Gunma Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gunma Bank Bundle

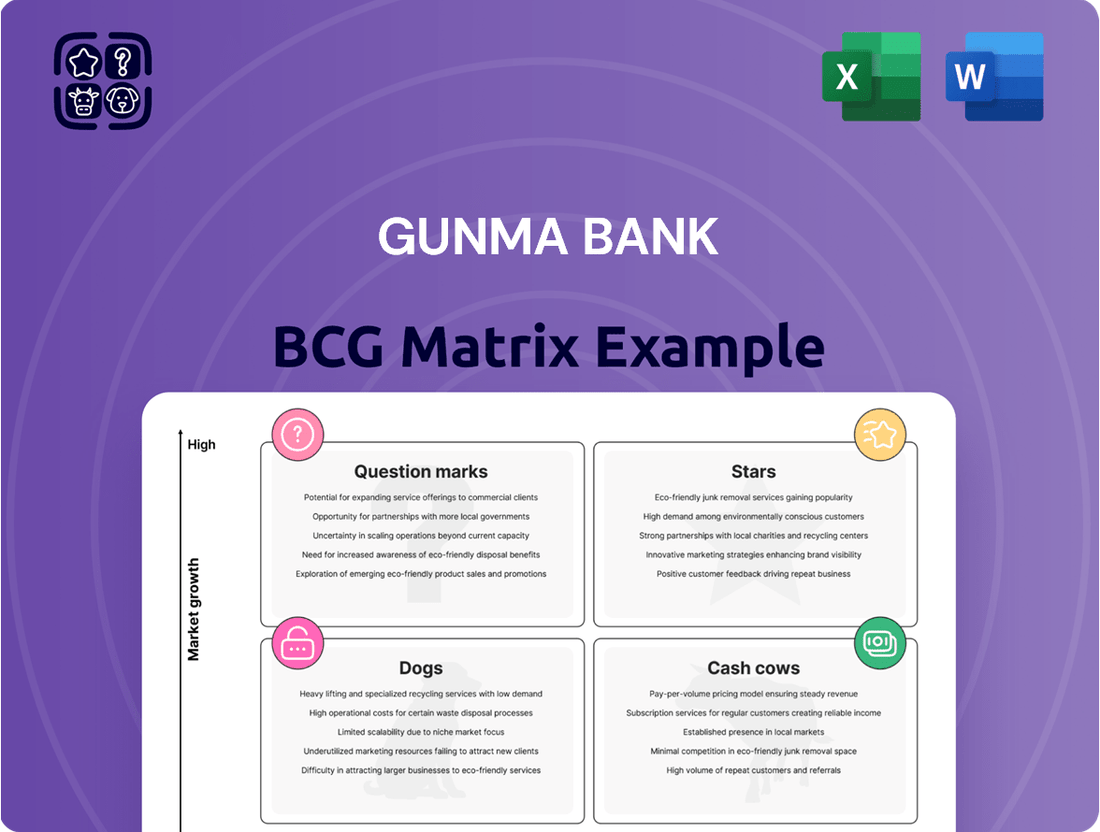

Curious about Gunma Bank's strategic positioning? This glimpse into their BCG Matrix reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture that unlocks actionable strategies for growth and resource allocation.

Purchase the complete Gunma Bank BCG Matrix for a detailed quadrant breakdown, expert analysis, and a clear roadmap to optimizing your investment decisions and product portfolio. Gain the competitive edge you need to navigate the market with confidence.

Stars

Gunma Bank is aggressively pursuing digital transformation, channeling significant investment into digitizing community engagement, customer touchpoints, and internal processes.

The Gungin App's impressive growth, boasting around 278,000 users by March 2024, highlights its strong market traction. Planned enhancements for fiscal 2024, including in-app loan functionalities and digital document services, further solidify this as a high-growth initiative.

These forward-thinking digital strategies are designed to boost customer convenience and streamline operations, positioning Gunma Bank at the forefront of regional digital banking innovation.

Gunma Bank's strategic business integration with Daishi Hokuetsu Financial Group, announced in April 2025, positions it as a key player in Japan's regional banking landscape. This merger aims to create one of the nation's largest regional financial groups by April 2027, targeting significant market share and growth.

The integration is designed to bolster the combined entity's scale and quality, a crucial factor in the consolidating regional banking sector. This move reflects a strategic imperative to consolidate market leadership and capitalize on potential synergies, indicating a high growth trajectory.

Gunma Bank is a leader in sustainable finance, evidenced by its October 2021 issuance of the first sustainability bond by a regional bank. Its commitment is further solidified by its Environmentally and Socially Conscious Investment and Loan Policy, which guides its offerings.

The bank actively provides services like Sustainability Linked Loans and financing for renewable energy projects. This directly taps into a surging market demand for investments that prioritize environmental and social responsibility.

This forward-thinking approach is poised to drive significant growth and capture a larger share of the expanding sustainable finance market.

Cross-border Loans and Structured Finance

Gunma Bank has demonstrated robust performance in its cross-border loans and structured finance segments, with loan yields showing an upward trend. This suggests these specialized financial services are proving to be a significant profit driver.

The bank's success in these complex, higher-yield areas signifies its growing expertise in sophisticated financial transactions. This specialization allows Gunma Bank to capture a larger share of the market for these specialized services, thereby boosting its overall revenue.

- Cross-border loan yields are increasing, signaling strong demand and profitability.

- Structured finance contributes significantly to the bank's income through specialized transaction expertise.

- Gunma Bank is actively expanding its presence in these lucrative, complex financial markets.

Advanced Data Utilization and Digital Ecosystem Building

Gunma Bank is actively developing a digital ecosystem by leveraging advanced data utilization, particularly focusing on payment data. This initiative aims to unlock new value propositions, such as targeted advertising and customer referral programs within the community. For instance, by analyzing transaction patterns, the bank can offer personalized promotions to local businesses, driving foot traffic and fostering economic growth. This strategy is designed to create a more integrated and valuable service environment for both customers and businesses.

The bank's forward-thinking approach in the increasingly data-centric financial landscape positions it for significant growth. By harnessing data insights, Gunma Bank can refine its marketing efforts and enhance service delivery, leading to deeper customer engagement and diversified revenue streams. This data-driven strategy is crucial for staying competitive and meeting evolving customer expectations in 2024 and beyond.

- Focus on Payment Data: Gunma Bank is prioritizing the analysis of payment data to identify trends and opportunities.

- New Value Propositions: This data will fuel services like targeted advertising for local businesses and customer referral incentives.

- Digital Ecosystem Building: The overarching goal is to create a connected digital environment that benefits the entire community.

- Growth Opportunity: This strategy represents a high-potential avenue for deepening customer relationships and expanding revenue in the current financial climate.

Gunma Bank's Gungin App, with approximately 278,000 users as of March 2024, is a clear Star in the BCG Matrix, demonstrating high market share and growth potential. Planned enhancements for fiscal 2024, including in-app loan functionalities, further solidify its position as a key growth driver. This digital initiative is central to the bank's strategy for enhanced customer convenience and operational efficiency.

What is included in the product

Analysis of Gunma Bank's portfolio across BCG quadrants.

Strategic recommendations for investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

The Gunma Bank BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

Traditional deposits are Gunma Bank's cash cows, forming the stable foundation of its funding with a significant market share in its operating regions. While growth is slow, these deposits offer a consistent, low-cost capital source essential for lending operations.

Gunma Bank's core lending to regional businesses and individuals is its established Cash Cow. This segment holds a significant market share within the mature market of Gunma Prefecture and surrounding areas, reflecting the bank's deep roots and long-standing relationships.

These established loan portfolios are the bedrock of Gunma Bank's financial stability, consistently generating robust net interest income. In 2023, the bank reported a net interest income of ¥113.5 billion, a testament to the reliable cash flow from these core lending activities.

The credit costs associated with these mature loan books remain stable, underscoring the predictability of this segment. Gunma Bank's commitment to fueling local economic growth through these lending activities solidifies its strong, albeit low-growth, position as a reliable Cash Cow.

Despite the digital shift, Gunma Bank's established branch network continues to be a cornerstone for a substantial segment of its customer base, especially in its traditional operating areas. In 2023, Gunma Bank operated approximately 140 branches across Gunma Prefecture and surrounding regions, serving as vital touchpoints for many customers.

While the growth rate of branch transactions might be modest, these physical locations are instrumental in maintaining high market penetration and reliably generate steady fee and interest income. These services are crucial for customer retention and provide a stable revenue stream, acting as the bank's cash cows.

Investments in this established network are strategically directed towards enhancing operational efficiency and customer experience, rather than pursuing new branch openings. This focus ensures the continued profitability and relevance of these key assets within the bank's overall business model.

Investment in Low-Yielding Japanese Government Bonds (JGBs)

Gunma Bank's investment in low-yielding Japanese Government Bonds (JGBs) serves as a significant Cash Cow within its BCG Matrix. These holdings, while offering modest returns, form a stable and predictable revenue stream, underpinning the bank's overall financial health.

The bank's commitment to managing these JGBs highlights a strategy focused on capital preservation and liquidity. As of early 2024, Japanese government debt yields remained historically low, with benchmark 10-year JGB yields hovering around 0.7% to 0.8%. This stability is crucial for a financial institution like Gunma Bank, ensuring it can meet its obligations and fund other operations.

- Stable Asset Base: JGBs provide a substantial and reliable asset base for Gunma Bank.

- Consistent, Low Returns: The yields, though low, are predictable and contribute to steady income.

- Liquidity and Capital Management: These holdings are essential for maintaining strong liquidity and managing capital effectively.

- Foundation for Stability: The JGB portfolio acts as a foundational component, supporting the bank's overall financial stability rather than driving aggressive growth.

Basic Payment Processing Services

Basic Payment Processing Services at Gunma Bank represent a classic Cash Cow within the BCG Matrix. These services, encompassing traditional fund transfers and essential bill payments, are characterized by their high market share and maturity. In 2024, Gunma Bank's payment processing volume saw a steady increase, with domestic transfers alone accounting for a significant portion of customer transactions, reflecting their ongoing utility.

These operations are vital for the bank's day-to-day functioning and contribute a reliable stream of fee income. While the growth rate for these services is modest, typically in the low single digits, their consistent demand ensures stable revenue generation. This stability is crucial for funding other areas of the bank's operations.

The minimal need for incremental investment in promotion or expansion for these mature services means they generate substantial cash flow. This surplus cash can then be strategically allocated to support growth initiatives or other business units within Gunma Bank.

- High Market Share: Dominant position in traditional payment services.

- Low Growth: Mature market with stable, predictable demand.

- Consistent Fee Income: Reliable revenue generation from essential banking functions.

- Strong Cash Flow: High profitability with low reinvestment needs.

Gunma Bank's core deposit base, particularly traditional savings and checking accounts, functions as a prime Cash Cow. These accounts represent a significant portion of the bank's liabilities, offering a stable and low-cost funding source. In 2023, Gunma Bank reported total deposits of ¥8.7 trillion, highlighting the sheer volume and stability of this revenue stream.

While deposit growth is typically modest, in line with economic conditions, the consistent inflow of funds from these accounts provides reliable liquidity. This stability is crucial for funding the bank's lending activities and maintaining its operational capacity. The net interest income generated from these deposits, even at low rates, contributes significantly to profitability.

The established branch network, while facing digital competition, remains a Cash Cow for Gunma Bank. These physical locations, numbering around 140 as of 2023, continue to serve a substantial customer base that values in-person interaction. This network generates steady fee and interest income, reinforcing its role as a reliable, albeit low-growth, contributor to the bank's earnings.

Gunma Bank's portfolio of Japanese Government Bonds (JGBs) acts as a stable Cash Cow. These holdings, characterized by their low risk and predictable, albeit modest, yields, provide a consistent revenue stream. As of early 2024, the yield on 10-year JGBs hovered around 0.7%-0.8%, offering a safe harbor for capital and contributing to the bank's overall financial stability.

| Business Unit | Market Share | Market Growth | Cash Flow Generation | Strategic Implication |

|---|---|---|---|---|

| Core Deposits | High | Low | Strong Positive | Fund other business units, maintain stability |

| Established Lending | High | Low | Strong Positive | Consistent net interest income, support regional economy |

| Branch Network | High | Low | Moderate Positive | Customer retention, steady fee income |

| JGB Portfolio | N/A (Investment) | Low (Yield) | Moderate Positive | Capital preservation, liquidity, stable income |

Delivered as Shown

Gunma Bank BCG Matrix

The Gunma Bank BCG Matrix preview you're seeing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis, detailing Gunma Bank's strategic positioning across its product portfolio, is ready for your direct use in business planning and decision-making.

Dogs

Gunma Bank's underperforming physical branches are likely categorized as 'dogs' in its BCG Matrix. As the banking sector increasingly prioritizes digital services, branches with consistently low transaction volumes and high operating expenses compared to their income generation are prime candidates for this classification. For instance, in 2024, Gunma Bank reported a continued emphasis on expanding its digital banking services, aiming to reach a wider customer base through online and mobile platforms. This strategic shift indicates a potential re-evaluation of its physical footprint, especially in areas experiencing population decline outside urban centers.

Outdated legacy IT systems at Gunma Bank are firmly in the 'dog' quadrant of the BCG Matrix. These systems are a significant drain, costing substantial amounts for maintenance and lacking the flexibility to integrate with newer digital technologies. For instance, in 2024, many regional banks in Japan, including those similar to Gunma Bank, reported that over 30% of their IT budget was allocated to maintaining legacy infrastructure, a figure that severely limits investment in innovation.

The bank's stated focus on 'Digital Strategies as the Foundation for Connections and Spinning the Threads' and 'Business Process Reform' directly addresses the inefficiencies caused by these aging systems. These legacy platforms hinder Gunma Bank's agility, making it difficult to offer competitive digital services or to streamline internal operations effectively. This inability to adapt quickly stifles growth potential and keeps the bank from fully leveraging modern technological advancements.

Niche, unprofitable investment products, often characterized by low customer adoption and minimal profit generation, can be considered 'dogs' within Gunma Bank's portfolio. These offerings may tie up valuable resources in marketing and management without yielding commensurate returns. For example, a specialized bond fund launched in 2023 that attracted only 0.05% of the bank's total asset management inflows by Q3 2024, while requiring dedicated analyst coverage, exemplifies such a product.

Non-Strategic Cross-Shareholdings

Non-strategic cross-shareholdings within Gunma Bank's portfolio are categorized as 'Dogs' in a BCG Matrix analysis. These are assets that generate low returns and have limited growth potential, thus tying up valuable capital. The bank's commitment to reducing the book value of these holdings by 50% over five years underscores their non-strategic nature.

This strategic divestment highlights a focus on optimizing capital allocation. By shedding these underperforming investments, Gunma Bank aims to free up resources for more promising opportunities. For instance, as of fiscal year 2023, Gunma Bank reported cross-shareholdings valued at approximately ¥100 billion, with a stated goal to reduce this by ¥50 billion by fiscal year 2028.

- Low Growth, Low Return: Non-strategic cross-shareholdings typically exhibit minimal revenue growth and low profitability.

- Capital Inefficiency: These holdings represent capital that could be reinvested in higher-yielding or strategically aligned ventures.

- Divestment Strategy: Gunma Bank's plan to cut these holdings by half over five years signals a move towards portfolio rationalization.

- Opportunity Cost: The capital locked in these 'Dogs' could be used for digital transformation initiatives or expanding core banking services.

Inefficient Manual Business Processes

Inefficient manual business processes at Gunma Bank represent a significant drag on profitability, particularly in areas untouched by the bank's digitalization initiatives. These legacy operations, often characterized by paper-based workflows and limited automation, incur higher operating costs without yielding commensurate revenue growth. For instance, manual loan processing or customer onboarding can take significantly longer and require more personnel than their digital counterparts, directly impacting the bank's cost-to-income ratio.

These 'cash traps' consume valuable resources that could be redirected towards more strategic growth areas. In 2024, financial institutions globally have been focusing on streamlining operations to improve efficiency; banks with a higher proportion of manual processes are at a distinct disadvantage. Gunma Bank's efforts in 'Business Process Reform' aim to address this, but processes lagging behind this push are prime candidates for immediate re-engineering or complete elimination to unlock capital and improve service delivery.

- Manual processes increase operational costs, potentially raising the bank's cost-to-income ratio.

- Slow service delivery due to manual workflows can negatively impact customer satisfaction and retention.

- These inefficient operations tie up financial and human capital, hindering investment in innovation and growth.

- Processes not aligned with digitalization efforts are likely candidates for elimination or significant overhaul.

Gunma Bank's underperforming physical branches, especially those in areas with declining populations, are classified as 'Dogs' in its BCG Matrix. These branches often have low transaction volumes and high operating costs, making them inefficient. The bank's 2024 strategy emphasizes digital expansion, signaling a potential re-evaluation of its physical network to optimize resource allocation.

Legacy IT systems at Gunma Bank are also 'Dogs' due to high maintenance costs and a lack of integration capabilities with modern digital platforms. In 2024, a significant portion of regional banks' IT budgets, often exceeding 30%, was dedicated to maintaining such outdated infrastructure, limiting innovation. Gunma Bank's focus on 'Digital Strategies' and 'Business Process Reform' aims to address these inefficiencies.

| Asset/Operation | BCG Category | Rationale | 2024 Data/Context |

| Underperforming Branches | Dog | Low transaction volume, high operating costs, declining customer footfall. | Focus on digital banking expansion, potential branch network rationalization. |

| Legacy IT Systems | Dog | High maintenance costs, inability to integrate with new technologies, hinder agility. | Over 30% of IT budgets in similar regional banks allocated to legacy maintenance. |

| Niche, Unprofitable Products | Dog | Low customer adoption, minimal profit, tie up resources. | Specialized bond fund with 0.05% asset management inflows by Q3 2024. |

| Non-Strategic Cross-Shareholdings | Dog | Low returns, limited growth potential, capital inefficiency. | ¥100 billion in cross-shareholdings as of FY2023, with a goal to reduce by ¥50 billion by FY2028. |

| Inefficient Manual Processes | Dog | Higher operating costs, slow service delivery, hinder innovation. | Processes lagging behind digitalization efforts are prime candidates for re-engineering. |

Question Marks

Gunma Bank's Gungin App is set to introduce new digital document and in-app loan functionalities in fiscal 2024, tapping into the expanding digital banking sector. This move positions the bank to capture a growing market, with digital banking services projected to see significant user growth in the coming years.

Despite the promising market outlook, these new features are in their nascent stages, meaning they currently possess a low market share. Substantial investment will be necessary for marketing and encouraging user uptake to ensure these digital offerings gain traction and avoid becoming underperforming assets.

Gunma Bank's strategic alliances, particularly its integration with Daishi Hokuetsu Financial Group and participation in the TSUBASA alliance, represent a calculated move to expand its reach into new, potentially high-growth geographical markets beyond its traditional base in Gunma and surrounding prefectures. This expansion strategy positions these new markets as potential Stars or Question Marks in the BCG Matrix, depending on their growth potential and Gunma Bank's current market share within them.

In these newly entered markets, Gunma Bank's market share is expected to be relatively low initially. For instance, in regions where Daishi Hokuetsu Financial Group has a stronger presence, Gunma Bank's standalone share might be negligible. This necessitates significant investment in tailored marketing campaigns and localized financial services to build brand recognition and capture market share, a characteristic of Question Marks needing strategic nurturing.

Gunma Bank's strategic focus on external collaborations for strengthening its position indicates a fertile ground for fintech partnerships. These nascent ventures, exploring novel digital financial services and high-growth but unproven business models, are prime candidates for the Question Marks quadrant of the BCG Matrix.

For instance, a hypothetical partnership with a new digital lending platform could represent such an investment. While the initial market penetration might be low, the potential for rapid scaling and disruption in specific lending niches is significant. These types of initiatives are characterized by substantial upfront investment and a high degree of uncertainty regarding future returns.

Specialized Sustainable Finance for Nascent Green Industries

Gunma Bank could pioneer specialized sustainable finance products for emerging green industries, such as advanced battery recycling or novel bio-plastics. These tailored offerings would address the unique challenges of unproven technologies, providing crucial early-stage capital. For instance, a dedicated green venture debt fund could support pilot projects, a segment currently underserved by traditional lending.

While the overall sustainable finance market saw significant growth, with global sustainable debt issuance reaching an estimated $1.5 trillion in 2024, these nascent sectors represent a fraction of that. Developing these specialized products requires substantial upfront investment from the bank to assess risk and build expertise. This strategic focus allows Gunma Bank to cultivate future market leaders and secure a first-mover advantage.

- Targeted Green Venture Debt: Offering debt financing specifically structured for pilot-scale green technology deployments.

- Impact-Linked Bonds for Early-Stage Tech: Creating bonds where returns are tied to achieving specific environmental milestones in nascent industries.

- Synergistic Partnerships: Collaborating with research institutions and accelerators to identify and de-risk promising green ventures.

Targeted Digital Ecosystem Services (e.g., Advertising, Referrals)

Gunma Bank's foray into targeted digital ecosystem services, like advertising and customer referrals, leverages payment data to create new value. This strategic move taps into the burgeoning market for data-driven services, a sector experiencing significant growth. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, highlighting the immense potential within this space.

This initiative positions Gunma Bank's digital ecosystem services as a potential 'Question Mark' in the BCG matrix. As a relatively new service model for a regional bank, it likely holds a low current market share. However, its target of a high-growth area suggests substantial future potential if successful.

- Low Market Share: Gunma Bank's digital ecosystem services are in their nascent stages, meaning they currently capture a small portion of the market.

- High Market Growth: The underlying trend of data-driven services and digital advertising presents a rapidly expanding market opportunity.

- Strategic Investment Needed: Significant investment in technology, data analytics, and marketing is required to build market share and prove the viability of these services.

- Uncertain Future Potential: Success hinges on customer adoption and the bank's ability to effectively monetize payment data for advertising and referral programs.

Gunma Bank's new digital offerings and expansion into new markets are currently positioned as Question Marks. These ventures have low market share but operate in high-growth sectors, requiring significant investment to gain traction.

The bank's strategic alliances and fintech partnerships also fall into this category, representing nascent, unproven business models with high growth potential but also high uncertainty.

Specialized sustainable finance products for emerging green industries and the development of digital ecosystem services are also considered Question Marks, needing substantial upfront capital and strategic nurturing to succeed.

These initiatives reflect Gunma Bank's proactive strategy to cultivate future market leaders and secure first-mover advantages in evolving financial landscapes.

BCG Matrix Data Sources

Our Gunma Bank BCG Matrix is built on a foundation of official financial disclosures, market growth statistics, and strategic industry analysis to provide actionable insights.