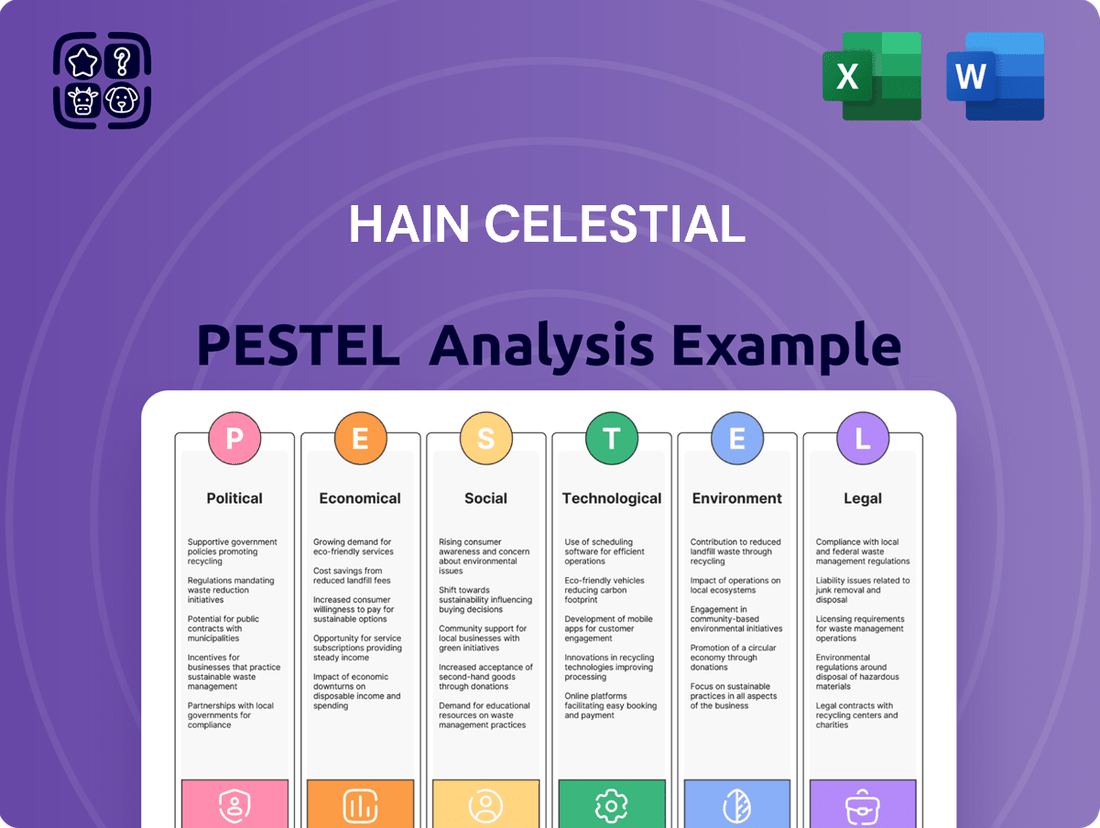

Hain Celestial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hain Celestial Bundle

Gain a competitive edge with our comprehensive PESTLE analysis of Hain Celestial. Uncover how evolving political landscapes, economic fluctuations, and technological advancements are shaping the future of the organic and natural food industry. Understand the social and environmental shifts impacting consumer preferences and regulatory frameworks. This actionable intelligence is crucial for strategic planning and informed decision-making.

Don't get left behind – our expertly crafted PESTLE analysis provides the deep-dive insights you need to navigate the complexities surrounding Hain Celestial. Explore the critical external factors influencing market dynamics and identify potential opportunities and threats. Equip yourself with the knowledge to adapt and thrive in this dynamic sector.

Ready to make smarter, data-driven decisions? Our PESTLE analysis of Hain Celestial is your essential tool for understanding the macro-environmental forces at play. Download the full version now and unlock the strategic intelligence that will empower your business planning and investment strategies.

Political factors

Government support plays a crucial role in shaping the landscape for organic agriculture, directly impacting companies like Hain Celestial. Policies and subsidies can significantly influence the cost and availability of organic raw materials, the very foundation of their product lines.

Programs such as the USDA's Transitional and Organic Grower Assistance (TOGA) are designed to bolster organic farming practices. These initiatives can translate into a more stable and predictable supply of organic ingredients for Hain Celestial, a key advantage in maintaining their market position.

Conversely, shifts in government funding can create headwinds. The defunding of certain organic programs, like the Organic Certification Cost Share Program, can lead to increased certification costs for farmers. This rise in operational expenses for growers might eventually translate to higher raw material prices for Hain Celestial, potentially affecting their supply chain economics.

Hain Celestial's global operations are significantly shaped by international trade policies and import regulations, particularly for its organic and natural product portfolio. Changes in these rules can directly influence sourcing costs, market entry, and overall competitiveness in key regions.

The new EU Organic Regulation, set to fully take effect in January 2025, marks a significant shift. It requires all organic imports to meet stringent EU standards, replacing previous equivalence agreements. This means ingredients sourced from countries not recognized as equivalent will face stricter scrutiny, potentially increasing compliance burdens and affecting supply chains for companies like Hain Celestial that rely on diverse global sourcing.

In the United States, the organic sector grapples with its own set of trade-related challenges. An oversupply of certain commodity crops can depress prices, while tariffs on imported goods can alter the competitive landscape. For Hain Celestial, these dynamics can impact ingredient costs and the pricing strategies for its diverse range of products distributed across the US market.

Government regulations are a major consideration for Hain Celestial, particularly concerning food safety and how products are labeled. These rules are essential for building consumer confidence and ensuring the company meets legal requirements across its product lines.

The U.S. Department of Agriculture (USDA) updated its organic regulations in March 2024. This revision is designed to enhance oversight and accountability, specifically targeting organic food fraud. The changes broaden the range of organizations that must adhere to these standards, impacting how Hain Celestial sources and markets its organic offerings.

Further complicating the landscape, the U.S. Food and Drug Administration (FDA) released draft guidance in January 2025. This guidance focuses on making sure that plant-based food alternatives are labeled clearly and accurately. Given Hain Celestial's significant presence in the plant-based sector, this regulatory development is particularly important for maintaining transparency and consumer trust.

Political Stability and Geopolitical Events

Geopolitical events and political instability in regions where Hain Celestial sources ingredients or sells its products can significantly disrupt operations. For instance, ongoing conflicts or trade disputes can impact the availability and cost of key organic ingredients, affecting production schedules and profitability. Hain Celestial, like many in the food industry, acknowledges that broader macroeconomic volatility, often fueled by geopolitical tensions, influences its business outlook and financial performance.

Such instability can directly influence ingredient sourcing, leading to potential shortages or price spikes for items like organic fruits, grains, or dairy. Furthermore, transportation costs can escalate due to rerouting or increased insurance premiums in volatile areas, impacting the final cost of goods. Market access can also be hindered by political changes, sanctions, or shifts in consumer sentiment driven by international events.

To navigate these risks, companies like Hain Celestial must employ agile supply chain management strategies. This includes diversifying sourcing locations to mitigate reliance on any single region and building robust relationships with multiple suppliers. Proactive risk assessment and contingency planning are crucial to address potential disruptions stemming from political instability.

For example, the ongoing global supply chain challenges, exacerbated by geopolitical events in 2023 and early 2024, have highlighted the need for resilience. Companies reported increased costs for shipping and raw materials, with some ingredient prices rising by 10-15% or more due to these factors. This underscores the direct financial impact of political and geopolitical events on companies in the consumer staples sector.

- Supply Chain Disruption: Geopolitical events can interrupt the flow of raw materials and finished goods, impacting production and delivery schedules.

- Cost Volatility: Political instability can lead to unpredictable fluctuations in the prices of key ingredients and transportation.

- Market Access: Changes in political climates or trade policies can affect a company's ability to sell products in certain international markets.

- Increased Operational Costs: Companies may face higher expenses for logistics, insurance, and compliance due to geopolitical risks.

Consumer Protection Laws and Advocacy

Consumer protection laws and advocacy are significant political factors influencing companies like Hain Celestial. Government bodies and consumer advocacy groups actively campaign for enhanced regulations concerning health claims, ingredient transparency, and the environmental footprint of products. These efforts frequently result in new legal requirements that demand modifications in product formulation, labeling practices, and marketing strategies.

Hain Celestial must continually adapt its product portfolio and operational procedures to align with these evolving consumer demands and regulatory landscapes. For instance, the increasing scrutiny on "natural" and "organic" claims, coupled with demands for clearer ingredient lists, directly impacts how the company communicates its product benefits and sourcing. This dynamic environment necessitates ongoing investment in research, development, and compliance to maintain market trust and avoid potential penalties. In 2023, the U.S. Federal Trade Commission (FTC) continued its focus on environmental marketing claims, issuing updated Green Guides that could affect how companies like Hain Celestial advertise the sustainability of their products.

- Stricter Regulations: Consumer protection laws often mandate changes in product formulation and labeling, impacting operational costs.

- Ingredient Transparency: Growing consumer demand for clear ingredient lists and sourcing information necessitates robust supply chain management.

- Health Claims Scrutiny: Regulatory bodies like the FDA (Food and Drug Administration) closely monitor health claims made by food companies, requiring scientific substantiation.

- Environmental Impact: Legislation related to packaging waste and sustainability practices can influence manufacturing processes and material sourcing.

Government support for organic agriculture directly impacts Hain Celestial's raw material costs and supply stability; for example, USDA programs like TOGA aim to bolster organic farming. Conversely, shifts in government funding, such as potential defunding of organic certification cost-share programs, could increase grower expenses, eventually affecting Hain Celestial's ingredient prices.

International trade policies significantly shape Hain Celestial's global operations, with the new EU Organic Regulation effective January 2025 requiring all organic imports to meet stringent EU standards, potentially increasing compliance burdens for diverse global sourcing.

US food safety and labeling regulations, like the USDA's March 2024 organic regulation updates enhancing oversight for organic food fraud, and the FDA's January 2025 draft guidance on plant-based food labeling, are critical for Hain Celestial's transparency and consumer trust.

What is included in the product

This PESTLE analysis of Hain Celestial examines how political, economic, social, technological, environmental, and legal factors impact its operations and strategy.

It provides a comprehensive understanding of the external forces shaping the company's competitive landscape and future growth potential.

This PESTLE analysis for Hain Celestial offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing for strategic discussions and decision-making.

Economic factors

Persistent inflation can significantly squeeze Hain Celestial's profit margins by increasing the cost of essential inputs like organic ingredients, packaging, and logistics. For instance, the Producer Price Index for food manufacturing saw a notable increase in late 2023 and into 2024, directly impacting these expenses. This rising cost structure poses a direct challenge to maintaining competitive pricing.

The elevated cost of living due to inflation directly affects consumer purchasing power, potentially dampening demand for premium-priced organic and natural foods, Hain Celestial's core market. While the company has seen some resilience in organic sales, this trend could slow as consumers become more price-sensitive. Reports from early 2024 indicated that consumers were actively seeking value, which could shift preferences away from higher-priced organic options.

Global economic growth trends significantly impact consumer purchasing power, directly affecting demand for Hain Celestial's premium and specialty food products, which are often considered discretionary. A slowing global economy or increased recessionary pressures can lead consumers to cut back on non-essential purchases, including higher-priced food items.

Hain Celestial itself acknowledged this dynamic, citing a volatile macro environment and a softer-than-expected first half of fiscal year 2025 in its recent financial reports. This led the company to revise its financial guidance downwards, signaling a cautious approach to the prevailing economic conditions.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.8% in 2025, down from 3.2% in 2024, reflecting ongoing geopolitical uncertainties and tight monetary policies. Such macroeconomic headwinds can translate into reduced consumer spending on brands like Hain Celestial.

The global supply chain's cost and efficiency directly impact Hain Celestial's economic performance. Fluctuations in logistics, raw material sourcing, and distribution networks present significant challenges. For instance, in fiscal year 2023, Hain Celestial reported that supply chain disruptions contributed to higher freight costs and input expenses, impacting gross margins.

Short-term supply issues, especially within its international segment where demand often outstripped available supply, have been a recurring problem. This dynamic limits Hain Celestial's ability to fully capitalize on market opportunities. Furthermore, the company's struggle to achieve economies of scale, when contrasted with larger, more integrated competitors, translates into less competitive pricing power and potentially lower profit margins on its products.

Competitive Landscape and Market Share

The natural and organic food sector is incredibly competitive, and Hain Celestial has faced significant headwinds. Declining organic sales over several quarters, as reported in their fiscal year 2023 and into early 2024, have directly impacted their market share and ability to maintain pricing power. This intensified competition puts pressure on margins.

In response, Hain Celestial initiated a strategic review aimed at simplifying its operations and boosting brand innovation. These moves are a direct reaction to the challenging market dynamics and the need to improve financial performance. The company's focus has been on streamlining its portfolio and investing in brands with higher growth potential.

- Intense Competition: The natural and organic food market is crowded with both established players and emerging brands, leading to price wars and increased marketing costs.

- Market Share Erosion: Hain Celestial has seen a dip in its market share in certain key categories due to this competitive pressure and its own internal challenges.

- Pricing Power Constraints: With increased competition, the company has had less flexibility in raising prices, impacting profitability.

- Strategic Realignment: Efforts to divest non-core brands and focus on core growth drivers are underway to address these competitive pressures.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact Hain Celestial's cost of capital. For instance, if the Federal Reserve maintains or increases interest rates, borrowing for significant investments like new product development or potential acquisitions becomes more expensive. This economic factor is crucial for a company like Hain Celestial, which relies on capital to fuel growth and maintain its competitive edge in the organic and natural foods sector.

Hain Celestial has been actively managing its financial structure, with a notable emphasis on debt reduction. As of the first quarter of fiscal year 2024, the company reported a decrease in its net debt. This strategic focus demonstrates an understanding of the importance of prudent capital management, especially in an environment where interest rate changes can significantly alter borrowing expenses and profitability. Generating strong operating cash flow further strengthens their ability to manage debt and fund operations without excessive reliance on new borrowing.

- Debt Reduction Focus: Hain Celestial has prioritized paying down its outstanding debt, aiming to improve its financial flexibility.

- Operating Cash Flow Generation: The company has demonstrated a capacity to produce robust cash from its core operations, supporting its financial health.

- Interest Rate Sensitivity: Rising interest rates can increase the cost of servicing existing debt and the expense of obtaining new capital for expansion or innovation.

- Impact on Investment: Higher borrowing costs may lead Hain Celestial to re-evaluate or delay capital expenditures, potentially slowing the pace of strategic initiatives.

The economic landscape presents significant challenges for Hain Celestial, primarily through persistent inflation that erodes profit margins and consumer purchasing power. Global economic slowdowns also dampen demand for their premium products, as highlighted by the company's own downward revisions to financial guidance for fiscal year 2025. These factors, combined with intense competition within the natural and organic food sector, have led to market share erosion and constrained pricing power.

Hain Celestial is actively navigating these economic headwinds by focusing on debt reduction and generating strong operating cash flow, as evidenced by a decrease in net debt in Q1 FY2024. This strategic financial management is crucial given the sensitivity to fluctuating interest rates, which can increase the cost of capital and impact investment decisions. The company's ability to manage costs and maintain competitive pricing in a volatile market remains a key determinant of its financial performance.

| Economic Factor | Impact on Hain Celestial | Supporting Data/Trend |

|---|---|---|

| Inflation | Increased input costs (ingredients, logistics), reduced consumer spending on premium goods. | Producer Price Index for food manufacturing up late 2023-2024; consumer focus on value in early 2024. |

| Global Economic Growth | Lower demand for discretionary food items. | IMF projects global growth slowing to 2.8% in 2025 from 3.2% in 2024. |

| Interest Rates | Higher cost of capital, increased debt servicing expenses. | Federal Reserve policy impacts borrowing costs for investments. |

| Competition | Market share erosion, pricing power constraints, pressure on margins. | Declining organic sales reported in FY2023 and early 2024. |

What You See Is What You Get

Hain Celestial PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hain Celestial delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to its detailed insights upon completing your purchase.

Sociological factors

The increasing consumer focus on health and wellness significantly benefits Hain Celestial. Consumers are actively seeking out natural and organic food choices, driven by a desire for better nutrition and reduced exposure to pesticides. In fact, reports indicate that over 95% of households purchased organic products within the last year, highlighting a robust market demand for such offerings.

The increasing consumer interest in plant-based eating is a major trend that directly benefits Hain Celestial. This shift is fueled by growing awareness around health, environmental sustainability, and ethical considerations. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $169.1 billion by 2030, indicating a robust compound annual growth rate (CAGR) of 28.4% during this period.

This growing demand for plant-based alternatives presents a substantial market opportunity for Hain Celestial, which has strategically positioned itself with a portfolio of plant-based products. Consumers are increasingly choosing these options not only for perceived health benefits but also due to a desire for more sustainable and ethically sourced food. Reports from 2024 indicate that over 35% of consumers globally are actively reducing their meat consumption, with a significant portion identifying as flexitarian, vegetarian, or vegan.

Consumers are increasingly demanding transparency, pushing for clear sustainability claims and minimal ingredients on product packaging. This 'clean label' trend, where less is more in terms of processing and artificial additives, directly benefits companies like Hain Celestial, which has built its brand around such principles. In 2024, surveys indicated that over 70% of consumers check ingredient lists, with a significant portion actively seeking products with fewer, recognizable ingredients.

Ethical Consumption and Sustainability Concerns

Consumers are increasingly prioritizing ethical consumption, with environmental sustainability and responsible sourcing playing a significant role. This trend directly impacts companies like Hain Celestial by shaping purchasing decisions. For instance, a 2024 Nielsen report indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact, highlighting a strong market demand for eco-conscious brands.

This growing awareness translates into a willingness to pay a premium for products that demonstrate genuine sustainability. Hain Celestial, therefore, needs to prominently feature its sustainability practices and relevant certifications to capture this segment. Research from 2025 suggests that nearly 60% of consumers are actively seeking out brands with clear eco-friendly labels, underscoring the financial incentive for companies to invest in and communicate their green initiatives.

- Consumer Demand: A significant portion of consumers, estimated at over 70% globally in 2024, are adjusting their buying habits to be more environmentally friendly.

- Willingness to Pay Premium: Approximately 60% of consumers in 2025 actively look for and are willing to pay more for products with verifiable eco-friendly attributes.

- Brand Perception: Companies like Hain Celestial benefit from enhanced brand loyalty and market share when they effectively communicate and implement sustainable practices.

Demographic Shifts and Lifestyle Changes

Younger consumers, especially Gen Z and Millennials, are increasingly making purchasing decisions based on their values. This is a significant driver for companies like Hain Celestial, as these demographics show a strong preference for natural and organic products. For instance, a 2024 report indicated that 65% of Gen Z consumers consider a brand's ethical practices when buying, directly impacting the demand for sustainably sourced and health-conscious food options that Hain Celestial offers.

The growing availability of organic and natural foods in conventional supermarkets and mass retailers signifies a profound lifestyle shift. What was once a niche market is now integrated into everyday shopping habits. This accessibility means that consumers no longer need to seek out specialty stores, making healthy eating a more convenient and mainstream choice. This trend supports Hain Celestial's strategy of broad distribution for its product lines, aligning with consumers' evolving daily routines.

- Shifting Consumer Priorities: Younger generations are placing a higher emphasis on health, wellness, and ethical sourcing.

- Market Expansion: The mainstreaming of organic and natural products broadens the potential customer base for companies like Hain Celestial.

- Brand Loyalty: Value-driven purchasing often translates to stronger brand loyalty among consumers who align with a company's mission.

- Data Point: By 2025, the global market for organic food is projected to reach over $375 billion, reflecting the sustained growth in this sector driven by these demographic trends.

Societal shifts towards health consciousness and ethical consumption continue to shape the food industry. Consumers, particularly younger demographics like Gen Z and Millennials, are increasingly prioritizing products that align with their values, including those that are natural, organic, and sustainably sourced. This trend directly benefits Hain Celestial, which has built its brand around these very principles.

The growing demand for transparency in food production is another key sociological factor. Consumers want to know what's in their food and how it's made, driving the "clean label" movement. Companies like Hain Celestial, with their focus on minimal ingredients and reduced processing, are well-positioned to meet this demand. For instance, in 2024, over 70% of consumers reported checking ingredient lists, seeking recognizable and fewer components.

The mainstreaming of plant-based diets is a significant sociological trend impacting Hain Celestial. Driven by health, environmental, and ethical concerns, more consumers are reducing meat consumption. The global plant-based food market, valued at approximately $29.7 billion in 2023, exemplifies this shift, with projections reaching $169.1 billion by 2030.

Consumer willingness to pay a premium for ethically produced and environmentally friendly products is also on the rise. By 2025, research indicates nearly 60% of consumers actively seek brands with clear eco-friendly labels. This presents a clear financial incentive for Hain Celestial to highlight its sustainability initiatives.

| Sociological Factor | Consumer Behavior Impact | Hain Celestial Relevance | Data Point (2024/2025) |

|---|---|---|---|

| Health & Wellness Focus | Increased demand for organic and natural foods | Core brand positioning | 95% of households purchased organic products |

| Ethical Consumption | Preference for sustainable and responsibly sourced products | Brand loyalty driver | 73% of global consumers would change habits to reduce environmental impact |

| Plant-Based Diets | Growing adoption of vegetarian, vegan, and flexitarian lifestyles | Significant market opportunity | 35% of consumers reducing meat consumption |

| Transparency & Clean Labels | Demand for clear ingredient lists and minimal processing | Competitive advantage | 70% of consumers check ingredient lists |

Technological factors

Technological advancements in sustainable packaging are a major driver for Hain Celestial. The company is actively exploring and implementing innovations like plant-fiber-based materials and recycled PET to reduce its environmental footprint.

By 2025, Hain Celestial has set ambitious goals, aiming for 100% of its plastic packaging to be recyclable, reusable, or compostable. This commitment is fueled by consumer demand for eco-friendly products and increasing regulatory pressures favoring sustainable solutions.

The market is witnessing a surge in seaweed-based packaging and other biodegradable alternatives, offering Hain Celestial further opportunities to enhance its product presentation while aligning with its sustainability targets. These innovations are key to maintaining brand reputation and competitive edge in the evolving food industry.

Hain Celestial's supply chain benefits significantly from technological advancements aimed at boosting visibility and traceability, particularly crucial for its organic product lines. Innovations like the Internet of Things (IoT) embedded in smart packaging, alongside RFID tags and QR codes, are transforming how product journeys are tracked. These technologies offer real-time data on critical factors such as freshness and precise origin, directly combating fraud and upholding the integrity of organic claims from farm to shelf.

The adoption of these digital tools empowers consumers with verifiable information, enhancing trust in Hain Celestial's organic offerings. For instance, a study by Statista in late 2024 indicated that 75% of consumers are more likely to purchase products with clear origin information. This trend underscores the market's demand for transparency, a demand that Hain Celestial can meet through enhanced supply chain digitalization, ensuring compliance and building brand loyalty in a competitive landscape.

The integration of AI-driven automation and advanced manufacturing techniques offers Hain Celestial significant opportunities to boost production efficiency and lower operational costs. These technologies are particularly beneficial in organic food processing, where maintaining strict separation of ingredients to prevent contamination is crucial. For example, automated sorting and packaging systems can ensure product integrity and consistency.

While these technological advancements promise improved quality and cost savings, the initial investment can be substantial. For instance, sophisticated AI-powered inventory management systems or robotic processing lines require considerable capital outlay. This increased expense needs to be carefully weighed against the long-term benefits of enhanced output and reduced waste.

E-commerce and Digital Retail Platforms

The escalating shift towards e-commerce and direct-to-consumer (DTC) models necessitates strong digital infrastructure for Hain Celestial. This includes capabilities for online storefronts, digital marketing, and efficient order fulfillment to meet evolving consumer purchasing habits. Hain Celestial is actively pursuing growth in these digital channels, recognizing that online sales continue to gain significant traction.

In 2023, the global e-commerce market was valued at approximately $6.3 trillion, with projections indicating continued robust growth. For Hain Celestial, this translates to a critical need to enhance its digital presence and optimize its online sales strategies to capture a larger share of this expanding market. This digital transformation is key to adapting to changing retail landscapes.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2026, underscoring the importance of a strong online strategy.

- Direct-to-Consumer (DTC) Importance: DTC channels offer higher margins and direct customer relationships, which Hain Celestial can leverage.

- Digital Capabilities: Investment in user-friendly websites, targeted digital advertising, and efficient online order processing is paramount.

- Consumer Behavior: The pandemic accelerated online shopping, and these habits are largely persisting, making digital engagement essential for sustained sales.

Product Innovation and R&D

Technological advancements are crucial for Hain Celestial's ability to innovate and stay ahead. Research and development efforts are focused on creating new and enhanced plant-based, clean label, and healthier product offerings.

This includes exploring functional ingredients that offer specific health benefits, developing personalized nutrition solutions tailored to individual needs, and creating novel flavor profiles that appeal to modern palates. For instance, in 2024, the plant-based food market continued its robust growth, with a projected CAGR of over 11% through 2028, underscoring the demand for such innovations.

- Functional Ingredients: Investments in R&D for ingredients like adaptogens, probiotics, and prebiotics are key.

- Personalized Nutrition: Developing products that cater to specific dietary needs and preferences, such as low-FODMAP or allergen-free options.

- Flavor Innovation: Utilizing advanced food science to create unique and appealing taste experiences in plant-based alternatives.

- Sustainable Packaging: Exploring and implementing new, eco-friendly packaging technologies to align with consumer values.

Hain Celestial is leveraging technology to enhance its supply chain visibility and traceability, particularly for its organic products. IoT devices and RFID tags are being integrated to provide real-time data on product freshness and origin, crucial for combating fraud and verifying organic claims.

The company is also investing in AI-driven automation and advanced manufacturing to improve production efficiency and reduce costs, especially vital in organic food processing for maintaining ingredient separation and product consistency.

The growing e-commerce and direct-to-consumer (DTC) channels require Hain Celestial to bolster its digital infrastructure, including online storefronts and digital marketing capabilities, to adapt to changing consumer purchasing habits.

Technological advancements are also fueling product innovation, with R&D focused on plant-based, clean label, and healthier offerings, including functional ingredients and personalized nutrition solutions to meet evolving consumer demands.

| Technology Area | Impact on Hain Celestial | Key Data/Trends (2024-2025) |

|---|---|---|

| Sustainable Packaging | Reduces environmental footprint, meets consumer demand. | Goal: 100% recyclable, reusable, or compostable plastic packaging by 2025. Seaweed-based and plant-fiber materials gaining traction. |

| Supply Chain Traceability | Enhances transparency, combats fraud, verifies organic claims. | IoT and RFID adoption increasing. 75% of consumers more likely to buy products with clear origin info (Statista, late 2024). |

| Automation & AI | Boosts production efficiency, lowers operational costs. | Robotic processing and AI inventory management enhance product integrity and reduce waste. |

| E-commerce & Digital | Supports growth in online sales and DTC channels. | Global e-commerce market ~$6.3 trillion (2023), projected to reach $8.1 trillion by 2026. |

| Product Innovation | Drives development of new plant-based and health-focused products. | Plant-based food market CAGR projected >11% through 2028. Focus on functional ingredients and personalized nutrition. |

Legal factors

Hain Celestial operates under strict food safety regulations, enforced by bodies such as the U.S. Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA). These regulations are dynamic, with ongoing updates to ensure consumer protection.

A significant development occurred in March 2024 when the USDA introduced revised guidelines to combat organic food fraud. These changes mandate enhanced record-keeping and more thorough traceability audits throughout the entire supply chain for all organic producers.

Compliance with these evolving food safety standards, particularly those related to organic integrity, is crucial for Hain Celestial's brand reputation and market access. Non-compliance can lead to product recalls, fines, and damage to consumer trust, impacting sales and profitability.

Hain Celestial’s commitment to organic certification is crucial for maintaining its brand reputation and consumer trust. Adherence to the USDA's National Organic Program (NOP) standards ensures that its products meet rigorous organic requirements.

The U.S. Food and Drug Administration's (FDA) January 2025 draft guidance on plant-based food labeling is particularly relevant. This guidance aims to prevent misleading consumers about the nature of plant-based alternatives, directly impacting how Hain Celestial describes its products, especially those in the rapidly growing plant-based sector.

Operating globally, Hain Celestial faces a complex web of international trade and import/export laws. These regulations, including tariffs and customs requirements, directly impact the cost and feasibility of sourcing ingredients and distributing finished products across borders. For instance, the upcoming EU Organic Regulation, effective January 1, 2025, mandates full compliance with EU standards for all organic imports, phasing out prior equivalence agreements. This change could require significant overhauls in how Hain Celestial sources its organic ingredients and manages its supply chains, potentially increasing compliance costs and affecting product availability in key European markets.

Advertising and Marketing Regulations

Hain Celestial must navigate a complex landscape of advertising and marketing regulations, particularly given its focus on health and wellness products. Laws require that all claims made about product benefits, ingredients, and sourcing are accurate and not misleading to consumers. For instance, the U.S. Federal Trade Commission (FTC) actively polices deceptive advertising, and companies can face significant penalties for unsubstantiated claims.

The increasing consumer demand for transparency and ethical practices means regulations around sustainability and environmental marketing are tightening. Companies are under more scrutiny to provide scientific backing for 'greenwashing' claims, ensuring that environmental benefits advertised are legitimate and verifiable. In 2024, regulatory bodies globally, including the FTC and the European Union’s consumer protection authorities, have continued to emphasize stricter enforcement on environmental marketing claims.

- Advertising Substantiation: Marketers must have competent and reliable scientific evidence to back up all health and environmental claims.

- Truthfulness in Advertising: Claims must be truthful, not misleading, and substantiated by evidence.

- Greenwashing Scrutiny: Increasing focus on verifying environmental marketing claims with scientific data.

- Consumer Protection Laws: Adherence to national and international consumer protection regulations is paramount.

Intellectual Property and Brand Protection

Hain Celestial places significant emphasis on safeguarding its extensive brand portfolio, which includes key trademarks and unique product formulations. This protection is vital for maintaining its competitive edge and brand value in the dynamic food and beverage sector. For instance, in 2023, the company continued to actively manage its intellectual property, which underpins its market differentiation and consumer trust.

Legal frameworks governing intellectual property rights are fundamental to Hain Celestial's strategy, providing recourse against infringement and ensuring the exclusive use of its innovations. This legal shield is essential for preventing competitors from capitalizing on Hain Celestial's established brand equity and product development investments. The company's commitment to IP protection directly supports its ability to command premium pricing and build lasting customer loyalty.

In 2024, the landscape for intellectual property enforcement remains robust, with ongoing legal actions and vigilance against counterfeit products and unauthorized brand usage. This proactive stance is crucial for preserving the integrity of brands like Celestial Seasonings, Earth Balance, and Dream.

Key aspects of Hain Celestial's IP protection strategy include:

- Trademark Registration and Enforcement: Maintaining and defending registered trademarks for all its product lines to prevent brand dilution and consumer confusion.

- Proprietary Formulation Safeguarding: Utilizing legal agreements and trade secret protections for unique recipes and manufacturing processes.

- International IP Protection: Securing IP rights across the various global markets where its products are sold, often involving complex international legal cooperation.

- Monitoring and Litigation: Actively monitoring the market for potential infringements and engaging in legal proceedings when necessary to protect its intellectual assets.

Hain Celestial navigates a stringent regulatory environment, particularly concerning food safety and organic integrity. The USDA's March 2024 revised guidelines for combating organic food fraud, requiring enhanced traceability, directly impact Hain Celestial's supply chain management and record-keeping. Furthermore, the FDA's January 2025 draft guidance on plant-based food labeling necessitates careful product descriptions to avoid misleading consumers, especially in its growing plant-based offerings.

Environmental factors

Climate change presents significant challenges for Hain Celestial, particularly concerning the availability and cost of its organic agricultural inputs. Organic farming, by its nature, often relies on natural processes that can be more sensitive to extreme weather events and shifts in growing seasons. This sensitivity can directly impact the company's raw material supply chain.

Recognizing these vulnerabilities, Hain Celestial has set an ambitious target to reduce its Scope 1, 2, and 3 greenhouse gas (GHG) emissions by 2030. For instance, in fiscal year 2023, the company reported progress in its emissions reduction efforts, though specific percentage decreases vary across scopes. This commitment underscores the company's awareness of how climate impacts its operations and the broader agricultural ecosystem it depends on.

Hain Celestial's commitment to healthier, more sustainable choices directly impacts its sourcing. For its plant-based and clean-label offerings, this means carefully managing resources like water, aiming for responsible agricultural methods, and actively working to minimize waste throughout production. In 2023, the company reported progress in its water stewardship, targeting a 10% reduction in water withdrawal intensity by 2025 against a 2020 baseline, with specific initiatives in water-stressed regions.

The growing global emphasis on minimizing packaging waste and fostering a circular economy presents a significant operational challenge and opportunity for Hain Celestial. This trend is driven by heightened consumer awareness and increasingly stringent governmental policies aimed at sustainable resource management.

Hain Celestial has responded by establishing ambitious goals to decrease its reliance on virgin packaging materials and enhance the recyclability of its product packaging. For instance, by 2025, the company aims for 100% of its plastic packaging to be reusable, recyclable, or compostable, a commitment directly influenced by evolving consumer preferences and regulatory landscapes.

Regulations such as the EU's Packaging and Packaging Waste Regulation (PPWR), with key provisions taking effect by 2025, mandate specific recycled content levels and recyclability standards, directly impacting companies like Hain Celestial that operate or sell within the European Union. This regulatory pressure necessitates a proactive approach to packaging innovation and supply chain adjustments.

Water Scarcity and Quality

Water availability and quality are crucial for Hain Celestial's agricultural supply chain and manufacturing operations. The company recognizes water management as important, but current disclosures suggest a need for more comprehensive assessments across its entire value chain and clearer reporting on water-related performance metrics. This indicates that managing water risks remains an evolving challenge for the company.

While specific 2024 or 2025 quantitative data on Hain Celestial's water risk assessment or performance metrics isn't publicly detailed, the broader industry context underscores the urgency. For instance, the U.S. Environmental Protection Agency (EPA) has highlighted that water scarcity affects over 40% of U.S. counties at some point in the year. For a company like Hain Celestial, relying on agricultural inputs, these regional water stresses can directly impact raw material availability and cost.

- Supply Chain Vulnerability: Dependence on water-intensive crops makes Hain Celestial susceptible to droughts and water quality degradation, potentially leading to supply disruptions.

- Operational Costs: Increased costs for water treatment or sourcing in water-stressed regions can impact profit margins.

- Regulatory Landscape: Evolving water usage regulations and quality standards could necessitate significant investment in compliance.

- Reputational Risk: Poor water stewardship can damage brand image, especially among environmentally conscious consumers.

Biodiversity and Ecosystem Health

Hain Celestial's focus on organic farming inherently promotes biodiversity and ecosystem health by eschewing synthetic pesticides and fertilizers, which can harm natural habitats and beneficial insects. This commitment to natural products directly contributes to a healthier environment throughout its supply chain.

The company’s efforts align with growing consumer and regulatory pressure for environmentally responsible sourcing. For instance, organic agricultural land globally has seen continued expansion; by 2022, over 77 million hectares were managed organically worldwide, demonstrating a significant market shift towards practices that support biodiversity.

To further bolster these benefits, Hain Celestial is increasingly focused on broader initiatives. These include working with suppliers to implement regenerative agriculture practices, which actively improve soil health, water retention, and support a wider array of plant and animal life.

Key areas of focus for Hain Celestial's biodiversity initiatives include:

- Promoting pollinator habitats: Supporting the planting of native wildflowers and hedgerows on farms to provide food and shelter for bees, butterflies, and other essential pollinators.

- Water stewardship: Implementing practices that reduce water usage and prevent runoff of agricultural chemicals, protecting aquatic ecosystems.

- Soil health improvement: Encouraging cover cropping and reduced tillage to enhance soil structure, carbon sequestration, and microbial diversity.

- Sustainable land management: Working with farming partners to protect existing natural areas like forests and wetlands within or adjacent to agricultural land.

Climate change poses a direct threat to Hain Celestial's organic supply chain, impacting crop yields and input costs due to extreme weather. The company is actively working to mitigate its environmental footprint, aiming to reduce greenhouse gas emissions by 2030, with fiscal year 2023 showing progress in this area. Water scarcity is another critical concern, affecting agricultural sourcing and operations, with a target to reduce water withdrawal intensity by 10% by 2025 against a 2020 baseline.

Packaging waste is a growing challenge, driven by consumer demand and stricter regulations like the EU's PPWR, effective by 2025, which mandates higher recycled content and recyclability. Hain Celestial is committed to making 100% of its plastic packaging reusable, recyclable, or compostable by 2025. Biodiversity initiatives, including promoting pollinator habitats and regenerative agriculture, are central to its sustainable sourcing strategy.

| Environmental Factor | Hain Celestial's Response/Goal | Relevant Data/Target Year |

|---|---|---|

| Climate Change/GHG Emissions | Reduce Scope 1, 2, & 3 GHG emissions | Target: 2030; Progress noted in FY2023 |

| Water Scarcity | Reduce water withdrawal intensity | Target: 10% by 2025 (vs. 2020 baseline) |

| Packaging Waste | 100% plastic packaging reusable, recyclable, or compostable | Target: 2025 |

| Biodiversity | Promote pollinator habitats, regenerative agriculture | Ongoing initiatives; 77+ million hectares organically managed globally by 2022 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hain Celestial is informed by a robust dataset including official government publications from key markets, reports from leading financial institutions, and industry-specific market research. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.