Gunma Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gunma Bank Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Gunma Bank's future. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate these complex external forces. Gain a strategic advantage by understanding the opportunities and threats impacting the banking sector. Download the full version now for immediate insights and to empower your decision-making.

Political factors

The Japanese government's financial policies, particularly those enacted by the Bank of Japan (BOJ) and the Financial Services Agency (FSA), significantly shape the operating environment for banks like Gunma Bank. The BOJ's recent pivot away from negative interest rates, with the first rate hike in March 2024 marking a significant policy shift, directly impacts lending margins and funding costs.

Furthermore, the FSA's strategic focus for 2024-2025, which includes bolstering financial stability and encouraging a transition from savings to investment, presents both challenges and opportunities for Gunma Bank. This regulatory push could spur demand for wealth management products and advisory services, areas where Gunma Bank can potentially expand its offerings.

Gunma Bank's focus on Gunma Prefecture and surrounding areas means government-led regional revitalization projects are crucial. Initiatives like boosting tourism, bolstering agriculture, and drawing new businesses directly influence local economic health and the demand for banking services.

For instance, Gunma Prefecture's "New Gunma Future Vision" aims to revitalize the region through tourism promotion and industrial development, with significant government funding allocated. These efforts, supported by Gunma Bank's partnership agreements with the prefecture and local municipalities, are designed to stimulate economic activity and create opportunities for the bank's lending and financial services.

The Japanese banking sector is experiencing a wave of consolidation discussions, particularly among regional banks. This trend is driven by demographic shifts, including shrinking populations, and persistent sluggish economic growth in certain prefectures.

Gunma Bank is actively participating in this movement, having signed a basic agreement for business integration with Daishi Hokuetsu Financial Group. This strategic move is set to forge a larger financial entity, significantly altering the competitive dynamics and market positioning for all involved institutions.

Regulatory Environment for Fintech

Japan's government is actively fostering fintech growth through regulatory adjustments, aiming to boost competition and collaborations between fintech firms and established banks. Recent amendments to the Banking Act and Payment Services Act are key components of this initiative. Gunma Bank's digital transformation efforts and integration of new technologies will be shaped by these evolving legal frameworks and the national drive towards a cashless economy.

The regulatory landscape is a critical factor for Gunma Bank's digital strategy. For instance, the Financial Services Agency (FSA) has been instrumental in developing guidelines for open banking and data sharing, which could unlock new opportunities for Gunma Bank to partner with fintechs. By mid-2024, Japan's cashless payment market share was projected to reach approximately 37% of total consumer spending, a significant increase that highlights the government's success in promoting digital transactions and the imperative for traditional banks to adapt.

- Regulatory Reforms: Updates to the Banking Act and Payment Services Act facilitate fintech integration and competition.

- Government Push: Active promotion of a cashless society influences digital strategy for institutions like Gunma Bank.

- Open Banking Initiatives: FSA's guidelines on data sharing encourage partnerships between banks and fintech companies.

- Market Trends: The projected 37% cashless payment market share by mid-2024 underscores the urgency for digital adoption.

Corporate Governance Reforms

Japan's Corporate Governance Code, updated in 2021, mandates enhanced disclosures for listed banks concerning climate risks, diversity, and Environmental, Social, and Governance (ESG) factors. It also emphasizes the appointment of independent external directors. For Gunma Bank, adhering to these reforms means strengthening its governance framework and boosting transparency, which is crucial for attracting investors prioritizing sustainable and responsible business practices. As of the latest available data, a significant portion of Japanese companies are actively working to meet these new standards, with a focus on increasing the proportion of independent directors on their boards.

These governance shifts directly influence Gunma Bank's operational strategies and investor relations. The push for greater transparency in ESG reporting, for instance, requires robust data collection and communication. This can lead to improved decision-making processes and a more resilient business model, ultimately enhancing Gunma Bank's standing in a market increasingly driven by sustainability considerations. For example, many Japanese banks are reporting on their progress in achieving gender diversity targets on their boards, a key aspect of the revised code.

Compliance with the Corporate Governance Code reforms can also impact Gunma Bank's financial performance and market valuation. Banks demonstrating strong governance and a commitment to ESG principles often experience greater investor confidence and potentially lower costs of capital. This aligns with global trends where sustainable investing is becoming a dominant force. In 2023, studies indicated a positive correlation between strong corporate governance scores and stock performance for Japanese financial institutions.

Key implications for Gunma Bank include:

- Enhanced Investor Appeal: Meeting ESG disclosure requirements makes Gunma Bank more attractive to a growing segment of socially responsible investors.

- Improved Risk Management: Greater transparency in climate-related risks, for example, can lead to more proactive risk mitigation strategies.

- Board Effectiveness: The appointment of independent directors is intended to bring diverse perspectives and oversight, strengthening board decision-making.

- Regulatory Alignment: Staying compliant ensures Gunma Bank operates within the evolving regulatory landscape for Japanese financial institutions.

The Japanese government's financial policies, particularly the Bank of Japan's shift away from negative interest rates in March 2024, directly impact Gunma Bank's lending margins and funding costs. Regulatory reforms, such as updates to the Banking Act, are fostering fintech integration and competition, influencing Gunma Bank's digital strategy. Furthermore, government-led regional revitalization projects in Gunma Prefecture are crucial for stimulating local economic activity and demand for banking services.

The ongoing consolidation among regional banks, driven by demographic shifts and economic growth, has led Gunma Bank to sign a basic agreement for business integration with Daishi Hokuetsu Financial Group, altering market dynamics. The government's active promotion of a cashless society, with cashless payments projected to reach approximately 37% of total consumer spending by mid-2024, necessitates digital adoption by institutions like Gunma Bank.

Japan's Corporate Governance Code, updated in 2021, mandates enhanced ESG disclosures and board independence, influencing Gunma Bank's investor relations and risk management. Compliance with these governance shifts is essential for attracting investors prioritizing sustainable practices, with many Japanese banks actively increasing the proportion of independent directors on their boards.

| Policy/Trend | Impact on Gunma Bank | Timeline/Data Point |

|---|---|---|

| BOJ Rate Hike | Affects lending margins and funding costs | March 2024 |

| Fintech Integration | Influences digital strategy and competition | Ongoing (Banking Act amendments) |

| Regional Revitalization | Drives local economic activity and service demand | Gunma Prefecture's "New Gunma Future Vision" |

| Bank Consolidation | Alters competitive landscape | Integration agreement with Daishi Hokuetsu FG |

| Cashless Society Push | Requires digital adoption | 37% cashless payment market share (projected mid-2024) |

| Corporate Governance Code | Enhances ESG disclosure and board independence | Updated 2021 |

What is included in the product

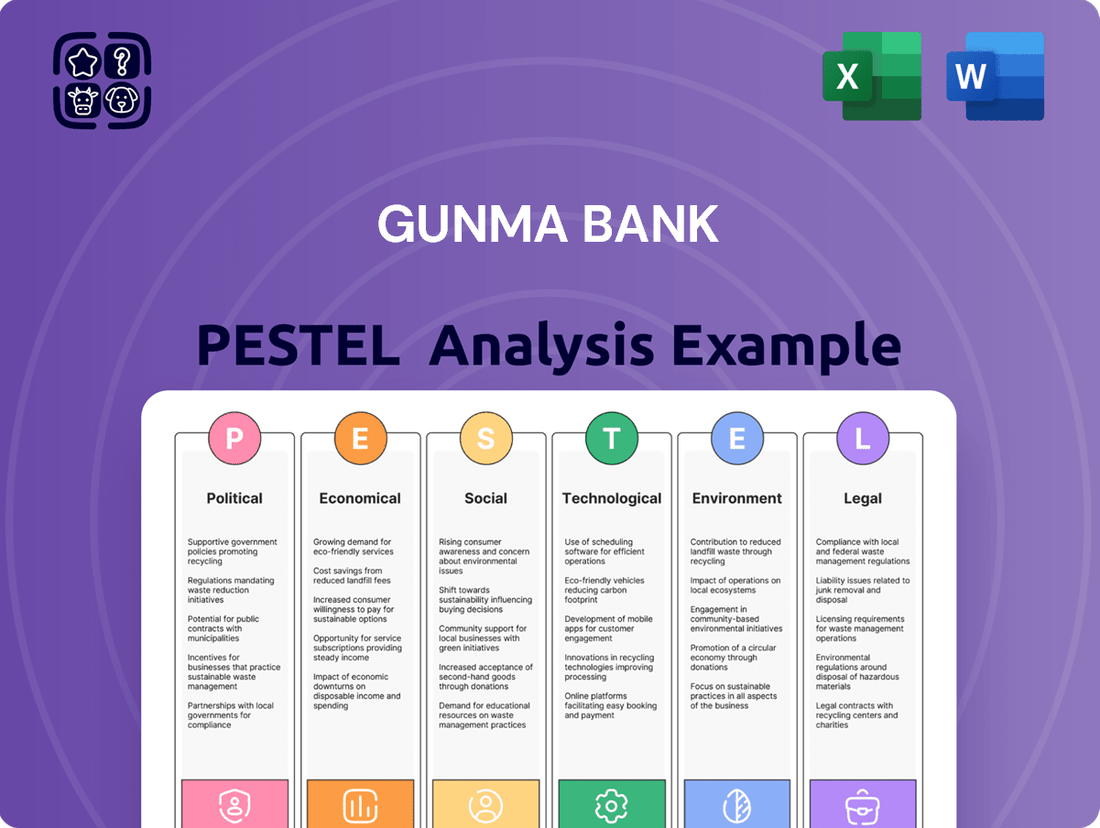

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Gunma Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying opportunities and threats stemming from these critical external influences.

A PESTLE analysis for Gunma Bank acts as a pain point reliever by offering a structured framework to proactively identify and address external challenges, enabling more informed strategic decisions and mitigating potential risks.

This analysis serves as a pain point reliever by providing a clear, summarized overview of the external landscape, allowing Gunma Bank to anticipate shifts and adapt its strategies, thereby reducing uncertainty and operational friction.

Economic factors

The Bank of Japan's pivot away from negative interest rates, with anticipated rate hikes in 2024 and 2025, marks a substantial shift in monetary policy. This move is expected to benefit Gunma Bank by potentially widening its net interest margin, a key driver of profitability.

However, the economic landscape is not without its complexities. While higher rates can boost bank earnings, they also pose risks to credit demand and overall economic activity. Careful observation of potential impacts, such as the unwinding of real estate bubbles or an increase in corporate bankruptcies, will be crucial for Gunma Bank's strategic planning.

Gunma Prefecture's economic trajectory significantly shapes Gunma Bank's performance. For instance, in 2023, Gunma's GDP saw a modest increase, reflecting ongoing industrial activity, particularly in manufacturing and agriculture, which directly influences loan demand and deposit growth for the bank.

Employment figures are also crucial; a stable or rising employment rate in Gunma, which stood at approximately 3.7% unemployment in early 2024, supports consumer spending and business investment, benefiting Gunma Bank's product offerings.

However, demographic trends present a long-term consideration. Gunma, like many Japanese prefectures, faces an aging population and a declining birthrate, potentially impacting its future customer base and overall economic vitality, a factor Gunma Bank must strategically address.

Japanese households possess substantial financial assets, with total household financial assets reaching ¥2,093 trillion as of December 2023, according to the Bank of Japan. A notable trend is the government's active encouragement for households to move these assets from traditional savings into investments.

Initiatives like the revamped NISA (Nippon Individual Savings Account) program, which began in January 2024 with increased contribution limits and tax-free investment periods, are designed to facilitate this shift. This governmental push creates a fertile ground for financial institutions.

Gunma Bank can strategically leverage this evolving landscape by broadening its wealth management services and investment product portfolio. Offering more comprehensive advisory services tailored to the new NISA framework and other investment vehicles will be key to capturing this growing demand.

Real Estate Market Dynamics

The stability of the real estate market, both in Gunma Prefecture and across Japan, directly influences Gunma Bank's financial health given its significant exposure to real estate loans. Fluctuations in property values, including potential mini-bubbles, can directly affect the quality of the bank's loan portfolio and its overall asset performance. For instance, as of Q1 2024, residential land prices in Gunma saw a modest increase of 1.5%, but commercial property values experienced a slight dip of 0.8%, indicating varied regional dynamics.

These market shifts are critical for Gunma Bank's risk management. A downturn in property values could lead to increased non-performing loans, impacting profitability and capital adequacy. Conversely, a stable or appreciating market supports the bank's lending activities and asset quality.

- Local Real Estate Trends: Gunma's residential property market has shown resilience, with average sale prices for new apartments in Maebashi rising by approximately 3% year-on-year in early 2024.

- National Economic Impact: National real estate trends, influenced by interest rate policies and economic growth, set the broader context for Gunma's market. Japan's overall housing price index remained relatively stable in late 2023, with minor regional variations.

- Loan Portfolio Risk: Gunma Bank's exposure to the real estate sector, particularly through mortgages and commercial property loans, makes it susceptible to market corrections.

- Impact on Asset Quality: A significant decline in property values could necessitate higher loan loss provisions, directly affecting the bank's profitability and capital ratios.

Inflationary Pressures and Consumer Spending

Inflationary pressures in Japan, particularly from rising food and fuel costs, are impacting consumer spending power. For instance, the Japanese CPI excluding fresh food and energy rose by 3.1% year-on-year in April 2024, indicating broad-based price increases. This trend directly affects household budgets and purchasing decisions.

While nominal wage growth, averaging around 2% in early 2024, offers some support to private consumption, its real impact is diminished by persistent inflation. If the Bank of Japan further tightens monetary policy by raising interest rates to combat inflation, this could lead to higher borrowing costs for both individuals and businesses, potentially dampening investment and consumption.

- Consumer Price Index (CPI) excluding fresh food and energy: 3.1% year-on-year in April 2024.

- Nominal Wage Growth: Averaging approximately 2% in early 2024.

- Impact of Inflation: Erodes real purchasing power, influencing consumer spending habits.

- Monetary Policy Risk: Potential for tighter credit conditions if the Bank of Japan raises interest rates.

The Bank of Japan's shift away from negative interest rates, with anticipated hikes in 2024 and 2025, is a significant economic development. This policy change could boost Gunma Bank's net interest margin, a crucial profitability metric, though it also risks dampening credit demand and economic activity, necessitating careful monitoring of potential real estate market impacts.

Gunma Prefecture's economic health, evidenced by its modest GDP growth in 2023 and a stable unemployment rate of around 3.7% in early 2024, directly influences loan demand and deposit growth for Gunma Bank. However, the region's aging population and declining birthrate pose long-term challenges to its economic vitality and the bank's future customer base.

Japanese households hold substantial financial assets, with ¥2,093 trillion as of December 2023, and government initiatives like the revamped NISA program from January 2024 are encouraging investment. Gunma Bank can capitalize on this by expanding its wealth management and investment advisory services to meet this growing demand.

The real estate market's stability is vital for Gunma Bank, given its loan exposure. While Gunma's residential land prices rose 1.5% in Q1 2024, commercial property dipped 0.8%, highlighting varied market dynamics that impact asset quality and necessitate robust risk management.

Preview Before You Purchase

Gunma Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Gunma Bank PESTLE analysis covers all key external factors impacting the bank's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on Gunma Bank.

The content and structure shown in the preview is the same document you’ll download after payment. This in-depth PESTLE analysis provides actionable insights for Gunma Bank's future success.

Sociological factors

Japan's demographic landscape is characterized by a rapidly aging population. By 2025, the proportion of individuals aged 65 and over is expected to reach approximately 30% of the total population. This significant shift directly influences the demand for banking services, likely boosting the need for specialized offerings like wealth management, inheritance planning, and financial products tailored to seniors.

This demographic trend also presents challenges for the labor force in regions like Gunma. A shrinking working-age population could impact the availability of skilled labor for the banking sector itself, potentially requiring adjustments in recruitment and retention strategies for institutions like Gunma Bank.

Customer behavior in Japan is rapidly shifting towards digital and cashless transactions. This trend, amplified by government pushes for digital transformation and the lingering effects of the pandemic, means traditional banking models must adapt. For instance, a 2023 survey indicated that over 70% of Japanese consumers now prefer digital payment methods for everyday purchases, a significant jump from previous years.

This evolving landscape directly impacts Gunma Bank. As more customers embrace online platforms and mobile banking, the bank must prioritize the continuous enhancement of its digital offerings. Failing to keep pace with this digital adoption could lead to a disconnect with customer expectations and a potential loss of market share to more agile competitors in the 2024-2025 period.

Gunma Bank's deep roots in the Gunma prefecture are central to its operations, with a stated mission to promote regional economic growth and cultivate strong local ties. This commitment to community is not just a social responsibility but a strategic advantage, fostering trust and loyalty among its customer base.

In 2023, Gunma Bank continued its support for local initiatives, including sponsoring over 50 community events and contributing to regional development projects. This engagement reinforces its identity as a bank intrinsically linked to the prosperity of Gunma.

Financial Literacy and Investment Awareness

Japan's government is actively encouraging a move from traditional savings towards investment, highlighting a critical need for improved financial literacy across the nation. This societal shift presents Gunma Bank with a significant opportunity to step in by offering educational materials and expert advice. By empowering individuals with the knowledge to make sound investment choices, the bank can attract a wider audience for its investment services and products.

Recent data underscores this trend. For instance, while savings rates remain relatively stable, there's a noticeable uptick in interest towards investment vehicles. A survey conducted in late 2024 indicated that over 60% of Japanese adults are considering increasing their investment exposure in the next year, driven by a desire for greater financial security and wealth accumulation. This growing awareness means that financial institutions like Gunma Bank can play a pivotal role.

- Growing Government Push: The Japanese government's policy direction favors investment over mere savings, creating a favorable environment for financial education initiatives.

- Increased Public Interest: A significant portion of the population is showing a greater inclination towards understanding and participating in investment markets.

- Bank's Strategic Role: Gunma Bank can leverage this by providing accessible financial literacy programs and personalized advisory services.

- Customer Base Expansion: Successfully engaging individuals through education can lead to a broader customer base for the bank's investment product offerings.

Workforce Demographics and Talent Acquisition

Japan's rapidly aging population, with Gunma Prefecture often reflecting national trends, presents a significant challenge for Gunma Bank's workforce. By 2025, projections indicate a continued shrinking of the working-age population, directly impacting the available talent pool for recruitment. This demographic shift necessitates a strategic focus on attracting and retaining skilled employees to maintain operational efficiency and drive growth.

To counter this, Gunma Bank must prioritize talent acquisition strategies, particularly in high-demand areas like digital transformation and information technology. The bank's ability to secure expertise in these fields is crucial for its ongoing strategic initiatives, including enhancing digital banking services and cybersecurity measures.

- Aging Workforce: Japan's demographic trend of an aging population means fewer younger individuals entering the workforce, impacting talent availability.

- Skill Gaps: There's a growing need for specialized skills in digital transformation and IT, creating a gap that Gunma Bank must actively address.

- Talent Retention: The bank faces the challenge of retaining its existing skilled workforce amidst a competitive market and the increasing demand for specialized expertise.

- Digitalization Imperative: Success in areas like digital banking and IT security hinges on Gunma Bank's ability to attract and keep employees with relevant, up-to-date skills.

Japan's societal shift towards prioritizing investment over traditional savings is a key sociological factor. This trend, supported by government initiatives, creates a demand for enhanced financial literacy. Gunma Bank can capitalize on this by offering educational resources and advisory services, potentially expanding its customer base for investment products.

The increasing preference for digital and cashless transactions among Japanese consumers, with over 70% favoring digital payments in 2023, necessitates a strong online presence. Gunma Bank must continuously improve its digital platforms to meet evolving customer expectations and avoid losing ground to more digitally adept competitors.

Gunma Bank's deep community ties and commitment to regional development are significant sociological assets. By actively supporting local events and initiatives, as it did with over 50 sponsorships in 2023, the bank fosters trust and loyalty, reinforcing its position within the Gunma prefecture.

The aging demographic, with projections showing individuals aged 65 and over reaching 30% by 2025, influences banking service demand. This necessitates specialized offerings like wealth management and inheritance planning tailored to seniors.

Technological factors

Gunma Bank is heavily invested in digital transformation, making it a core tenet of its mid-term business plan. This strategic push aims to modernize community services, enhance customer interactions, and streamline internal processes through digitalization.

Key initiatives include the development of user-friendly mobile applications and dedicated portal sites for corporate clients, alongside a significant push to improve non-face-to-face customer service channels. For instance, in fiscal year 2023, Gunma Bank reported a substantial increase in digital transaction volumes, reflecting the growing adoption of its online services.

The bank recognizes that sustained investment in its digital infrastructure is not just about convenience but is fundamental to maintaining a competitive edge in the evolving financial landscape. This ongoing commitment ensures they can adapt to changing customer expectations and technological advancements.

The Japanese financial sector, including regional banks like Gunma Bank, is rapidly embracing fintech. This includes advancements like AI-driven credit scoring for loans and the expansion of digital payment infrastructure. For instance, by the end of fiscal year 2023, the Bank of Japan reported a continued increase in the use of electronic payment methods across various sectors.

Gunma Bank's strategic integration of these fintech solutions, possibly through collaborations with innovative fintech firms, will be crucial. This adoption is essential for developing new customer offerings and enhancing operational efficiency. The bank's performance in this area will directly impact its competitiveness in the evolving financial landscape.

As Gunma Bank increasingly relies on digital platforms, cybersecurity is a critical technological factor. In 2024, the financial sector continued to face sophisticated cyber threats, with data breaches costing an average of $4.45 million globally, according to IBM's 2024 Cost of a Data Breach Report. For Gunma Bank, safeguarding customer data and ensuring the integrity of online transactions is paramount to maintaining trust and preventing significant financial and reputational losses.

Strict adherence to data privacy regulations, such as Japan's Act on the Protection of Personal Information (APPI), is non-negotiable. In 2025, regulatory scrutiny on data handling practices is expected to intensify. Gunma Bank must invest in advanced security infrastructure and continuous employee training to comply with evolving privacy laws and protect sensitive customer information from breaches.

Automation and AI in Operations

Gunma Bank is increasingly leveraging AI and automation to boost its operational efficiency. This includes automating repetitive back-office tasks and enhancing customer interactions through AI-powered chatbots. For instance, the bank's adoption of Robotic Process Automation (RPA) is designed to streamline workflows, leading to significant cost reductions and a more responsive service delivery.

These technological advancements are crucial for maintaining competitiveness in the evolving financial landscape. By integrating AI and automation, Gunma Bank aims to improve accuracy, speed up transaction processing, and free up human resources for more complex, value-added activities. This strategic implementation directly supports the bank's goal of providing superior customer experiences and optimizing internal processes.

The impact of these technologies is already being observed. For example, a significant portion of customer inquiries are now handled by AI, reducing wait times.

- AI-driven analytics are being deployed to identify operational bottlenecks and predict potential issues, allowing for proactive problem-solving.

- The bank reported a 15% increase in processing speed for certain back-office functions after implementing RPA in early 2024.

- Customer satisfaction scores related to digital service channels have seen a measurable uplift following the integration of AI chatbots.

Payment System Modernization

Japan's accelerating move towards a cashless economy is a significant technological factor. By the end of 2024, it's projected that cashless payments will account for over 50% of all transactions in Japan, a substantial increase from previous years. This trend necessitates that Gunma Bank modernize its transaction infrastructure to seamlessly integrate new payment methods.

The rise of QR code-based payments and the continued expansion of debit card services are key components of this modernization. Gunma Bank must ensure its systems are compatible with these increasingly popular payment channels. Furthermore, the data generated from these transactions presents a valuable opportunity for the bank to enhance its marketing strategies and customer engagement.

- Cashless Adoption: Japan's cashless payment share is expected to surpass 50% by the end of 2024.

- Payment Innovations: QR code payments and debit card usage are rapidly gaining traction.

- Data Monetization: Leveraging transaction data can drive targeted marketing and personalized services.

Gunma Bank's technological focus centers on digital transformation, aiming to enhance customer experience and operational efficiency. Initiatives include user-friendly mobile apps and robust non-face-to-face service channels, with digital transaction volumes showing a notable increase in fiscal year 2023.

The bank is integrating fintech advancements like AI for credit scoring and expanding digital payment infrastructure, aligning with Japan's broader trend toward cashless transactions, which was projected to exceed 50% of all payments by the end of 2024.

Cybersecurity is paramount, especially with global data breaches costing an average of $4.45 million in 2024, necessitating strict adherence to data privacy regulations like Japan's APPI and investment in advanced security measures.

AI and automation, including RPA, are being deployed to streamline back-office tasks and improve customer service via chatbots, with a 15% increase in processing speed reported for some functions after RPA implementation in early 2024.

| Technological Factor | Description | Impact on Gunma Bank | Relevant Data/Trend (2023-2025) |

|---|---|---|---|

| Digital Transformation | Modernizing services and internal processes through digitalization. | Enhanced customer interaction, streamlined operations, competitive edge. | Digital transaction volumes increased in FY2023; Mid-term plan prioritizes digital initiatives. |

| Fintech Integration | Adoption of AI, digital payments, and other financial technologies. | Improved loan assessment, expanded payment options, operational efficiency. | Bank of Japan reported increased use of electronic payments by FY2023; Japan's cashless payments projected >50% by end of 2024. |

| Cybersecurity | Protecting data and online transactions from threats. | Maintaining customer trust, preventing financial/reputational loss, regulatory compliance. | Global data breach costs averaged $4.45 million in 2024; Intensifying scrutiny on data handling in 2025. |

| AI & Automation | Utilizing AI chatbots and RPA for efficiency. | Cost reduction, faster transaction processing, improved customer service. | 15% processing speed increase for some functions via RPA in early 2024; AI handles significant customer inquiries. |

Legal factors

Ongoing amendments to Japan's Banking Act and the Financial Instruments and Exchange Act (FIEA) are reshaping the operational landscape for institutions like Gunma Bank. These revisions, particularly those concerning large shareholding rules and takeover bid regulations, directly influence the bank's strategic maneuvering in mergers and acquisitions and its broader investment portfolio management.

Recent legislative adjustments, such as those refining the framework for asset management businesses, are particularly relevant. For instance, the Financial Services Agency (FSA) has been actively reviewing and updating regulations governing investment trusts and other asset management vehicles, aiming to enhance investor protection and market transparency. These changes could impact Gunma Bank's ability to offer certain financial products or its partnerships within the asset management sector.

Japanese financial institutions, including Gunma Bank, operate under rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations. These rules are continually being enhanced to align with global benchmarks, such as those set by the Financial Action Task Force (FATF). For instance, Japan's Financial Services Agency (FSA) actively updates its guidelines, emphasizing the need for banks to implement advanced transaction monitoring and customer due diligence processes.

Gunma Bank must maintain highly effective compliance frameworks to mitigate risks associated with financial crime. This involves investing in technology and training to ensure adherence to evolving regulatory demands and to prevent illicit activities. Recent reports from the Bank of Japan highlight the increasing focus on digital asset risks, requiring banks to adapt their AML/CFT strategies accordingly.

Consumer protection laws are paramount for financial institutions like Gunma Bank. These regulations ensure transparency in product offerings, such as clear disclosure of fees and interest rates on loans and savings accounts, a critical aspect for customer trust. For instance, Japan's Financial Services Agency (FSA) continuously updates guidelines on fair treatment of customers, impacting how banks market and sell financial products.

Measures to combat fraud and protect vulnerable customer segments, including the elderly, are also key. Gunma Bank must implement robust internal controls and training programs to prevent unauthorized transactions and provide secure financial advice, especially given the increasing digital financial landscape. In 2023, the FSA emphasized enhanced consumer education and fraud prevention campaigns across the banking sector.

Corporate Governance Codes and Disclosure Requirements

Gunma Bank, as a publicly traded financial institution in Japan, must adhere to the nation's Corporate Governance Code. This code emphasizes enhanced transparency, particularly concerning climate-related risks and the promotion of diversity within the company. For instance, the Tokyo Stock Exchange, which lists many Japanese companies, has been actively encouraging listed firms to improve their disclosures in these areas, with a focus on actionable strategies by 2025.

Compliance with these governance codes directly influences how investors perceive Gunma Bank. Greater transparency in reporting on environmental, social, and governance (ESG) factors, including climate risk management and diversity metrics, can bolster investor confidence and attract a wider pool of capital. For example, a 2024 survey of Japanese institutional investors indicated a growing preference for companies with robust ESG reporting, with over 70% stating it influences their investment decisions.

- Corporate Governance Code Compliance: Gunma Bank is obligated to follow Japan's Corporate Governance Code, promoting better disclosure.

- Disclosure Focus: Key areas include climate-related risks and diversity initiatives, crucial for stakeholder trust.

- Investor Relations Impact: Adherence enhances transparency, positively affecting investor perception and access to capital.

- Market Trends: Institutional investors increasingly prioritize ESG disclosures, influencing investment choices in 2024 and beyond.

Data Privacy and Cybersecurity Laws

Gunma Bank faces a dynamic legal landscape, particularly concerning data privacy and cybersecurity. As digital transactions and customer data management escalate, compliance with stringent regulations is paramount. This includes adhering to Japan's Act on the Protection of Personal Information (APPI), which governs how personal data is collected, stored, and utilized. In 2024, the APPI continues to emphasize consent and transparency, requiring financial institutions like Gunma Bank to clearly inform customers about data usage.

The increasing sophistication of cyber threats necessitates robust cybersecurity measures. Gunma Bank must invest in advanced security protocols to safeguard sensitive customer information against breaches and unauthorized access. Failure to comply with these evolving legal requirements can result in significant penalties and reputational damage. For instance, in 2023, various financial entities globally faced fines for data mishandling, underscoring the critical need for proactive compliance.

- Increased regulatory scrutiny on data handling practices

- Mandatory implementation of advanced cybersecurity frameworks

- Potential for substantial fines and legal repercussions for non-compliance

- Need for continuous adaptation to evolving data protection legislation

Japan's evolving legal framework significantly impacts Gunma Bank's operations, particularly regarding financial regulations and consumer protection. Amendments to the Banking Act and FIEA influence M&A strategies and investment management, while updated asset management rules affect product offerings. Strict AML/CFT compliance, aligned with FATF standards, remains critical, with the FSA emphasizing advanced transaction monitoring and digital asset risk management. Consumer protection laws mandate transparency in product disclosures and robust fraud prevention, especially for vulnerable groups, with the FSA promoting enhanced consumer education.

| Legal Area | Key Regulations/Focus | Impact on Gunma Bank | Recent Developments/Trends (2023-2025) |

|---|---|---|---|

| Financial Markets | Banking Act, FIEA Amendments | Influences M&A, investment portfolio management | Ongoing revisions to large shareholding and takeover bid rules |

| Asset Management | FSA Reviews/Updates | Affects product offerings, partnerships | Enhanced investor protection and market transparency in investment trusts |

| Financial Crime | AML/CFT, FATF Standards | Requires advanced transaction monitoring, due diligence | Increased focus on digital asset risks by Bank of Japan and FSA |

| Consumer Protection | Fair Treatment, Fraud Prevention | Ensures transparency in fees/rates, protects vulnerable customers | FSA emphasizes enhanced consumer education and fraud prevention campaigns (2023); focus on clear data usage consent (2024 APPI) |

| Corporate Governance | Corporate Governance Code | Promotes transparency in climate risk, diversity | TSE encourages improved ESG disclosures by listed firms, with actionable strategies by 2025; 70%+ institutional investors prioritize ESG reporting (2024 survey) |

| Data Privacy | Act on the Protection of Personal Information (APPI) | Mandates clear data usage policies, robust cybersecurity | APPI emphasizes consent and transparency in data handling (2024); global fines for data mishandling highlight risk (2023) |

Environmental factors

Gunma Bank, like many Japanese financial institutions, is navigating the evolving landscape of climate change initiatives. The banking sector in Japan is showing a strong commitment to the Sustainable Development Goals (SDGs), with a growing emphasis on addressing climate change. This means Gunma Bank can expect increased expectations to back decarbonization projects and offer sustainable financing options.

This commitment translates into tangible pressure for Gunma Bank to embed ESG principles into its core operations. Specifically, the bank will likely see a push to integrate environmental, social, and governance factors into its lending criteria and investment strategies. For instance, the Bank of Japan's climate stress tests, initiated in 2022, highlight the growing regulatory focus on climate-related financial risks for financial institutions.

Japan's financial sector is experiencing a significant uptick in Environmental, Social, and Governance (ESG) investing. This surge is fueled by proactive government policies and a growing consciousness among investors regarding sustainability. For instance, the Tokyo Stock Exchange has been increasingly emphasizing ESG disclosure requirements for listed companies, with a notable increase in companies reporting on their ESG metrics in recent years, aiming to attract global capital.

Gunma Bank's commitment to showcasing robust ESG performance and offering clear, transparent disclosures on its environmental footprint and sustainability efforts will be crucial. This transparency is key to attracting a wider investor base and meeting evolving market demands for responsible financial practices. By aligning with these trends, Gunma Bank can enhance its appeal to investors prioritizing long-term value and positive societal impact, a sentiment gaining traction globally, with ESG funds in Japan seeing substantial inflows.

Beyond climate change, the banking sector is increasingly recognizing the importance of natural capital and biodiversity conservation. Gunma Bank, as a regional institution, may have opportunities to support local environmental projects or integrate biodiversity considerations into its financing decisions for businesses operating in environmentally sensitive areas.

In 2023, Japan's Ministry of the Environment reported that approximately 30% of its national parks faced degradation due to human activities, highlighting the relevance of biodiversity conservation for regional economies. Gunma Prefecture, known for its natural beauty and agricultural sector, is particularly susceptible to these environmental shifts.

Gunma Bank could leverage its position to finance sustainable agriculture initiatives or ecotourism ventures, thereby contributing to the preservation of local biodiversity. For instance, supporting businesses that adopt practices minimizing impact on natural habitats could align with the bank's long-term risk management and community engagement strategies.

Regulatory Focus on Environmental Risk Management

Financial regulators are increasingly scrutinizing how banks manage environmental risks, particularly those stemming from climate change. This heightened focus means Gunma Bank will likely need to conduct thorough assessments of its exposure to climate-related risks across its loan book and operations. For instance, by the end of 2024, Japanese financial institutions are expected to enhance their climate risk disclosure frameworks, aligning with international standards.

Gunma Bank's strategy development will need to incorporate robust mitigation plans for these identified risks. This could involve re-evaluating lending criteria for carbon-intensive industries or investing in green financial products. The Bank of Japan’s ongoing efforts to integrate climate considerations into its monetary policy and financial stability assessments underscore the systemic importance of these environmental factors for institutions like Gunma Bank.

- Increased regulatory scrutiny on climate risk management

- Mandatory assessment and disclosure of climate-related exposures

- Development of risk mitigation strategies for environmental impacts

- Alignment with evolving Japanese financial regulatory expectations regarding sustainability

Local Environmental Conditions and Community Impact

Gunma Bank's operations are intrinsically linked to the environmental health of Gunma Prefecture. Factors like water quality and land use directly influence the agricultural and industrial sectors, key client bases for the bank. For instance, concerns about water contamination could impact agricultural output, potentially affecting loan repayments and the bank's overall portfolio health. In 2023, Gunma Prefecture reported that approximately 85% of its river water quality met standards, a positive indicator for its primary industries, but ongoing monitoring remains crucial.

The region's susceptibility to natural disasters, such as earthquakes and heavy rainfall leading to landslides, also presents a significant risk. The bank must consider these environmental vulnerabilities when assessing loan applications and developing risk management strategies. Following the heavy rains in August 2023, which caused localized flooding and landslides in certain areas of Gunma, the bank provided financial support programs for affected businesses and individuals, demonstrating its commitment to community resilience.

Gunma Bank's role in community development extends to fostering environmental sustainability. This includes supporting local initiatives aimed at reducing carbon emissions and promoting eco-friendly business practices among its clients. The bank is actively involved in financing renewable energy projects within the prefecture, contributing to a greener economy. As of early 2024, Gunma Prefecture has set targets to increase its renewable energy generation capacity by 20% by 2030, a goal Gunma Bank actively supports through its lending activities.

- Water Quality: Over 85% of Gunma's river water met quality standards in 2023, supporting local agriculture and industry.

- Natural Disaster Risk: The prefecture faces risks from earthquakes and landslides, requiring robust risk assessment by Gunma Bank.

- Community Impact: Gunma Bank provided financial aid following August 2023 heavy rains to support affected businesses and residents.

- Sustainability Focus: The bank supports renewable energy projects, aligning with Gunma's goal to boost renewable energy by 20% by 2030.

Gunma Bank faces increasing pressure to align with Japan's decarbonization goals and ESG investing trends, with the Bank of Japan's climate stress tests highlighting regulatory focus on climate risk. The bank's transparency in disclosing its environmental footprint is key to attracting investors, as ESG funds in Japan see substantial inflows, with the Tokyo Stock Exchange increasing ESG disclosure requirements.

The bank must also consider local environmental factors, such as water quality, which impacts its agricultural clients, and the risk of natural disasters like landslides, as seen with the August 2023 heavy rains. Gunma Bank's support for renewable energy projects aligns with Gunma Prefecture's target to increase renewable energy generation by 20% by 2030.

| Environmental Factor | Status/Trend | Impact on Gunma Bank |

|---|---|---|

| Climate Change Initiatives | Growing commitment to SDGs, decarbonization pressure | Increased demand for green financing, ESG integration in lending |

| Water Quality | 85% of Gunma's river water met standards in 2023 | Supports agricultural sector, influences portfolio health |

| Natural Disaster Risk | Susceptibility to landslides, flooding (e.g., August 2023) | Requires robust risk assessment and mitigation strategies |

| Renewable Energy | Gunma Prefecture aims for 20% increase by 2030 | Opportunities for financing green projects, supporting local economy |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Gunma Bank is informed by a comprehensive review of official Japanese government publications, Bank of Japan reports, and reputable financial news outlets. This ensures all insights into political, economic, social, technological, legal, and environmental factors are grounded in current and authoritative data.