GXO Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GXO Logistics Bundle

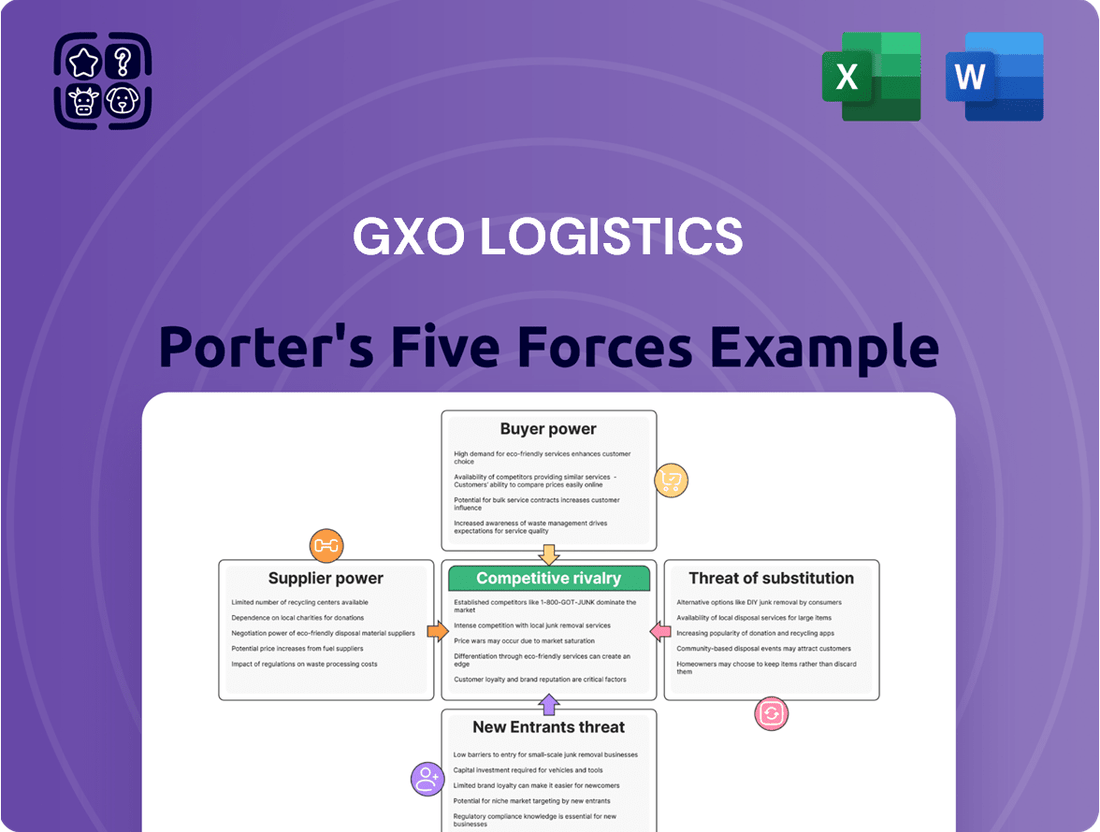

GXO Logistics navigates a dynamic industry shaped by several powerful forces. Understanding the intensity of buyer power, the threat of new entrants, the bargaining power of suppliers, the availability of substitutes, and the level of rivalry is crucial for strategic success. This analysis provides a framework to assess these competitive pressures.

The complete report reveals the real forces shaping GXO Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

GXO Logistics sources a wide array of goods and services, from warehouse real estate and cutting-edge automation technology to labor and transportation fleets. The degree to which these suppliers are concentrated, particularly for niche automation or essential software solutions, directly impacts their sway.

For instance, a limited number of providers offering highly specialized robotics or advanced warehouse management systems could command greater pricing power. In 2024, the global industrial automation market was valued at over $170 billion, with significant growth expected, indicating that suppliers in this segment could indeed wield considerable influence if GXO relies heavily on a few dominant players.

The bargaining power of suppliers for GXO Logistics is significantly influenced by switching costs. For GXO, the expense and complexity involved in changing suppliers can be substantial, especially when dealing with integrated technology platforms or advanced automation systems crucial for modern logistics operations.

Migrating from a current warehouse management system or robotics provider to a new one requires considerable capital outlay for new infrastructure, extensive employee training, and can lead to operational disruptions. These factors inherently increase the leverage suppliers hold over GXO.

For instance, a significant investment in a proprietary warehouse automation solution by a supplier means GXO faces high costs to replace that system, thereby strengthening the supplier's position. In 2024, the increasing reliance on sophisticated technology in logistics means these switching costs are likely to remain a potent factor.

Suppliers providing highly unique or proprietary technology, like advanced AI for optimizing warehouse operations or specialized robotic systems, hold significant sway. GXO Logistics' commitment to technological advancement and automation means it relies on these distinctive capabilities to stay ahead of competitors.

For instance, if a supplier offers a patented sorting system that significantly reduces processing time, GXO’s ability to negotiate terms for this technology is diminished because alternatives are scarce. This dependence on innovation from a limited number of suppliers directly translates into increased bargaining power for them.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into logistics services, thereby becoming competitors to GXO Logistics, is generally low but warrants consideration. While technology providers could theoretically offer end-to-end logistics solutions, the significant capital investment and intricate operational expertise required for contract logistics present a substantial barrier to entry. GXO's own substantial investments in warehousing, transportation networks, and advanced technology, such as its extensive use of robotics and automation which saw significant upgrades in 2024, underscore the difficulty for a technology supplier to replicate this scale and capability.

This forward integration risk is not entirely absent, particularly for specialized technology or equipment suppliers. However, the core competencies of such suppliers typically lie in their specific technology, not in managing complex global supply chains, which is GXO's forte. For instance, a company providing advanced warehouse management systems might possess the software, but acquiring and managing a fleet of trucks or a global network of distribution centers is a vastly different undertaking.

- Low Likelihood: The significant capital expenditure and operational expertise needed to run a comprehensive logistics operation deter most technology suppliers from direct forward integration.

- GXO's Scale Advantage: GXO's substantial investments in infrastructure and technology, including significant 2024 upgrades in automation, create a high barrier to entry for potential competitors.

- Core Competency Mismatch: Technology suppliers typically lack the established operational capabilities and market presence necessary to compete effectively in the contract logistics sector.

- Deterrent Factors: The complexity and capital intensity of contract logistics, including managing diverse fleets and global networks, remain significant deterrents to suppliers considering forward integration.

Importance of GXO to Suppliers

GXO Logistics, as the largest pure-play contract logistics provider globally, holds considerable sway over its suppliers. Its sheer scale means that many suppliers depend heavily on GXO for a substantial portion of their revenue. For instance, a supplier of warehouse automation technology or specialized packaging materials might see GXO represent a significant percentage of their annual sales. This dependency inherently limits the supplier's bargaining power, as the risk of losing GXO as a major client often outweighs their ability to negotiate more favorable terms.

The impact of this dynamic is quite pronounced. Losing GXO as a customer could mean a severe blow to a supplier's financial health, potentially leading to reduced operations or even business failure for smaller entities. This economic reality encourages suppliers to maintain competitive pricing and service levels to retain GXO's business, thereby diminishing their leverage in price negotiations and contract renewals. In 2023, GXO reported revenues of $9.9 billion, underscoring the significant financial weight they carry in their supplier relationships.

- Significant Customer: GXO's status as the world's largest pure-play contract logistics provider makes it a crucial client for numerous suppliers in the supply chain ecosystem.

- Revenue Dependence: Many suppliers rely on GXO for a substantial percentage of their overall revenue, creating a strong incentive to maintain the relationship.

- Reduced Supplier Power: The high dependency of suppliers on GXO's business volume inherently weakens their bargaining power.

- Financial Risk for Suppliers: Losing GXO as a customer can pose a significant financial risk, potentially impacting a supplier's operational stability and profitability.

Suppliers of highly specialized or proprietary technology, such as advanced automation or unique software solutions, wield considerable bargaining power over GXO Logistics due to limited alternatives. The global industrial automation market's growth, exceeding $170 billion in 2024, highlights the potential leverage of key players in this segment. GXO's reliance on these innovations to maintain its competitive edge amplifies supplier influence.

Switching costs significantly bolster supplier leverage. For GXO, replacing integrated technology platforms or essential automation systems involves substantial capital, training, and potential operational disruptions. In 2024, the increasing reliance on sophisticated logistics technology means these switching costs are a potent factor, strengthening suppliers' positions and limiting GXO's negotiation flexibility.

The bargaining power of suppliers is somewhat mitigated by GXO's immense scale as the world's largest pure-play contract logistics provider. Many suppliers depend on GXO for a significant portion of their revenue, with GXO's 2023 revenues reaching $9.9 billion. This revenue dependence inherently weakens suppliers' ability to dictate terms, as losing GXO as a major client poses a substantial financial risk, thus reducing their overall leverage.

What is included in the product

This analysis tailors Porter's Five Forces to GXO Logistics, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its logistics operations.

Gain immediate clarity on GXO Logistics' competitive landscape with a single-page overview of all five forces, enabling swift strategic adjustments.

Customers Bargaining Power

GXO Logistics serves a diverse client base, including major players in health sciences, retail, and manufacturing. The concentration of revenue from a few key clients directly impacts their bargaining power. If a substantial percentage of GXO's income, say over 20% in 2024, originates from a small group of large corporations, these clients can exert significant pressure for reduced pricing or preferential contract terms.

Switching costs for customers in the logistics sector can be substantial, especially when a company like GXO Logistics provides deeply integrated, technology-driven solutions. Initially, setting up new logistics processes, migrating data, and retraining staff can represent significant upfront investment and operational disruption. For instance, a recent survey of supply chain managers indicated that the average cost to switch logistics providers can range from 5% to 15% of annual logistics spend, largely due to the complexity of integrating IT systems.

GXO actively works to embed its services and technology into its clients' operations, thereby raising these switching costs. By offering advanced visibility platforms, automation, and tailored supply chain management, GXO makes it more challenging and expensive for clients to transition to a competitor. This strategy aims to create sticky customer relationships, as demonstrated by GXO's reported customer retention rates, which have consistently remained above 95% in recent years, highlighting the effectiveness of their integrated service model in mitigating customer bargaining power.

Customer price sensitivity is a significant factor for logistics providers like GXO. Businesses often outsource their supply chain operations to achieve greater efficiency and lower operational expenses. This inherent need to manage costs makes them keenly aware of pricing, directly impacting GXO's ability to set rates.

When GXO's customers face economic downturns or intense market competition, their drive for cost reduction intensifies. This heightened demand for savings translates into considerable downward pressure on the prices GXO can charge for its services. For instance, in 2024, many industries experienced inflationary pressures, forcing companies to scrutinize every expense, including logistics.

Threat of Backward Integration by Customers

Customers, especially very large corporations, can bring logistics operations in-house, a move known as backward integration. This capability acts as a constant pressure point on logistics providers like GXO Logistics.

While the option exists, the sheer complexity and scale of modern supply chains often make it more efficient and cost-effective for companies to outsource these functions. For instance, managing a global network of warehouses, transportation fleets, and advanced tracking systems requires specialized expertise and significant capital investment that many firms would rather not undertake.

- Large customers with substantial capital and internal expertise are most capable of backward integration.

- The increasing complexity of global supply chains often makes outsourcing logistics more appealing than in-house management.

- The threat of backward integration can limit pricing power for logistics providers.

- GXO Logistics' ability to offer specialized technology and economies of scale can mitigate this threat for its clients.

Availability of Alternative Logistics Providers

The contract logistics market is quite crowded and spread out, meaning customers have a lot of choices. This makes it easier for them to switch providers if they aren't happy or if they find a better deal elsewhere. For instance, GXO Logistics operates in a space with major players like DHL Supply Chain and Geodis, who also offer extensive global networks and services.

With numerous third-party logistics (3PL) providers available worldwide, customers can easily compare offerings and pricing. This abundance of alternatives significantly boosts their negotiating leverage. They can demand better terms, more customized solutions, or lower rates, knowing that if GXO doesn't meet their needs, other large, capable providers likely will.

This competitive landscape empowers customers by giving them the freedom to select the best fit for their specific supply chain requirements.

- Market Fragmentation: The contract logistics sector features a large number of players, increasing customer choice.

- Global Competitors: Major global 3PLs like DHL and Geodis provide significant alternative options to GXO's customers.

- Customer Leverage: The availability of numerous providers strengthens customers' ability to negotiate favorable contract terms and pricing.

- Switching Costs: While switching providers can involve some effort, the competitive nature of the market often makes it feasible for customers to explore alternatives.

The bargaining power of GXO Logistics' customers is moderate, influenced by factors like customer concentration, switching costs, price sensitivity, and the threat of backward integration. While high switching costs and integrated services mitigate this power, the competitive landscape and customer price sensitivity remain significant. In 2024, many clients intensified cost-saving efforts due to economic pressures, directly impacting GXO’s pricing flexibility.

| Factor | Impact on GXO | 2024 Relevance |

|---|---|---|

| Customer Concentration | Moderate to High | A few large clients could exert significant price pressure if their share of GXO's revenue exceeded 20%. |

| Switching Costs | Low to Moderate | While integration raises costs (5-15% of spend), the competitive market offers alternatives. |

| Price Sensitivity | High | Customers, especially in competitive markets, actively seek cost reductions, pressuring GXO's margins. |

| Backward Integration Threat | Low | The complexity of modern supply chains makes in-house operations less appealing for most customers. |

What You See Is What You Get

GXO Logistics Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of GXO Logistics meticulously examines the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Each force is thoroughly detailed, providing strategic insights into GXO Logistics' market position and potential challenges. You are previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The contract logistics arena is a crowded space, featuring a vast array of global giants, regional specialists, and niche operators. This fragmentation means GXO Logistics faces a broad spectrum of rivals, each with its own strengths and market focus. For instance, in 2024, the contract logistics market is estimated to be worth hundreds of billions of dollars globally, highlighting the sheer scale of the industry and the numerous participants vying for market share.

GXO directly contends with established global players such as DHL Supply Chain, Geodis, and ID Logistics. These companies operate extensive networks and offer comprehensive end-to-end supply chain solutions. Beyond these large-scale competitors, GXO also encounters a multitude of smaller, specialized firms that often excel in specific sectors or geographic regions, providing tailored services that can challenge broader offerings.

The global contract logistics market is experiencing moderate growth, with projections indicating a 3.3% expansion in 2025. This growth is primarily fueled by the ongoing surge in e-commerce and the increasing trend of companies outsourcing their logistics operations.

While this growth presents opportunities, it's not so explosive that it easily absorbs every player in the market. Consequently, the competitive landscape remains quite intense as companies vie for a larger slice of this expanding pie.

This dynamic means that established players and newcomers alike are constantly looking for ways to differentiate themselves and capture market share, often through service innovation or strategic partnerships.

GXO Logistics carves out its competitive edge by heavily investing in technology, automation, and tailored solutions delivered at significant scale. This approach allows them to offer specialized services that can be a key differentiator in the market.

However, the logistics landscape is highly competitive, with many rivals also pouring resources into similar technological advancements and automation. For instance, in 2024, major competitors like DHL Supply Chain and Kuehne+Nagel continued to expand their automated warehouse capabilities and digital platforms.

This necessitates that GXO maintains a relentless pace of innovation to ensure its technological offerings remain distinct and provide a genuine competitive advantage. Failing to innovate could quickly erode the perceived uniqueness of their solutions.

The challenge lies in demonstrating that GXO's technological integration and customized solutions at scale are not just comparable but demonstrably superior and more efficient than what competitors offer, thereby justifying premium pricing or securing higher market share.

Exit Barriers

High fixed costs in the logistics sector, particularly for warehousing, specialized equipment, and advanced technology, create substantial barriers for companies looking to exit. These investments, often in the millions for large-scale operations, mean that shutting down or selling off assets can incur significant losses, making continued operation, even at reduced profitability, a more viable option. This scenario fosters persistent competition as firms are reluctant to depart.

For instance, GXO Logistics, as a major player, would have substantial capital tied up in its global network of distribution centers and its fleet. The cost of maintaining and upgrading this infrastructure means that even in a downturn, the sunk costs discourage immediate withdrawal. This commitment to assets contributes to the intensity of rivalry, as companies strive to utilize their existing capacity.

- High Fixed Asset Investment: Logistics firms like GXO invest heavily in warehouses, automated systems, and transportation fleets, creating substantial sunk costs.

- Reluctance to Divest: The significant capital outlay makes it economically difficult and often loss-making to sell off or abandon these assets quickly.

- Sustained Competitive Pressure: Companies are incentivized to remain operational, even in challenging market conditions, to try and recover their investments, thereby maintaining competitive rivalry.

- Industry Norms: The capital-intensive nature of the industry means that even smaller players face similar, albeit scaled-down, exit challenges.

Acquisition and Consolidation Activity

The contract logistics sector is buzzing with mergers and acquisitions (M&A). Larger companies are snapping up smaller ones to broaden their service offerings and gain a stronger presence in different regions. This trend isn't just happening to others; GXO Logistics has been a player in this too, notably acquiring Wincanton. This move significantly alters the competitive field, potentially leading to fiercer competition among the remaining major logistics providers as they adapt to this new landscape.

This consolidation means fewer, but larger, players dominate the market. For instance, the acquisition of Wincanton by GXO in 2024, valued at approximately £768 million, is a prime example of this. Such deals can create more formidable competitors, forcing others to either scale up or face increased pressure.

- Increased Market Share: Acquisitions allow companies to quickly gain a larger share of the contract logistics market.

- Expanded Service Portfolios: Acquiring firms often brings new services or technologies that enhance the buyer's capabilities.

- Geographic Expansion: M&A provides a faster route to entering new markets or strengthening an existing presence.

- Intensified Rivalry: As the market consolidates, the remaining large players often engage in more aggressive competition for contracts.

The contract logistics industry is characterized by intense rivalry, with numerous global, regional, and specialized players competing for market share. This high level of competition is further amplified by the sector's substantial fixed asset investments, making market exit difficult and encouraging firms to remain competitive even in challenging conditions. The ongoing trend of mergers and acquisitions, such as GXO's 2024 acquisition of Wincanton for approximately £768 million, is consolidating the market and intensifying competition among the larger remaining entities.

| Competitor | Estimated 2024 Revenue (USD Billions) | Key Service Areas | Notes |

|---|---|---|---|

| DHL Supply Chain | ~25.0 | Warehousing, Transportation, E-commerce Logistics | Extensive global network |

| Kuehne+Nagel | ~17.0 | Contract Logistics, Freight Forwarding | Strong in European markets |

| Geodis | ~13.0 | Contract Logistics, Freight Forwarding, Distribution | Global presence with a focus on sustainability |

| ID Logistics | ~2.5 | Contract Logistics, E-commerce Fulfillment | Specializes in tailored solutions |

SSubstitutes Threaten

The primary substitute for GXO's contract logistics services is a company choosing to manage its own supply chain and warehousing operations. This in-house approach offers a sense of direct control over every aspect of the logistics process.

For some businesses, particularly very large enterprises, the perceived advantages of managing logistics internally can be compelling. This perception often centers on potential cost savings and greater oversight, even when factoring in the significant capital investment and operational complexities involved.

While GXO reported a revenue of $9.04 billion in 2023, demonstrating the value customers find in outsourced logistics, the option for in-house management remains a viable alternative for a subset of the market. Companies like Amazon, for instance, have built extensive in-house logistics networks, highlighting the scale at which this substitute can operate.

Manufacturers and large retailers, especially those with robust online sales, are increasingly exploring direct-to-consumer shipping. This bypasses the need for third-party logistics providers like GXO for specific product lines or customer segments. For instance, many fashion brands now handle their own warehousing and shipping, leveraging their existing infrastructure. In 2024, the e-commerce sector continued its rapid expansion, with direct fulfillment models becoming more viable as technology and carrier networks mature.

Emerging logistics models, like co-warehousing and specialized fulfillment for SMBs, present a growing threat to traditional contract logistics providers such as GXO. These alternatives offer more agile and budget-friendly solutions for niche markets. For instance, the rise of flexible workspace providers extending into logistics services means businesses can tap into shared warehousing infrastructure without the commitment of large, dedicated facilities.

The increasing availability of on-demand warehousing platforms, which connect businesses with underutilized storage space, further intensifies this threat. These platforms allow companies to scale their warehousing needs up or down rapidly, providing a cost-effective alternative to long-term contracts. In 2024, the growth in the gig economy for logistics workers also supports these more flexible fulfillment models.

Technology-driven Self-management Solutions

The rise of technology-driven self-management solutions presents a notable threat of substitutes for logistics providers like GXO. Advancements in supply chain management software, the Internet of Things (IoT), and predictive analytics are making it increasingly feasible for companies to handle their logistics operations internally.

While GXO provides sophisticated technology-enabled solutions, the growing accessibility and affordability of these tools could empower clients to insource their logistics, thereby reducing their dependence on third-party providers.

- Increased In-house Capabilities: Businesses can now implement advanced warehouse management systems (WMS) and transportation management systems (TMS) with greater ease. For instance, many cloud-based solutions offer scalable and modular features, allowing companies to customize their logistics tech stack.

- Data Analytics Empowerment: Predictive analytics, fueled by IoT data from fleets and warehouses, enables better demand forecasting and inventory management, skills that were once the exclusive domain of specialized logistics firms.

- Cost Efficiency for Clients: For large enterprises with significant logistics volumes, the potential cost savings from managing operations in-house, leveraging these accessible technologies, can outweigh the benefits of outsourcing.

- Reduced Switching Costs: As technology becomes more standardized and user-friendly, the effort and cost associated with switching from a third-party provider to an in-house solution decrease.

Specialized Niche Logistics Providers

For highly specialized logistics needs, such as cold chain or hazardous materials handling, niche providers can offer more tailored solutions than a general contract logistics company like GXO. These specialized providers, focusing on specific industry requirements, represent a viable substitute for certain clients seeking bespoke services. For instance, a pharmaceutical company requiring strict temperature-controlled transportation might find a dedicated cold chain logistics firm a more attractive option than a broad-service provider.

This threat is particularly relevant in segments where advanced technology, specific regulatory compliance, and deep industry expertise are paramount. While GXO offers a wide range of services, its broad approach might not always match the granular precision demanded by these specialized niches. In 2024, the global cold chain logistics market was valued at approximately $230 billion, demonstrating the significant size and importance of these specialized segments. Companies operating within these niches often command premium pricing due to their expertise and infrastructure.

- Niche Specialization: Providers focusing on cold chain, hazardous materials, or specific industry verticals offer tailored solutions that general logistics providers may not fully replicate.

- Regulatory Compliance: For industries with stringent regulations, specialized providers often possess deeper expertise and established compliance frameworks.

- Technological Advancement: Niche players may invest more heavily in specialized technologies (e.g., advanced refrigeration monitoring) crucial for specific logistics requirements.

- Client Needs: Highly specific client demands in areas like pharmaceuticals or aerospace can make specialized logistics providers a more compelling substitute.

The threat of substitutes for GXO Logistics primarily stems from businesses opting for in-house logistics management or specialized niche providers. While GXO reported $9.04 billion in revenue for 2023, indicating strong demand for outsourced services, the increasing accessibility of advanced logistics technology empowers companies to manage their supply chains internally. This trend is further amplified by the growth of flexible, on-demand warehousing platforms and a maturing e-commerce landscape in 2024, where direct-to-consumer fulfillment is becoming more prevalent.

These substitutes offer a direct control that some large enterprises find appealing, potentially leading to cost efficiencies. For instance, the global cold chain logistics market, valued around $230 billion in 2024, highlights the significant opportunities for specialized providers who can offer tailored solutions that broader logistics companies might not match. This specialization is crucial for industries with strict regulatory or technological demands.

Entrants Threaten

Entering the contract logistics arena, particularly at a significant scale, demands a considerable outlay of capital. This investment is directed towards acquiring and equipping warehouses, implementing advanced technology and automation, and building out transportation fleets. For instance, GXO Logistics, a major player, operates more than 1,000 facilities worldwide, underscoring the immense financial hurdle that new competitors must overcome to establish a comparable presence.

Established players in the logistics sector, such as GXO Logistics, benefit immensely from economies of scale and scope. This means they can spread their fixed costs over a larger volume of business, leading to lower per-unit costs. For instance, GXO's extensive network of warehouses and transportation assets allows them to negotiate better rates with suppliers and optimize delivery routes, directly impacting their pricing competitiveness.

Newcomers face a steep challenge in replicating these efficiencies. Building a comparable network and achieving similar operational leverage takes substantial capital investment and time. Without this scale, new entrants often find it difficult to match the pricing offered by incumbents or to provide the same breadth of integrated services that customers expect, thus limiting their ability to gain market share.

The significant investment required to develop or acquire advanced logistics technology, including AI and automation, acts as a formidable barrier to entry. GXO Logistics, for instance, utilizes sophisticated systems to manage complex supply chains, a capability that is costly and time-consuming for newcomers to replicate. This technological sophistication, coupled with the deep operational expertise needed to expertly manage diverse logistics needs, deters potential new entrants from challenging established players.

Customer Loyalty and Switching Costs

GXO Logistics cultivates deep, long-term relationships with its substantial corporate clientele. These established connections create a significant hurdle for potential new entrants aiming to disrupt the market. Customers often encounter substantial switching costs, encompassing not just financial outlays for new systems and training but also the disruption to ongoing operations and the loss of established service efficiencies. For instance, integrating a new logistics provider can involve considerable time and resources to align with existing supply chain workflows. This loyalty and the associated switching costs inherently raise the barrier to entry, making it difficult for newcomers to poach GXO's existing customer base without offering a demonstrably superior value proposition.

The threat of new entrants is therefore tempered by the ingrained customer loyalty and the high switching costs associated with GXO Logistics' services. New players must not only match existing service levels but also provide a compelling incentive, such as significantly lower pricing or innovative technological solutions, to persuade established clients to undertake the transition. This dynamic protects incumbent firms like GXO from immediate, disruptive competition.

In 2024, the logistics industry continues to see intense competition, but the specialized nature of GXO's offerings, particularly in areas like e-commerce fulfillment and contract logistics, fosters strong client dependencies. While the overall market may see new entrants, their ability to displace GXO's established relationships is limited by the inherent friction and investment required for clients to change providers.

- Customer Loyalty: GXO's focus on building enduring partnerships with large corporations fosters strong client retention.

- Switching Costs: Clients face considerable financial and operational challenges when transitioning to a new logistics provider.

- Barrier to Entry: High switching costs and established relationships make it difficult for new entrants to attract GXO's clientele.

- Value Proposition: New entrants must offer a clearly superior value to overcome these ingrained barriers.

Regulatory Hurdles and Network Complexity

The logistics industry presents significant barriers to entry due to the sheer complexity of global operations. For instance, GXO Logistics, a major player, manages operations across numerous countries, each with its own intricate web of customs regulations, trade agreements, and import/export laws. Establishing a compliant network of this scale requires substantial investment and specialized knowledge, making it difficult for newcomers to compete. In 2024, the ongoing evolution of trade policies and digital customs requirements further escalates this challenge for potential entrants.

Building a robust and reliable global logistics network is a formidable undertaking. This involves not only physical infrastructure but also sophisticated IT systems for tracking, visibility, and management across vast distances. The intricacies of diverse labor laws in different regions also add layers of compliance and operational complexity. For example, navigating the varying employment regulations in North America, Europe, and Asia necessitates dedicated legal and HR resources, a significant upfront cost for any new competitor.

- Global Regulatory Navigation: New entrants must master diverse international customs, trade compliance, and varying legal frameworks across multiple jurisdictions.

- Network Infrastructure Investment: Establishing a geographically extensive and technologically advanced logistics network demands substantial capital expenditure.

- Labor Law Complexity: Adhering to different labor regulations and employment standards in each operating region presents a significant compliance challenge.

- IT and Systems Integration: Implementing and integrating sophisticated tracking, management, and data systems across a global footprint is a costly and complex endeavor.

The logistics sector, especially for large-scale operators like GXO Logistics, faces a low threat from new entrants. This is primarily due to the substantial capital investment required for infrastructure, technology, and global network development. In 2024, the continuing need for advanced automation and integrated IT systems further elevates these entry barriers. New companies struggle to match the operational efficiencies and economies of scale that established players have cultivated over years.

Customer loyalty and high switching costs are significant deterrents for newcomers. Clients are often hesitant to move from established providers like GXO due to the financial and operational disruptions involved in changing systems and retraining staff. This inertia protects incumbent market share, as new entrants must offer a compelling, often lower-cost, value proposition to entice clients away from their existing, integrated logistics solutions.

Navigating complex global regulations and building extensive, compliant networks also presents a formidable challenge for potential new logistics companies. Each country's unique customs, trade laws, and labor regulations add layers of complexity and cost. For instance, GXO’s extensive global footprint in 2024, spanning numerous countries, highlights the depth of expertise and investment needed to simply operate, let alone compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for warehouses, technology, and fleets. | Significant financial hurdle to achieve scale. |

| Economies of Scale | Lower per-unit costs due to large operational volume. | New entrants struggle to match pricing and service breadth. |

| Customer Loyalty & Switching Costs | Deep client relationships and operational integration. | Difficult for new players to attract established customers. |

| Global Network Complexity | Navigating diverse regulations and building infrastructure. | Requires substantial investment and specialized knowledge. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GXO Logistics is built upon a foundation of industry-specific market research reports, company annual filings (10-K), and financial data from reputable sources like S&P Capital IQ.