GXO Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GXO Logistics Bundle

GXO Logistics, a leader in contract logistics, boasts significant strengths in its global reach and technology-driven solutions, positioning it well to capitalize on e-commerce growth. However, it faces challenges from intense competition and potential economic downturns that could impact demand for its services. Understanding these dynamics is crucial for strategic planning.

Discover the complete picture behind GXO Logistics' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to navigate the complex logistics landscape.

Strengths

GXO Logistics stands as the undisputed global leader in pure-play contract logistics, operating across 28 countries with more than 1,000 facilities. This singular focus on logistics enables them to concentrate resources and expertise, setting them apart from competitors with broader business interests. Their vast global reach and significant operational scale are crucial for effectively supporting multinational corporations and navigating intricate supply chain demands.

GXO Logistics distinguishes itself through significant investment in advanced technology and automation. The company poured $187 million into digital transformation and automation initiatives in 2023 alone, showcasing a strong commitment to innovation. This includes the deployment of AI-driven warehouse management systems and intelligent robotics, aimed at boosting operational efficiency.

Further demonstrating their forward-thinking approach, GXO is actively piloting humanoid robotics. This strategic adoption of cutting-edge solutions allows them to provide customers with highly efficient, cost-effective, and scalable logistics services, ultimately improving accuracy and productivity across their operations.

GXO Logistics boasts a robust and diverse customer base, serving more than 1,000 active clients across dynamic sectors such as e-commerce, retail, healthcare, and technology. The company's client relationships are substantial, with an average contract length of 5.2 years, indicating strong customer loyalty and satisfaction.

The company has demonstrated impressive growth in securing new business. GXO Logistics has surpassed the $1 billion mark in new business wins for two consecutive years, in 2023 and again in 2024. This consistent performance highlights the significant market demand for GXO's comprehensive logistics solutions and its proven capability to attract and onboard major clients.

Strategic Acquisitions and Geographic Expansion

GXO Logistics bolstered its position in the UK and Ireland significantly with the acquisition of Wincanton in April 2024, a deal valued at roughly $1 billion. This strategic move not only increased GXO's market share but also broadened its expertise in crucial industry sectors.

Beyond acquisitions, GXO has pursued organic growth, notably entering new markets such as Germany. This expansion has proven highly successful, with Germany emerging as GXO's fastest-growing market in 2024, further solidifying its international footprint.

- Wincanton Acquisition Value: Approximately $1 billion (April 2024)

- Geographic Expansion: Entered Germany, becoming its fastest-growing market.

- Strategic Impact: Enhanced UK/Ireland market share and expanded capabilities.

- Revenue Diversification: Global presence and new market entry diversify income sources.

Commitment to ESG and Sustainability Initiatives

GXO Logistics demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, setting ambitious goals for its operations. The company aims for carbon neutrality in its Scope 1 and 2 emissions by 2040, with a broader target of net-zero emissions across its entire value chain by 2045. This forward-thinking approach is a significant strength, resonating with a growing segment of environmentally aware clients and investors.

Their tangible actions support these targets, including widespread implementation of 100% LED lighting across facilities and a goal to achieve an 80% global landfill diversion rate by 2025. Furthermore, GXO is actively working to reduce single-use plastics for its customers, demonstrating a practical application of its sustainability strategy. These initiatives not only bolster GXO's corporate reputation but also position it favorably in a market increasingly prioritizing sustainable business practices.

- Ambitious ESG Targets: Carbon neutrality (Scope 1 & 2) by 2040 and net-zero across value chain by 2045.

- Operational Initiatives: 100% LED lighting and 80% global landfill diversion by 2025.

- Plastic Reduction: Focused efforts on reducing single-use plastics for clients.

- Market Appeal: Attracts environmentally conscious customers and investors.

GXO Logistics is the world's largest pure-play contract logistics provider, operating over 1,000 facilities in 28 countries. This singular focus allows for concentrated expertise and resources, differentiating them from more diversified competitors. Their extensive global presence and substantial operational scale are critical for serving multinational clients and managing complex supply chains.

What is included in the product

Delivers a strategic overview of GXO Logistics’s internal and external business factors, highlighting its strengths in technology and global reach, while identifying weaknesses in integration and opportunities in e-commerce expansion, alongside threats from competition and economic downturns.

GXO Logistics' SWOT analysis offers a clear roadmap to identify and leverage strengths, turning potential threats into opportunities for operational efficiency and growth.

Weaknesses

While GXO Logistics has seen impressive revenue growth, its net income has taken a hit. Net income fell from $233 million in 2023 to $138 million in 2024, with a reported net loss of $95 million in the first quarter of 2025. This downturn is largely attributable to significant transaction and litigation costs, increased general and administrative expenses stemming from acquisitions such as Wincanton, and elevated interest expenses.

GXO Logistics' significant reliance on the broader economic climate presents a notable weakness. The logistics sector is inherently sensitive to macroeconomic shifts, meaning a slowdown in the global economy can directly impact GXO's operational performance and revenue streams. For instance, a decline in consumer confidence often translates to reduced spending, which in turn lowers demand for goods and consequently, freight transportation volumes.

This vulnerability to global economic downturns poses a risk to GXO's growth trajectory. Periods of economic contraction typically coincide with a slowdown in global trade, directly affecting the volume of goods GXO moves. While GXO's business model, often built on long-term contracts, provides a degree of resilience, a sustained softer economic environment in its key operating regions can still hinder its organic growth and overall business activity.

For example, in 2023, while GXO demonstrated resilience, the company, like many in the industry, navigated a complex economic landscape. The International Monetary Fund (IMF) projected global economic growth to be around 3.1% for 2024, a modest figure that underscores the ongoing sensitivity of the logistics sector to prevailing economic conditions. Any deviation from these projections, particularly towards contraction, would directly impact GXO's ability to secure new business and expand existing contracts.

GXO Logistics faces integration challenges following its significant $1 billion acquisition of Wincanton. These complexities, including transaction and restructuring costs, can divert crucial management attention and resources.

The realization of targeted synergies, amounting to $58 million, is still in progress and contingent upon regulatory approvals, such as the ongoing review by the UK's Competition and Markets Authority (CMA).

This intricate integration process has the potential to temporarily impact operational efficiency as GXO works to combine its operations with Wincanton's.

High Debt Levels and Financial Health Concerns

GXO Logistics carries a notable debt burden, which raises questions about its financial resilience. As of the first quarter of 2025, the company reported total debt of $2.72 billion and net debt of $2.439 billion. This substantial leverage, reflected in a significant debt-to-equity ratio, could constrain its ability to pursue new opportunities or weather economic downturns.

Analysts have expressed some concern over GXO's interest coverage ratio, suggesting it might be on the lower side. A lower interest coverage ratio indicates that a company has less room to maneuver in meeting its interest obligations, potentially signaling financial strain. This is particularly relevant in a market where interest rates can be volatile, impacting borrowing costs and overall financial health.

The high level of debt limits GXO's financial flexibility. This means the company may have fewer resources available for strategic investments, acquisitions, or even managing unexpected operational challenges. In essence, a significant portion of its cash flow is already committed to servicing its existing debt obligations.

Furthermore, a highly leveraged company like GXO becomes more susceptible to economic shocks. Should revenue decline or interest rates rise unexpectedly, the company could face greater difficulty in meeting its financial commitments, potentially leading to a downgrade in credit rating or other negative consequences.

- Total Debt: $2.72 billion (as of March 31, 2025)

- Net Debt: $2.439 billion (as of March 31, 2025)

- Financial Flexibility: Limited due to high debt servicing requirements.

- Vulnerability: Increased exposure to economic downturns and interest rate fluctuations.

Workforce Retention and Labor Cost Challenges

GXO Logistics, like many in the logistics sector, grapples with significant workforce retention issues and rising labor expenses. The industry frequently sees high employee turnover, making it tough to keep skilled staff. This is particularly true for roles requiring expertise in newer logistics technologies.

Attracting and holding onto qualified personnel is a constant hurdle, directly impacting operational costs. For instance, the U.S. Bureau of Labor Statistics reported that the average hourly wage for transportation and warehousing occupations increased by approximately 6.5% in the year leading up to April 2024, reflecting these upward pressures.

Labor shortages and turnover can severely disrupt GXO's ability to meet customer demands, especially during busy seasons. This instability also threatens the consistent maintenance of operational efficiency across its network.

- High Turnover: The logistics industry often experiences elevated employee turnover rates, impacting operational consistency.

- Rising Labor Costs: Wage inflation in the warehousing and transportation sector adds to GXO's operating expenses.

- Skills Gap: Difficulty in finding and retaining employees with expertise in advanced logistics technology is a persistent challenge.

- Operational Risk: Labor shortages and turnover pose a direct risk to meeting service level agreements and maintaining efficiency, particularly during peak demand periods.

GXO Logistics' profitability has been impacted by substantial transaction and litigation costs, alongside increased administrative expenses associated with acquisitions like Wincanton. This led to a notable decline in net income, from $233 million in 2023 to $138 million in 2024, with a reported net loss of $95 million in Q1 2025.

The company's significant debt load, totaling $2.72 billion in total debt and $2.439 billion in net debt as of March 31, 2025, limits its financial flexibility and increases vulnerability to economic downturns and interest rate volatility.

High employee turnover and rising labor costs, with average hourly wages in transportation and warehousing up around 6.5% by April 2024, present ongoing operational challenges and increase operating expenses.

Furthermore, GXO's reliance on the broader economic climate means that a global slowdown or reduced consumer spending directly impacts freight volumes and revenue, as seen in the IMF's modest 3.1% global growth projection for 2024.

What You See Is What You Get

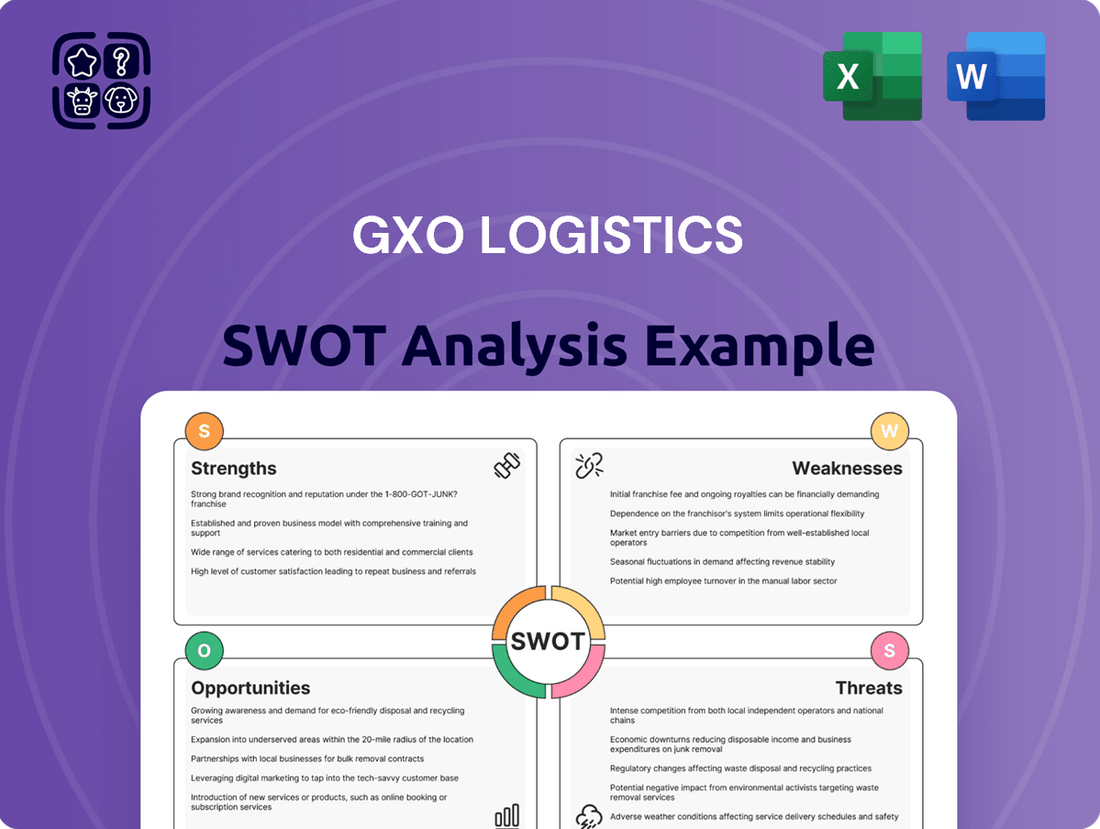

GXO Logistics SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version detailing GXO Logistics' Strengths, Weaknesses, Opportunities, and Threats. This professional analysis offers actionable insights into their market position and strategic considerations. You'll receive the complete, ready-to-use document immediately after purchase.

Opportunities

The e-commerce sector is experiencing explosive growth, with global sales expected to jump from $18.77 trillion in 2024 to a staggering $75.12 trillion by 2034. This presents a massive opportunity for GXO Logistics. The company is seeing a strong uptick in e-fulfillment projects, demonstrating its ability to meet the demands of this expanding market.

GXO's strategic emphasis on advanced solutions for omnichannel retail is perfectly aligned with current market needs. Retailers are increasingly seeking integrated supply chains that seamlessly connect online and in-store experiences. This requires significant warehouse capacity and sophisticated management systems, precisely where GXO's technological capabilities shine.

Businesses are increasingly handing over their logistics to specialized third-party providers, a move that directly benefits companies like GXO. This trend is driven by a desire for greater efficiency and lower operating expenses, acting as a strong tailwind for the industry.

A substantial amount of GXO's new client acquisitions stem from companies bringing their logistics in-house or shifting from other providers. This highlights a clear market movement towards professional logistics management, a core strength of GXO.

By capitalizing on this outsourcing trend, GXO is well-positioned to grow its market share. The company can effectively deploy its expertise to manage complex supply chains for a wider range of clients.

GXO is well-positioned to capitalize on the growing trend of automation and AI in logistics. Continued investment in these technologies, like their GXO IQ operating system, can significantly boost productivity and cut costs. The global artificial intelligence in logistics market is expected to reach a substantial $14.9 billion by 2026, highlighting the vast potential for GXO's AI-first approach to create a strong competitive advantage.

Expansion into High-Growth Verticals (e.g., Healthcare)

GXO Logistics is strategically broadening its reach into rapidly expanding sectors like healthcare and technology. This expansion is underscored by significant wins, such as their largest contract to date, valued at $2.5 billion within the health sciences sector, and new ventures in technology, including critical data center management services. These complex, specialized logistics demands align perfectly with GXO's expertise in sophisticated supply chain solutions.

Key opportunities arising from this focus include:

- Access to Resilient and Growing Markets: Healthcare and technology sectors demonstrate consistent demand and growth, offering a stable revenue stream.

- Leveraging Specialized Expertise: GXO's advanced capabilities in temperature-controlled logistics, sterile environments, and secure handling are highly valuable in these verticals.

- Increased Contract Value: The complexity of these sectors often commands higher contract values, boosting overall revenue and profitability.

- Diversification of Revenue Streams: Reducing reliance on traditional retail logistics by tapping into these high-growth areas enhances GXO's business resilience.

Leveraging Data Analytics for Supply Chain Optimization

GXO Logistics possesses a wealth of operational data, which, when analyzed with their advanced analytics tools, can unlock significant opportunities. By translating this raw data into deeper insights and actionable recommendations, GXO can offer enhanced value to its customers. This data-driven approach is key to optimizing supply chains and improving logistical efficiency.

The company can further leverage these capabilities to develop more sophisticated predictive logistics models. This means anticipating potential disruptions or demand shifts before they occur, allowing for proactive adjustments. Such predictive power not only enhances GXO's service offering but also positions them as a critical strategic partner for clients seeking to improve their own decision-making processes.

- Enhanced Customer Value: GXO's data analytics can translate into more efficient inventory management and reduced transit times for clients, directly impacting their bottom line.

- Predictive Capabilities: By analyzing vast datasets, GXO can forecast demand fluctuations with greater accuracy, enabling proactive resource allocation and mitigating stockouts or overstock situations.

- Strengthened Relationships: Offering data-driven insights and tailored solutions fosters deeper partnerships, moving beyond transactional services to strategic collaboration.

- Competitive Differentiation: In a crowded logistics market, superior data analytics and its application in optimizing customer supply chains provides a distinct competitive advantage.

GXO is positioned to benefit from the burgeoning e-commerce market, projected to reach $75.12 trillion by 2034, with strong demand for its e-fulfillment services. Their focus on omnichannel retail solutions directly addresses the growing need for integrated supply chains. The increasing trend of businesses outsourcing logistics to specialized third-party providers, like GXO, offers substantial growth potential, as evidenced by new client acquisitions shifting from competitors or bringing logistics in-house.

Threats

The logistics sector is incredibly crowded, with a vast number of companies all trying to capture a piece of the market. This intense rivalry often forces companies like GXO to keep prices low, which can squeeze profit margins. For instance, the global third-party logistics market was valued at approximately $1.15 trillion in 2023 and is projected to grow, but this growth is accompanied by fierce competition from both established giants and emerging players.

GXO contends with other major third-party logistics providers (3PLs), but also directly with the internal logistics departments of large retailers and manufacturers who choose to manage their own supply chains. This dual competitive pressure means GXO must constantly adapt to maintain its edge.

The threat of losing ground due to a lack of innovation is significant. If GXO doesn't consistently develop and offer new, improved services that set it apart, it risks seeing its revenue decline and its market share erode. Staying ahead requires continuous investment in technology and service enhancements, a challenge in a rapidly evolving industry where clients expect more efficiency and customization.

Ongoing macroeconomic volatility, particularly persistent inflation and fluctuating interest rates, presents a significant headwind. For instance, elevated inflation in key markets like the US and Europe during 2024 could continue to pressure operating costs and consumer spending, potentially dampening demand for logistics services.

Geopolitical instability, including ongoing trade disputes and regional conflicts, poses a substantial threat to GXO Logistics' global operations. The imposition of tariffs or trade restrictions can directly increase the cost of cross-border shipments and disrupt established supply chains, impacting GXO's ability to deliver efficient services and potentially leading to higher operational expenses.

The specter of a potential recession in major economies in late 2024 or early 2025 could significantly reduce freight volumes as businesses scale back production and consumer demand softens. This downturn risk directly translates to lower revenue opportunities for GXO's transportation and warehousing segments, impacting overall business volumes and profitability.

GXO Logistics, as a leader in logistics, heavily relies on its technology infrastructure, making it a prime target for cyber threats. A significant data breach could not only expose sensitive customer information but also cripple GXO's operations, leading to costly downtime and reputational damage. In 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the potential financial impact for companies like GXO.

The company's increasing investment in automation and artificial intelligence, while boosting efficiency, also introduces new vulnerabilities. Failures in these advanced systems, whether through cyberattacks or unforeseen malfunctions, could severely disrupt supply chains and impact service delivery. For instance, a ransomware attack on a logistics provider's automated warehouse system could halt all inbound and outbound shipments, creating significant economic losses and client dissatisfaction.

Regulatory and Compliance Burdens

GXO Logistics navigates a complex web of regulations across its global operations, encompassing diverse areas like employment, environmental standards, and data privacy. For instance, in 2023, the logistics sector faced increased scrutiny on labor practices and emissions, impacting companies like GXO. Failure to adapt to evolving compliance requirements can result in significant operational cost increases and potential legal penalties.

The ongoing regulatory review of the Wincanton acquisition by the UK's Competition and Markets Authority (CMA) highlights a specific instance of these burdens. This process can introduce delays and uncertainty, impacting strategic growth initiatives. Such reviews are crucial for ensuring fair competition but represent a tangible threat to expansion plans.

- Global Regulatory Complexity: Operating in over 20 countries means GXO must adhere to a multitude of differing national and regional laws.

- Compliance Costs: Maintaining compliance with evolving standards, such as those related to ESG (Environmental, Social, and Governance) reporting, adds to operational expenses.

- Risk of Penalties: Non-compliance can lead to substantial fines, reputational damage, and even suspension of operations in certain jurisdictions.

- Acquisition Hurdles: Regulatory approvals, as seen with the Wincanton deal, can be lengthy and costly, potentially altering deal terms or blocking transactions altogether.

High Capital Expenditure Requirements

GXO Logistics faces a significant threat from its high capital expenditure requirements. The company needs to continuously invest in cutting-edge technology, automation, and expanding its warehouse capacity to remain competitive. For instance, in 2023, GXO reported capital expenditures of $479 million, a substantial amount reflecting these ongoing investments.

This substantial CAPEX, coupled with the costs associated with acquisitions, places considerable pressure on GXO's profit margins and its ability to generate free cash flow. While these investments are crucial for fueling long-term growth and maintaining a competitive edge in the logistics industry, they can strain the company's financial resources in the near to medium term.

- Ongoing investment in automation and technology: GXO's commitment to modernizing its operations necessitates significant upfront capital.

- Warehouse capacity expansion: Meeting growing customer demand requires continuous investment in new or expanded facilities.

- Impact on financial flexibility: High CAPEX can limit financial resources available for other strategic initiatives or shareholder returns.

- Acquisition-related costs: Integrating acquired businesses also adds to the capital outlay.

GXO faces intense competition from a crowded logistics market, forcing price sensitivity that impacts profit margins. The global third-party logistics market, valued at approximately $1.15 trillion in 2023, is characterized by numerous established players and new entrants, intensifying rivalry.

The company is also vulnerable to macroeconomic volatility, with inflation and interest rate fluctuations in 2024 potentially increasing operating costs and dampening demand for logistics services. Furthermore, geopolitical instability, including trade disputes, can escalate shipping costs and disrupt supply chains, directly affecting GXO's operational efficiency and profitability.

Cyber threats and the potential for system failures in advanced automation pose significant risks, with a data breach costing an average of $4.45 million globally in 2023. Navigating diverse international regulations also presents compliance costs and the risk of penalties, as demonstrated by the UK's regulatory review of GXO's Wincanton acquisition.

SWOT Analysis Data Sources

This GXO Logistics SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and insightful expert commentary, ensuring a data-driven and accurate strategic assessment.