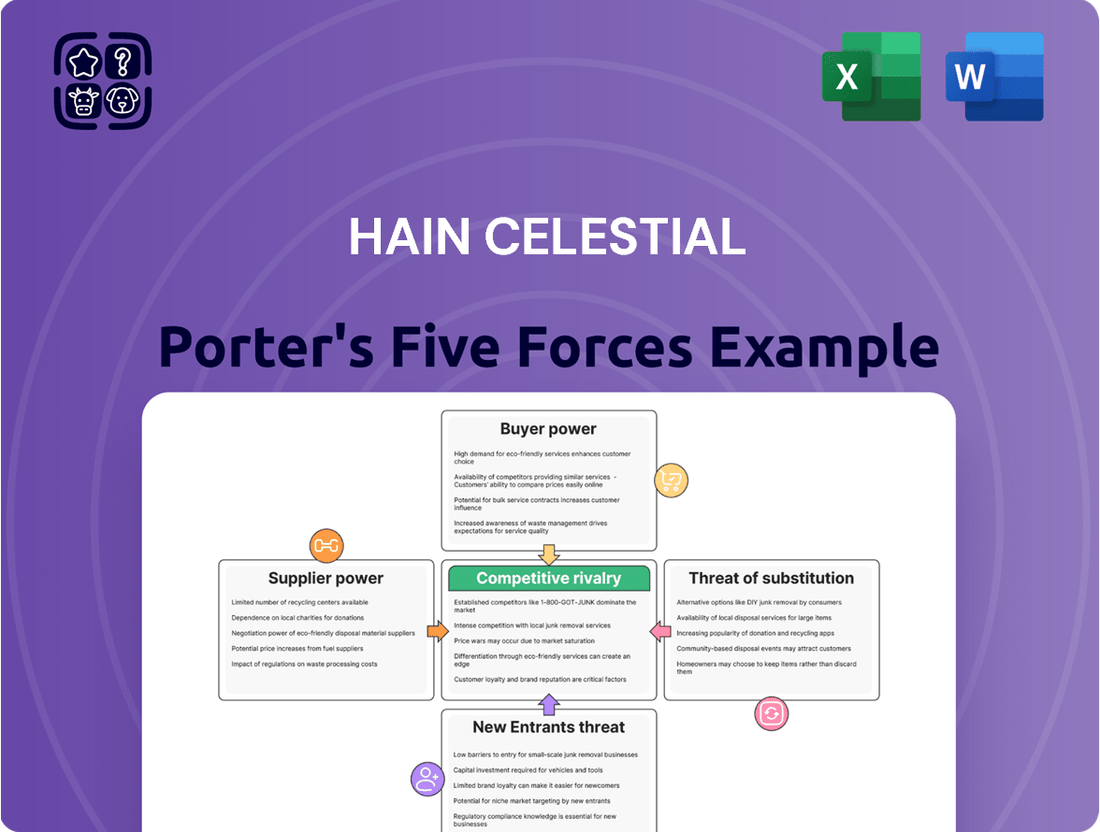

Hain Celestial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hain Celestial Bundle

Hain Celestial operates in a dynamic industry, facing significant buyer power from large retailers and intense rivalry among numerous natural and organic food brands. The threat of substitutes is also a key consideration, as consumers have a wide array of food choices available. Understanding these forces is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hain Celestial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hain Celestial's need for certified organic and natural ingredients places it at the mercy of a select group of specialized suppliers. These suppliers, often possessing unique certifications or proprietary growing techniques, wield considerable leverage because their products are not easily replicated.

This reliance on a niche supply chain means Hain Celestial must cultivate strong relationships to guarantee a steady flow of high-quality ingredients. For instance, in fiscal year 2023, Hain Celestial reported that it sources a significant portion of its key organic ingredients from a limited number of long-term partners, underscoring the critical nature of these supplier relationships.

The concentration of key suppliers significantly impacts Hain Celestial's bargaining power. If a few suppliers provide essential ingredients, like organic grains or specific plant-based proteins, they hold considerable sway. This leverage can translate into higher prices for Hain, as seen when supply chain disruptions in 2021-2022 led to increased costs for many food manufacturers due to limited availability of certain agricultural inputs.

The bargaining power of suppliers for Hain Celestial is significantly influenced by high switching costs associated with certified inputs. For instance, securing specialized organic certifications or unique clean-label ingredients often requires rigorous and time-consuming re-validation processes. These aren't minor hurdles; they can involve extensive quality assurance recalibrations and even modifications to existing production lines to ensure compatibility and adherence to strict standards.

This complexity directly translates into reduced flexibility for Hain Celestial. When a company has invested heavily in qualifying a specific supplier for a critical, certified ingredient, the effort and expense to change that supplier become substantial. This situation naturally strengthens the hand of those existing suppliers who are already familiar with Hain Celestial's precise needs and operational workflows, making them less susceptible to price pressures or demands for better terms.

Threat of Forward Integration by Suppliers

In specialized niches within the organic food sector, a few highly specialized ingredient suppliers could theoretically integrate forward into manufacturing or branding. This potential, though often limited by the significant capital required for food processing, grants them leverage when negotiating terms with Hain Celestial.

For instance, if a supplier controls a unique, proprietary organic ingredient essential for a popular Hain Celestial product, they might use the threat of launching their own branded product to secure more favorable pricing or contract terms. This is especially true if the ingredient's supply chain is concentrated among very few producers.

While the capital barriers in food manufacturing are substantial, deterring most suppliers from full-scale integration, even the credible threat can influence negotiations. For example, the organic dairy market, while competitive, can see a few key organic milk producers wielding some influence if they possess unique certifications or processing capabilities.

- Niche Ingredient Control: Suppliers of highly specialized organic ingredients may possess bargaining power if their product is critical and difficult to source elsewhere.

- Theoretical Forward Integration: The possibility of suppliers entering manufacturing or branding, though capital-intensive, can enhance their negotiating leverage.

- Capital Intensity as a Deterrent: The high cost of establishing food processing and distribution infrastructure generally limits the practical realization of this threat for most suppliers.

- Impact on Negotiations: Even a theoretical threat can lead to more favorable contract terms for suppliers in specific, high-dependency scenarios.

Impact of Agricultural Commodity Price Volatility

The bargaining power of suppliers for Hain Celestial is significantly impacted by the volatility of global organic agricultural commodity prices. These prices can swing unpredictably due to factors like adverse weather, crop diseases, and changing consumer demand. For instance, a drought in a key growing region in 2024 could dramatically increase the cost of organic grains or fruits.

When the prices of essential organic inputs escalate, suppliers are in a stronger position to pass these increased costs directly onto Hain Celestial. This directly squeezes the company's cost of goods sold and can erode its profit margins. This dynamic, driven by external market forces, constantly redefines the leverage suppliers hold.

- Supplier Leverage Factor: Global organic commodity price fluctuations.

- Impact on Hain Celestial: Increased cost of goods sold and reduced profit margins.

- Key Influences: Weather patterns, crop diseases, and demand shifts.

- Example Scenario: A 2024 drought impacting organic corn prices.

Hain Celestial's reliance on specialized organic ingredients means certain suppliers hold considerable sway, especially when these inputs are unique or difficult to replicate. This bargaining power is amplified by the high costs and time involved in switching suppliers for certified organic products, making it challenging for Hain Celestial to seek alternative sources. For example, in fiscal year 2023, Hain Celestial highlighted its dependence on a limited number of long-term partners for key organic ingredients, underscoring the supplier leverage.

The concentration of these specialized suppliers, particularly for niche ingredients like organic grains or specific plant-based proteins, further strengthens their negotiating position. This was evident in the 2021-2022 period when supply chain disruptions led to increased ingredient costs for many food manufacturers due to limited availability of certain agricultural inputs, a situation Hain Celestial likely also experienced.

While the potential for suppliers to integrate forward into manufacturing or branding exists, the substantial capital required for food processing typically limits this threat in practice. However, even the credible threat can influence negotiations, especially if a supplier controls a unique, essential ingredient for a popular Hain Celestial product, as seen in markets with concentrated organic milk producers.

Global organic commodity price volatility, influenced by factors like weather and crop diseases, also empowers suppliers. For instance, a drought in a key growing region in 2024 could significantly drive up the cost of organic grains, allowing suppliers to pass these increases directly onto Hain Celestial, impacting its cost of goods sold and profit margins.

| Supplier Leverage Factor | Impact on Hain Celestial | Key Influences | Example Scenario |

|---|---|---|---|

| Niche Ingredient Control | Increased ingredient costs, reduced profit margins | Unique certifications, proprietary growing techniques | Difficulty sourcing specific organic grains |

| High Switching Costs | Limited sourcing flexibility | Rigorous re-validation, production line modifications | Time and expense to qualify new organic suppliers |

| Supplier Concentration | Strengthened negotiating position | Few suppliers for critical ingredients | Limited availability of organic proteins |

| Price Volatility | Higher cost of goods sold | Weather, crop diseases, demand shifts | 2024 drought impacting organic corn prices |

What is included in the product

This analysis delves into the competitive forces impacting Hain Celestial, specifically examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the prevalence of substitute products within the natural and organic food industry.

Instantly understand strategic pressure with a powerful spider/radar chart, revealing the competitive landscape for Hain Celestial's portfolio.

Customers Bargaining Power

Major grocery chains, mass merchandisers, and large e-commerce platforms wield significant bargaining power as key customers for Hain Celestial. Their consolidated purchasing power allows them to exert considerable pressure on pricing, demand promotional allowances, and dictate payment terms. For instance, Walmart, a dominant force in the US retail landscape, often commands favorable terms from its suppliers due to its immense sales volume. This concentration of retail power means Hain Celestial must carefully manage these relationships to ensure continued market access.

Even though organic products often come with a higher price tag, a significant portion of consumers are still very focused on cost. This is especially true as more store brands, or private-label options, offering organic choices become available. For instance, in 2023, private-label organic sales in the US saw continued growth, capturing market share from national brands.

Customers can easily switch to other brands or even non-organic products if they feel prices are too high. This ability to switch easily gives them considerable leverage. In 2024, the average price difference between conventional and organic produce in many U.S. supermarkets remained substantial, encouraging price-conscious shoppers to seek alternatives.

Hain Celestial needs to carefully manage its premium image against the need for competitive pricing. If prices are too high, consumers will simply opt for less expensive organic or conventional items. This balance is crucial for maintaining customer loyalty and market share in a competitive landscape.

The natural and organic food sector is brimming with options, featuring many established names, innovative smaller companies, and even conventional products that can serve as alternatives. This wide selection, seen across snacks, drinks, and personal care, gives consumers considerable freedom to switch brands without much fuss, lessening their reliance on any one company like Hain Celestial.

This abundance of substitutes significantly strengthens customer bargaining power. For instance, in 2024, the U.S. organic food market alone was valued at approximately $77.5 billion, reflecting intense competition and a vast array of choices for consumers in every category.

Hain Celestial, therefore, faces pressure to constantly innovate and clearly communicate the unique value of its products. Failure to differentiate effectively means customers can easily opt for a competitor's offering, potentially impacting sales volumes and pricing power.

Low Switching Costs for Consumers

For end consumers, switching between organic snack and beverage brands is typically effortless and inexpensive. This low friction means shoppers can easily try new products if they discover better prices, updated features, or simply a new preference. This ease of switching directly empowers consumers, giving them more leverage in the marketplace.

Hain Celestial must actively cultivate strong brand loyalty and consistently introduce innovative products to counteract this inherent consumer flexibility. In 2024, consumer surveys indicated that over 60% of organic food buyers are willing to switch brands for a price discount of 10% or more, highlighting the sensitivity to cost. This means that maintaining competitive pricing while delivering unique value is crucial for customer retention.

- Low Switching Costs: Consumers face minimal financial or logistical hurdles when moving from one organic snack or beverage brand to another.

- Increased Bargaining Power: The ease of switching allows consumers to readily explore alternatives based on price, quality, or brand appeal.

- Competitive Landscape: This dynamic pressures Hain Celestial to focus on differentiation through product innovation and strong brand equity.

- Consumer Behavior: Data from early 2024 suggests a significant portion of organic consumers are price-sensitive and open to brand switching for savings.

Increased Consumer Information and Transparency Demands

Modern consumers possess unprecedented access to information, readily researching product ingredients, sourcing, and ethical considerations. This trend significantly impacts companies like Hain Celestial, as consumers increasingly demand transparency. For instance, in 2024, a significant majority of consumers reported checking online reviews and social media before making purchasing decisions, indicating a strong reliance on peer-generated content.

This heightened awareness translates into empowered customers who actively question brands about their product claims, sustainability initiatives, and overall corporate responsibility. Hain Celestial, operating in a competitive natural and organic food market, faces direct pressure to substantiate its marketing messages and demonstrate genuine commitment to ethical practices. Failure to meet these elevated expectations can swiftly erode customer loyalty and negatively impact sales figures.

- Informed Consumers: Consumers in 2024 are highly informed, utilizing online resources to scrutinize product details.

- Demand for Transparency: This leads to increased demands for clarity on ingredients, sourcing, and ethical production.

- Brand Accountability: Companies like Hain Celestial are held accountable for their sustainability and corporate responsibility claims.

- Impact on Sales: A lack of transparency or failure to meet expectations can result in lost customer trust and reduced sales.

The bargaining power of customers for Hain Celestial is substantial, driven by low switching costs and a vast array of alternatives in the natural and organic food market. Consumers can easily shift between brands based on price or preference, a trend amplified in 2024 as private-label organic options continued to gain traction, often undercutting national brands.

The intense competition within the U.S. organic food sector, valued at approximately $77.5 billion in 2024, further empowers consumers. With numerous brands and product types available, Hain Celestial must actively differentiate its offerings and maintain competitive pricing to retain its customer base.

Informed consumers, actively researching products in 2024, demand transparency regarding ingredients and ethical sourcing. This heightened awareness means Hain Celestial faces pressure to substantiate its claims and uphold strong brand values, as a lack of transparency can quickly erode customer trust and impact sales.

Key customer segments, like major grocery chains and e-commerce platforms, leverage their significant purchasing volume to negotiate favorable terms, impacting pricing and promotional strategies for Hain Celestial. For instance, large retailers often command preferred payment terms due to their market dominance.

Preview the Actual Deliverable

Hain Celestial Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You are viewing the complete Hain Celestial Porter's Five Forces Analysis, detailing the competitive landscape of the organic and natural foods industry. This includes a thorough examination of the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. What you see here is the professionally formatted and ready-to-use report you will download.

Rivalry Among Competitors

The organic and natural products market is a battleground with many participants. This includes giant corporations dabbling in organics, specialized mid-sized firms, and a vast number of small, local producers. This fragmentation means Hain Celestial must constantly vie for consumer attention across its various product lines.

Hain Celestial faces direct competition from a wide array of companies. For instance, in the plant-based beverage sector, brands like Oatly and Califia Farms are significant rivals, while in the snack aisle, companies such as Kind and SkinnyPop offer competing natural options. This diverse competitive set intensifies the struggle for shelf space and customer loyalty.

The sheer number of competitors, from global giants like Danone, which owns the Silk and So Delicious brands, to emerging artisanal producers, creates a highly dynamic environment. This intense rivalry pressures pricing and necessitates continuous innovation to maintain market share.

The booming market for organic and plant-based foods, a key area for Hain Celestial, is a magnet for new players. This sustained growth, fueled by increasing consumer preference for healthier options, naturally draws in both large, established food corporations looking to capitalize on this trend and nimble startups with specialized offerings. For instance, the global organic food market was valued at approximately $250 billion in 2023 and is projected to grow substantially, creating a highly attractive landscape.

This constant influx of competitors intensifies the competitive rivalry within the sector. Hain Celestial faces pressure to not only maintain its current market share but also to continuously innovate its product lines and effectively differentiate itself. New entrants, often unburdened by legacy operations, can be more agile in responding to evolving consumer tastes and market dynamics, posing a significant challenge to established players like Hain Celestial.

Competitive rivalry in the organic and natural foods sector, where Hain Celestial operates, is intense and largely fought on the battlefield of product differentiation. Companies vie for consumer attention by highlighting unique ingredients, distinctive flavor profiles, specific functional benefits like gut health or plant-based protein, and increasingly, robust sustainability claims. This requires substantial investment in research and development to create new products and in marketing to build and maintain a strong, unique brand identity. For example, in 2024, the global organic food market was projected to reach over $300 billion, underscoring the significant revenue opportunities but also the fierce competition to capture market share.

Intense Marketing and Distribution Competition

The natural and organic food sector, where Hain Celestial operates, is characterized by intense marketing and distribution competition. Success hinges on effective marketing campaigns, robust brand building, and securing prime retail shelf space. This creates a constant battle for consumer attention and market presence.

Competitors are known to allocate significant resources to advertising, consumer promotions, and forging strategic partnerships with key retailers. For Hain Celestial, this translates into an ongoing need to maintain brand visibility and accessibility across all relevant sales channels. Meeting this challenge demands substantial and sustained investments in marketing and sales efforts.

In 2023, the global organic food market was valued at approximately $250 billion, with projections indicating continued growth. This expansion fuels aggressive marketing tactics as companies vie for market share.

- Marketing Spend: Major players in the natural and organic space often dedicate 5-10% of their revenue to marketing and promotional activities.

- Distribution Reach: Securing placement in over 30,000 retail locations, including major grocery chains and natural food stores, is a common benchmark for broad market access.

- Promotional Costs: Slotting fees and promotional allowances for retailers can represent a significant portion of a company's operating expenses, sometimes reaching 15-20% of gross sales.

- Brand Loyalty: While strong brands exist, consumer preferences can shift rapidly, necessitating continuous engagement through digital marketing, social media, and in-store activations.

Price Competition Amidst Premium Positioning

Hain Celestial faces significant competitive rivalry, particularly concerning price, even though its products are positioned as premium organic offerings. The organic sector, while commanding higher prices, is seeing increased production scale from major competitors and a rise in store-brand organic options. This dynamic forces Hain Celestial to carefully balance its pricing strategies to remain competitive without diluting its premium brand perception or impacting its profit margins. For instance, in fiscal year 2023, while specific promotional data isn't publicly detailed for competitive comparisons, the broader trend in the natural and organic food market involved aggressive promotional activities from both established and emerging players.

The intensity of price competition is further fueled by rivals frequently engaging in promotional activities and discounting. This creates an environment where consumers often expect deals, putting pressure on premium brands to participate or risk losing market share. This pricing pressure necessitates meticulous cost management for Hain Celestial. The company needs to find ways to optimize its supply chain and production processes to offer competitive pricing points. For example, in 2024, the market saw continued emphasis on value-driven promotions across the grocery sector, impacting even premium segments.

- Premium Brand Challenge: Maintaining a premium image while engaging in price competition is a delicate balancing act for Hain Celestial.

- Scale and Private Labels: Larger competitors’ economies of scale and the growth of private-label organic products intensify pricing pressures.

- Cost Structure Management: Hain Celestial must efficiently manage its costs to offer competitive prices without sacrificing profitability or brand equity.

- Promotional Environment: Frequent discounting by competitors forces Hain Celestial to consider promotional strategies, potentially impacting its premium positioning.

Competitive rivalry within the organic and natural foods sector is exceptionally high, with Hain Celestial facing numerous competitors ranging from large conglomerates to smaller niche players. This intense competition is evident in aggressive marketing, distribution battles for shelf space, and a constant drive for product innovation. For instance, the global organic food market was projected to exceed $300 billion in 2024, highlighting both the opportunity and the fierce fight for market share.

The battle for consumers is often waged on price, even for premium organic products. Hain Celestial must navigate this by balancing its premium brand image with competitive pricing, a challenge amplified by larger competitors' economies of scale and the rise of private-label organic offerings. The market's dynamic nature, characterized by rapid shifts in consumer preferences and constant new entrants, demands continuous adaptation and significant investment in marketing and product development to maintain relevance and market position.

| Competitor Type | Examples | Impact on Hain Celestial |

|---|---|---|

| Large Food Corporations | Danone (Silk, So Delicious), Nestlé | Significant marketing budgets, broad distribution, economies of scale |

| Specialized Natural/Organic Brands | Oatly, Califia Farms, Kind, SkinnyPop | Direct product competition, innovation in specific categories |

| Private Label Brands | Store brands from major retailers | Price pressure, consumer price sensitivity |

| Emerging Artisanal Producers | Numerous small, local companies | Niche market appeal, potential for rapid trend adoption |

SSubstitutes Threaten

The most significant threat of substitutes for Hain Celestial's offerings comes from conventional food and beverage products. These traditional items are generally more budget-friendly and accessible across a wider retail footprint. For consumers where organic certification or specific ingredient lists are not primary concerns, these conventional options represent an easy and often cheaper choice.

This broad availability of non-organic alternatives means that a large segment of the food market can readily switch away from Hain Celestial's products. For instance, in 2024, the average US household grocery bill saw an increase, making price a more critical factor for many consumers, thus amplifying the appeal of lower-cost conventional options over premium organic selections.

The increasing consumer preference for home cooking and meal preparation poses a significant threat of substitution to Hain Celestial's product portfolio. As more individuals embrace preparing meals from scratch, they bypass the need for many of Hain's packaged and convenience-focused items. This shift is driven by a desire for greater control over ingredients, a focus on freshness, and often, a more budget-conscious approach to food. For instance, the meal kit delivery service market, a direct substitute, saw substantial growth, with some reports indicating it reached over $10 billion globally by 2023, highlighting the scale of this trend.

Consumers increasingly prioritize holistic well-being, potentially diverting funds from premium organic foods to other health-focused areas. This means spending on fitness memberships, specialized supplements, or health services can act as a substitute for traditional organic food purchases. For instance, the global wellness market was valued at an estimated $4.5 trillion in 2022, with significant growth projected. This broadens the competitive landscape for companies like Hain Celestial.

Proliferation of Private Label Organic Brands

The rise of private-label organic brands presents a significant threat of substitutes for companies like Hain Celestial. Many large retailers, from Walmart to Kroger, have launched their own organic and natural product lines. These store brands directly challenge national brands by offering comparable quality at often lower price points.

These private-label offerings benefit from established customer loyalty and prime shelf placement within their respective retail environments. This makes them convenient and cost-effective alternatives for consumers who prioritize organic choices but aren't tied to specific brand names. For instance, by mid-2024, major grocery chains reported that their private-label organic sales represented a growing segment of their overall organic market share.

- Retailer Private Label Expansion: Many major retailers have significantly expanded their private-label organic and natural product portfolios.

- Price Competitiveness: These store brands often undercut national brands on price, making them attractive substitutes for budget-conscious consumers.

- Leveraging Existing Infrastructure: Retailers utilize their established customer base and prime shelf space to promote and sell their private-label organic options.

- Impact on Brand Loyalty: The availability of credible, lower-priced store brands can erode consumer loyalty to national organic brands.

- Market Share Growth: In 2024, private-label organic product sales continued to capture market share from national brands across various categories.

Consumer Preference for Unprocessed Whole Foods

A significant threat to Hain Celestial comes from the growing consumer preference for unprocessed, whole foods. This trend represents a substitute for even conventionally packaged organic products, as consumers increasingly seek food in its most natural state, often bypassing packaged goods altogether. This philosophical shift can directly impact the demand for Hain Celestial’s diverse portfolio of organic and natural products.

This movement is not just about organic certification; it's about a deeper connection to food sourcing, often involving direct engagement with local farms and farmers' markets. For instance, in 2024, the demand for locally sourced produce continued to climb, with farmers' markets reporting increased foot traffic and sales compared to previous years. This suggests a segment of the market is actively seeking alternatives that bypass traditional retail channels, including those offered by major organic brands.

The implications for Hain Celestial are clear: while the company caters to the clean-label movement, this even more fundamental shift towards unprocessed foods presents a distinct substitution threat. Consumers embracing this philosophy may view any packaged product, regardless of its organic or natural claims, as less desirable than a direct farm-to-table option.

- Consumer Shift: A growing segment of consumers is prioritizing unprocessed, whole foods over packaged organic options.

- Direct Sourcing: This preference often leads consumers to source food directly from local farms or farmers' markets.

- Bypassing Packaged Goods: These consumers may disregard packaged items, even those with organic certifications.

- Impact on Demand: This evolving dietary preference directly challenges the market share for companies like Hain Celestial.

The threat of substitutes for Hain Celestial's offerings is multifaceted, extending beyond direct organic competitors to encompass broader food consumption trends. While conventional food products serve as a readily available and often cheaper substitute, the increasing consumer preference for home cooking and a move towards unprocessed, whole foods present more nuanced substitution challenges. Furthermore, the expansion of retailer private-label organic brands directly competes with Hain Celestial's established product lines by offering comparable quality at lower price points, leveraging existing customer loyalty and shelf space.

| Substitute Type | Description | Impact on Hain Celestial | Example/Data Point (2023-2024) |

| Conventional Foods | Lower-cost, widely available non-organic alternatives. | Attracts price-sensitive consumers, especially with rising grocery costs. | US household grocery bills increased in 2024, making conventional options more appealing. |

| Home Cooking/Meal Kits | Consumers preparing meals from scratch or using meal kit services. | Reduces demand for convenient, packaged organic foods. | Meal kit market exceeded $10 billion globally by 2023. |

| Unprocessed/Whole Foods | Direct sourcing from local farms, farmers' markets, bypassing packaged goods. | Challenges the need for any packaged organic product, regardless of claims. | Demand for locally sourced produce and farmers' markets sales increased in 2024. |

| Private-Label Organic Brands | Retailer-owned organic product lines. | Offers direct competition on price and convenience, potentially eroding brand loyalty. | Major grocery chains reported growing private-label organic market share in 2024. |

Entrants Threaten

The natural and organic food market, where Hain Celestial operates, demands extensive brand building and a deep level of consumer trust. For new companies to even consider entering, they must overcome the significant hurdle of establishing recognition and a reputation for quality. Hain Celestial, for instance, has cultivated its brand over many years, fostering loyalty that is not easily replicated. This means new entrants face substantial upfront investment in marketing, product innovation, and rigorous quality control to build the credibility necessary for market acceptance, thereby slowing down their ability to gain market share.

Securing prime shelf space in major grocery chains and building robust distribution networks presents a significant hurdle for newcomers aiming to compete with established players like Hain Celestial. For instance, in 2024, the top five grocery retailers in the US controlled a substantial portion of the market, making it difficult for new brands to gain visibility. These incumbents leverage decades of established relationships and optimized logistics, creating a formidable barrier.

The struggle for widespread product availability directly impacts a new entrant's potential to scale and reach a broad consumer base. In 2024, the average supermarket carried tens of thousands of SKUs, meaning limited shelf space is a constant battle. Without this crucial access, new companies find it challenging to build brand recognition and generate sufficient sales volumes, thereby heightening the threat of new entrants.

While a small organic food business might launch with modest capital, reaching a national audience with efficient production and reliable supply chains demands substantial investment. Hain Celestial leverages significant economies of scale in procurement, manufacturing, and distribution, a cost advantage that new competitors struggle to match.

This substantial financial hurdle, stemming from the need for large-scale operations, acts as a powerful deterrent for potential new entrants aiming to compete effectively in the organic food market.

Navigating Complex Regulatory and Certification Hurdles

The organic and natural products sector presents significant barriers to entry due to demanding regulatory frameworks and certification requirements. Companies aspiring to compete must invest heavily in time and capital to secure approvals like USDA Organic or Non-GMO Project Verified, a process that can take years and substantial financial outlay.

These compliance costs and timelines act as a deterrent for potential newcomers. For established companies like Hain Celestial, these certifications are already secured, representing an existing competitive moat. For instance, in 2024, the USDA Organic certification renewal process can involve extensive documentation and on-site inspections, adding to the cost of entry for any new player.

The threat of new entrants is therefore moderated by these complex regulatory and certification hurdles.

- Regulatory Complexity: Navigating USDA Organic and other certifications requires significant investment.

- Certification Costs: Obtaining and maintaining these credentials is an expensive undertaking.

- Time Investment: The approval process for certifications can be lengthy.

- Established Advantage: Existing players like Hain Celestial benefit from already possessing these vital certifications.

Expertise in Supply Chain Management and Sourcing

Developing reliable and traceable supply chains for specialized organic ingredients, managing inventory, and optimizing logistics are critical for success in the organic food industry. For instance, in 2024, the global organic food market was valued at approximately $250 billion, indicating significant demand but also the complexity of sourcing.

Established companies like Hain Celestial have accumulated extensive expertise and built robust networks over many years, giving them a significant advantage.

New entrants face a steep learning curve and the considerable challenge of securing consistent, high-quality ingredient supplies and building efficient supply chains from scratch.

- Supplier Relationships: Access to reliable organic farmers and processors is a major barrier.

- Logistical Infrastructure: Building an efficient cold chain and distribution network requires substantial investment.

- Traceability Systems: Implementing systems to track ingredients from farm to shelf is complex and costly.

- Inventory Management: Minimizing waste for perishable organic goods demands sophisticated forecasting.

The threat of new entrants in the natural and organic food sector, where Hain Celestial operates, is significantly tempered by high capital requirements for brand building, distribution, and scaling production. For example, in 2024, establishing a recognizable brand in the competitive grocery landscape requires millions in marketing and promotional activities, a substantial barrier for startups. Furthermore, securing shelf space in major retail chains, which in 2024 saw intense competition for limited placement, demands established relationships and significant slotting fees, making it difficult for newcomers to achieve widespread availability.

| Barrier to Entry | Description | Impact on New Entrants | Example for 2024 |

| Brand Loyalty and Trust | Building consumer confidence in natural/organic products. | Requires extensive marketing and time. | Hain Celestial's long-standing brands like Earth's Best have deep consumer trust. |

| Distribution and Shelf Space | Gaining access to retail channels. | High upfront costs and competition for limited space. | Top US grocers in 2024 controlled a large market share, making entry difficult. |

| Capital Requirements | Funding for operations, marketing, and R&D. | New entrants often lack the scale and financial muscle of incumbents. | Achieving economies of scale in sourcing and manufacturing requires significant investment. |

| Regulatory and Certification Hurdles | Meeting standards like USDA Organic. | Time-consuming and costly to obtain and maintain. | USDA Organic certification renewal in 2024 involves rigorous documentation and inspections. |

Porter's Five Forces Analysis Data Sources

Our Hain Celestial Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, SEC filings, and industry-specific market research reports from firms like Mintel and Euromonitor.