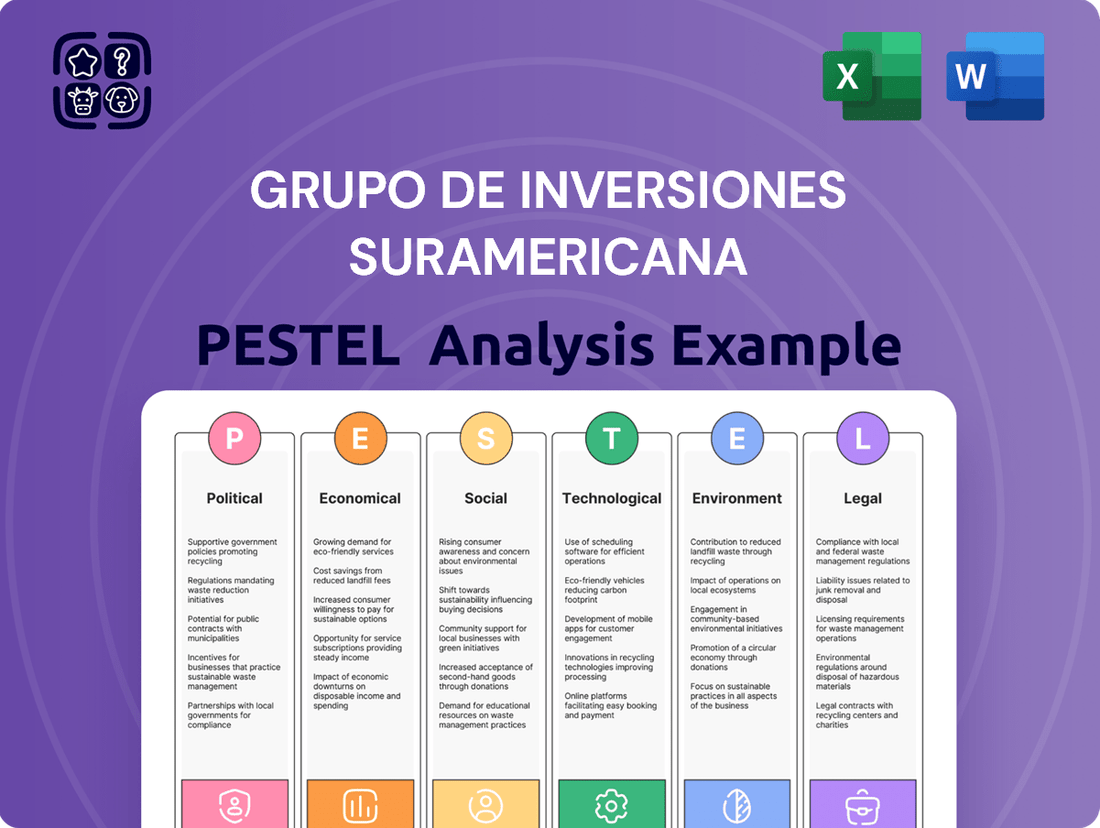

Grupo De Inversiones Suramericana PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo De Inversiones Suramericana Bundle

Grupo De Inversiones Suramericana operates within a dynamic external environment, significantly influenced by political stability, economic fluctuations, and evolving social trends across Latin America. Understanding these forces is crucial for strategic planning and identifying future opportunities. Unlock a comprehensive view of these critical factors.

Political factors

Grupo SURA's extensive operations across Latin America, including Colombia, Chile, Peru, and Mexico, mean that governmental stability in these key markets is paramount. For instance, Colombia, a core market for SURA, experienced a change in administration in 2022, which can lead to shifts in economic and regulatory priorities impacting financial services.

Changes in government policies, especially concerning financial sector regulations, taxation, and foreign investment, can directly influence Grupo SURA's operational costs and strategic flexibility. For example, potential regulatory reforms in Peru or Chile could alter capital requirements or consumer protection laws for banking and insurance operations.

The company's long-term strategic planning hinges on its ability to anticipate and adapt to these political dynamics. In 2024, several of these markets will be navigating evolving political landscapes, making proactive risk assessment and scenario planning critical for maintaining market share and profitability.

Mexico's 2024 pension reform, establishing a Welfare Pension Fund aimed at a 100% replacement rate for low-income earners, directly impacts SURA Asset Management's Mexican operations. This reform, financed through state assets and dormant accounts, signifies a shift in the pension landscape. For instance, by the end of 2023, Mexico's pension system managed approximately $200 billion USD in assets, a significant pool that could be influenced by such reforms.

The potential for similar pension system reforms or ongoing discussions in other Latin American countries presents a dynamic environment for pension fund managers like SURA. These evolving regulatory frameworks can introduce both operational challenges, such as adapting to new funding mechanisms or investment mandates, and strategic opportunities, like expanding services to meet new demographic needs or managing newly established state pension funds.

Governments throughout Latin America are strengthening financial regulations, with a strong focus on combating fraud and safeguarding consumers. New mandates in key markets like Mexico, Brazil, Chile, and Peru, rolling out in 2024 and 2025, compel financial entities to adopt more robust authentication protocols and comprehensive fraud prevention strategies. For instance, Brazil's Central Bank introduced enhanced KYC (Know Your Customer) requirements in early 2024, impacting all financial institutions.

Grupo SURA, through its extensive network of banking and insurance operations, must proactively adapt to these dynamic legal landscapes. Ensuring full compliance with these updated frameworks is crucial to avoid potential penalties and maintain operational integrity. The evolving regulatory environment necessitates continuous investment in technology and compliance personnel to meet these heightened standards.

Cross-Border Regulatory Cooperation

The growing integration of Latin American financial markets highlights the critical need for enhanced cross-border regulatory collaboration. This cooperation is essential for managing systemic risks and fostering a stable investment environment across the region.

Regulators are actively developing frameworks for emerging areas like fintech, aiming to boost financial inclusion, and increasingly prioritizing environmental, social, and governance (ESG) factors in their oversight. For instance, by the end of 2024, several Latin American countries are expected to finalize new digital banking regulations, potentially streamlining operations for companies like Grupo SURA.

Grupo SURA's extensive regional footprint means it must navigate a complex web of national regulations. However, the push towards harmonized standards, particularly in areas like data privacy and capital requirements, could significantly simplify its operations and reduce compliance costs, potentially unlocking new avenues for growth.

- Harmonization Efforts: Initiatives like the Mercado Integrado Latinoamericano (MILA) aim to create more unified capital markets, facilitating cross-border investment.

- Fintech Regulation: By mid-2025, it is anticipated that at least three major Latin American economies will have implemented comprehensive digital asset regulatory frameworks.

- Sustainability Focus: Growing regulatory pressure on ESG reporting by 2024 is prompting financial institutions to integrate sustainability into their core strategies and risk management.

Fiscal Policies and Public Spending

Fiscal policies and public spending in countries where Grupo de Inversiones Suramericana (SURA) operates, particularly Colombia, significantly shape the financial services landscape. Government budgetary decisions can directly affect economic growth, interest rates, and the availability of credit, all crucial for SURA's operations.

Colombia's projected national budget deficit for 2025, estimated to be around 4.3% of GDP, presents a key fiscal consideration. This growing deficit may necessitate either spending cuts or revenue enhancements, potentially impacting sectors where SURA has investments, such as financial services and insurance.

- Budgetary Pressures: A widening deficit could lead to government austerity measures or increased borrowing, influencing market liquidity and investment sentiment.

- Regulatory Uncertainty: Potential shifts in fiscal policy, such as changes in taxation or public spending priorities, can create uncertainty for businesses and investors.

- Consumer Confidence: Fiscal stability is closely linked to consumer confidence, which in turn affects demand for financial products and services offered by SURA.

Political stability across Grupo SURA's key markets, including Colombia, Chile, Peru, and Mexico, directly impacts its operations and strategic planning. Shifts in government policies, particularly regarding financial sector regulations, taxation, and foreign investment, can alter operational costs and flexibility. For instance, Mexico's 2024 pension reform, aiming for a 100% welfare pension replacement rate, significantly affects SURA Asset Management's Mexican business, mirroring the approximately $200 billion USD in assets managed by Mexico's pension system by late 2023.

Governments are enhancing financial regulations to combat fraud and protect consumers, with new mandates in Mexico, Brazil, Chile, and Peru from 2024-2025 requiring robust authentication and fraud prevention. Brazil's Central Bank, for example, implemented stricter Know Your Customer (KYC) rules in early 2024. Furthermore, fiscal policies, such as Colombia's projected 2025 national budget deficit of around 4.3% of GDP, influence economic growth, interest rates, and credit availability, impacting SURA's financial services and insurance sectors.

| Political Factor | Description | Impact on Grupo SURA | 2024/2025 Data/Trend |

| Government Stability | Political stability in operating countries. | Influences economic and regulatory priorities. | Colombia saw a change in administration in 2022. |

| Regulatory Changes | New laws and regulations affecting financial services. | Affects operational costs, capital requirements, and consumer protection. | Mexico's 2024 pension reform; Brazil's enhanced KYC in early 2024. |

| Fiscal Policy | Government spending and taxation decisions. | Impacts economic growth, interest rates, and credit availability. | Colombia's projected 2025 budget deficit around 4.3% of GDP. |

| Harmonization Efforts | Cross-border regulatory cooperation and market integration. | Simplifies operations, reduces compliance costs, and unlocks growth. | MILA initiative; anticipation of comprehensive digital asset frameworks by mid-2025 in 3 major economies. |

What is included in the product

This PESTLE analysis of Grupo De Inversiones Suramericana provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting its operations and strategic planning.

It offers actionable insights by detailing current trends and potential future developments within these macro-environmental dimensions, enabling informed decision-making and proactive strategy formulation.

A PESTLE analysis for Grupo De Inversiones Suramericana acts as a pain point reliver by providing a structured framework to proactively identify and address external threats and opportunities, thereby mitigating potential business disruptions.

Economic factors

The economic outlook for Latin America in 2024-2025 anticipates moderate growth, with Colombia's financial sector projected to be a key driver of GDP expansion. For instance, Colombia's GDP growth was estimated at around 1.7% in 2024, with the financial services sector showing resilience.

This generally positive economic environment creates a favorable backdrop for Grupo SURA's diverse operations, including insurance, asset management, and banking. A stable or growing economy typically translates to higher disposable incomes and increased investment, directly benefiting financial service providers.

Sustained economic expansion is expected to fuel greater demand for financial products and services across the region. In 2024, Latin America's financial services industry saw a notable increase in digital adoption, indicating a growing market for innovative offerings that Grupo SURA can leverage.

Colombia's inflation has been on a downward trend, with the goal of reaching target levels by 2025. This suggests a continued easing of interest rates, which is positive for financial institutions like Bancolombia and SURA Asset Management. Lower borrowing costs can encourage more spending and investment, boosting business for these entities.

For instance, if the benchmark interest rate, which stood around 11.75% in early 2024, continues to fall, it directly impacts the cost of credit. This reduction in borrowing costs for consumers and businesses can lead to increased loan demand and improved financing capacity, directly benefiting Bancolombia's lending operations and SURA's investment products.

While the overall trend is favorable, it's crucial to monitor specific sectors or international markets where inflationary pressures might linger. Persistent inflation in key operational areas or investment destinations could still create headwinds, impacting profitability and investment strategies for Grupo de Inversiones Suramericana.

Latin America's insurance penetration lags behind global averages, creating a fertile ground for growth. For example, Chile's penetration rate hovers around 5%, a figure that, while higher than many regional peers, still signals substantial untapped potential.

Grupo SURA is well-positioned to leverage this market dynamic. By expanding its distribution networks and diversifying its product portfolio, the company can capture a larger share of this underdeveloped insurance sector.

Structured Finance Market Development

The structured finance market in Latin America is poised for significant expansion, with projections indicating a reach of $35 billion by 2025. This growth is largely fueled by the escalating demand for infrastructure funding and the financing requirements of corporations across the region.

This burgeoning market presents a clear avenue for SURA Asset Management to engage with and capitalize on the rising interest in structured products. The increasing volume of these financial instruments offers opportunities for diversification and enhanced returns.

Despite prevailing macroeconomic uncertainties, the region is experiencing a relatively stable investment environment. This stability is a critical enabler for the projected growth in structured finance, providing a foundation for increased deal flow and investor confidence.

- Market Growth Projection: Latin America's structured finance market is expected to reach $35 billion by 2025.

- Key Drivers: Infrastructure funding needs and corporate financing demands are primary growth catalysts.

- Opportunity for SURA: The trend offers SURA Asset Management increased participation and benefits from structured product demand.

- Enabling Environment: A stable investment climate, even with economic uncertainties, supports this market expansion.

Foreign Exchange Rate Volatility

Foreign exchange rate volatility presents a significant challenge for Grupo SURA. The Colombian peso, for instance, is anticipated to continue facing downward pressure stemming from fiscal deterioration, declining oil revenues, and a normalization of trade terms.

Fluctuations in currency values across Grupo SURA's key operational markets directly affect its consolidated financial reporting and the valuation of its international investments. This necessitates a robust strategy for managing foreign exchange risk.

- Colombian Peso Outlook: Projections for 2024 and 2025 indicate continued pressure on the COP due to fiscal deficits and lower commodity prices.

- Impact on Financials: Currency swings can distort reported earnings and the book value of assets held in foreign currencies. For example, a weaker peso could reduce the peso-equivalent value of dollar-denominated revenues.

- Cross-Border Investment Value: The value of Grupo SURA's investments in countries like Mexico, Peru, and Chile can be significantly altered by exchange rate movements.

- Risk Management Imperative: Effective hedging strategies and careful monitoring of currency markets are crucial for mitigating potential losses and preserving shareholder value.

The economic landscape for Latin America in 2024-2025 points towards moderate GDP growth, with Colombia's financial sector expected to be a significant contributor. Colombia's GDP growth was projected around 1.7% for 2024, and the financial services sector demonstrated resilience.

Inflation in Colombia has been trending downwards, aiming for target levels by 2025, suggesting a potential easing of interest rates. This is beneficial for financial institutions like Bancolombia, as lower borrowing costs can stimulate lending and investment, boosting demand for financial products offered by Grupo SURA.

Latin America's insurance penetration remains below global averages, presenting a substantial growth opportunity. Furthermore, the structured finance market is anticipated to reach $35 billion by 2025, driven by infrastructure and corporate financing needs, offering avenues for SURA Asset Management.

However, foreign exchange rate volatility, particularly for the Colombian peso, poses a challenge. Projections for 2024-2025 indicate continued pressure on the COP due to fiscal deficits and declining commodity revenues, impacting consolidated financial reporting and international investment valuations for Grupo SURA.

| Economic Factor | 2024 Projection (Colombia) | 2025 Outlook (Latin America) | Impact on Grupo SURA | Key Data Point |

|---|---|---|---|---|

| GDP Growth | ~1.7% | Moderate | Favorable for demand in financial services | Colombia's financial sector resilience |

| Inflation | Downward trend | Target levels expected | Potential for lower interest rates, boosting lending | Benchmark interest rate ~11.75% (early 2024) |

| Insurance Penetration | Low vs. global averages | Untapped potential | Growth opportunity for insurance offerings | Chile's penetration ~5% |

| Structured Finance Market | Growing | $35 billion by 2025 | Opportunity for asset management | Driven by infrastructure and corporate finance |

| Foreign Exchange (COP) | Downward pressure | Continued pressure expected | Risk to consolidated financials and investments | Fiscal deterioration, declining oil revenues |

Preview the Actual Deliverable

Grupo De Inversiones Suramericana PESTLE Analysis

The preview you see here is the exact Grupo De Inversiones Suramericana PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Grupo Suramericana. You can trust that the insights and structure presented are precisely what you'll be working with.

Sociological factors

Latin America's financial landscape is marked by a significant unbanked population, with roughly 40% of adults lacking formal savings accounts as of recent data, representing a considerable market opportunity. Grupo SURA can tap into this by focusing on expanding access to financial services for these underserved communities.

The rise of digital payments and mobile banking is a critical enabler for financial inclusion across the region. These technologies are transforming how people access and manage their money, making financial services more convenient and affordable.

Grupo SURA is well-positioned to leverage these technological advancements. By investing in and developing innovative digital solutions, the company can effectively reach new customer segments, thereby contributing to broader financial inclusion objectives and fostering economic growth.

Customers in financial services now expect banking to be flexible, transparent, and easy on the wallet, with many wanting a single digital platform for everything. This shift is compelling established players like Bancolombia to expand their offerings beyond traditional services into more comprehensive digital ecosystems.

Grupo SURA's various companies need to prioritize improving their user experience and offering more personalized services to stay competitive against newer fintech and neobank competitors. For instance, in 2024, digital banking adoption continued its upward trajectory, with a significant percentage of Latin American consumers preferring mobile banking for daily transactions, underscoring the need for enhanced digital capabilities.

Aging populations are a significant trend, particularly impacting sectors like pension and life insurance. As more people live longer, the demand for long-term savings and retirement solutions naturally increases. This demographic shift means companies like SURA Asset Management need to ensure their product suites align with the needs of an older clientele.

Governmental responses to aging populations are evident in pension system reforms worldwide. For instance, Mexico's Welfare Pension Fund represents a governmental effort to adapt to these demographic realities. Such changes can influence the regulatory landscape and the types of financial products that are viable or encouraged.

In 2024, the global population aged 65 and over is projected to reach over 770 million, a substantial increase that highlights the growing importance of retirement planning. SURA Asset Management must therefore innovate its offerings to effectively serve this expanding segment of the population, potentially focusing on products that provide stable income streams and healthcare-related financial services.

Human Talent and Employability

Human talent is central to Grupo SURA's strategy, serving as a key differentiator and driver of its ability to adapt and grow. The company actively invests in developing its employees' skills and fostering an environment that promotes employability, ensuring a robust and capable workforce. This focus on human capital not only strengthens the organization but also contributes to societal progress by enhancing the skills of the broader labor market.

Grupo SURA's commitment to talent development is reflected in its continuous training programs and initiatives aimed at career progression. For instance, in 2023, the company reported investing significantly in employee education and development, with over 1.5 million hours of training delivered across its various subsidiaries. This strategic emphasis on upskilling and reskilling its workforce is crucial for maintaining a competitive edge in the evolving financial services and healthcare sectors.

The company's dedication to promoting employability extends beyond its own operations, aiming to create a positive ripple effect in the communities where it operates. By fostering a culture of continuous learning and providing opportunities for professional growth, Grupo SURA contributes to a more skilled and adaptable society. This approach aligns with its broader sustainability objectives, recognizing that a strong human capital base is fundamental to long-term economic and social well-being.

- Talent as a Differentiator: Grupo SURA views its human capital as a primary competitive advantage, essential for navigating market changes and driving innovation.

- Employability Focus: The company prioritizes enhancing the employability of its workforce through targeted training, development programs, and career pathing.

- Societal Contribution: By investing in talent, Grupo SURA aims to contribute to the harmonious development of society by creating a more skilled and adaptable labor pool.

- Training Investment: In 2023, Grupo SURA allocated substantial resources to employee development, with over 1.5 million hours of training provided across the group.

Social Well-being and Competitiveness

Grupo SURA is deeply invested in enhancing both individual well-being and the overall competitiveness of businesses through its extensive range of financial products. For example, in 2024, Suramericana continued to focus on delivering robust solutions designed to help clients navigate life's uncertainties, thereby improving their quality of life and financial security. This commitment mirrors a growing societal emphasis on personal prosperity and stability.

The company's strategy directly addresses societal aspirations for enhanced quality of life and economic security. By offering comprehensive financial management tools, Grupo SURA empowers individuals and businesses to build resilience. This approach is particularly relevant as global economic shifts in 2024 and 2025 continue to highlight the importance of financial planning and risk mitigation for long-term success.

Grupo SURA's efforts to foster competitiveness extend beyond individual clients. By supporting businesses with financial solutions, the group contributes to a more dynamic economic landscape. This focus aligns with broader trends observed in 2024, where economic resilience and adaptability are paramount for sustained growth and societal advancement.

Key aspects of their social contribution include:

- Financial Inclusion Initiatives: Grupo SURA actively promotes access to financial services, aiming to uplift underserved populations and foster broader economic participation.

- Support for Entrepreneurship: The group provides financial and advisory support to small and medium-sized enterprises (SMEs), recognizing their crucial role in economic development and job creation.

- Commitment to Quality of Life: Through its insurance and pension products, Suramericana aims to provide a safety net, enabling individuals to live with greater peace of mind and plan for their future.

Societal expectations are shifting towards greater financial inclusion and digital accessibility. In 2024, Latin America continued to see a significant portion of its adult population unbanked, creating a clear opportunity for Grupo SURA to expand its reach through innovative digital solutions and accessible financial products.

The growing demand for integrated digital platforms, where customers can manage all their financial needs, is a key trend. Grupo SURA's focus on enhancing user experience and offering personalized services is crucial to compete with agile fintech competitors, especially as mobile banking adoption surged in 2024.

Demographic shifts, particularly aging populations, are increasing the need for long-term savings and retirement solutions. With the global population aged 65 and over projected to exceed 770 million by 2024, SURA Asset Management must adapt its offerings to cater to this expanding segment, potentially emphasizing stable income and healthcare-related financial services.

Grupo SURA's strategic emphasis on human talent development is a significant differentiator, with over 1.5 million training hours delivered in 2023. This investment in employee skills not only strengthens the company but also contributes to broader societal employability and economic adaptability.

Technological factors

The financial sector in Latin America is rapidly adopting digital technologies, with a significant majority of institutions, over 50% in 2024, boosting their IT spending. This surge is driven by the need to enhance cybersecurity measures and broaden access through digital platforms.

Grupo SURA's various business units are strategically investing in digital transformation initiatives. These efforts are aimed at streamlining internal processes, tapping into previously unreached customer bases, and delivering enhanced value through innovative digital offerings.

Fintech and neobanks are rapidly reshaping Latin America's financial sector, offering agile and customer-focused alternatives that challenge traditional players. This trend is particularly pronounced in Colombia, where digital payment solutions and online lending platforms are seeing significant adoption.

For Grupo SURA, this means increased competition from agile fintechs that can quickly adapt to market demands. For instance, by the end of 2024, the number of digital bank accounts in Latin America is projected to surpass 200 million, highlighting the rapid shift in consumer preference towards digital financial services.

Grupo SURA's continued investment in its digital infrastructure and the development of innovative, user-friendly financial products is crucial. This strategic focus allows the company to maintain its competitive edge and cater to the evolving needs of a digitally-native customer base in the region.

The financial sector, including companies like Grupo SURA, is seeing a significant uptick in Artificial Intelligence (AI) adoption, particularly for customer service and risk management. For instance, by the end of 2023, financial institutions globally were projected to invest over $10 billion in AI solutions, a trend expected to continue growing through 2025.

AI presents opportunities to streamline operations and create more tailored client experiences, boosting efficiency. This technology is not just about automation; it's about enhancing how businesses interact with their customers and manage their risks more intelligently.

Grupo SURA can capitalize on AI to refine its operational frameworks and pioneer innovative financial products and services. The potential for improved data analysis and predictive capabilities can lead to more robust business models and a competitive edge in the evolving market.

Expansion of Digital Payments and Mobile Banking

The surge in demand for digital payments and the rapid expansion of e-commerce are significant drivers for the fintech-as-a-service sector in Latin America. This trend is further amplified by high mobile penetration rates throughout the region, which makes adopting these digital financial services much easier for consumers. Grupo SURA's strategic emphasis on digital channels directly supports this shift towards modern payment solutions, aiming to increase deposit balances as reliance on cash continues to decline.

Key statistics highlight this digital transformation:

- Digital Payment Growth: Latin America's digital payments market was projected to reach over $2.5 trillion by 2025, demonstrating substantial growth potential.

- E-commerce Expansion: E-commerce sales in the region saw an increase of approximately 25% in 2024 compared to the previous year.

- Mobile Penetration: Mobile internet penetration in Latin America reached over 75% in 2024, providing a vast user base for digital financial services.

- Fintech Investment: Fintech startups in Latin America attracted over $2 billion in investment in 2024, fueling innovation in payment solutions.

Cybersecurity and Data Privacy

The increasing reliance on digital platforms for financial services places cybersecurity and data privacy at the forefront of Grupo SURA's operational priorities. As financial institutions, protecting sensitive customer information and ensuring the integrity of online transactions are critical for maintaining stakeholder trust and adhering to evolving regulatory frameworks. This necessitates continuous and substantial investment in advanced cybersecurity solutions.

The global cybersecurity market is projected to grow significantly, with estimates suggesting it could reach over $300 billion by 2025, highlighting the increasing demand for robust security measures. For Grupo SURA, this translates into an ongoing need to bolster its defenses against sophisticated cyber threats.

- Investment in advanced threat detection systems

- Regular security audits and penetration testing

- Employee training on data protection protocols

- Compliance with global data privacy regulations like GDPR and local equivalents

Technological advancements are fundamentally reshaping Latin America's financial landscape, with Grupo SURA actively participating in this digital evolution. The company's strategic investments in digital transformation are designed to enhance operational efficiency and expand its market reach. This focus is critical as fintech innovation and the rise of digital banking rapidly alter consumer preferences and competitive dynamics across the region.

Grupo SURA's commitment to digital infrastructure and innovative product development is key to maintaining its competitive edge. The increasing adoption of AI for customer service and risk management, alongside the surge in digital payments, underscores the imperative for continuous technological adaptation. By prioritizing cybersecurity and data privacy, Grupo SURA aims to build trust and navigate the evolving regulatory environment effectively.

| Technology Trend | Impact on Grupo SURA | Key Data/Projections (2024-2025) |

|---|---|---|

| Digital Transformation | Streamlining operations, expanding customer base, offering innovative digital services. | Over 50% of Latin American financial institutions boosting IT spending in 2024. |

| Fintech & Neobanks | Increased competition from agile players, shift in consumer preferences. | Digital bank accounts in Latin America projected to exceed 200 million by end of 2024. |

| Artificial Intelligence (AI) | Enhanced customer service, improved risk management, operational efficiency. | Global financial institutions projected to invest over $10 billion in AI solutions by end of 2023, with continued growth through 2025. |

| Digital Payments & E-commerce | Growth opportunities in digital channels, increased reliance on modern payment solutions. | Latin America's digital payments market projected to reach over $2.5 trillion by 2025. E-commerce sales increased ~25% in 2024. |

| Cybersecurity | Critical priority for maintaining trust, protecting data, and ensuring regulatory compliance. | Global cybersecurity market projected to reach over $300 billion by 2025. |

Legal factors

Latin America's financial regulatory environment is in flux, with fintech innovation and a growing emphasis on sustainable practices prompting significant shifts. Regulators are actively creating new rules for fintech companies and strengthening their oversight mechanisms.

Grupo SURA faces the ongoing challenge of staying abreast of and adapting to these dynamic regulations across its various markets to maintain compliance and mitigate potential risks. For instance, in 2024, several Latin American nations introduced updated cybersecurity requirements for financial institutions, directly impacting data handling and operational protocols.

New fraud prevention laws are sweeping across Latin America, significantly impacting financial institutions like Grupo SURA. For instance, Peru's SBS regulation No. 2286-2024 and Chile's updated Law No. 20.009 are now demanding more rigorous customer authentication processes. These regulations also carry serious penalties for those caught using payment methods fraudulently.

To navigate this evolving legal landscape, Grupo SURA's banking and insurance arms must prioritize the implementation of strong security measures. This includes deploying robust two-factor authentication systems and developing comprehensive fraud prevention plans to ensure full compliance with these stringent mandates.

The Mexican government's 2024 decree establishing the Welfare Pension Fund significantly reshapes pension benefits and funding, directly affecting SURA Asset Management's operations in the country. This new legislation necessitates strict adherence to national pension rules, including specific eligibility criteria and funding source mandates for SURA's asset management division.

Insurance Sector Regulatory Advancements

Chile's Financial Market Commission (CMF) is progressively shifting towards a risk-based supervision model for the insurance sector, a move designed to enhance financial stability and consumer protection. This evolution includes the ongoing alignment with International Financial Reporting Standard 17 (IFRS 17), which standardizes insurance contract accounting globally, impacting how companies like Suramericana report their financial performance. For instance, IFRS 17 implementation requires significant adjustments to actuarial models and data management systems, with many global insurers dedicating substantial resources to this transition throughout 2024 and into 2025.

Legal developments concerning ISAPREs, Chile's private health insurance providers, are also creating a dynamic regulatory environment. Recent court rulings and legislative proposals addressing repayment obligations for ISAPREs are directly influencing the healthcare insurance market. These changes necessitate careful review and adaptation of insurance products and operational strategies to comply with evolving legal frameworks and manage associated financial liabilities.

- CMF Risk-Based Supervision: Focuses on proactive identification and mitigation of risks within financial institutions, including insurers.

- IFRS 17 Adoption: Aims to bring greater transparency and comparability to insurance contract accounting, with full implementation deadlines approaching for many entities.

- ISAPRE Legal Landscape: Ongoing judicial and legislative actions are reshaping the financial obligations and operational requirements for health insurance providers in Chile.

Corporate Governance and ESG Compliance

Grupo SURA places a strong emphasis on robust corporate governance, ensuring its management practices are transparent and directly support its strategic goals. This commitment is vital for building and maintaining trust with stakeholders.

The company actively manages environmental, social, and governance (ESG) risks, demonstrating a dedication to sustainable operations. For instance, in 2023, Grupo SURA reported a 15% reduction in its carbon footprint compared to 2020, a testament to its ESG focus.

Adherence to evolving ESG regulations is paramount for Grupo SURA. By aligning with these standards, the company reinforces its reputation and attracts investors who prioritize sustainability. Failure to comply could impact investor confidence and market valuation.

Key aspects of Grupo SURA's governance and ESG compliance include:

- Transparent financial reporting and ethical business conduct

- Proactive management of environmental impacts, including emissions and resource utilization

- Commitment to social responsibility, employee well-being, and community engagement

- Adaptation to new sustainability disclosure requirements and international ESG frameworks

Grupo SURA must navigate a complex and evolving legal landscape across Latin America, particularly concerning financial regulations and consumer protection. New mandates in 2024, such as updated cybersecurity requirements in several nations and stricter fraud prevention laws in Peru and Chile, necessitate significant investment in compliance and security measures. The company's operations are also directly impacted by legislative changes, like Mexico's 2024 decree for the Welfare Pension Fund, which alters the operational framework for asset management services.

Environmental factors

The financial landscape in Latin America is increasingly prioritizing sustainability, with Environmental, Social, and Governance (ESG) factors becoming central to regulatory frameworks and investment strategies. This shift is particularly evident as investors and institutions seek to align capital with long-term value creation and societal impact.

Grupo SURA's significant stake in Bancolombia positions it to leverage this trend. Bancolombia has been actively enhancing its ESG integration across its banking, investment, and asset management operations, reflecting a commitment to responsible finance. For instance, in 2023, Bancolombia reported a 15% increase in its sustainable finance portfolio, reaching over COP 20 trillion.

This growing emphasis on ESG directly influences investment decisions and drives product innovation within the financial sector. Companies like Grupo SURA, by aligning with these evolving market demands, can enhance their competitive positioning and attract a broader base of ethically-minded investors.

Grupo SURA actively integrates climate change considerations into its sustainability framework, overseen by its Executive Management Committee and Internal Sustainability Committee. This commitment means they're not just reacting to environmental shifts but proactively managing them.

Their approach to risk management is comprehensive, encompassing the identification of both potential threats and emerging opportunities stemming from environmental factors. This dual focus is crucial for navigating the complexities of a changing climate.

By adopting this proactive stance, Grupo SURA is better positioned to mitigate climate-related risks, such as extreme weather events impacting their investments, and to strategically pursue opportunities in areas like green finance and sustainable infrastructure, aligning with global trends toward decarbonization and ESG investing.

Grupo SURA is actively embedding sustainability into its operations, with SURA Asset Management measuring the carbon footprint of 71.5% of its assets under management as of early 2024. This proactive approach, underscored by its signatory status to the Principles for Responsible Investment (PRI), demonstrates a commitment to environmental stewardship.

This focus on sustainable finance not only generates tangible added value for stakeholders but also positions Grupo SURA favorably within the accelerating global trend towards responsible investment practices.

Resource Scarcity and Environmental Regulations

Latin America, including nations where Grupo SURA operates, is increasingly prioritizing environmental sustainability. Chile, for instance, has pledged to achieve carbon neutrality by 2050 and actively encourages industries to adopt greener practices. This trend signals a tightening regulatory landscape focused on conservation and efficient resource management.

Grupo SURA's strategic planning and investment decisions must account for these evolving environmental mandates and the potential impact of resource availability.

- Chile's commitment to carbon neutrality by 2050

- Growing regional emphasis on sustainable industry practices

- Implications of resource availability on operational costs and investment opportunities

- Need for Grupo SURA to align its portfolio with evolving environmental regulations

Social and Planetary Health Commitment

Suramericana has embraced a 'Social and Planetary Health' program, a strategic framework designed to harmonize social progress with ecological limits. This approach underscores their dedication to fostering economic development that is both inclusive and environmentally responsible.

This commitment is more than just a policy; it's a guiding principle for their operations. For instance, in 2024, Suramericana reported a 15% increase in investments directed towards sustainable projects, aligning with their planetary health objectives. This initiative is crucial for long-term business viability and societal benefit.

- Social and Planetary Health Framework: Suramericana's core strategy integrates social equity with environmental sustainability.

- Inclusive Economic Development: The program aims to promote growth that benefits all segments of society while respecting planetary boundaries.

- Corporate Responsibility: This reflects a deep-seated commitment to environmental stewardship and the well-being of future generations.

- Sustainable Investment Growth: In 2024, the company saw a 15% rise in funding for sustainable initiatives, demonstrating tangible progress.

Environmental factors are increasingly shaping investment and operational strategies for Grupo SURA, particularly in Latin America where sustainability is a growing priority. Chile's 2050 carbon neutrality goal and broader regional trends towards greener industries necessitate careful consideration of resource availability and regulatory shifts.

Grupo SURA's proactive approach includes embedding climate change considerations and measuring the carbon footprint of its assets. For example, SURA Asset Management measured the carbon footprint of 71.5% of its assets under management by early 2024, demonstrating a tangible commitment to environmental stewardship.

The company's 'Social and Planetary Health' program further solidifies this commitment, aiming for inclusive economic development that respects ecological limits. This is supported by a 15% increase in investments directed towards sustainable projects in 2024, reflecting a strategic alignment with long-term environmental and societal well-being.

| Environmental Factor | Grupo SURA's Response/Action | Relevant Data/Metric |

|---|---|---|

| Climate Change | Integrated into sustainability framework; proactive risk and opportunity management. | Executive Management Committee and Internal Sustainability Committee oversight. |

| Carbon Neutrality Goals (e.g., Chile 2050) | Aligning portfolio with evolving environmental regulations and sustainable practices. | Chile's commitment to carbon neutrality by 2050. |

| Sustainable Finance Growth | Increasing investment in sustainable projects; measuring carbon footprints. | SURA Asset Management measured carbon footprint of 71.5% of AUM (early 2024); 15% increase in sustainable project investments (2024). |

| Resource Availability | Strategic planning and investment decisions account for resource impacts. | Growing regional emphasis on efficient resource management. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grupo De Inversiones Suramericana is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside official government publications and leading economic research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.