Guild Mortgage Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guild Mortgage Bundle

Guild Mortgage navigates a complex landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping Guild Mortgage’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Capital providers, such as banks offering warehouse lines of credit, hold significant bargaining power over Guild Mortgage. The cost and accessibility of these essential funds are directly tied to prevailing interest rates and the overall health of financial markets. For instance, as of March 31, 2025, Guild Mortgage reported $1.5 billion in unutilized loan funding capacity, highlighting its dependence on these external capital sources.

The mortgage industry's rapid digital shift places considerable leverage with technology providers. Companies specializing in AI, machine learning, automation, and advanced CRM solutions are vital for achieving operational efficiencies and a competitive edge. These technologies are instrumental in enabling faster loan decisions, improving customer interactions, and bolstering fraud detection capabilities, all critical factors in today's market.

For instance, the adoption of AI in mortgage lending is projected to grow significantly. According to a 2024 report, the AI in mortgage market was valued at approximately $1.5 billion and is expected to reach over $5 billion by 2029, showcasing the increasing reliance on these tech partners. Guild Mortgage's strategic investment in its proprietary AI system, GuildGPT, and other digital platforms underscores the essential role these suppliers play in enhancing efficiency and maintaining a competitive advantage in this evolving landscape.

Guild Mortgage's ability to retain Mortgage Servicing Rights (MSRs) after selling originated loans into the secondary market is crucial. The fluctuating demand and pricing for these MSRs directly influence Guild's financial performance and capital availability. For instance, in Q1 2025, a significant valuation adjustment on MSRs resulted in a net loss for the company, highlighting the volatility associated with this asset.

Data and Analytics Providers

Data and analytics providers hold significant sway in the mortgage industry because their insights are crucial for assessing risk and making smart business choices. Guild Mortgage, like other lenders, relies heavily on this information to understand creditworthiness, market shifts, and how borrowers behave. Without accurate data, originating and underwriting loans becomes much slower and riskier.

The ability of these providers to offer comprehensive and precise data directly impacts a lender's operational efficiency and profitability. For instance, in 2024, the demand for advanced analytics in mortgage origination continued to grow, with companies leveraging AI-driven credit scoring models to improve decision-making speed and accuracy. This reliance gives these data providers considerable bargaining power.

- Data Accuracy and Comprehensiveness: Lenders depend on the quality of data for effective risk management.

- Influence on Loan Origination: Providers' analytics directly impact the speed and success rate of loan approvals.

- Market Trend Insights: Access to up-to-date market and borrower behavior data is a key differentiator.

- Technological Advancements: Providers offering cutting-edge analytical tools and AI capabilities often command higher prices.

Regulatory Compliance Services

The mortgage industry's intricate web of federal and state regulations, which are perpetually updated, significantly amplifies the bargaining power of suppliers offering regulatory compliance services. These providers, including specialized software vendors, legal experts, and auditing firms, are indispensable for Guild Mortgage to navigate the complex compliance landscape and avert costly penalties. For instance, the Consumer Financial Protection Bureau (CFPB) continues to issue new rules and interpretations, demanding constant adaptation from mortgage lenders. As of early 2024, the sheer volume and evolving nature of these requirements mean that firms excelling in this niche can command premium pricing due to their critical role in maintaining operational integrity and avoiding legal repercussions.

The increasing complexity and heightened scrutiny surrounding mortgage regulations, particularly concerning data privacy and fair lending practices, further bolster the leverage of these specialized suppliers. Guild Mortgage, like its peers, must invest heavily in staying ahead of these changes. The demand for expert guidance in areas like TRID (TILA-RESPA Integrated Disclosure) compliance and cybersecurity protocols, which are subject to ongoing regulatory review, creates a strong dependency on these service providers. This reliance translates into substantial bargaining power for those who can demonstrate deep expertise and a proven track record in managing these critical compliance functions.

- Mortgage Industry Regulatory Environment: Constantly evolving federal and state compliance requirements.

- Essential Suppliers: Software providers, legal counsel, and auditing services are critical for avoiding penalties.

- Impact of Complexity: Increasing regulatory complexity enhances the power of specialized compliance service providers.

- Market Trend: Demand for expertise in areas like TRID and cybersecurity continues to grow, strengthening supplier leverage.

Suppliers of specialized technology, particularly those offering AI and automation solutions, wield considerable bargaining power over Guild Mortgage. The company's reliance on these advanced systems for efficiency and competitive advantage means that the cost and terms offered by these tech providers significantly influence Guild's operations. For example, Guild's investment in its proprietary AI system, GuildGPT, demonstrates this dependence, as such technologies are crucial for faster loan decisions and improved customer experiences.

The market for AI in mortgage lending is expanding rapidly, with projections indicating substantial growth. In 2024, this market was valued at approximately $1.5 billion and is anticipated to surpass $5 billion by 2029. This upward trend underscores the increasing leverage of technology suppliers who can provide cutting-edge solutions that enhance operational efficiency and maintain a competitive edge in the evolving mortgage landscape.

What is included in the product

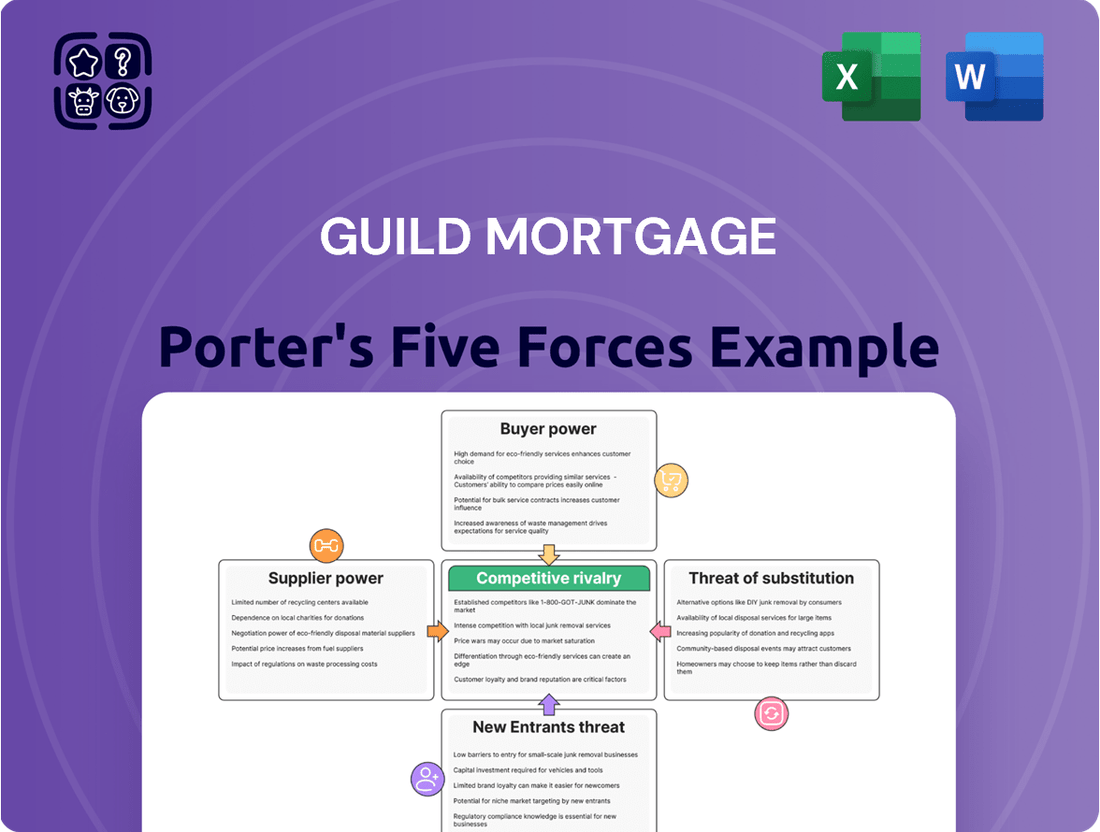

This analysis applies Porter's Five Forces to Guild Mortgage, dissecting the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the mortgage industry.

Instantly identify and address competitive threats with Guild Mortgage's Five Forces analysis, providing a clear roadmap to navigate market pressures and enhance strategic positioning.

Customers Bargaining Power

Borrower interest rate sensitivity is a crucial factor in the mortgage industry. When rates are high, like the projected increases anticipated for late 2024 and early 2025, borrowers become much more focused on finding the lowest possible rate. This heightened awareness means they're more likely to compare offers from multiple lenders, increasing their bargaining power.

In 2024, for instance, the average 30-year fixed mortgage rate hovered around 7%, a significant jump from previous years. This elevated rate environment directly translates to borrowers actively seeking out lenders who can offer even a small reduction, giving them leverage to negotiate terms and fees.

The increasing digital savviness of homebuyers significantly boosts their bargaining power. In 2024, a substantial portion of mortgage applications are initiated online, with many consumers utilizing comparison websites and digital tools to research rates and lenders. This accessibility to information allows them to easily identify the most competitive offers, putting pressure on Guild Mortgage to maintain attractive pricing and service levels.

Customers at Guild Mortgage can choose from a wide array of loan products like conventional, FHA, VA, and USDA mortgages. This variety, offered by numerous lenders, empowers borrowers to select options aligning with their specific financial situations and homeownership goals, such as first-time buyer programs or refinancing. In 2024, the mortgage market continued to see strong demand for government-backed loans, with FHA and VA loans playing a significant role for specific borrower segments.

Refinancing Opportunities

When interest rates drop, homeowners can significantly increase their bargaining power by refinancing their existing mortgages. This ability to seek out better terms or lower rates elsewhere puts pressure on lenders like Guild Mortgage to remain competitive. In 2024, as interest rates saw fluctuations, homeowners actively explored refinancing to lock in more favorable conditions.

This dynamic forces mortgage companies to offer attractive refinancing options to retain their existing customer base and servicing portfolio. Failure to do so can lead to a substantial outflow of business.

- Refinancing Activity: In the first half of 2024, the Mortgage Bankers Association reported a noticeable uptick in refinance application volume compared to the same period in 2023, driven by lower average rates.

- Customer Retention: Companies like Guild Mortgage must invest in competitive refinancing programs to prevent customers from migrating to lenders offering superior terms.

- Market Pressure: The ease with which customers can switch lenders during periods of declining interest rates directly enhances their bargaining power.

Customer-for-Life Strategy and Referrals

Guild Mortgage's strategy to cultivate a customer-for-life approach directly impacts the bargaining power of its customers. By prioritizing repeat business and referrals, Guild empowers satisfied clients. These customers, having navigated the loan process and experienced Guild's servicing, wield influence through their potential to generate future revenue or recommend the company to their networks.

This customer loyalty strategy means that positive experiences translate into tangible power for consumers. A strong referral program can significantly reduce Guild's customer acquisition costs. For instance, in 2024, companies with robust referral programs often see acquisition costs drop by as much as 50% compared to traditional marketing channels.

- Customer Lifetime Value: Satisfied customers who return for future mortgages or refinancing represent a significant source of recurring revenue, increasing their inherent value and thus their bargaining power.

- Referral Network Strength: The more a customer refers new business, the greater their implicit leverage, as they are directly contributing to Guild's growth and reducing marketing spend.

- Word-of-Mouth Influence: Positive online reviews and personal recommendations from existing customers can attract new clients, giving these influential customers a powerful voice in the market.

- Reduced Switching Costs for Customers: When customers feel valued and are likely to receive preferential treatment for repeat business, their incentive to switch to a competitor diminishes, but their power to negotiate better terms on future interactions can increase.

Customers possess significant bargaining power in the mortgage market, especially when interest rates fluctuate, as seen in 2024 with average 30-year fixed rates around 7%. This sensitivity to rates drives borrowers to compare offers, increasing their leverage to negotiate terms and fees. The digital age further amplifies this power, with homebuyers in 2024 readily using online comparison tools to identify the most competitive lenders, compelling companies like Guild Mortgage to maintain attractive pricing.

The wide availability of diverse loan products and lenders empowers borrowers to select options that best fit their financial needs. Furthermore, Guild's focus on customer loyalty and referrals creates a powerful dynamic; satisfied, repeat customers wield influence through their potential for future business and recommendations. In 2024, companies with strong referral programs saw acquisition costs decrease by up to 50%, highlighting the tangible value and power of loyal customers.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Interest Rate Sensitivity | High sensitivity leads to increased shopping and negotiation | Average 30-year fixed rate around 7% |

| Digital Savviness & Information Access | Easy comparison of offers empowers informed choices | Majority of applications initiated online; widespread use of comparison sites |

| Product Variety & Lender Options | Access to multiple loan types and lenders increases choice | Continued strong demand for government-backed loans (FHA, VA) |

| Refinancing Opportunities | Ability to switch lenders for better terms | Uptick in refinance applications in H1 2024 |

| Customer Loyalty & Referrals | Repeat customers and referrals gain influence | Referral programs can reduce acquisition costs by up to 50% |

Same Document Delivered

Guild Mortgage Porter's Five Forces Analysis

This preview shows the exact Guild Mortgage Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive breakdown of competitive forces within the mortgage industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all presented in a professionally formatted document ready for your immediate use.

Rivalry Among Competitors

The mortgage lending landscape is incredibly fragmented, featuring a mix of large national banks, agile independent mortgage banks (IMBs), and emerging non-traditional lenders. This crowded field means intense rivalry, pushing companies like Guild Mortgage to continuously seek new borrowers, especially when origination volumes are unpredictable.

Fluctuating interest rates directly influence mortgage origination volumes, creating a dynamic competitive landscape for companies like Guild Mortgage. When rates climb, the market for new mortgages and refinancing shrinks, forcing lenders to compete more fiercely for a smaller pool of borrowers. For instance, in early 2024, the Federal Reserve's continued stance on interest rates, holding them at elevated levels, contributed to a slowdown in mortgage originations compared to previous years.

Conversely, periods of lower interest rates, while boosting overall volume, also tend to attract new entrants and intensify competition as the market becomes more attractive. This ebb and flow means that lenders must constantly adapt their strategies to capture market share, whether in a high-rate or low-rate environment.

The mortgage industry in 2024 and the first quarter of 2025 has seen a significant pivot towards purchase originations. This means lenders are now more intensely vying for new homebuyers than for homeowners looking to refinance existing loans. Guild Mortgage's strategic emphasis on purchase mortgages, which constituted 88% of its volume in Q1 2025, positions it directly within this competitive arena.

This focus on purchase business highlights Guild Mortgage's understanding of the critical success factors in this market segment. Success here often hinges on building robust relationships with real estate agents and cultivating a strong, localized presence within communities. These relationships are vital for securing a steady flow of purchase business.

Technological Advancements and Digitalization

Technological innovation, particularly in areas like artificial intelligence, automation, and digital platforms, is a significant force intensifying competition within the mortgage industry. Lenders are channeling substantial investments into these technologies to optimize operations, improve customer interactions, and boost overall efficiency. For instance, in 2024, many mortgage originators are prioritizing AI-powered underwriting to reduce processing times, with some aiming for same-day approvals.

Companies that fail to embrace these technological shifts risk falling behind their more digitally adept rivals. This could manifest in slower loan processing, a less appealing customer experience, and ultimately, a loss of market share. The digital mortgage market is projected to continue its robust growth, with digital channels expected to handle an increasing percentage of originations.

- AI-driven loan origination platforms are reducing application processing times by up to 30%.

- Digital mortgage adoption is expected to reach 70% of all originations by 2025.

- Investments in mortgage technology by lenders saw a significant increase in 2024, with a focus on cloud-based solutions and data analytics.

- Companies lagging in digital transformation may face higher operational costs and a reduced ability to attract tech-savvy borrowers.

Acquisitions and Market Consolidation

The mortgage industry is experiencing significant consolidation, driven by larger companies acquiring smaller ones to bolster their market share and operational capacity. This trend intensifies rivalry as fewer, larger entities dominate the landscape.

Guild Mortgage's acquisition of Academy Mortgage Corp. in February 2024 exemplifies this consolidation. This strategic move significantly expanded Guild's volume, workforce, and branch network, directly reshaping the competitive dynamics within the sector.

- Guild Mortgage's acquisition of Academy Mortgage Corp. in February 2024 added approximately $10 billion in annual origination volume.

- This consolidation increases the market concentration, potentially leading to fewer independent players.

- Such acquisitions allow companies to achieve economies of scale and broaden their service offerings, intensifying pressure on remaining competitors.

The competitive rivalry within the mortgage industry is fierce, driven by a fragmented market and fluctuating interest rates that dictate origination volumes. Companies like Guild Mortgage must constantly innovate and adapt to capture market share, especially with the increasing focus on purchase originations. Technological advancements are also a key battleground, with lenders investing heavily in AI and digital platforms to streamline operations and enhance customer experience.

| Metric | 2024 Data/Projection | Impact on Rivalry |

|---|---|---|

| Mortgage Origination Volume (Purchase Focus) | Expected increase in purchase originations as refinancing opportunities diminish. | Intensified competition for new homebuyers. |

| Digital Mortgage Adoption | Projected to reach 70% of all originations by 2025. | Lenders with superior digital platforms gain a competitive edge. |

| AI in Loan Origination | Platforms reducing processing times by up to 30%. | Faster processing becomes a key differentiator; lagging firms face disadvantages. |

| Industry Consolidation | Significant M&A activity, like Guild's acquisition of Academy Mortgage in Feb 2024. | Larger players gain market share, increasing pressure on smaller competitors. |

SSubstitutes Threaten

Financially robust buyers opting for all-cash transactions bypass mortgage lenders entirely, presenting a direct substitute for traditional mortgage services. This segment, though smaller, gains prominence in markets where elevated interest rates diminish the appeal of financing.

In 2024, data suggests that all-cash sales accounted for approximately 25% of existing home sales in certain metropolitan areas, a figure that can rise significantly in high-cost markets or during periods of economic uncertainty.

Seller financing and lease-to-own agreements present viable alternatives to traditional mortgages, particularly for buyers facing tighter credit standards or seeking more flexible terms. These arrangements allow sellers to directly provide financing or offer a path to ownership through rental payments, effectively bypassing the need for a mortgage lender like Guild Mortgage.

In 2024, the housing market has seen a resurgence in creative financing as interest rates remain elevated. For instance, the National Association of Realtors reported that a portion of home sales, while not exclusively seller-financed, involved non-traditional arrangements, indicating a growing interest in these substitutes.

A strong rental market, particularly with rising rents, presents a significant substitute for homeownership. For instance, in 2024, median rents in many major US cities continued their upward trend, making the upfront costs and ongoing mortgage payments of buying a home less appealing for a segment of the population. This can directly dampen demand for residential mortgages.

Equity Release Products (Reverse Mortgages)

For older homeowners, equity release products, commonly known as reverse mortgages, present a significant substitute for traditional refinancing or home equity loans. These products allow seniors to tap into their home's equity, converting it into cash without the burden of monthly mortgage payments. Guild Mortgage, by offering reverse finance solutions, acknowledges this competitive threat and its potential to draw customers away from conventional mortgage products.

The appeal of reverse mortgages lies in their ability to provide liquidity to homeowners who may have limited income streams. In 2024, the demand for such products is expected to remain robust, driven by an aging population and rising home values. For instance, the U.S. Department of Housing and Urban Development (HUD) insures Home Equity Conversion Mortgages (HECMs), the most popular type of reverse mortgage, indicating government support and market acceptance.

- Growing Senior Population: The number of individuals aged 65 and older is projected to increase significantly, creating a larger pool of potential reverse mortgage customers.

- Home Equity as a Resource: Many older Americans hold substantial equity in their homes, which can be accessed through equity release products when other financial resources are insufficient.

- Alternative to Traditional Loans: For those on fixed incomes, the absence of monthly payments associated with reverse mortgages makes them a more attractive alternative than traditional loans that require regular repayment.

Delaying Homeownership

Economic headwinds are significantly impacting the threat of substitutes for homeownership. High interest rates, which saw the average 30-year fixed mortgage rate hover around 6.5% to 7.5% in late 2023 and early 2024, coupled with elevated home prices, are pushing many prospective buyers to the sidelines. This creates a situation where renting or continuing to live with family becomes a more viable, albeit temporary, substitute for immediate homeownership.

This delay in purchasing decisions directly affects mortgage originations. When individuals postpone buying a home, they are not seeking new mortgages, thereby reducing the demand for Guild Mortgage's core services. This 'wait and see' mentality is a powerful substitute, as it delays the need for a mortgage altogether.

- Delayed Homeownership: High interest rates and home prices force many to rent longer.

- Reduced Demand: This postponement directly lowers the need for new mortgage originations.

- Economic Impact: Slow wage growth exacerbates affordability issues, strengthening the substitute of continued renting.

The threat of substitutes for Guild Mortgage is multifaceted, encompassing direct financial alternatives and broader lifestyle choices that reduce the need for traditional mortgage financing.

All-cash purchases, seller financing, and lease-to-own agreements bypass lenders, while a robust rental market and equity release products for seniors offer distinct alternatives to homeownership and conventional loans, respectively.

Economic conditions, particularly high interest rates and home prices, amplify the appeal of renting and delay homeownership, directly impacting mortgage demand.

| Substitute Type | Description | 2024 Impact/Data Point |

|---|---|---|

| All-Cash Purchases | Buyers bypass mortgage lenders entirely. | Approx. 25% of existing home sales in some metro areas in 2024. |

| Seller Financing/Lease-to-Own | Direct arrangements between buyer and seller. | Increased interest in non-traditional arrangements reported by the National Association of Realtors in 2024. |

| Rental Market | Renting as an alternative to homeownership. | Median rents continued upward trend in many major US cities in 2024, impacting affordability of buying. |

| Reverse Mortgages | Equity release for seniors, no monthly payments. | Demand expected to remain robust; HECM program insured by HUD. |

| Delayed Homeownership | Economic headwinds (high rates/prices) encourage renting. | 30-year fixed mortgage rates hovered around 6.5%-7.5% in early 2024, impacting purchasing decisions. |

Entrants Threaten

The mortgage industry is a labyrinth of regulations, demanding rigorous licensing, strict adherence to consumer protection laws like the Truth in Lending Act, and navigating intricate underwriting standards. These requirements act as substantial deterrents for newcomers, as the upfront investment in compliance and the potential for legal exposure are considerable. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued to enforce robust oversight, with mortgage lenders facing significant penalties for non-compliance, underscoring the high cost of entry.

Starting a mortgage lending business demands significant upfront capital for loan origination, technology, and daily operations. Newcomers often face challenges securing the necessary funding, particularly warehouse lines of credit, which are crucial for funding loans before they are sold. Established companies like Guild Mortgage benefit from existing, stable relationships with lenders, giving them a distinct advantage in accessing affordable capital.

Guild Mortgage, a company with roots stretching back to 1960, has cultivated substantial brand recognition and trust. This long-standing presence allows them to command loyalty from both homebuyers and real estate agents, a critical asset in an industry that thrives on relationships and reputation.

Newcomers to the mortgage market must overcome the considerable hurdle of establishing a similar level of credibility. Without this established trust, attracting customers and forging necessary partnerships becomes a much steeper climb, potentially hindering market penetration.

Technological Investment and Expertise

The mortgage industry's increasing reliance on advanced technology, such as AI and sophisticated loan origination platforms, presents a significant barrier to new entrants. These technologies require substantial capital investment and specialized expertise to implement and maintain effectively. For instance, developing or acquiring cutting-edge loan origination software can cost millions, a prohibitive expense for many startups.

New companies lacking these advanced technological capabilities will struggle to compete with the operational efficiency and enhanced customer experiences provided by established players. In 2024, companies heavily investing in digital transformation, including AI-driven underwriting and automated customer service, are seeing improved turnaround times and reduced operational costs. This technological gap makes it challenging for newcomers to offer competitive pricing or service levels.

The threat of new entrants is therefore moderated by the high costs and specialized knowledge required to build and operate technologically advanced mortgage businesses.

- High Capital Outlay: Significant investment is needed for AI, automation, and advanced loan platforms.

- Specialized Expertise Required: Access to skilled personnel in technology and data science is crucial.

- Competitive Disadvantage: New entrants without robust tech may offer less efficient services.

- Impact on Customer Experience: Incumbents with advanced tech can provide superior customer journeys.

Incumbent Advantages in Servicing and Relationships

Guild Mortgage, by managing the entire loan lifecycle from origination to servicing, cultivates a significant advantage. This integrated model generates consistent cash flow from its servicing portfolio, a crucial buffer against market volatility. Furthermore, it allows for the development of deep, enduring client relationships, fostering repeat business and valuable referrals, which are difficult for newcomers to replicate.

New entrants face a steep uphill battle. They typically lack the established servicing infrastructure and the robust referral networks that incumbent players like Guild Mortgage have spent years building. This absence makes it considerably harder for them to acquire customers and gain market share efficiently.

- Servicing Portfolio Value: In 2024, the mortgage servicing rights (MSRs) market continued to be a significant asset for originators, with valuations often reflecting the stable, long-term cash flows they represent. Companies with large, well-managed servicing portfolios, like Guild Mortgage, possess a distinct financial advantage.

- Client Relationship Leverage: Repeat customers and referrals are estimated to account for a substantial portion of new loan originations for established lenders. This loyalty, built on years of positive service experiences, is a powerful barrier to entry for new firms.

- Cost of Customer Acquisition: Without an existing client base or strong referral channels, new entrants often face significantly higher customer acquisition costs, needing to invest heavily in marketing and sales to compete with established brands.

The threat of new entrants in the mortgage industry is significantly mitigated by substantial barriers. High capital requirements for technology, licensing, and operations, coupled with stringent regulatory compliance, make entry costly. Established players like Guild Mortgage benefit from strong brand recognition, deep client relationships, and established servicing portfolios, creating a competitive moat that newcomers find challenging to breach.

Porter's Five Forces Analysis Data Sources

Our Guild Mortgage Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial statements from Guild Mortgage and its competitors, industry-specific market research reports from leading firms, and current economic indicators impacting the housing and lending sectors.