Hain Celestial Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hain Celestial Bundle

Hain Celestial's success is deeply rooted in its strategic marketing mix. Their product portfolio, brimming with healthy, organic options, caters to a growing conscious consumer base. This focus on well-being is a powerful differentiator in today's marketplace.

Discover how Hain Celestial leverages its diverse product range, from plant-based foods to natural personal care, to capture market share. Understand their pricing strategies that balance premium quality with accessibility, making healthy choices attainable for more consumers.

Explore the intricate details of Hain Celestial's distribution channels, ensuring their popular brands reach consumers effectively across various retail environments. Uncover their promotional tactics that build brand loyalty and drive demand for their wholesome offerings.

Gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into the natural and organic food industry.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning. Get the full analysis in an editable, presentation-ready format and elevate your understanding of successful CPG marketing.

Product

Hain Celestial boasts a diverse portfolio, encompassing snacks, beverages, and personal care items, all firmly rooted in natural and organic ingredients. This extensive range effectively addresses varied consumer preferences while consistently upholding a core brand commitment to health and well-being. For instance, in fiscal year 2024, the company continued to emphasize its core brands like Celestial Seasonings and Garden of Eatin', contributing significantly to its revenue streams.

The company strategically focuses on product development and refreshing existing offerings to ensure continued relevance within the dynamic natural products sector. This approach is evident in their ongoing innovation, such as introducing new plant-based options or reformulating existing products to meet emerging consumer demands for cleaner labels. Hain Celestial's commitment to innovation is crucial for maintaining market share against a backdrop of increasing competition.

Hain Celestial's commitment to plant-based and clean label products is a significant differentiator, directly addressing a major shift in consumer preferences. This focus taps into the increasing demand for foods with simple, understandable ingredient lists and those perceived as healthier and more sustainably produced. The company has actively pursued this strategy, with plant-based products representing a substantial and growing portion of its portfolio.

This dedication to 'better-for-you' formulations is evident in their ongoing product development. For instance, Hain Celestial has consistently worked to reformulate products, reducing or eliminating artificial colors, flavors, preservatives, and common allergens like gluten and dairy. This proactive approach aligns with consumer desires for transparency and perceived wellness benefits. In fiscal year 2024, the company reported continued growth in its plant-based and better-for-you segments.

Hain Celestial prioritizes innovation in its 'better-for-you' product development, actively reformulating conventional items to be healthier. This involves reducing sugar, sodium, and unhealthy fats while simultaneously enhancing nutritional value.

Consumer demand for health and wellness fuels this innovation, leading to new offerings like Garden Veggie™ Flavor Burst™ tortilla chips. For instance, in fiscal year 2024, the company reported continued progress in its brand portfolio optimization and innovation pipeline, aiming to meet evolving consumer preferences for healthier options across its brands, including Celestial Seasonings® tea varieties.

Quality and Ingredient Sourcing

Hain Celestial places a significant emphasis on ingredient quality, frequently opting for organic and non-GMO components. This commitment to premium, responsibly sourced materials forms a core part of their product's appeal. For instance, in fiscal year 2023, the company continued its strategic shift, focusing on its core brands where its quality sourcing initiatives are most prominent.

Their stringent quality control protocols are designed to meet rigorous regulatory standards and align with consumer demand for natural and organic products. Hain Celestial actively promotes its commitment to 'no artificial flavors and only colors from natural sources', a key differentiator in the market. This dedication to purity resonates with health-conscious consumers, contributing to brand loyalty.

- Focus on Organic and Non-GMO: Hain Celestial prioritizes premium ingredients.

- Commitment to Natural: Emphasizes 'no artificial flavors and only colors from natural sources'.

- Quality Control: Strict measures ensure adherence to standards and consumer expectations.

Strategic Portfolio Simplification

Hain Celestial is strategically simplifying its product portfolio by cutting down on Stock Keeping Units (SKUs) and selling off brands that don't fit its core mission. This move is all about sharpening its focus on those 'better-for-you' brands that are seeing strong growth.

The goal here is to make things less complicated and boost how efficiently the company operates, which should also lead to better gross margins. This kind of portfolio streamlining is a common tactic for companies looking to optimize performance and resource allocation.

A prime example of this strategy in action is Hain Celestial's divestiture of its ParmCrisps® and Thinsters® snack brands. These sales are part of a broader effort to concentrate on brands with higher potential and clearer strategic alignment.

By shedding less critical assets, Hain Celestial can reallocate capital and management attention to its more promising ventures. This focus allows for deeper investment in innovation and marketing for its core 'better-for-you' offerings.

This simplification initiative is expected to yield tangible financial benefits, including improved operational leverage and a more concentrated brand equity. For instance, the company has been working to enhance profitability, with efforts to improve gross margins being a key financial objective throughout 2024.

Hain Celestial's product strategy centers on a curated portfolio of natural and organic goods, emphasizing health-conscious attributes like plant-based and clean-label formulations. This focus directly addresses evolving consumer preferences for wellness and transparency, a trend that continued to drive growth in fiscal year 2024.

The company actively innovates within its core brands, such as Celestial Seasonings® teas and Garden of Eatin'® snacks, by reformulating products and introducing new offerings that align with 'better-for-you' demands. For instance, the introduction of Garden Veggie™ Flavor Burst™ tortilla chips exemplifies this commitment to meeting consumer desires for healthier options.

Hain Celestial is also streamlining its product offerings by divesting non-core brands and reducing Stock Keeping Units (SKUs) to concentrate on high-potential, 'better-for-you' brands. This strategic simplification aims to improve operational efficiency and enhance profitability, with a focus on improving gross margins throughout fiscal year 2024.

| Product Strategy Focus | Key Attributes | Examples | Fiscal Year 2024 Observation |

| Natural & Organic Portfolio | Health-conscious, Plant-based, Clean-label | Celestial Seasonings®, Garden of Eatin'® | Continued emphasis on core brands driving revenue. |

| Product Innovation | Reformulations, New 'Better-for-You' Offerings | Garden Veggie™ Flavor Burst™ chips | Ongoing pipeline to meet evolving consumer demand. |

| Portfolio Simplification | SKU reduction, Divestitures | ParmCrisps®, Thinsters® divestiture | Focus on high-potential brands, aiming to improve gross margins. |

What is included in the product

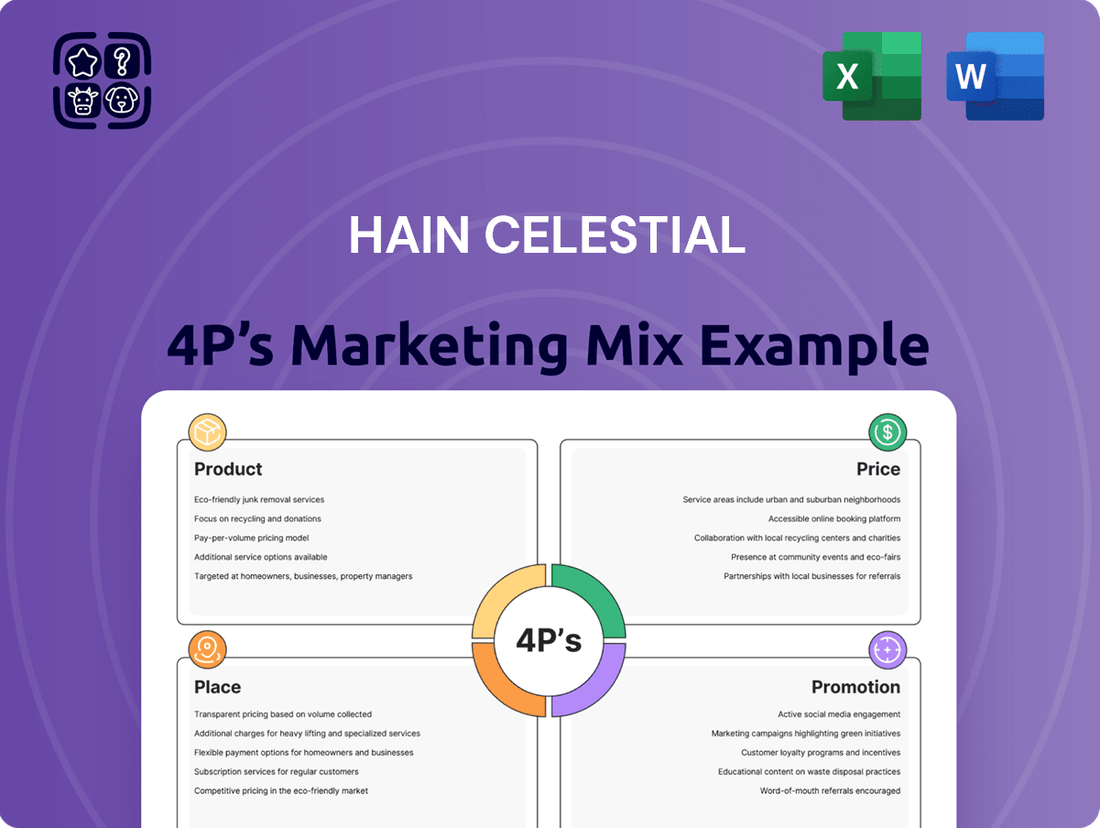

This analysis delves into Hain Celestial's Product portfolio, Price strategies, Place distribution, and Promotion tactics, offering a comprehensive view of their marketing mix.

It provides a detailed breakdown of how Hain Celestial leverages its 4Ps to maintain its position in the competitive natural and organic products market.

Provides a clear, concise overview of Hain Celestial's 4Ps marketing mix, streamlining complex strategies into an easily digestible format for quick decision-making.

Simplifies the understanding of Hain Celestial's product, price, place, and promotion strategies, alleviating the pain of deciphering intricate marketing plans for busy executives.

Place

Hain Celestial boasts an impressive retail footprint, with its products readily available in major supermarkets, natural food stores, and online platforms. This expansive reach is exemplified by their presence in key retailers such as Walmart, Amazon, and Target, ensuring widespread consumer accessibility.

The company's commitment to extensive distribution is a cornerstone of its marketing strategy. For instance, in fiscal year 2023, Hain Celestial's North American segment generated approximately $1.5 billion in net sales, a significant portion of which is directly attributable to its broad retail penetration.

These strategic partnerships are vital for securing prominent shelf space and driving sales volumes across their diverse product lines, from plant-based alternatives to better-for-you snacks.

Hain Celestial has actively embraced the digital marketplace, recognizing the significant shift in how consumers shop. This strategic pivot includes bolstering its e-commerce infrastructure to meet growing demand.

The company’s products are now readily accessible across various online grocery platforms and prominent e-commerce retailers. This broad online availability is a key component of their strategy to capture market share in the digital space.

E-commerce is projected to be a substantial growth engine for Hain Celestial, with expectations for continued strong performance throughout fiscal year 2025 and into the future. This digital channel offers unparalleled convenience for customers.

By investing in its online presence, Hain Celestial effectively expands its market reach, connecting with consumers who increasingly prefer the ease of online purchasing over traditional brick-and-mortar shopping experiences.

Hain Celestial significantly bolstered its distribution capabilities by completing a multi-year U.S. network expansion, culminating in the February 2025 launch of a fourth distribution center in Savannah, Georgia. This strategic addition effectively doubles their U.S. network capacity.

The new Savannah facility is a cornerstone of their plan to reach over 90% of U.S. customers within a swift 1-2 transit days. This enhanced reach is projected to streamline deliveries and cut down on mileage.

By optimizing delivery routes and reducing transportation mileage, Hain Celestial anticipates a notable decrease in overall transportation costs. This efficiency gain directly supports their supply chain optimization efforts.

This network expansion is a key part of Hain Celestial's strategy to improve efficiency and customer service through a more robust and cost-effective supply chain.

International Market Penetration

Hain Celestial's international market penetration is a key element of its global strategy, extending its reach beyond its robust domestic presence. The company actively distributes its natural and organic products in key international markets, with a significant focus on Europe and Canada.

This expansive global footprint serves to diversify Hain Celestial's revenue streams, tapping into the growing worldwide appetite for healthier food options. By making its products available in over 70 countries, the company positions itself to capitalize on diverse consumer preferences and market trends.

Recent financial reports for fiscal year 2024 indicate continued international sales growth, although specific figures are subject to ongoing disclosure. For instance, the company's European segment has consistently shown resilience, benefiting from established brand recognition and a strong consumer preference for organic and plant-based foods in regions like the UK and Germany.

- Europe: Significant presence in the UK, Germany, and France, with a growing portfolio of brands catering to local tastes.

- Canada: A well-established market, benefiting from similar consumer trends towards natural and organic products as seen in the US.

- Global Reach: Distribution network extends to over 70 countries, offering a broad platform for sales and brand building.

- Strategic Focus: International expansion aims to mitigate risks associated with relying solely on the US market and capture global growth opportunities in the health and wellness sector.

Strategic Channel Partnerships

Hain Celestial actively cultivates strategic channel partnerships to bolster its market presence. These collaborations with distributors, brokers, and third-party logistics (3PL) providers are crucial for navigating the intricate retail environment and accessing specialized consumer segments, ensuring robust product placement and consistent promotional activities.

These alliances are instrumental in driving operational efficiency and expanding market penetration. By leveraging the expertise and infrastructure of its partners, Hain Celestial can more effectively manage its supply chain and reach a broader customer base, which is particularly important in the competitive natural and organic food sector.

A key aspect of this strategy is the company's reliance on 3PL providers for its distribution network. For instance, all four of Hain Celestial's U.S. distribution facilities operate in conjunction with a third-party logistics company. This outsourcing allows for specialized management of warehousing and transportation, optimizing delivery times and reducing logistical costs.

These partnerships are not just about logistics; they also play a vital role in sales and marketing efforts. Brokers, for example, often facilitate relationships with retailers and support in-store promotions, directly impacting sales volume and brand visibility. As of their fiscal year 2023 filings, Hain Celestial's focus on optimizing its supply chain through such partnerships aimed to support its revenue growth targets.

- Distribution Partnerships: Collaborations with key distributors to ensure wide availability of products across various retail channels.

- Broker Networks: Utilizing brokers to manage retailer relationships and execute promotional plans, enhancing in-store presence.

- 3PL Integration: Outsourcing logistics to specialized third-party providers for efficient warehousing and transportation, as seen in all four U.S. distribution centers.

- Market Penetration: These strategic alliances are designed to improve reach into niche markets and support consistent product placement.

Hain Celestial's place strategy is characterized by broad accessibility, encompassing both traditional retail and burgeoning e-commerce channels. The company's extensive distribution network, recently enhanced by a new Savannah, Georgia distribution center operational by February 2025, aims to reach over 90% of U.S. customers within 1-2 transit days. This expansion, coupled with a global presence in over 70 countries, particularly in Europe and Canada, underscores their commitment to widespread market penetration and efficient supply chain management, supporting their fiscal year 2023 net sales of approximately $1.5 billion in North America.

| Distribution Channel | Key Features | Fiscal Year 2023/2024 Data |

|---|---|---|

| Traditional Retail | Presence in major supermarkets, natural food stores | North American Net Sales: ~$1.5 billion |

| E-commerce | Growing online grocery platforms, major e-commerce retailers | Projected strong performance through FY2025 |

| U.S. Distribution Network | Four distribution centers (Savannah operational Feb 2025) | Capacity to reach >90% of U.S. customers within 1-2 transit days |

| International Markets | Europe (UK, Germany, France), Canada, 70+ countries | Consistent sales growth in European segment |

Same Document Delivered

Hain Celestial 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Hain Celestial's Product, Price, Place, and Promotion strategies, offering valuable insights into their market positioning. You'll gain a clear understanding of their brand portfolio, pricing tactics, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

Hain Celestial's promotional efforts are deeply rooted in highlighting the health and wellness advantages of its diverse product portfolio, which includes organic, natural, and plant-based options. The company consistently communicates the value of clean ingredients, superior nutritional content, and environmentally conscious production methods. This strategic focus aligns perfectly with a growing consumer base prioritizing healthier living choices and demanding greater transparency regarding what they consume.

In 2023, the natural and organic food market in the U.S. continued its upward trajectory, with sales reaching an estimated $280 billion, underscoring the significant consumer demand Hain Celestial aims to capture. Their marketing campaigns often feature endorsements from health and wellness influencers, further amplifying the message of well-being and natural goodness. For instance, campaigns for brands like Celestial Seasonings often emphasize herbal benefits and caffeine-free options, appealing to consumers seeking relaxation and natural remedies.

Hain Celestial actively engages consumers through digital channels, leveraging social media, influencer collaborations, and content marketing. This strategy fosters direct interaction, builds brand communities, and shares valuable content like recipes and wellness advice, connecting with health-conscious individuals. For instance, their 'YUMbelievably Delicious' campaign for Garden Veggie chips garnered millions of impressions in 2024, highlighting the effectiveness of digital outreach in reaching their target demographic.

Hain Celestial's in-store strategies, a key part of their merchandising approach, focus on driving trial and impulse buys. Traditional tactics like in-store sampling, special discounts, and prominent product displays are vital for cutting through the noise in busy retail settings.

A notable shift in promotional activity for the snacks division is planned for Q3 FY2025. This strategic timing aims to maximize the impact of these in-store efforts, ensuring they align with peak consumer engagement periods.

Effective shelf placement is crucial; for example, securing end-cap displays can significantly boost visibility. In 2024, brands that leveraged such prominent placements saw an average sales uplift of 15-20% on promotional items compared to standard shelf placement.

The company understands that compelling merchandising, including eye-catching packaging and point-of-sale materials, directly influences consumer perception and purchase decisions, especially for new product introductions.

Public Relations & Brand Storytelling

Hain Celestial strategically leverages public relations to cultivate a strong brand image, emphasizing its dedication to sustainability, product quality, and promoting healthier lifestyles. The company actively communicates its corporate values and the unique stories behind its extensive brand portfolio, aiming to build enduring consumer trust and foster loyalty.

Through compelling narratives, Hain Celestial highlights its significant 30-plus year journey in the better-for-you food sector and its continuous innovation in catering to a wide array of dietary requirements. This approach reinforces their position as a leader in providing healthier options to consumers.

Recent communications underscore Hain Celestial's commitment to transparency and its role in shaping consumer perceptions regarding health-conscious eating. For instance, their ongoing efforts in 2024 focus on expanding accessibility to plant-based and allergen-free options, aligning with growing market demand.

- Brand Reputation: Public relations efforts are central to building and maintaining Hain Celestial's reputation as a trusted provider of healthier food options.

- Sustainability Focus: The company consistently communicates its commitment to environmental responsibility and sustainable sourcing practices.

- Consumer Trust: Storytelling around brand heritage and company values aims to create an emotional connection with consumers, fostering loyalty.

- Innovation Showcase: PR initiatives highlight the company's ongoing development of products that meet evolving dietary needs and preferences, such as gluten-free and plant-based alternatives.

Partnerships & Collaborations

Hain Celestial actively cultivates strategic alliances with prominent health advocates, registered nutritionists, and various organizations aligned with its mission. These collaborations are designed to amplify its core messaging and tap into previously unreached consumer demographics. For instance, the company has a history of expanding its involvement in campaigns such as Walmart's Fight Hunger. Spark Change initiative, underscoring its commitment to broader social impact.

These carefully chosen partnerships serve a dual purpose: they bolster Hain Celestial's credibility within the health and wellness sphere and significantly broaden its brand influence. By associating with respected figures and impactful initiatives, the company reinforces its positioning as a leader in the natural and organic products market. In 2023, Hain Celestial reported a net sales increase, reflecting the ongoing consumer demand for brands that demonstrate social responsibility and authentic health-focused values.

- Strategic Alliances: Partnerships with health advocates and nutritionists to enhance brand messaging and reach.

- Campaign Collaborations: Involvement in initiatives like Walmart's Fight Hunger. Spark Change to broaden reach and demonstrate social commitment.

- Credibility Building: Leveraging partnerships to gain trust and influence within the health and wellness community.

- Market Expansion: Utilizing collaborations to access new consumer segments and reinforce market positioning.

Hain Celestial's promotional strategy heavily relies on digital engagement and influencer marketing, particularly for its brands targeting health-conscious consumers. The company reported significant engagement in 2024 with campaigns like the 'YUMbelievably Delicious' initiative for Garden Veggie chips, which garnered millions of impressions, demonstrating the power of social media outreach. This focus on digital channels helps build brand communities and share valuable wellness content.

Price

Hain Celestial typically utilizes a premium pricing strategy. This approach is a direct reflection of their commitment to organic and natural ingredients, sustainable sourcing practices, and specialized production methods, all of which carry higher associated costs.

This premium pricing is carefully calibrated to match the enhanced perceived value and superior quality of their 'better-for-you' product offerings. Consumers who prioritize health and environmental consciousness are often prepared to invest more in products that align with these values.

For instance, as of early 2024, organic food products, a core segment for Hain Celestial, often command a price premium ranging from 10% to 50% compared to their conventional counterparts. This demonstrates a market acceptance of higher price points for perceived benefits.

The company's target demographic generally exhibits a greater willingness to pay a premium for the health benefits and positive environmental impact associated with their brands, supporting the viability of this premium pricing model.

Hain Celestial positions its products, often at a premium, by strongly emphasizing their value. This isn't just about the price tag; it's about what consumers get for that price. The company highlights significant health benefits, the purity of its ingredients, and a commitment to ethical sourcing practices.

Marketing efforts actively educate consumers, explaining the rationale behind the higher price points. This communication strategy aims to build understanding and acceptance by showcasing the long-term health advantages and unwavering quality assurance that differentiate Hain Celestial's offerings in the marketplace.

While Hain Celestial's products often carry a premium due to their natural and organic positioning, the company actively engages in competitive pricing within this specific market segment. This means that even though consumers expect higher quality, the prices are set to remain appealing when compared to similar offerings from other natural and organic brands.

The company dedicates resources to closely observing competitor pricing strategies. This allows Hain Celestial to ensure its own product prices are attractive and aligned with consumer expectations for the natural and organic food sector, preventing them from being priced out of the market.

Hain Celestial is prepared to make strategic pricing adjustments when necessary. These adjustments are crucial for maintaining its market share, especially when targeting consumers who are value-conscious but still prioritize the benefits of natural and organic products within that premium category.

For instance, during its fiscal year 2024, Hain Celestial reported a net sales increase of 3% to $2.36 billion. This growth, achieved while navigating a competitive landscape, suggests their pricing strategy is effectively balancing premium appeal with market competitiveness.

Promotional Pricing and Discounts

Hain Celestial strategically employs promotional pricing, including discounts and couponing, to boost sales volume and encourage initial product trials. These tactics are particularly useful when facing competitive pressures in the market. For instance, during the fiscal year ending June 30, 2023, Hain Celestial reported net sales of $2.3 billion, and effective promotional strategies are key to maintaining and growing this revenue.

These short-term price adjustments aim to attract new consumers and foster loyalty among existing ones, driving repeat purchases. The company carefully balances these promotions to ensure they don't negatively impact the perceived quality or premium positioning of its brands.

- Promotional Pricing: Utilized to stimulate demand and encourage trial of new or existing products.

- Discounts and Couponing: Employed to offer value to consumers and drive immediate sales.

- Competitive Response: Pricing strategies are adjusted to remain competitive in the marketplace.

- Brand Image Management: Promotions are designed to avoid brand dilution and maintain a premium perception.

Cost Management & Efficiency for Value

Hain Celestial actively pursues operational efficiencies and supply chain optimization to keep its production costs in check, which directly benefits its pricing approach. This focus on cost management is crucial for maintaining a competitive edge in the market.

By implementing strategies such as reducing the number of Stock Keeping Units (SKUs) and consolidating its operational footprint, Hain Celestial works to boost its gross margins. For example, the company has been actively streamlining its portfolio, a process that continued into 2024, aiming for higher profitability per product line.

These cost-saving measures allow Hain Celestial to offer compelling value to consumers without compromising on product quality or brand perception. The company's commitment to efficiency aims to translate into more attractive price points for its diverse range of natural and organic products.

- Focus on Operational Efficiencies: Hain Celestial prioritizes streamlining its manufacturing and distribution processes.

- Supply Chain Optimization: Efforts are made to reduce logistics costs and improve inventory management.

- SKU Rationalization: The company strategically reduces its product variety to simplify operations and lower costs.

- Operating Footprint Consolidation: Hain Celestial looks to combine facilities or reduce their number to save on overhead.

Hain Celestial's pricing strategy centers on a premium for its organic and natural products, reflecting higher production costs and perceived value. This approach is supported by consumer willingness to pay more for health and environmental benefits, as evidenced by the 10%-50% premium often seen in the organic food market as of early 2024. The company actively manages this by remaining competitive within the premium segment and employing promotional pricing, such as discounts and coupons, to drive sales without devaluing the brand. Strategic operational efficiencies, including SKU rationalization and footprint consolidation, help maintain gross margins, allowing Hain Celestial to offer attractive value propositions. For instance, the company reported net sales of $2.36 billion in its fiscal year 2024, indicating successful navigation of its pricing strategy within a competitive landscape.

| Pricing Strategy Element | Description | Supporting Data/Context |

|---|---|---|

| Premium Pricing | Reflects higher costs of organic/natural ingredients and perceived value. | Organic products command a 10%-50% premium over conventional (early 2024). |

| Competitive Premium | Prices remain appealing compared to similar natural/organic brands. | Active monitoring of competitor pricing in the natural/organic sector. |

| Promotional Pricing | Discounts and coupons used to drive trial and sales volume. | Net sales of $2.3 billion for fiscal year ending June 30, 2023, supported by promotions. |

| Cost Management Impact | Operational efficiencies and SKU reduction support pricing. | Net sales increased 3% to $2.36 billion in fiscal year 2024. |

4P's Marketing Mix Analysis Data Sources

Our Hain Celestial 4P's Marketing Mix Analysis leverages a comprehensive array of data, including official SEC filings, investor relations materials, and detailed product portfolio information. We also incorporate insights from retail sales data, competitor pricing strategies, and industry-wide market research reports.