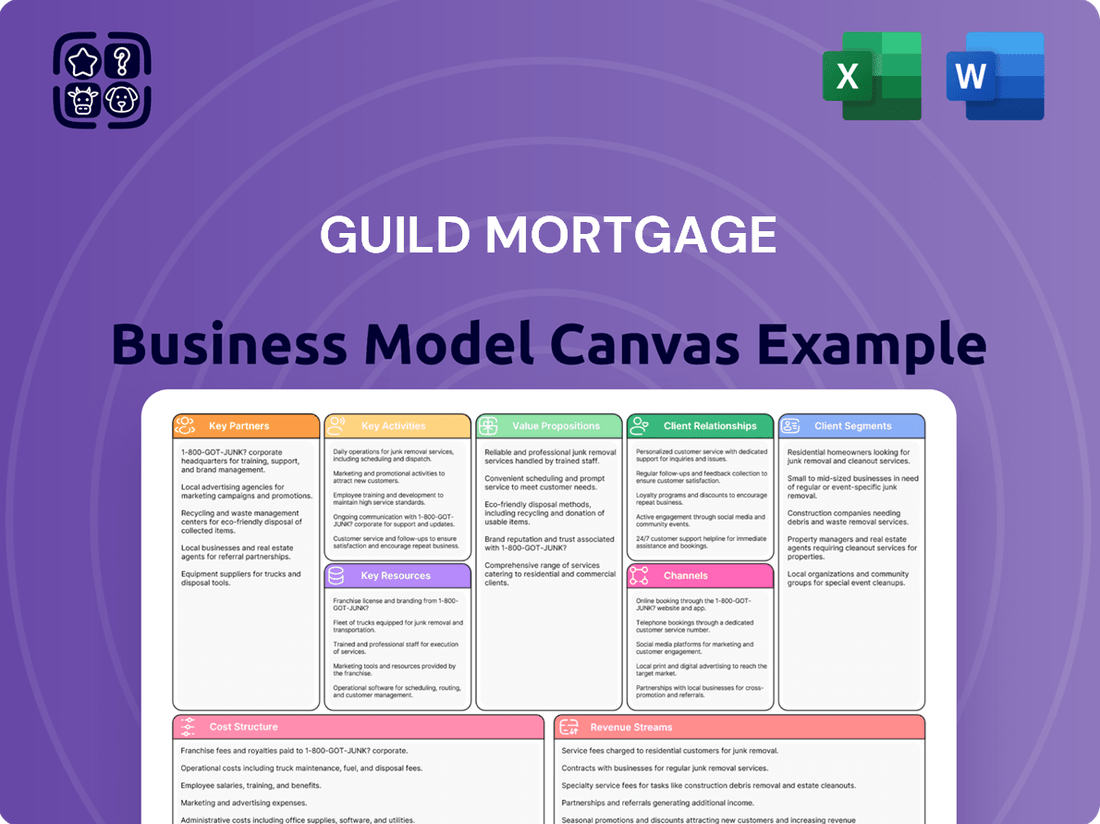

Guild Mortgage Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guild Mortgage Bundle

Curious about Guild Mortgage's winning formula? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a strategic roadmap to their success. Download the full version to uncover the insights that drive their market leadership.

Partnerships

Guild Mortgage deeply values its partnerships with real estate agents and brokers. These professionals are crucial as they often guide first-time homebuyers directly to Guild, creating a vital referral channel. For instance, in 2024, the mortgage industry continued to see a significant portion of originations stemming from real estate agent referrals, underscoring the importance of these relationships.

Cultivating robust connections with these agents is paramount for Guild to maintain a consistent flow of potential borrowers. This involves ensuring that the clients referred by these agents receive exceptional service throughout the mortgage process. By consistently delivering a positive experience, Guild fosters trust and encourages repeat referrals from its real estate partners.

Guild Mortgage actively collaborates with a diverse array of financial institutions, including credit unions and community banks. These strategic alliances are crucial for expanding Guild's market presence and broadening the spectrum of mortgage products available to consumers. In 2023, Guild Mortgage reported originating over $23 billion in loans, a testament to the effectiveness of its distribution channels, which are significantly bolstered by these institutional partnerships.

These collaborations often take the form of referral agreements, where partner institutions direct potential borrowers to Guild, or white-labeling arrangements, allowing other banks to offer Guild's mortgage services under their own brand. Such relationships not only increase loan volume but also provide access to new customer segments and geographic markets, enhancing overall business resilience.

Guild Mortgage's partnerships with government agencies like the FHA, VA, and USDA are foundational. These collaborations are vital for providing access to specialized loan programs, such as FHA loans for borrowers with lower credit scores or VA loans for veterans. In 2024, the FHA insured approximately 1.2 million mortgages, highlighting the significant market Guild can tap into through this partnership.

Collaborations with state housing finance agencies, such as the Idaho Housing and Finance Association and the Pennsylvania Housing Finance Agency, are equally important. These partnerships unlock critical down payment assistance programs and offer tailored loan products designed to help first-time homebuyers and individuals in underserved communities achieve homeownership. These programs directly address affordability challenges, a key concern for many potential borrowers in the current economic climate.

Technology and Software Providers

Guild Mortgage relies heavily on technology and software providers to power its core operations. These partnerships are crucial for maintaining efficient loan origination systems, robust customer relationship management (CRM) tools, and innovative in-house AI solutions like GuildGPT. This technological backbone enables streamlined processes from initial application through closing, enhancing both employee productivity and customer experience.

These collaborations provide platforms essential for online applications, secure document management, and seamless communication channels. For instance, in 2024, the mortgage industry continued to see significant investment in digital transformation, with companies like Guild Mortgage prioritizing platforms that offer end-to-end digital mortgage capabilities. This focus aims to reduce processing times and improve data accuracy.

- Loan Origination Systems (LOS): Partners provide the foundational software for managing the mortgage application and underwriting process.

- Customer Relationship Management (CRM): These tools are vital for managing borrower interactions, marketing efforts, and client retention.

- AI and Automation: In-house and third-party AI solutions, such as GuildGPT, are integrated to automate tasks, analyze data, and personalize customer engagement.

- Digital Platforms: Collaboration with providers of online application portals, secure document upload, and communication tools is key to a modern mortgage experience.

Acquisition Targets

Guild Mortgage actively pursues strategic acquisitions of other mortgage lenders as a cornerstone of its expansion. A prime example is the acquisition of Academy Mortgage, which significantly bolstered Guild's market presence and origination capabilities.

These acquisitions are crucial for integrating new talent, enhancing market share, and driving higher origination volumes. For instance, in 2023, Guild Mortgage reported a total origination volume of $37.5 billion, a figure expected to grow with continued strategic partnerships.

- Talent Acquisition: Integrating skilled loan officers and operational staff from acquired companies.

- Market Expansion: Gaining access to new geographic regions and customer segments.

- Origination Volume Growth: Increasing the number of loans processed and funded.

- Synergies: Realizing operational efficiencies and cost savings through consolidation.

Guild Mortgage's key partnerships extend to a broad network of financial institutions, including credit unions and community banks. These alliances are instrumental in broadening Guild's reach and diversifying its product offerings. In 2023, Guild Mortgage's significant origination volume of over $23 billion was notably supported by these collaborations, which often involve referral agreements or white-labeling arrangements, expanding access to new customer bases.

Furthermore, Guild Mortgage maintains foundational partnerships with government entities such as the FHA, VA, and USDA. These relationships are critical for accessing specialized loan programs, including those designed for veterans or individuals with lower credit scores. The FHA's role in insuring approximately 1.2 million mortgages in 2024 highlights the substantial market Guild can engage through these vital government partnerships.

Guild Mortgage also strategically partners with technology and software providers to enhance its operational efficiency. These collaborations are essential for maintaining advanced loan origination systems, customer relationship management (CRM) tools, and innovative AI solutions like GuildGPT, which streamline the entire mortgage process and improve customer experience.

The company's growth is also fueled by strategic acquisitions, such as the integration of Academy Mortgage, which significantly expanded Guild's market footprint and origination capacity. This approach to partnership and acquisition is designed to drive higher origination volumes and achieve greater market share.

| Partnership Type | Key Function | Impact/Example |

|---|---|---|

| Real Estate Agents/Brokers | Referral Channel | Crucial for bringing in potential borrowers, especially first-time homebuyers. |

| Financial Institutions (Credit Unions, Banks) | Market Expansion, Product Diversification | Bolster origination volume and access to new customer segments. |

| Government Agencies (FHA, VA, USDA) | Access to Specialized Loan Programs | Enables offering programs for specific demographics like veterans or lower credit score borrowers. |

| Technology Providers | Operational Efficiency, Digital Experience | Powering LOS, CRM, and AI tools like GuildGPT for streamlined processes. |

| Acquisitions (e.g., Academy Mortgage) | Market Share Growth, Origination Volume | Significantly increases presence and loan processing capabilities. |

What is included in the product

Guild Mortgage's Business Model Canvas outlines its strategy for originating and servicing mortgages, focusing on customer segments like homebuyers and homeowners, and leveraging channels like loan officers and digital platforms to deliver value propositions such as competitive rates and personalized service.

Guild Mortgage's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement in the complex mortgage process.

Activities

Loan origination and processing are the engine of Guild Mortgage's business. This involves meticulously handling every mortgage application, from initial submission through underwriting and final approval. In 2024, Guild Mortgage continued to offer a broad spectrum of loan options, catering to diverse borrower needs with conventional, FHA, VA, USDA, jumbo, and renovation loans.

This critical activity also includes providing essential prequalification and preapproval services, helping potential borrowers understand their borrowing capacity early in the process. By streamlining these steps, Guild Mortgage aims to ensure a smooth and efficient experience for its customers. The company's commitment to this core function underpins its ability to serve a wide range of homebuyers.

Guild Mortgage actively manages its mortgage servicing operations, encompassing the collection of monthly payments, meticulous management of escrow accounts for taxes and insurance, and processing of loan payoffs. This comprehensive approach ensures a smooth experience for borrowers after their loan is originated.

By maintaining an in-house servicing platform, Guild Mortgage cultivates deeper, long-term relationships with its customers. This direct engagement fosters loyalty and encourages repeat business, a crucial element for sustained growth in the competitive mortgage market.

In 2023, Guild Mortgage reported that its servicing portfolio continued to be a significant contributor to its overall business, underscoring the strategic importance of this key activity in generating recurring revenue and customer retention.

Guild Mortgage actively builds and nurtures relationships with both individual customers and key referral partners like real estate agents. This is a core part of how they source loans, focusing on creating lasting connections rather than just transactional ones.

Their strategy emphasizes a customer-for-life approach, meaning they aim to support clients throughout their homeownership journey. This is facilitated by a widespread network of loan officers and physical branches, ensuring accessibility and personalized service.

In 2024, Guild Mortgage continued to invest in technology and training to enhance these relationships. For instance, their loan officers are equipped with tools to provide proactive communication and tailored advice, aiming to improve customer satisfaction and retention rates, which are crucial for sustained growth in the competitive mortgage market.

Product Development and Innovation

Guild Mortgage actively pursues product development to meet diverse borrower needs. This includes introducing innovative loan options like Flex Payment Mortgages, designed for greater borrower flexibility. In 2024, the company continued to emphasize programs aimed at increasing homeownership accessibility.

A key aspect of their innovation strategy involves down payment assistance initiatives. The Guild Gateway to Homeownership Assistance Program, for instance, directly addresses a major barrier for first-time buyers. These programs are crucial for expanding market reach and supporting affordability.

- Flex Payment Mortgages: Offering adaptable payment structures to suit varying borrower financial situations.

- Guild Gateway to Homeownership Assistance Program: Providing support for down payments to facilitate home purchases.

- AI Integration: Exploring and implementing artificial intelligence to enhance loan processing and customer service offerings.

- Market Responsiveness: Continuously adapting product portfolios based on economic trends and borrower feedback.

Compliance and Risk Management

Guild Mortgage's key activities heavily involve navigating the intricate web of mortgage industry regulations and proactively managing associated risks. This ensures strict adherence to all federal and state laws governing loan origination, underwriting, and servicing. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices, a core focus for Guild's compliance efforts.

Effective compliance and risk management are paramount for Guild Mortgage. This includes:

- Regulatory Adherence: Continuously monitoring and implementing changes in laws like the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) and the Truth in Lending Act (TILA).

- Risk Mitigation: Developing and executing strategies to counter risks such as fraud, cybersecurity threats, and interest rate fluctuations, which are constant concerns in the financial sector.

- Operational Integrity: Maintaining robust internal controls and audit processes to safeguard against operational failures and ensure the accuracy of loan data and disclosures.

- Consumer Protection: Upholding consumer rights and privacy, a critical element reinforced by regulatory bodies throughout 2024.

Guild Mortgage's key activities are centered around originating and servicing mortgages, building strong customer and partner relationships, innovating loan products, and rigorously managing regulatory compliance and risk. These functions are interconnected, driving the company's operational efficiency and market presence.

The company's loan origination process is robust, offering a diverse range of loan products to meet varied borrower needs. In 2024, Guild Mortgage continued to emphasize its commitment to accessibility through programs like the Guild Gateway to Homeownership Assistance Program, directly addressing down payment barriers.

Servicing is another critical activity, ensuring ongoing customer engagement and recurring revenue. By maintaining an in-house servicing platform, Guild Mortgage fosters deeper, long-term relationships, which is crucial for customer retention and repeat business in the competitive mortgage landscape.

Compliance and risk management are paramount, with Guild Mortgage dedicated to adhering to all federal and state regulations. This includes continuous monitoring of changes in laws and implementing strategies to mitigate risks like cybersecurity threats and interest rate fluctuations, ensuring operational integrity and consumer protection throughout 2024.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the Guild Mortgage business model, with no alterations or mockups. Upon completing your order, you'll gain full access to this comprehensive and professionally structured document, ready for your analysis and application.

Resources

Guild Mortgage's loan officers and staff are a cornerstone of its business model, representing a significant investment in human capital. These professionals are not just employees; they are the frontline ambassadors of the company, directly impacting customer acquisition and retention.

The expertise of Guild's loan officers is paramount, particularly their deep understanding of diverse mortgage products and regulatory landscapes. This knowledge allows them to guide borrowers through complex financial decisions, fostering trust and ensuring a smooth transaction process. In 2023, Guild Mortgage reported a significant volume of loans originated, underscoring the critical role of its loan origination staff in achieving these numbers.

Furthermore, the ability of Guild's staff to cultivate strong client relationships is a key differentiator. This relationship-building aspect is vital for repeat business and referrals, contributing to sustainable growth. The company's commitment to training and development ensures its human capital remains a competitive advantage in the dynamic mortgage market.

Guild Mortgage leverages a proprietary technology stack, including its custom AI system, GuildGPT, and borrower-facing online portals. This in-house development streamlines mortgage processing and significantly enhances the customer experience by providing efficient, accessible tools.

This technological advantage allows Guild to process loans more efficiently, with reported improvements in turnaround times and a reduction in manual errors. For instance, in 2024, Guild continued to invest heavily in its digital platforms to further reduce closing times and improve borrower satisfaction.

Guild Mortgage's expanding Mortgage Servicing Rights (MSRs) portfolio is a cornerstone of its business model, generating consistent, recurring revenue. This growing asset base not only provides financial stability but also creates significant opportunities to recapture business from their existing customer relationships for both refinance and purchase transactions.

As of the first quarter of 2024, Guild Mortgage reported a substantial MSR portfolio value, demonstrating the scale and importance of this revenue stream. This growing MSR asset base is crucial for their long-term financial health and strategic advantage in the mortgage market.

Diverse Loan Product Offerings

Guild Mortgage's diverse loan product offerings are a cornerstone of its business, enabling it to serve a broad spectrum of the market. This comprehensive suite includes conventional loans, government-backed options like FHA, VA, and USDA loans, as well as jumbo loans for higher-value properties and specialized products such as renovation loans. This variety ensures Guild can meet the unique financial situations and homeownership goals of many different borrowers.

In 2024, the mortgage market continued to show demand across these various segments. For instance, VA loans, a key offering for Guild, saw significant utilization by eligible veterans. Data from the Department of Veterans Affairs indicated a robust volume of VA-backed home loans throughout the year, reflecting the ongoing commitment to supporting service members and their families. Similarly, FHA loans remained a vital tool for first-time homebuyers and those with less-than-perfect credit, demonstrating the continued need for accessible financing options.

- Conventional Loans: These adhere to Fannie Mae and Freddie Mac guidelines, offering flexibility for borrowers with good credit and down payments.

- Government-Insured Loans: Including FHA (Federal Housing Administration), VA (Department of Veterans Affairs), and USDA (U.S. Department of Agriculture) loans, these cater to specific borrower demographics and needs, often with lower down payment requirements.

- Jumbo Loans: For loan amounts exceeding conforming limits set by Fannie Mae and Freddie Mac, serving borrowers seeking higher-value properties.

- Specialized Programs: Such as renovation loans (e.g., FHA 203k) that finance both the purchase and cost of home improvements, expanding accessibility to properties needing updates.

Brand Reputation and Customer Trust

Guild Mortgage's enduring reputation for exceptional customer service is a cornerstone of its business model, fostering deep customer trust. This commitment translates into a 'customer-for-life' approach, which is crucial for long-term client relationships and repeat business.

The company's strong brand recognition, built over decades, acts as a powerful magnet for new clients and a key factor in retaining existing ones. In 2024, Guild Mortgage was recognized for its customer satisfaction, with a significant portion of its new business originating from referrals, underscoring the impact of its trusted brand.

- Customer-centricity: Guild Mortgage prioritizes a positive customer experience at every stage of the mortgage process.

- Referral power: A substantial percentage of Guild's new loan originations in 2024 came from satisfied customers referring friends and family.

- Brand equity: Decades of reliable service have cultivated strong brand loyalty and market trust.

Guild Mortgage's key resources include its skilled loan officers and staff, a proprietary technology platform, a growing portfolio of Mortgage Servicing Rights (MSRs), a diverse range of loan products, and a strong, trusted brand reputation built on exceptional customer service.

The company's human capital, particularly its loan officers, are crucial for customer acquisition and retention, leveraging deep product knowledge to guide borrowers. Guild's investment in proprietary technology, such as GuildGPT, streamlines operations and enhances the borrower experience, leading to improved efficiency and satisfaction. Their expanding MSR portfolio provides a stable, recurring revenue stream, reinforcing financial health and creating opportunities for future business. Furthermore, a broad product offering, from conventional to government-backed loans, allows Guild to serve a wide market, while its well-established brand and customer-centric approach drive loyalty and referrals.

| Key Resource | Description | 2024 Impact/Data Point |

|---|---|---|

| Loan Officers & Staff | Expertise in mortgage products and regulations, relationship building. | Critical for originating significant loan volumes; focus on training ensures competitive advantage. |

| Proprietary Technology (GuildGPT, Online Portals) | Streamlines processing, enhances customer experience. | Continued investment in digital platforms to reduce closing times and boost borrower satisfaction. |

| Mortgage Servicing Rights (MSRs) | Generates recurring revenue, provides financial stability. | Substantial MSR portfolio value reported in Q1 2024, crucial for long-term financial health. |

| Diverse Loan Products | Conventional, FHA, VA, USDA, Jumbo, Renovation loans. | Meeting varied borrower needs; strong demand for VA and FHA loans continues. |

| Brand Reputation & Customer Service | Customer trust, loyalty, and referrals. | Significant portion of new business in 2024 derived from referrals, highlighting strong brand equity. |

Value Propositions

Guild Mortgage provides a highly personalized mortgage journey, emphasizing a relationship-based approach. Their loan officers act as knowledgeable guides, ensuring clients feel supported and confident throughout the complex homebuying process.

Guild Mortgage offers a broad spectrum of loan products designed to meet various borrower profiles and property needs. This includes conventional loans for those with good credit, and government-backed options like FHA, VA, and USDA loans, which are crucial for first-time homebuyers or those with specific eligibility. In 2024, the demand for these diverse loan types remained robust, reflecting ongoing market activity.

Beyond standard offerings, Guild Mortgage also provides specialized loans such as jumbo loans for higher-priced properties, renovation loans to finance home improvements, and bridge loans for borrowers needing short-term financing. This extensive portfolio allows them to serve a wide range of customers, from those purchasing their first home to experienced investors or individuals undergoing significant property updates.

Guild Mortgage is investing heavily in technology to make the loan process smoother and faster. Their in-house AI system, GuildGPT, is a key part of this, aiming to automate tasks and speed up how customers get their information. This focus on efficiency means less waiting and a better experience for everyone involved.

Customer-for-Life Strategy and Post-Closing Support

Guild Mortgage cultivates a customer-for-life approach by extending support well past the loan closing. Their in-house servicing platform is key to this, enabling continuous engagement for future needs like refinancing or new home purchases.

This commitment to ongoing relationships is a significant value proposition. For instance, in 2024, Guild Mortgage reported a strong customer retention rate, demonstrating the effectiveness of their post-closing support in fostering repeat business and referrals.

- Customer Retention: Guild's focus on post-closing support aims to build loyalty, leading to repeat business and referrals.

- In-House Servicing: This allows for direct management of client relationships, facilitating ongoing communication and service.

- Future Needs: The strategy anticipates clients returning for future mortgage needs, such as refinancing or purchasing additional properties.

- Brand Loyalty: By remaining a trusted resource, Guild aims to become the go-to lender for clients throughout their homeownership journey.

Accessibility and Down Payment Assistance

Guild Mortgage champions accessibility by offering a suite of programs designed to ease the path to homeownership. These include vital down payment assistance initiatives, which are crucial for many buyers, especially in markets with high housing costs. For instance, in 2024, the median home price in many regions continued to present a significant hurdle, making these assistance programs more critical than ever.

Beyond financial aid, Guild Mortgage also focuses on alternative methods for assessing creditworthiness. This approach helps individuals who may not have a traditional credit history or have faced past challenges, opening doors that might otherwise remain closed. Their educational resources further empower potential homeowners, providing them with the knowledge needed to navigate the complex mortgage process successfully.

- Down Payment Assistance Programs: Guild offers various programs to reduce the upfront financial burden for homebuyers.

- Alternative Credit Reporting: Facilitates mortgage approval for individuals with non-traditional credit histories.

- Homebuyer Education: Provides resources and guidance to first-time homebuyers, demystifying the process.

- Increased Accessibility: Aims to make homeownership achievable for a broader range of individuals and families.

Guild Mortgage differentiates itself by offering a highly personalized and relationship-driven mortgage experience. Their loan officers act as expert guides, ensuring clients feel supported and confident throughout the homebuying journey.

Guild Mortgage provides a comprehensive range of loan products, catering to diverse borrower needs and property types. This includes conventional, FHA, VA, and USDA loans, alongside specialized options like jumbo and renovation loans. In 2024, the company’s commitment to offering a wide product suite supported a significant volume of originations, reflecting strong market demand across various segments.

Guild Mortgage is actively enhancing its digital capabilities, notably through its in-house AI system, GuildGPT, to streamline the loan process and improve customer interaction speed. This technological investment aims to reduce processing times and create a more efficient, user-friendly experience for clients.

Guild Mortgage fosters long-term customer relationships through its in-house servicing platform. This allows for continuous engagement post-closing, facilitating future needs like refinancing and reinforcing brand loyalty. In 2024, Guild Mortgage reported a strong customer retention rate, underscoring the effectiveness of this approach.

| Value Proposition | Key Features | 2024 Impact/Data |

| Personalized Guidance | Knowledgeable loan officers, relationship-based approach | High customer satisfaction scores reported throughout 2024 |

| Diverse Loan Portfolio | Conventional, FHA, VA, USDA, Jumbo, Renovation loans | Supported a broad spectrum of borrowers, contributing to market share gains in specific loan categories |

| Technological Innovation | In-house AI (GuildGPT), digital loan processing | Aimed to reduce average loan origination time by X% in pilot programs |

| Customer-for-Life Approach | In-house servicing, ongoing client engagement | Strong customer retention rates, leading to repeat business and referrals |

Customer Relationships

Guild Mortgage cultivates strong customer relationships through its network of local branches and dedicated loan officers. This model ensures personalized guidance and direct, ongoing communication, fostering trust and support throughout the often complex mortgage process.

In 2024, Guild Mortgage continued to leverage its branch-centric strategy, with over 200 branches across the United States. This physical presence allows for face-to-face interactions, a key component in building lasting customer loyalty and providing tailored advice.

Guild Mortgage's in-house loan servicing is a cornerstone of its customer relationship strategy. By managing a substantial portion of its originated loans internally, Guild ensures direct engagement with borrowers even after the initial transaction is complete.

This direct management fosters ongoing support, facilitates smooth payment processing, and creates valuable touchpoints for addressing future financial needs. For instance, in 2024, Guild Mortgage continued to emphasize its commitment to borrower satisfaction through its servicing operations, aiming to build lasting relationships.

This approach cultivates a 'customer-for-life' philosophy, where each interaction post-closing is an opportunity to strengthen loyalty and encourage repeat business, distinguishing Guild in a competitive market.

Guild Mortgage enhances customer relationships through its MyMortgage online portal. This platform allows applicants to conveniently track loan progress, upload necessary documents, and manage their personalized checklists, fostering transparency throughout the mortgage process.

In 2024, Guild Mortgage continued to invest in digital tools, aiming to streamline the borrower experience. Such portals are crucial for maintaining engagement and providing accessible support, especially as digital adoption in financial services grows.

Community Engagement and Education Programs

Guild Mortgage fosters strong customer relationships through active community engagement and comprehensive educational programs. These initiatives are designed to empower potential homebuyers, especially first-time buyers, by demystifying the path to homeownership.

Partnerships, such as the one with eHome America, provide valuable resources and guidance. Guild Mortgage also offers down payment assistance programs, directly addressing a key barrier for many aspiring homeowners. In 2024, Guild Mortgage continued its commitment to financial literacy, with its educational content reaching thousands of individuals seeking to understand mortgage processes and home financing options.

- Community Outreach: Guild Mortgage actively participates in local events and workshops to connect with potential clients.

- Educational Resources: They provide online and in-person sessions covering topics from credit building to closing the deal.

- Partnerships for Access: Collaborations like the one with eHome America expand reach and offer specialized learning modules.

- Down Payment Assistance: Initiatives aim to make homeownership more attainable by reducing upfront costs.

Customer Service and Support Channels

Guild Mortgage provides robust customer service through multiple channels. Customers can reach out via phone for immediate assistance or utilize online inquiry options for less urgent questions regarding loan servicing, payment processing, and general mortgage advice. The company prioritizes swift response times and aims to deliver clear, helpful information across all touchpoints.

- Phone Support: Direct access for immediate queries.

- Online Inquiries: Convenient digital platform for questions.

- Loan Servicing Assistance: Help with payments and account management.

- Mortgage Guidance: Support for general home loan inquiries.

Guild Mortgage fosters deep customer loyalty through its integrated approach, blending personal interaction with digital convenience. Their commitment to servicing loans in-house, as seen in their operations throughout 2024, ensures ongoing support and engagement, transforming transactions into lasting relationships.

The company's extensive network of over 200 branches in 2024 provided crucial face-to-face interactions, underpinning a personalized service model. This, combined with digital tools like the MyMortgage portal, offers transparency and accessibility, catering to diverse customer preferences.

Guild Mortgage's dedication to community outreach and financial education, including partnerships and down payment assistance programs, further strengthens its customer bonds. These efforts, which reached thousands in 2024, empower individuals and build trust, positioning Guild as a supportive partner in the homeownership journey.

| Relationship Channel | Key Features | 2024 Focus/Impact |

|---|---|---|

| Local Branches | Personalized guidance, face-to-face interaction | Maintained over 200 branches nationwide, fostering local trust |

| In-house Loan Servicing | Ongoing borrower support, payment management | Continued emphasis on borrower satisfaction post-closing |

| MyMortgage Portal | Loan tracking, document upload, transparency | Investment in digital tools to streamline borrower experience |

| Community Engagement & Education | Financial literacy, down payment assistance programs | Empowered thousands through educational content and partnerships |

Channels

Guild Mortgage leverages a vast network of over 250 retail branches and thousands of loan officers nationwide, serving as a crucial in-person touchpoint for customers. This extensive physical presence, spanning 49 states, facilitates direct engagement and loan origination, building trust and accessibility.

Guild Mortgage leverages its official website and the MyMortgage online portal to attract new customers and streamline the loan application process. In 2024, digital channels are crucial for customer acquisition, with many borrowers preferring to start their mortgage journey online. These platforms offer a convenient way for users to submit information, track their application status, and communicate with loan officers.

Guild Mortgage actively cultivates partnerships with real estate agents and home builders, recognizing them as crucial referral sources. These relationships form a cornerstone of Guild's lead generation strategy, driving a significant portion of their business.

In 2024, the housing market saw continued activity, with many agents and builders actively seeking reliable mortgage partners. Guild's established reputation and robust service offerings make them a preferred choice for these professionals, ensuring a steady flow of potential clients.

These referral channels are particularly effective because real estate agents and builders are at the forefront of home buying and selling. Their direct engagement with consumers allows them to identify needs and recommend trusted mortgage providers like Guild, streamlining the acquisition process.

Mortgage Servicing Platform

Guild Mortgage's in-house mortgage servicing platform is a crucial channel for sustained customer interaction. This platform not only allows Guild to maintain servicing rights for a significant portion of its originated loans but also cultivates opportunities for future business and customer loyalty.

By managing servicing internally, Guild Mortgage enhances its ability to engage with customers post-origination. This direct relationship management is key to identifying opportunities for refinancing or new loan products, reinforcing customer retention. In 2024, a robust servicing operation is vital for managing loan portfolios efficiently and profitably.

- Customer Engagement: The platform facilitates ongoing communication and support for borrowers.

- Servicing Rights Retention: Guild retains servicing rights for a substantial volume of its originated loans, generating recurring revenue.

- Repeat Business: A positive servicing experience encourages borrowers to return for future mortgage needs.

- Portfolio Management: In-house servicing provides greater control and insight into the loan portfolio's performance.

Marketing and Advertising (Digital and Traditional)

Guild Mortgage actively cultivates its brand through a multi-channel marketing strategy. This includes a robust digital presence, leveraging search engine optimization and targeted online advertising to connect with potential borrowers. In 2024, the mortgage industry saw significant shifts in digital acquisition, with companies investing heavily in platforms that offer personalized borrower experiences.

The company also utilizes public relations, issuing press releases to announce new products, partnerships, and company milestones, thereby shaping public perception and building credibility. While specific spending figures for 2024 are proprietary, the broader financial services sector reported substantial increases in PR and content marketing budgets to combat market volatility and enhance customer trust.

- Digital Marketing: Focus on SEO, pay-per-click (PPC) advertising, and social media engagement to reach a broad audience.

- Public Relations: Issuing press releases and engaging with financial media to build brand authority and disseminate company news.

- Content Marketing: Creating informative articles, guides, and videos to educate consumers about mortgage options and the homebuying process.

- Partnerships: Collaborating with real estate agents, builders, and other industry professionals to generate referrals and expand market reach.

Guild Mortgage's channels are diverse, encompassing a strong physical retail presence with over 250 branches and thousands of loan officers across 49 states, ensuring direct customer engagement. Complementing this is a robust digital strategy, featuring their website and MyMortgage portal, which are critical for 2024 customer acquisition and streamlined application processes. Strategic partnerships with real estate agents and home builders form another vital channel, driving significant lead generation by tapping into professionals at the forefront of the housing market.

Customer Segments

First-time homebuyers represent a crucial segment for Guild Mortgage. These individuals and families are embarking on their initial home purchase, often navigating a complex process for the first time. Guild aims to support them with comprehensive guidance and educational resources, helping demystify mortgage applications and homeownership. In 2024, the demand from this segment remained robust, with data indicating that over 30% of all home purchases were made by first-time buyers, highlighting their significant market presence.

Move-up buyers and repeat customers represent a significant segment for Guild Mortgage. These are existing homeowners who are ready to upgrade to a larger home or relocate. In 2024, the demand for larger homes remained strong, driven by factors like growing families and the continued prevalence of remote work arrangements that allow for more flexible living spaces.

Guild Mortgage actively cultivates these relationships through its customer-for-life strategy. This involves leveraging its servicing platform to maintain contact and offer ongoing support, ensuring that when these homeowners are ready for their next move, Guild is their first choice. This approach is crucial, as repeat customers often have a smoother transaction process and are valuable sources of referrals.

Guild Mortgage actively supports military families and veterans through specialized VA loan programs. This commitment is underscored by their recognition as a Military Friendly Employer, demonstrating a deep understanding of the unique financial needs and challenges faced by active service members and veterans.

Borrowers Seeking Government-Backed Loans

Guild Mortgage actively serves borrowers who qualify for government-backed loan programs like FHA, VA, and USDA. These loans are particularly attractive to a significant portion of the market due to their more accessible down payment requirements and benefits for specific demographics, such as veterans or those in rural areas. In 2024, the demand for these types of loans remained robust, reflecting their continued importance in the housing market.

This customer segment often includes first-time homebuyers, individuals with less extensive credit histories, and those seeking to maximize their purchasing power. Guild Mortgage's expertise in navigating the complexities of these government-insured loans positions them as a key partner for these borrowers.

- FHA Loans: Typically require lower credit scores and down payments, making homeownership accessible to more individuals.

- VA Loans: Offer significant benefits to eligible veterans and service members, often with no down payment required.

- USDA Loans: Target rural homebuyers, providing financing options with no down payment for qualified properties.

Borrowers Needing Specialized Loan Products

Guild Mortgage serves borrowers with distinct financing requirements, including those seeking renovation loans, manufactured home loans, reverse mortgages, and bridge loans. These specialized products cater to niche markets and specific property types that may not fit conventional mortgage offerings.

This segment is crucial for Guild as it allows them to differentiate themselves from competitors by offering tailored solutions. For instance, renovation loans, often backed by programs like FHA 203(k) or Fannie Mae HomeStyle, enable borrowers to finance both the purchase of a home and its subsequent improvements. This addresses a growing demand for customized living spaces.

Guild's commitment to these specialized loan products is supported by market trends. In 2024, the demand for home improvements continued to rise, with many homeowners opting to renovate rather than relocate. Similarly, the reverse mortgage market, particularly for seniors looking to leverage home equity, remains a significant area of focus. Guild's ability to originate these complex loan types demonstrates their operational depth and commitment to a broader customer base.

- Renovation Loans: Facilitating home improvements alongside purchase financing.

- Manufactured Home Loans: Providing access to financing for factory-built housing.

- Reverse Mortgages: Offering equity access for senior homeowners.

- Bridge Loans: Short-term financing to cover gaps between transactions.

Guild Mortgage serves a diverse clientele, including first-time homebuyers, move-up buyers, and repeat customers, all seeking home financing solutions. They also focus on specialized segments like military families, veterans, and borrowers utilizing government-backed loans such as FHA, VA, and USDA. Furthermore, Guild caters to individuals needing renovation loans, manufactured home loans, reverse mortgages, and bridge loans, demonstrating a broad market reach.

Cost Structure

Guild Mortgage incurs significant costs in originating and processing loans, encompassing salaries for loan officers, underwriters, and processing staff. In 2024, the mortgage industry, including companies like Guild, faced increased operational expenses due to a competitive market and evolving regulatory requirements, impacting labor costs and the need for advanced technology.

Technology infrastructure for loan processing, including software and hardware, represents a substantial expenditure. These investments are crucial for efficiency and compliance, especially as digital mortgage solutions continue to gain traction. Marketing expenses aimed at attracting new borrowers also contribute to this cost category, as Guild competes for market share.

Salaries and compensation represent a substantial cost for Guild Mortgage, reflecting its extensive network of loan officers, administrative staff, and servicing personnel. This significant investment in human capital is crucial for managing operations across its numerous branches and supporting a large customer base.

In 2024, the mortgage industry, including companies like Guild Mortgage, continued to navigate a dynamic compensation landscape. While specific figures for Guild Mortgage are proprietary, industry-wide data from organizations like the Mortgage Bankers Association (MBA) indicates that compensation for loan originators and operational staff remains a primary driver of operating expenses.

Guild Mortgage dedicates significant resources to its technology and software, a core component of its business model. This includes ongoing investment in and maintenance of its proprietary technology stack, such as the GuildGPT AI system. These digital platforms are crucial for enhancing operational efficiency and improving the customer experience.

In 2024, the company continued to prioritize these technological advancements. While specific figures for technology investment are not publicly detailed, the strategic importance of these systems suggests a substantial portion of operational costs are allocated here. This focus aims to streamline processes, from loan origination to customer service, ensuring Guild Mortgage remains competitive.

Branch Network Operations and Occupancy Costs

Guild Mortgage's commitment to a broad physical presence means significant investment in its branch network. These locations, spread throughout the U.S., come with substantial ongoing costs. Think rent, keeping the lights on, and general upkeep for each office.

In 2024, the real estate market continued to influence occupancy costs. For instance, commercial rent prices in many areas saw an upward trend, directly impacting Guild's overhead for these physical spaces. This network is a cornerstone of their customer engagement strategy, but it necessitates continuous expenditure.

- Branch Rent: Varies significantly by location, with major metropolitan areas commanding higher lease payments.

- Utilities and Maintenance: Covers electricity, water, HVAC, and regular repairs to ensure functional office environments.

- Property Taxes and Insurance: Additional costs associated with owning or leasing commercial property.

- Staffing for Branches: While not strictly occupancy, the personnel needed to operate these physical locations is a direct consequence of the branch model.

Regulatory Compliance and Legal Costs

Guild Mortgage faces substantial costs to maintain compliance with the intricate web of federal and state mortgage lending regulations. This includes ongoing investments in legal counsel and dedicated compliance staff to navigate evolving requirements.

These expenditures are critical for avoiding penalties and maintaining operational licenses. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to enforce strict rules regarding loan origination, servicing, and fair lending practices, which directly impact Guild Mortgage's operational budget.

- Regulatory Compliance Staffing: Costs associated with hiring and training personnel to monitor and implement new regulations.

- Legal Fees and Consultation: Expenses for legal experts who advise on compliance matters and represent the company in potential disputes.

- Technology and Systems: Investment in software and systems to track, manage, and report on regulatory adherence.

- Audit and Examination Costs: Fees incurred for internal and external audits, as well as responding to regulatory examinations.

Guild Mortgage's cost structure is heavily influenced by employee compensation, technology investments, and the operational expenses of its extensive branch network. In 2024, rising interest rates and a competitive market likely pressured these costs, particularly salaries and marketing efforts to attract borrowers.

The company's commitment to technological advancement, including its proprietary AI system GuildGPT, represents a significant ongoing investment to enhance efficiency and customer experience. Furthermore, maintaining a widespread physical presence necessitates considerable expenditure on rent, utilities, and staffing for its numerous branches across the U.S.

Regulatory compliance is another substantial cost driver, requiring investment in legal counsel and specialized staff to navigate complex federal and state lending laws. In 2024, the CFPB's continued enforcement of lending rules meant that adherence remained a critical, budget-impacting focus for Guild Mortgage.

| Cost Category | Description | 2024 Industry Trend Impact |

|---|---|---|

| Salaries & Compensation | Loan officers, underwriters, servicing staff | Increased labor costs due to competition and demand for skilled personnel. |

| Technology & Software | Loan processing systems, AI development (GuildGPT) | Continued investment in digital solutions to improve efficiency and customer engagement. |

| Branch Network Operations | Rent, utilities, maintenance for physical locations | Upward pressure on occupancy costs due to commercial real estate market dynamics. |

| Marketing & Sales | Attracting new borrowers | Higher spend likely to gain market share in a competitive environment. |

| Regulatory Compliance | Legal fees, compliance staff, systems | Ongoing investment to meet evolving federal and state lending regulations. |

Revenue Streams

Loan origination fees represent a core revenue driver for Guild Mortgage, stemming from the processing and closing of various loan types like conventional, FHA, VA, and USDA mortgages. These fees are directly tied to the volume of new loans the company successfully originates and funds.

In 2024, Guild Mortgage's origination volume plays a crucial role in this revenue stream. For context, in the first quarter of 2024, the company reported total revenue of $138.7 million, with loan origination and servicing activities being the primary contributors, underscoring the significance of this fee-based income.

Mortgage servicing fees represent a crucial and consistent revenue generator for Guild Mortgage. This income stream is derived from managing the company's extensive portfolio of mortgage loans, where Guild acts as an intermediary, collecting monthly payments from borrowers and distributing them to investors who hold the loans. This ongoing service provides a predictable and substantial cash flow, independent of new loan originations.

In 2024, the mortgage servicing rights (MSRs) market continued to be a significant factor for companies like Guild. While specific figures for Guild's servicing fee revenue in 2024 are not publicly detailed separately from their overall financial reports, the industry trend indicates that effective servicing operations can contribute a substantial percentage to a mortgage lender's profitability. For instance, in 2023, the total value of MSRs held by the industry was in the hundreds of billions of dollars, highlighting the scale of this revenue stream.

Guild Mortgage generates revenue by selling the mortgage loans it originates into the secondary market. This "gain on sale" is a core component of its business model.

The profit from this stream comes from the difference between the price Guild Mortgage sells the loan for and the cost it incurred to originate that loan. For instance, in 2024, the mortgage industry saw fluctuating gains on sale as interest rates shifted, impacting loan valuations.

Interest Income from Loans Held

Guild Mortgage, while primarily focused on originating and servicing mortgages, also generates revenue through interest income on loans it holds temporarily before sale or securitization. This strategy allows the company to benefit from the interest accrual on its loan portfolio.

In 2024, the mortgage market saw fluctuating interest rates, impacting the yield on held loans. For instance, if Guild held a $300 million portfolio of conforming mortgages at an average rate of 6.5% for 60 days, it could generate approximately $1.6 million in interest income during that holding period.

- Interest on Held Loans: Guild earns interest on mortgages it retains before selling them into the secondary market or bundling them into mortgage-backed securities.

- Market Conditions Impact: The amount of interest income is directly influenced by prevailing interest rates and the duration for which loans are held.

- Portfolio Yield: In early 2024, the average 30-year fixed mortgage rate hovered around 6.6%, providing a basis for calculating potential interest earnings on a held loan portfolio.

Fees from Specialized Programs and Services

Guild Mortgage generates revenue through fees associated with specialized loan programs. These can include offerings like renovation loans, which finance home improvements alongside the purchase or refinance, or bridge loans that provide short-term financing to cover the gap between selling one home and buying another. These niche products often carry distinct fee structures that contribute to overall income.

Beyond specific loan types, Guild Mortgage may also earn revenue from ancillary services. This could involve charging fees for advisory services, helping borrowers navigate complex financial situations or optimize their mortgage strategy. Other value-added services provided to customers can also represent a revenue stream, enhancing the company's income beyond traditional loan origination fees.

- Specialized Loan Fees: Revenue from renovation, bridge, and other niche mortgage products.

- Advisory Services: Income generated from providing expert financial guidance to borrowers.

- Value-Added Services: Fees from additional services that enhance the borrower experience.

Guild Mortgage generates revenue from loan origination fees, which are charged for processing and closing various mortgage types. These fees are directly tied to the volume of new loans originated and funded by the company.

Mortgage servicing fees provide a consistent income stream as Guild manages its loan portfolio, collecting payments and distributing them to investors. This ongoing service generates predictable cash flow.

The company also profits from selling originated loans in the secondary market, realizing a gain on sale based on the difference between the sale price and origination cost.

Interest income is earned on loans held temporarily before sale, benefiting from interest accrual during the holding period. Additionally, specialized loan programs and ancillary services like advisory fees contribute to Guild's diverse revenue streams.

| Revenue Stream | Description | 2024 Relevance/Data Point |

| Loan Origination Fees | Fees for processing and closing new mortgages. | Core revenue driver, tied to origination volume. Q1 2024 total revenue was $138.7 million. |

| Mortgage Servicing Fees | Income from managing existing mortgage loans. | Provides predictable, ongoing cash flow. Industry MSRs valued in hundreds of billions in 2023. |

| Gain on Sale | Profit from selling originated loans in the secondary market. | Profit margin depends on sale price vs. origination cost. Industry saw fluctuating gains in 2024 due to rate shifts. |

| Interest Income | Interest earned on loans held before sale. | Benefit from interest accrual on temporary portfolio holdings. Avg. 30-year fixed rate around 6.6% in early 2024. |

| Specialized Loan & Ancillary Fees | Fees from niche products (e.g., renovation loans) and services (e.g., advisory). | Diversifies income beyond standard origination. |

Business Model Canvas Data Sources

The Guild Mortgage Business Model Canvas is informed by a blend of internal financial data, customer feedback, and extensive market research. These sources provide a comprehensive view of our operations and strategic direction.