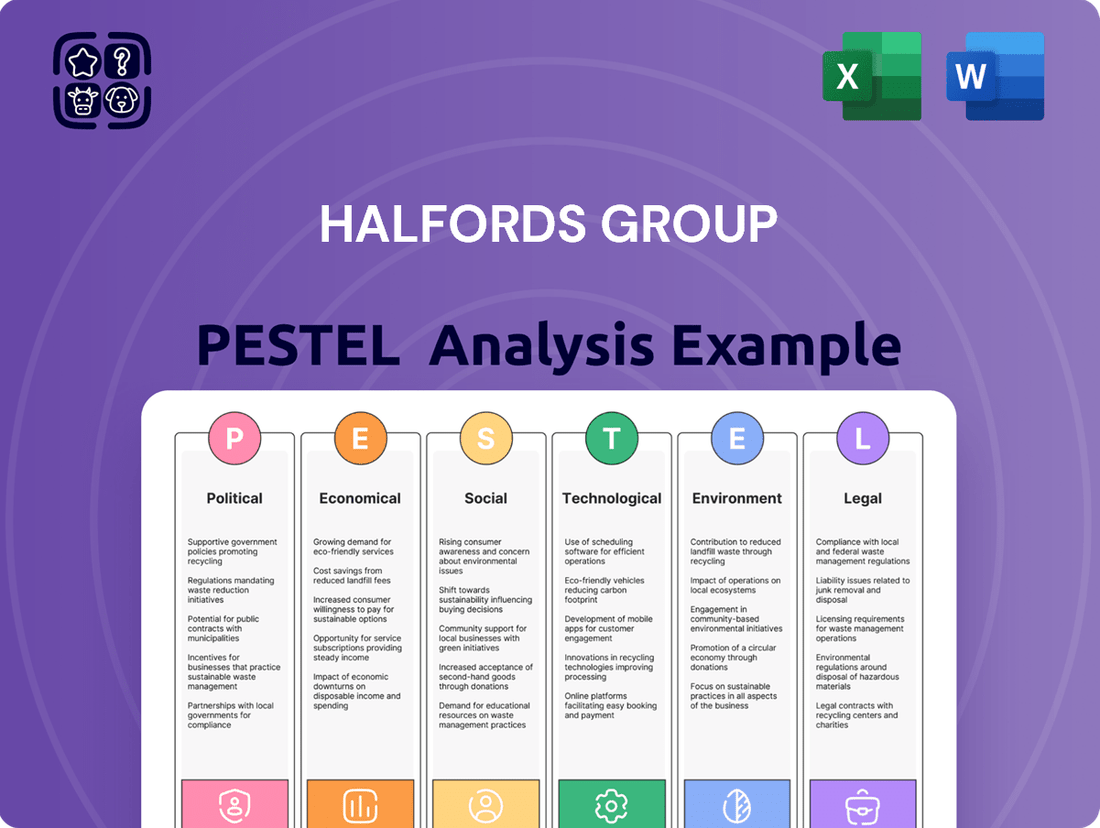

Halfords Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halfords Group Bundle

Navigate the evolving landscape of the automotive and cycling sectors with our comprehensive PESTLE analysis of Halfords Group. Understand how political shifts, economic fluctuations, and societal trends are directly impacting their operations and strategic direction. Gain a critical edge by uncovering the technological advancements and environmental regulations shaping their future. Download the full analysis now to unlock actionable intelligence and inform your own strategic decisions.

Political factors

The UK government's push for decarbonisation significantly impacts Halfords' motoring services. The Zero Emission Vehicle (ZEV) mandate, effective from January 2024, requires manufacturers to sell an increasing proportion of electric vehicles (EVs), directly shaping consumer choices and future servicing demands.

Although the ban on new petrol and diesel vehicle sales has been pushed back to 2035, the government's overarching commitment to reducing road transport emissions remains strong. This policy direction necessitates that Halfords continues to adapt its service offerings to support the growing EV market and the evolving needs of vehicle owners.

New consumer protection laws, such as the Digital Markets, Competition and Consumers Act 2024 effective April 2025, are reshaping the retail landscape. These regulations grant the Competition & Markets Authority (CMA) enhanced powers, including the ability to levy fines up to 10% of a company's annual turnover for violations like drip pricing or misleading reviews.

For Halfords, this necessitates rigorous adherence to its pricing, advertising, and online review management strategies. Failure to comply could result in significant financial penalties and damage to its brand reputation, underscoring the importance of proactive compliance measures.

The UK government's fiscal policies, particularly the autumn budget, directly influence Halfords' operational expenses. For example, adjustments to the minimum wage and National Insurance contributions are projected to increase Halfords' direct labor costs by around £23 million in the fiscal year 2026.

While Halfords is implementing strategies to offset these increased labor costs, the wider economic implications of government policies on consumer disposable income and spending habits remain a significant political factor for the company.

Potential Licensing of Motor Retail Industry

Consumer protection groups and the Chartered Trading Standards Institute are pushing for mandatory licensing in the UK motor retail sector. This potential legislation, likely to be a focus for the next UK government, aims to address a rising number of complaints concerning used car sales and vehicle repair quality. For Halfords, this could mean new regulatory hurdles and operational standards for its Autocentres.

The drive for licensing stems from persistent issues within the industry. For instance, in 2023, the Financial Conduct Authority (FCA) reported that over 1.2 million consumers sought help with motor finance issues, a significant portion of which could be linked to the broader retail experience. Such a move would require businesses like Halfords to adhere to stricter compliance, potentially impacting service delivery and cost structures.

Key implications for Halfords' Autocentres include:

- Increased Compliance Burden: Meeting new licensing requirements could necessitate investment in training, technology, and process improvements.

- Enhanced Consumer Trust: Mandatory licensing could elevate industry standards, potentially boosting consumer confidence in services like vehicle repairs.

- Competitive Landscape Shift: Businesses already operating with high standards might see a leveling of the playing field, while less compliant operators could face significant challenges.

Government Investment in Automotive and Cycling Infrastructure

Government investment in electric vehicle (EV) charging infrastructure and cycling initiatives presents a significant tailwind for Halfords. For instance, the UK government's commitment to installing hundreds of thousands of new charge points by 2030, coupled with a £350 million investment in EV battery manufacturing announced in 2024, directly supports Halfords' strategic focus on EV servicing and parts. This infrastructure development encourages EV adoption, a key growth area for the company.

Furthermore, the ongoing support for cycling infrastructure, including dedicated cycle lanes and investment in active travel, is projected to boost participation in cycling. This trend is expected to translate into increased demand for bicycles, accessories, and maintenance services, all core offerings for Halfords. The company is well-positioned to capitalize on this shift towards more sustainable transportation methods.

- EV Charging Infrastructure Growth: The UK aims for 300,000 public EV charge points by 2030, a substantial increase from the approximately 60,000 available in early 2024.

- Cycling Participation: Government initiatives aim to double cycling rates by 2030, potentially increasing the market for cycling products and services.

- Manufacturing Support: Investments in British automotive manufacturing, including EV components, can create a more robust supply chain for Halfords' automotive parts division.

Political factors significantly shape Halfords' operating environment, particularly through the UK's decarbonisation agenda and evolving consumer protection laws. The push for electric vehicles, despite the delayed ban on new petrol and diesel sales to 2035, means Halfords must continue adapting its services for EVs. New regulations like the Digital Markets, Competition and Consumers Act 2024, effective April 2025, grant the CMA powers to fine companies up to 10% of annual turnover for issues like misleading pricing, directly impacting Halfords' retail practices.

Government fiscal policies, such as changes to minimum wage and National Insurance, are projected to increase Halfords' direct labor costs by approximately £23 million in FY26. Furthermore, potential mandatory licensing for the UK motor retail sector, a focus for the next government, could introduce new regulatory burdens for Halfords' Autocentres, stemming from persistent industry complaints and a significant number of motor finance issues reported by the FCA in 2023.

Government investment in EV charging infrastructure and cycling initiatives provides a substantial boost for Halfords. The UK's commitment to installing 300,000 public EV charge points by 2030 and £350 million in EV battery manufacturing support Halfords' EV servicing focus. Similarly, ongoing support for cycling infrastructure is expected to increase demand for bicycles and related services, aligning with Halfords' core offerings.

| Political Factor | Impact on Halfords | Relevant Data/Legislation |

| Decarbonisation Agenda | Drives demand for EV servicing and parts; necessitates adaptation to changing vehicle technology. | ZEV mandate (Jan 2024); Ban on new petrol/diesel sales pushed to 2035. |

| Consumer Protection Laws | Requires strict adherence to pricing and advertising; potential for significant fines. | Digital Markets, Competition and Consumers Act 2024 (April 2025); CMA fines up to 10% of turnover. |

| Fiscal Policy | Increases operational costs, particularly labor expenses. | Projected £23 million increase in direct labor costs for FY26 due to wage/NI changes. |

| Motor Retail Licensing | Potential for increased compliance burden and operational standards for Autocentres. | Focus for next UK government; FCA reported 1.2 million motor finance issues in 2023. |

| Infrastructure Investment | Supports growth in EV servicing and cycling product sales. | 300,000 public EV charge points by 2030; £350 million EV battery manufacturing investment (2024). |

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting Halfords Group, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a strategic framework for understanding how these global and local trends create both challenges and opportunities for the automotive and cycling retailer.

A concise, PESTLE-driven overview of Halfords Group's external environment, designed to swiftly identify and address potential market disruptions and opportunities for strategic advantage.

Economic factors

Consumer spending and confidence are vital for Halfords, particularly concerning discretionary items such as premium cycling gear. While early 2025 showed some positive shifts in consumer sentiment, the immediate future for larger purchases remains somewhat clouded.

Halfords has observed ongoing softness in the cycling and tyre markets, with a noticeable trend of consumers opting for more budget-friendly options, which has consequently affected overall retail volumes.

Inflationary pressures remain a significant concern for Halfords, especially impacting technician wages and the cost of managed services. These rising operational expenses directly affect the company's bottom line.

To counter these challenges, Halfords has actively pursued cost-saving measures. Initiatives like the 'Better Buying programme' and strategic pricing optimisation are in place to absorb some of these increased costs.

Despite these mitigation efforts, the persistent rise in costs, notably the increase in the National Living Wage, continues to pose a substantial hurdle to maintaining and improving profitability throughout 2024 and into 2025.

The UK cycling market saw a downturn in 2024, with overall sales declining. However, the pace of this decline eased in the second half of the year, offering a glimmer of recovery.

While traditional bicycle sales dipped, the demand for cycling services, including maintenance and repair, remained robust. Similarly, sales of parts, accessories, and clothing (PAC) demonstrated resilience, indicating a shift in consumer spending within the sector.

Looking ahead, the Bicycle Association projects a return to market growth in 2025. This anticipated expansion could provide a significant boost to Halfords' retail operations, particularly its cycling segment.

Automotive Market Trends and EV Adoption

The automotive market's shift towards electric vehicles (EVs) is a critical factor for Halfords' Autocentres. While new car registrations in the UK showed a healthy increase in 2024, reaching over 1.9 million units by the end of the year, EV adoption by private buyers has lagged behind government targets. This slower consumer uptake means a more gradual, yet significant, transition in vehicle servicing needs.

Halfords' Autocentres have demonstrated resilience by focusing on growing service, maintenance, and repair revenues. This strategic emphasis has helped to counterbalance weaker performance in the consumer tyre market. As the complexity of EV servicing increases, with specialized diagnostic and repair requirements, Halfords is well-positioned to capitalize on this evolving demand.

- EV Servicing Demand: The increasing complexity of electric vehicle maintenance presents a significant opportunity for Halfords' Autocentres to offer specialized services.

- Market Transition: Despite overall new car registration growth in 2024, private EV adoption rates are slower than anticipated, creating a phased but growing market for EV repairs.

- Revenue Diversification: Strong performance in Autocentres' service and repair segments has effectively offset challenges in the consumer tyre sector, highlighting the business's adaptability.

- Future Growth: Halfords' investment in EV-specific training and equipment positions its Autocentres to capture a larger share of the burgeoning EV aftercare market.

Supply Chain and Global Trade Volatility

Global trade volatility, marked by fluctuating tariffs and trade disputes, presents a significant challenge for Halfords Group. These shifts can directly impact the cost of goods and the expense of shipping, affecting overall profitability. While Halfords doesn't directly engage in US trade, the interconnectedness of global supply chains means indirect impacts are unavoidable, influencing everything from component availability to freight costs.

The ongoing geopolitical landscape and trade tensions have led to increased unpredictability in international commerce. For instance, disruptions in key manufacturing regions or unexpected changes in import/export regulations can ripple through supply chains, affecting lead times and product availability for retailers like Halfords. The company's reliance on a global network of suppliers means it's susceptible to these external shocks, even if its own direct import/export activities are limited.

In response to this volatility, Halfords may find it increasingly strategic to bolster its supply chain resilience. This could involve a greater emphasis on localizing production where feasible and expanding regional sourcing initiatives. Such strategies aim to reduce dependence on distant suppliers and mitigate the risks associated with long, complex international trade routes, ultimately providing greater stability and control over costs and inventory.

- Supply Chain Costs: Fluctuations in global shipping rates, influenced by geopolitical events and trade policies, can directly impact Halfords' cost of goods. For example, the average container shipping cost from Asia to Europe saw significant increases in late 2023 and early 2024 due to port congestion and rerouting around conflict zones, impacting retailers globally.

- Tariff Impacts: While Halfords may not directly import from the US, changes in tariffs between major trading blocs can indirectly affect component costs or finished goods prices from suppliers who operate within those blocs.

- Regional Sourcing Benefits: Increasing regional sourcing can lead to shorter lead times and reduced exposure to international shipping disruptions. For example, a UK-based automotive parts supplier might offer more predictable pricing and delivery compared to sourcing from distant markets.

- Resilience Strategy: The trend towards nearshoring and reshoring is gaining momentum as businesses seek to de-risk their supply chains. This strategic shift could see companies like Halfords investing more in domestic or nearby manufacturing capabilities to ensure a more stable supply of products.

Economic factors significantly shape Halfords' performance, with consumer spending on discretionary items like premium bikes remaining sensitive to economic sentiment. While inflation pressures persist, impacting operational costs such as wages, Halfords is implementing cost-saving measures like its 'Better Buying programme' to mitigate these effects. The UK cycling market experienced a downturn in 2024, but projections for 2025 suggest a return to growth, which could benefit Halfords' retail segment.

What You See Is What You Get

Halfords Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Halfords Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Consumers are increasingly prioritizing health, well-being, and sustainable living, which directly impacts their transportation choices. This shift is fueling demand for cycling and electric mobility solutions. For instance, in the UK, cycling saw a notable increase in participation, with Department for Transport figures indicating a rise in cycle traffic, particularly in urban areas, throughout 2023 and early 2024.

Halfords Group is strategically positioned to capitalize on these evolving consumer lifestyles. The company's focus on supporting customers with their transport and leisure needs aligns perfectly with the growing interest in e-bikes and e-scooters. This includes providing a range of products and services that cater to both traditional cycling enthusiasts and those embracing newer forms of electric personal mobility, reflecting a broader trend towards active and eco-conscious lifestyles.

Demographic shifts, particularly the ageing population in the UK, directly impact consumer needs. By 2025, the proportion of those aged 65 and over is projected to continue its upward trend, potentially increasing demand for services that offer convenience and reliability. This could translate to greater reliance on Halfords' Autocentres for vehicle maintenance, as older drivers may prefer professional servicing over DIY repairs.

Furthermore, the growing popularity of e-bikes presents a significant opportunity. As of early 2025, e-bike sales have seen consistent year-on-year growth, appealing to a wider age demographic seeking accessible and less strenuous cycling solutions. This trend aligns well with Halfords' strategy to expand its cycling offerings, catering to both younger enthusiasts and older individuals looking for mobility and leisure options.

The persistent cost of living crisis is making consumers more hesitant about spending, especially on larger, non-essential items like new bicycles. This trend directly affects Halfords' retail performance, potentially dampening sales of new bikes.

However, this economic pressure can also boost demand for Halfords' Autocentres. As people try to make their current vehicles and bikes last longer, they're more likely to invest in maintenance and repair services, a segment where Halfords operates.

For instance, in the UK, inflation remained elevated through late 2024, with the Office for National Statistics reporting CPI at 4.7% in April 2024, impacting household budgets and discretionary spending power.

Increased Awareness of Vehicle Maintenance and Safety

Consumers are increasingly focused on keeping their vehicles in good condition, a trend that directly benefits Halfords Autocentres. This heightened awareness, perhaps spurred by the need to extend vehicle lifespans due to economic factors or evolving MOT regulations, drives demand for essential maintenance and repair services. For instance, Halfords reported a 10% increase in its Autocentre revenue in the first half of 2024, underscoring this consumer shift.

This growing emphasis on vehicle longevity and roadworthiness translates into a stronger market for Halfords' core offerings. The company's strategic investment in its service, maintenance, and repair (SMR) segment has proven prescient, as customers actively seek to ensure their cars remain safe and compliant with regulations. This focus on SMR contributed significantly to Halfords' overall performance in the 2024 fiscal year, with the segment growing by 8% year-on-year.

- Increased demand for routine servicing: Customers are proactively booking regular checks and maintenance to prevent costly future repairs.

- Higher uptake of safety-related repairs: Awareness of stricter safety standards encourages drivers to address potential issues promptly.

- Extended vehicle ownership: Economic pressures encourage consumers to maintain existing vehicles rather than replace them, boosting the SMR market.

- Growth in MOT testing and related repairs: Changes in MOT requirements may be driving more customers to seek professional assistance.

Growth of Online Communities and Digital Influence

The increasing prevalence of online communities and digital platforms significantly shapes consumer choices, with reviews and social media acting as powerful influencers. For Halfords, this means actively managing its online reputation is crucial. For instance, by late 2024, the UK's Competition and Markets Authority (CMA) has been strengthening enforcement against misleading online reviews, impacting businesses like Halfords that rely on customer feedback.

Engaging authentically with these digital communities and offering clear, transparent information about products and services can foster trust and directly boost sales. Halfords' commitment to transparency, particularly in areas like electric vehicle servicing or cycle maintenance advice shared online, can attract and retain customers.

Key impacts include:

- Enhanced Consumer Trust: Transparent engagement in online forums and social media builds credibility.

- Reputation Management: Proactive handling of online feedback is vital, especially with regulatory crackdowns on inauthentic reviews.

- Sales Influence: Positive digital word-of-mouth, driven by active community participation, can lead to increased sales.

- Competitive Advantage: Businesses that effectively leverage digital influence can differentiate themselves in the market.

Sociological factors significantly influence Halfords' market position, driven by evolving consumer lifestyles and demographic shifts. The growing emphasis on health, well-being, and sustainability is boosting demand for cycling and electric mobility solutions, with UK cycling traffic showing an upward trend through early 2024. Simultaneously, an aging UK population by 2025 may increase reliance on professional vehicle maintenance services like Halfords Autocentres, as older drivers might prefer expert care.

Economic pressures, such as persistent inflation reported at 4.7% by the ONS in April 2024, are making consumers more cautious with spending. This can dampen sales of new bikes but concurrently drives demand for maintenance and repair services, as customers aim to extend the lifespan of their existing vehicles and bikes. Halfords' Autocentre revenue saw a 10% increase in the first half of 2024, reflecting this trend.

The digital landscape also plays a crucial role, with online communities and reviews heavily influencing consumer choices. Halfords must actively manage its online reputation, especially with regulatory bodies like the CMA strengthening enforcement against misleading reviews by late 2024. Transparent engagement and positive digital word-of-mouth are key to building trust and driving sales.

| Sociological Factor | Impact on Halfords | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Health & Sustainability Focus | Increased demand for cycling and e-mobility products and services. | UK cycle traffic up in urban areas (early 2024). |

| Demographic Shifts (Aging Population) | Potential rise in demand for Autocentre maintenance and repair services. | Projected increase in 65+ population by 2025. |

| Cost of Living Crisis | Reduced discretionary spending on new bikes; increased spending on vehicle/bike maintenance. | UK CPI at 4.7% (April 2024); 10% H1 2024 Autocentre revenue growth. |

| Digital Influence & Online Communities | Need for strong online reputation management and transparent communication. | CMA strengthening enforcement on online reviews (late 2024). |

Technological factors

The automotive industry's shift towards electric vehicles (EVs) and e-mobility, including e-bikes and e-scooters, is a significant technological factor for Halfords. By late 2024, global EV sales were projected to surpass 14 million units, indicating a substantial market for related services.

Halfords is proactively addressing this trend by investing in specialized training for its technicians and upgrading its garage facilities to handle EV maintenance and repairs. This strategic move positions them to capitalize on the growing demand for electric vehicle servicing, aiming to become a key player in this evolving sector.

The speed at which consumers embrace EVs directly impacts the need for Halfords' specialized services. For instance, in the UK, EV market share reached over 16% of new car registrations in early 2024, a figure expected to climb as charging infrastructure and vehicle options expand.

The increasing digitalisation of retail and services is a critical factor for Halfords. This includes the expansion of online sales platforms and the enhancement of digital customer experiences, as well as advancements in contact centre technology. For example, in the fiscal year ending March 2024, Halfords saw continued growth in its digital channels, with online sales contributing a significant portion of revenue.

Halfords' investment in its omnichannel infrastructure is key to its strategy. The Halfords Motoring Club, a prime example, effectively leverages proprietary data to deepen customer engagement and improve the efficiency of service delivery. This focus on digital integration allows Halfords to better understand and serve its customer base in an increasingly online world.

Leveraging data analytics to understand customer behaviour and offer personalized services is a crucial technological driver for Halfords. By analyzing vast datasets, the company can gain deep insights into consumer preferences and purchasing patterns.

The Halfords Motoring Club, boasting over 5 million members as of late 2023, is a prime example of this. This extensive membership base generates invaluable vehicle and customer health data, enabling Halfords to tailor its product and service offerings more effectively. This personalization is key to improving customer retention and driving highly targeted marketing campaigns, ultimately optimizing financial returns.

Diagnostic and Repair Technologies in Automotive

The automotive industry's rapid technological evolution, especially with the rise of electric vehicles (EVs), necessitates advanced diagnostic and repair capabilities. Halfords Autocentres must continually invest in sophisticated equipment and technician training to remain competitive in servicing these complex vehicles.

For instance, the complexity of EV powertrains, with their high-voltage systems and intricate software, demands specialized diagnostic tools that go beyond traditional internal combustion engine (ICE) diagnostics. This ongoing technological shift directly impacts the types of services Halfords can offer and the expertise required.

- Investment in EV-specific diagnostic tools: Many independent garages are still catching up, with a significant portion reporting challenges in acquiring the necessary EV diagnostic equipment in 2024.

- Technician training and certification: The demand for qualified EV technicians is projected to grow substantially, with estimates suggesting a need for tens of thousands more certified EV technicians across the UK by 2025.

- Software updates and remote diagnostics: Modern vehicles rely heavily on software, making the ability to perform remote diagnostics and software updates a key technological factor for efficient repair and maintenance.

Impact of AI and Automation in Operations

The integration of AI and automation presents significant opportunities for Halfords to streamline operations. For instance, AI-powered inventory management systems can forecast demand more accurately, potentially reducing stockouts and overstock situations. In 2024, many retail operations are exploring AI for predictive maintenance on their fleet vehicles or store equipment, aiming to cut downtime and repair costs.

Automation can also enhance customer service, with AI chatbots handling common inquiries, freeing up human staff for more complex issues. This could lead to improved customer satisfaction and operational efficiency. For example, by early 2025, we expect to see wider adoption of AI in personalized marketing efforts, tailoring offers to individual customer preferences, which can drive sales.

The potential benefits extend to supply chain optimization. AI can analyze vast datasets to identify inefficiencies, reroute logistics, and improve delivery times. This could translate into substantial cost savings for Halfords. A key area for 2024-2025 is the use of AI in route optimization for their service vans, directly impacting fuel costs and service delivery speed.

- Enhanced Inventory Management: AI can predict demand with greater accuracy, reducing holding costs and improving product availability.

- Streamlined Customer Service: AI-powered chatbots can handle routine queries, allowing human agents to focus on complex customer needs.

- Optimized Supply Chains: Automation can improve logistics, leading to faster delivery times and reduced transportation expenses.

- Predictive Maintenance: AI can forecast equipment failures, enabling proactive repairs and minimizing operational disruptions.

The accelerating shift to electric vehicles (EVs) and e-mobility presents a significant technological imperative for Halfords. By the end of 2024, global EV sales were anticipated to exceed 14 million units, underscoring the growing market for specialized EV servicing and parts. This trend directly influences the demand for Halfords' technical expertise and infrastructure upgrades. For instance, the UK's EV market share surpassed 16% of new car registrations in early 2024, a figure poised for continued growth as charging infrastructure expands.

Halfords is actively investing in technician training and facility enhancements to cater to EV maintenance and repairs, aiming to capture a substantial share of this evolving market. The increasing digitalisation of retail and services, including online sales platforms and enhanced digital customer experiences, is also a critical factor. In the fiscal year ending March 2024, Halfords reported continued growth in its digital channels, with online sales forming a significant revenue component.

The Halfords Motoring Club, with over 5 million members by late 2023, exemplifies the strategic use of data analytics for personalized customer engagement and service delivery optimization. This extensive membership base provides invaluable data, enabling Halfords to tailor its offerings and marketing efforts more effectively, enhancing customer retention and driving targeted sales campaigns.

| Technology Factor | Description | Impact on Halfords | Relevant Data (2024/2025) |

|---|---|---|---|

| EV & E-Mobility Growth | Increasing adoption of electric vehicles, e-bikes, and e-scooters. | Demand for specialized servicing, parts, and charging solutions. | Global EV sales projected to exceed 14 million units by end of 2024. UK EV market share >16% of new car registrations (early 2024). |

| Digitalisation | Expansion of online retail, digital customer experiences, and contact centre technology. | Need for robust e-commerce platforms and data-driven customer engagement. | Continued growth in Halfords' digital channels (FY ending March 2024). Halfords Motoring Club: >5 million members (late 2023). |

| AI & Automation | Integration of artificial intelligence and automated processes in operations. | Opportunities for efficiency gains in inventory, customer service, and logistics. | Exploration of AI for predictive maintenance and personalized marketing in retail operations (2024). AI in route optimization for service vans (2024-2025). |

Legal factors

The Digital Markets, Competition and Consumers Act 2024, coming into effect in April 2025, will bolster consumer protections. This legislation grants the Competition and Markets Authority (CMA) direct enforcement capabilities. Key provisions include bans on drip pricing and misleading online reviews, alongside more stringent regulations for subscription services from April 2026.

Halfords needs to ensure absolute clarity in its pricing, advertising, and how it handles customer reviews. Failure to comply could result in significant penalties, potentially reaching up to 10% of the company's global annual turnover, a substantial risk to manage.

The UK's Zero Emission Vehicle (ZEV) mandate, effective from January 2024, obliges manufacturers to ensure a growing percentage of their new car sales are zero-emission. For instance, in 2024, 22% of new cars sold must be ZEVs, rising to 80% by 2030. This regulatory shift directly influences the types of vehicles entering the market, impacting the future servicing and repair demands Halfords will encounter.

While Halfords is not directly bound by the ZEV mandate's sales targets, the regulation significantly shapes its operational landscape. The increasing prevalence of EVs in the vehicle parc means Halfords needs to invest in technician training and equipment for electric vehicle maintenance. By 2025, it's projected that over 1 million EVs will be on UK roads, underscoring the urgency for businesses like Halfords to adapt their service offerings.

Changes in employment law, such as the projected increase in the National Living Wage for 2025, directly impact Halfords' operational expenses. For instance, the National Living Wage is expected to rise to £11.44 per hour from April 2024, a significant jump that will increase labour costs for a company with a large retail and service workforce.

Furthermore, National Insurance contributions for both employees and employers can fluctuate, adding another layer of cost variability. These regulatory shifts necessitate strategic adjustments within Halfords, potentially leading to price adjustments on services or a renewed focus on operational efficiencies to offset the increased direct labour costs.

Product Safety and Liability Standards

Halfords operates under stringent product safety and liability standards, particularly for its motoring and cycling goods. Adherence to these regulations is paramount for safeguarding customer well-being and mitigating potential legal repercussions stemming from defective merchandise. For instance, in 2023, the UK government continued to emphasize product safety directives, with ongoing enforcement actions against non-compliant businesses.

The company must ensure all products sold meet rigorous UK safety benchmarks, such as those set by the General Product Safety Regulations 2005. This proactive approach is vital for preventing accidents and managing the financial and reputational impact of potential product recalls or liability claims. In 2024, the Office for Product Safety and Standards (OPSS) reported an increase in investigations into consumer goods, highlighting the heightened regulatory scrutiny.

- Product Safety Compliance: Ensuring all automotive parts, accessories, and bicycles meet or exceed UK and EU safety certifications.

- Liability Management: Maintaining robust processes for handling customer complaints, product recalls, and potential legal claims related to product defects.

- Regulatory Updates: Staying abreast of evolving safety legislation and standards impacting the automotive and cycling retail sectors.

- Supplier Due Diligence: Verifying that third-party suppliers also adhere to strict product safety and ethical manufacturing practices.

Data Protection and Privacy Laws (GDPR, DPA)

Halfords must navigate the complexities of data protection and privacy laws, including the UK GDPR and the Data Protection Act 2018. Given its significant customer base through programs like the Halfords Motoring Club and its e-commerce platforms, robust data handling practices are paramount. Failure to comply can result in substantial fines, with the Information Commissioner's Office (ICO) having the authority to levy penalties. For instance, in 2023, the ICO issued significant fines for data protection breaches across various sectors, underscoring the financial risks of non-compliance.

The company's commitment to safeguarding customer information directly impacts trust and brand reputation. Proper data management ensures that customer details collected for services, loyalty programs, and online purchases are securely stored and ethically utilized. This is particularly relevant as digital interactions increase, making data security a critical operational and legal consideration for Halfords' ongoing business strategy.

- Compliance Requirements: Adherence to UK GDPR and Data Protection Act 2018 mandates strict rules on consent, data minimization, and security measures for customer data.

- Customer Trust Factor: Maintaining customer confidence hinges on transparent and secure data handling, which is vital for the success of loyalty programs and online sales.

- Regulatory Oversight: The Information Commissioner's Office (ICO) actively enforces data protection laws, with potential penalties for breaches impacting financial performance.

- Operational Impact: Robust data protection protocols are essential for managing customer relationships and mitigating legal and financial risks associated with data handling.

The Digital Markets, Competition and Consumers Act 2024, effective April 2025, enhances consumer protections with direct enforcement powers for the CMA, including bans on drip pricing and misleading reviews, alongside stricter subscription service rules from April 2026. Halfords must ensure pricing and advertising transparency to avoid penalties up to 10% of global turnover.

The UK's Zero Emission Vehicle (ZEV) mandate, requiring 22% of new car sales to be ZEVs in 2024, rising to 80% by 2030, impacts Halfords by increasing the prevalence of EVs. This necessitates investment in EV servicing training and equipment, as over 1 million EVs are projected to be on UK roads by 2025.

Changes in employment law, such as the projected National Living Wage increase to £11.44 per hour from April 2024, directly raise Halfords' operational costs. Fluctuations in National Insurance contributions also add to cost variability, requiring strategic adjustments like service price changes or efficiency improvements.

Halfords faces stringent product safety and liability standards, with ongoing emphasis on directives like the General Product Safety Regulations 2005. The Office for Product Safety and Standards (OPSS) reported increased investigations into consumer goods in 2024, highlighting the need for Halfords to ensure all products meet rigorous safety benchmarks.

Environmental factors

Halfords Group is actively pursuing Net Zero across its value chain by 2050, underpinned by ambitious interim targets. This includes a significant reduction in greenhouse gas emissions, aiming for a 42% cut in absolute Scope 1 and 2 emissions by 2030, compared to a 2020 baseline.

Furthermore, the company is focused on reducing Scope 3 emissions, specifically those related to purchased goods, capital goods, and upstream transportation, targeting a 25% reduction by 2030 from the same 2020 benchmark.

These environmental commitments directly shape Halfords' operational strategies, influencing choices in energy procurement, supply chain management, and product development to align with sustainability goals.

Halfords is actively working to reduce its environmental footprint through enhanced waste management and recycling programs. This commitment spans across their product lifecycle, packaging choices, and overall operational waste. For instance, the company aims to improve the recycling rates for materials like used tyres and batteries, reflecting growing regulatory pressures and consumer demand for sustainable practices.

Halfords is actively championing sustainable transport, with a strong focus on electric vehicles (EVs) and cycling. Their strategic aim is to become a frontrunner in electric mobility services, making e-mobility accessible to a wider audience and thereby contributing to a reduction in transport-related carbon emissions.

This commitment is evident in their expanding product and service offerings, which include a growing selection of e-bikes and e-scooters, alongside enhanced EV servicing capabilities. For instance, by mid-2024, the UK government reported a significant surge in EV registrations, and Halfords' investment in this sector positions them to capitalize on this growing market trend.

Impact of Climate Change on Operations

Climate change presents a nuanced challenge for Halfords, particularly concerning its cycling segment. Increased instances of extreme weather, such as prolonged periods of heavy rainfall, can directly influence consumer behaviour and product demand. For instance, the wetter weather experienced in the UK during parts of 2024 was cited as a factor potentially dampening cycling traffic, which in turn could affect sales of bikes and related accessories.

This environmental shift necessitates a strategic re-evaluation of business models to build resilience. Halfords may need to adapt its product offerings and marketing strategies to better suit changing weather patterns and consumer engagement with outdoor activities.

- Extreme weather events can disrupt supply chains and retail operations.

- Shifts in seasonal weather patterns impact demand for seasonal products like cycling gear.

- Consumer participation in outdoor activities, like cycling, is sensitive to weather conditions.

Sustainable Sourcing and Supply Chain Ethics

Halfords is actively enhancing supply chain transparency and championing sustainability within its product offerings. A key initiative involves collaborating with suppliers to curb Scope 3 emissions, a significant component of their environmental footprint.

This commitment extends to fostering partnerships with vendors to collectively pursue a Net Zero future across the entire value chain. The group emphasizes ethical sourcing and sustainable practices, recognizing their importance in building a resilient and responsible business model.

- Supplier Engagement: Halfords actively engages with its suppliers to address sustainability goals, particularly concerning emissions reduction.

- Scope 3 Emissions Focus: The company prioritizes reducing Scope 3 emissions, which are indirect emissions occurring in the value chain.

- Net Zero Ambition: Collaboration with suppliers is central to Halfords' strategy for achieving Net Zero across its entire operational and value chain.

- Ethical Sourcing: A strong emphasis is placed on ensuring that sourcing practices are both ethical and environmentally sustainable.

Halfords is committed to reducing its environmental impact, targeting a 42% cut in Scope 1 and 2 emissions by 2030 from a 2020 baseline, and a 25% reduction in Scope 3 emissions by the same year. This focus on Net Zero influences their energy procurement, supply chain management, and product development. The company is also enhancing waste management and recycling programs, with a specific aim to improve tyre and battery recycling rates.

The company's strategic push into electric mobility, including e-bikes and e-scooters, aligns with the growing UK EV market, which saw a significant surge in registrations by mid-2024. However, Halfords' cycling segment is vulnerable to climate change impacts, as evidenced by potentially dampened cycling traffic during wetter periods in 2024, affecting sales of related products.

| Environmental Target | Baseline Year | Target Year | Reduction Target |

| Scope 1 & 2 Emissions | 2020 | 2030 | 42% absolute reduction |

| Scope 3 Emissions | 2020 | 2030 | 25% reduction |

PESTLE Analysis Data Sources

Our PESTLE analysis for Halfords Group is built on a robust foundation of data from official government publications, reputable market research firms, and leading industry trade bodies. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the automotive and cycling sectors.