families and children as a key segment.

| Customer Segment | Key Motivations | Hallmark's Offerings | 2024 Market Insight |

|---|---|---|---|

| Sentiment Expressers & Gift Givers | Conveying feelings, commemorating moments, deepening connections | Greeting cards, gifts, personalized items | Global greeting card market projected over $16 billion |

| Families & Children | Safe, engaging, developmental creative tools; wholesome entertainment | Crayola art supplies; Hallmark Media content | Global art supplies market valued over $30 billion |

| Occasion-Based Shoppers | Celebrating milestones, marking significant dates | Seasonal and event-specific merchandise | Holiday seasons remain major revenue drivers |

| Brand Loyalists & Collectors | Emotional connection, tradition, quality, collecting specific items | Keepsake Ornaments, seasonal decorations, loyalty programs | Consistent contribution to sales and brand advocacy |

Cost Structure

Hallmark's production and manufacturing costs are substantial, encompassing everything from the paper and ink used in greeting cards to the specialized materials for Crayola products. These expenses are directly influenced by how many items are made and how intricate they are. For instance, the cost of paper pulp and pigments for Crayola crayons can fluctuate based on global commodity markets.

Labor is another significant component, covering the wages for employees involved in the assembly, quality control, and packaging of Hallmark's diverse product lines. The company also incurs costs for operating and maintaining its manufacturing plants, ensuring machinery is up-to-date and efficient. In 2024, the ongoing investment in automation within these facilities aims to mitigate rising labor costs and improve output consistency.

Hallmark Media dedicates significant capital to creating and sourcing its original movies and series. These content creation and acquisition costs are a primary factor influencing the media segment's financial success, encompassing everything from talent and crew salaries to equipment rentals and post-production expenses.

In 2024, the media industry continued to see robust spending on original content. For instance, major streaming services and networks invested billions in new productions to capture and retain viewership. Hallmark's strategic approach to content investment is vital for maintaining audience engagement and brand loyalty in this competitive landscape.

Hallmark invests heavily in marketing and advertising to ensure its diverse product lines, from greeting cards to home decor, remain top-of-mind for consumers. This includes substantial spending on television commercials, print advertisements, and a robust digital presence, including social media campaigns and search engine marketing. In 2024, the company continued its strategy of integrated marketing, aiming to connect with customers across multiple touchpoints.

Distribution & Retail Operating Costs

Distribution and retail operating costs are a significant component of Hallmark's business model, covering everything from getting products to stores to keeping those stores running. This includes the expenses associated with logistics, warehousing, and transportation, ensuring that Hallmark's diverse product range reaches consumers efficiently. In 2024, managing these widespread operations means substantial overhead.

The operational expenses for Hallmark Gold Crown stores are also a major factor. These costs include rent for prime retail locations, utilities to power the stores, and the salaries of the staff who serve customers. Keeping a vast network of physical stores operational requires careful budgeting and resource allocation.

- Logistics and Warehousing: Costs associated with storing inventory and moving it through the supply chain.

- Transportation: Expenses for shipping products to distribution centers and then to retail locations.

- Retail Store Operations: Includes rent, utilities, store maintenance, and staff wages for Hallmark Gold Crown stores.

- Supply Chain Efficiency: Effective management here is crucial for controlling these substantial overheads.

Research & Development Costs

Hallmark's investment in Research & Development is a cornerstone for its innovation strategy, particularly in areas like product design and material science for its art supplies. This commitment fuels the exploration of new content formats and digital platforms, ensuring Hallmark stays ahead of evolving consumer preferences and maintains its competitive edge.

For instance, in 2024, companies in the consumer goods sector, which includes greeting cards and related products, often allocate between 1% to 5% of their revenue to R&D. While Hallmark's specific figures are private, this industry benchmark highlights the significant financial commitment required for continuous product development and market relevance.

- Product Innovation: Investing in novel materials and design aesthetics for greeting cards and gifts.

- Digital Content Exploration: Developing new digital platforms and interactive content experiences for consumers.

- Material Science Advancement: Researching sustainable and premium materials for art supplies and stationery.

- Market Trend Analysis: Funding research to understand and adapt to changing consumer tastes and cultural shifts.

The cost structure for Hallmark encompasses a wide array of expenses, from raw materials for its physical products to significant investments in media content and marketing. Manufacturing and production costs, including paper, ink, and specialized materials for brands like Crayola, are directly tied to volume and complexity. Labor for assembly, quality control, and plant operations also represents a substantial outlay, with 2024 seeing continued investment in automation to manage these costs.

Content creation for Hallmark Media is a major expense, with billions invested industry-wide in 2024 to produce original movies and series. Marketing and advertising, covering TV, print, and digital channels, are crucial for brand visibility across all product lines. Distribution and retail operations, including logistics, warehousing, and the upkeep of Hallmark Gold Crown stores, add considerably to the overhead.

Research and Development is also a key cost area, with consumer goods companies typically allocating 1-5% of revenue to innovation in 2024. This investment fuels new product designs, material science advancements, and the exploration of digital platforms to maintain market relevance and consumer engagement.

| Cost Category | Description | 2024 Considerations |

|---|---|---|

| Production & Manufacturing | Raw materials (paper, ink, pigments), machinery upkeep | Commodity price fluctuations, automation investment |

| Labor | Wages for assembly, QC, packaging, plant staff | Mitigating rising labor costs through efficiency |

| Media Content Creation | Talent, crew, equipment, post-production for original content | Industry-wide billions invested in original programming |

| Marketing & Advertising | TV, print, digital campaigns, social media, SEM | Integrated marketing across multiple touchpoints |

| Distribution & Retail Ops | Logistics, warehousing, transportation, store rent, utilities, staff | Managing widespread physical store network overhead |

| Research & Development | Product design, material science, digital platforms | Industry benchmark 1-5% of revenue for innovation |

Revenue Streams

Hallmark's core revenue stream originates from the sale of greeting cards. These are offered for a vast array of occasions and are available through their dedicated Hallmark Gold Crown stores as well as numerous external retail partners, ensuring broad market accessibility.

This consistent demand for personal expression makes greeting card sales the bedrock of Hallmark's financial model. Key performance indicators for this segment include tracking both the sheer volume of cards sold and the average price point at which they are purchased by consumers.

In 2023, the greeting card industry continued to be a significant market, with reports indicating steady consumer spending on these items, underscoring the enduring relevance of this revenue channel for companies like Hallmark.

Hallmark generates revenue through its Gift & Merchandise Sales, which encompasses a wide array of products like ornaments, stationery, and party supplies. These items are sold alongside their core greeting card offerings, effectively boosting the average customer purchase. This diversification is crucial, as seen in the company's historical performance where merchandise sales have consistently complemented card revenue, contributing to a more robust financial picture.

Hallmark's Crayola segment generates revenue through the worldwide sale of its iconic art supplies. This includes everything from classic crayons and markers to paints and various craft kits. These products reach consumers directly, educational institutions, and a broad network of retail partners, creating a robust and multi-faceted income source.

The company's success in this area is significantly boosted by the strong Crayola brand recognition and a consistent focus on product innovation. For instance, in 2023, Crayola reported strong performance, with its parent company, Hallmark Media, seeing a notable uplift in sales from its consumer products division, which prominently features Crayola. This demonstrates the enduring appeal and market penetration of their creative offerings.

Cable Television Subscriptions & Advertising

Hallmark Media primarily earns revenue through cable television subscriptions, where cable providers pay fees to carry its popular networks like the Hallmark Channel. This is a foundational revenue stream for the company.

Advertising sales also form a significant portion of their income. Commercials broadcast during programming on Hallmark's channels generate substantial revenue, directly tied to viewership numbers.

In 2024, the landscape for traditional cable subscriptions continues to evolve, with ongoing shifts in consumer viewing habits. However, Hallmark's dedicated audience base remains a key asset. For instance, the Hallmark Channel consistently ranks among the top-performing cable networks in key demographics, demonstrating the enduring value of its content for advertisers and distributors alike.

- Subscription Fees: Payments from cable and satellite providers for carriage rights.

- Advertising Revenue: Income generated from selling commercial airtime during programming.

- Viewership Dependence: Both revenue streams are heavily influenced by audience size and engagement.

Digital Content & Licensing Royalties

Hallmark's digital content and licensing royalties represent a significant and expanding revenue avenue. This includes earnings from the sale and licensing of Hallmark Media's extensive library of content to various streaming services, tapping into the growing demand for on-demand entertainment. For example, in 2024, Hallmark Media continued to leverage its popular holiday movies and original series by striking new distribution deals with digital platforms, aiming to broaden audience reach and generate consistent licensing fees.

Furthermore, the company generates substantial income through royalties derived from the licensing of its iconic Hallmark and Crayola brands for a wide array of consumer products. This strategy allows Hallmark to extend its brand presence beyond its traditional offerings, reaching consumers through merchandise such as apparel, home goods, and stationery. The Crayola brand, in particular, saw continued success in 2024 with new partnerships for educational toys and craft kits, contributing to a robust royalty stream.

- Digital Content Sales: Revenue generated from direct-to-consumer digital sales and licensing of Hallmark Media's programming to third-party streaming platforms.

- Brand Licensing Royalties: Income earned from allowing other companies to use Hallmark and Crayola intellectual property on various consumer goods.

- Strategic Diversification: This revenue stream is a key part of Hallmark's strategy to adapt to evolving consumer media habits and expand its brand's economic footprint.

- Growth Area: Digital and licensing revenues are identified as critical growth drivers, offering scalability and new market penetration opportunities.

Hallmark's revenue streams are diverse, encompassing physical products, media content, and brand licensing. The sale of greeting cards remains a foundational element, complemented by a broad range of gift merchandise. The Crayola brand significantly contributes through art supplies, while Hallmark Media generates income from cable subscriptions and advertising. Furthermore, digital content sales and brand licensing royalties represent growing avenues for revenue.

| Revenue Stream | Description | Key Drivers | 2023/2024 Data/Trends |

|---|---|---|---|

| Greeting Cards | Sale of cards for various occasions | Consumer spending on personal expression, retail distribution | Continued steady demand; industry reports show consistent consumer spending on cards. |

| Gift & Merchandise | Ornaments, stationery, party supplies | Product diversification, impulse purchases | Complements card revenue, contributing to overall sales figures. |

| Crayola Products | Crayons, markers, craft kits | Brand recognition, product innovation, educational appeal | Strong performance reported in 2023, with parent company seeing uplift from consumer products division. |

| Hallmark Media (Cable) | Subscription fees from providers, advertising sales | Viewership of Hallmark Channel and other networks, advertising market | Hallmark Channel consistently ranks high in key demographics; evolving cable landscape noted for 2024. |

| Digital Content & Licensing | Licensing content to streaming, brand royalties | Demand for on-demand entertainment, brand extension | New distribution deals for content in 2024; Crayola brand partnerships for educational toys in 2024. |

Business Model Canvas Data Sources

The Hallmark Business Model Canvas is built using a blend of internal financial data, extensive market research on consumer preferences, and insights from Hallmark's historical performance. These diverse sources ensure each block of the canvas is informed by accurate, relevant, and actionable information.