Grupo De Inversiones Suramericana Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo De Inversiones Suramericana Bundle

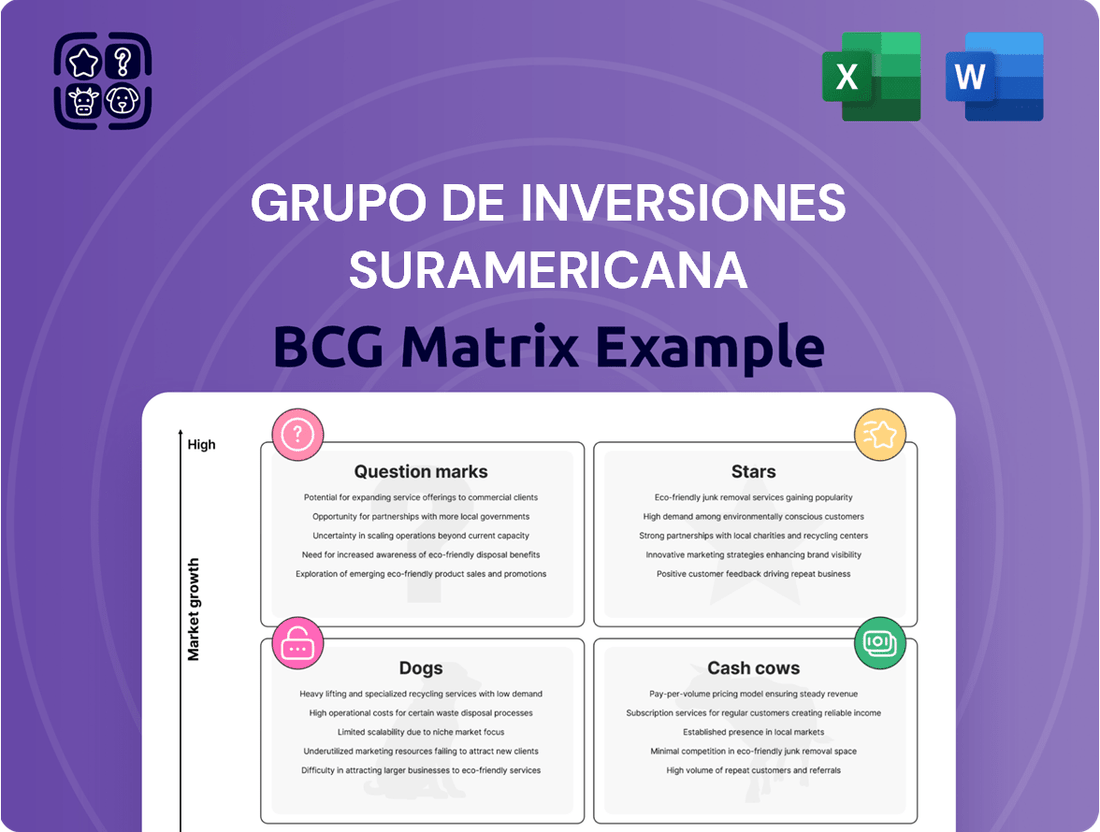

Unlock the strategic potential of Grupo De Inversiones Suramericana's portfolio with our comprehensive BCG Matrix analysis. Understand which of their ventures are poised for growth as Stars, which are generating consistent returns as Cash Cows, and which require careful evaluation as Dogs or Question Marks.

This preview offers a glimpse into the strategic positioning of Grupo De Inversiones Suramericana's diverse business units. For a complete understanding of their market share and growth potential, and to receive actionable insights for optimizing their investment strategy, purchase the full BCG Matrix report today.

Stars

Suramericana is aggressively expanding in Mexico and Brazil, two key Latin American markets with substantial growth potential. This strategic push is supported by the overall health of the regional insurance sector, which saw premiums rise significantly in 2024, though a slight deceleration is anticipated for 2025.

The insurer's focus on these burgeoning territories, coupled with its strong existing presence in Colombia, Chile, and Uruguay, highlights its ambition to capture a larger share of the expanding insurance landscape. This makes Mexico and Brazil prime candidates for Suramericana's continued investment and development efforts.

SURA Asset Management stands out as a premier pension fund administrator across Latin America, a vital segment of the asset management industry poised for substantial expansion.

The broader Latin American asset management market is projected to experience robust growth, with an anticipated compound annual growth rate of 26.2% between 2024 and 2030. This impressive market trajectory, coupled with SURA Asset Management's commanding presence in pension fund administration, solidifies its position as a star performer within the BCG matrix.

Bancolombia, a key player within Grupo SURA's extensive portfolio, is a shining example of a star in the BCG matrix, particularly within the burgeoning digital banking sector of Latin America. Its substantial market share reflects the region's accelerating embrace of digital financial services.

The Latin American banking industry is witnessing impressive expansion, largely fueled by the widespread adoption of digital platforms and services. This trend underscores the strategic importance of Bancolombia's digital-first approach.

As of early 2024, Bancolombia reported over 10 million active digital users, a testament to its robust digital infrastructure and customer engagement. This dominance in digital transactions positions it firmly as a star, poised for continued growth in this dynamic market.

SURA Investments' Alternative Investment Offerings

SURA Investments, a key player within SURA Asset Management, is strategically positioning itself to capture the burgeoning demand for alternative investments across Latin America. This segment is experiencing significant growth, driven by a notable shift in allocation from both high-net-worth individuals and institutional investors like pension funds.

The appetite for alternative assets in Latin America is projected to double in 2024, presenting a substantial opportunity. SURA Investments is responding by developing and offering a range of diversified alternative investment solutions, aiming to meet this increasing demand and establish a stronger market presence.

- High-Growth Demand: Latin America's alternative investment market is expanding rapidly.

- Investor Shift: Wealthy individuals and pension funds are increasing their allocations to alternatives.

- Market Opportunity: The sector is expected to see its value double in 2024.

- SURA's Strategy: SURA Investments is building market share through diversified offerings and expertise.

Suramericana's Voluntary Insurance Solutions Expansion

Suramericana is actively broadening its voluntary insurance offerings, recognizing the substantial growth opportunities in Latin America where insurance penetration lags behind more developed markets. The company's objective is to onboard 2.6 million new customers by introducing innovative value propositions, particularly in the mobility and health sectors. This strategic expansion into diverse and easily accessible voluntary insurance products within a burgeoning market strongly suggests these initiatives are positioned as stars within the Grupo De Inversiones Suramericana BCG Matrix.

- Focus on Voluntary Insurance: Suramericana is prioritizing the expansion of its voluntary insurance portfolio.

- Growth Potential: This segment offers significant growth prospects due to lower insurance penetration in Latin America compared to developed nations.

- Client Acquisition Target: The company aims to attract 2.6 million new clients through enhanced value propositions.

- Key Areas of Focus: New offerings are being developed in sectors such as mobility and health.

SURA Asset Management, particularly its pension fund administration services, is a star performer. The Latin American asset management market is projected for substantial growth, with an anticipated compound annual growth rate of 26.2% between 2024 and 2030.

Bancolombia's digital banking operations also shine as a star. With over 10 million active digital users as of early 2024, its strong market share in the rapidly digitizing Latin American financial sector highlights its growth trajectory.

SURA Investments' focus on alternative assets, a segment expected to double in value in 2024, positions it as a star. This is driven by increasing allocations from high-net-worth individuals and institutional investors.

Suramericana's expansion in voluntary insurance, targeting 2.6 million new customers in mobility and health, marks another star. This initiative capitalizes on the lower insurance penetration in Latin America.

| Business Unit | Market Growth | Market Share | BCG Category |

| SURA Asset Management (Pension Funds) | High (26.2% CAGR 2024-2030) | Leading | Star |

| Bancolombia (Digital Banking) | High | Substantial | Star |

| SURA Investments (Alternatives) | Very High (doubling in 2024) | Growing | Star |

| Suramericana (Voluntary Insurance) | High | Expanding | Star |

What is included in the product

Highlights which units to invest in, hold, or divest for Grupo Suramericana based on market growth and share.

The BCG Matrix visually clarifies Grupo Suramericana's portfolio, easing the pain of strategic resource allocation.

It provides a clear, actionable roadmap for optimizing investments across diverse business units.

Cash Cows

Suramericana's established operations in Colombia represent a significant cash cow for Grupo SURA. As the leading insurance provider in this mature market, it consistently delivers robust financial results.

In 2024, Suramericana's performance was particularly strong, with revenues reaching USD 5.1 billion and a net profit of USD 186 million. This consistent profitability in a stable, dominant market position ensures a reliable source of cash flow for the broader Grupo SURA conglomerate.

SURA Asset Management stands as a cornerstone of Grupo SURA's BCG Matrix, firmly positioned as a Cash Cow. As of May 2025, it manages a substantial USD 158.7 billion in assets for 23.7 million clients, underscoring its regional leadership.

This robust asset management operation, especially its pension and savings administration, thrives in a well-established market. Its consistent ability to generate surplus cash provides essential financial stability for the entire Grupo SURA conglomerate.

Bancolombia, as a cornerstone of Grupo SURA, firmly sits as a Cash Cow within the BCG matrix. Its dominance in traditional banking, encompassing commercial and consumer loans and deposits, translates to a substantial and stable market share in Colombia.

Despite a challenging economic climate across Latin America in 2024, Bancolombia demonstrated resilience. The bank successfully leveraged widening credit spreads, reporting robust financial performance and solidifying its position as a consistent cash generator for the group.

Grupo SURA's Consistent Dividend Income from Investments

Grupo SURA's position as a Cash Cow is firmly established by the consistent and substantial dividend income it generates from its key holdings. These core investments, namely Suramericana, SURA Asset Management, and Bancolombia, are mature and highly profitable entities that reliably distribute profits to the parent company.

For the year 2024, Grupo SURA was projected to receive approximately COP 2 trillion in dividends from its investments. This figure represents an all-time high, underscoring the robust cash-generating power of its primary subsidiaries and their maturity in the market.

- Consistent Dividend Flow: Grupo SURA benefits from regular dividend payments from its established subsidiaries like Suramericana, SURA Asset Management, and Bancolombia.

- Record Dividend Projections for 2024: The company anticipated receiving close to COP 2 trillion in dividends in 2024, marking a significant milestone.

- Strong Cash Generation: This substantial dividend income highlights the strong and stable cash-generating capabilities of Grupo SURA's core investment portfolio.

- Maturity and Profitability: The subsidiaries contributing to this income are mature, profitable businesses, characteristic of Cash Cow entities in a BCG Matrix.

Operational Efficiency Across Core Businesses

Grupo SURA's core businesses, like Suramericana, are prime examples of Cash Cows. Their strategic focus on operational and administrative efficiency is yielding tangible results. In 2024, Suramericana notably boosted its technical results and operational efficiency, achieving 11.3% of written premiums, a 202 basis point improvement.

This emphasis on efficiency within established, high-market-share segments is crucial. It directly translates to enhanced profit margins and stronger cash flow generation.

- Suramericana's 2024 operational efficiency reached 11.3% of written premiums.

- This represents a 202 basis point increase compared to the previous period.

- Focus on mature, high-market-share businesses drives profit margin enhancement.

- Improved efficiency generates substantial cash flow without significant new investment needs.

Grupo SURA's established subsidiaries, particularly Suramericana, SURA Asset Management, and Bancolombia, function as its primary Cash Cows. These entities operate in mature, stable markets with significant market share, consistently generating substantial and reliable cash flows for the conglomerate.

In 2024, these core businesses demonstrated robust performance. Suramericana reported revenues of USD 5.1 billion and a net profit of USD 186 million, while SURA Asset Management oversaw USD 158.7 billion in assets as of May 2025. Bancolombia also showed resilience, leveraging credit spreads to maintain solid financial results.

The consistent profitability and strong cash generation from these mature operations are vital for Grupo SURA's overall financial health. This stability allows the conglomerate to fund growth initiatives in its Stars and Question Marks segments, as well as provide returns to shareholders.

| Subsidiary | Market Position | 2024 Performance Highlight | Cash Flow Contribution |

|---|---|---|---|

| Suramericana | Leading Insurer (Colombia) | USD 5.1B Revenue, USD 186M Net Profit | Strong, consistent |

| SURA Asset Management | Regional Leader | USD 158.7B Assets Under Management (May 2025) | Stable, reliable |

| Bancolombia | Dominant Bank (Colombia) | Resilient performance, leveraged credit spreads | Significant, dependable |

Delivered as Shown

Grupo De Inversiones Suramericana BCG Matrix

The Grupo De Inversiones Suramericana BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, ready for immediate strategic application, contains no watermarks or demo content, ensuring you get a professional-grade report. You can confidently expect to download the complete BCG Matrix, meticulously prepared for your business planning needs. This is the final, unedited version, designed for clarity and actionable insights into Grupo De Inversiones Suramericana's portfolio.

Dogs

Grupo SURA finalized the spin-off of its Grupo Nutresa stake, marking an exit from its food sector investments. This strategic divestment aims to sharpen Grupo SURA's focus exclusively on financial services, simplifying its overall business structure.

Assets that are divested because they no longer align with a company's core strategy are often categorized as 'Dogs' in the BCG matrix. This classification reflects their reduced contribution to the desired business focus and future growth potential within the parent company.

Grupo SURA's strategic disentanglement from Grupo Argos, finalized in July 2025, involved the elimination of intricate cross-shareholdings. This operation, part of a broader spin-off, allowed Grupo SURA to refine its focus on its core financial services business, divesting from non-financial assets that were historically intertwined.

This structural adjustment signals a deliberate move away from investments that, while once important, are no longer deemed critical for Grupo SURA's future expansion and capital deployment. For instance, by shedding these holdings, Grupo SURA can potentially reallocate capital towards higher-return financial services segments, a move supported by the fact that the financial services sector globally saw an average return on equity of 12.5% in 2024.

Grupo SURA's strategic pivot towards financial services means that non-core, legacy investments outside this sector are likely categorized as Dogs. These are typically smaller holdings with limited market share and low growth potential, representing assets that are no longer strategically aligned with the company's primary focus.

While specific 2024 figures for these exact legacy assets aren't publicly detailed, Grupo SURA’s stated strategy implies a rigorous evaluation process for such holdings. The company aims to concentrate resources on its core financial services businesses, suggesting these non-aligned investments may be candidates for divestment to unlock capital and improve overall portfolio efficiency.

Underperforming or Obsolete Technologies

Within Grupo De Inversiones Suramericana, underperforming or obsolete technologies represent a significant concern. These are legacy systems that have not been modernized or integrated into the company's broader digital transformation initiatives. For instance, older IT infrastructure might still be in place for certain back-office functions, requiring ongoing maintenance without yielding substantial returns or supporting new business avenues.

These outdated technologies often become resource drains, consuming capital and human resources for upkeep rather than driving innovation or enhancing customer experience. While not necessarily slated for immediate divestiture, they highlight areas with a low return on investment, potentially hindering the group's ability to adapt to evolving market demands and maintain a competitive edge. In 2024, companies across the financial sector are increasingly scrutinizing such assets to reallocate resources towards more strategic digital investments.

- Legacy IT Infrastructure: Systems requiring constant patching and support, offering minimal scalability.

- Maintenance Costs: Expenses associated with keeping obsolete hardware and software operational.

- Low ROI: Lack of contribution to revenue growth or market share expansion.

- Resource Allocation: Funds and personnel tied up in maintaining these systems instead of investing in future-ready technologies.

Segments with Persistent Low Penetration and Stagnant Growth

Within Grupo SURA's diverse financial services, certain segments exhibit characteristics of Dogs. These are areas where market share has remained stubbornly low despite ongoing investment, and where the overall market itself isn't expanding. For instance, consider specific niche insurance products or particular regional banking operations that have consistently underperformed. These segments are not expected to generate substantial future returns.

These underperforming areas represent a drain on resources that could be better allocated to more promising ventures. Grupo SURA's strategy for these "Dogs" would typically involve minimizing further investment, focusing on cost containment, or exploring divestiture options. The goal is to exit these low-growth, low-market-share positions to improve overall portfolio efficiency and profitability.

For example, if a particular digital payment solution in a less developed market failed to gain traction, showing only a 2% market share in 2024 with a projected market growth rate of 1% annually, it would fit this category. Such a product line would be a prime candidate for a strategic review, potentially leading to its discontinuation or sale.

- Persistent Low Market Share: Identifying specific financial products or services where Grupo SURA has struggled to capture significant customer adoption, often below 5% of the target market.

- Stagnant Market Growth: Pinpointing geographic regions or industry sub-sectors where the overall demand for financial services is not growing, typically showing less than 2% annual expansion.

- Resource Allocation Review: These segments are candidates for reduced capital expenditure and operational support, shifting focus to higher-potential business units.

- Potential Divestiture Candidates: Areas that have consistently failed to improve performance despite strategic initiatives may be considered for sale to unlock capital and streamline operations.

Grupo SURA's strategic divestment from non-financial assets, such as its stake in Grupo Nutresa, positions these divested entities as "Dogs" in the BCG matrix. These are assets that no longer align with the company's core focus on financial services, indicating limited future growth potential within the parent organization.

Legacy IT infrastructure and underperforming niche financial products or regional banking operations also fall into the "Dog" category for Grupo SURA. These areas consume resources without contributing significantly to revenue growth or market expansion, often characterized by low market share and stagnant growth, typically below 2% annually.

Grupo SURA's approach to these "Dog" assets involves minimizing investment, controlling costs, or exploring divestiture to improve portfolio efficiency. For instance, a digital payment solution with a mere 2% market share in 2024 and a projected 1% annual market growth would be a prime candidate for divestment.

The company's strategic pivot means these non-core holdings are evaluated for their low return on investment, potentially hindering adaptation to market demands. In 2024, financial sector companies are increasingly scrutinizing such assets to reallocate capital toward more strategic digital investments.

Question Marks

Suramericana's strategic push into insurtech signifies a clear move towards capturing a larger share of the rapidly expanding digital insurance market. By 2025, the company aims to significantly boost its direct channel, targeting over 10% of total written premiums, a substantial leap from its current less than 3%.

This initiative is categorized as a 'Question Mark' within the BCG matrix due to the high investment required in a high-growth, yet currently low-market-share segment. Suramericana's goal of acquiring 2.6 million new clients through these digital channels highlights the ambitious nature of this transformation.

Suramericana's aggressive push into markets like Brazil, aiming for growth north of 20% in 2024, positions it as a Question Mark. These ventures are characterized by substantial investment to seize burgeoning opportunities, reflecting a strategy to cultivate a stronger market presence from a currently limited base.

The company's commitment to these high-growth emerging economies signifies a calculated risk. Suramericana is channeling significant capital into these regions, mirroring the typical requirements for Question Mark entities that need ongoing funding to climb the market share ladder and transition into Stars.

Grupo SURA's subsidiaries, Suramericana and SURA Asset Management, are heavily investing in digital transformation. This includes developing new digital solutions and modernizing their technology-driven operating models to boost efficiency and improve customer interactions. These efforts are vital for staying competitive in today's increasingly digital financial world, positioning them for future expansion.

These digital initiatives, while promising for long-term growth, represent significant investments. For example, in 2023, digital transformation was a key pillar of SURA Asset Management's strategy, with a focus on enhancing client experience through digital platforms. The success of these new developments hinges on gaining market acceptance and achieving widespread adoption, which often requires substantial upfront capital and time to mature, placing them in the 'question mark' category of the BCG matrix.

Strategic Alliances for Deeper Market Penetration

Grupo SURA is actively forging strategic alliances and bolstering its distribution networks to expand its insurance and financial services footprint throughout Latin America. This proactive approach is designed to reach populations currently underserved by financial products, thereby increasing overall market penetration in regions where opportunities for growth are significant.

These initiatives are strategically focused on areas exhibiting high growth potential. For instance, in 2024, Grupo SURA continued to invest in digital channels and partnerships to reach rural and lower-income segments. A key objective is to secure substantial market share in these burgeoning markets, which necessitates considerable investment and meticulous execution of their expansion plans.

- Expanding Reach: Grupo SURA's strategy targets an increase in market penetration, particularly in segments with lower current financial service adoption.

- Digital Transformation: Investments in digital platforms and partnerships are crucial for accessing new customer bases and improving service delivery efficiency.

- Investment Focus: High-growth potential markets are prioritized, requiring substantial capital allocation and robust execution capabilities.

- Market Share Growth: The ultimate goal is to capture significant market share by effectively tapping into underserved populations and expanding service offerings.

Bancolombia's Ventures into Specific Niche Digital Financial Services

Bancolombia, as part of Grupo SURA, is exploring niche digital financial services, potentially fitting into the "Question Mark" category of the BCG matrix. These ventures target emerging customer segments within financial inclusion, focusing on high-growth digital finance areas. However, they represent nascent stages requiring substantial investment to scale and capture significant market share.

For instance, a hypothetical venture into micro-insurance for informal gig economy workers in Colombia could be a prime example. This segment, while growing, is underserved by traditional insurance products. Bancolombia's digital platform could offer tailored, affordable micro-insurance policies.

- Targeting underserved segments: Focusing on specific groups like smallholder farmers or urban informal traders with unique digital financial needs.

- High-growth potential: These niches often represent rapidly expanding markets within the broader digital finance landscape.

- Significant investment required: Developing specialized platforms, user education, and regulatory navigation for these niches demands considerable upfront capital.

- Uncertain market share: The success and scalability of these niche services are yet to be proven, placing them in the question mark quadrant.

Suramericana's strategic expansion into new, high-growth markets, particularly in Latin America, positions its ventures as Question Marks. These initiatives demand significant capital investment to build market share from a relatively low base. For example, in 2024, Suramericana targeted over 20% growth in markets like Brazil, requiring substantial resource allocation to achieve its ambitious client acquisition goals through digital channels.

The company's focus on digital transformation, including developing new insurtech solutions and modernizing operating models, also falls into the Question Mark category. These efforts, exemplified by SURA Asset Management's 2023 digital platform enhancements, require considerable investment with uncertain immediate returns but hold the potential for future market leadership. The success of these digital ventures hinges on gaining widespread customer adoption, a key characteristic of Question Mark entities needing time and funding to mature.

BCG Matrix Data Sources

Our Grupo De Inversiones Suramericana BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.