Hager Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hager Group Bundle

The Hager Group leverages its strong brand reputation and innovative product development as key strengths, but faces challenges from intense market competition and evolving regulatory landscapes. Understanding these dynamics is crucial for strategic planning.

Want the full story behind the Hager Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hager Group boasts an extensive product portfolio covering energy distribution, cable management, wiring accessories, building automation, and security systems. This breadth allows them to offer integrated solutions for a wide array of building types, from homes to large industrial facilities.

Hager Group showcased impressive financial resilience and expansion in 2023, with turnover climbing by 12.3% to reach €3.2 billion. This upward trajectory was fueled by astute strategic acquisitions and a focused investment in digital transformation, strengthening its market position.

Looking ahead to 2024, the company maintained its robust performance, generating sales of approximately €3.0 billion with its workforce of 13,000 employees. This consistent financial output underscores Hager Group's stable and growing business model.

Hager Group demonstrates a robust commitment to innovation, backing it with significant investments. In 2024, the company allocated €40 million towards new product development, underscoring its focus on future growth and market leadership.

This dedication is further exemplified by their advanced R&D center, which consistently drives the creation of cutting-edge solutions. Hager Group's innovative spirit was recently recognized with prestigious awards, including the iF Design Award Gold 2025 for Hager Charge and the German Innovation Award 2025 Gold for their EDISON V2H bidirectional charging system.

Industry Leadership in Sustainability

Hager Group's commitment to sustainability is a significant strength, anchored by its E3 (ethics, employees, environment) strategy and a Blue Planet Commitment. This focus is not just internal; it's externally validated. In early 2024, the company achieved EcoVadis Gold certification, a notable recognition of its environmental and social performance.

The company further solidified its leadership by improving to an EcoVedas Platinum rating in November 2024. This achievement places Hager Group within the top 1% of companies globally assessed by EcoVadis, underscoring their advanced sustainability practices and robust management systems.

Hager Group is making tangible investments to reduce its carbon footprint. These initiatives include implementing biomass heating systems across its facilities and establishing electric truck charging stations to support sustainable logistics.

- Industry Leadership in Sustainability: Hager Group's E3 strategy and Blue Planet Commitment demonstrate a clear, actionable approach to corporate responsibility.

- External Recognition: Achieving EcoVadis Platinum status in November 2024, up from Gold in early 2024, places them in the top 1% of global companies for sustainability.

- Decarbonization Investments: Active investments in biomass heating and electric truck charging infrastructure highlight a practical commitment to reducing environmental impact.

Global Presence and Strategic Investments

Hager Group boasts an impressive global presence, with production facilities strategically located in 23 countries and its products reaching customers in over 100 nations. This extensive international network is a significant advantage, allowing the company to serve diverse markets effectively. The company's commitment to its industrial base is further demonstrated by substantial investments, such as the €120 million allocated for its French operations by 2026. This capital injection is earmarked for enhancing production capacity and upgrading machine technology, solidifying Hager Group's competitive edge.

Hager Group's strengths lie in its comprehensive product range, financial stability, and commitment to innovation and sustainability. The company's 2023 turnover of €3.2 billion and continued strong sales in 2024, supported by a workforce of 13,000, highlight its market resilience.

Significant investment in R&D, with €40 million allocated in 2024, fuels the development of cutting-edge solutions, recognized by awards like the iF Design Award Gold 2025. Furthermore, its EcoVadis Platinum rating in November 2024, placing it in the top 1% globally, underscores its advanced sustainability practices and tangible decarbonization efforts.

| Metric | 2023 Data | 2024 Data (approx.) | Significance |

|---|---|---|---|

| Turnover | €3.2 billion | €3.0 billion | Demonstrates financial stability and market presence. |

| R&D Investment | N/A | €40 million | Drives innovation and future product development. |

| EcoVadis Rating | Gold (early 2024) | Platinum (Nov 2024) | Top 1% globally, highlighting strong sustainability commitment. |

What is included in the product

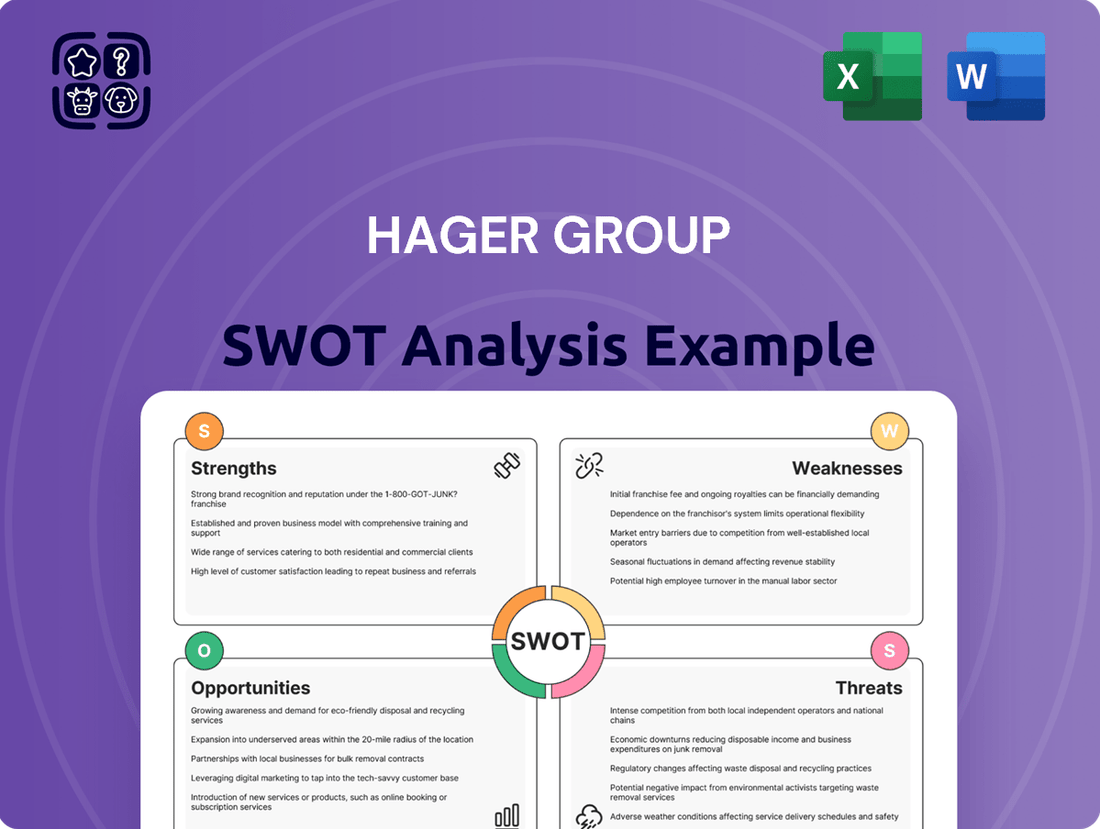

Analyzes Hager Group’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear and actionable framework for identifying and addressing potential market challenges and internal weaknesses.

Weaknesses

Hager Group's strong ties to the construction sector, supplying essential electrical installations for various building types, make its revenue highly susceptible to the cyclical nature of this industry. A downturn in global construction, such as the projected 2.5% contraction in global construction output for 2024 according to Oxford Economics, directly translates to reduced demand for Hager's product portfolio.

Hager Group faces significant challenges in the building automation systems (BAS) market, a key segment for its operations. This sector is characterized by intense competition from well-established global giants like Johnson Controls, Honeywell International, Siemens AG, and Schneider Electric. These competitors offer comprehensive solutions that directly challenge Hager's market position.

The BAS market is moderately consolidated, meaning a few large players hold substantial market share. This intense rivalry can lead to price wars and put downward pressure on profit margins for all participants, including Hager Group. For instance, reports from 2024 indicate that the global BAS market is projected to grow, but this growth is accompanied by aggressive market strategies from these major players.

The electronics and electrical installation sectors are still grappling with supply chain woes. Think raw material shortages, longer waits for essential parts, and global instability. These factors can easily cause production holdups, higher expenses, and even product unavailability.

Hager Group, operating within this landscape, is inherently exposed to these external pressures. For instance, in 2024, many electrical component manufacturers reported lead times extending to 6-12 months for certain semiconductors, a critical input for Hager's smart home and building automation solutions.

High Initial Investment for Advanced Systems

Hager Group's cutting-edge building automation and energy management systems, while beneficial long-term, require a significant initial investment. This includes the cost of advanced hardware, sophisticated software, and professional installation services. For instance, a comprehensive smart building solution could easily run into tens of thousands of euros, depending on the scale and complexity.

This high upfront cost can present a considerable hurdle, especially for small to medium-sized enterprises (SMEs) or organizations operating with tighter financial constraints. The substantial capital required for initial deployment may therefore slow down the widespread adoption of these advanced technological offerings, impacting Hager's market penetration in certain segments.

- Significant upfront capital expenditure for advanced building automation systems.

- Potential barrier for smaller businesses or those with limited budgets.

- Installation and integration costs add to the initial financial burden.

- Slower adoption rates in price-sensitive market segments.

Need for Continuous Technological Adaptation

The smart building and energy management sectors are evolving at a breakneck pace, driven by innovations like the Internet of Things (IoT), artificial intelligence (AI), and advanced data analytics. Hager Group faces a significant challenge to continuously invest in research and development to ensure its product offerings remain current and competitive. Failing to adapt quickly could lead to technological obsolescence, diminishing its market position.

For instance, the global smart building market was valued at an estimated USD 80.9 billion in 2023 and is projected to grow substantially, reaching over USD 200 billion by 2030 according to various market reports. This rapid expansion is fueled by the increasing adoption of smart technologies. Hager Group's commitment to R&D spending, which historically represents a significant portion of its revenue, is crucial to navigate this dynamic landscape. In 2023, the company reported investing heavily in innovation, aiming to integrate next-generation features into its solutions.

- Rapid Technological Shifts: The integration of IoT, AI, and predictive analytics in building management systems necessitates constant innovation.

- R&D Investment Imperative: Hager Group must maintain substantial investment in research and development to keep pace with technological advancements.

- Risk of Obsolescence: Failure to adapt product lines to emerging technologies could result in Hager Group's solutions becoming outdated and uncompetitive.

- Market Relevance: Staying ahead of the technological curve is paramount for Hager Group to retain its relevance and capture market share in the evolving smart building industry.

Hager Group's reliance on the construction industry makes it vulnerable to economic downturns, as evidenced by Oxford Economics' projection of a 2.5% contraction in global construction output for 2024. This cyclical dependency directly impacts demand for its electrical installation products.

The company faces stiff competition in the building automation systems (BAS) market from major players like Siemens and Schneider Electric, who offer extensive solutions. The BAS market, while growing, is characterized by intense rivalry, potentially leading to price wars and reduced profit margins for Hager Group.

Supply chain disruptions, including raw material shortages and extended lead times for critical components like semiconductors (reported as 6-12 months in 2024), can hinder production and increase costs for Hager's smart building technologies.

The high upfront investment required for Hager's advanced building automation and energy management systems can be a significant barrier for SMEs, potentially slowing market penetration in price-sensitive segments.

What You See Is What You Get

Hager Group SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for the Hager Group. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase. This ensures you receive the full, detailed report you see a glimpse of here.

Opportunities

The global smart building market is on a significant upward trajectory, expected to surge from an estimated USD 100.58 billion in 2024 to USD 277.92 billion by 2034. This impressive growth, projected at a compound annual growth rate of 10.70%, highlights a substantial opportunity for Hager Group. The increasing integration of smart technologies across residential, commercial, and industrial sectors is a key driver for this expansion.

This burgeoning market presents a prime chance for Hager Group to bolster its presence in building automation, advanced energy management systems, and comprehensive integrated solutions. By capitalizing on the widespread adoption of smart technologies, Hager can further solidify its market position and drive revenue growth.

Growing global concerns about energy consumption and stricter regulatory mandates for energy efficiency are significantly boosting the demand for sustainable building solutions. For instance, the European Union's Energy Performance of Buildings Directive continues to push for higher standards, impacting new constructions and renovations throughout 2024 and beyond.

Government initiatives and evolving Environmental, Social, and Governance (ESG) standards are compelling both commercial and residential sectors to adopt energy management software and technologies. In 2024, many countries are increasing incentives for green building certifications, directly influencing purchasing decisions towards energy-saving products.

Hager Group is well-positioned to capitalize on this trend by leveraging its sustainable product portfolio and ongoing decarbonization efforts. The company's commitment to developing energy-efficient solutions, such as smart grid technologies and low-energy distribution systems, directly addresses this rising demand in key markets.

The global electric vehicle (EV) market is experiencing explosive growth, with projections indicating over 300 million EVs on the road by 2030, driving a massive demand for charging solutions. This surge creates a significant opportunity for Hager Group to expand its offerings in residential, commercial, and public charging infrastructure.

Government mandates and incentives worldwide are accelerating the deployment of EV charging stations, with many regions targeting 2030-2035 for significant portions of new vehicle sales to be electric. This regulatory push directly benefits Hager Group by creating a robust market for their compliant and advanced charging hardware.

Hager Group’s established expertise in electrical distribution and building technology provides a strong foundation to integrate and scale their EV charging solutions. Their existing product portfolio, encompassing everything from circuit breakers to smart grid components, is well-positioned to meet the complex electrical demands of widespread EV charging networks.

Leveraging Digital Transformation and IoT Integration

The increasing adoption of digital technologies and the Internet of Things (IoT) in building management presents a significant opportunity for Hager Group. By integrating IoT sensors and data analytics into their electrical installation systems, Hager can offer enhanced smart building solutions. This digital shift is projected to see the global smart building market reach approximately $150 billion by 2025, with a compound annual growth rate (CAGR) of over 12% in the coming years.

Hager can capitalize on this trend by developing advanced software, cloud-based platforms, and predictive maintenance services. These offerings can create new recurring revenue streams and deepen customer relationships by providing ongoing value. For instance, predictive maintenance could reduce building operational costs by an estimated 10-20% through early detection of potential system failures.

- Enhanced Smart Solutions: Integrating IoT and AI into electrical installations to create more responsive and efficient smart buildings.

- New Revenue Streams: Developing sophisticated software and cloud-based platforms for building management and data analysis.

- Predictive Maintenance: Offering services that leverage data analytics to anticipate and prevent system failures, improving building uptime and reducing costs.

- Strategic Alignment: This focus directly supports Hager's stated commitment to digitalization and innovation in the building technology sector.

Favorable Regulatory Landscape for Modernization

The evolving electrical wiring regulations and building codes present a significant opportunity for Hager Group. For instance, the BS 7671 2024/2025 updates in the UK and changes in the 2024 National Electrical Code (NEC) in the United States are driving demand for enhanced safety and energy efficiency in electrical installations.

These regulatory shifts, such as the mandated inclusion of Arc Fault Detection Devices (AFDDs) and surge protection devices (SPDs), create a consistent market for compliant, modern electrical products. Hager Group's established portfolio of advanced solutions directly addresses these new requirements, positioning the company to capitalize on this ongoing demand.

- Mandated Upgrades: Regulations like the 2024 NEC in the US and BS 7671 2024/2025 in the UK are increasingly requiring AFDDs and SPDs.

- Market Growth: This regulatory push is projected to fuel a steady increase in the market for smart and safe electrical components.

- Hager's Position: Hager Group is well-positioned with its range of compliant and innovative electrical distribution and safety products.

The global smart building market is projected to grow significantly, reaching an estimated USD 277.92 billion by 2034. This expansion offers Hager Group a substantial opportunity to enhance its offerings in building automation and integrated smart solutions, driven by the increasing adoption of smart technologies across various sectors.

Growing environmental awareness and stricter energy efficiency regulations, such as the EU's Energy Performance of Buildings Directive, are boosting demand for sustainable building solutions. Hager Group can leverage its energy-efficient product portfolio to meet this demand, aligning with global decarbonization efforts.

The rapidly expanding electric vehicle (EV) market, with projections of over 300 million EVs by 2030, creates a significant demand for charging infrastructure. Hager Group's expertise in electrical distribution positions it well to capitalize on this trend by expanding its EV charging solutions.

The increasing integration of IoT and digital technologies in building management presents a key opportunity for Hager Group to develop advanced software and cloud-based platforms. These digital solutions can create new recurring revenue streams and enhance customer relationships through services like predictive maintenance, which can reduce building operational costs by up to 20%.

Evolving electrical wiring regulations, such as the 2024 NEC in the US and BS 7671 2024/2025 in the UK, are driving demand for enhanced safety and energy efficiency. Hager Group's portfolio of compliant products, including AFDDs and SPDs, is well-suited to meet these new requirements, ensuring continued market relevance.

Threats

The electronics and electrical components supply chain remains a significant concern, with ongoing geopolitical tensions and scarcity of raw materials like copper and rare earth elements contributing to its instability. This volatility directly impacts lead times for crucial items such as transformers, potentially extending them by 30-50% compared to pre-pandemic levels. Consequently, Hager Group may face increased component costs and production delays, affecting its manufacturing efficiency and overall profitability.

Hager Group faces a fiercely competitive market, contending with giants like Siemens, Schneider Electric, Legrand, and ABB. These established players offer similar comprehensive electrical installation and building automation solutions, intensifying price pressures and posing a risk to Hager's market share.

The sheer scale of these competitors means they can leverage economies of scale and extensive distribution networks, making it challenging for Hager to compete solely on price. For instance, in 2023, Schneider Electric reported revenues of €35.9 billion, highlighting the significant financial muscle of key rivals.

To counter this aggressive landscape, Hager must prioritize differentiation through continuous innovation in product development and superior customer service. This focus on unique value propositions is essential to stand out and maintain its competitive edge in the evolving building technology sector.

The rapid evolution of smart building and energy management technologies presents a significant threat of product obsolescence for Hager Group. Companies in this sector are seeing product lifecycles shrink as new innovations emerge constantly. For instance, advancements in AI-driven predictive maintenance and next-generation IoT communication protocols are rapidly changing user expectations and capabilities, potentially making existing Hager solutions outdated if not proactively updated.

To counter this, Hager Group faces the imperative of sustained, substantial investment in research and development. This is crucial for maintaining a competitive edge and ensuring its product portfolio remains relevant. Failure to adapt swiftly to these emerging technologies, such as the widespread adoption of Wi-Fi 7 for faster data transfer in smart homes or advanced machine learning algorithms for energy optimization, could lead to a erosion of its market share and diminished brand perception.

Economic Downturns and Construction Market Slumps

Economic downturns pose a significant threat to Hager Group. A slowdown in global or regional economies can directly curtail investment in new construction and renovation projects, which are the primary drivers of demand for Hager's electrical installation systems and building automation solutions. For instance, a projected 2.5% contraction in global GDP in early 2025, as forecast by some economic bodies, would likely translate into reduced construction spending.

A slump in the construction market would directly impact Hager Group's sales and revenue streams. The company's performance is intrinsically linked to the health of the building sector. For example, if new residential construction starts decline by a projected 10% in key European markets during 2025, this would represent a substantial challenge for Hager.

- Economic Slowdown Impact: Reduced consumer and business confidence during economic downturns often leads to postponed or canceled construction projects, directly affecting demand for Hager's product portfolio.

- Construction Sector Vulnerability: Hager's reliance on new builds and renovations makes it susceptible to cyclical downturns in the construction industry, which can experience sharp contractions.

- Geopolitical and Inflationary Pressures: Persistent inflation and geopolitical instability can exacerbate economic downturns, further dampening construction activity and investment in building technologies.

Complex and Evolving Regulatory Frameworks

Hager Group faces significant challenges from complex and ever-changing regulatory landscapes. For instance, updates to directives like the Restriction of Hazardous Substances (RoHS) and evolving energy efficiency standards necessitate constant vigilance and investment in compliance. Failure to adapt quickly can result in substantial fines and hinder market access.

The global nature of Hager's operations means navigating a patchwork of national and international regulations, which can be resource-intensive. A prime example is the ongoing harmonization efforts within the European Union for electrical equipment safety, which demands continuous updates to product documentation and manufacturing processes. This complexity can also lead to product launch delays if compliance is not achieved in a timely manner.

- Regulatory Scrutiny: Increased focus on environmental and safety standards, such as those impacting materials used in electrical components, requires proactive compliance strategies.

- Compliance Costs: Adapting to new regulations, like stricter energy performance requirements for buildings, can increase research and development and manufacturing expenses.

- Market Access Barriers: Non-compliance with standards in key markets, such as the updated safety certifications for smart home devices in North America, can prevent product sales.

Hager Group faces intense competition from major players like Siemens and Schneider Electric, whose substantial revenues, such as Schneider Electric's €35.9 billion in 2023, allow for greater economies of scale and wider distribution networks. This competitive pressure necessitates continuous innovation and superior customer service to maintain market share and avoid price wars.

The rapid advancement of smart building technologies and IoT protocols poses a threat of product obsolescence, requiring significant R&D investment to keep pace with innovations like AI-driven predictive maintenance and faster data transfer protocols such as Wi-Fi 7. Failure to adapt quickly to these evolving standards could erode Hager's market position.

Economic downturns, potentially marked by a projected 2.5% global GDP contraction in early 2025, directly impact demand for Hager's products by curtailing construction and renovation projects. A decline in new residential construction starts, for example a projected 10% drop in key European markets for 2025, presents a substantial revenue challenge.

Navigating complex and evolving regulatory landscapes, including updates to RoHS directives and energy efficiency standards, demands constant vigilance and investment. Non-compliance with standards in key markets, such as updated safety certifications for smart home devices in North America, can create market access barriers and incur significant penalties.

SWOT Analysis Data Sources

This Hager Group SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence, and insightful expert evaluations. These sources provide the reliable data necessary for a thorough and accurate strategic assessment.