Hager Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hager Group Bundle

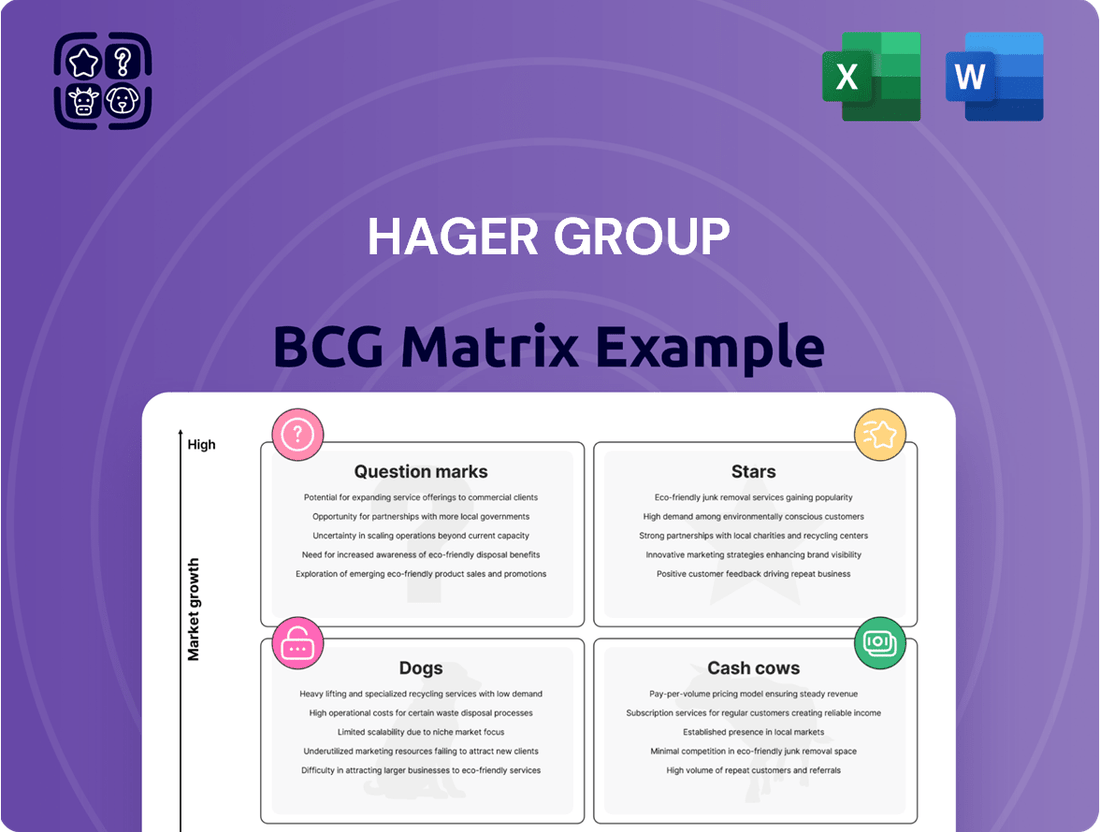

The Hager Group BCG Matrix offers a powerful framework to understand their product portfolio's market share and growth potential. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, it provides a clear snapshot of their current strategic standing. Don't miss out on the actionable insights; purchase the full BCG Matrix to unlock detailed analysis and guide your investment decisions.

Stars

Smart building automation solutions represent a significant growth area for Hager Group, fitting the profile of a Star in the BCG Matrix. The market is expected to expand rapidly, with projected compound annual growth rates (CAGRs) between 10.70% and 24.4% from 2024/2025 to 2034.

Hager is actively investing in these advanced systems, which utilize technologies like AI, IoT, and cloud-native platforms. These innovations are designed to boost energy efficiency, improve occupant comfort, and streamline building operations.

The company's strategy of offering integrated solutions for smart buildings positions it favorably within this dynamic and high-potential market segment. This makes smart building automation a crucial focus for Hager's ongoing strategic investments.

Integrated Energy Management Systems represent a significant area for Hager Group, reflecting the booming global market. The market is projected to grow at an 11% CAGR from 2025 to 2033, reaching an impressive USD 154.5 billion. Hager's strategic investments in research and development, along with enhanced production capabilities, underscore their commitment to meeting this escalating demand for smarter, more sustainable energy solutions across various building types.

Hager Group is making significant strides in the burgeoning e-mobility sector with a comprehensive suite of charging solutions. Their offerings, including the witty one, witty plus, witty pro, and witty park 2 charging stations, are engineered for efficient PV-optimized charging and intelligent load management, crucial for integrating electric vehicles into building energy systems.

The market's positive reception is underscored by the Hager Charge app's iF Design Award Gold 2025 win, a testament to the company's commitment to user-centric innovation. This rapidly expanding segment is vital for the ongoing energy transition, positioning Hager Group for substantial growth by addressing the increasing demand for sustainable charging infrastructure.

Digitalization and IoT-enabled Devices

Digitalization and IoT-enabled Devices are a significant driver for Hager Group, positioning them within the Stars quadrant of the BCG Matrix. The increasing integration of the Internet of Things (IoT) and Artificial Intelligence (AI) into electrical equipment and building management systems is fueling substantial market growth. Consumers and businesses alike are demanding smarter, more connected devices for enhanced control and efficiency.

Hager Group is actively prioritizing digital innovation to streamline the networking of these devices. Their strategy focuses on simplifying the process for users to monitor, plan, and manage energy consumption more effectively. This commitment to intelligent, digitally connected solutions places Hager Group at the forefront of a rapidly expanding technological shift, anticipating strong future performance.

- Market Growth: The global smart building market, heavily influenced by IoT integration, was projected to reach over $100 billion by 2024, with continued robust growth expected.

- Hager's Focus: Hager's investment in digital platforms aims to simplify complex installations and provide intuitive energy management interfaces for end-users.

- Strategic Advantage: By embracing IoT and AI, Hager Group is capitalizing on the demand for energy efficiency and automated building functions, a key trend in modern construction and renovation.

Renewable Energy Integration Products

Hager Group's renewable energy integration products are a key part of their strategy in the evolving energy landscape. These solutions are designed to seamlessly incorporate renewable sources like solar power into existing and new building electrical systems. This focus positions Hager to capitalize on the increasing demand for clean energy infrastructure.

The company's offerings support the growing trend of decentralized energy production, allowing buildings to generate and manage their own power. This not only enhances energy efficiency but also contributes to grid stability in an era of increasing renewable penetration. For instance, the global renewable energy market was valued at approximately $1.2 trillion in 2023 and is projected to grow significantly in the coming years, with solar power being a major contributor.

- Smart Grid Compatibility: Hager's products facilitate the integration of distributed energy resources, crucial for smart grid development.

- Energy Efficiency Focus: Solutions are engineered to optimize energy consumption and management within buildings.

- Market Growth Potential: The increasing global adoption of solar PV and other renewables directly fuels demand for Hager's integration technologies.

- Decentralized Energy Support: Products enable buildings to act as active participants in the energy system, generating and storing power.

Hager Group's smart building automation solutions are a prime example of a Star in the BCG Matrix, driven by a rapidly expanding market. With projected CAGRs between 10.70% and 24.4% from 2024/2025 to 2034, Hager's investment in AI, IoT, and cloud-native platforms positions them for significant growth in this high-potential segment. Their integrated approach enhances energy efficiency and occupant comfort, aligning perfectly with market demands for smarter, more connected buildings.

The company's e-mobility charging solutions, including the witty range, also represent a Star. These products, recognized with an iF Design Award Gold 2025 for the Hager Charge app, cater to the critical need for sustainable EV charging infrastructure. By focusing on PV-optimized charging and intelligent load management, Hager is tapping into a vital component of the ongoing energy transition, ensuring strong future performance.

Digitalization and IoT-enabled devices are another key Star for Hager Group. The increasing demand for smarter, connected devices, fueled by AI and IoT integration, is driving substantial market growth. Hager's strategic focus on simplifying the networking and management of these devices for end-users provides a distinct competitive advantage in this evolving technological landscape.

Renewable energy integration products solidify Hager's Star status. By enabling seamless incorporation of solar power and other renewables into building systems, Hager supports decentralized energy production and grid stability. The global renewable energy market, valued at approximately $1.2 trillion in 2023, offers immense growth potential for these solutions.

| Hager Group Product Category | BCG Matrix Classification | Market Growth Potential | Hager's Strategic Focus | Key Differentiator |

|---|---|---|---|---|

| Smart Building Automation | Star | High (10.70%-24.4% CAGR 2024/25-2034) | AI, IoT, Cloud-native platforms | Integrated solutions for efficiency & comfort |

| E-mobility Charging Solutions | Star | High (driven by EV adoption) | PV-optimized, load management, user-centric design | iF Design Award Gold 2025 (Hager Charge app) |

| Digitalization & IoT Devices | Star | High (driven by smart home/building trends) | Simplified networking, intuitive energy management | Enhanced control and efficiency for users |

| Renewable Energy Integration | Star | High (driven by renewable energy market growth) | Seamless solar PV integration, decentralized energy support | Supports grid stability and energy independence |

What is included in the product

The Hager Group BCG Matrix analyzes its business units based on market share and growth, guiding investment and divestment strategies.

Hager Group BCG Matrix offers a clear, actionable overview of business unit performance.

This visual tool simplifies complex data, relieving the pain of strategic decision-making.

Cash Cows

Standard Energy Distribution Systems, like Hager Group's distribution boards and main switchgear, are firmly entrenched as Cash Cows. Despite the broader electrical equipment market experiencing a projected compound annual growth rate of 6.5% to 7.4% between 2024 and 2029, these essential products command a significant market share.

Hager's established reputation and the fundamental need for these systems ensure a consistent and reliable cash flow. Their widespread necessity in virtually all electrical installations, from residential to commercial, underpins their stable demand and strong market position within the Hager Group's portfolio.

Hager's core wiring accessories, encompassing switches and sockets, are fundamental to both residential and commercial construction, suggesting a strong market position for the company. These products are staples in the electrical industry, a mature market where growth might be modest.

However, the consistent demand for these essential items, coupled with Hager's established brand reputation, enables these offerings to function as reliable cash cows. They likely generate substantial and stable profits with relatively low marketing expenditure, contributing significantly to the group's overall financial health.

Traditional enclosures and consumer units represent a core strength for Hager Group, forming a significant part of their portfolio. These are essential components in electrical installations, a sector where Hager has a long-standing presence and a substantial market share.

The demand for these products is generally stable, particularly in established construction markets. This stability allows Hager to generate consistent cash flow from this segment, a characteristic of a cash cow in the BCG matrix.

Hager's market leadership in this area means that the investment required to maintain its position is typically lower than that needed for high-growth product lines. This focus on efficient cash generation from mature products is a key strategy for supporting other areas of the business.

Basic Cable Management Systems

Hager Group's basic cable management systems represent a classic Cash Cow. These products are fundamental to electrical installations, ensuring safety and order. The market for these solutions, while not experiencing explosive growth, offers stability.

The cable management accessories market is projected to grow at a moderate pace, with a compound annual growth rate (CAGR) estimated between 6.80% and 8.1% from 2025 to 2034. Hager's long-standing reputation and extensive product range within this essential sector suggest a strong, established market share.

- Consistent Revenue: Basic cable management systems generate predictable and steady income for Hager Group due to their essential nature in construction and renovation projects.

- High Market Share: Hager's established presence and comprehensive offerings in this mature market likely translate to a dominant position, capitalizing on consistent demand.

- Low Investment Needs: As a mature product category, these systems typically require minimal investment in research and development or aggressive marketing, allowing for significant cash generation.

- Market Stability: The moderate growth forecast for the cable management accessories market indicates a stable environment where Hager can continue to leverage its existing strengths.

Conventional Security Systems

Hager Group's conventional security systems, encompassing products like basic alarm systems and door entry phones, represent a significant segment within their building technology offerings. These established products likely hold a strong market position, particularly in developed regions, contributing steady revenue streams.

While the market trend is towards sophisticated smart home and integrated security solutions, these conventional systems continue to cater to a substantial customer base seeking reliable and straightforward security. This stability allows them to function as Cash Cows, generating consistent cash flow that can be reinvested into newer, more innovative product lines.

- Stable Market Share: Conventional systems often benefit from brand loyalty and a proven track record, securing a solid market share in many geographies.

- Consistent Revenue: Despite evolving technology, the demand for foundational security features ensures a predictable and reliable revenue source for Hager Group.

- Cash Generation: The mature nature of this segment typically means lower investment needs compared to growth areas, allowing for significant cash generation.

- Support for Innovation: The cash generated from these systems can be strategically allocated to research and development for Hager's next-generation security and smart building solutions.

Hager Group's established distribution boards and main switchgear are prime examples of Cash Cows. These essential electrical components, serving a fundamental market need, maintain a significant market share.

The electrical equipment market is projected to grow between 6.5% and 7.4% annually from 2024 to 2029, yet Hager's core systems benefit from their entrenched position. Their consistent demand, driven by universal application in construction, ensures stable cash flow with minimal reinvestment needs.

These products are vital for electrical safety and functionality, making them indispensable in both new builds and renovations. Hager's strong brand recognition in this mature segment allows for consistent revenue generation, supporting the group's overall financial stability and funding innovation in other areas.

| Product Segment | BCG Category | Market Characteristic | Hager's Position | Financial Implication |

| Distribution Boards & Main Switchgear | Cash Cow | Mature market, stable demand | High market share, strong brand | Consistent, predictable cash flow |

| Wiring Accessories (Switches & Sockets) | Cash Cow | Essential, stable demand | Strong market presence | Reliable profit generation |

| Traditional Enclosures & Consumer Units | Cash Cow | Stable demand in established markets | Market leadership | High cash generation, low investment |

| Basic Cable Management Systems | Cash Cow | Moderate growth (6.8-8.1% CAGR 2025-2034) | Established presence, comprehensive range | Steady income, low marketing spend |

| Conventional Security Systems | Cash Cow | Continued demand for foundational security | Solid market share | Generates cash for new technologies |

What You See Is What You Get

Hager Group BCG Matrix

The BCG Matrix report you are currently previewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just the complete, professionally designed analysis ready for immediate strategic application.

Dogs

Hager Group divested its smoke detector business unit in May 2025, a move that strongly suggests this segment was positioned as a Dog within the BCG Matrix. This strategic divestment allows Hager to concentrate resources on its core energy management solutions and services, areas likely offering higher growth potential and better alignment with the company's future vision.

Hager Group's legacy product lines, those lacking modern features, connectivity, or sustainability upgrades, would likely be categorized as Dogs in the BCG Matrix. These offerings are experiencing a decline in demand and are increasingly challenged by newer, more innovative solutions available in the market.

Continuing to invest in these outdated product lines would offer very little return, making them prime candidates for discontinuation. For instance, if a significant portion of Hager's revenue in 2024 came from products introduced over a decade ago without substantial updates, this would strongly indicate a Dog status.

In Hager Group's extensive product range, basic electrical components like standard circuit breakers or wiring accessories often fall into the highly commoditized category. These items typically have very little differentiation between manufacturers, leading to fierce price wars and slim profit margins. For instance, in 2024, the global market for low-voltage electrical components, a segment where Hager operates, saw average profit margins in the single digits for purely commoditized products.

Products with Limited Geographic Reach or Niche Appeal

Products with limited geographic reach or niche appeal within Hager Group's portfolio would likely be classified as Dogs in the BCG Matrix. These are offerings that, while perhaps profitable in their specific, small markets, lack the potential for significant expansion or scalability. For instance, a specialized electrical component designed for a single industrial application in a particular region might fall into this category. Its success is tied to that narrow segment, making it difficult to replicate elsewhere or grow substantially.

The inherent limitation of such products is their inability to achieve economies of scale or capture a larger market share. Even if they are currently meeting demand, the lack of broader appeal or accessible markets prevents them from becoming stars or cash cows. Consider a product line with sales in 2024 that remain stagnant, showing less than 1% year-over-year growth and contributing minimally to overall revenue, perhaps less than 0.5% of Hager Group's total sales. This scenario highlights the characteristics of a Dog – low growth and low market share.

- Limited Market Penetration: These products often serve a highly specific customer base or geographic area, restricting their overall sales volume.

- Low Growth Potential: The niche nature or geographic constraint means there's little organic growth to be found, hindering future revenue increases.

- Scalability Challenges: Expanding production or marketing efforts for these items is often uneconomical due to the specialized nature or limited demand.

- Potential for Divestment: Companies often consider divesting or phasing out Dog products to reallocate resources to more promising areas of the business.

Underperforming Acquired Product Lines

Even with strategic acquisitions like Pmflex and Eficia, which were highlighted in Hager Group's 2022/23 Annual Report, some acquired product lines may struggle to integrate effectively or achieve desired market share and growth. These underperforming assets, especially those in slow-growing markets, can become 'Dogs' in the BCG Matrix. They consume valuable resources and management attention without generating a proportional return on investment.

For instance, if an acquired product line experiences declining sales or a shrinking market share, it fits the 'Dog' profile. This situation can be exacerbated if the market itself is not expanding. Hager Group must continually evaluate these acquired assets to determine if divestment or a significant turnaround strategy is more beneficial than continued investment.

Consider a hypothetical scenario where an acquired electrical component line, operating in a mature and highly competitive market with minimal innovation, fails to capture even 5% market share by 2024. If its revenue contribution remains stagnant or declines, it would represent a classic 'Dog' within Hager Group's portfolio, demanding resources that could be better allocated to higher-potential business units.

- Underperforming Acquired Product Lines: These are acquired businesses or product lines that fail to meet performance expectations.

- Market Stagnation: A key characteristic is operating within a market that exhibits little to no growth.

- Resource Drain: 'Dogs' tie up capital, management time, and other resources without providing adequate returns.

- Strategic Review: Hager Group needs to assess if these 'Dogs' warrant continued investment or should be divested.

Dogs in Hager Group's portfolio represent products with low market share and low growth potential, often requiring significant investment for minimal returns. These segments, like basic electrical components with single-digit profit margins in 2024's competitive market, are prime candidates for divestment or discontinuation to reallocate resources more effectively. The divestment of the smoke detector business in May 2025 exemplifies this strategy, allowing Hager to focus on higher-growth areas.

Legacy product lines lacking modern features and facing declining demand also fall into the Dog category. For instance, products introduced over a decade ago without updates, if contributing less than 0.5% of Hager Group's 2024 revenue with less than 1% year-over-year growth, clearly exhibit Dog characteristics. These underperforming assets, including some acquired product lines, necessitate careful strategic review to determine their future within the company.

| Product Category Example | Market Share (Estimated 2024) | Annual Growth Rate (Estimated 2024) | Profit Margin (Estimated 2024) | Strategic Implication |

|---|---|---|---|---|

| Basic Circuit Breakers (Commoditized) | Low (<10%) | Low (<2%) | Low (3-7%) | Divestment or Cost Optimization |

| Outdated Wiring Accessories | Very Low (<5%) | Declining (-1% to -3%) | Very Low (<3%) | Phase-out / Discontinuation |

| Niche Industrial Components (Limited Reach) | Low (<5%) | Stagnant (0-1%) | Moderate (5-10%) | Evaluate for Niche Profitability or Divestment |

Question Marks

Hager Group is heavily invested in Vehicle-to-Grid (V2G) and advanced bidirectional charging, recognizing its potential to integrate electric vehicles into decentralized energy systems. Their collaboration with Audi AG on V2G technology and the recognition of E3/DC's EDISON V2H system with a German Innovation Award in 2025 highlight their commitment to this emerging field.

This technology allows EV batteries to act as mobile storage, a crucial element for future energy grids. While the market's potential is vast, adoption is still in its nascent stages. Consequently, Hager's current market share in this specific, advanced V2G segment is likely minimal, positioning it as a 'Question Mark' requiring significant investment to capitalize on future growth opportunities.

AI-powered predictive maintenance services for buildings are a prime example of a question mark in the BCG matrix for Hager Group. While AI is a significant trend in building automation, highly specialized predictive maintenance solutions are still in their early stages of development and market penetration. Hager is actively incorporating AI into its smart building offerings, but the widespread adoption and establishment of a substantial market share for these advanced services are yet to materialize.

This segment holds considerable growth potential within the broader smart building market. However, it currently demands significant investment in research and development, with the ultimate success of large-scale market adoption remaining uncertain. For instance, the global predictive maintenance market, which includes building applications, was projected to reach $11.5 billion in 2024, indicating a growing, albeit still developing, opportunity.

Hager Group's exploration into peer-to-peer (P2P) energy trading solutions positions it within the 'Question Mark' quadrant of the BCG Matrix. This is driven by the significant growth potential stemming from the decentralization of energy systems through concepts like energy communities. The market is rapidly evolving, with projections suggesting the global P2P energy trading market could reach billions by the late 2020s, indicating substantial future revenue but currently low adoption rates for any single provider.

New Digital Software Platforms for Integrated Solutions

Hager's commitment to digital innovation is evident in its focus on user-friendly digital networking for energy management. The development of new, comprehensive digital software platforms aims to integrate diverse building systems, signaling high growth potential in this evolving market.

These platforms are positioned as question marks within the BCG matrix because while they offer significant growth prospects, they also require substantial investment to achieve market adoption and build a competitive advantage. The software sector is highly competitive, making the success of these new ventures uncertain until market share is firmly established. For instance, the global building management systems market, which these platforms aim to serve, was valued at approximately USD 6.5 billion in 2023 and is projected to grow at a CAGR of over 12% through 2030, highlighting the opportunity but also the competitive landscape.

- High Growth Potential: Integration of diverse building systems addresses a growing demand for smart and efficient building management.

- Substantial Investment Required: Developing and marketing sophisticated software platforms demands significant capital outlay.

- Intense Competition: The digital solutions space for building management is crowded with established players and new entrants.

- Market Adoption Uncertainty: Until significant market share is gained, these platforms remain in the question mark category, balancing potential with risk.

Cutting-edge Sustainable Material Applications in Products

Hager Group's pursuit of cutting-edge sustainable material applications, particularly in complex electrical components, represents a significant investment in future growth. While the company aims for 100% sustainable packaging by 2024, the integration of novel, advanced sustainable materials into core product lines faces initial hurdles in terms of cost and market penetration. This segment, while holding immense potential due to growing environmental consciousness, currently exhibits a low market share for these specific innovations.

The challenge lies in balancing the high growth potential driven by global sustainability trends with the current reality of limited market adoption for these advanced materials. For instance, while the global market for sustainable building materials is projected to reach over $400 billion by 2027, the specific niche of advanced bio-based or recycled polymers for high-performance electrical applications is still nascent.

- High Growth Potential: Driven by increasing consumer demand and regulatory pressures for eco-friendly products.

- Low Market Share: Current adoption of truly cutting-edge sustainable materials in complex electrical components is limited.

- High Investment Needs: Research, development, and scaling of these new materials can be costly.

- Technological Hurdles: Ensuring performance, durability, and safety standards with novel materials is a key challenge.

Hager Group's focus on advanced energy storage solutions, beyond basic EV charging, places them in the Question Mark category. These solutions, like sophisticated battery management systems for grid stabilization, represent a high-growth area as renewable energy integration increases.

However, the market for these highly specialized storage solutions is still developing, with significant investment needed for R&D and market penetration. For example, the global energy storage market was projected to grow substantially, with the stationary storage segment alone expected to reach over $200 billion by 2030, but advanced integration technologies are still finding their footing.

Hager's investment in these areas reflects a strategic bet on future energy infrastructure, balancing high potential rewards with the inherent uncertainties of emerging technologies and nascent markets.

| Hager Group BCG Matrix: Question Marks | Market Growth | Relative Market Share |

|---|---|---|

| Vehicle-to-Grid (V2G) & Bidirectional Charging | High | Low |

| AI-Powered Predictive Maintenance for Buildings | High | Low |

| Peer-to-Peer (P2P) Energy Trading | High | Low |

| Advanced Digital Networking Platforms | High | Low |

| Sustainable Material Applications (Advanced) | High | Low |

| Advanced Energy Storage Solutions | High | Low |

BCG Matrix Data Sources

Our Hager Group BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position each business unit.