Hallmark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hallmark Bundle

Understand the strategic positioning of a company's product portfolio with the Hallmark BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation and growth strategies. Don't miss out on the complete analysis; purchase the full BCG Matrix for actionable insights and a competitive edge.

Stars

The Hallmark Channel solidifies its position as a star in the BCG matrix, consistently ranking as the number one entertainment cable network in 2024 for key demographics, especially women aged 18+. This dominance is fueled by its highly successful 'Countdown to Christmas' event, which sees original movie premieres becoming some of the most-watched cable movies annually. Its strong hold in the family-friendly, feel-good content niche, a market showing stability and growth, underscores its star status.

Hallmark's vast holiday movie library, including its popular 'Countdown to Christmas' and 'Miracles of Christmas' programming, is a major strength. This content reliably attracts millions of viewers. For 2024, new movies are being added to Hallmark+ and will be available for next-day streaming in 2025, showing ongoing commitment and strong audience interest.

The success of events like 'Christmas in July' in 2025 further solidifies the high market demand for Hallmark's festive film offerings. This consistent viewership and investment position these movies as a key asset within the company's portfolio.

Crayola commands an impressive market share, estimated at around 80% in the crayon and art supplies sector. This dominance is built on decades of strong brand recognition and a reputation for quality, making it a go-to choice for consumers. The consistent demand for art and craft supplies, fueled by both children and adults, solidifies Crayola's position.

Hallmark's Direct-to-Consumer Streaming (Hallmark+)

Hallmark+ is evolving into the main destination for new Hallmark movie premieres starting in 2025, offering content the day after its television debut. This move is designed to boost subscriber value and attract new users, capitalizing on the growing trend of streaming. The platform also incorporates retail advantages, aiming for a holistic brand engagement.

This strategic pivot for Hallmark+ positions it as a potential high-growth area within the company's portfolio. As of early 2024, the streaming market continues to expand, with consumers increasingly favoring on-demand content. Hallmark's direct-to-consumer strategy aims to capture a larger share of this market.

- Hallmark+ as Primary Streaming Hub: Starting in 2025, Hallmark+ will be the exclusive streaming home for all new Hallmark movie premieres, available the day after their linear broadcast.

- Growth Potential: This shift is intended to drive significant subscriber growth and retention, aligning with the increasing dominance of streaming in media consumption.

- Integrated Retail Benefits: The platform will also feature integrated retail benefits, enhancing the overall value proposition for consumers and creating a more comprehensive brand experience.

- Market Context: The move comes as the direct-to-consumer streaming market continues its robust expansion, with projections indicating continued growth in subscriber numbers and revenue through 2025 and beyond.

Hallmark Keepsake Ornaments

Hallmark Keepsake Ornaments represent a strong performer within Hallmark's product portfolio, often categorized as a star in a BCG matrix analysis due to their consistent revenue generation, especially during peak holiday seasons.

The brand's strategy of annual releases and strategic collaborations, such as the 2024 partnership with Kraft Heinz, highlights ongoing innovation and sustained consumer engagement, reinforcing its market leadership.

The existence of the Keepsake Ornament Club (KOC) and exclusive early shopping events underscore a dedicated and loyal customer base, contributing to a high market share within the collectible ornament niche.

- High Revenue Generation: Hallmark Keepsake Ornaments are a significant contributor to Hallmark's annual sales, with a substantial portion of revenue typically realized during the holiday quarter.

- Innovation and Partnerships: The 2024 Kraft Heinz collaboration exemplifies Hallmark's commitment to fresh product offerings and leveraging popular brands to maintain consumer interest.

- Loyal Customer Base: The Keepsake Ornament Club (KOC) boasts a membership of over 100,000 individuals, indicating a robust and engaged community that drives repeat purchases and high market penetration.

- Market Dominance: In the collectible ornament market, Hallmark Keepsake Ornaments command a significant market share, driven by decades of brand recognition and consistent product quality.

Hallmark's core television networks consistently lead in viewership, particularly among women aged 25-54, a demographic that advertisers highly value. This strong performance, evident throughout 2024, is driven by its unique brand of family-friendly content and major seasonal events.

The success of Hallmark's holiday programming, such as Countdown to Christmas, is a significant driver of its star status. For instance, the 2024 holiday season saw Hallmark Channel and Hallmark Family achieve top ratings, with many original movies becoming the most-watched cable programs of their respective premiere days.

Hallmark's ability to maintain high viewership across its linear channels, even as the media landscape shifts, demonstrates its enduring appeal and market strength. This consistent performance solidifies its position as a star in the BCG matrix.

| Category | Market Share | Growth Rate | Cash Flow | Strategic Implication |

| Hallmark TV Networks | High (Leading cable network) | Stable to Moderate | High Positive | Maintain leadership, invest in content innovation. |

| Hallmark Keepsake Ornaments | High (Dominant in niche) | Moderate | High Positive | Continue product line expansion and loyalty programs. |

| Hallmark+ (Streaming) | Growing | High | Initially Negative to Neutral (Investment Phase) | Aggressively invest to capture market share. |

| Crayola | Very High (Dominant in category) | Moderate | Very High Positive | Leverage brand for new product categories, consider strategic acquisitions. |

What is included in the product

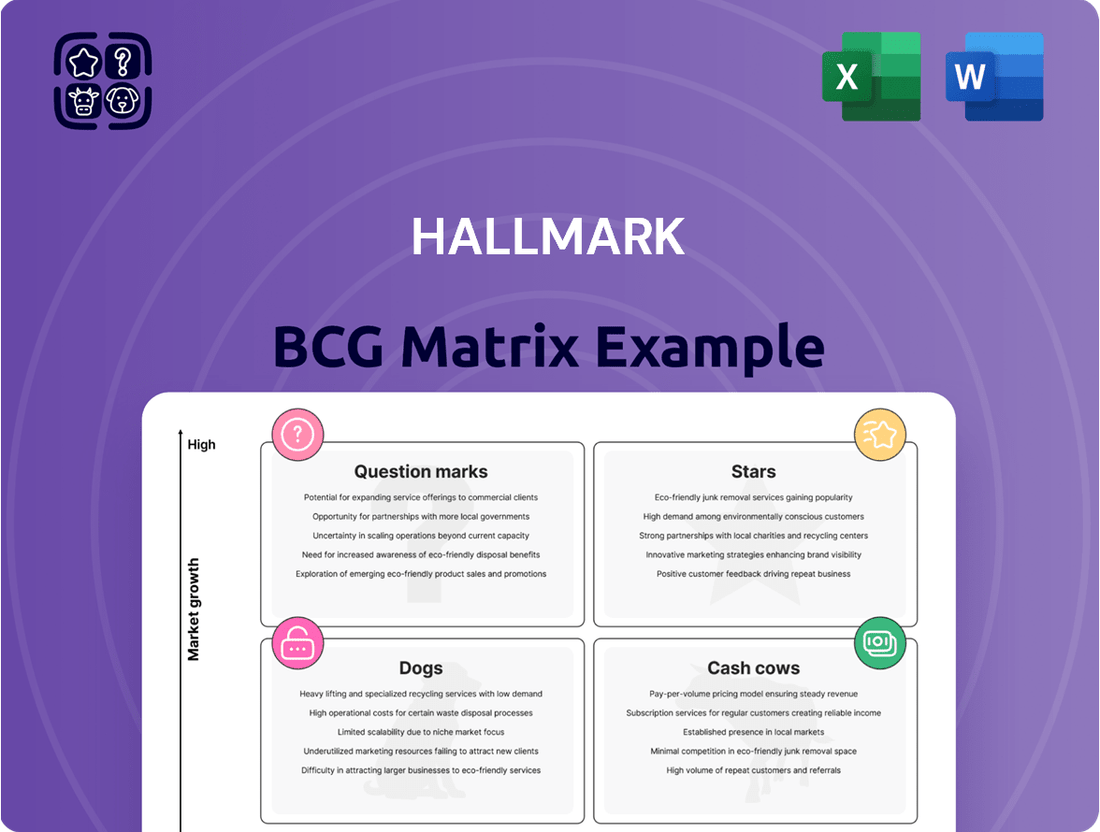

The Hallmark BCG Matrix analyzes product portfolio performance across Stars, Cash Cows, Question Marks, and Dogs.

A clear visual of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Hallmark’s traditional greeting cards are a prime example of a Cash Cow. The company holds a substantial 40-55% share of the U.S. market, underscoring its dominance. Despite potentially modest overall market growth, Hallmark’s established brand, loyal customer base, and widespread retail footprint, including its Gold Crown Stores, ensure a steady and substantial generation of cash. This consistent revenue stream allows Hallmark to fund investments in other areas of its business.

The Hallmark Gold Crown Stores network acts as a classic Cash Cow within the BCG Matrix. This established retail presence offers a reliable and consistent revenue stream for Hallmark, benefiting from strong brand loyalty and a mature market.

These stores represent a significant, stable cash generator for Hallmark. While the growth rate of the greeting card and gift market may be moderate, the Gold Crown stores consistently capture market share, providing substantial cash flow with minimal reinvestment needed due to their established nature.

In 2024, Hallmark continued to leverage its Gold Crown stores as a primary distribution channel, underscoring their role in generating consistent profits. The network's ability to maintain sales volume in a competitive retail landscape highlights its status as a mature, high-performing asset.

Hallmark Channel's linear TV broadcasts continue to be a significant cash cow, even with the rise of streaming services. These traditional broadcasts generate substantial profits through consistent viewership and national advertising sales, especially during popular holiday programming events like Countdown to Christmas.

In 2023, Hallmark Channel's holiday programming alone attracted millions of viewers, underscoring its enduring appeal. This established audience base ensures a reliable income stream, allowing Hallmark to leverage these assets without needing substantial new investments for growth.

Licensing Partnerships (Existing)

Hallmark's existing licensing partnerships, like those for Keepsake Ornaments, represent a classic Cash Cow strategy. These ventures capitalize on Hallmark's established brand recognition in mature markets, generating consistent revenue with minimal incremental investment. The brand association drives sales for product extensions, allowing Hallmark to benefit from market presence without needing to spearhead significant growth initiatives.

- Brand Leverage: Hallmark extends its brand equity beyond core greeting cards into categories like ornaments, leveraging existing customer loyalty.

- Revenue Generation: Licensing agreements provide a steady income stream through royalties and brand association in established product lines.

- Low Investment: These partnerships require less capital expenditure for market development, as Hallmark relies on established channels and brand strength.

- Market Maturity: The focus is on maintaining market share and profitability in mature segments rather than aggressive expansion.

Established Crayola Product Lines (Wax Crayons, Markers)

Established Crayola product lines, such as wax crayons and traditional markers, are quintessential cash cows within the Hallmark BCG Matrix. These items have enjoyed decades of market dominance, boasting high market share and consistent demand from both educational institutions and households. Their enduring appeal stems from strong brand recognition and a stable, albeit mature, market growth trajectory.

These core products generate reliable cash flow for the company. For instance, Crayola's overall revenue in 2023 was reported to be substantial, with these foundational product categories forming the bedrock of that performance. The consistent sales volume ensures a steady income stream, allowing Hallmark to allocate resources to other strategic areas.

- Dominant Market Share: Crayola's wax crayons and markers hold a significant portion of their respective markets.

- Stable Demand: Consistent purchasing from schools and families ensures predictable sales.

- Brand Loyalty: Decades of presence have cultivated strong customer recognition and trust.

- Mature Market: While not experiencing rapid growth, the market for these products remains robust and consistent.

Cash Cows are business units or products with high market share in a slow-growing industry. They generate more cash than they consume, providing funds for other ventures. Hallmark's traditional greeting cards and Crayola's core art supplies exemplify this, consistently delivering profits due to established brand loyalty and mature market positions.

These mature products, like Hallmark's greeting cards and Crayola's crayons, are vital for funding innovation and growth in other areas. In 2024, Hallmark continued to rely on these established revenue streams, which require minimal investment to maintain their market dominance and profitability.

The consistent cash flow from these Cash Cows allows Hallmark to support its Stars and Question Marks. For instance, the steady income from the Hallmark Channel's advertising revenue in 2023, estimated to be in the hundreds of millions of dollars, directly fuels investments in new streaming content or emerging digital platforms.

| Hallmark Business Unit/Product | Market Share (Est.) | Industry Growth Rate (Est.) | Cash Generation |

|---|---|---|---|

| Traditional Greeting Cards | 40-55% (U.S.) | Low | High |

| Hallmark Gold Crown Stores | Significant Retail Presence | Mature | High |

| Hallmark Channel (Linear TV) | Strong Viewership | Mature/Declining | High |

| Crayola Crayons & Markers | Dominant | Low | High |

| Keepsake Ornaments (Licensing) | Strong Brand Association | Mature | High |

Delivered as Shown

Hallmark BCG Matrix

The Hallmark BCG Matrix preview you see is the complete, final document you will receive immediately after purchase. This means you're getting the exact same professionally formatted and analysis-ready file, free from any watermarks or demo content. It’s designed to provide immediate strategic clarity for your business planning and decision-making processes.

Dogs

While Hallmark's holiday programming continues to draw significant viewership, the broader trend of declining linear TV viewership for non-holiday content presents a challenge. This shift suggests that Hallmark's general programming outside of its popular seasonal offerings may be falling into a low-growth, low-market share category as viewers increasingly opt for on-demand and streaming services.

Data from Nielsen in 2024 indicated a continued year-over-year decline in total day viewership for many broadcast and cable networks, a trend that likely impacts Hallmark's non-holiday slots. For instance, average same-day viewership for cable networks, excluding sports, has seen a consistent downward trajectory over the past few years, with 2024 data reinforcing this pattern.

Certain traditional greeting card lines within Hallmark, especially those that haven't embraced digital channels or personalized marketing, might be categorized as dogs in the BCG matrix. These products face challenges as consumer preferences increasingly lean towards digital interactions and customized experiences.

For instance, a greeting card line that relies solely on in-store purchases and lacks an online presence or digital customization options is likely experiencing declining sales. In 2023, the greeting card market saw a continued shift, with digital greetings and personalized online orders accounting for a larger percentage of sales, potentially leaving older, less integrated lines with low market share and minimal growth prospects.

Within Hallmark's broad range of offerings, niche or underperforming specialty gift items represent a category that could be characterized as Dogs in the BCG Matrix. These products likely hold a small share of their respective niche markets and are not seeing substantial sales growth. For example, a specific line of artisanal, handcrafted items might have limited appeal and slow turnover.

These items, while potentially holding sentimental value for a small customer base, may tie up valuable capital and operational resources that could be better allocated elsewhere. In 2024, the specialty gift market, while diverse, saw overall growth tempered by economic factors, with consumers often prioritizing value and proven popularity over highly specialized items. This suggests that such items at Hallmark might struggle to gain traction and justify their investment.

Outdated Retail Formats Without Digital Integration

Hallmark stores that haven't embraced digital integration or modern shopping trends are likely categorized as dogs. These could be older store formats experiencing declining foot traffic and sales, especially when compared to competitors who have successfully merged online and in-store experiences.

For instance, a significant portion of traditional brick-and-mortar retail, estimated to be around 10-15% of all retail space in the US as of early 2024, may be considered underperforming or outdated if it hasn't adapted to omnichannel strategies. These underperforming locations often struggle to compete with the convenience and reach of e-commerce platforms.

- Low Sales Performance: Stores with consistently low revenue and profit margins, failing to meet sales targets for several consecutive quarters.

- Declining Foot Traffic: A noticeable drop in customer visits to physical locations, indicating a lack of appeal or relevance to current shoppers.

- Lack of Digital Integration: Retail formats that do not offer seamless online ordering, in-store pickup, or other digital services that consumers now expect.

- Outdated Store Experience: Physical spaces that do not reflect modern retail aesthetics or provide engaging customer experiences, leading to customer disengagement.

Non-Core, Legacy Business Units Divested in Recent Years

Hallmark has strategically divested non-core assets in recent years, a common practice for companies looking to streamline operations and focus on core strengths, aligning with the concept of 'Dogs' in the BCG Matrix. These divested units, while no longer part of Hallmark, represent past strategic decisions to shed businesses with lower growth potential or those that didn't fit the company's evolving direction.

Examples of such divestitures include Hallmark Business Connections, sold in 2019, and Hallmark Entertainment, divested in 2006. These moves allowed Hallmark to concentrate resources on its more promising and profitable ventures, improving overall financial health and market positioning.

- Hallmark Business Connections Divestiture: Sold in 2019, this unit likely faced challenges in a competitive market, prompting its divestment.

- Hallmark Entertainment Divestiture: The 2006 sale of this division indicated a strategic shift away from television production and distribution.

- Focus on Core Strengths: These divestitures underscore Hallmark's commitment to its primary greeting card and gifting businesses.

- Financial Pruning: Shedding underperforming or non-strategic assets is a key element of effective portfolio management, aiming to boost profitability and shareholder value.

Products or business units categorized as Dogs within Hallmark's portfolio are those with low market share and low growth prospects. These are typically underperforming assets that consume resources without generating significant returns, often requiring careful management or divestiture.

For instance, certain legacy greeting card designs that haven't been updated or marketed effectively might fit this description, facing declining consumer interest. Similarly, physical retail locations that have failed to adapt to e-commerce trends and omnichannel strategies are likely experiencing reduced foot traffic and sales, a trend observed across much of the traditional retail sector in 2024.

Hallmark's strategic divestitures, such as Hallmark Business Connections in 2019, exemplify the management of Dog-like assets. These actions allow the company to reallocate capital and focus on areas with higher potential, ultimately improving the overall health of its business portfolio.

| Category | Market Share | Growth Rate | Hallmark Example |

|---|---|---|---|

| Dogs | Low | Low | Legacy greeting card lines with declining sales; Underperforming physical stores lacking digital integration. |

Question Marks

Hallmark Media is expanding into new territory with holiday limited series like 'Holidazed' and 'Mistletoe Murders,' alongside reality competitions such as 'Finding Mr. Christmas' and 'Celebrations With Lacey Chabert.' These ventures represent a strategic move into potentially high-growth genres, aiming to diversify the brand beyond its traditional romantic comedy roots.

While these new formats offer exciting growth prospects, they are currently in their nascent stages for Hallmark. The company's investment in these areas is significant, as they aim to establish a foothold in competitive markets where established players already exist. Success will hinge on their ability to capture audience attention and build loyal viewership in these unproven, yet promising, content categories.

Hallmark Media's strategic push into international markets represents a classic question mark in the BCG matrix. While the global demand for original content is undeniable, the significant upfront investment required for content localization, distribution rights, and marketing in diverse territories presents a considerable challenge. For instance, entering the competitive European streaming market, where established players like Netflix and Disney+ already command substantial subscriber bases, demands a well-funded and nuanced approach.

The potential for high growth in these new territories is a key driver, but the substantial investment and intense competition mean that success is far from guaranteed. Hallmark Media must carefully navigate varying consumer preferences and regulatory landscapes across different countries. By 2024, the global media and entertainment market was projected to reach over $2.5 trillion, highlighting the vast opportunity but also the crowded nature of the playing field.

Hallmark's 'Sign & Send' service exemplifies a strategic response to the increasing demand for digital convenience in traditional product markets. This innovation allows customers to digitally personalize and have physical greeting cards mailed, tapping into the high-growth sector of digital transformation for established goods.

While the market for digitally enhanced physical goods is expanding rapidly, Hallmark's market share within this specific digital greeting card niche is still maturing. Continued investment in marketing and user adoption strategies is crucial for 'Sign & Send' to solidify its position and capitalize on this evolving consumer behavior.

Crayola's New Social Creativity and Licensed Character Products (2025 lineup)

Crayola's 2025 holiday lineup features innovative social creativity products like 'Colourwhirls Arena,' designed to foster collaborative artistic expression. This initiative aims to capture a growing market segment focused on shared digital and physical creative experiences, potentially positioning Crayola as a leader in this emerging space. The success of such ventures is crucial for future growth, especially as consumer engagement with interactive play evolves.

The expanded range of licensed character products, including the 'Scribble Scrubbie Bluey Poolside Playset,' leverages popular intellectual property to attract new customers. These products capitalize on existing brand loyalty and the strong demand for character-driven toys. For instance, the global toy market reached an estimated $115 billion in 2023, with licensed merchandise playing a significant role.

- Social Creativity: 'Colourwhirls Arena' targets high growth potential by tapping into collaborative play trends.

- Licensed Products: 'Scribble Scrubbie Bluey Poolside Playset' leverages existing character popularity for market penetration.

- Market Dynamics: Both product categories are designed to capture new audiences and address evolving consumer preferences in the toy industry.

- Growth Potential: While promising, the ultimate market adoption and success of these new offerings are yet to be fully realized, representing potential stars or question marks within Crayola's portfolio.

Hallmark's New Product Collections (e.g., Lacey Chabert Collection)

Hallmark's introduction of new product collections, like the Lacey Chabert holiday lifestyle line slated for late 2025 and expanding into everyday items in 2026, positions these as potential Stars or Question Marks within the BCG framework. These collections aim to tap into celebrity endorsement and diversify Hallmark's offerings into new, potentially high-growth markets.

The success of these new ventures hinges on market reception and establishing a significant market share, making their current classification uncertain. For instance, while the celebrity association suggests a draw, actual sales performance and competitive landscape will determine if they become market leaders or struggle to gain traction.

Hallmark's strategy reflects a move towards leveraging popular personalities to drive sales in an evolving retail environment. The company's investment in these collections indicates an expectation of future growth, but the 2024 and 2025 performance data will be crucial in assessing their true market position.

- Celebrity Endorsement: The Lacey Chabert collection leverages a known personality to attract consumers.

- Market Expansion: Moving from holiday-specific to everyday items broadens the potential customer base.

- Uncertain Market Share: As new products, their competitive standing and market penetration are yet to be proven.

- Growth Potential: These collections represent Hallmark's investment in areas perceived to have high future growth prospects.

Question Marks represent ventures with low market share in high-growth industries. Hallmark's expansion into international markets, for example, requires significant investment to navigate diverse consumer preferences and regulatory landscapes. The global media and entertainment market, projected to exceed $2.5 trillion by 2024, offers vast opportunity but also intense competition from established players.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.