Halfords Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halfords Group Bundle

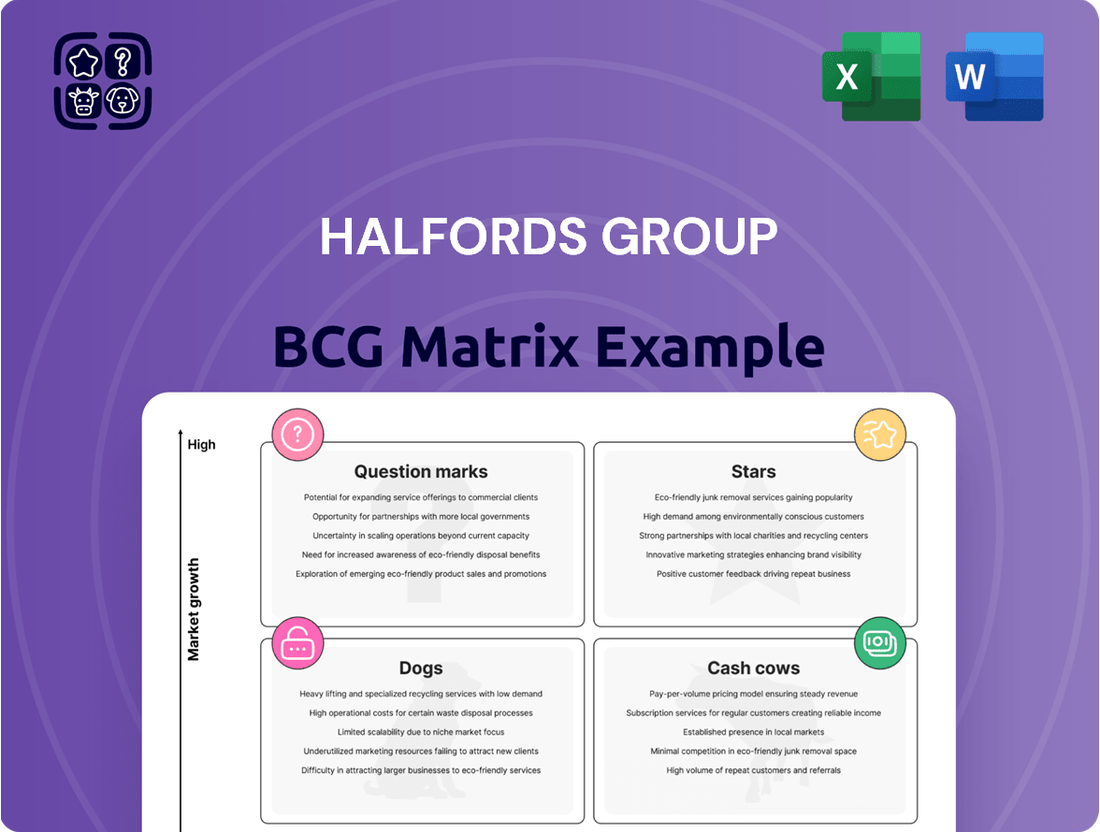

Curious about Halfords Group's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the detailed insights and actionable strategies that will empower your own business decisions.

Ready to truly understand Halfords Group's market performance? The complete BCG Matrix provides a detailed quadrant breakdown, revealing precisely where their offerings stand. Purchase the full report for data-driven recommendations and a clear roadmap to optimizing your own product portfolio.

This preview offers a taste of Halfords Group's strategic landscape, but the full BCG Matrix is your key to unlocking deeper insights. Discover which products are driving growth and which might be holding them back, and gain the knowledge to make smarter investment choices for your business.

Stars

Halfords' Autocentres and Mobile Expert services are shining stars in their BCG Matrix, showcasing robust growth and a dominant market presence. These service-oriented businesses are driving significant revenue, with Autocentres alone generating £710.3 million in FY25, alongside a healthy 3.7% like-for-like sales increase.

Strategic investments are fueling this segment's ascent, notably the 'Fusion' program aimed at seamlessly blending retail and autocentre operations. With 50 locations already operational and ambitious plans to expand to over 100 by the close of FY26, Halfords is solidifying its leadership in the aftermarket car servicing sector.

This concentrated focus on services, now contributing more than half of the Group's overall revenue, positions Halfords as a key player in the expanding market for car maintenance and repair.

The Halfords Motoring Club is a clear star in the BCG matrix for Halfords Group. Its rapid expansion is a major win, with membership surpassing 5 million in FY25, a significant achievement that outpaced initial projections.

This loyalty program is central to Halfords' long-term strategy, fostering customer retention and providing rich data for targeted marketing initiatives. It's a key driver of recurring revenue, with a substantial 40% of Autocentre MOTs originating from club members.

The club also proves effective in attracting new customers to the broader Halfords Group, as evidenced by 45% of new members in FY24 being first-time Halfords customers.

Halfords is strategically investing in electric vehicle (EV) servicing, aiming for market leadership in this rapidly expanding sector. Despite the UK's revised timeline for phasing out new petrol and diesel cars, Halfords sees a substantial growth opportunity.

The company is actively upskilling its technicians and acquiring specialized equipment to cater to the growing EV fleet. This forward-thinking approach, leveraging Halfords' established automotive service capabilities, positions EV servicing as a strong contender for a star product in their portfolio.

B2B Services (e.g., Cycle2Work, Commercial Fleet Services)

Halfords' B2B services, including Cycle2Work and Commercial Fleet Services, are performing well, contributing substantially to the company's overall revenue. This segment is strategically important, aiming to build more stable, recurring income for the group.

While precise market share data for 2024 isn't readily available, the continued investment and expansion in these B2B offerings suggest a robust and growing presence in their respective markets.

- Cycle2Work: This scheme facilitates tax-efficient bicycle purchases for employees, aligning with corporate wellness and sustainability goals.

- Commercial Fleet Services: Halfords provides maintenance and repair services for business vehicle fleets, offering convenience and cost-effectiveness to commercial clients.

- Revenue Contribution: These B2B segments are a key driver of growth, diversifying Halfords' revenue beyond its retail operations.

Digital and Omnichannel Capabilities

Halfords has significantly ramped up its investment in digital and omnichannel capabilities, recognizing their critical role in modern retail. This includes bolstering its online shopping platform and introducing digital booking for its automotive services, aiming to create a seamless customer journey.

These digital advancements are designed to elevate the customer experience and boost operational efficiency across both the retail and service segments of the business. The company’s strategic digital transformation efforts are focused on strengthening its online footprint and enriching customer interactions, which is essential for staying competitive.

- Online Sales Growth: In the fiscal year ending March 2024, Halfords reported a notable increase in online sales, contributing significantly to overall revenue.

- Digital Service Bookings: The adoption of digital booking for services has seen a substantial rise, with a growing percentage of customers now utilizing this convenient option.

- Customer Engagement: Investments in digital tools have led to improved customer engagement metrics, reflecting a more connected and responsive service.

- Omnichannel Integration: Halfords continues to refine its omnichannel strategy, ensuring a consistent brand experience whether customers shop online, in-store, or through mobile channels.

The Autocentres and Mobile Expert services are undoubtedly stars for Halfords. In FY25, Autocentres alone brought in £710.3 million, with a healthy 3.7% like-for-like sales increase. This segment is a major revenue driver, with strategic investments in the 'Fusion' program to integrate retail and autocentre operations, aiming for over 100 locations by FY26.

The Halfords Motoring Club is another shining star, boasting over 5 million members in FY25, exceeding expectations. This loyalty program is crucial for customer retention, with 40% of Autocentre MOTs coming from club members and 45% of new members in FY24 being first-time Halfords customers.

Halfords' focus on Electric Vehicle (EV) servicing positions it for star status, with significant investment in technician training and specialized equipment. This proactive approach taps into the growing EV market, leveraging existing service capabilities for future growth.

B2B services like Cycle2Work and Commercial Fleet Services are also performing strongly, contributing to diversified and recurring revenue. While specific 2024 market share figures are not detailed, ongoing investment and expansion indicate a growing presence in these areas.

| Business Segment | BCG Status | Key Performance Indicators (FY25 unless stated) | Strategic Focus |

| Autocentres & Mobile Expert | Star | £710.3m revenue (Autocentres); 3.7% LFL sales growth | 'Fusion' program integration; EV servicing expansion |

| Halfords Motoring Club | Star | >5m members; 40% of MOTs from members; 45% new customers in FY24 | Customer retention; data insights; recurring revenue |

| B2B Services (Cycle2Work, Fleet) | Star | Continued investment and expansion; diversified revenue | Stable, recurring income; corporate partnerships |

What is included in the product

This analysis highlights which Halfords Group units to invest in, hold, or divest based on market growth and share.

A clear BCG matrix visualizes Halfords' portfolio, easing the pain of strategic uncertainty by highlighting growth vs. market share.

Cash Cows

Halfords' traditional retail motoring products, including car parts and accessories, formed a substantial 62% of its Retail revenue in the fiscal year 2024. This segment, though in a more mature market, consistently generates strong cash flow for the company due to its established market share.

The company's strategic initiatives, such as 'Better Buying' and careful pricing adjustments within this category, are instrumental in preserving healthy profit margins. These efforts ensure that this core business continues to be a reliable source of income for Halfords.

The established network of Halfords Autocentres, excluding the recently integrated Fusion sites, are firmly positioned as cash cows within the Halfords Group's BCG Matrix.

These centers consistently deliver significant revenue streams from essential services like vehicle servicing, MOT testing, and general repairs, demonstrating their mature and stable market presence.

With a commanding market share in the aftermarket car servicing sector, these operations are a dependable source of cash flow, enabling strategic allocation of capital towards emerging growth opportunities.

For instance, in the fiscal year ending March 2024, Halfords reported that its Autocentres division contributed significantly to overall group revenue, underscoring its role as a reliable generator of funds.

Halfords' tyre replacement services are a cornerstone of its Autocentres division. Despite facing a challenging market with anticipated volume decreases in fiscal year 2025, these services remain a vital contributor to revenue and overall cash generation for the group.

The company has proactively adapted its approach, exiting the wholesale tyre distribution business and forging new supply chain agreements. These strategic moves are designed to bolster efficiency and profitability within this mature segment of the automotive market.

Camping and Touring Products

Halfords' camping and touring products, while influenced by seasonal demand and discretionary spending, likely function as a cash cow. This category serves established leisure interests, generating reliable, though not rapidly expanding, revenue. For instance, during the summer months of 2024, sales in outdoor leisure, which includes camping and touring, saw a notable uptick as consumers prioritized domestic travel and staycations.

The company benefits from its extensive retail network, allowing it to effectively reach and serve customers in this market. Halfords' strategy involves leveraging its brand recognition and store footprint to maintain a strong presence in the camping and touring sector. This approach ensures consistent market share capture even with moderate growth rates.

- Seasonal Strength: Camping and touring products typically experience peak sales during spring and summer months, contributing significantly to Halfords' annual revenue.

- Established Market: The demand for camping and touring gear is consistent, driven by recurring leisure activities and a stable customer base.

- Retail Footprint Advantage: Halfords' widespread store locations facilitate easy access for consumers purchasing these goods, reinforcing its market position.

- Contribution to Profitability: While growth might be modest, the consistent sales volume and established supply chains for these products make them a reliable source of profit for the group.

Halfords General Retail Stores

Halfords' general retail stores, despite a strategic pivot towards services, remain a significant revenue generator. They cater to a broad customer base with automotive, cycling, and leisure products. Their established UK and Ireland footprint provides a steady income stream within a mature market.

- Revenue Contribution: In the financial year ending March 2024, Halfords Group reported total revenue of £1,174.6 million, with retail operations forming a substantial part of this figure, demonstrating the continued importance of the general retail store network.

- Product Diversification: The stores offer a comprehensive selection, from car maintenance essentials and accessories to bicycles and camping gear, appealing to a wide demographic.

- Market Position: With decades of brand recognition, Halfords' retail stores benefit from customer loyalty and a strong presence in a market segment that, while mature, maintains consistent demand for its core offerings.

The Autocentres, excluding recent acquisitions, are key cash cows for Halfords. They consistently generate strong cash flow from essential services like MOTs and repairs, holding a significant market share in aftermarket car servicing.

Tyre replacement services within Autocentres, despite market challenges, remain a vital contributor to revenue and cash generation. Halfords' strategic supply chain adjustments aim to enhance profitability in this mature segment.

Camping and touring products, driven by seasonal demand and domestic travel trends, also function as cash cows. Halfords leverages its retail network and brand recognition to maintain a strong, consistent presence in this market.

The general retail stores, a significant revenue generator, cater to a broad customer base with automotive, cycling, and leisure products. Their established UK and Ireland footprint provides a steady income stream.

| Category | BCG Status | Key Characteristics | FY24 Contribution/Notes |

| Traditional Retail Motoring Products | Cash Cow | Mature market, established market share, strong cash flow | 62% of Retail revenue |

| Autocentres (excluding Fusion) | Cash Cow | Consistent revenue from essential services, dominant aftermarket share | Significant contributor to group revenue |

| Tyre Replacement Services | Cash Cow | Vital revenue and cash contributor, strategic supply chain focus | Despite anticipated volume decreases in FY25 |

| Camping & Touring Products | Cash Cow | Seasonal demand, established leisure interests, reliable revenue | Uptick in summer 2024 due to domestic travel |

| General Retail Stores | Cash Cow | Broad product offering, established network, steady income | Total Group Revenue FY24: £1,174.6 million |

What You See Is What You Get

Halfords Group BCG Matrix

The BCG Matrix analysis of Halfords Group you are currently previewing is the complete and final document you will receive upon purchase. This means the strategic insights, market share data, and growth rate assessments presented are precisely what you'll utilize for your business planning, with no watermarks or placeholder content. You can be confident that the professional formatting and comprehensive analysis will be immediately available for your team's strategic discussions and decision-making processes.

Dogs

Discretionary big-ticket cycling products, like premium bicycles, present a hurdle for Halfords. This segment is experiencing a downturn due to shaky consumer confidence and a general contraction in the cycling market.

Despite Halfords seeing a small uptick in cycling sales for FY25, the wider market has been volatile, with competitors facing significant sales drops. This indicates a low-growth environment where Halfords might be losing ground on these higher-priced items.

Halfords Group has strategically divested its wholesale tyre distribution businesses, Viking and BDL, classifying them as 'Dogs' within its BCG matrix. This move signals a clear intention to exit low-growth, low-market-share segments that were not contributing significantly to profitability.

The closure of these operations and the subsequent outsourcing of the tyre supply chain were undertaken with the objective of achieving annual savings and enhancing stock management. For instance, by Q3 2023, Halfords reported a 2.1% decrease in group revenue, partly attributed to the ongoing strategic review and divestment of non-core assets like the wholesale tyre business.

This divestment aligns with Halfords' broader strategy to focus on its retail and service-led businesses, such as motoring services and cycling. Such strategic exits are common when a business unit is consuming resources without generating commensurate returns, freeing up capital for investment in more promising areas.

Within Halfords' diverse product lines, certain niche or slow-moving retail items likely reside in the 'Dog' quadrant of the BCG Matrix. These could include specialized cycling accessories with declining popularity or automotive parts for older vehicle models that are no longer widely in use.

These 'Dog' products typically exhibit low sales volumes and minimal market growth potential. For instance, if a particular brand of car polish, once popular, now sees very few purchases, it would fit this category, tying up valuable inventory space and capital without generating significant returns for Halfords.

Halfords must continually assess and streamline its product assortment to identify and manage these underperforming items. By doing so, the company can free up resources, reduce holding costs, and focus on more profitable or high-growth potential product categories, ensuring efficient inventory management and capital allocation.

Outdated Automotive Accessories

Outdated automotive accessories, such as cassette tape adapters or basic car stereos without Bluetooth, represent the Dogs in Halfords Group's BCG Matrix. These items once enjoyed popularity but now face declining demand due to technological advancements like integrated infotainment systems and the shift towards digital music streaming. In 2023, sales of these specific accessory types likely saw a continued decrease, reflecting their low market share in a shrinking segment.

These products are characterized by their minimal contribution to revenue and often require significant effort to move. Halfords may need to implement aggressive clearance strategies or consider outright discontinuation to free up shelf space and capital for more profitable product lines.

- Cassette tape adapters: Once essential for playing music from portable devices, now largely obsolete.

- Basic car stereos without Bluetooth: Consumers increasingly prioritize seamless smartphone connectivity.

- Wired phone chargers (non-USB-C): The market is rapidly standardizing on USB-C technology.

- Traditional GPS devices: Smartphone navigation apps have largely replaced standalone GPS units.

Traditional ICE Vehicle Products with Declining Demand

Traditional internal combustion engine (ICE) vehicle products, particularly those not essential for basic maintenance, are experiencing a noticeable decline in demand as the automotive market pivots towards electric vehicles (EVs).

This shift presents a challenge for companies like Halfords Group, as legacy product lines face long-term reduced consumer interest. While Halfords is actively investing in EV servicing capabilities, certain segments of their traditional product offerings may be categorized as 'Dogs' in the BCG matrix.

- Declining Market Share: Products catering to older ICE vehicle technologies may see their market share shrink as the overall number of ICE vehicles on the road decreases.

- Low Growth Potential: The inherent shift towards EVs limits the growth prospects for products solely dependent on ICE vehicle ownership.

- Reduced Investment Focus: Companies may reallocate resources away from these declining product categories to focus on more promising areas like EV charging and servicing.

Halfords Group has strategically divested its wholesale tyre distribution businesses, Viking and BDL, classifying them as 'Dogs' within its BCG matrix. This move signals a clear intention to exit low-growth, low-market-share segments that were not contributing significantly to profitability. These 'Dog' products typically exhibit low sales volumes and minimal market growth potential, often consuming resources without generating commensurate returns.

Outdated automotive accessories, such as cassette tape adapters or basic car stereos without Bluetooth, represent the Dogs in Halfords Group's BCG Matrix. These items once enjoyed popularity but now face declining demand due to technological advancements. In 2023, sales of these specific accessory types likely saw a continued decrease, reflecting their low market share in a shrinking segment.

Traditional internal combustion engine (ICE) vehicle products, particularly those not essential for basic maintenance, are experiencing a noticeable decline in demand as the automotive market pivots towards electric vehicles (EVs). Products catering to older ICE vehicle technologies may see their market share shrink as the overall number of ICE vehicles on the road decreases, limiting growth prospects.

Halfords must continually assess and streamline its product assortment to identify and manage these underperforming items. By doing so, the company can free up resources, reduce holding costs, and focus on more profitable or high-growth potential product categories, ensuring efficient inventory management and capital allocation.

Question Marks

Electric bikes and e-scooters represent a 'Question Mark' within Halfords' BCG Matrix. While Halfords is strategically positioning itself as a leader in e-mobility services, the sales of these specific products face market growth alongside significant uncertainties. Consumer adoption rates and the evolving regulatory landscape create a dynamic, yet unpredictable, environment for these offerings.

The market's potential is undeniable, but the path to market leadership requires substantial investment. The Bicycle Association's forecast of a slight dip in electric bike sales for 2025 highlights this volatility. Therefore, Halfords must strategically allocate resources towards robust marketing campaigns and an expanded, appealing product range to effectively capture and grow market share in this segment.

Halfords' strategic push into new car parts markets positions them as a Question Mark in the BCG matrix. This means they are exploring growth opportunities in segments where their current market share isn't yet established, requiring careful consideration of investment and potential returns.

The motoring market itself remains robust, but success in these nascent car parts segments hinges on substantial capital allocation. This includes building out extensive inventory, fostering strong supplier networks, and launching targeted marketing campaigns to build brand recognition and customer loyalty in these new territories.

The accelerated rollout of Halfords Mobile Expert vans, bringing fitting and servicing directly to customers, positions this initiative as a 'Question Mark' within the BCG matrix. This strategy taps into a clear market trend towards convenience, a factor increasingly valued by consumers. However, the significant capital expenditure required for vehicles, specialized equipment, and training skilled technicians presents a considerable hurdle.

For instance, in the fiscal year ending March 2024, Halfords reported that its Autocentres division, which includes mobile services, saw revenue growth. The expansion of the mobile fleet is a key component of their strategy to capture a larger share of this convenient service market. The success of this 'Question Mark' hinges on Halfords' ability to quickly scale its operations and establish a dominant market presence, thereby justifying the substantial upfront investment and navigating complex logistical challenges effectively.

Subscription-Based Service Offers (Future)

Halfords' ambition to introduce subscription-based services across its operations, particularly by leveraging data from its Motoring Club, places it squarely in the 'Question Mark' category of the BCG matrix. This strategic direction signals a pursuit of high-growth, recurring revenue streams, a highly attractive proposition in today's market.

However, the nascent stage of these subscription offers means their market acceptance and profitability are yet to be definitively proven. This uncertainty necessitates substantial investment in technological infrastructure, the development of compelling pricing strategies, and robust customer acquisition campaigns to ensure successful market entry and scalability. For instance, the automotive aftermarket is increasingly seeing subscription models for services like roadside assistance and maintenance plans, indicating a growing consumer appetite for predictable costs and convenience.

- High Growth Potential: Subscription services offer a path to predictable, recurring revenue, aligning with industry trends favoring service-based models.

- Uncertain Market Adoption: The success of these future offers hinges on proving their value proposition to a broad customer base.

- Significant Investment Required: Developing and launching these services will demand considerable capital for technology, marketing, and operational setup.

- Strategic Importance: This initiative is key to Halfords' long-term strategy of diversifying revenue and deepening customer relationships.

Avayler (Halfords' Software Solution)

Avayler, Halfords' proprietary software, fits the Question Mark category in the BCG matrix. This is because it's a relatively new venture with significant growth potential in the software solutions space, but it currently holds a modest market share. While crucial for Halfords' internal efficiency, its external market penetration and revenue generation as a distinct product are still in the early stages of development.

For instance, while specific financial performance data for Avayler as a standalone product isn't publicly detailed in Halfords' 2024 reports, the company has emphasized its role in driving operational improvements. Halfords reported a revenue of £1,376.2 million for the fiscal year ending March 29, 2024. The success of Avayler will be key to potentially increasing this revenue through external licensing or enhanced service offerings in the future.

- High Growth Potential: Avayler operates in the expanding digital solutions market, offering opportunities for significant future growth.

- Low Market Share: As a newer entrant or internal development, its current share of the broader software solutions market is limited.

- Investment Required: To move from Question Mark to Star, Avayler will likely require substantial investment in further development, marketing, and sales to capture a larger market share.

- Strategic Importance: Even with its current market position, Avayler is strategically important for Halfords' digital transformation and operational efficiency.

Halfords' foray into new car parts markets represents a 'Question Mark' in their BCG matrix. This strategic move aims to tap into the robust motoring market, but success in these nascent segments demands significant capital for inventory, supplier networks, and brand building.

The company's expansion of its Mobile Expert van fleet also falls into the Question Mark category. While capitalizing on the consumer demand for convenience, the substantial investment in vehicles, equipment, and technician training presents a challenge. For the fiscal year ending March 2024, Halfords' Autocentres division, which includes mobile services, did report revenue growth, underscoring the potential of this segment.

Subscription services, leveraging data from the Motoring Club, are another Question Mark. This strategy targets recurring revenue, a growing trend in the automotive aftermarket, but requires significant investment in technology and customer acquisition to prove its market viability.

Avayler, Halfords' proprietary software, is also a Question Mark. It has high growth potential in the digital solutions market but currently holds a low market share. While contributing to internal efficiency, its external revenue generation is still developing, with Halfords reporting total revenue of £1,376.2 million for the fiscal year ending March 29, 2024.

| Category | Description | Key Considerations | Relevant Data (FY24) |

| E-mobility (E-bikes/E-scooters) | High market growth potential, but uncertain market share for Halfords. | Consumer adoption, regulatory landscape, investment in marketing and product range. | Bicycle Association forecasts slight dip in e-bike sales for 2025. |

| New Car Parts Markets | Exploring growth in established market segments. | Capital allocation for inventory, supplier networks, and brand building. | Motoring market remains robust. |

| Mobile Expert Vans | Expansion into convenient, on-demand services. | Capital expenditure for fleet, equipment, training; scaling operations. | Autocentres division revenue growth reported. |

| Subscription Services | Pursuit of recurring revenue streams. | Investment in technology, pricing strategies, customer acquisition. | Growing consumer appetite for predictable costs and convenience. |

| Avayler (Proprietary Software) | Internal software with external market potential. | Development, marketing, sales investment for market share growth. | Total revenue: £1,376.2 million. |

BCG Matrix Data Sources

Our Halfords Group BCG Matrix leverages comprehensive data from company financial reports, market share analysis, and industry growth forecasts to accurately position each business unit.