GXO Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GXO Logistics Bundle

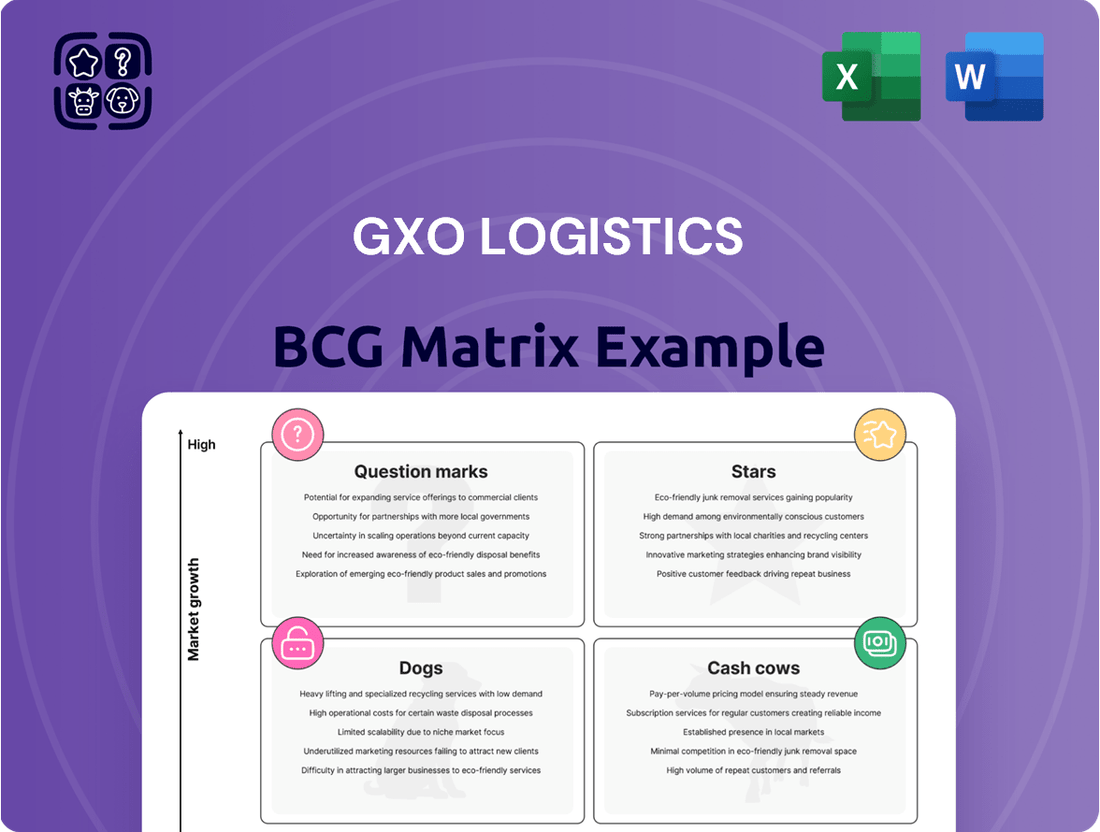

Curious about GXO Logistics' market performance? Our BCG Matrix analysis reveals their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks within their diverse portfolio. Understanding these quadrants is crucial for optimizing resource allocation and future growth. Don't miss out on the complete picture.

This preview offers a glimpse into GXO Logistics' strategic landscape, but the full BCG Matrix report provides the in-depth analysis you need to make informed decisions. Gain access to precise quadrant placements, actionable insights, and a roadmap for maximizing profitability and market share.

Unlock the full potential of your understanding of GXO Logistics by purchasing the complete BCG Matrix. It's your key to identifying high-growth opportunities and managing underperforming assets effectively, ensuring GXO Logistics stays ahead of the curve.

Stars

Automated e-commerce fulfillment represents a significant growth area for GXO Logistics. The global e-commerce market is projected to expand from $18.77 trillion in 2024 to a substantial $75.12 trillion by 2034, highlighting the immense opportunity. GXO's strategic investment in advanced automation within its fulfillment centers allows it to efficiently manage the escalating volume and intricacy of online orders, a key driver for its market position.

GXO Logistics is heavily investing in advanced robotics and AI, evident in their pilot programs with humanoid robots and automated guided vehicles. This strategic move aims to boost operational efficiency and precision in their vast network of warehouses, positioning them as a leader in a market projected to reach $200 billion by 2030.

These technological advancements are designed to reduce reliance on manual labor and mitigate associated costs, while simultaneously improving order accuracy and throughput. By embracing these innovations, GXO is not just optimizing current operations but also preparing for future demands in the rapidly growing logistics technology sector.

The explosion of e-commerce, especially noted in 2024 with continued strong growth trajectories, has amplified the challenges associated with product returns. GXO Logistics is strategically positioned to capitalize on this trend by offering advanced reverse logistics solutions. These services are designed to streamline the often-complex process of handling returned goods, making it more efficient and cost-effective for their clients.

GXO's investment in technology and specialized infrastructure for reverse logistics directly addresses a significant market demand. For instance, the e-commerce return rate in 2023 was reported to be around 16.5% in the US, a figure that necessitates robust solutions. By providing efficient processing, inspection, and disposition of returned items, GXO helps businesses reduce waste and recover value, turning a potential liability into an opportunity.

Omni-channel Logistics for Major Brands

GXO Logistics excels in omni-channel logistics, seamlessly integrating online and brick-and-mortar retail operations for major brands. This capability is crucial as consumers increasingly blend their shopping habits, demanding consistent experiences across all touchpoints.

The market for these integrated solutions is expanding at a rapid pace, positioning GXO's omni-channel logistics as a high-growth, high-share segment. For example, in 2024, GXO reported significant growth in its contract logistics segment, driven by demand from large retailers seeking to optimize their supply chains for both e-commerce and physical stores.

- High Market Demand: The increasing convergence of online and offline shopping fuels the need for unified logistics.

- GXO's Strength: GXO's expertise in managing complex, multi-channel fulfillment is a key competitive advantage.

- Growth Trajectory: This segment represents a substantial opportunity for GXO due to its high growth potential.

- Customer Base: Major brands rely on GXO to provide these integrated services, underscoring its importance.

Logistics for High-Growth Verticals (e.g., Healthcare, Aerospace)

GXO Logistics is making significant inroads into high-growth verticals like healthcare and aerospace. This strategic focus is evidenced by substantial new business, including a notable $2.5 billion health sciences contract secured in 2024. These sectors require highly specialized, compliant, and intricate logistics capabilities, areas where GXO is demonstrably strengthening its market position.

- Healthcare Logistics: GXO is investing in specialized infrastructure and compliance expertise to manage temperature-sensitive pharmaceuticals and medical devices, a market projected for robust expansion.

- Aerospace & Defense: The company is developing capabilities to handle the complex supply chains and stringent regulations inherent in the aerospace and defense industries, tapping into a sector with significant growth drivers.

- Strategic Contract Wins: The $2.5 billion health sciences contract in 2024 highlights GXO's success in capturing share within these demanding, high-potential markets.

- Value-Added Services: GXO offers tailored solutions, including reverse logistics and regulatory support, critical for clients in these specialized fields.

Stars in the BCG Matrix represent high-growth, high-market-share business segments. For GXO Logistics, automated e-commerce fulfillment and omni-channel logistics clearly fit this description, driven by strong market demand and GXO's significant investments in technology and service integration. These areas are poised for continued expansion, solidifying GXO's leadership position.

GXO's commitment to advanced automation and AI in fulfillment centers positions it strongly within the high-growth e-commerce sector. Simultaneously, its expertise in omni-channel logistics caters to the evolving needs of major retailers, blending online and physical store operations seamlessly. These strategic focuses are generating substantial growth for GXO.

| Segment | Market Growth | GXO's Market Share | Strategic Importance |

|---|---|---|---|

| Automated E-commerce Fulfillment | Very High (Global e-commerce to reach $75.12T by 2034) | High (Due to significant automation investments) | Key growth driver, efficiency enhancer |

| Omni-channel Logistics | High (Driven by consumer blending of shopping habits) | High (Expertise in integrating online/offline) | Essential for major retailers, competitive differentiator |

What is included in the product

The GXO Logistics BCG Matrix offers a framework for understanding the company's business units based on market share and growth potential.

It helps identify which segments to invest in, harvest, or divest for optimal resource allocation.

A clear BCG Matrix overview of GXO's business units simplifies strategic decisions, acting as a pain point reliever for complex portfolio management.

Cash Cows

GXO Logistics’ traditional warehousing and distribution segment operates as a robust cash cow. With a sprawling global network encompassing over 1,030 facilities and approximately 218 million square feet, these operations are the backbone of GXO's consistent revenue generation. This extensive infrastructure supports high-volume, steady demand from established industries.

These core services, often secured through long-term agreements, yield predictable and substantial cash flows. While the growth trajectory for these mature segments may be more moderate compared to newer ventures, their reliability makes them a vital source of capital for GXO. For example, in 2023, GXO reported total revenue of $9.2 billion, with a significant portion attributed to these established distribution services.

GXO Logistics' dedicated contract logistics for large enterprises represent a significant cash cow. These aren't just occasional services; they are deep, integrated partnerships that have been cultivated over years, often spanning decades.

These long-standing relationships with global giants mean GXO has a predictable and robust revenue stream. Think of it as a steady paycheck from some of the world's biggest companies that rely on GXO to manage their entire supply chains.

This stability comes from the contractual nature of these deals and GXO's proven ability to operate these complex logistics efficiently. For 2024, GXO reported that contract logistics, particularly for large enterprise clients, continued to be a cornerstone of their business, demonstrating consistent performance and strong cash generation.

GXO Logistics' cross-docking and freight consolidation services are prime examples of its Cash Cows. These mature offerings are highly efficient due to GXO's extensive network and scale, allowing for optimized transportation and significant cost reductions for clients. This operational excellence translates into stable and predictable cash flows for the company.

In 2024, GXO's commitment to these services is evident in its continued investment in technology and infrastructure to further enhance efficiency. The company's ability to consolidate shipments across its vast network not only lowers per-unit shipping costs but also minimizes transit times, a critical factor for many of its customers. This consistent performance underpins the Cash Cow status of these operations.

Managed Transportation Services

Managed transportation services represent a core strength for GXO Logistics, functioning as a significant cash cow within their BCG Matrix. GXO excels at offering comprehensive transportation management, utilizing its extensive scale and well-established network to streamline routes and select the most efficient carriers for its clients.

This established service is vital, delivering steady revenue and robust profit margins by maximizing the efficiency of current logistics infrastructure, even if its growth rate isn't exceptionally high. For instance, GXO's commitment to optimizing logistics was evident in 2023, where they reported managing over 11 million shipments.

- Consistent Revenue Generation: The demand for efficient logistics solutions remains strong, allowing GXO to generate reliable income from its managed transportation offerings.

- Strong Profit Margins: By leveraging its scale and expertise, GXO can achieve healthy margins through route optimization and carrier negotiation.

- Network Optimization: GXO's extensive network allows for significant cost savings and service improvements for clients.

- Established Market Position: This service is a foundational element of GXO's business, benefiting from long-term client relationships and proven operational capabilities.

Established Value-Added Services

Established value-added services, like kitting and co-packing, are steady contributors to GXO Logistics' profitability. These services, often integrated into existing warehouse operations, benefit from GXO's strong infrastructure and operational know-how. This allows for reliable cash flow from mature service offerings.

For instance, GXO's 2023 revenue reached $9.06 billion, with a significant portion likely stemming from these foundational services. The company's focus on operational efficiency in these areas ensures consistent, albeit not rapid, growth. This stability makes them a reliable 'cash cow' within their portfolio.

- Steady Profit Margins: Standardized services maintain consistent profitability.

- Leveraging Infrastructure: Existing warehouses enhance efficiency and reduce costs.

- Operational Expertise: GXO's experience ensures high-quality service delivery.

- Reliable Cash Flow: Mature service lines provide predictable revenue streams.

GXO Logistics' core warehousing and distribution services, along with dedicated contract logistics for large enterprises, are firmly established cash cows. These mature operations benefit from a vast global network and long-term client relationships, ensuring consistent revenue generation. Their stability is further bolstered by strong profit margins derived from operational expertise and scale.

| Service Area | BCG Category | Key Characteristics | 2023 Revenue (Approx.) | 2024 Outlook |

|---|---|---|---|---|

| Warehousing & Distribution | Cash Cow | Extensive global network, high-volume demand, predictable cash flows | $9.2 Billion (Total Revenue) | Continued stability and steady contribution |

| Dedicated Contract Logistics | Cash Cow | Long-term partnerships, deep integration, robust revenue stream | Significant portion of total revenue | Cornerstone of business, consistent performance |

| Cross-docking & Freight Consolidation | Cash Cow | Highly efficient, cost reduction for clients, stable cash flows | Integral to overall performance | Continued investment in efficiency |

| Managed Transportation | Cash Cow | Extensive scale, network optimization, strong profit margins | Managing over 11 million shipments (2023) | Maximizing efficiency and delivering steady revenue |

| Value-Added Services (Kitting, Co-packing) | Cash Cow | Leverages existing infrastructure, operational know-how, reliable cash flow | Significant portion of total revenue | Consistent, albeit not rapid, growth |

Full Transparency, Always

GXO Logistics BCG Matrix

The BCG Matrix for GXO Logistics you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This preview showcases the complete analysis, offering a clear strategic overview without any watermarks or demo content, ready for your immediate use.

Dogs

While GXO Logistics is a leader in automating warehouse operations, certain legacy manual processes might still exist in highly commoditized sectors. These operations, often characterized by lower market share and limited growth prospects, can be seen as the company's Dogs in the BCG matrix.

These segments, despite their manual nature, contributed to GXO's revenue in 2023, though their profitability is likely constrained by lower margins. For instance, if these manual operations are in regions experiencing slower economic growth, their contribution to GXO’s overall 2.8% revenue growth in 2023 would be minimal, potentially tying up resources without substantial returns.

Niche, non-integrated consulting services within GXO Logistics' portfolio might represent its Dogs. These are often small-scale operations, fragmented, and don't fully utilize GXO's core technological advantages or its vast operational scale. For instance, a consulting arm focused solely on optimizing local last-mile delivery for a single city, without integrating with GXO's broader network or advanced analytics platforms, fits this description. This segment may struggle to achieve significant market share or profitability, potentially leading GXO to de-emphasize or seek closer integration with its main business lines.

Highly commoditized regional transport without scale represents a challenge for GXO Logistics. These operations, often characterized by basic trucking services, face intense competition from numerous smaller, regional players. GXO's global scale and advanced technology may not offer a distinct advantage in these localized markets, leading to potentially lower profit margins and limited growth prospects.

In 2024, the less-than-truckload (LTL) segment, a common area for regional transport, saw freight volumes fluctuate. While overall demand remained, the highly fragmented nature of regional LTL providers means GXO might struggle to achieve significant differentiation or pricing power against these specialized competitors. This segment often operates on thin margins, with profitability heavily reliant on operational efficiency and density, which can be difficult to achieve without substantial regional scale.

Small, Non-Strategic Acquisitions or Client Contracts

Small, non-strategic acquisitions or client contracts represent potential Dogs in GXO Logistics' BCG Matrix. These are typically smaller deals or contracts that don't significantly contribute to GXO's core strategy of leveraging technology, automation, and focusing on high-growth sectors.

These entities may lack substantial market share or consistent profitability. For example, while GXO pursued a strategic acquisition of Wincanton in 2024, valued at approximately £1.25 billion, smaller, tangential deals that don't bolster this strategic direction could be classified as Dogs.

- Low Growth Potential: These acquisitions or contracts operate in mature or declining markets with limited opportunities for expansion.

- Suboptimal Profitability: They may generate low profit margins or even incur losses, failing to justify the resources invested.

- Strategic Misalignment: They do not align with GXO's stated objectives of enhancing technological capabilities or expanding into rapidly growing industry verticals.

- Resource Drain: Managing these smaller, underperforming assets can divert management attention and capital from more promising strategic initiatives.

Outdated or Low-Demand Specialized Logistics

Outdated or low-demand specialized logistics services are likely to be considered Dogs for GXO Logistics. These could include offerings for industries experiencing significant decline, such as certain types of print media distribution or legacy manufacturing equipment transport, where demand is shrinking.

These segments would struggle to grow and may even see a contraction in revenue. For instance, a specialized service catering to the obsolete floppy disk manufacturing sector would certainly fall into this category, with minimal to no market opportunity.

GXO's focus would be on either divesting these low-performing units or finding ways to phase them out efficiently, minimizing any associated losses.

- Declining Industry Support: Services tied to industries like traditional retail logistics for brick-and-mortar stores facing e-commerce disruption.

- Technological Obsolescence: Logistics solutions for outdated technologies that have been replaced by more efficient digital or automated systems.

- Low Market Share & Growth: These segments are characterized by a small and shrinking market share, with little to no potential for future growth.

- Profitability Challenges: Often, these services are unprofitable or barely break even due to low volume and high operational costs per unit.

Within GXO Logistics' portfolio, operations in highly commoditized, low-growth sectors, particularly those with limited automation or scale, can be categorized as Dogs. These segments, while contributing to overall revenue, often exhibit constrained profitability and minimal strategic advantage.

For example, niche regional transport services without significant density or technological integration represent potential Dogs. In 2024, the less-than-truckload (LTL) market, known for its fragmentation, illustrates this challenge, where GXO might face intense competition from smaller, specialized players, impacting margins.

These underperforming units, such as certain legacy manual warehousing processes or small, non-strategic acquisitions, might tie up resources without yielding substantial returns, a situation GXO aims to mitigate by focusing on efficiency and strategic alignment.

The following table illustrates potential Dog segments within GXO Logistics, considering their market characteristics and GXO's strategic focus:

| Segment Example | Market Growth Potential | GXO's Strategic Fit | Profitability Outlook |

|---|---|---|---|

| Niche Regional Transport (Low Density) | Low | Limited leverage of global scale/tech | Constrained margins, high competition |

| Legacy Manual Warehousing (Commoditized) | Low | Lower automation potential | Lower profit margins, resource intensive |

| Non-Strategic Small Acquisitions | Varies, often low | Lack of synergy with core strategy | Suboptimal returns, potential drain |

| Outdated Specialized Logistics | Declining | Mismatched with evolving market needs | Unprofitable, low volume |

Question Marks

GXO Logistics is strategically investing in Robotics-as-a-Service (RaaS) and advanced automation, including humanoid robots, through research and development partnerships. This focus on emerging technologies positions GXO to capture significant growth in a market with substantial potential, though broader market share for these specific advanced solutions is still being built.

The expansion into RaaS, particularly with humanoid robots, represents a considerable investment for GXO. Successful widespread adoption of these advanced automation solutions could elevate them to a Star category within the BCG matrix, signifying high growth and market leadership.

In 2024, the global RaaS market was projected to reach approximately $3.5 billion, with expectations of robust compound annual growth rates in the coming years. GXO's participation in this burgeoning sector underscores its commitment to innovation and capturing future market share.

GXO Logistics is actively pursuing opportunities in emerging green industries, offering specialized logistics for sectors like renewable energy infrastructure and circular economy initiatives. These are considered high-growth markets where GXO is developing critical expertise and forging valuable client relationships. For instance, the global green energy market alone was projected to reach over $1.5 trillion by 2024, highlighting the significant potential.

While these emerging sectors present substantial growth prospects, GXO's current market share within these very specific niches may still be relatively modest. The company is strategically positioning itself to capture a larger portion of this expanding market by tailoring its services to the unique demands of these environmentally focused industries. This often involves complex transportation, storage, and reverse logistics for specialized components and materials.

GXO Logistics' expansion into emerging, high-growth international markets, like its intensified presence in Germany post-Clipper Logistics acquisition, positions these ventures as Question Marks in their BCG Matrix. These regions present substantial growth opportunities, but GXO is a relatively new player, necessitating significant capital infusion to establish a strong foothold and gain market share.

In 2024, GXO's German operations, bolstered by the Clipper acquisition completed in 2023, are a prime example of this Question Mark strategy. While specific growth figures for Germany in 2024 are still emerging, the acquisition itself represented a significant investment aimed at tapping into a key European market with strong e-commerce and industrial logistics demand.

The potential for these new geographic markets is high, driven by increasing outsourcing trends in logistics and the growth of e-commerce. GXO’s strategy here involves careful market analysis and targeted investments to build brand recognition and operational capabilities, aiming to transform these Question Marks into future Stars.

AI-Powered Predictive Analytics and Supply Chain Orchestration

GXO Logistics' investment in AI-powered predictive analytics and supply chain orchestration places it in a high-growth, albeit nascent, market segment. This advanced capability aims to provide unparalleled end-to-end visibility and foresight, allowing for more agile and efficient supply chain management. The potential for dominant market share is significant as businesses increasingly recognize the value of data-driven decision-making.

While still in the development and early adoption phase, these AI solutions represent a strategic move for GXO to differentiate itself. The market for such sophisticated tools is expanding rapidly, with projections indicating continued strong growth in the coming years. GXO's commitment here positions it to capture a significant portion of this evolving landscape.

- Market Potential: The global supply chain analytics market was valued at approximately $5.3 billion in 2023 and is projected to reach over $13.5 billion by 2028, growing at a CAGR of around 20.5%.

- GXO's Strategy: GXO is actively developing and integrating AI for predictive analytics and orchestration to enhance its service offerings, aiming for superior operational efficiency and customer value.

- Adoption Curve: Widespread adoption of these advanced AI tools is still underway, with many companies in the early stages of implementation, presenting an opportunity for early movers like GXO to establish leadership.

- Competitive Landscape: The field is competitive, with many technology providers and logistics firms investing in similar capabilities, making market share acquisition a key focus for GXO.

Specialized Last-Mile Delivery Innovations

GXO Logistics is exploring specialized last-mile delivery innovations, a potential star in its BCG matrix. These ventures, often tech-driven, target niche markets with high growth potential, moving beyond their core contract logistics. For instance, GXO's investment in autonomous delivery solutions or advanced route optimization software for complex urban environments could represent these emerging areas.

The company is actively testing these waters, aiming to build a strong market presence in these specialized segments. In 2024, the global last-mile delivery market was valued at approximately $220 billion and is projected to grow significantly. GXO's focus on innovation here could capture a substantial share of this expanding market.

- Autonomous Delivery: Testing drones and self-driving vehicles for faster, more efficient deliveries.

- Urban Consolidation Centers: Establishing hubs to streamline deliveries in congested city centers.

- Tech-Enabled Fleet Management: Implementing AI for predictive maintenance and dynamic routing.

- E-commerce Specialization: Developing tailored solutions for the unique demands of online retail last-mile.

GXO Logistics' expansion into new geographic markets, such as Germany following the Clipper Logistics acquisition, highlights key Question Mark investments. These markets offer substantial growth potential, but GXO is still establishing its presence, requiring significant capital to build market share.

In 2024, GXO's German operations are a prime example, representing a strategic play in a major European logistics hub. The success of these ventures hinges on GXO's ability to gain traction against established players and capitalize on increasing e-commerce and industrial logistics demand.

The company is actively analyzing these markets and making targeted investments to build brand recognition and operational capabilities. The aim is to nurture these Question Marks into future Stars, leveraging their inherent growth prospects.

BCG Matrix Data Sources

Our GXO Logistics BCG Matrix draws from a robust blend of internal financial disclosures, competitor market share data, and industry growth forecasts. This comprehensive approach ensures accurate strategic positioning.