Guosen Securities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guosen Securities Bundle

Navigate the complex external landscape impacting Guosen Securities with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their strategic direction. Gain a competitive edge by leveraging these critical insights. Download the full PESTLE analysis now for actionable intelligence to inform your own market strategy.

Political factors

The Chinese government's substantial influence over the financial sector directly shapes Guosen Securities' operations. Policy directives, licensing mandates, and ongoing market supervision are key levers. For instance, in 2024, the China Securities Regulatory Commission (CSRC) continued to emphasize risk control and investor protection, leading to stricter compliance requirements for brokerage firms.

Shifts in regulatory policy, whether tightening or loosening oversight on areas like investment banking or asset management, have a tangible effect on Guosen's business potential and earnings. The government's proactive approach to managing systemic financial risks, evident in measures announced in late 2023 and early 2024 concerning capital requirements for certain financial activities, underscores this impact.

Political stability and transparent policy communication are vital for fostering market confidence, which in turn supports Guosen Securities' growth. In 2024, the government's commitment to opening up the financial markets further, while maintaining robust regulatory frameworks, signals a balancing act aimed at attracting foreign investment without compromising domestic stability.

Heightened geopolitical tensions, especially between China and key global players, significantly influence investor confidence and capital movement into and out of China. For Guosen Securities, this translates to indirect impacts from evolving foreign investment regulations and the broader global economic climate shaped by these dynamics.

Trade disputes and diplomatic realignments can introduce market volatility or create specific sector opportunities. For instance, the US-China trade friction has historically led to fluctuations in sectors reliant on international trade, affecting investment strategies and client portfolios managed by firms like Guosen.

China's commitment to capital market reforms, including the expansion of its derivatives market and the liberalization of foreign investment rules, is a significant political factor. These moves, aimed at boosting market efficiency and attracting global capital, directly impact firms like Guosen Securities by potentially increasing trading volumes and investment banking opportunities. For instance, the Shanghai-London Stock Connect, launched in 2019, represents a step in this opening-up process, facilitating cross-border capital flows.

Industrial Policy and Strategic Sectors

Guosen Securities navigates a landscape shaped by China's industrial policy, which actively promotes strategic sectors like advanced manufacturing and green energy. This government backing translates directly into investment banking opportunities, particularly in underwriting and advisory services for companies within these favored industries. For instance, the nation’s commitment to electric vehicles, with sales reaching over 9.5 million units in 2023, presents substantial avenues for capital raising and M&A advisory.

The allocation of state capital and incentives towards areas such as semiconductors and artificial intelligence directly impacts asset management strategies at Guosen. As policy steers capital into these high-growth sectors, Guosen’s portfolio managers are positioned to capitalize on emerging investment themes. Conversely, shifts in policy, such as potential tightening of regulations in the fintech sector, could alter investment flows and require strategic adjustments in asset allocation.

- Government support for strategic industries like AI and green energy creates underwriting and advisory mandates for Guosen.

- China's push into advanced manufacturing, evidenced by significant state investment, offers opportunities for Guosen's capital allocation strategies.

- Policy shifts impacting sectors like fintech can influence investment banking activities and asset management focus at Guosen.

Anti-Corruption Campaigns and Market Integrity

China's persistent anti-corruption drives, a key political factor, are fundamentally reshaping the financial landscape by prioritizing market integrity. This focus aims to curb illicit activities, fostering a more transparent and equitable environment for all participants. For Guosen Securities, this translates into an imperative for stringent compliance, fortified internal controls, and an unwavering commitment to ethical operations. While these measures may initially elevate compliance expenditures, they pave the way for a more robust market, ultimately attracting sustained and legitimate investment capital.

The impact of these campaigns is significant, as evidenced by the substantial fines levied in recent years for compliance breaches. For instance, in 2023, regulatory bodies across China imposed penalties totaling billions of yuan on financial institutions for various infractions, underscoring the heightened scrutiny. Guosen Securities, like its peers, must navigate this environment by embedding robust risk management frameworks and fostering a culture of accountability. This proactive approach is crucial for maintaining operational stability and investor confidence amidst evolving regulatory expectations.

- Enhanced Regulatory Scrutiny: Increased enforcement actions against financial misconduct signal a government commitment to market fairness.

- Compliance Costs: Investment in advanced compliance technologies and personnel is becoming essential for firms like Guosen Securities.

- Investor Confidence: A cleaner market, driven by anti-corruption efforts, is expected to boost foreign and domestic long-term investment.

- Ethical Business Practices: The emphasis on integrity necessitates a review and reinforcement of corporate governance and ethical standards within Guosen Securities.

The Chinese government's strong regulatory hand significantly influences Guosen Securities' operations, with policies from bodies like the CSRC dictating compliance and risk management. In 2024, the focus remained on investor protection, leading to stricter rules for brokerages, while efforts to manage systemic risks continued to shape capital requirements.

Political stability and clear policy communication are crucial for market confidence, a key driver for Guosen's growth. The government's strategy in 2024 aimed to balance financial market opening with robust regulation to attract foreign investment while ensuring domestic stability.

Geopolitical tensions, such as US-China trade friction, indirectly impact Guosen by affecting investor sentiment and capital flows, influencing foreign investment regulations and the global economic climate.

China's industrial policy actively supports strategic sectors like advanced manufacturing and green energy, creating significant opportunities for Guosen in underwriting and advisory services, as seen with the booming electric vehicle market.

What is included in the product

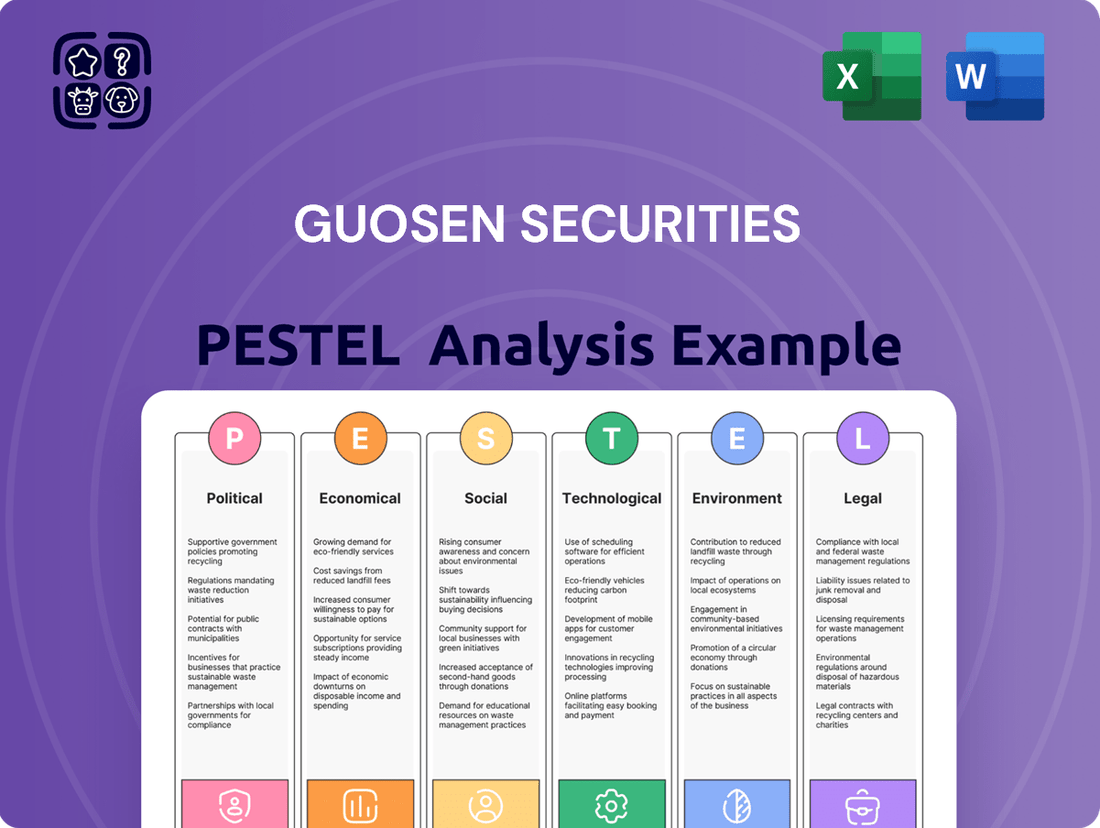

This Guosen Securities PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors shape the company's operating landscape, offering a comprehensive view of external influences.

Offers a clear, actionable framework for Guosen Securities to navigate complex external forces, transforming potential disruptions into strategic opportunities.

Economic factors

China's economic growth, a pivotal factor for Guosen Securities, is projected to moderate but remain substantial. In 2024, the IMF forecasts China's GDP to grow by 4.6%, a slight deceleration from 2023's estimated 5.2% but still a strong performance. This sustained growth underpins demand for brokerage, investment banking, and asset management services as businesses expand and investors seek opportunities.

The quality of this growth is also crucial. A focus on domestic consumption and technological innovation, rather than solely export-driven expansion, suggests a more resilient economic base. This shift could translate into more stable capital markets and a broader client base for Guosen, even amidst global economic uncertainties.

However, potential headwinds such as property sector adjustments and geopolitical tensions could temper this growth trajectory. For Guosen Securities, navigating these complexities will be key to maintaining its market position and capitalizing on opportunities within China's evolving economic landscape.

The People's Bank of China's (PBOC) interest rate policies are a crucial determinant of Guosen Securities' operating environment. For instance, the PBOC maintained its benchmark Loan Prime Rate (LPR) at 3.95% for the one-year tenor and 4.50% for the five-year tenor as of early 2024, reflecting a generally accommodative stance. These decisions directly impact Guosen's funding costs and the overall attractiveness of various investment products, influencing client demand for different asset classes.

Lower interest rates, such as those seen during periods of monetary easing, tend to make borrowing cheaper, potentially boosting investment and trading activity within the markets Guosen serves. Conversely, a tightening monetary stance with higher rates can increase funding costs for the firm and reduce investor appetite for riskier assets, impacting trading volumes and the profitability of fixed-income portfolios. The PBOC's management of liquidity supply also plays a vital role, directly affecting the availability of funds for market participants and influencing the performance of interest-sensitive financial instruments.

Inflationary pressures in China, as indicated by a CPI increase of 2.8% in 2023, can significantly influence Guosen Securities' operations. Higher inflation can erode the real value of fixed-income investments, potentially shifting investor preference towards equities or inflation-protected securities, requiring Guosen to adapt its product suite and advisory strategies.

Conversely, deflationary trends, though less pronounced recently, could dampen corporate earnings and overall market activity. For instance, a persistent low inflation environment might reduce trading volumes and fee income for securities firms. Guosen Securities must remain agile in its investment recommendations and risk management to navigate these shifting price levels.

Foreign Exchange Rate Stability

The stability of the Chinese Yuan (CNY) is a critical economic factor for Guosen Securities, especially impacting its institutional clients engaged in international trade and cross-border investments. Fluctuations in the Yuan's exchange rate against major currencies like the US Dollar (USD) or Euro (EUR) can significantly alter the value of foreign assets held by these clients and introduce currency risks that need careful management. For instance, in early 2024, the Yuan experienced periods of depreciation against the dollar, a trend that could affect the profitability of Chinese companies with substantial overseas earnings or foreign entities invested in China.

For Guosen Securities, managing these currency exposures is paramount. A volatile exchange rate can create uncertainty in capital flows, influencing both inbound foreign direct investment and outbound portfolio investments. This dynamic directly affects the overall investment landscape within China, impacting market liquidity and asset valuations. The People's Bank of China (PBOC) actively manages the Yuan's exchange rate, often through interventions or policy adjustments, aiming to maintain a generally stable and predictable environment for international economic activities.

- Yuan's Performance: The CNY to USD exchange rate hovered around 7.20 in early 2024, reflecting ongoing global economic pressures and domestic policy considerations.

- Impact on Investments: A stronger Yuan can make Chinese exports more expensive and reduce the value of foreign investments held by Chinese entities, while a weaker Yuan has the opposite effect.

- Capital Flow Influence: Exchange rate stability is a key determinant for foreign investors considering capital allocation into China's financial markets, impacting Guosen Securities' client advisory services.

- PBOC's Role: The central bank's management of the exchange rate aims to balance export competitiveness with import costs and financial market stability.

Household Income and Wealth Accumulation

The expansion of China's middle class and the resulting increase in disposable income are directly fueling demand for Guosen Securities' wealth management and retail brokerage services. As more households gain financial capacity, their need for investment advice and sophisticated financial products grows, creating a substantial opportunity for Guosen.

Wealth accumulation among Chinese households is a key indicator for Guosen Securities' growth. For instance, by the end of 2023, total household savings in China reached a record high, indicating a strong propensity to invest.

- Rising Disposable Income: China's per capita disposable income continued its upward trend through 2024, supporting increased consumer spending and investment.

- Growing Middle Class: The expanding middle-income segment is a primary driver for demand in financial advisory and wealth management.

- Increased Financial Literacy: Improved financial education is leading households to seek more complex investment solutions.

- Household Savings: High levels of household savings provide a substantial pool of capital available for investment through securities firms like Guosen.

China's economic trajectory remains a cornerstone for Guosen Securities, with growth expected to continue, albeit at a more measured pace. The IMF projected China's GDP to expand by 4.6% in 2024, a testament to its underlying economic resilience despite global headwinds. This sustained economic activity directly supports the demand for Guosen's diverse financial services, from brokerage to investment banking.

The composition of this growth is also noteworthy. A pivot towards domestic consumption and technological advancement, rather than a sole reliance on exports, signals a more robust and sustainable economic model. This shift is beneficial for Guosen Securities, potentially leading to more stable capital markets and a broader, more engaged client base.

However, potential challenges, such as ongoing adjustments in the property sector and geopolitical uncertainties, could influence the pace of economic expansion. Guosen Securities' ability to adeptly navigate these economic complexities will be crucial for its continued success and market leadership.

Monetary policy, particularly the People's Bank of China's (PBOC) interest rate decisions, significantly shapes Guosen Securities' operational landscape. The PBOC's stance, exemplified by maintaining the one-year Loan Prime Rate at 3.95% and the five-year LPR at 4.50% in early 2024, indicates a generally supportive environment. These rates directly affect Guosen's cost of capital and the attractiveness of investment products, influencing client investment decisions across various asset classes.

The inflationary environment in China, with the CPI rising by 2.8% in 2023, presents another critical economic factor for Guosen Securities. Elevated inflation can diminish the real returns on fixed-income investments, prompting a potential shift in investor preferences towards equities or inflation-hedging instruments. This necessitates that Guosen adapt its product offerings and advisory strategies to align with evolving market conditions and client needs.

The stability of the Chinese Yuan (CNY) is a vital economic consideration for Guosen Securities, particularly for its institutional clients involved in international trade and cross-border investments. Exchange rate volatility, such as the Yuan's depreciation against the USD observed in early 2024, can impact the valuation of foreign assets and introduce currency risks. Guosen must effectively manage these exposures to safeguard client portfolios and maintain market confidence.

The expansion of China's middle class and the subsequent rise in disposable income are significant drivers for Guosen Securities' wealth management and retail brokerage segments. As household wealth grows, so does the demand for sophisticated financial advice and investment products, creating substantial opportunities for Guosen to deepen its client relationships and expand its service offerings.

| Economic Indicator | 2023 (Estimate/Actual) | 2024 (Projection) | Impact on Guosen Securities |

|---|---|---|---|

| GDP Growth Rate | 5.2% (Est.) | 4.6% (IMF) | Sustained growth supports demand for financial services. |

| CPI Inflation | 2.8% | ~3.0% (Est.) | Influences investor preference between fixed income and equities. |

| One-Year LPR | 3.95% | 3.95% | Affects funding costs and investment product attractiveness. |

| CNY/USD Exchange Rate | ~7.20 | ~7.20-7.30 | Impacts cross-border investments and currency risk management. |

| Household Savings | Record High | Continued Growth | Provides a large pool of capital for investment services. |

Same Document Delivered

Guosen Securities PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Guosen Securities PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, offering critical insights for strategic decision-making.

Sociological factors

China's demographic landscape is rapidly changing, with a notable aging population and a growing middle class. This evolution directly impacts the demand for financial services, pushing companies like Guosen Securities to innovate.

By 2024, China's elderly population (60 and above) is projected to exceed 290 million, representing a significant portion of the consumer base. Guosen Securities must therefore refine its wealth management and retirement planning offerings to meet the needs of this demographic, focusing on stable income generation and wealth preservation strategies.

Simultaneously, Guosen Securities needs to appeal to younger, tech-savvy investors who are comfortable with digital platforms. This dual focus requires a strategic diversification of products and a reimagining of how the company engages with its clients across different age groups.

The rising financial literacy in China directly shapes investor demand. As of 2024, a significant portion of the retail investor base, particularly younger demographics, actively seeks more sophisticated investment products beyond traditional savings accounts.

This trend means investors are looking for tailored advice and complex instruments, pushing firms like Guosen Securities to offer more than just basic trading platforms. For instance, the demand for wealth management services, which often involve more complex products, saw substantial growth in 2023.

Guosen Securities can leverage this by investing in robust investor education programs and developing higher-value advisory services. By empowering clients with knowledge, Guosen can foster deeper, more loyal relationships and capture a larger share of the evolving market.

Investor preferences are shifting, with a notable rise in socially responsible investing (SRI) and environmental, social, and governance (ESG) considerations, especially among younger demographics. This trend saw global sustainable investment assets reach an estimated $37.8 trillion in early 2024, a significant increase from previous years.

Guosen Securities needs to proactively integrate ESG factors across its research, product offerings, and advisory services to cater to this growing demand. By developing and promoting green bonds, sustainable investment funds, and portfolios aligned with ESG principles, the firm can attract and retain a new wave of ethically-minded investors.

Urbanization and Regional Disparities

China's ongoing urbanization trend continues to funnel economic power and financial services into its megacities. This concentration, while creating hubs of activity, also highlights persistent regional economic disparities. For Guosen Securities, understanding these uneven development patterns is crucial for strategic expansion, both in terms of physical branches and digital service delivery.

The reality of these disparities means that a one-size-fits-all approach to market penetration won't be effective. For instance, while Tier 1 cities like Shanghai and Beijing boast high disposable incomes and sophisticated financial needs, lower-tier cities and rural areas present different opportunities and challenges. Guosen Securities needs to adapt its product offerings and marketing strategies to resonate with the unique economic and social landscapes of each region to tap into diverse client bases and unlock untapped market potential across the nation.

- Urban Concentration: By the end of 2023, China's urbanization rate reached 66.16%, with a significant portion of economic activity and financial services concentrated in major metropolitan areas.

- Regional Gaps: Per capita GDP in developed coastal regions often significantly outpaces that of inland or western provinces, impacting wealth accumulation and investment capacity.

- Targeted Strategies: Guosen Securities' success in capturing diverse client segments will hinge on its ability to tailor digital platforms and financial advisory services to the specific income levels, investment literacy, and market demands prevalent in different provinces and cities.

Trust and Confidence in Financial Institutions

Public trust in financial institutions significantly impacts Guosen Securities' ability to attract and retain clients. Market volatility, such as the fluctuations observed in global markets throughout 2024, can erode confidence. Regulatory actions, like the ongoing adjustments to capital requirements for securities firms in China, also play a critical role in shaping public perception.

Maintaining a strong reputation for integrity and transparency is paramount for Guosen Securities. For instance, in 2024, increased scrutiny on corporate governance and disclosure practices by the China Securities Regulatory Commission (CSRC) highlights the importance of ethical operations. Consistent, reliable performance, even amidst economic uncertainties, is key to building and sustaining this trust.

Building and sustaining trust requires a commitment to ethical practices and consistent service delivery. Guosen Securities' efforts in 2024 to enhance its digital security measures and client data protection, in response to growing cyber threats, directly contribute to this goal. This focus on reliability and client-centricity is essential for long-term success in the competitive financial landscape.

- Market Volatility Impact: Investor sentiment can shift rapidly based on economic indicators and global events, affecting willingness to engage with financial services.

- Regulatory Influence: Changes in regulations, such as those concerning capital adequacy and investor protection in China, directly shape the operational environment and public trust.

- Reputational Capital: Guosen Securities' emphasis on transparency and ethical conduct is crucial for maintaining its brand image and client loyalty.

- Client Retention: Trust is a foundational element for retaining existing clients and attracting new ones, especially in a sector where perceived reliability is paramount.

China's evolving social structure, marked by an aging population and increasing financial literacy, presents both challenges and opportunities for Guosen Securities. The growing elderly demographic, projected to exceed 290 million by 2024, necessitates a focus on retirement planning and wealth preservation services.

Simultaneously, a more financially educated populace, particularly younger investors, demands sophisticated products and tailored advice, pushing Guosen to enhance its advisory capabilities and digital offerings.

The rising trend of socially responsible investing (SRI) and ESG considerations, with global sustainable investment assets reaching an estimated $37.8 trillion in early 2024, requires Guosen Securities to integrate these factors into its product development and client engagement strategies.

Urbanization, reaching 66.16% by the end of 2023, concentrates economic power in megacities, creating regional disparities that Guosen must navigate with targeted regional strategies for service delivery.

Public trust, crucial for client retention and acquisition, is influenced by market volatility and regulatory actions; Guosen's commitment to transparency and ethical practices, highlighted by CSRC scrutiny in 2024, is vital for maintaining its reputation.

Technological factors

Guosen Securities is increasingly integrating artificial intelligence and big data analytics to sharpen its competitive edge. This technological shift is pivotal for enhancing risk management, automating complex trading strategies, and delivering highly personalized client services. For instance, by analyzing vast datasets, Guosen can identify subtle market shifts and potential risks far more effectively than traditional methods.

The practical applications of AI and big data are already yielding tangible benefits. Guosen's adoption of these tools allows for more accurate market predictions, a crucial advantage in volatile financial markets. Furthermore, these technologies bolster fraud detection capabilities, safeguarding both the firm and its clients. In 2024, the global financial services industry saw significant investment in AI, with firms reporting an average 15% increase in operational efficiency through AI-driven automation.

By leveraging AI and big data, Guosen Securities can offer tailored investment recommendations, significantly boosting client satisfaction and retention. These advanced analytics provide deeper, more actionable insights into market trends and intricate client behavior patterns, enabling proactive service delivery and product development. This data-driven approach is essential for maintaining relevance and driving growth in the rapidly evolving financial landscape.

Fintech innovation is dramatically altering financial services access, with mobile trading apps and online wealth management platforms becoming mainstream. Guosen Securities needs to aggressively invest in and enhance its digital offerings, ensuring a smooth and intuitive client experience. This means providing cutting-edge online trading capabilities, digital advisory solutions, and streamlined account management to capture the growing segment of tech-savvy investors.

As financial transactions increasingly move online, cybersecurity is a paramount concern for Guosen Securities. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the escalating risks. Protecting sensitive client data and financial assets from threats like data breaches and ransomware is critical for maintaining trust and complying with regulations.

Robust cybersecurity infrastructure is essential for Guosen Securities to safeguard its operations and reputation. The increasing sophistication of cyberattacks means continuous investment in advanced threat detection and prevention systems is necessary. Failure to do so could lead to significant financial losses and reputational damage, impacting client confidence and regulatory standing.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape the securities sector, particularly in areas like clearing, settlement, and data management. These advancements promise greater transparency, speed, and security for financial transactions. For instance, by mid-2025, industry estimates suggest that widespread adoption of DLT in post-trade processing could reduce operational costs by as much as 30% for financial institutions.

Guosen Securities can strategically leverage these technologies. Potential applications include streamlining back-office functions, managing digital assets more effectively, and even launching innovative products such as tokenized securities. This could lead to significant cost savings and accelerated transaction times, enhancing overall operational efficiency.

- Enhanced Efficiency: DLT can reduce settlement times from days to near real-time, improving capital utilization.

- Cost Reduction: Automating processes through blockchain can lower operational expenses by an estimated 15-20% in the coming years.

- New Revenue Streams: Tokenization of assets opens up new investment opportunities and market segments.

- Increased Security: Immutable ledgers offer robust protection against fraud and data tampering.

Cloud Computing Infrastructure

Guosen Securities' strategic adoption of cloud computing infrastructure is a significant technological enabler. This move allows for enhanced scalability, offering the ability to adjust IT resources up or down based on market demands, a crucial advantage in the volatile financial sector. The flexibility inherent in cloud solutions supports agile development and deployment of new financial products and services.

Migrating core systems to the cloud is instrumental for Guosen Securities to manage the increasing volume and complexity of financial data. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating widespread industry reliance on these platforms. This migration directly supports rapid expansion, enables real-time data analytics for better decision-making, and bolsters disaster recovery protocols, ensuring business continuity.

The ability to handle massive transaction volumes and process complex financial models efficiently is a direct benefit of robust cloud infrastructure. This technological advancement is key to Guosen Securities' capacity for innovation, allowing for faster testing and implementation of new trading algorithms and customer-facing applications. By mid-2024, major financial institutions were reporting significant cost savings and performance improvements from their cloud migrations, with some seeing operational cost reductions of up to 30%.

- Scalability: Ability to dynamically adjust IT resources to meet fluctuating market demands.

- Cost Efficiency: Reduced capital expenditure on hardware and IT maintenance.

- Data Processing: Enhanced capability for real-time analysis of large financial datasets.

- Innovation: Faster deployment of new financial technologies and services.

Guosen Securities' technological advancement is heavily reliant on artificial intelligence and big data analytics for enhanced risk management and personalized client services. By mid-2024, financial firms reported an average 15% efficiency boost through AI automation, a trend Guosen is capitalizing on for market prediction and fraud detection.

The firm must also prioritize its digital offerings and robust cybersecurity, especially as global cybercrime costs are projected to hit $10.5 trillion annually by 2025. Innovations like blockchain and DLT offer significant potential for cost reduction, estimated at 15-20% through process automation, and faster settlement times, improving capital utilization.

Cloud computing provides Guosen Securities with essential scalability and cost efficiency, supporting real-time data analysis and faster deployment of new financial technologies. The global cloud market exceeded $1.3 trillion by 2024, highlighting its critical role in enabling firms to manage complex data and drive innovation.

| Technology Area | Key Application for Guosen | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|---|

| AI & Big Data | Risk Management, Trading Strategies, Client Personalization | Improved market prediction, enhanced fraud detection, increased operational efficiency | 15% average increase in operational efficiency from AI automation |

| Fintech & Digital Platforms | Mobile Trading, Online Wealth Management | Improved client experience, capture tech-savvy investors | N/A (Industry trend) |

| Cybersecurity | Data Protection, Asset Security | Maintaining trust, regulatory compliance, preventing financial loss | Global cybercrime costs projected to reach $10.5 trillion annually by 2025 |

| Blockchain & DLT | Clearing, Settlement, Data Management, Digital Assets | Increased transparency, speed, security, cost reduction | Potential 15-20% reduction in operational costs through automation |

| Cloud Computing | Scalability, Data Processing, Innovation Deployment | Agile resource management, real-time analytics, business continuity | Global cloud market exceeded $1.3 trillion by 2024 |

Legal factors

Guosen Securities operates under the stringent oversight of the China Securities Regulatory Commission (CSRC), adhering to a comprehensive framework of securities laws. This includes regulations on initial public offerings, secondary market trading, and mandatory information disclosure to ensure market integrity. For instance, in 2024, the CSRC continued to refine rules around data security and cross-border data flow, directly affecting how financial institutions like Guosen manage client information and technological infrastructure.

Compliance with these evolving regulations is paramount, influencing Guosen's business model and operational costs. The CSRC's ongoing efforts to combat market manipulation and insider trading, as evidenced by increased enforcement actions in 2023 and early 2024, necessitate robust internal control systems. Failure to comply can result in significant penalties, impacting profitability and reputation.

Guosen Securities must strictly adhere to Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws to prevent the facilitation of illicit financial activities. This necessitates rigorous client identification and verification processes, ongoing transaction monitoring for suspicious patterns, and timely reporting to authorities. For instance, in 2023, global AML fines reached an estimated $5.9 billion, highlighting the significant financial risks of non-compliance.

Failure to comply with these regulations can lead to substantial penalties, including hefty fines, operational sanctions, and severe damage to Guosen Securities' reputation. In 2024, regulatory bodies worldwide continue to increase scrutiny, with a focus on digital asset transactions and cross-border financial flows, making robust compliance frameworks paramount.

To effectively navigate this landscape, Guosen Securities needs to invest in continuous training for its employees and regularly update its AML/CTF policies and procedures. This ensures that the firm remains aligned with evolving regulatory expectations and best practices in combating financial crime, a critical component for maintaining trust and operational integrity.

Guosen Securities faces significant legal hurdles with China's Personal Information Protection Law (PIPL), enacted in November 2021. This law mandates stringent rules for handling personal information, impacting how Guosen collects, stores, processes, and transfers client data. Failure to comply can result in substantial fines, with PIPL stipulating penalties of up to 5% of annual turnover or ¥1 million for violations.

Ensuring PIPL compliance necessitates robust data security measures, clear consent mechanisms for data usage, and transparent data governance policies. This legal framework directly affects Guosen's operations, requiring investments in technology and processes to safeguard client information and maintain trust, especially as digital financial services expand.

Cross-Border Investment Regulations

Regulations on cross-border capital flows and foreign investment in China's financial sector significantly impact Guosen Securities' operations. For instance, the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) programs, which allow foreign entities to invest in China's capital markets, directly shape Guosen's capacity to serve international clients and manage global transactions.

As of late 2023 and early 2024, China has continued to liberalize its financial markets, making it easier for foreign investors to participate. The State Administration of Foreign Exchange (SAFE) oversees these capital flows, with ongoing adjustments to quotas and accessibility measures. These regulatory shifts directly influence Guosen Securities' ability to expand its global service offerings and attract foreign institutional capital.

- QFII/RQFII Quota Expansion: Continued expansion of QFII and RQFII quotas, reaching over $160 billion USD in combined quotas by early 2024, directly benefits securities firms like Guosen by increasing the pool of investable foreign capital.

- Bond Connect and Stock Connect: The ongoing development and potential expansion of schemes like Bond Connect and Stock Connect provide additional avenues for cross-border investment, impacting Guosen's role in facilitating these flows.

- Foreign Ownership Limits: Reductions in foreign ownership limits in securities firms, with many now fully open to foreign majority ownership, create a more competitive landscape that Guosen must navigate.

- Capital Account Liberalization: Gradual steps towards capital account convertibility and simplified approval processes for cross-border investments by Chinese institutions influence Guosen's outbound investment services.

Intellectual Property Rights and Licensing

Guosen Securities' competitive advantage hinges on robust protection of its intellectual property, including proprietary trading algorithms and financial models. Failure to safeguard these assets could lead to significant financial losses and erosion of market position. In 2024, China's commitment to strengthening IP protection, as evidenced by legislative reforms and increased enforcement, offers a more secure environment for innovation.

Ensuring proper licensing for all third-party software and data is paramount. For instance, in 2024, financial institutions faced increased scrutiny and penalties for unlicensed software usage, with fines potentially reaching millions of dollars. Guosen Securities must maintain meticulous records and compliance protocols to avoid such risks.

Adherence to intellectual property laws is not just about avoiding penalties; it actively fosters the development of innovative financial solutions. By respecting IP rights, Guosen Securities can build upon existing frameworks and create unique offerings, contributing to the dynamic financial technology sector.

- IP Protection: Safeguarding trading algorithms and financial models is critical for maintaining Guosen Securities' competitive edge.

- Licensing Compliance: Ensuring proper licensing for all third-party software and data prevents legal and financial repercussions.

- Innovation Ecosystem: Adherence to IP laws encourages the development of novel financial products and services.

Guosen Securities operates under the stringent oversight of the China Securities Regulatory Commission (CSRC), which enforces comprehensive securities laws governing market integrity and investor protection. The CSRC's ongoing refinement of data security and cross-border data flow rules in 2024 directly impacts how Guosen manages client information and technology infrastructure.

Compliance with evolving regulations, including those addressing market manipulation and insider trading, necessitates robust internal controls, as evidenced by increased enforcement actions in 2023-2024. Failure to comply can lead to substantial penalties, affecting profitability and reputation, with global AML fines reaching an estimated $5.9 billion in 2023.

China's Personal Information Protection Law (PIPL) imposes strict rules on handling personal data, with potential fines up to 5% of annual turnover for violations, directly influencing Guosen's data governance and security investments.

Environmental factors

The accelerating global adoption of Environmental, Social, and Governance (ESG) investing is a significant environmental factor shaping Guosen Securities' strategic direction. By the end of 2024, global ESG assets under management were projected to exceed $30 trillion, reflecting a strong market preference for sustainable investments.

This trend translates into heightened client demand for investment products that demonstrably align with sustainability principles. Consequently, Guosen Securities is compelled to embed ESG criteria across its research, asset management, and advisory functions to meet this evolving market need.

Developing and promoting ESG-themed funds and green financial products is no longer optional but a crucial differentiator, offering a competitive edge in attracting and retaining clients who prioritize responsible investing.

China's ambitious goal of achieving carbon neutrality by 2060 is fueling a significant regulatory drive towards green finance. This commitment is translating into concrete policies that encourage financial institutions like Guosen Securities to actively participate in sustainable development. For instance, the People's Bank of China has been actively promoting green financial products and services, aiming to channel capital towards environmentally friendly projects.

Guosen Securities is therefore compelled to integrate these green finance mandates into its core business strategies. This could involve expanding its involvement in underwriting green bonds, which saw significant growth in China, with issuance reaching RMB 1.55 trillion in 2023. Furthermore, developing capabilities in carbon trading services and prioritizing investments in sectors aligned with China's sustainability targets are becoming crucial for compliance and competitive advantage.

This evolving regulatory landscape presents a fertile ground for new business opportunities within the sustainable finance sector. As the market matures, Guosen Securities can leverage its expertise to offer innovative solutions, potentially capturing a larger share of the rapidly expanding green finance market, which is projected to continue its upward trajectory in the coming years.

Climate change presents significant financial risks for Guosen Securities, categorized as physical and transition risks. Physical risks include damage to assets from extreme weather, while transition risks arise from policy shifts impacting carbon-intensive sectors. For instance, the increasing frequency of typhoons in Asia, a key market for Guosen, directly threatens physical assets and supply chains, potentially leading to asset devaluation.

Guosen Securities must integrate these climate risks into its core operations, from risk management to investment analysis. This proactive approach is crucial for client advisory, helping them understand and mitigate potential portfolio impacts. By 2025, financial institutions globally are expected to face heightened scrutiny over their climate risk disclosures, making robust assessment a competitive imperative.

Corporate Social Responsibility (CSR) Expectations

Beyond environmental concerns, Guosen Securities faces increasing societal demands for robust corporate social responsibility (CSR). This encompasses ethical employment, active community involvement, and transparent operational governance. Meeting these expectations is crucial for reputation, talent acquisition, and stakeholder trust, ultimately bolstering long-term viability and brand equity.

In 2024, the financial sector, including firms like Guosen Securities, is under scrutiny for its broader societal contributions. Stakeholders are increasingly evaluating companies not just on financial performance but also on their ethical conduct and community impact. This trend is amplified by global ESG (Environmental, Social, and Governance) initiatives, which are becoming standard benchmarks for investment decisions.

- Ethical Labor Practices: Ensuring fair wages, safe working conditions, and diversity and inclusion within Guosen Securities' workforce is paramount.

- Community Engagement: Initiatives such as financial literacy programs or local development support demonstrate a commitment beyond core business.

- Transparent Governance: Clear communication regarding executive compensation, board diversity, and ethical decision-making processes builds stakeholder confidence.

- Brand Value Enhancement: A strong CSR profile can differentiate Guosen Securities in a competitive market, attracting socially conscious investors and customers.

Resource Scarcity and Supply Chain Impacts

Guosen Securities, though not a direct manufacturer, faces indirect risks from resource scarcity and supply chain vulnerabilities impacting the industries it finances and invests in. For instance, the ongoing global semiconductor shortage, which continued to affect various sectors through 2024, directly influences the profitability and operational capacity of many technology and automotive companies Guosen may hold in its portfolios.

Assessing a company's resilience to these environmental factors is increasingly vital in investment due diligence. Investors are scrutinizing how businesses manage their reliance on specific raw materials or critical components. For example, reports in late 2024 highlighted how companies with diversified sourcing strategies or those investing in alternative materials were better positioned to weather price volatility and supply disruptions.

The financial implications are significant. Companies heavily reliant on scarce resources or facing logistical bottlenecks may see reduced margins and slower growth, directly impacting their valuation and Guosen's investment returns.

- Resource Dependency: Companies in sectors like electric vehicles, reliant on critical minerals such as lithium and cobalt, face price fluctuations and supply chain risks.

- Supply Chain Resilience: Investments in companies with robust, diversified supply chains are becoming more attractive due to their ability to mitigate disruption impacts.

- Industry Exposure: Guosen's analysis must consider the specific environmental risks faced by industries like renewable energy (solar panel components) or advanced manufacturing.

- Valuation Impact: Environmental factors are increasingly integrated into discounted cash flow (DCF) models, affecting long-term profitability assessments.

Guosen Securities must navigate the increasing global focus on environmental sustainability, driven by a surge in ESG investing, which saw global assets under management surpass $30 trillion by the end of 2024. China's commitment to carbon neutrality by 2060 is a significant driver, leading to policies that encourage green finance, with Guosen needing to integrate these mandates by expanding green bond underwriting and carbon trading services.

Climate change poses both physical risks, like asset damage from extreme weather, and transition risks, stemming from policy shifts impacting carbon-intensive sectors, necessitating robust climate risk assessment by 2025.

Societal demands for corporate social responsibility are growing, pushing Guosen to focus on ethical labor, community engagement, and transparent governance to enhance brand value and stakeholder trust.

Resource scarcity and supply chain vulnerabilities, exemplified by the 2024 semiconductor shortage, directly impact the profitability of industries Guosen finances, making supply chain resilience a key factor in investment due diligence.

| Environmental Factor | Impact on Guosen Securities | Key Data/Trend (2024-2025) |

|---|---|---|

| ESG Investing Growth | Increased client demand for sustainable products; need to embed ESG criteria. | Global ESG AUM projected to exceed $30 trillion by end of 2024. |

| China's Carbon Neutrality Goal | Regulatory push for green finance; opportunities in green bonds and carbon trading. | China's green bond issuance reached RMB 1.55 trillion in 2023. |

| Climate Change Risks | Need for robust climate risk assessment and disclosure by 2025. | Increased frequency of extreme weather events impacting Asian markets. |

| Resource Scarcity/Supply Chains | Impact on portfolio company profitability; focus on supply chain resilience. | Ongoing global semiconductor shortage affecting various industries through 2024. |

PESTLE Analysis Data Sources

Our Guosen Securities PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and comprehensive industry-specific reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the securities sector.