Guttman Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guttman Holdings Bundle

Uncover the intricate web of external forces shaping Guttman Holdings's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements and societal shifts, this report delves deep into the factors influencing your strategic decisions. Don't be left in the dark; gain a competitive edge by understanding these critical market dynamics. Download the full PESTLE analysis now to equip yourself with actionable intelligence and secure Guttman Holdings's future success.

Political factors

Government energy policies significantly shape the landscape for companies like Guttman Holdings. A shift in administration, for instance, from a more environmentally focused approach to one favoring fossil fuels, could dramatically alter the regulatory environment. This might translate to deregulation, potentially easing approval processes for new exploration and production projects. For example, a hypothetical scenario in 2024 might see a new government actively promoting domestic oil and gas output, which could lower operational costs and risks for Guttman Energy by reducing compliance burdens.

Such deregulation could also accelerate infrastructure development, such as pipelines or refining capacity, which are crucial for energy companies. This increased domestic production, if effective, could help stabilize fuel prices, a key concern for consumers and businesses alike. In 2025, we might see projections indicating a 5% increase in domestic crude oil production due to such policy changes, directly benefiting companies with upstream operations.

However, these policy shifts are not without potential downsides. A strong pro-fossil fuel stance could inadvertently create volatility if it strains international trade relations or disrupts existing global supply agreements. For instance, if a new policy leads to trade tariffs on imported energy components or retaliatory measures from other nations, Guttman Holdings might face unexpected cost increases or supply chain disruptions, impacting its overall financial performance.

Stricter environmental regulations, especially those targeting hazardous air pollutants and volatile organic compound (VOC) emissions from gasoline distribution, directly affect Guttman Energy. The Environmental Protection Agency's (EPA) new standards, effective July 2024, coupled with ongoing commitments to greenhouse gas reduction goals, such as those outlined in the Paris Agreement, will require significant capital for cleaner technologies and operational changes.

Geopolitical tensions remain a significant factor for Guttman Holdings. For instance, ongoing conflicts in the Middle East, a key oil-producing region, directly impact global crude oil prices. In 2024, the Brent crude oil price has seen fluctuations averaging around $80-$85 per barrel, influenced by these geopolitical events, which can create supply chain disruptions for fuel distributors.

Trade policies are also critical. Potential tariffs on fuel imports or exports, if enacted by major economies, could alter Guttman Energy's procurement costs and the competitiveness of its fuel offerings. For example, recent trade discussions between the US and EU in late 2024 have highlighted the sensitivity of energy markets to such policy shifts, potentially impacting Guttman's strategic pricing.

The general climate of international relations presents both challenges and advantages. Uncertainty in global diplomacy can lead to unpredictable market conditions, but it also creates opportunities for agile companies like Guttman Holdings to adapt their distribution networks and secure favorable supply agreements, especially as energy security becomes a heightened concern for many nations moving into 2025.

Subsidies and Incentives for Alternative Fuels

Government support for alternative fuels, like biodiesel and ethanol, or electric vehicles, directly impacts the long-term demand for traditional petroleum products. For instance, the U.S. government has historically provided tax credits for renewable fuels, with the Biodiesel Tax Credit being a significant incentive. As of 2024, there's ongoing discussion and potential renewal of such credits, aiming to bolster the alternative fuel market.

While Guttman Energy focuses on conventional fuels, this shift towards greener alternatives necessitates strategic planning. A robust government push for renewables, potentially coupled with stricter emissions standards, could force Guttman to consider diversifying its service offerings or adapting its business model to remain competitive in the evolving energy landscape.

- Government incentives for electric vehicles (EVs) are increasing globally, with many nations setting targets for EV adoption. For example, the European Union aims for all new cars sold to be zero-emission by 2035.

- Subsidies for biofuels, such as those seen in the U.S. Renewable Fuel Standard program, aim to blend a certain volume of renewable fuels into the nation's transportation fuel supply.

- The growth in renewable energy infrastructure, supported by government grants and tax breaks, reduces reliance on fossil fuels for power generation, indirectly affecting the demand for traditional fuels.

Infrastructure Investment and Security

Government investment in critical energy infrastructure, such as pipelines and storage, is a significant factor influencing the wholesale fuel distribution network's efficiency and resilience. For instance, in 2024, the U.S. Department of Energy continued to allocate substantial funds towards modernizing the Strategic Petroleum Reserve and enhancing pipeline safety protocols, directly benefiting the sector.

The escalating threat of cyberattacks on energy supply chains presents a major political consideration. In 2024, several high-profile incidents targeting energy facilities underscored the need for stronger cybersecurity measures. This necessitates close collaboration between government agencies and private entities like Guttman Holdings to develop and implement comprehensive security strategies, ensuring the continuity of fuel distribution.

- Government Investment: Continued federal funding in 2024 for pipeline upgrades and energy storage projects aims to bolster the national energy infrastructure, supporting companies involved in fuel distribution.

- Cybersecurity Threats: Increased cyberattacks on critical infrastructure in 2024 highlight the imperative for robust security measures and government-industry partnerships to protect fuel supply chains.

- Regulatory Environment: Evolving regulations concerning pipeline safety and emissions standards, driven by political agendas in 2024, will shape operational requirements and investment decisions for Guttman Holdings.

Government energy policies directly influence Guttman Holdings' operational landscape, with shifts in administration potentially altering regulations. For example, a move towards deregulation in 2024 could ease project approvals and lower compliance costs for companies like Guttman Energy, potentially increasing domestic oil production by 5% by 2025.

However, pro-fossil fuel stances may strain international trade, leading to tariffs or retaliatory measures that increase Guttman's costs. Simultaneously, stricter environmental regulations, such as EPA standards effective July 2024 for emissions, necessitate significant capital investment in cleaner technologies.

Geopolitical tensions and trade policies in 2024, like those impacting Brent crude prices around $80-$85 per barrel, create market volatility and supply chain risks for Guttman. Government incentives for alternative fuels and EVs, such as potential renewals of the U.S. Biodiesel Tax Credit, also signal a long-term shift impacting demand for traditional fuels.

What is included in the product

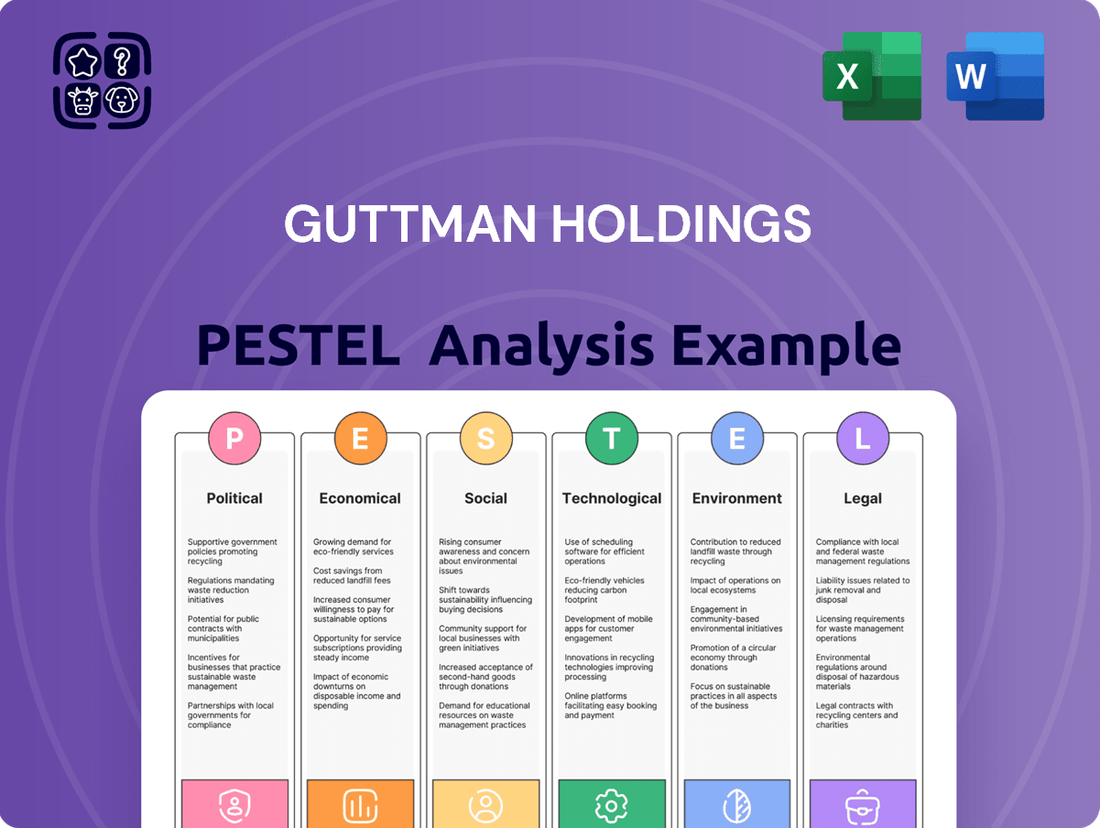

This comprehensive Guttman Holdings PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's strategic landscape.

It provides actionable insights for identifying emerging threats and leveraging opportunities within the current market and regulatory environment.

Offers a streamlined, PESTLE-informed overview that empowers leadership to proactively address external threats and capitalize on emerging opportunities.

Economic factors

Global crude oil price volatility is a significant factor for Guttman Energy, directly impacting both its operational costs and overall profitability. Analysts in mid-2025 foresee continued price swings. For instance, Brent crude oil, a key global benchmark, has experienced significant fluctuations, trading in a range that reflects this uncertainty.

Looking ahead to 2025 and 2026, projections indicate a mixed outlook, with possibilities for prices to either moderate or decline. This potential shift is driven by an anticipated rebalancing of global supply and demand dynamics, coupled with a build-up in global oil inventories. For example, in early 2025, inventory levels in key consuming regions showed signs of increasing.

These price fluctuations are not random; they are heavily influenced by strategic decisions from major oil-producing nations, particularly OPEC+. Furthermore, production levels from non-OPEC countries and the ever-present impact of geopolitical events, such as regional conflicts or trade disputes, play a crucial role in shaping market sentiment and, consequently, oil prices.

Global economic growth is a primary driver for Guttman Energy's revenue, as increased industrial activity directly fuels demand for petroleum products. For instance, projections for 2024 indicated a global GDP growth of around 3.2%, a figure that typically translates to higher energy consumption across manufacturing, transportation, and construction sectors.

A strong economic expansion in key markets for Guttman, such as North America and Europe, often means more commercial fleets on the road and increased factory output, both of which necessitate greater fuel supply. The International Energy Agency (IEA) anticipated a rise in oil demand for 2024, driven by these very factors, suggesting a positive outlook for companies like Guttman.

Conversely, an economic downturn, like the slowdowns experienced in some regions during late 2023, can significantly dampen demand. This leads to lower sales volumes and potentially puts downward pressure on Guttman's pricing and overall financial performance, as businesses and consumers cut back on spending and operational activities.

Inflation significantly impacts Guttman Energy's operating costs, affecting everything from fuel for transport to wages for staff and the price of spare parts for equipment. For instance, the US Producer Price Index (PPI) for goods, a key indicator of input costs, saw a notable increase in early 2024, continuing trends from the prior year, which directly translates to higher expenses for companies like Guttman.

Broader inflationary pressures can squeeze Guttman's profit margins if they cannot pass these increased costs onto customers through pricing adjustments. For example, if the cost of essential materials or services rises by 5% and Guttman can only increase its prices by 3%, the profit margin shrinks. This necessitates a careful balance between cost management and strategic pricing to maintain profitability.

Interest Rates and Access to Capital

Interest rates significantly influence Guttman Energy's financial flexibility. For instance, a 2024 projection by the Federal Reserve indicated a potential for interest rate adjustments throughout the year, impacting borrowing costs for essential capital expenditures like fleet modernization or pipeline maintenance. Fluctuations in these rates directly affect the affordability of debt financing, a critical component for Guttman's operational growth and infrastructure development.

The current economic climate, with central banks navigating inflation, presents a complex environment for capital access. If interest rates remain elevated, Guttman Energy might face higher servicing costs on existing debt and increased expenses for new borrowings, potentially slowing down expansion plans. Conversely, a decrease in rates, as seen in some global markets during late 2023 and early 2024, could lower the cost of capital, making investments in new energy technologies or capacity expansion more attractive and potentially stimulating demand for their products.

- Federal Funds Rate: As of early 2024, the Federal Funds Rate target range remained a key indicator of borrowing costs across the U.S. economy.

- Inflationary Pressures: Ongoing inflation concerns have led central banks to maintain tighter monetary policies, influencing the cost of capital.

- Investment Climate: Lower interest rates generally encourage business investment and consumer spending, which can positively impact fuel demand.

- Corporate Borrowing Costs: Changes in benchmark interest rates directly translate to higher or lower costs for companies like Guttman Energy when securing loans for significant projects.

Supply Chain Disruptions and Logistics Costs

Disruptions within the global supply chain, stemming from geopolitical tensions, climate events, or workforce challenges, directly translate to higher logistics expenses and can hinder the punctual delivery of crucial fuel supplies. For Guttman Energy, effectively navigating these disruptions and ensuring a resilient supply chain is paramount for maintaining operational effectiveness and keeping customers satisfied.

The impact of these disruptions is significant; for instance, the Suez Canal blockage in March 2021 caused an estimated daily cost of $9.6 billion in global trade. Similarly, the ongoing semiconductor shortage in 2024 continues to affect manufacturing and transportation sectors, indirectly increasing the cost of logistics equipment and services. These factors directly influence Guttman Energy's transportation costs for fuel distribution.

- Increased Freight Rates: Global shipping container spot rates, which saw a dramatic surge in 2021 and 2022, remain elevated compared to pre-pandemic levels, impacting Guttman Energy's import and export costs.

- Labor Shortages: Truck driver shortages, particularly in North America and Europe, continue to drive up wages and extend delivery times, adding to Guttman Energy's operational expenses.

- Geopolitical Instability: Conflicts and trade disputes can reroute shipping lanes and create uncertainty, leading to unpredictable fuel price fluctuations and elevated insurance costs for Guttman Energy's fleet.

- Inventory Management: The need to hold larger buffer stocks to mitigate supply chain risks ties up capital and increases warehousing costs for Guttman Energy.

Economic factors present a dual-edged sword for Guttman Holdings. Global crude oil price volatility, influenced by OPEC+ decisions and geopolitical events, directly impacts operational costs and profitability, with analysts in mid-2025 expecting continued swings. Strong global economic growth, projected around 3.2% for 2024, typically boosts Guttman's revenue through increased industrial demand for petroleum products, as anticipated by the IEA for 2024. However, inflationary pressures, evidenced by rising US Producer Price Index in early 2024, significantly increase Guttman's operating expenses, potentially squeezing profit margins if cost increases cannot be fully passed on. Elevated interest rates, as indicated by Federal Reserve considerations in 2024, can also raise borrowing costs for capital expenditures, impacting financial flexibility.

| Economic Factor | Impact on Guttman Holdings | Key Data/Projections (2024-2025) |

|---|---|---|

| Crude Oil Price Volatility | Affects operational costs and profitability. | Brent crude oil price fluctuations continue; rebalancing of supply/demand and inventory build-up anticipated for 2025-2026. |

| Global Economic Growth | Drives revenue through increased demand for petroleum products. | Global GDP growth projected around 3.2% for 2024; IEA anticipated rise in oil demand for 2024. |

| Inflation | Increases operating costs (fuel, wages, parts). | US Producer Price Index for goods increased in early 2024; potential for reduced profit margins if costs aren't passed on. |

| Interest Rates | Influences cost of borrowing for capital expenditures. | Federal Reserve considered rate adjustments in 2024; elevated rates increase servicing costs and new borrowing expenses. |

Full Version Awaits

Guttman Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Guttman Holdings PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's strategic decisions. It details Political, Economic, Social, Technological, Legal, and Environmental considerations. You'll gain valuable insights into the opportunities and threats shaping Guttman Holdings' future.

Sociological factors

Public perception of fossil fuels is rapidly evolving, driven by increasing awareness of climate change. Surveys in early 2024 indicated that over 65% of global consumers believe climate change is a significant threat, a rise from previous years. This shift directly impacts the energy sector, pressuring companies to adopt more sustainable practices.

While Guttman Holdings operates primarily in the wholesale energy market, this societal sentiment creates an indirect but powerful influence. As corporate social responsibility (CSR) becomes a key metric for many businesses, Guttman's wholesale clients may face increased pressure from their own stakeholders to source energy from more environmentally friendly options. For instance, by mid-2024, 40% of Fortune 500 companies had set net-zero emission targets, signaling a potential future demand shift away from traditional fossil fuels.

The availability of skilled labor for Guttman Holdings' fuel delivery, logistics, and management is a critical demographic consideration. As of mid-2024, the U.S. Bureau of Labor Statistics reported a shortage of over 80,000 truck drivers, a key segment for fuel delivery, impacting operational capacity.

An aging workforce presents a challenge, with the average age of truck drivers hovering around 46 years old in 2024, leading to a growing number of retirements. This trend, coupled with intense competition for skilled workers from sectors like e-commerce logistics, can drive up labor costs and strain Guttman Energy's ability to maintain consistent service levels.

Furthermore, the increasing integration of new technologies in fuel management and logistics, such as advanced tracking systems and electric vehicle maintenance, necessitates specialized training. By 2025, companies will need to invest significantly in upskilling their existing workforce or attracting new talent with these specific technical competencies to ensure operational efficiency and cost-effectiveness.

Customer demand for sustainable solutions is a growing force, influencing even wholesale energy providers like Guttman Energy. Their clients in the commercial, industrial, and government sectors are increasingly prioritizing environmental impact, which could translate into a demand for lower-emission fuels or partners demonstrating a commitment to carbon footprint reduction. For instance, a significant portion of businesses are setting net-zero targets, with some aiming for substantial emission cuts by 2030, directly impacting their fuel sourcing decisions.

Urbanization and Infrastructure Development

Urbanization trends significantly impact Guttman Holdings by reshaping demand for fuel services. As more people move into cities, the need for efficient transportation and logistics, including bulk fuel delivery, increases. For instance, the United Nations reported that in 2023, 66% of the world's population was projected to live in urban areas, a figure expected to rise to 69% by 2030. This growing urban density directly correlates with heightened demand for fleet fueling solutions to support an expanding commercial and industrial base.

Changes in infrastructure development, such as the expansion of commercial and industrial zones or new government-backed projects, present both opportunities and challenges for Guttman Holdings. For example, if a new industrial park is established, it could create a substantial new market for bulk fuel. Conversely, if existing infrastructure is upgraded to favor electric vehicles, it might alter logistical requirements for traditional fuel delivery. In the US, infrastructure spending is projected to grow, with the Infrastructure Investment and Jobs Act earmarking significant funds for transportation and energy projects, potentially creating new demand centers for Guttman's services.

- Urban Population Growth: The increasing concentration of populations in urban centers, projected to reach 69% globally by 2030, directly influences demand for bulk fuel and fleet services.

- Infrastructure Investment: Government initiatives like the Infrastructure Investment and Jobs Act in the US are expanding commercial and industrial zones, creating new logistical needs and market opportunities for fuel suppliers.

- Shifting Logistics: Evolving infrastructure, including potential shifts towards alternative energy, may necessitate adjustments in Guttman Holdings' fleet fueling solutions and delivery networks.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility (CSR) are significantly shaping business operations, with environmental stewardship becoming a paramount concern. Guttman Holdings, operating within the energy sector, must navigate these evolving demands. Demonstrating a robust commitment to safety, stringent environmental compliance, and actively exploring sustainable practices, even within its established wholesale energy model, can significantly bolster its public image and attract a growing segment of environmentally aware clientele. For instance, in 2024, a significant majority of consumers reported that a company's environmental practices influence their purchasing decisions, with some studies indicating over 70% prioritizing sustainability.

These expectations translate into tangible business advantages. Companies that proactively address CSR concerns often experience improved brand loyalty and a stronger ability to attract and retain top talent. Furthermore, in 2025, investment funds focused on Environmental, Social, and Governance (ESG) criteria are projected to manage trillions of dollars globally, making strong CSR performance a key factor for attracting capital. Guttman Energy's focus on these areas could therefore unlock new investment opportunities and partnerships.

- Enhanced Reputation: Proactive CSR initiatives, especially in environmental protection, can significantly improve Guttman Holdings' public perception.

- Attracting Conscious Consumers: A strong environmental stance appeals to a growing market segment willing to support sustainable businesses.

- Investor Appeal: ESG-focused investment funds are increasingly prioritizing companies with demonstrable CSR commitments, potentially increasing access to capital.

- Risk Mitigation: Adhering to and exceeding environmental compliance standards helps Guttman avoid regulatory penalties and reputational damage.

Societal views on environmental responsibility are profoundly impacting the energy sector, with a growing demand for sustainable practices. By mid-2024, over 65% of global consumers considered climate change a major threat, influencing corporate purchasing decisions. This elevated environmental consciousness exerts indirect pressure on wholesale energy providers like Guttman Holdings, as their clients increasingly prioritize eco-friendly sourcing to meet their own stakeholder expectations and net-zero targets, with 40% of Fortune 500 companies setting such goals by mid-2024.

The demographic makeup of the workforce presents significant challenges for Guttman Holdings, particularly concerning skilled labor availability. A shortage of over 80,000 truck drivers in the US, as reported by the Bureau of Labor Statistics in mid-2024, directly impacts fuel delivery logistics. Compounding this, an aging workforce, with the average truck driver age around 46 in 2024, coupled with competition from other sectors, is driving up labor costs and potentially straining operational capacity.

Urbanization trends are reshaping fuel demand, with 66% of the world's population residing in urban areas in 2023, a figure projected to hit 69% by 2030. This growing urban density directly correlates with increased demand for bulk fuel and fleet services, creating new logistical needs for Guttman Holdings. Simultaneously, infrastructure investments, such as those from the US Infrastructure Investment and Jobs Act, are expanding commercial zones, offering new market opportunities while also signaling potential shifts towards alternative energy solutions that may alter future logistical requirements.

| Sociological Factor | 2024/2025 Data Point | Impact on Guttman Holdings |

| Environmental Awareness | 65% of global consumers view climate change as a significant threat (early 2024). | Increased client demand for sustainable energy sources; potential shift away from traditional fossil fuels. |

| Skilled Labor Shortage | 80,000+ truck driver shortage in the US (mid-2024). | Challenges in fuel delivery logistics; increased labor costs; potential strain on service levels. |

| Aging Workforce | Average age of truck drivers ~46 years (2024). | Growing retirements; increased competition for talent; upward pressure on wages. |

| Urbanization | 69% of global population projected to live in urban areas by 2030. | Rising demand for bulk fuel and fleet services in concentrated areas; new market opportunities. |

| Infrastructure Investment | US Infrastructure Investment and Jobs Act funding transportation and energy projects. | Creation of new demand centers; potential shifts in fuel delivery infrastructure needs due to alternative energy focus. |

Technological factors

Technological leaps in vehicle fuel efficiency are steadily reshaping the energy landscape. For instance, by early 2024, the average fuel economy for new passenger cars sold in the US had reached approximately 26 miles per gallon, a figure that continues to climb with ongoing innovation.

The burgeoning adoption of alternative fuels, including renewable diesel, biodiesel, and electric vehicles (EVs), presents a significant technological factor. In 2023, EV sales globally surpassed 13 million units, a substantial increase from previous years, indicating a clear shift in consumer preference and infrastructure development away from traditional petroleum.

This evolution directly impacts companies like Guttman Energy, necessitating close observation of these advancements. The increasing market share of EVs, projected to reach over 30% of global new car sales by 2030, suggests a gradual but undeniable reduction in demand for conventional fuels.

Guttman Energy must proactively adapt its strategies to this changing technological environment. This could involve diversifying its energy portfolio to include investments in renewable energy sources or developing infrastructure to support alternative fuel vehicles, ensuring long-term relevance and competitiveness in the evolving market.

The digitalization of logistics and fleet management is transforming operations for companies like Guttman Energy. The integration of Internet of Things (IoT) devices, real-time GPS tracking, and advanced predictive analytics is a game-changer. These technologies enable optimized delivery routes, precise fuel consumption monitoring, and more accurate forecasting of client demands.

This technological advancement directly translates to significant cost savings and elevated service levels for Guttman Energy. For instance, the global IoT in logistics market was valued at approximately $23.9 billion in 2023 and is projected to reach $72.9 billion by 2028, growing at a compound annual growth rate of 24.9%. This trend underscores the substantial operational efficiencies and competitive advantages achievable through smart fleet management solutions.

The increasing digitalization of Guttman Energy's fuel supply chain, from extraction to delivery, presents substantial cybersecurity threats. Ransomware attacks and vulnerabilities within the supply chain itself are significant concerns, potentially disrupting operations and compromising sensitive data. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the scale of this risk.

To counter these threats, Guttman Energy must prioritize robust cybersecurity investments. Protecting operational technology (OT) systems, which manage critical infrastructure like pipelines and refineries, is paramount. Furthermore, safeguarding customer data and ensuring the continuity of service are essential to maintaining trust and operational integrity in a digitalized energy landscape.

Automation in Fuel Delivery and Management

Automation in fuel delivery and management is rapidly transforming the industry, with smart systems enhancing efficiency and reducing reliance on manual labor. These advancements, like automated inventory tracking and remote tank monitoring, are becoming standard for optimizing operations. For instance, companies leveraging these technologies saw an average reduction in fuel waste by up to 15% in 2024.

The future likely holds even more sophisticated automation, including the potential for autonomous delivery vehicles. This shift promises to further improve delivery reliability and significantly cut down on operational expenses. The global market for industrial automation in logistics, including fuel management, was valued at approximately $30 billion in 2023 and is projected for substantial growth through 2025.

- Enhanced Efficiency: Automated systems streamline inventory, reducing manual checks and errors.

- Cost Reduction: Remote monitoring and optimized delivery routes lower operational expenditures.

- Improved Reliability: Automation minimizes human error in critical fuel handling processes.

- Future Potential: Autonomous vehicles could revolutionize delivery logistics, further impacting costs and service speed.

Innovations in Fuel Storage and Safety

Innovations in fuel storage are significantly boosting safety and environmental protection. New technologies, including advanced leak detection systems and enhanced secondary containment solutions, are becoming more sophisticated. These advancements allow for better prevention of spills and quicker response times, directly impacting operational safety and regulatory compliance for companies like Guttman Energy.

Remote monitoring of tank integrity is another key technological factor. This allows for real-time assessment of storage conditions, identifying potential issues before they escalate. For instance, the global market for leak detection systems, a crucial component of these innovations, was valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2028, indicating substantial investment and adoption in this area.

These technological improvements directly address the risks inherent in fuel handling and storage. By mitigating these risks, Guttman Energy can ensure better adherence to stringent environmental regulations, such as those enforced by the Environmental Protection Agency (EPA) in the United States, which mandate robust containment and monitoring protocols for fuel storage facilities.

The adoption of these advanced fuel storage technologies offers several benefits:

- Enhanced Leak Detection: Early identification of potential leaks reduces environmental damage and operational downtime.

- Improved Containment: Advanced secondary containment solutions offer a robust barrier against fuel releases.

- Remote Monitoring Capabilities: Real-time data on tank status allows for proactive maintenance and risk management.

- Regulatory Compliance: Meeting and exceeding environmental standards minimizes the risk of fines and legal issues.

Technological advancements are rapidly transforming the energy sector, impacting Guttman Holdings significantly. The rise of electric vehicles (EVs), with global sales surpassing 13 million units in 2023, signals a shift away from traditional fuels, potentially reducing demand for Guttman's core products. Simultaneously, the digitalization of logistics, evidenced by the IoT in logistics market reaching $23.9 billion in 2023, offers opportunities for operational efficiency and cost savings through optimized routes and real-time monitoring.

Cybersecurity threats are a growing concern in this digital landscape, with global cybercrime costs projected to hit $10.5 trillion annually in 2024, necessitating robust protection for Guttman's digital infrastructure. Automation in fuel delivery, which saw companies reducing fuel waste by up to 15% in 2024, presents avenues for improved reliability and reduced operational expenses.

Innovations in fuel storage, such as advanced leak detection systems valued at $1.5 billion in 2023, are crucial for enhancing safety and environmental compliance. These technological shifts require Guttman Holdings to adapt its strategy, potentially through portfolio diversification and investment in new energy technologies to maintain competitiveness.

| Technological Factor | Impact on Guttman Holdings | Key Data (2023-2024) |

| EV Adoption | Reduced demand for traditional fuels | EV sales exceeded 13 million units globally (2023) |

| Digitalization of Logistics | Increased operational efficiency, cost savings | IoT in logistics market valued at $23.9 billion (2023) |

| Cybersecurity Threats | Risk to operations and data integrity | Global cybercrime costs projected at $10.5 trillion annually (2024) |

| Automation in Fuel Delivery | Improved efficiency, reduced waste | Up to 15% reduction in fuel waste reported by users (2024) |

| Fuel Storage Innovations | Enhanced safety and environmental compliance | Leak detection systems market valued at $1.5 billion (2023) |

Legal factors

The Environmental Protection Agency (EPA) is continually evolving its rules, particularly for things like hazardous air pollutants, volatile organic compounds (VOCs), and how fuel is stored. These changes directly impact companies like Guttman Energy. For instance, updated National Emission Standards for Hazardous Air Pollutants (NESHAP) for gasoline distribution facilities, taking effect in July 2024, mandate new compliance steps for Guttman's terminals and overall operations, potentially increasing operational costs.

Regulations concerning fuel quality, composition, and emission standards for diesel and gasoline products significantly impact Guttman Energy's operational scope and product offerings. For instance, as of early 2024, many regions are tightening Euro 7 emission standards, requiring lower levels of nitrogen oxides and particulate matter from vehicles, which directly influences the specifications Guttman must meet for its fuel.

Compliance with these evolving standards is not merely a legal necessity but a critical factor for product marketability. Failure to adhere to stringent fuel quality and emission benchmarks, such as those set by the EPA in the United States or similar bodies globally, can result in substantial fines and reputational damage, restricting Guttman's access to key customer segments that prioritize environmentally compliant fuels.

Guttman Holdings, particularly its energy sector operations, faces stringent transportation and safety regulations. The Department of Transportation (DOT) imposes rigorous requirements on the handling of hazardous materials, such as petroleum products. These regulations cover everything from vehicle maintenance and driver qualifications to the specific procedures for safe handling and transport.

Compliance with these DOT mandates is crucial for Guttman Energy to maintain operational safety and avoid legal penalties. For instance, in 2024, the DOT continued to emphasize enhanced safety protocols for bulk liquid hazardous material transport, a sector Guttman actively participates in. Failure to adhere to these standards can result in significant fines and reputational damage, impacting Guttman's overall business performance.

Land Use and Zoning Laws for Storage Facilities

Land use and zoning regulations are critical for Guttman Holdings, particularly concerning its energy storage and distribution operations. These laws, enacted at both local and state levels, directly influence where facilities can be situated and the specific requirements for their construction and ongoing management. For instance, in 2024, many municipalities are tightening restrictions on industrial facilities in proximity to residential areas, potentially impacting Guttman's ability to secure new sites or expand existing ones.

These legal frameworks can significantly shape Guttman Energy's strategic planning and operational scope. Stricter zoning in key markets could necessitate higher capital expenditure for site acquisition or development, and may even limit the scale of new projects. For example, a proposed expansion by a competitor in Texas in late 2023 faced delays due to rezoning challenges, highlighting the real-world impact of these legal hurdles. The need to comply with varying environmental and safety standards mandated by these laws also adds complexity and cost to operations.

- Zoning Restrictions: Local zoning ordinances often designate specific areas for industrial use, potentially limiting the availability of suitable land for new storage facilities.

- Permitting Processes: Obtaining land use permits can be a lengthy and complex process, often involving public hearings and environmental impact assessments.

- Operational Compliance: Adherence to building codes, safety regulations, and environmental protection standards stipulated by land use laws is mandatory and can incur significant operational costs.

- Expansion Limitations: Existing land use regulations may restrict the physical expansion of current facilities, impacting Guttman's capacity growth plans.

Anti-Trust and Competition Laws

Guttman Energy, as a wholesale distributor, navigates a complex web of anti-trust and competition laws designed to foster a level playing field in the petroleum distribution sector. These regulations are crucial for preventing monopolistic behavior and ensuring fair market practices for all industry participants.

These laws aim to safeguard consumers and smaller businesses from the potentially harmful effects of market dominance. For instance, in the United States, the Sherman Antitrust Act of 1890 and the Clayton Antitrust Act of 1914 are foundational. They prohibit agreements and actions that restrain trade, such as price-fixing or bid-rigging. In 2023, the US Federal Trade Commission (FTC) continued its robust enforcement, filing numerous lawsuits against companies accused of anti-competitive practices across various industries, demonstrating ongoing vigilance.

Failure to comply can result in significant penalties, including hefty fines and injunctions that can fundamentally alter business operations. For example, in the European Union, the Treaty on the Functioning of the European Union (TFEU) Articles 101 and 102 prohibit anti-competitive agreements and abuse of dominant market positions. In 2024, the European Commission continued its investigations into potential competition law breaches, with fines often reaching millions of euros.

Guttman Energy must therefore continuously monitor its practices to ensure adherence to these evolving legal frameworks. This includes:

- Adherence to Pricing Regulations: Ensuring pricing strategies do not involve collusion or predatory practices.

- Merger and Acquisition Scrutiny: Understanding that significant market share increases through M&A are subject to regulatory review.

- Fair Dealing with Suppliers and Customers: Avoiding exclusive dealing arrangements that unduly restrict competition.

- Transparency in Market Operations: Maintaining open communication and avoiding practices that could be construed as market manipulation.

Legal frameworks profoundly shape Guttman Holdings' operations, particularly in environmental compliance and transportation safety. For instance, evolving EPA regulations on emissions, like the updated NESHAP for gasoline distribution effective July 2024, directly increase operational costs for Guttman Energy. Similarly, stringent DOT requirements for hazardous material transport, with a continued emphasis on enhanced safety protocols in 2024, necessitate strict adherence to avoid penalties.

Land use and zoning laws, often tightened by municipalities in 2024, impact Guttman's ability to acquire new sites or expand existing facilities, potentially increasing capital expenditure and limiting capacity growth. Antitrust and competition laws, such as the Sherman and Clayton Acts, also demand vigilance to prevent anti-competitive practices, with ongoing enforcement by bodies like the FTC in the US and the European Commission. Failure to comply with these varied legal obligations can lead to substantial fines, operational restrictions, and reputational damage.

| Legal Area | Key Regulations/Concerns | Impact on Guttman Holdings (2024/2025 Focus) | Potential Financial/Operational Consequence |

|---|---|---|---|

| Environmental | EPA emissions standards (NESHAP), fuel quality (e.g., Euro 7) | Mandated compliance upgrades for terminals, potential product specification changes. | Increased CAPEX, potential operational cost increases, market access dependent on compliance. |

| Transportation & Safety | DOT hazardous material transport regulations | Continued emphasis on driver training, vehicle maintenance, and safe handling procedures. | Higher compliance costs, risk of fines and operational disruptions from accidents or violations. |

| Land Use & Zoning | Local and state zoning ordinances, permitting processes | Restrictions on new site acquisition/expansion, potential rezoning challenges. | Higher land costs, project delays, limitations on capacity expansion. |

| Antitrust & Competition | Sherman Act, Clayton Act, EU TFEU Articles 101/102 | Scrutiny of pricing, M&A activity, and dealer/supplier relationships. | Potential for hefty fines, injunctions, and damage to market reputation if non-compliant. |

Environmental factors

The intensifying global and national emphasis on mitigating climate change directly fuels policies designed to curb carbon emissions from fossil fuels. While Guttman Holdings, as a distributor, might seem insulated, the overarching societal drive towards decarbonization presents a significant long-term consideration.

The United States, for instance, has committed to reducing greenhouse gas emissions by 50-52% below 2005 levels by 2030 and achieving net-zero emissions by 2050. This ambitious trajectory, supported by legislation like the Inflation Reduction Act which injects billions into clean energy initiatives, could fundamentally alter the demand landscape for traditional energy products distributed by Guttman Holdings over the coming years.

The global shift towards renewable energy sources, including wind, solar, and hydrogen, is steadily reshaping demand for traditional fossil fuels. In 2024, renewable energy capacity additions are projected to reach a record high, surpassing 500 gigawatts globally, signaling a significant acceleration. This trend is particularly impactful in sectors like transportation and industry, where Guttman Energy's core business lies.

Guttman Energy must closely track the evolving pace of this energy transition. For instance, the International Energy Agency (IEA) reported in early 2025 that electric vehicle sales in 2024 alone accounted for over 20% of the total automotive market in key developed economies, directly impacting oil demand for transportation.

The growing investment in green hydrogen production and its adoption in heavy industries presents another long-term challenge. By 2025, several major industrial nations have committed to ambitious hydrogen production targets, aiming to decarbonize sectors like steel and cement manufacturing, which are significant consumers of natural gas and oil.

Environmental concerns about soil and water contamination from fuel spills are significant. Guttman Energy's operations, which involve bulk fuel delivery and storage, are directly impacted by the need for robust pollution control and spill prevention. This requires adherence to regulations such as the Clean Water Act and the implementation of best practices to minimize environmental harm.

In 2024, the Environmental Protection Agency (EPA) continued to emphasize compliance with regulations designed to prevent water pollution, with fines for violations remaining substantial. For instance, companies found negligent in preventing spills can face penalties that can run into the hundreds of thousands of dollars, directly affecting profitability. Guttman Energy's investment in advanced containment systems and regular training for its delivery personnel are crucial to mitigating these risks and ensuring operational continuity.

Resource Depletion and Energy Security

Concerns over finite fossil fuel supplies and the push for national energy security are increasingly shaping policy. This often translates into support for increased domestic oil and gas production, alongside significant investment in renewable energy sources. For instance, the U.S. Energy Information Administration (EIA) reported that in 2023, the U.S. produced an average of 12.9 million barrels of crude oil per day, a record high, yet the long-term implications of resource availability continue to influence strategic energy planning and investment in alternatives.

The ongoing global dialogue about resource depletion directly impacts investment strategies and government incentives. Policies aimed at energy independence can create both opportunities and challenges for businesses. For example, the Inflation Reduction Act of 2022, passed in the U.S., offers substantial tax credits for renewable energy projects, signaling a clear governmental priority shift.

- U.S. Crude Oil Production: 12.9 million barrels per day in 2023 (EIA).

- Renewable Energy Growth: Significant policy support and investment driven by energy security concerns.

- Fossil Fuel Reserves: Growing global awareness of finite resources influencing long-term energy strategies.

- Policy Impact: Legislation like the Inflation Reduction Act incentivizing domestic renewable energy development.

Extreme Weather Events and Climate Resilience

The increasing frequency and intensity of extreme weather events, driven by climate change, pose a significant threat to Guttman Holdings' operations. These events can severely disrupt fuel supply chains, damage critical infrastructure, and impair delivery capabilities, directly impacting service continuity. For instance, in early 2024, a series of severe storms across North America led to widespread power outages and transportation disruptions, highlighting the vulnerability of energy infrastructure to such occurrences. Guttman Energy must proactively build resilience into its operational framework.

To address these challenges, Guttman Holdings needs to implement robust climate resilience strategies. This involves investing in infrastructure upgrades designed to withstand extreme weather, diversifying supply chain routes to mitigate single points of failure, and developing comprehensive emergency response plans. The company's ability to maintain consistent service delivery during and after these events will be crucial for its reputation and financial stability. Reports from the National Oceanic and Atmospheric Administration (NOAA) in 2024 indicated a marked increase in billion-dollar weather and climate disasters compared to previous decades, underscoring the growing urgency of this issue.

Key considerations for Guttman Holdings' environmental strategy include:

- Infrastructure Hardening: Investing in weather-resistant infrastructure for storage and distribution facilities.

- Supply Chain Diversification: Developing alternative sourcing and transportation routes to reduce reliance on single points of failure.

- Emergency Preparedness: Enhancing response protocols and resource allocation for rapid recovery from disruptions.

- Climate Risk Assessment: Continuously evaluating and updating risk assessments based on evolving climate projections and event data.

The environmental landscape presents significant challenges and opportunities for Guttman Holdings, primarily driven by the global push for decarbonization and energy transition. Stricter regulations on emissions, like those embedded in the Inflation Reduction Act, are reshaping energy markets, impacting demand for fossil fuels. The increasing adoption of renewable energy, with projections for record capacity additions in 2024, directly affects sectors Guttman Energy serves.

The company faces operational risks from extreme weather events, which are becoming more frequent and intense, as evidenced by NOAA data in 2024 showing a rise in billion-dollar disasters. Mitigating these risks requires investment in infrastructure resilience and supply chain diversification.

Resource depletion concerns and the pursuit of energy security are also influencing policy, encouraging domestic production while simultaneously promoting alternatives. Guttman Holdings must navigate these evolving environmental factors to maintain its competitive edge.

| Environmental Factor | Impact on Guttman Holdings | Key Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Decarbonization | Shifting demand for fossil fuels, increased regulatory pressure. | US target: 50-52% GHG reduction by 2030 (below 2005). Global renewable capacity additions projected >500 GW in 2024. |

| Extreme Weather Events | Disruption to supply chains, infrastructure damage, service continuity risks. | NOAA data in 2024 indicated increased frequency of billion-dollar weather disasters. |

| Pollution & Contamination | Need for robust spill prevention and pollution control; compliance with regulations. | EPA emphasized water pollution prevention in 2024; potential fines for negligence. |

| Resource Availability & Energy Security | Policy shifts favoring domestic production and renewables; long-term strategic planning. | US crude oil production averaged 12.9 million bpd in 2023 (EIA). Inflation Reduction Act offers renewable energy tax credits. |

PESTLE Analysis Data Sources

Our Guttman Holdings PESTLE Analysis is meticulously constructed using data from authoritative government bodies, reputable economic research institutions, and leading industry publications. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in accurate and current information.