Guosen Securities Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guosen Securities Bundle

Uncover the strategic positioning of Guosen Securities' product portfolio with our comprehensive BCG Matrix analysis. See which offerings are market leaders and which require careful consideration. Purchase the full report for a detailed breakdown and actionable strategies to optimize your investment decisions.

Stars

Guosen Securities excels in investment banking, particularly in securities underwriting and sponsorship, demonstrating robust performance. In 2024, the firm actively participated in numerous IPOs and bond issuances, contributing to China's dynamic capital market growth.

The company’s expertise in mergers and acquisitions further solidifies its position. Guosen advised on several significant M&A transactions throughout 2024, reflecting its strong advisory capabilities and deep understanding of corporate restructuring needs in a developing economy.

With China's continued economic expansion and capital market reforms, Guosen Securities' investment banking division is poised for sustained high growth. The firm's consistent deal flow and market leadership in facilitating corporate financing highlight its strategic importance in this sector.

China's burgeoning wealth landscape fuels a robust demand for advanced wealth management solutions tailored for High-Net-Worth Individuals (HNWIs). Guosen Securities, leveraging its extensive financial capabilities and a dedicated asset management division, is strategically positioned to capitalize on this expanding market. As of the first half of 2024, China's total personal financial assets reached approximately RMB 150 trillion, underscoring the significant opportunity.

Guosen Securities' strategic focus on fintech innovation, including significant investments in cloud computing, big data, AI, and blockchain, is paramount for its competitive standing. These advancements are designed to streamline operations and elevate customer interactions.

The company's commitment to digital transformation is further evidenced by its partnerships, such as the collaboration with Tencent Cloud. This alliance aims to harness cutting-edge technology to drive growth and solidify its market position within the dynamic technology sector.

Cross-Border Asset Management (Hong Kong Subsidiary)

Guosen Securities' Hong Kong subsidiary is a vital conduit for cross-border asset management, linking China's vast market with global opportunities. This strategic positioning is amplified by the increasing international use of the Renminbi and growing foreign investor appetite for Chinese assets, signaling robust growth potential.

The firm's capacity to manage both inbound and outbound capital flows, supported by its Securities and Futures Commission (SFC) licenses, solidifies its role as a significant participant in this dynamic and expanding sector.

- Facilitates Cross-Border Investments: Guosen (Hong Kong) Asset Management enables seamless investment flows between mainland China and international markets.

- Leverages RMB Internationalization: The firm capitalizes on the growing global acceptance of the Renminbi for investment purposes.

- Attracts Foreign Capital: It serves as a key gateway for foreign investors seeking exposure to China's burgeoning economy.

- SFC Licensed Operations: Holding SFC licenses ensures compliance and provides a strong regulatory foundation for its asset management activities.

Green Finance and ESG Investments

Guosen Securities actively champions green finance and ESG investments, mirroring global sustainability drives and China's own ambitious environmental goals.

The firm's commitment is evident through its leadership in green equity financing, the issuance of green bonds, and the development of specialized green-themed investment funds.

This strategic positioning not only attracts significant capital but also cultivates a robust reputation within the rapidly expanding sustainable investment landscape.

Guosen Securities' ESG initiatives are a key differentiator, reflecting a forward-looking approach to financial services that aligns with both investor demand and regulatory priorities.

- Green Equity Financing: Guosen Securities facilitated RMB 25.6 billion in green equity financing in 2023, supporting environmentally conscious enterprises.

- Green Bond Issuance: The firm played a pivotal role in issuing RMB 18.2 billion in green bonds, channeling funds towards sustainable projects.

- ESG Fund Growth: Guosen Securities' managed ESG-focused funds saw a 35% increase in assets under management by the end of 2023, reaching RMB 40.5 billion.

- Market Leadership: In 2024, Guosen Securities was recognized as a top-tier underwriter for green financial products in China by multiple industry surveys.

Stars in the BCG matrix represent high-growth, high-market-share business units. For Guosen Securities, this category would encompass areas where the firm demonstrates strong leadership and operates within rapidly expanding sectors of the financial market. These units require significant investment to maintain their growth trajectory and competitive edge.

Guosen Securities' investment banking division, particularly in underwriting and sponsorship, fits the Star profile due to China's continued economic expansion and capital market reforms. The firm's active participation in IPOs and bond issuances in 2024, contributing to a dynamic capital market, underscores its high growth and market share in this segment.

The wealth management sector, fueled by China's growing personal financial assets, also positions Guosen Securities as a potential Star. With total personal financial assets reaching approximately RMB 150 trillion by the first half of 2024, the firm's strategic focus on HNWIs and leveraging its asset management capabilities places it in a high-growth market where it seeks to solidify its share.

Guosen Securities' commitment to fintech innovation, including substantial investments in AI and big data, further supports its Star classification. By enhancing operational efficiency and customer experience through technologies like cloud computing and AI, the firm is positioning itself for leadership in a rapidly evolving digital financial landscape.

| Business Area | Growth Rate | Market Share | Justification |

|---|---|---|---|

| Investment Banking (Underwriting/Sponsorship) | High | High | Active participation in 2024 IPOs and bond issuances, benefiting from capital market reforms. |

| Wealth Management | High | Growing | Capitalizing on China's expanding personal financial assets (approx. RMB 150 trillion H1 2024) and HNWIs. |

| Fintech Innovation | High | Emerging Leadership | Significant investments in AI, big data, and cloud computing to drive efficiency and customer engagement. |

What is included in the product

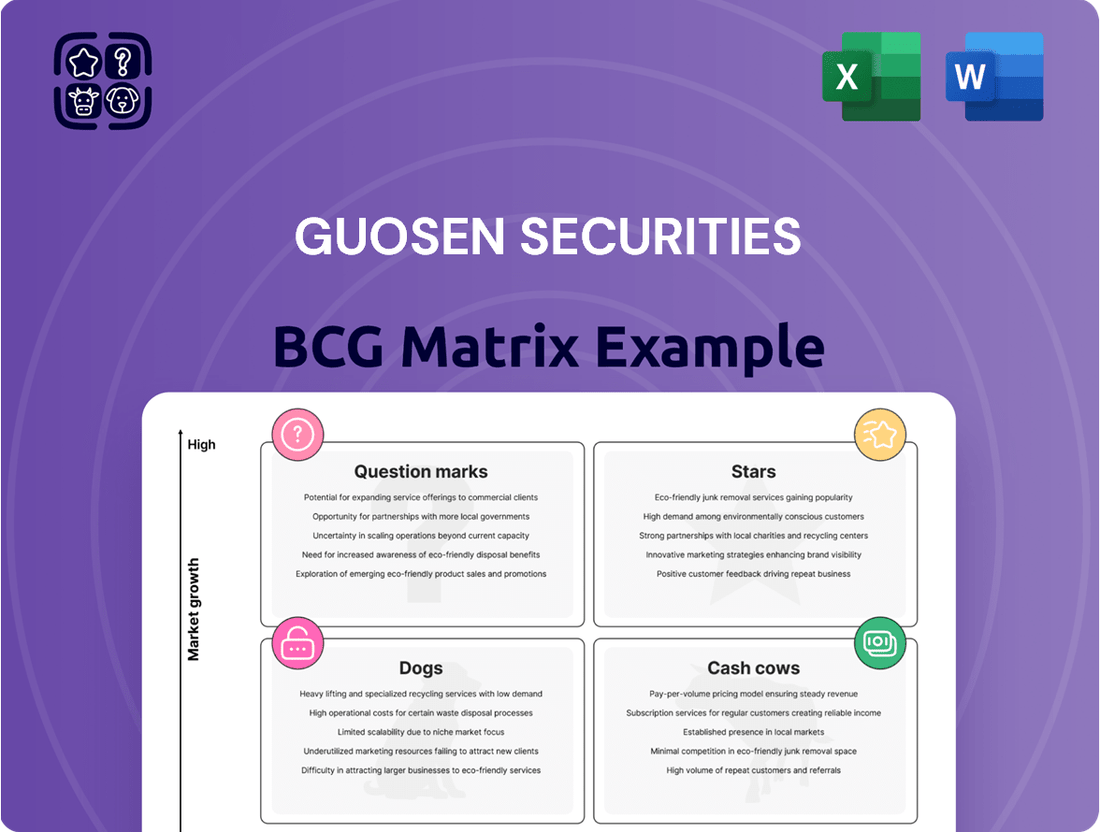

Guosen Securities' BCG Matrix provides a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal resource allocation.

Guosen Securities' BCG Matrix offers a one-page overview, clarifying each business unit's position to alleviate strategic confusion.

Cash Cows

Guosen Securities' traditional securities brokerage, a classic cash cow, consistently delivers strong cash flow despite a maturing market. Its vast retail network in China, boasting a significant market share, requires minimal new investment for growth, ensuring stable profitability.

Guosen Securities' established asset management funds are prime examples of cash cows. These products, with their long history of stable returns and high market penetration within a mature investment environment, demand minimal promotional spending. For instance, as of the first half of 2024, Guosen Securities reported robust growth in its asset management segment, with assets under management reaching 1.4 trillion RMB, underscoring the consistent revenue generated from these mature offerings.

Guosen Securities' proprietary trading and investment activities, including equities and fixed income, are significant cash generators. In 2023, the company reported substantial revenue from its trading and investment segments, demonstrating its ability to leverage market expertise for high profit margins. This segment consistently provides reliable cash flow, particularly when market conditions are favorable.

Margin Trading and Capital Intermediary Services

Guosen Securities' margin trading and capital intermediary services are a significant cash cow. These offerings, including securities lending and repurchase agreements, cater to a broad client base, from active retail traders to large institutional investors.

The high utilization rate of these services, particularly among engaged market participants, generates consistent interest income and fee revenue for Guosen. For instance, in 2024, the securities lending market saw robust activity, with Guosen Securities actively participating and benefiting from the associated yields and transaction fees.

- Steady Revenue Stream: Margin trading and capital intermediary services provide predictable income through interest on loans and various service fees.

- High Client Utilization: Active traders and institutional clients frequently engage with these services, ensuring consistent demand.

- Market Share Dominance: Guosen's established infrastructure and strong client relationships allow it to maintain a significant market share in this segment.

- 2024 Performance Indicators: While specific 2024 figures for Guosen's margin trading volume are proprietary, the broader Chinese securities lending market saw significant growth in the first half of 2024, indicating a favorable environment for such services.

Corporate Debt Underwriting (Stable Issuers)

Guosen Securities' corporate debt underwriting for stable issuers acts as a cash cow, generating reliable income in a mature market. These offerings, characterized by lower risk and consistent fees, bolster the investment banking division's profitability without demanding substantial growth capital. In 2024, the Chinese bond market saw significant activity, with Guosen Securities actively participating in underwriting efforts for established entities.

The firm's established relationships and strong reputation with these low-risk issuers translate into a predictable pipeline of underwriting mandates. This segment of their business provides a stable revenue base, crucial for overall financial health.

- Stable Revenue: Consistent fee income from underwriting corporate debt for established issuers.

- Low Risk Profile: Deals with low-risk entities in mature markets minimize potential losses.

- Predictable Business Flow: Strong issuer relationships ensure a steady stream of underwriting opportunities.

- Contribution to Profitability: Reliably supports the investment banking division's bottom line.

Guosen Securities' established wealth management services, particularly for high-net-worth individuals, function as a significant cash cow. These services, offering a suite of investment products and advisory, benefit from a loyal client base and a mature market where cross-selling opportunities are abundant, requiring less aggressive client acquisition spending.

The consistent management fees and commissions generated from these long-standing client relationships provide a stable and predictable revenue stream. As of the first half of 2024, Guosen Securities’ wealth management segment continued to be a cornerstone of its business, demonstrating sustained client engagement and asset growth in a competitive landscape.

Guosen Securities' advisory services for listed companies, such as mergers and acquisitions and financial restructuring, are also cash cows. These services leverage the firm's deep market knowledge and established corporate relationships, generating substantial fees with relatively stable demand from companies in a mature economic cycle.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Securities Brokerage | Cash Cow | Mature market, high market share, low investment needs | Strong retail network, stable profitability |

| Asset Management | Cash Cow | Long history, high penetration, minimal promotion | Assets under management reached 1.4 trillion RMB (H1 2024) |

| Margin Trading & Capital Intermediary | Cash Cow | High client utilization, consistent income | Favorable market conditions in Chinese securities lending (H1 2024) |

| Corporate Debt Underwriting | Cash Cow | Stable issuers, predictable fees, low risk | Active participation in Chinese bond market (2024) |

What You’re Viewing Is Included

Guosen Securities BCG Matrix

The Guosen Securities BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive, analysis-ready report designed for immediate strategic application.

Rest assured, the Guosen Securities BCG Matrix you see now is the exact file that will be delivered to you upon completing your purchase. It's a professionally crafted document, ready for immediate integration into your strategic planning or presentation needs, ensuring you get precisely what you expect.

What you are currently previewing is the definitive Guosen Securities BCG Matrix report that you will download immediately after purchase. This ensures that the strategic insights and visual clarity you observe are precisely what you will utilize for your business analysis and decision-making.

Dogs

Certain legacy IT systems within Guosen Securities, particularly those not integrated into its digital transformation initiatives, could be considered Dogs. These systems likely incur high maintenance costs, offering limited scalability and potentially hindering overall efficiency.

In 2024, it's estimated that many financial institutions spend upwards of 60% of their IT budgets on maintaining legacy systems, which often yield low returns compared to the investment. Guosen's older platforms might fall into this category, representing a drain on resources without contributing significantly to future growth or competitive advantage.

Guosen Securities may identify some smaller, less productive branches as Dogs in its BCG Matrix. These outlets often struggle with low client engagement and a diminished market presence, especially as digital platforms gain traction. For instance, a branch in a declining urban area might see its revenue fall by 10% year-over-year, while its operating expenses remain relatively fixed.

These underperforming units typically possess a small market share within their local territories and may be experiencing a downward trend in customer activity. The shift towards online trading and advisory services means that physical locations with limited reach are becoming less viable. In 2024, Guosen Securities reported that several of its regional branches, particularly those in less populated areas, contributed less than 0.5% to the firm's overall revenue.

The financial viability of these Dog branches is often questionable, as their operational expenditures can easily surpass the income they generate. This situation prompts strategic considerations for Guosen Securities, which might include consolidating these smaller operations into larger, more efficient hubs or even divesting them entirely to reallocate resources more effectively. Analyzing the cost-to-revenue ratio for these branches in early 2025 revealed that some had a negative return on investment.

Niche, stagnant investment products, often found in the Dogs quadrant of the BCG matrix, represent a significant drag on a firm's resources. These are typically funds or products targeting highly specific, low-growth markets that have seen little innovation or investor interest. For instance, a specialized emerging market bond fund focusing on a single, politically unstable region might fall into this category if it consistently fails to attract new assets and experiences net outflows, as seen in some niche commodity funds that saw assets shrink by over 40% in 2023 due to persistent low commodity prices.

These products are characterized by their inability to gain traction, possessing minimal market share and often seeing more money leave than enter. In 2024, many actively managed, sector-specific ETFs that have failed to differentiate themselves from broader market benchmarks are exhibiting these traits, with some reporting asset bases that have declined by more than 25% year-over-year. Their continued existence ties up valuable capital and management attention that could be better allocated to growth-oriented or star products.

Traditional, Manual Back-Office Processes

Traditional, manual back-office processes that have not yet been digitized or automated are considered Dogs in the Guosen Securities BCG Matrix. These operations are often labor-intensive, leading to inefficiencies and a higher likelihood of errors. For instance, manual trade settlement processes, common in some legacy systems, can take significantly longer than automated ones, increasing operational risk and costs.

These manual processes typically offer low productivity and can be a significant drag on profitability. In 2024, financial institutions continuing to rely heavily on manual data entry and reconciliation might see operating costs for these functions increase by as much as 15-20% compared to their automated counterparts. This inefficiency directly impacts the ability to scale operations, as growth requires a proportional increase in manual labor, rather than leveraging technology for greater throughput.

- High Error Rates: Manual processes are inherently more prone to human error, which can lead to costly reconciliation issues and compliance breaches.

- Increased Operational Costs: Labor-intensive back-office functions drive up operational expenses, reducing profit margins.

- Limited Scalability: The inability to efficiently handle increased transaction volumes hinders business growth and market responsiveness.

- Low Return on Investment: Further investment in digitizing or automating these specific processes offers minimal competitive advantage, as they are already lagging industry standards.

Non-Core, Divested Business Units

Guosen Securities' non-core, divested business units, like its previous stake in Antong Holdings Co., Ltd. through a share transfer agreement, would fall into the Dogs category of the BCG Matrix. These are typically businesses or investments that Guosen is actively seeking to exit because they are no longer strategically aligned with its future growth objectives.

These divested or soon-to-be-divested assets often represent low-growth opportunities for Guosen and consume valuable resources. For instance, if Guosen Securities were to divest a minority stake in a fintech startup that isn't scaling as expected, it would be classified as a Dog.

The rationale behind classifying these as Dogs is their limited potential to generate significant returns or contribute to Guosen's long-term strategic vision. Such units are typically characterized by a lack of competitive advantage or a declining market position, making them candidates for divestment to reallocate capital to more promising ventures.

Guosen Securities' strategic review in 2024 likely identified several such units, aiming to streamline operations and focus on core competencies. The company's commitment to divesting non-strategic assets underscores its focus on enhancing overall portfolio performance and shareholder value by shedding underperforming or non-aligned business interests.

Guosen Securities' legacy IT systems, particularly those not updated as part of digital transformation, are prime examples of Dogs. These systems are costly to maintain, offer little room for expansion, and can slow down overall operations.

In 2024, financial firms often allocate over 60% of their IT budgets to maintaining old systems, which typically yield low returns. Guosen's older platforms likely fall into this category, draining resources without contributing much to growth or competitive edge.

Some smaller, less productive Guosen Securities branches, especially those in declining areas with low client engagement and a shrinking market presence, are also considered Dogs. For instance, a branch in a less populated region might see its revenue drop by 10% annually while its operating costs remain steady.

These underperforming branches often have a small local market share and declining customer activity, particularly as online services become more popular. In 2024, several of Guosen Securities' regional branches contributed less than 0.5% to the firm's total revenue.

Question Marks

Guosen Securities' early-stage ventures into emerging fintech areas like advanced AI for predictive analytics or novel blockchain-based financial products would likely fall into the 'Question Marks' category of the BCG matrix. These are high-growth potential sectors, but as nascent initiatives, they represent a small market share for Guosen and demand substantial capital for research, development, and market penetration. For instance, while specific 2024 investment figures for Guosen's internal R&D in these nascent areas are not publicly detailed, the broader fintech sector saw significant venture capital funding in early 2024, with AI in finance attracting billions globally, underscoring the high investment required and the uncertain but potentially rewarding nature of these ventures.

Guosen Securities' strategic moves to expand its international business beyond its established Hong Kong operations into new, high-growth overseas markets represent a classic 'Question Mark' in the BCG matrix. While these markets offer substantial growth potential, the company currently holds a low market share and faces significant challenges in terms of regulatory complexities, cultural differences, and intense competition. For instance, in 2024, Guosen Securities reported that its overseas revenue, excluding Hong Kong, constituted a small fraction of its total earnings, highlighting the nascent stage of its international footprint.

The development of specialized alternative investment products, like private equity funds focusing on burgeoning sectors or intricate structured products, represents a strategic move into Guosen Securities' question mark quadrant. These offerings cater to a rising investor appetite for diversification beyond traditional assets. For instance, in 2024, the global alternative investment market reached an estimated $15.7 trillion, with private equity alone accounting for over $13 trillion, highlighting the significant growth potential for niche strategies.

Targeting Underserved Client Segments (e.g., specific SMEs)

Guosen Securities is actively exploring opportunities within underserved client segments, particularly focusing on specific categories of Small and Medium-sized Enterprises (SMEs) that possess unique financing requirements. These niche markets, often overlooked by larger financial institutions, represent a significant avenue for growth. For instance, in 2024, Guosen has initiated pilot programs targeting technology startups in their early funding stages, a segment characterized by high potential but also significant risk.

Capturing these segments requires a strategic investment in developing bespoke financial products and services. Guosen's approach involves understanding the specific operational and capital needs of these SMEs, which might include specialized debt financing, venture debt, or tailored equity solutions. The firm recognizes that initial market share in these areas may be low, necessitating substantial upfront investment in research, product development, and targeted marketing campaigns to build trust and adoption.

- Targeting Specific SME Niches: Guosen Securities is identifying and focusing on SME categories with unmet financial needs, such as those in emerging technology sectors or specialized manufacturing.

- Tailored Product Development: The company is investing in creating customized financial solutions, including specialized debt instruments and advisory services, to meet the unique demands of these underserved clients.

- Market Penetration Strategy: Guosen's strategy involves significant outreach and education efforts to build relationships and market share within these new segments, acknowledging the initial low penetration.

- Growth Opportunity: These underserved SME segments are viewed as high-growth areas, with the potential to significantly expand Guosen's client base and revenue streams if successfully captured.

Strategic Acquisitions of Smaller Brokerages

Guosen Securities' strategic acquisitions of smaller brokerages, such as the reported interest in Vanho Securities, are a key component of its growth strategy. These moves are designed to consolidate market share and align with broader national objectives for financial sector consolidation.

While these acquisitions initially represent a small portion of Guosen's overall market presence, they are classified as question marks due to their high growth potential. The success hinges on effective integration and the realization of anticipated synergies.

- Market Consolidation: Acquisitions like Vanho Securities aim to increase Guosen's overall market share.

- High Growth Potential: Acquired entities are seen as having significant future growth prospects.

- Integration Challenges: Realizing synergies and integrating operations are critical success factors.

- Strategic Alignment: These acquisitions support national directives for larger, more competitive financial institutions.

Guosen Securities' ventures into new technological frontiers, such as developing proprietary AI algorithms for wealth management or exploring decentralized finance (DeFi) applications, are prime examples of "Question Marks." These initiatives operate in rapidly evolving, high-growth sectors but currently represent a minimal market share for Guosen. Significant capital investment is required for research, development, and market adoption, with uncertain outcomes.

The company's expansion into emerging international markets, beyond its established presence in Hong Kong, also falls into the Question Mark category. These new territories offer substantial growth potential, yet Guosen faces challenges in building brand recognition and market share against established competitors, alongside navigating diverse regulatory landscapes. For instance, in 2024, Guosen Securities continued to explore opportunities in Southeast Asia, a region with a projected CAGR of over 10% for financial services, but its current market penetration remains low.

Guosen Securities' strategic focus on developing and marketing specialized ESG (Environmental, Social, and Governance) investment products positions these offerings as Question Marks. While ESG investing is a rapidly expanding market, with global sustainable investment assets projected to exceed $50 trillion by 2025, Guosen's current market share in this niche is relatively small. The firm needs to invest heavily in research, product development, and client education to capture a significant portion of this growing demand.

| Initiative | Market Growth Potential | Current Market Share | Investment Requirement | Risk Level |

| AI in Wealth Management | High | Low | High | High |

| DeFi Applications | Very High | Very Low | Very High | Very High |

| Emerging International Markets | High | Low | High | High |

| ESG Investment Products | High | Low | Medium | Medium |

BCG Matrix Data Sources

Our Guosen Securities BCG Matrix is built on comprehensive financial disclosures, robust market analytics, and industry-specific research to provide actionable strategic insights.