Guild Mortgage PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guild Mortgage Bundle

Navigate the complex landscape Guild Mortgage operates within with our detailed PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are directly impacting their business. This comprehensive report offers actionable insights to inform your strategy and mitigate risks. Download the full version now to gain a competitive edge.

Political factors

Government housing policies, particularly those from the Department of Housing and Urban Development (HUD), significantly shape Guild Mortgage's operational landscape. Changes in affordable housing programs, such as FHA, VA, and USDA loans, directly impact Guild's customer base and the types of mortgages they can offer. For instance, HUD's adjustments to income limits and rent increase caps for 2024 can alter eligibility for various assistance programs, consequently affecting demand in the broader housing market and Guild's loan origination volumes.

The Federal Reserve's monetary policy, particularly its stance on interest rates, directly influences mortgage rates. Higher rates can dampen borrower demand and affect Guild Mortgage's profitability by making loans more expensive.

Looking ahead to 2025, forecasts from entities like the Mortgage Bankers Association suggest mortgage rates will likely hover in the mid-6% range. This projection is sensitive to ongoing inflation concerns and the Federal Reserve's potential adjustments to its benchmark rates.

Consumer protection regulations significantly shape Guild Mortgage's operational landscape. Agencies like the Consumer Financial Protection Bureau (CFPB) are instrumental in setting standards for mortgage servicing, loss mitigation, and borrower outreach. For instance, proposed CFPB rules in 2024 focus on enhancing loss mitigation processes and improving communication clarity for borrowers, including multilingual options, requiring Guild Mortgage to adapt its systems and protocols to ensure compliance.

Loan Limit Adjustments

Political factors significantly shape Guild Mortgage's operational landscape, particularly through adjustments to loan limits. Entities like the Federal Housing Finance Agency (FHFA) and the Department of Housing and Urban Development (HUD) annually revise conforming and FHA loan limits, respectively. These changes directly dictate the maximum loan amounts Guild Mortgage can originate for conventional and government-backed mortgages.

For 2025, these limits have seen notable increases, reflecting the persistent rise in housing prices across the nation. For instance, the FHFA announced a new conforming loan limit of $766,550 for 2025, a substantial jump from the previous year, with higher limits in designated high-cost areas. Similarly, FHA loan limits also saw upward revisions, impacting affordability and market access for many borrowers.

- FHFA Conforming Loan Limit (2025): $766,550 (standard)

- FHA Loan Limit Increases: Reflecting market appreciation, impacting government-backed lending.

- Impact on Guild Mortgage: Ability to finance higher-value properties, potentially increasing origination volume.

- Market Sensitivity: Loan limit adjustments are a direct response to economic conditions and housing market trends.

Political Stability and Trade Policies

Political stability is a cornerstone for Guild Mortgage's operational environment. Broader political stability, or lack thereof, directly impacts consumer confidence and, consequently, mortgage demand. For instance, during periods of political uncertainty in 2024, consumer spending on large purchases like homes often dips, affecting Guild Mortgage's origination volumes.

Trade policies, including potential tariffs or shifts in international economic relations, can also introduce economic uncertainties. These uncertainties can indirectly influence the housing market by affecting inflation, interest rates, and overall economic growth, all of which are critical factors for mortgage lenders. A stable political climate generally supports a more predictable market for Guild Mortgage.

- 2024 Economic Outlook: Projections for 2024 indicated a potential slowdown in economic growth in several key markets due to geopolitical tensions, which could dampen housing demand and mortgage activity.

- Interest Rate Sensitivity: Changes in government fiscal policy and central bank actions, often influenced by political considerations, directly impact interest rates, a primary driver of mortgage affordability and origination volumes.

- Regulatory Environment: Political decisions shape the regulatory landscape for financial institutions. For example, discussions around housing finance reform in 2024 could lead to new compliance requirements or market opportunities for Guild Mortgage.

Government housing policies, such as those from HUD and FHFA, directly influence Guild Mortgage's business by setting loan limits and eligibility criteria. For 2025, the FHFA increased the conforming loan limit to $766,550, allowing Guild to finance higher-value properties and potentially boost origination volumes.

Monetary policy, particularly the Federal Reserve's interest rate decisions, significantly impacts mortgage rates and borrower demand. Forecasts for 2025 suggest rates may stabilize in the mid-6% range, a key factor for Guild's profitability and market competitiveness.

Consumer protection regulations from bodies like the CFPB mandate changes in servicing and communication. For instance, 2024 proposals aimed at enhancing loss mitigation and borrower outreach require Guild to adapt its systems for compliance, impacting operational costs.

Political stability is crucial; periods of uncertainty in 2024 led to dips in consumer confidence and housing demand, directly affecting Guild Mortgage's origination volumes.

What is included in the product

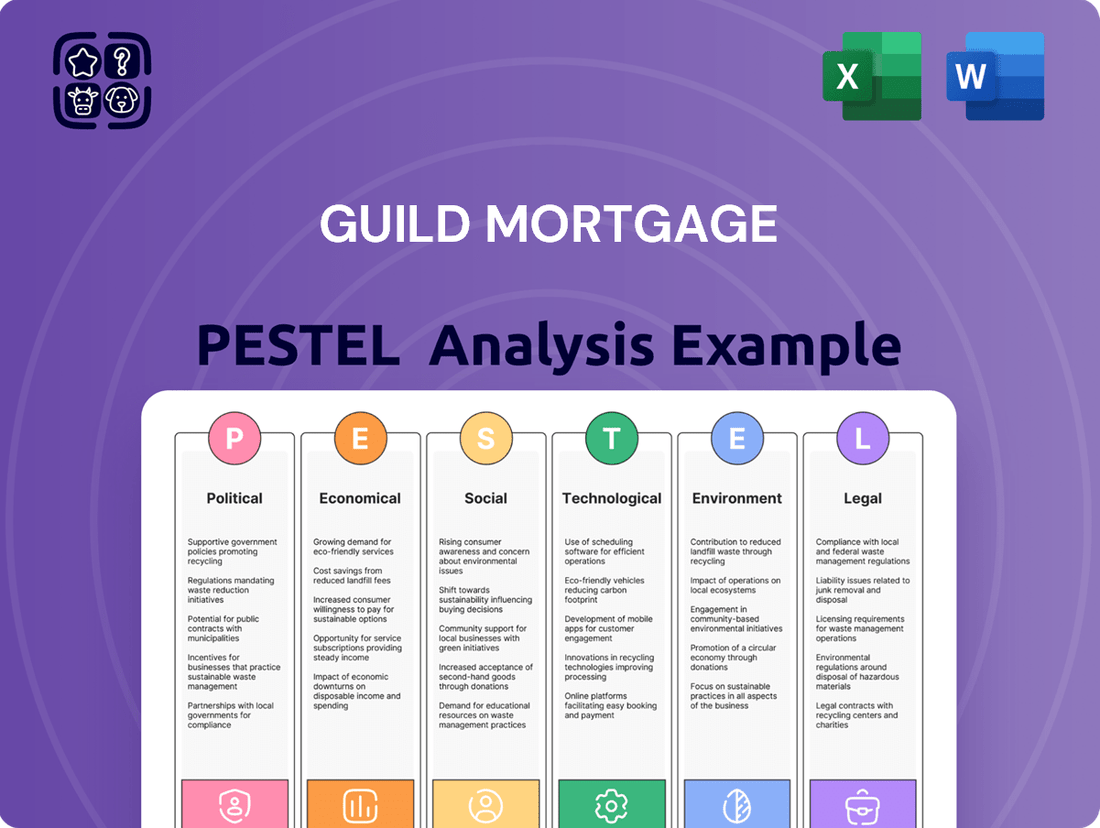

This Guild Mortgage PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic positioning.

Guild Mortgage's PESTLE analysis offers a clear, summarized version of external factors, providing readily accessible insights to alleviate the pain of complex market understanding during meetings and presentations.

Economic factors

Mortgage interest rates significantly influence Guild Mortgage's business. Higher rates reduce buyer affordability, leading to fewer purchase loans, while also dampening refinance activity. For instance, the average rate for a 30-year fixed mortgage hovered around 6.5% in early 2024, a level that continues to shape the lending landscape.

Looking ahead, projections suggest mortgage rates will likely stay within the mid-6% range through 2025. This sustained environment means affordability challenges will persist for many potential homeowners, impacting overall loan origination volumes for companies like Guild Mortgage.

The health of the housing market is a critical driver for Guild Mortgage. In 2025, while home prices are anticipated to see continued, albeit moderated, growth, existing home sales are forecast to decline. This suggests persistent affordability issues and limited housing inventory will remain significant factors.

Inflationary pressures and the overall economic growth trajectory significantly shape the Federal Reserve's monetary policy. These policy shifts directly affect mortgage rates and how much consumers can afford to spend. For instance, if inflation remains elevated, the Fed might keep interest rates higher, making mortgages more expensive.

Looking ahead to 2025, forecasts suggest a moderation in economic growth and a slight uptick in unemployment. This cooling economic environment is expected to ease inflationary pressures, potentially leading to a more favorable environment for borrowers and the housing market.

Consumer Income and Employment Levels

Consumer income and employment levels are foundational to mortgage lending. When people have stable jobs and their incomes are growing, they are more likely to qualify for loans and, crucially, to keep up with their payments. This directly influences the demand for housing and the overall health of the mortgage market.

The U.S. unemployment rate remained low, hovering around 3.9% in early 2024, indicating a robust job market. Wage growth, while showing some moderation, continued to outpace inflation for many workers through late 2024, boosting purchasing power. This economic backdrop generally supports a healthy demand for mortgage originations.

- Job Market Strength: A low unemployment rate signifies greater financial security for potential borrowers.

- Income Growth: Rising wages improve borrowers' debt-to-income ratios, making them more creditworthy.

- Demand Correlation: Strong income and employment trends typically correlate with increased home purchase applications.

- Risk Mitigation: Stable income streams reduce the risk of mortgage defaults for lenders like Guild Mortgage.

Competition in the Mortgage Lending Market

The mortgage lending market is intensely competitive, with Guild Mortgage navigating a landscape populated by traditional banks, credit unions, and numerous independent mortgage companies. This dynamic environment directly influences Guild's ability to capture market share and dictates its pricing strategies, forcing continuous adaptation to remain competitive.

Guild Mortgage has actively pursued growth through both strategic acquisitions and organic expansion initiatives. For instance, in 2023, the company continued to invest in technology and talent to enhance its service offerings and broaden its geographical reach, aiming to solidify its position amidst fierce competition.

Key competitive factors impacting Guild Mortgage include:

- Lender Diversity: The presence of large national banks, regional institutions, and specialized non-bank lenders creates a fragmented market where differentiation is crucial.

- Pricing Pressures: Intense competition often leads to aggressive pricing, impacting profit margins for all players, including Guild.

- Technological Innovation: Lenders adopting advanced digital platforms for origination, underwriting, and servicing gain a competitive edge, a trend Guild is actively addressing.

- Market Share Dynamics: In 2024, the overall mortgage origination market is projected to see shifts, with non-bank lenders like Guild aiming to maintain or grow their share against traditional banks, particularly as interest rates influence borrower behavior.

Economic factors significantly shape the mortgage market for Guild Mortgage. Persistent inflation and evolving Federal Reserve policy directly influence interest rates, impacting borrower affordability. For instance, while inflation showed signs of easing by late 2024, the Federal Reserve's stance on rates remains a key variable for 2025 mortgage origination volumes.

The overall economic growth trajectory and employment landscape are critical. Projections for 2025 suggest a moderation in economic growth and a slight increase in unemployment. This cooling economic environment could ease inflationary pressures but may also temper housing demand, impacting Guild Mortgage's business.

Consumer income and employment levels remain foundational. The U.S. unemployment rate was around 3.9% in early 2024, indicating a strong job market that generally supports mortgage demand. Continued wage growth, even with some moderation, bolsters purchasing power, benefiting lenders like Guild Mortgage.

| Economic Indicator | Value (Early 2024) | Projection (2025) | Impact on Guild Mortgage |

|---|---|---|---|

| 30-Year Fixed Mortgage Rate | ~6.5% | Mid-6% range | Sustained affordability challenges, moderating origination volumes |

| U.S. Unemployment Rate | ~3.9% | Slight increase expected | Potential softening of housing demand, increased default risk |

| Economic Growth (GDP) | Moderate | Moderating | Influences consumer confidence and borrowing capacity |

What You See Is What You Get

Guild Mortgage PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Guild Mortgage PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping their strategic landscape.

Sociological factors

Demographic shifts are significantly reshaping the housing market, with a notable increase in first-time homebuyers, particularly among Millennials and Gen Z. These younger generations are entering the homeownership journey, influencing demand for specific loan products like FHA loans and adjustable-rate mortgages. Guild Mortgage is well-positioned to serve these evolving needs, offering a range of options tailored to first-time buyers and those looking to upgrade.

Evolving household formations, including single-person households and multi-generational living arrangements, also impact housing demand and mortgage product preferences. As more individuals choose to live alone or with extended family, the need for flexible and varied housing solutions grows. Guild Mortgage's ability to adapt its offerings to these changing family structures is crucial for capturing a broader market share.

Generational preferences play a vital role in how individuals approach homeownership and financing. For instance, data from the National Association of Realtors (NAR) in early 2024 indicated that Gen Z and younger Millennials prioritize affordability and digital-first experiences when seeking mortgages. Guild Mortgage's investment in user-friendly technology and diverse loan programs directly addresses these generational expectations, aiming to simplify the mortgage process for a new wave of homeowners.

Consumers increasingly favor digital channels for mortgage applications, with many preferring online portals for self-service and convenience. This trend is reshaping how Guild Mortgage interacts with its customer base, pushing for more robust technological integration.

Data from 2024 indicates a substantial portion of homebuyers, potentially over 70%, actively use online platforms during their home search and financing journey. This reliance on digital experiences means companies like Guild Mortgage must continually enhance their online offerings to meet evolving customer expectations.

The financial literacy of potential homebuyers significantly impacts their grasp of mortgage options and the often-complex application journey. A recent survey indicated that only 57% of U.S. adults feel confident in their ability to manage their finances, highlighting a widespread need for improved financial education.

Guild Mortgage's commitment to offering a diverse range of loan products, from conventional to FHA and VA loans, coupled with robust borrower education initiatives, directly addresses this gap. By providing clear explanations and resources, Guild Mortgage empowers individuals to make informed decisions, thereby increasing access to homeownership.

Community Engagement and Social Responsibility

Guild Mortgage's dedication to community engagement and social responsibility significantly bolsters its brand image and customer appeal. By actively supporting underserved populations, the company demonstrates a commitment beyond mere financial transactions, fostering goodwill and trust. This approach is crucial in the current market, where consumers increasingly favor businesses that align with their social values.

The expansion of Guild Mortgage's Gateway to Homeownership Assistance program is a prime example of this strategy in action. This initiative directly addresses housing affordability challenges, particularly for minority and low-to-moderate income borrowers. Such programs not only fulfill a social need but also open doors to new market segments, driving growth and customer loyalty.

- Enhanced Brand Reputation: Programs assisting underserved borrowers, like Guild Mortgage's Gateway to Homeownership Assistance, build positive brand perception.

- Broader Customer Base: Socially responsible initiatives attract a wider range of customers, including those who prioritize community impact.

- Market Expansion: Targeting underserved communities through tailored programs can unlock new revenue streams and market share.

- Industry Leadership: Demonstrating commitment to social responsibility positions Guild Mortgage as a leader in ethical business practices within the mortgage sector.

Housing Affordability and Accessibility

Societal concerns about housing affordability and accessibility, especially for those with lower and moderate incomes, are increasingly shaping government policy and influencing the demand for particular mortgage programs. This trend directly impacts lenders like Guild Mortgage, as they must adapt their offerings to meet these evolving needs.

The U.S. Department of Housing and Urban Development (HUD) actively works to boost affordable housing options and encourage homeownership, underscoring these widespread societal priorities. For instance, in 2023, HUD allocated billions to programs aimed at increasing housing supply and providing rental assistance, reflecting a commitment to addressing these challenges.

- Rising Housing Costs: The median home price in the U.S. continued to climb in early 2024, reaching over $400,000 in many markets, making homeownership a significant hurdle for many.

- Demand for Affordable Loans: This affordability crisis fuels a greater demand for FHA loans and other government-backed programs designed to lower down payment requirements and offer more accessible financing.

- Policy Influence: Government initiatives and potential policy shifts, such as proposed changes to mortgage interest deductions or new affordable housing mandates, can directly affect the mortgage market landscape.

Societal expectations for transparency and ethical lending practices are paramount, influencing consumer trust and lender choice. Consumers in 2024 increasingly seek out mortgage providers with a strong commitment to fair lending and clear communication throughout the loan process. Guild Mortgage's emphasis on borrower education and accessible customer support directly addresses this societal demand, fostering stronger relationships.

The growing awareness of economic inequality and the desire for inclusive financial services are shaping lending priorities. Many consumers, particularly younger generations, are actively looking for lenders that demonstrate a commitment to serving diverse communities and addressing systemic barriers to homeownership. Guild Mortgage's outreach to underserved markets aligns with these evolving societal values.

Community engagement and corporate social responsibility are becoming key differentiators in the mortgage industry. Lenders that actively invest in their communities and support initiatives promoting financial literacy and affordable housing are building stronger brand loyalty. Guild Mortgage's programs, such as their Gateway to Homeownership Assistance, resonate with consumers who value social impact.

Technological factors

The mortgage sector is rapidly embracing digital transformation, with automation, AI, and machine learning at the forefront. These advancements are designed to streamline critical functions like underwriting, loan processing, and document management, aiming to boost speed and accuracy. For Guild Mortgage, adopting these technologies presents a significant opportunity to improve operational efficiency and minimize human error in its lending processes.

By integrating AI-powered underwriting tools, Guild Mortgage could potentially reduce loan approval times by as much as 30%, as seen in industry benchmarks from late 2024. Furthermore, automation in document verification can cut processing costs by an estimated 15-20% in 2025, directly impacting the bottom line and allowing for more competitive loan offerings.

Artificial intelligence and machine learning are fundamentally reshaping the mortgage industry, particularly in areas like credit risk assessment, customer interaction via chatbots, and identifying fraudulent activities during loan origination. Guild Mortgage is actively leveraging these technologies, having developed its proprietary AI system, GuildGPT, to streamline service and provide rapid access to crucial customer data.

This investment in AI is designed to improve operational efficiency and customer experience. For instance, AI-powered tools can analyze vast datasets to predict borrower default risk with greater accuracy than traditional methods, potentially leading to more responsible lending practices. Guild Mortgage's commitment to GuildGPT underscores a strategic move to harness AI for competitive advantage in a rapidly evolving digital landscape.

As Guild Mortgage navigates increasing digitalization, robust cybersecurity and data privacy are paramount. Protecting sensitive borrower information is crucial for maintaining trust in the mortgage sector, where data breaches can have severe repercussions.

The mortgage industry, like many others, continues to grapple with evolving cyber threats. Ransomware attacks and privacy breaches remain significant challenges, demanding constant vigilance and investment in advanced security measures to safeguard customer data and operational integrity.

Cloud Computing and Remote Collaboration Tools

Cloud computing and robust remote collaboration tools are reshaping Guild Mortgage's operational landscape. These technologies allow for seamless interaction among geographically dispersed teams, including loan officers and support staff, which is crucial for Guild's branch network. In 2024, the mortgage industry's reliance on cloud infrastructure continued to grow, with many firms reporting significant improvements in data accessibility and processing speeds. This shift supports a more agile and responsive business model, essential for navigating market fluctuations.

The scalability offered by cloud solutions is a key technological factor. Guild Mortgage can efficiently adjust its IT resources to manage peaks and troughs in loan application volume, a common occurrence in the housing market. For instance, a surge in refinance activity, driven by interest rate changes, can be handled without significant upfront investment in physical infrastructure. This flexibility is projected to be even more critical in 2025 as market dynamics remain fluid.

The adoption of these tools directly impacts operational efficiency and cost management. Companies leveraging cloud-based platforms often see reduced IT maintenance costs and enhanced disaster recovery capabilities. Furthermore, the ability to collaborate remotely empowers a distributed workforce, potentially expanding Guild Mortgage's talent pool beyond local geographic constraints.

- Enhanced Collaboration: Cloud platforms facilitate real-time document sharing and communication for Guild Mortgage's distributed workforce.

- Scalability: Companies can dynamically adjust computing resources to match fluctuating mortgage application volumes.

- Operational Efficiency: Remote work enablement through these tools can lead to cost savings and improved productivity.

- Data Accessibility: Secure cloud storage ensures that critical loan data is accessible from any location, supporting faster decision-making.

Blockchain Technology for Transparency and Security

Blockchain technology is making inroads into the mortgage sector, promising to simplify processes like title searches and enable smart contracts. This offers a significant boost in transparency and security for all parties involved. For instance, in 2024, several pilot programs explored blockchain for property records, aiming to reduce fraud and speed up transactions.

While adoption is still developing, blockchain's potential to streamline the intricate mortgage lifecycle is substantial. By creating immutable records and automating certain contractual obligations through smart contracts, it can reduce manual errors and the need for intermediaries. This could lead to faster closings and lower administrative costs.

Key advancements and potential impacts include:

- Enhanced Data Integrity: Blockchain ensures that title information is tamper-proof, reducing the risk of errors and disputes.

- Streamlined Title Searches: By providing a secure and accessible ledger of property ownership, blockchain can significantly cut down the time and cost associated with title verification.

- Smart Contract Automation: The use of smart contracts can automate loan servicing, payment processing, and escrow management, increasing efficiency and reducing operational overhead.

Technological advancements are fundamentally reshaping Guild Mortgage's operations, with AI and automation streamlining underwriting and loan processing. These tools are projected to increase efficiency and accuracy, with industry benchmarks in late 2024 indicating potential reductions in loan approval times by up to 30%. Furthermore, automation in document verification could decrease processing costs by an estimated 15-20% in 2025.

Legal factors

The Consumer Financial Protection Bureau (CFPB) continuously shapes mortgage servicing through proposed and amended rules. These regulations directly influence Guild Mortgage's practices in areas like loss mitigation, borrower communication, and foreclosure management. For instance, recent CFPB proposals in 2024 aim to streamline options for homeowners facing financial hardship, potentially reducing default rates and servicing costs.

The Truth in Lending Act, specifically Regulation Z, mandates disclosures and sets thresholds for various mortgage types. For 2024, the threshold for higher-priced mortgage loans (HPMLs), which trigger stricter appraisal requirements, was set at an annual percentage rate (APR) that exceeds the average prime offer rate (APOR) by 1.5 percentage points or more for a first lien. This directly impacts Guild Mortgage by increasing compliance costs and potentially limiting the types of loans offered, especially those that might fall into the HPML category.

Guild Mortgage operates under stringent fair lending laws and anti-discrimination regulations designed to ensure all eligible borrowers have equitable access to home loans. This commitment is crucial for maintaining trust and compliance within the financial sector.

Recent regulatory shifts, such as HUD's proposed rules to prevent conviction history from automatically disqualifying individuals from subsidized housing, signal a broader trend toward promoting fair access in housing finance. This aligns with the ongoing efforts to broaden financial inclusion.

Data Privacy Laws and Consumer Information Protection

Guild Mortgage must navigate a complex web of data privacy regulations, including those governing the collection, storage, and utilization of sensitive consumer financial information. Compliance is not merely a legal obligation but a cornerstone of maintaining borrower trust and avoiding significant penalties, which can include substantial fines and reputational damage.

The increasing focus on data protection, exemplified by evolving regulations like the California Privacy Rights Act (CPRA) and potential federal privacy legislation, necessitates robust security measures and transparent data handling practices. For instance, the CPRA, which became fully effective in 2023, grants consumers more control over their personal information, requiring businesses to be more diligent in their data management and consent processes.

- Compliance with GDPR and CCPA: Guild Mortgage must adhere to global and state-specific data privacy laws, ensuring lawful processing and consumer rights.

- Data Breach Costs: The average cost of a data breach in the financial sector reached $5.90 million in 2023, underscoring the financial impact of non-compliance.

- Consumer Trust: Protecting borrower data is paramount; a breach can erode trust, leading to customer attrition and negative brand perception.

- Regulatory Fines: Violations of data privacy laws can result in substantial fines, impacting profitability and operational capacity.

State and Local Lending Laws

Guild Mortgage operates within a labyrinth of state and local lending regulations, each presenting unique compliance challenges. These laws, distinct from federal mandates, dictate everything from licensing requirements and interest rate caps (usury limits) to the intricate processes for foreclosures. For instance, in 2024, states like California continue to have specific disclosure requirements that differ from those in Texas, necessitating tailored compliance strategies for each operational region.

Navigating this patchwork of rules demands a sophisticated compliance infrastructure. Failure to adhere to these varied state and local statutes can result in significant penalties, including fines and the revocation of lending licenses. As of early 2025, the Mortgage Bankers Association (MBA) has reported an increasing focus by state regulators on consumer protection laws, particularly concerning predatory lending practices.

- State-Specific Licensing: Guild Mortgage must maintain active licenses in each state where it originates or services loans, with renewal fees and continuing education requirements varying by jurisdiction.

- Usury Limits: Many states impose caps on the interest rates lenders can charge, which can impact the profitability of certain loan products, especially in high-interest rate environments. For example, some states may have APR caps below 20%, while others allow for higher rates.

- Foreclosure Procedures: The legal pathways for foreclosure differ significantly by state, with some requiring judicial foreclosure (court involvement) and others allowing non-judicial foreclosure, impacting timelines and costs.

- Consumer Protection Laws: State-level regulations often provide additional consumer protections beyond federal laws, such as specific requirements for loan servicing, fee disclosures, and rescission rights.

The legal landscape for mortgage lenders like Guild Mortgage is dynamic, with regulatory bodies such as the CFPB constantly issuing new rules. These regulations directly affect servicing practices, loss mitigation, and borrower communications, with 2024 proposals aiming to ease hardship options for homeowners.

Federal laws like the Truth in Lending Act (Regulation Z) set crucial disclosure standards and loan thresholds. For instance, the 2024 threshold for higher-priced mortgage loans (HPMLs) impacting appraisal requirements underscores the need for meticulous compliance and can influence product offerings.

Fair lending statutes and anti-discrimination laws are paramount, ensuring equitable access to credit. Recent shifts, like HUD's considerations on conviction history for housing access, reflect a broader push for financial inclusion that Guild Mortgage must align with.

Data privacy is a critical legal concern, with evolving regulations like the CPRA demanding robust security and transparent data handling. Non-compliance with these stringent rules, including potential federal privacy legislation, can lead to significant financial penalties and damage consumer trust.

Environmental factors

The escalating frequency and intensity of climate-driven events, such as floods and wildfires, are demonstrably affecting property values in at-risk regions. For instance, areas prone to severe weather may see declining market values as potential buyers factor in increased risks and potential repair costs.

Consequently, property insurance premiums are climbing, making homeownership less affordable and potentially impacting the long-term insurability of mortgages in vulnerable locations. This trend poses a direct challenge to mortgage servicers like Guild Mortgage, necessitating a proactive approach to portfolio risk assessment.

By mid-2024, reports indicated a significant uptick in insurance claims related to extreme weather events, further pressuring the insurance market and, by extension, the mortgage industry. Guild Mortgage must integrate these evolving environmental risks into its underwriting and portfolio management strategies to ensure stability and mitigate potential losses.

The increasing demand for sustainable and energy-efficient homes is reshaping the housing market. For instance, in 2024, the U.S. Green Building Council reported a 15% year-over-year increase in LEED-certified projects, indicating a strong consumer pull towards eco-friendly construction. This trend is likely to fuel growth in green mortgage products and financing options for energy-saving renovations, creating new opportunities for lenders like Guild Mortgage.

Lenders like Guild Mortgage are increasingly integrating environmental risk assessments into their underwriting. This is particularly true for properties in regions susceptible to natural disasters or environmental hazards. For instance, the increasing frequency and severity of climate-related events, like wildfires and floods, directly impact property values and insurability, forcing a more rigorous evaluation of these risks during the loan approval process.

This shift means loan eligibility and pricing could be directly affected by a property's environmental profile. Properties situated in flood zones, for example, may face higher insurance premiums or even be deemed uninsurable, potentially impacting their mortgage availability and terms. This heightened scrutiny is a direct response to growing concerns about climate change and its financial implications for the real estate market.

Regulatory Pressure for Green Financing

While the U.S. residential mortgage market hasn't seen widespread mandates for green financing yet, this is a growing area of consideration. Future regulatory shifts could encourage or require lenders like Guild Mortgage to offer more eco-friendly loan products or to report on the environmental risks within their existing portfolios. For instance, the Biden administration's focus on climate resilience and sustainable finance signals a potential direction for policy. By mid-2024, several financial institutions globally have already launched green mortgage initiatives, indicating a trend that could influence U.S. regulations.

The increasing global focus on climate change is driving discussions around financial sector responsibility. This translates to potential future requirements for mortgage lenders to:

- Incorporate environmental risk assessments into loan underwriting.

- Offer incentives for energy-efficient home purchases.

- Develop and disclose green financing products.

Resource Scarcity and Building Material Costs

Environmental factors, like extreme weather events, can disrupt the supply of key building materials, leading to price volatility. For instance, in 2024, lumber prices saw significant swings due to factors like wildfire seasons impacting timber harvests in North America. This directly affects the cost of new home construction and renovation projects.

Fluctuations in the availability and cost of materials like lumber, concrete, and steel, driven by environmental concerns or supply chain bottlenecks, can slow down the housing market. This slowdown indirectly impacts Guild Mortgage by reducing the demand for construction and renovation loans. For example, a 10% increase in the cost of lumber in early 2025 could delay numerous planned home improvement projects.

- Lumber Price Volatility: Saw an average increase of 15% in Q1 2024 compared to the previous year, influenced by supply chain issues and demand surges.

- Concrete Costs: Experienced a steady rise of approximately 5% throughout 2024, attributed to energy price increases impacting production.

- Impact on Construction Loans: A 2024 survey indicated that 30% of builders cited material cost increases as a primary reason for project delays.

Environmental factors are increasingly influencing the mortgage industry, with climate change driving more frequent and severe weather events. These events directly impact property values and insurability, forcing lenders like Guild Mortgage to reassess risk. For example, by mid-2024, insurance claims related to extreme weather saw a notable increase, pressuring the market.

PESTLE Analysis Data Sources

Our Guild Mortgage PESTLE analysis is meticulously crafted using data from reputable sources such as the Mortgage Bankers Association, government housing agencies like HUD and FHFA, and leading economic indicators from the Bureau of Labor Statistics and Federal Reserve. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the mortgage industry.