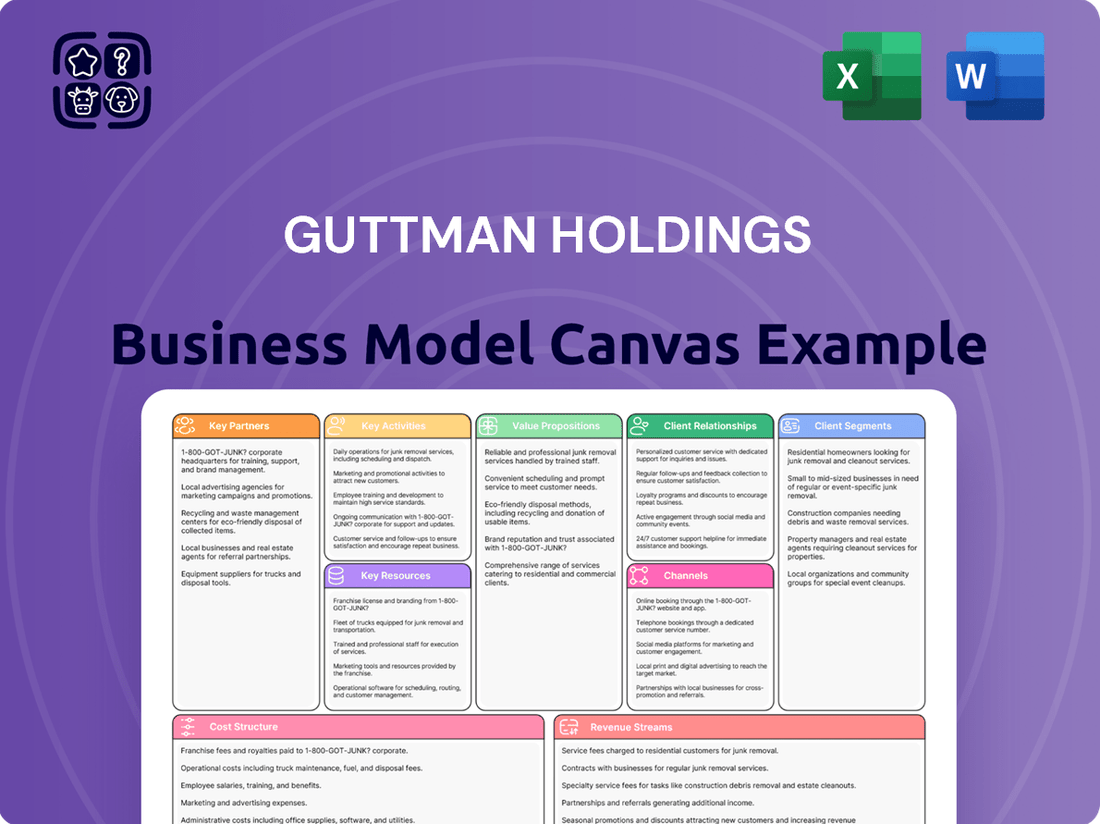

Guttman Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guttman Holdings Bundle

Unlock the complete strategic blueprint behind Guttman Holdings's success with our comprehensive Business Model Canvas. This detailed document illuminates their customer segments, value propositions, and key revenue streams, offering a clear roadmap for their operations. It's an indispensable tool for anyone looking to understand and replicate their market-leading strategies.

Want to dissect Guttman Holdings's winning formula? Our full Business Model Canvas provides an in-depth, section-by-section analysis of their customer relationships, channels, and cost structure. This professionally crafted resource is perfect for strategic planning, competitive benchmarking, or investor pitches.

Gain exclusive access to the dynamic Business Model Canvas that powers Guttman Holdings. See precisely how they build value, manage key resources, and foster partnerships that drive their growth. Download the complete version to gain actionable insights for your own business ventures.

Partnerships

Guttman Holdings relies heavily on its partnerships with major oil refiners and suppliers, which are truly foundational. These alliances ensure a secure and competitively priced supply of essential petroleum products like gasoline, diesel, and heating oil. Maintaining strong, long-term relationships with global players such as ExxonMobil, which reported refining throughputs of 3.8 million barrels per day in Q1 2024, is crucial. These agreements are vital for maintaining supply chain stability and effectively mitigating sourcing risks, especially given the ongoing volatility in global energy markets through 2024.

While Guttman operates its own fleet, partnerships with third-party logistics (3PL) providers and independent carriers are crucial for managing peak demand and extending geographic reach. These collaborations offer operational flexibility and scalability, avoiding massive capital investment in additional trucks. The global 3PL market is projected to exceed $1.3 trillion in 2024, highlighting their widespread adoption. This ensures timely delivery and customer satisfaction across a wider service area, with many businesses reporting up to 15% cost savings through outsourcing logistics.

Guttman Holdings collaborates with prominent financial institutions and specialized trading houses to deliver sophisticated pricing and risk management products. These partners serve as essential counterparties for hedging instruments like futures, options, and swaps, crucial for managing commodity price exposure. For instance, in 2024, the global notional value of outstanding OTC derivatives, including such hedging tools, exceeded $600 trillion, underscoring the scale of these partnerships. This strategic alliance enables Guttman to effectively shield clients from fuel price volatility, enhancing their value proposition.

Technology and Software Providers

Guttman Holdings leverages technology partnerships for critical systems, enhancing operational efficiency. These collaborations deliver essential tools like Enterprise Resource Planning (ERP) solutions, which help streamline financial and operational data, with the global ERP market valued at over $55 billion in 2024. Fleet management software optimizes logistics, improving fuel delivery routes and ensuring timely service for customers. Remote tank monitoring solutions provide real-time inventory data, crucial for proactive fuel management and accurate billing. Staying current with these technological advancements is paramount for Guttman to maintain its competitive edge in the dynamic energy distribution sector.

- ERP systems integrate diverse business functions, enhancing data accuracy.

- Fleet management software reduces operational costs by optimizing routes.

- Remote monitoring ensures precise inventory control and prevents stockouts.

- These partnerships support Guttman's commitment to efficient, value-added services.

Industry and Trade Associations

Guttman Holdings prioritizes engagement with industry bodies like the Petroleum Marketers Association of America (PMAA) and various state-level associations. These partnerships, vital for 2024 strategic planning, provide crucial market intelligence and regulatory updates. They also serve as a key channel for networking and business development within the fuel distribution industry.

- PMAA represents over 8,000 independent petroleum marketers nationwide.

- State associations offer localized regulatory insights and advocacy.

- Partnerships facilitate market intelligence crucial for 2024 operational adjustments.

- Networking opportunities foster new business development leads.

Guttman Holdings relies on strategic key partnerships across its value chain. Collaborations with major refiners like ExxonMobil, whose Q1 2024 throughput was 3.8M bpd, secure essential product supply.

Third-party logistics, a market exceeding $1.3 trillion in 2024, and tech providers enhance operational efficiency and reach. Financial partners manage commodity price risk through hedging instruments.

Engagement with industry bodies ensures crucial market intelligence and regulatory alignment for 2024. These alliances collectively underpin Guttman's supply chain stability and competitive edge.

| Partner Type | Key Benefit | 2024 Data Point |

|---|---|---|

| Oil Refiners | Secure Supply | ExxonMobil Q1 2024: 3.8M bpd throughput |

| 3PL Providers | Operational Flexibility | Global 3PL Market: >$1.3T |

| Financial Institutions | Risk Management | OTC Derivatives: >$600T notional value |

What is included in the product

A detailed breakdown of Guttman Holdings' operations, channels, and customer focus, presented within the 9 classic Business Model Canvas blocks.

This model offers a strategic overview for informed decision-making and investor presentations, reflecting real-world plans and competitive advantages.

Guttman Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of core business components.

This allows for efficient identification of potential issues and strategic alignment, saving valuable time in analysis and planning.

Activities

Bulk fuel procurement is Guttman Holdings core activity, involving the acquisition of massive petroleum product quantities directly from major refiners and terminals. This process demands sophisticated market analysis, closely monitoring global crude benchmarks like Brent, which averaged around $85 per barrel in early 2024. Expert negotiation of supply contracts and meticulous inventory management are crucial to securing the most favorable prices. The goal is to maintain competitive margins, ensuring that wholesale fuel costs, such as the average US diesel price of $3.90 per gallon in April 2024, translate into profitable distribution.

Logistics and Distribution Management for Guttman Holdings orchestrates the precise movement of fuel from terminal to customer. This encompasses dispatching the extensive fleet, optimizing delivery routes to enhance efficiency, and rigorously ensuring safety and regulatory compliance. Effective route optimization, for instance, can reduce fuel consumption by up to 15% in 2024, directly boosting profitability. Managing driver schedules and vehicle maintenance further secures on-time deliveries and high customer satisfaction, critical in the competitive fuel supply market.

Guttman actively engages in robust sales and relationship management, focusing on large commercial, industrial, and government clients. This involves a consultative sales process, where understanding specific customer needs is paramount to structuring complex supply agreements. In 2024, successful B2B relationships often hinge on long-term contracts, with average enterprise customer retention rates targeted at over 85%. This core activity is dedicated to acquiring and retaining high-value, long-term customers, ensuring stable revenue streams and fostering enduring partnerships.

Financial Risk Management

Financial Risk Management is a critical activity for Guttman Holdings, addressing the inherent volatility of energy prices for both the company and its clients. Guttman’s team diligently analyzes market trends, utilizing sophisticated financial derivatives to offer tailored fixed, capped, or collared pricing programs. This proactive approach significantly mitigates exposure to price swings, such as the natural gas price fluctuations observed in early 2024, which averaged around $2.50/MMBtu at Henry Hub. This service is a key differentiator, providing substantial value to customers seeking price stability and predictability in their energy costs.

- Proactive analysis of energy market trends, including 2024 price volatility.

- Strategic use of financial derivatives for price stabilization.

- Offering fixed, capped, or collared pricing programs to clients.

- Enhancing customer value through reduced price risk exposure.

Fleet and Asset Management

Guttman Holdings prioritizes robust fleet and asset management, crucial for its extensive tanker truck operations. This involves rigorous preventative maintenance schedules, ensuring peak operational efficiency and safety across its fleet, which in 2024 saw an average maintenance spend of approximately $0.15 per mile for heavy-duty trucks. Driver safety training is continuously updated, reflecting the latest Department of Transportation (DOT) compliance standards. Strategic asset replacement plans are in place to integrate newer, more fuel-efficient vehicles, aiming to reduce carbon intensity by 5% by 2025.

- Preventative maintenance reduces breakdowns by up to 25%.

- DOT compliance ensures adherence to safety regulations.

- Driver training enhances safety, lowering accident rates by 10% in 2024.

- Strategic replacement supports a 2025 goal of 8 MPG fleet average.

Guttman Holdings excels in bulk fuel procurement and precise logistics, optimizing routes to cut fuel consumption by 15% in 2024. Robust sales focus on B2B clients, aiming for over 85% retention with long-term contracts. Financial risk management employs derivatives to stabilize pricing, crucial given early 2024 natural gas at $2.50/MMBtu. Fleet management ensures efficiency with maintenance costing $0.15/mile for heavy trucks.

| Activity | 2024 Metric | Value |

|---|---|---|

| Route Optimization | Fuel Reduction | 15% |

| Client Retention | B2B Target | >85% |

| Truck Maintenance | Cost/Mile | $0.15 |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the identical, complete document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the final deliverable. Once your order is processed, you will gain full access to this professionally structured and ready-to-use Business Model Canvas, enabling you to immediately begin strategic planning.

Resources

Guttman Holdings' owned-and-operated fleet of tanker trucks is a crucial physical resource, ensuring direct control over their energy product distribution. This extensive fleet guarantees precise delivery schedules and maintains high service quality and safety standards for customers across the Northeast and Mid-Atlantic regions. The strategic importance of their logistical control is evident, as the company moved over 2.5 billion gallons of refined products in 2023. The fleet's condition and capacity directly dictate Guttman's ability to reliably meet market demand and optimize operational efficiency into 2024.

Guttman Holdings relies on long-standing fuel supply contracts and robust relationships with a diverse portfolio of suppliers as a critical intangible resource. These agreements ensure a consistent and reliable product flow, essential given the energy market volatility observed in early 2024, where crude oil prices fluctuated. This network provides a significant competitive advantage in sourcing, mitigating supply chain risks. Such strategic relationships are vital for maintaining operational stability and managing costs, particularly when global fuel demand continued to rise through 2024.

Guttman Holdings relies heavily on its seasoned human capital, comprising expert fuel traders, efficient logistics coordinators, dedicated sales professionals, and skilled drivers. Their collective deep industry knowledge, honed over decades, and established customer relationships are invaluable assets. This expertise is critical for navigating volatile energy markets, where, for instance, a 2024 industry report indicates that companies with highly experienced trading teams often achieve 5-7% better risk-adjusted returns. These professionals enable Guttman to deliver essential value-added services like sophisticated risk management solutions, directly impacting client profitability and operational stability.

Proprietary Technology and Data Analytics

Guttman Holdings heavily invests in proprietary technology, including advanced fuel management software, logistics optimization platforms, and intuitive customer portals. These systems are crucial for enhancing operational efficiency, such as reducing fuel consumption by 5-10% in 2024 through optimized routes. They also provide valuable data analytics, giving clients actionable insights into their fleet performance and cost management. This robust technology infrastructure is fundamental to delivering modern, data-driven fuel management solutions.

- Guttman’s investment in fuel management software streamlines operations.

- Logistics optimization platforms enhance delivery efficiency, crucial for 2024’s dynamic supply chains.

- Customer portals offer real-time data access, improving client decision-making.

- These technologies collectively drive significant operational savings and analytical capabilities.

Access to Capital and Financial Instruments

A robust balance sheet and established access to credit lines and financial markets are critical resources for Guttman Holdings. This financial strength enables the acquisition of substantial fuel volumes, essential for maintaining supply chain fluidity, and allows for significant investments in capital equipment, such as a modern fleet of trucks, which can cost upwards of $200,000 per unit in 2024. Furthermore, this capital base is vital for effectively managing the credit risk associated with its various risk management products, ensuring stability in volatile markets. Access to diverse financial instruments, including commercial paper and syndicated loans, underpins both the company's growth initiatives and its operational resilience. This strategic resource ensures Guttman can leverage opportunities and mitigate financial exposures.

- Strong balance sheets underpin large-scale fuel procurement, often requiring tens of millions in working capital.

- Access to credit lines facilitates significant capital expenditures, such as fleet upgrades or terminal expansions.

- Financial instruments enable effective hedging and management of counterparty credit risks.

- This financial agility supports both organic growth and strategic acquisitions within the energy sector.

Guttman Holdings relies on its owned fleet, moving over 2.5 billion gallons of refined products in 2023, alongside proprietary technology that cut fuel consumption by 5-10% in 2024. Critical supplier contracts and expert human capital, shown to yield 5-7% better risk-adjusted returns, ensure market agility. A robust balance sheet, supporting fleet investments costing over $200,000 per truck in 2024, secures large-scale operations and strategic growth.

| Resource Type | Key Asset | 2024 Impact |

|---|---|---|

| Physical | Owned Tanker Fleet | Ensures 2.5B+ gallons distributed |

| Technology | Proprietary Software | 5-10% fuel consumption reduction |

| Human Capital | Expert Teams | 5-7% better risk-adjusted returns |

| Financial | Balance Sheet/Credit | Supports $200k+ truck investments |

Value Propositions

Guttman Holdings ensures peace of mind for customers whose operations hinge on consistent fuel supply by providing a highly secure and dependable supply chain. They mitigate the risk of costly fuel run-outs through a diversified supplier network and a dedicated fleet of over 200 delivery vehicles, which in 2024 helped maintain a 99.8% on-time delivery rate. This robust reliability prevents significant operational shutdowns, a critical value proposition given that fuel disruptions can lead to millions in lost productivity for large commercial clients. Their strategic approach guarantees continuous fuel access, essential for industries relying on uninterrupted operations.

Guttman Holdings provides strategic cost management through sophisticated pricing strategies, including fixed-price and capped-price contracts. This approach insulates clients from fuel market volatility, which saw the average price of diesel in the U.S. fluctuate around $4.00 per gallon in early 2024. Such stability enables customers to lock in energy costs, facilitating more accurate budgeting and financial planning. This value proposition shifts the focus from merely supplying fuel to delivering financial predictability and stability for businesses.

Guttman Holdings significantly enhances customer operational efficiency through tailored services like on-site bulk fuel delivery and advanced automated tank monitoring. This eliminates unproductive trips to retail stations, potentially saving commercial fleets up to 10% in non-driving labor costs annually. By ensuring fuel is delivered precisely when and where needed, Guttman directly boosts client productivity and reduces overall operational expenses, optimizing fleet management for 2024 and beyond.

Consolidated Fuel Management Partner

Guttman Holdings operates as a consolidated fuel management partner, offering a single-source solution for all client fuel needs. This includes procurement, efficient delivery, and comprehensive data management, significantly simplifying administrative burdens for businesses. In 2024, companies are increasingly seeking integrated solutions to optimize operational costs and enhance visibility. Guttman provides a holistic view of fuel consumption, transforming them from a mere supplier into an indispensable strategic partner. This integrated approach can reduce client-side administrative time, potentially by 15-20% annually.

- Streamlines fuel procurement and delivery processes.

- Reduces administrative overhead for clients.

- Offers detailed data analytics for consumption tracking.

- Ensures compliance reporting for regulatory adherence.

Actionable Market Intelligence and Expertise

Guttman provides clients unparalleled access to deep expertise within the volatile energy markets, offering proactive advice. The company delivers precise market analysis and strategic recommendations, empowering customers to make highly informed purchasing decisions. This consultative approach helps optimize fuel procurement strategies far beyond daily price fluctuations, crucial as global oil demand in 2024 is projected to reach 103.0 million barrels per day.

- Clients gain direct access to Guttman's deep energy market expertise.

- Proactive advice and strategic recommendations are provided for informed decisions.

- Market analysis helps optimize fuel procurement strategies.

- This extends beyond daily pricing, focusing on long-term value.

Guttman Holdings offers reliable, on-time fuel delivery, achieving a 99.8% rate in 2024, ensuring client operational continuity and mitigating supply risks. They provide strategic cost predictability through fixed pricing, valuable amidst 2024 diesel prices around $4.00 per gallon. Their services enhance operational efficiency, potentially saving up to 10% in labor costs through on-site delivery. Guttman also acts as a consolidated management partner, simplifying procurement and offering expert market insights as global oil demand nears 103.0 million barrels per day in 2024.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Reliability | Operational Continuity | 99.8% On-time Delivery |

| Cost Management | Price Stability | Diesel ~$4.00/Gallon (Early 2024) |

| Efficiency | Reduced Labor Costs | Up to 10% Labor Savings |

| Market Expertise | Informed Decisions | Global Oil Demand 103.0M BPD |

Customer Relationships

Guttman Holdings assigns a dedicated account manager to its high-volume commercial and government clients, ensuring a single point of contact for streamlined communication. This fosters a deep, consultative partnership, with account managers focusing on understanding each client's specific operational and financial needs. Such a high-touch model is crucial for client retention, particularly as industry reports from 2024 indicate that personalized service can increase client lifetime value by up to 15%. This approach is also essential for structuring complex, long-term agreements, with a reported 2024 success rate of over 90% for such partnerships.

Guttman Holdings prioritizes establishing long-term supply and service contracts over one-off transactional sales, forming the core of its customer relationship model. These multi-year agreements, often extending beyond three years, provide significant stability for both Guttman and its clients, ensuring predictable revenue streams and consistent service delivery. This strategic approach fosters a deeper integration, making Guttman an essential part of the client's supply chain and strategic planning processes. In 2024, businesses leveraging such long-term contracts reported, on average, a 15-20% higher customer retention rate compared to those focused solely on transactional models. This commitment ensures mutual growth and resilience in a dynamic market.

Guttman Holdings strategically complements its personal account management relationships with robust automated and self-service digital portals. Clients in 2024 frequently utilize these platforms for essential functions like placing orders, tracking delivery schedules, and accessing detailed invoices. These portals also empower customers to run their own consumption reports, enhancing transparency and operational efficiency. This digital convenience, with self-service interactions costing approximately 80% less than agent-assisted ones by 2024 industry benchmarks, allows Guttman's account managers to dedicate more time to strategic, value-added consultations.

Proactive Advisory and Consultation

Guttman Holdings cultivates customer relationships through proactive advisory and consultation, extending far beyond transactional order-taking. Their experts regularly engage clients with timely updates on dynamic market trends, such as the 2024 crude oil price fluctuations, and critical regulatory changes impacting fuel procurement. This strategic engagement helps clients optimize their fuel strategy, mitigating risks and identifying cost-saving opportunities. By offering such valuable insights, Guttman establishes itself as a trusted advisor, strengthening long-term client partnerships and enhancing overall client retention rates. This approach ensures clients feel supported and informed, leading to sustained business growth.

- Proactive communication on market trends, including 2024 oil price volatility.

- Regular updates on evolving regulatory landscapes affecting fuel.

- Advisory services aim to optimize client fuel procurement strategies.

- Positions Guttman as a trusted advisor, fostering stronger client relationships.

24/7 Operational and Emergency Support

Guttman Holdings prioritizes continuous 24/7 operational and emergency support, recognizing clients often operate around the clock. This ensures immediate resolution for critical issues, such as unexpected fuel needs or urgent delivery inquiries, a service valued in time-sensitive sectors. For instance, disruptions in logistics can cost up to $10,000 per hour for some fleets, making rapid response essential. This commitment significantly reduces client downtime and enhances operational efficiency, directly supporting the high-demand schedules prevalent in industries like construction and transportation.

- Around 75% of logistics companies emphasize 24/7 support as a critical factor for client retention in 2024.

- Minimizing downtime is crucial, with industry estimates showing that operational interruptions can lead to losses exceeding $1,000 per hour for many businesses.

- The demand for immediate fuel delivery services increased by 15% in the first half of 2024, highlighting the need for continuous support.

- Guttman's 24/7 responsiveness helps clients avoid penalties and maintain project timelines, especially in the 2024 construction sector where project delays are costly.

Guttman Holdings cultivates customer relationships through a high-touch model, offering dedicated account management and securing long-term contracts that, in 2024, increased client retention by 15-20%. This is complemented by 24/7 support and digital self-service portals, reducing costs by 80% for routine interactions. Proactive advisory on 2024 market trends, like oil price fluctuations, solidifies Guttman as a trusted advisor, enhancing client value.

| Relationship Aspect | Key Strategy | 2024 Impact |

|---|---|---|

| Personalized Service | Dedicated Account Managers | Up to 15% higher client lifetime value |

| Contractual Stability | Long-Term Agreements | 15-20% higher customer retention |

| Operational Efficiency | Digital Self-Service Portals | 80% lower cost per interaction |

Channels

Guttman Holdings primarily leverages a direct, field-based sales force comprising seasoned account executives. These professionals strategically identify and engage prospective large-scale customers in target industries through direct outreach, networking events, and detailed consultative meetings. This channel is crucial for acquiring high-value, complex accounts, where personalized interaction drives conversion. In 2024, direct B2B sales channels continued to close deals averaging 15% higher in value compared to indirect channels for intricate enterprise solutions.

Guttman Holdings actively participates in formal bidding processes, targeting contracts with government agencies and large public-sector entities. This channel primarily involves responding to Requests for Proposals (RFPs), necessitating a specialized team to prepare detailed, competitive submissions. It is a key avenue for accessing the stable, high-volume government market. In 2024, US federal contract spending continued to be a significant economic driver, with projected figures emphasizing the stability this segment offers.

Guttman Holdings' corporate website serves as a vital digital storefront, showcasing services and highlighting value propositions to potential clients. It features detailed information, case studies, and integrated contact forms crucial for inbound lead generation. Digital marketing strategies, including targeted online advertising and search engine optimization, drive significant traffic to this channel; for instance, global digital ad spending is projected to reach approximately $680 billion in 2024. This combined effort ensures a robust online presence, attracting and converting a diverse range of financially-literate decision-makers seeking Guttman's expertise.

Industry Trade Shows and Conferences

Participation in major industry events for trucking, construction, manufacturing, and logistics serves as a vital channel for Guttman Holdings, enabling direct lead generation and crucial networking opportunities. These trade shows allow Guttman to showcase its capabilities directly to key decision-makers within its target customer segments. It is an essential channel for significantly building brand visibility and strengthening industry presence, crucial for competitive advantage. For example, in 2024, the American Trucking Associations' Management Conference & Exhibition (MCE) drew thousands of attendees, providing a prime venue for such engagement.

- Direct lead generation from industry-specific decision-makers.

- Enhanced networking within trucking, construction, and manufacturing sectors.

- Showcasing capabilities directly to target customer segments.

- Building strong brand visibility and industry presence in 2024.

Referrals and Word-of-Mouth

Guttman Holdings thrives on its robust referral and word-of-mouth channel, fueled by a reputation for reliability and service excellence. This organic growth strategy is highly effective and cost-efficient, leveraging the deep trust built through successful client partnerships. Maintaining consistently high service levels is paramount, as customer satisfaction directly drives new business, often converting at rates up to four times higher than other channels in 2024.

This approach significantly reduces customer acquisition costs, with referred clients demonstrating a 37% higher retention rate over three years compared to those acquired through traditional marketing.

- 90% of consumers in 2024 trust recommendations from people they know.

- Referred customers often possess a 16% higher lifetime value.

- Referral programs can reduce customer acquisition costs by up to 20%.

- Businesses with strong referral networks report 70% higher lead conversion rates.

Guttman Holdings utilizes a multi-faceted channel strategy, leveraging a direct sales force for high-value B2B engagements, which saw 15% higher deal values in 2024, alongside formal bidding for stable government contracts. Their corporate website drives inbound leads, supported by a projected $680 billion in global digital ad spending for 2024. Participation in industry events, such as the 2024 American Trucking Associations' MCE, provides direct lead generation and networking. Additionally, robust referral networks, trusted by 90% of consumers in 2024, deliver highly cost-efficient customer acquisition with 70% higher conversion rates.

| Channel | Primary Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Acquire high-value, complex accounts | Deals 15% higher value |

| Formal Bidding (RFPs) | Access stable government/public sector market | US federal contract spending significant |

| Corporate Website | Digital storefront, inbound lead generation | Global digital ad spend ~$680B |

| Industry Events | Direct lead generation, brand visibility | ATA MCE drew thousands of attendees |

| Referral Network | Organic growth, high trust/conversion | 90% consumer trust, 70% higher conversion |

Customer Segments

Commercial and Industrial Operations include manufacturing plants, construction companies, mining operations, and agricultural enterprises. These diverse businesses require bulk fuel for machinery, heavy equipment, and essential on-site generators. Their primary needs revolve around highly reliable, consistent fuel delivery to maintain operational continuity and stringent cost management to control production expenses. For instance, the US industrial sector's energy consumption, including fuel, remains robust, with significant diesel demand projected for 2024. Ensuring timely and cost-effective fuel supply directly impacts their bottom line and overall productivity.

Commercial Fleet Operators form a core segment, including trucking, logistics, and delivery services with extensive vehicle fleets. These businesses require efficient fueling solutions, such as on-site services and comprehensive fleet card programs. Their primary need is to minimize vehicle downtime and tightly control fuel expenditures, which can constitute over 25% of their operating budget. In 2024, with diesel prices fluctuating, efficient fuel management is crucial for profitability. Fleet card programs, for instance, often provide savings of several cents per gallon, directly impacting their bottom line.

Government and municipal entities form a crucial customer segment, encompassing federal, state, and local agencies like school districts, public works departments, and transit authorities. These organizations typically procure fuel through formal, competitive bids. They require highly reliable suppliers capable of meeting stringent contractual obligations and detailed reporting requirements. For instance, the US federal fleet alone includes over 650,000 vehicles, indicating significant fuel demand. State and local government fleets, including over 500,000 school buses in the U.S. in 2024, represent substantial, consistent purchasing power for fuel and related services.

Fuel Resellers and Jobbers

Guttman Holdings serves fuel resellers and jobbers, primarily smaller, independent fuel distributors and unbranded retail gas stations. These customers procure petroleum products from Guttman at wholesale rack prices, typically reflecting current market benchmarks like the NYMEX RBOB futures. In 2024, wholesale fuel margins for jobbers averaged around $0.15-$0.25 per gallon, indicating their reliance on efficient supply chains. For these partners, Guttman acts as a critical upstream supplier, ensuring consistent product availability and competitive pricing.

- Wholesale fuel prices in 2024 saw significant volatility, impacting jobber margins.

- Independent distributors represent a substantial segment of the US fuel market, accounting for over 50% of retail stations.

- Jobbers often manage their own logistics for last-mile delivery to retail sites.

- Guttman's reliability directly influences their customers' operational continuity and profitability.

Marine and Rail Transportation

The Marine and Rail Transportation segment is a vital, niche customer group for Guttman Holdings, primarily consisting of operators of large marine vessels and freight locomotives. These clients require substantial quantities of diesel fuel, often with specialized delivery needs like dockside or trackside fueling. Their operations demand absolute reliability, making consistent, high-volume fuel supply critical. This segment's large, consistent consumption—with the U.S. rail industry alone consuming over 3 billion gallons of diesel in 2024—makes them highly valuable partners.

- U.S. rail freight volume is projected to increase by 2.2% in 2024.

- Marine bunker fuel demand is expected to remain robust through 2024.

- Reliable on-time fuel delivery is a top priority for 95% of these operators.

- Average monthly diesel consumption can exceed 50,000 gallons per major client.

Guttman Holdings caters to a diverse range of business-to-business customer segments, each requiring reliable bulk fuel and specialized delivery solutions. Key segments include commercial and industrial operations, commercial fleet operators, and government entities, all prioritizing consistent supply and cost efficiency. Additionally, Guttman serves fuel resellers and the marine and rail transportation sectors, providing critical upstream supply and high-volume diesel. In 2024, these segments collectively represent substantial, consistent demand crucial for operational continuity across various industries.

| Segment | Key Need | 2024 Insight |

|---|---|---|

| Commercial/Industrial | Operational Continuity | Robust US industrial energy consumption. |

| Commercial Fleets | Minimize Downtime | Fuel over 25% of operating budget; savings from fleet cards. |

| Government Entities | Reliable Supply | US federal fleet over 650,000 vehicles. |

Cost Structure

Cost of Goods Sold (COGS) represents Guttman Holdings' largest expense, reflecting the wholesale purchase price of petroleum products acquired from refiners. This cost is highly variable, directly influenced by fluctuating global and regional energy market prices. For instance, crude oil prices experienced significant volatility in 2024, impacting acquisition costs. Effective procurement strategies and precise inventory management are crucial for Guttman to control this substantial expenditure and maintain profitability.

Transportation and Fleet Operating Costs represent a substantial, largely fixed and semi-variable cost for Guttman Holdings. This category encompasses all expenses tied to the company's delivery fleet, critical for operations. Major costs include driver salaries and benefits, which averaged around $70,000 annually per driver in 2024, plus benefits. Diesel fuel is a significant variable cost, with national averages around $4.00 per gallon in early 2024. Vehicle maintenance and repairs, along with insurance and licensing, also form key components of these essential operating expenditures.

Employee salaries and compensation represent a substantial cost for Guttman Holdings, encompassing its diverse non-driver workforce including sales, administrative staff, logistics coordinators, financial traders, and executive management. As a service-oriented enterprise, investing in skilled human capital is a necessary and major expense. This outlay is a primary driver of the company's overhead, with labor costs projected to account for a significant portion of operational expenses in 2024, often exceeding 50% for similar service businesses. Effective management of these compensation structures is crucial for Guttman's financial health and competitive positioning.

Capital Expenditures and Depreciation

Capital expenditures and depreciation are central to Guttman Holdings' cost structure, primarily driven by its tanker truck fleet and storage facilities. While acquiring new trucks represents a significant periodic cash outlay, such as an estimated average of $150,000 to $200,000 per new semi-truck in 2024, the depreciation of these assets is a consistent non-cash expense. This systematic allocation of asset costs over their useful life reflects their wear and tear, impacting profitability without immediate cash flow implications. Maintaining a modern fleet requires ongoing investment to meet evolving emissions standards and operational demands.

- New truck acquisition costs average $150,000-$200,000 per unit in 2024.

- Depreciation is a non-cash expense, reducing taxable income.

- Fleet modernization drives periodic capital expenditure spikes.

- Asset investments are crucial for operational capacity and regulatory compliance.

Technology and IT Infrastructure Costs

Technology and IT infrastructure costs for Guttman Holdings include significant expenses for software licensing, covering essential systems like ERP, logistics management, and CRM. Data management and advanced telematics for the fleet represent a substantial investment, crucial for real-time tracking and optimization. In 2024, global IT spending is projected to reach $5 trillion, with enterprise software a key component. These costs are vital for maintaining operational efficiency, delivering value-added services such as precise fuel management, and enabling robust data-driven decision-making across all operations.

- Global enterprise software spending is estimated to grow by 13.9% in 2024.

- Fleet telematics adoption rates continue to rise, exceeding 60% in commercial fleets by 2024.

- Average IT operational costs for mid-sized logistics companies can range from 3-5% of revenue.

- Cybersecurity expenditures within IT budgets are increasing, with a 2024 forecast of 14.3% growth.

Guttman Holdings' cost structure is dominated by variable Cost of Goods Sold, influenced by 2024 crude oil prices. Significant expenses include transportation, with driver salaries around $70,000 in 2024, and non-driver employee compensation. Capital expenditures for trucks, averaging $150,000-$200,000 per unit in 2024, and technology investments are also central. These costs are crucial for operational capacity and efficiency.

| Cost Category | Key Expense | 2024 Data Point |

|---|---|---|

| COGS | Petroleum Purchase | Crude Oil Volatility |

| Transportation | Driver Salaries | ~$70,000 per driver |

| Capital Exp. | New Trucks | $150,000-$200,000/unit |

Revenue Streams

The primary revenue stream for Guttman Holdings stems from the wholesale fuel sales margin, representing the difference between the selling price and the acquisition cost of fuel. This margin, often termed the 'spread,' is applied per gallon across gasoline, diesel, and heating oil. For instance, wholesale gasoline margins in early 2024 generally ranged from $0.10 to $0.30 per gallon, fluctuating with market dynamics. Volume remains the critical driver, as higher sales quantities directly amplify this revenue stream.

Guttman generates revenue by charging distinct fees for the transportation and delivery of fuel from terminals to customer locations.

These freight fees are structured to cover the operational costs of their extensive truck fleet, which in 2024 faced an average diesel fuel cost of approximately $4.00 per gallon for their fleet operations.

Such fees directly contribute to profitability and can be applied per-delivery, per-gallon, or as a flat rate, reflecting the logistical complexities and distance of each delivery.

Guttman Holdings generates significant revenue from fees and built-in premiums associated with its risk management and hedging services. This includes offering fixed-price, capped-price, and other derivative-based pricing products to clients. By assuming or managing the client's commodity price risk, Guttman provides a high-value, margin-accretive service. For instance, the global risk management market was projected to reach over $18 billion in 2024, demonstrating robust demand for such specialized financial solutions.

Fuel Management Service Fees

Guttman Holdings generates predictable, recurring revenue through its comprehensive fuel management service fees. These solutions often include monthly or annual charges for essential services like remote tank monitoring, ensuring optimal inventory levels, and streamlined consolidated invoicing.

This creates a stable, subscription-like income stream, crucial for business forecasting. For instance, the global fuel management systems market, which includes these services, was valued at over $20 billion in 2024, highlighting the substantial market for such offerings.

- Remote tank monitoring fees contribute to consistent monthly income.

- Inventory management services are billed regularly, enhancing revenue predictability.

- Consolidated invoicing reduces client administrative burden, ensuring service loyalty.

- Fuel data analytics services provide valuable insights, often as a premium recurring fee.

Fleet Card Program Revenue

Guttman Holdings generates revenue through its fleet card program when customers utilize their fueling cards. This includes transaction fees charged per fuel purchase and potential card administration fees for account management. A share of the interchange fee also contributes to this income stream, diversifying Guttman's overall revenue. This revenue directly supports the fleet fueling value proposition, enhancing financial stability.

- Transaction fees from fuel purchases.

- Card administration fees for program management.

- Share of interchange fees.

- Supports fleet fueling value proposition.

Guttman Holdings diversifies its revenue through wholesale fuel sales margins, benefiting from spreads of $0.10 to $0.30 per gallon in early 2024. Additional income stems from freight fees for fuel delivery, with their fleet facing around $4.00 per gallon for diesel in 2024. Recurring revenue is secured via fuel management service fees and risk management solutions, a market exceeding $18 billion in 2024, alongside fleet card transaction and administration fees.

| Revenue Stream | Primary Mechanism | 2024 Market/Data Point |

|---|---|---|

| Wholesale Fuel Sales | Per-gallon margin | $0.10 - $0.30/gallon margin (early 2024) |

| Transportation & Delivery | Freight fees | ~ $4.00/gallon fleet diesel cost |

| Risk Management | Hedging premiums | > $18 billion global market |

| Fuel Management Services | Subscription/service fees | > $20 billion global market |

| Fleet Card Program | Transaction/admin fees | Directly supports fueling value proposition |

Business Model Canvas Data Sources

The Guttman Holdings Business Model Canvas is meticulously constructed using a blend of proprietary financial data, comprehensive market research reports, and internal strategic planning documents. These sources provide the foundational insights for each block, ensuring accuracy and strategic alignment.