Grupo De Inversiones Suramericana Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo De Inversiones Suramericana Bundle

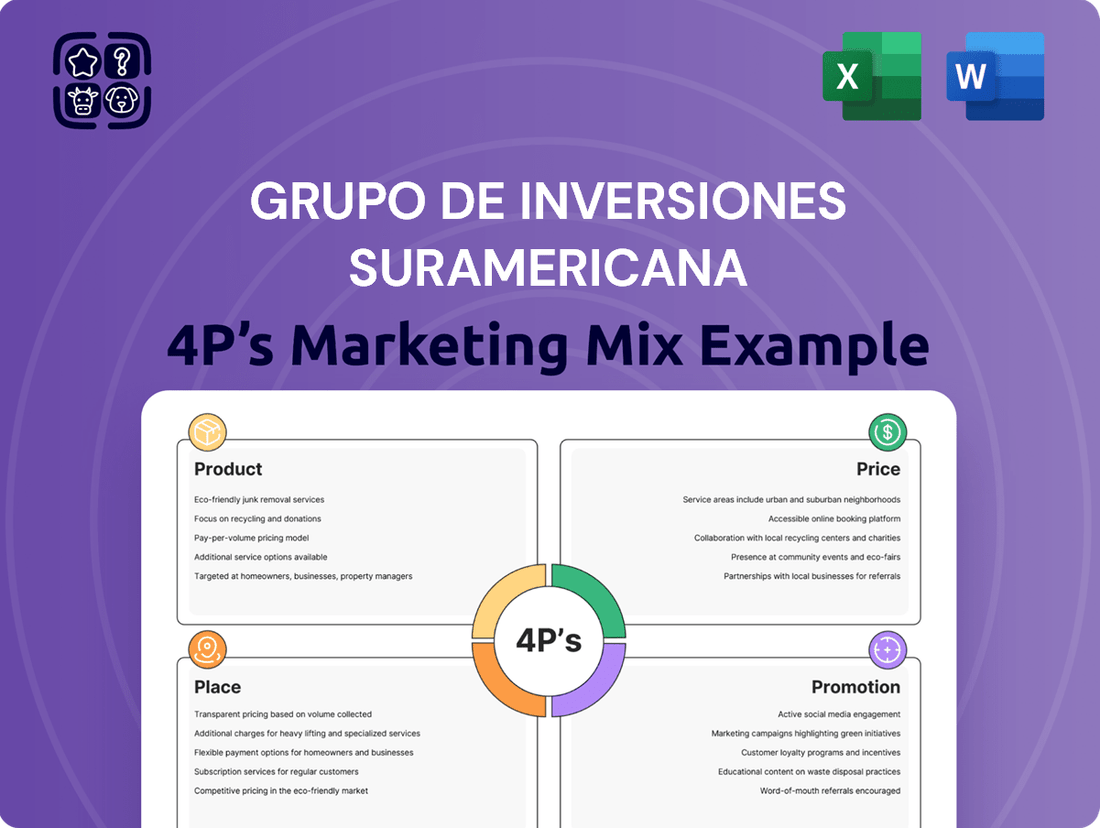

Grupo De Inversiones Suramericana masterfully crafts its market presence through a strategic 4Ps approach. This analysis delves into how their diversified product portfolio, competitive pricing, expansive distribution networks, and targeted promotional campaigns create a powerful synergy. Discover the core elements of their success and unlock actionable insights for your own marketing endeavors.

Product

Grupo SURA's product strategy focuses on a comprehensive financial services portfolio, offering everything from insurance and asset management to universal banking. This broad range ensures they can cater to a wide spectrum of client needs, from individual savings and protection to complex corporate financial solutions.

In 2023, Grupo SURA reported total assets of approximately COP 260 trillion (around USD 66 billion), underscoring the scale and depth of its product offerings. This extensive portfolio is designed to capture value across different financial life stages and economic cycles.

Their insurance segment, a core component, provides life, health, and property/casualty insurance, while asset management handles significant investment portfolios for institutional and individual clients. The banking arm offers a full suite of services, solidifying their position as a one-stop financial shop.

Suramericana's insurance solutions, a key component of Grupo SURA's marketing mix, focus heavily on Product and Promotion by offering specialized trend and risk management. They provide comprehensive general, life, and health insurance, addressing both voluntary and mandatory needs. This is further enhanced by value-added services designed to boost customer well-being and competitiveness.

The Place aspect is evident in Suramericana's strategic distribution channels, making their diverse insurance products accessible. Their commitment to innovation in Product is highlighted by offerings like micromobility and usage-based insurance, reflecting evolving market demands and a forward-thinking approach to risk coverage.

In terms of Price and Promotion, Suramericana leverages its expertise in trend and risk management to offer competitive pricing structures and targeted promotional campaigns. For instance, in 2023, Grupo SURA reported a significant increase in insurance revenues, driven by strong performance in its life and general insurance segments across Latin America, underscoring the effectiveness of their market penetration strategies.

SURA Asset Management, a key player within Grupo SURA, offers a comprehensive suite of pension, savings, and investment solutions. As of late 2024, they manage a significant portion of the pension market in several Latin American countries, with assets under management exceeding $150 billion USD across their operations.

Their product strategy focuses on providing diverse investment vehicles, including access to over 1000 funds, both their own and from external managers, catering to individual and institutional clients alike. This broad selection aims to meet varied risk appetites and financial goals, from retirement planning to wealth accumulation.

In terms of promotion, SURA emphasizes its leadership position and expertise in managing pension funds and voluntary savings. They highlight their robust investment management capabilities for institutional clients and tailored corporate solutions for capital and asset management, underscoring a commitment to financial security and growth for their diverse clientele.

Universal Banking Services via Bancolombia

Through its substantial investment in Bancolombia, Grupo SURA significantly broadens its market reach by offering a comprehensive suite of universal banking services. This strategic integration allows Grupo SURA to provide everything from everyday commercial and consumer banking to specialized investment banking, sophisticated treasury solutions, and personalized private banking. This expansive product portfolio caters to a wide array of clients, including individuals, large corporations, and small to medium-sized enterprises (SMEs), reinforcing Grupo SURA's presence across Colombia and Central America.

Bancolombia's operational strength is underscored by its robust financial performance and extensive network. As of the first quarter of 2024, Bancolombia reported a net income of COP 1.5 trillion (approximately USD 385 million), demonstrating its continued profitability and market leadership. The bank's digital transformation efforts have also yielded significant results, with digital channels accounting for over 60% of customer transactions in 2023, highlighting its commitment to innovation and customer convenience. This focus on digital accessibility, coupled with a strong physical presence, positions Bancolombia as a key financial partner for diverse economic actors.

- Product Breadth: Bancolombia offers commercial, consumer, investment, treasury, and private banking services.

- Clientele: Services are provided to individuals, corporations, and SMEs.

- Geographic Reach: Primary operations are in Colombia and Central America.

- Financial Strength: Q1 2024 net income reached COP 1.5 trillion, reflecting strong performance.

Integrated Solutions for Well-being and Competitiveness

Grupo SURA's product strategy centers on integrated solutions designed to foster both client well-being and competitiveness. This approach anticipates evolving customer needs, ensuring value propositions remain relevant against present and future challenges. For instance, in 2024, the company continued to emphasize holistic financial planning, moving beyond basic insurance to include savings, investment, and health management components.

The company's offerings are crafted to provide comprehensive support, addressing financial stability, robust risk management, and the cultivation of long-term wealth. This integrated model aims to empower individuals and businesses to navigate an increasingly complex landscape. Grupo SURA's commitment to innovation is reflected in its 2024 product development pipeline, which saw the introduction of digital tools for personalized financial advice and risk assessment.

Key aspects of this product strategy include:

- Holistic Financial Planning: Bundling insurance, savings, and investment products.

- Risk Mitigation Tools: Offering solutions for health, life, and property protection.

- Long-Term Wealth Accumulation: Providing investment vehicles and advisory services.

- Digital Integration: Enhancing accessibility and personalization through technology.

Grupo SURA's product strategy is characterized by a broad and integrated financial services portfolio, encompassing insurance, asset management, and banking. This diversification allows them to cater to a wide spectrum of client needs, from individual savings and protection to complex corporate financial solutions. Their commitment to innovation is evident in offerings like usage-based insurance and digital financial advice tools, reflecting an adaptive approach to market demands.

| Segment | Key Products | 2023/2024 Highlights |

|---|---|---|

| Insurance (Suramericana) | General, Life, Health Insurance; Trend & Risk Management Services; Micromobility Insurance | Strong revenue growth in life and general insurance segments. Focus on value-added services for customer well-being. |

| Asset Management (SURA Asset Management) | Pension Funds, Voluntary Savings, Investment Funds (1000+ options) | Manages over $150 billion USD in assets under management across Latin America. Leadership in pension fund management. |

| Banking (Bancolombia) | Commercial, Consumer, Investment, Treasury, Private Banking | Q1 2024 net income of COP 1.5 trillion. Over 60% of transactions via digital channels in 2023. |

What is included in the product

This analysis provides a comprehensive breakdown of Grupo De Inversiones Suramericana's Product, Price, Place, and Promotion strategies, offering actionable insights for marketing professionals.

It delves into the company's actual marketing practices and competitive positioning, making it ideal for benchmarking and strategic planning.

This analysis of Grupo Suramericana's 4Ps marketing mix provides a clear, actionable roadmap, alleviating the pain of fragmented marketing strategies and enabling focused execution for improved market penetration.

Place

Grupo SURA boasts an extensive Latin American presence, operating in 10 countries. This broad geographical footprint is anchored by its key subsidiaries: Suramericana, SURA Asset Management, and Bancolombia. This expansive network allows the group to cater to a massive customer base, exceeding 76.5 million clients throughout the region, ensuring widespread access to its diverse financial services and products.

Grupo de Inversiones Suramericana, or Grupo SURA, utilizes a robust multi-channel distribution strategy to maximize product accessibility. This approach leverages both traditional and digital avenues, ensuring a broad reach across its diverse customer segments.

A cornerstone of their strategy is the extensive physical presence, notably through Bancolombia's vast banking network. As of early 2024, Bancolombia operates over 1,000 branches across Colombia, providing a significant physical touchpoint for Grupo SURA's financial products and services. This traditional channel remains vital for engaging customers who prefer in-person interactions for banking and insurance needs.

Complementing its physical footprint, Grupo SURA also employs direct sales models and a substantial network of intermediaries. Insurance brokers and agents are key partners, extending the company's reach into specialized markets and offering personalized advice. This hybrid model, combining direct engagement with the expertise of intermediaries, allows Grupo SURA to cater to a wide spectrum of client preferences and financial requirements, enhancing market penetration and customer satisfaction.

Grupo SURA is heavily invested in its digital transformation, aiming to make its services more accessible and efficient for customers. This includes a significant push to expand digital solutions and modernize its technology infrastructure. For instance, in 2024, the company continued to enhance its digital platforms, seeing a notable increase in online transactions and customer engagement across its insurance, investment, and banking arms.

These digital platforms are crucial for Grupo SURA's brand positioning, acting as key channels for sales and providing seamless customer experiences. By updating its technology-driven operating model, the company ensures that users can easily manage their policies, investments, and accounts. This focus on digital innovation is a cornerstone of its strategy to stay competitive and meet evolving customer expectations in the financial services sector.

Strategic Alliances and Partnerships

Grupo SURA's marketing strategy is significantly bolstered by its strategic alliances and partnerships. A prime example is its substantial stake in Bancolombia, a leading financial institution in Colombia. This partnership grants Grupo SURA unparalleled access to an extensive banking network, facilitating broader product distribution and customer reach.

These collaborations are crucial for leveraging existing infrastructures and achieving deeper market penetration. By integrating with established networks, Grupo SURA ensures its diverse financial products and services are readily accessible to customers across various segments, precisely when and where they are needed. This synergy enhances customer convenience and strengthens Grupo SURA's market position.

- Bancolombia Stake: Grupo SURA holds a significant stake in Bancolombia, one of Latin America's largest financial groups. As of early 2024, Bancolombia reported over 30 million customers across its operations.

- Distribution Network: This alliance provides Grupo SURA access to Bancolombia's extensive branch network and digital platforms, enhancing product availability.

- Market Penetration: Partnerships allow Grupo SURA to tap into established customer bases and distribution channels, accelerating market penetration for its insurance, pension, and investment products.

- Customer Convenience: By leveraging partner infrastructures, Grupo SURA improves the accessibility and ease of use of its offerings, a key element in its marketing mix.

Localized Market Development

Grupo de Inversiones Suramericana actively pursues localized market development by enhancing its distribution networks across Latin America. This strategy is particularly evident in their push to boost insurance penetration in key markets such as Mexico and Brazil. For example, in 2024, Suramericana announced plans to expand its digital sales channels, aiming for a 15% increase in online policy acquisitions by the end of 2025.

This localized approach ensures that Suramericana's offerings are finely tuned to regional needs and regulatory landscapes. By adapting products and service delivery, they aim to unlock greater sales potential in diverse territories. Their focus on specific regions like Mexico, where insurance penetration was around 2.5% of GDP in 2023, and Brazil, with a slightly higher penetration, highlights a data-driven strategy to address market gaps.

Key aspects of their localized market development include:

- Strengthening distribution channels: Expanding agent networks and digital platforms for wider reach.

- Product customization: Tailoring insurance products to meet specific regional demands and cultural nuances.

- Regulatory compliance: Ensuring all offerings adhere to local laws and financial regulations in each target market.

- Market penetration goals: Targeting increased insurance uptake, with specific objectives for territories like Mexico and Brazil.

Grupo SURA's place strategy emphasizes widespread accessibility across Latin America, leveraging both extensive physical networks and robust digital platforms. Their presence spans 10 countries, serving over 76.5 million clients through key subsidiaries like Suramericana and Bancolombia.

This multi-channel approach is critical. Bancolombia's network of over 1,000 branches in Colombia as of early 2024 provides a strong physical anchor, complemented by direct sales and a vast network of insurance brokers and agents. Digital transformation is also a major focus, with enhanced online platforms driving increased customer engagement and transactions throughout 2024.

Strategic alliances, particularly the significant stake in Bancolombia, further amplify their reach. This partnership grants access to a massive customer base, estimated at over 30 million by Bancolombia itself in early 2024, facilitating deeper market penetration and customer convenience.

Grupo SURA also prioritizes localized market development, aiming to boost insurance penetration in regions like Mexico and Brazil. For instance, Suramericana targeted a 15% increase in online policy acquisitions by the end of 2025, adapting offerings to specific regional demands and regulatory environments.

| Distribution Channel | Key Metrics/Facts (as of early 2024 or latest available) | Strategic Importance |

|---|---|---|

| Physical Branches (Bancolombia) | Over 1,000 branches in Colombia | Provides essential in-person service and trust for banking and insurance needs. |

| Digital Platforms | Continued enhancement in 2024, increased online transactions and engagement | Drives efficiency, accessibility, and meets evolving customer expectations for digital services. |

| Intermediaries (Brokers/Agents) | Extensive network across Latin America | Extends reach into specialized markets and offers personalized customer advice. |

| Strategic Alliances (Bancolombia Stake) | Bancolombia serves over 30 million customers | Leverages established infrastructure for broader product distribution and market penetration. |

Same Document Delivered

Grupo De Inversiones Suramericana 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Grupo De Inversiones Suramericana's 4Ps Marketing Mix is fully complete and ready for your immediate use.

Promotion

Grupo SURA's promotional efforts strongly emphasize its dedication to creating lasting value for its investors and customers, anchored by a forward-thinking, long-term outlook. This messaging consistently portrays the company as a stable, responsible, and visionary entity within the financial services landscape.

The company's communications frequently underscore its contribution to the well-being and economic advancement of the communities it serves. For instance, in 2023, Grupo SURA reported total assets of approximately COP 249 trillion (USD 63 billion), demonstrating its significant scale and capacity to impact regional development.

Grupo De Inversiones Suramericana leverages digital marketing to sharpen its brand positioning and drive online sales, focusing on building awareness and desire for its financial offerings. This involves active online engagement and showcasing product advantages through digital channels.

The company aims to connect with its target demographics efficiently by utilizing appropriate digital platforms. For instance, in 2024, digital channels are increasingly vital for financial services, with many consumers preferring online research and transactions for products like insurance and investment funds.

Grupo SURA prioritizes open communication with its stakeholders through comprehensive investor relations. They regularly release detailed annual reports, quarterly financial statements, and investor kits, offering a clear view of their financial health and strategic direction. This commitment to transparency, evident in their consistent disclosures, fosters trust among financial professionals and individual investors alike.

Emphasis on Trust and 80 Years of History

Suramericana, a cornerstone of Grupo De Inversiones Suramericana, prominently features its 80-year legacy in its promotional strategies. This extensive history is a powerful tool for building trust and assuring customers of its long-standing reliability in the insurance and risk management sectors.

The company positions itself as a knowledgeable partner, guiding Latin Americans through life's uncertainties. Its marketing narrative emphasizes a consistent ability to adapt and innovate, ensuring it remains relevant and effective in serving its client base across generations. This historical perspective is crucial for reinforcing brand credibility and fostering customer loyalty.

- 80 Years of Operation: Suramericana's deep roots in Latin America underscore its stability and experience.

- Expertise in Insurance & Risk Management: The brand highlights its specialized knowledge to build confidence.

- Adaptability & Evolution: Promotions showcase the company's commitment to meeting changing customer needs over time.

- Trust & Reliability: The historical narrative is a key element in establishing Suramericana as a dependable provider.

Commitment to ESG Practices and Social Impact

Grupo SURA and its diverse subsidiaries are deeply committed to embedding sustainability and robust ESG principles into their core operations. This commitment is not just a statement but is actively demonstrated through their business practices and recognized externally. For instance, SURA Asset Management has consistently received accolades for its dedication to sustainable investing, underscoring the group's focus on responsible growth.

This emphasis on ESG resonates strongly with today's investors and business leaders who increasingly prioritize companies that exhibit strong corporate citizenship. Grupo SURA's proactive stance on environmental stewardship, social responsibility, and sound corporate governance enhances its reputation and attractiveness as a long-term investment and business partner. This focus is crucial for attracting capital and talent in the evolving financial landscape of 2024 and beyond.

Grupo SURA's commitment to ESG is reflected in tangible results and industry recognition:

- SURA Asset Management's recognition for sustainable practices: In 2023, SURA Asset Management was recognized by the Latin American Private Equity & Venture Capital Association (LAVCA) for its ESG efforts, highlighting their leadership in responsible investment within the region.

- ESG integration in investment portfolios: By the end of 2023, over 70% of the assets managed by SURA Asset Management incorporated ESG criteria, demonstrating a significant shift towards sustainable financial products.

- Social impact initiatives: In 2024, Grupo SURA launched a new program focused on financial education for underserved communities, aiming to reach over 500,000 individuals by 2025, thereby strengthening its social impact footprint.

Grupo SURA's promotional strategy centers on building trust and highlighting its long-term vision, emphasizing stability and responsible growth. Digital channels are increasingly vital for reaching target demographics and driving sales, with a focus on showcasing product advantages and fostering online engagement.

The company prioritizes transparent communication through investor relations, regularly releasing financial reports and investor kits to clearly outline its financial health and strategic direction, building confidence among stakeholders.

Suramericana leverages its 80-year legacy to promote expertise in insurance and risk management, positioning itself as an adaptable and reliable partner for Latin Americans navigating life's uncertainties.

Grupo SURA and its subsidiaries actively promote their commitment to ESG principles, with SURA Asset Management receiving accolades for sustainable investing and integrating ESG criteria into over 70% of its managed assets by the end of 2023.

Price

Suramericana leverages advanced actuarial science and risk-based methodologies to set premiums across its extensive insurance portfolio, encompassing life, health, casualty, and occupational risk coverage. This meticulous approach guarantees that pricing aligns precisely with identified risks and the associated cost of providing coverage, thereby safeguarding profitability and market competitiveness.

The company's pricing strategies carefully account for both voluntary insurance choices made by individuals and businesses, as well as mandatory insurance requirements stipulated by regulations. For instance, in 2024, Suramericana's robust risk assessment for auto insurance in Colombia, a significant market, allowed it to maintain competitive rates while managing claims effectively, reflecting an average premium adjustment of 5% year-over-year based on updated actuarial data.

Grupo SURA navigates a vibrant Latin American financial services sector, where its banking, pension, and investment products demand agile pricing. This strategy is shaped by fluctuating market demand, the pricing of rival firms, and the broader economic climate. For instance, in early 2024, average interest rates for personal loans in key Latin American markets ranged from 15% to 30%, a benchmark SURA considers when setting its own rates to remain competitive while ensuring accessibility.

The company aims to present financial solutions that are not only competitively priced but also easily attainable for its diverse customer base. By closely monitoring competitor pricing and economic indicators, such as inflation rates which hovered around 4-7% in several Latin American countries during 2024, Grupo SURA adjusts its product pricing to maintain market share and attract new clients across its service offerings.

For its specialized financial solutions, especially in wealth management and corporate services through SURA Asset Management, Grupo De Inversiones Suramericana employs value-based pricing. This strategy focuses on the perceived worth, deep expertise, and all-encompassing nature of their offerings, rather than just the cost. For instance, in 2024, SURA Asset Management reported managing over $150 billion in assets under management, reflecting the trust and value clients place in their specialized guidance.

Consideration of Market Demand and Economic Conditions

Grupo SURA's pricing strategies are dynamic, adapting to market demand and economic shifts across Latin America. For instance, in 2024, persistent inflation and fluctuating interest rates in key markets like Colombia and Peru necessitate careful consideration of consumer purchasing power when setting prices for financial products and insurance premiums. This agile approach ensures that Grupo SURA's offerings remain competitive and accessible, even amidst economic volatility.

The company's pricing policies are continuously reviewed against a backdrop of economic indicators. In 2024, for example, the average inflation rate across Latin America was projected to be around 5.8%, impacting the cost of living and, consequently, consumer spending habits. Grupo SURA's ability to adjust pricing in response to these conditions is crucial for maintaining product relevance and affordability.

- Market Demand: Grupo SURA analyzes consumer needs and willingness to pay for financial services and insurance in each operating country.

- Inflationary Pressures: Pricing models account for rising costs and their impact on disposable income, particularly in economies experiencing higher inflation rates in 2024.

- Interest Rate Sensitivity: For investment products, pricing reflects prevailing interest rates, influencing returns and attractiveness to investors.

- Economic Outlook: Broader economic trends, such as GDP growth and employment figures, inform the overall pricing strategy and product positioning.

Flexible Offerings and Financing Options

Grupo SURA's pricing strategy emphasizes flexibility to broaden market reach. This includes offering varied payment schedules and potential discounts, especially for significant financial products. For instance, in 2024, SURA continued to refine its digital platforms, aiming to streamline access to financial services and potentially offer more tailored pricing based on customer profiles and product uptake.

To cater to a wide customer base, SURA's approach to pricing involves diverse financing options. This strategy is crucial for making its extensive portfolio of insurance, investment, and pension services accessible. By providing these adaptable financial structures, SURA aims to meet the varying economic capabilities of individuals and businesses across Latin America.

- Flexible Payment Plans: SURA may offer installment options to spread costs over time, enhancing affordability.

- Discounts and Promotions: Targeted discounts could be applied to specific products or for bundled services, increasing value perception.

- Financing Partnerships: Collaborations with financial institutions can provide customers with broader financing avenues for larger commitments.

- Tiered Pricing Models: Offering different service levels at varying price points allows customers to choose based on their needs and budget.

Grupo SURA's pricing strategy is a dynamic blend of actuarial precision, market responsiveness, and value-based considerations. The company meticulously aligns premiums with risk across its insurance lines, ensuring competitiveness. For financial products, pricing adapts to demand, competitor actions, and economic conditions, such as the 15-30% interest rate range for personal loans observed in Latin America in early 2024. Value-based pricing is employed for specialized services, reflecting the significant assets under management, over $150 billion in 2024 for SURA Asset Management, underscoring client trust.

| Pricing Factor | 2024 Data/Observation | Impact on Pricing |

|---|---|---|

| Risk Assessment (Insurance) | Actuarial science, cost-based | Ensures premiums match identified risks and coverage costs. |

| Market Demand & Competition (Financial Services) | Interest rates (15-30% for loans), competitor pricing | Agile pricing to remain competitive and accessible. |

| Inflationary Pressures | Avg. LatAm inflation ~5.8% (projected 2024) | Pricing adjusted for consumer purchasing power and rising costs. |

| Value Perception (Wealth Management) | $150B+ Assets Under Management (SURA AM, 2024) | Value-based pricing reflecting expertise and client trust. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Grupo de Inversiones Suramericana is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry analyses and market research reports to capture their strategic positioning.