Grupo Catalana Occidente PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Catalana Occidente Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Grupo Catalana Occidente's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive roadmap to understanding these external forces, empowering you to anticipate challenges and seize opportunities. Download the full version now for actionable intelligence to refine your strategy.

Political factors

Political stability in Spain, a key market for Grupo Catalana Occidente, is crucial for maintaining investor confidence. Spain's government, led by Prime Minister Pedro Sánchez as of mid-2025, continues to navigate a complex political landscape, which can influence long-term business planning.

Changes in financial services regulation, such as those potentially introduced by the European Union's Solvency II directive updates, directly affect insurance providers like Grupo Catalana Occidente. These regulatory shifts can necessitate adjustments in capital requirements and operational procedures, impacting profitability and market strategy.

The Spanish government's approach to market consolidation within the financial sector, including insurance, is a significant political factor. Policies that either encourage or restrict mergers and acquisitions can shape Grupo Catalana Occidente's growth opportunities and competitive positioning within its operating markets.

The insurance sector's regulatory environment, exemplified by Europe's Solvency II directive, significantly shapes Grupo Catalana Occidente's capital needs, risk management strategies, and reporting duties. For instance, Solvency II, which came into full effect in 2016, mandates higher capital reserves and more sophisticated risk assessment for insurers across the EU, impacting how Grupo Catalana Occidente allocates capital and manages its risk exposure.

Increased consumer protection measures or enhanced market transparency requirements can compel operational changes within Grupo Catalana Occidente, potentially leading to higher compliance costs. For example, regulatory bodies in Spain, where Grupo Catalana Occidente is headquartered, have increasingly focused on ensuring fair treatment of policyholders, which could involve more rigorous disclosure requirements or complaint handling procedures.

Shifts in policy concerning specific insurance categories, such as health or property insurance, can directly influence Grupo Catalana Occidente's profitability. In 2023, for example, Spain saw discussions around potential reforms to the private healthcare insurance market, which could have implications for insurers operating in that segment.

Grupo Catalana Occidente, through its subsidiary Atradius, operates heavily within the global credit insurance market. International trade policies, such as the imposition of tariffs or the formation of new trade blocs, directly impact the volume of global commerce. For instance, the World Trade Organization (WTO) reported that global merchandise trade volume grew by 0.2% in 2023, a slowdown from previous years, which can affect demand for credit insurance.

Geopolitical tensions and trade disputes create uncertainty, potentially leading to increased defaults and higher claims for insurers like Atradius. The ongoing conflicts and shifting alliances observed in 2024 and projected into 2025 present a complex risk landscape. For example, disruptions in supply chains due to regional conflicts can exacerbate payment delays for businesses, directly impacting credit risk.

Taxation Policies

Changes in corporate tax rates directly impact Grupo Catalana Occidente's bottom line. For instance, Spain's corporate income tax rate stood at 25% in 2024, a figure that can significantly influence the group's net profit.

Favorable tax treatments for specific insurance products, such as those incentivizing long-term savings or pensions, can create avenues for growth. These policies encourage consumer uptake, indirectly benefiting insurers like Grupo Catalana Occidente.

Conversely, an escalation in tax burdens, whether through higher corporate rates or specific levies on insurance premiums, could erode profitability and weaken the group's competitive standing in the market.

- Corporate Tax Rate: Spain's 25% corporate tax rate in 2024 is a key factor.

- Tax Incentives: Policies encouraging savings products can boost insurance sales.

- Tax Burden: Increased taxes on premiums could negatively affect net income.

Government Support and Economic Stimulus

Government support and economic stimulus measures play a crucial role in shaping the operating environment for Grupo Catalana Occidente. Initiatives aimed at boosting economic growth, such as tax incentives for businesses or grants for innovation, can indirectly benefit the insurer by increasing demand for its products. For instance, a strong economic recovery, often fueled by government spending, leads to higher disposable incomes and greater business activity, both of which translate to more opportunities for insurance coverage.

Policies designed to support specific sectors, like renewable energy or technological advancements, can also create new insurance markets. In 2024, many European governments continued to roll out programs to support SMEs, a key demographic for insurance providers. These programs often include financial aid or reduced regulatory burdens, encouraging business expansion and thus the need for robust insurance solutions.

The Spanish government's focus on digital transformation and sustainable development, for example, could spur demand for specialized insurance products related to cybersecurity and environmental risks. Conversely, a reduction in government stimulus or a shift towards austerity measures could dampen economic activity, potentially slowing the growth of the insurance sector and impacting Grupo Catalana Occidente's revenue streams.

- Economic Stimulus Impact: Government spending on infrastructure projects or consumer subsidies can boost overall economic activity, leading to increased demand for insurance products from both individuals and businesses.

- SME Support: Initiatives supporting small and medium-sized enterprises, such as loan guarantees or tax breaks, encourage business creation and growth, expanding the pool of potential insurance customers.

- Industry-Specific Policies: Government support for sectors like green energy or technology can create niche insurance markets, offering new revenue opportunities for companies like Grupo Catalana Occidente.

- Fiscal Policy Reversals: A withdrawal of government support or a move towards austerity could lead to slower economic growth, potentially impacting the demand for and profitability of insurance services.

Political stability in Spain, a key market for Grupo Catalana Occidente, is crucial for maintaining investor confidence. Spain's government, led by Prime Minister Pedro Sánchez as of mid-2025, continues to navigate a complex political landscape, which can influence long-term business planning.

Changes in financial services regulation, such as those potentially introduced by the European Union's Solvency II directive updates, directly affect insurance providers like Grupo Catalana Occidente. These regulatory shifts can necessitate adjustments in capital requirements and operational procedures, impacting profitability and market strategy.

The Spanish government's approach to market consolidation within the financial sector, including insurance, is a significant political factor. Policies that either encourage or restrict mergers and acquisitions can shape Grupo Catalana Occidente's growth opportunities and competitive positioning within its operating markets.

What is included in the product

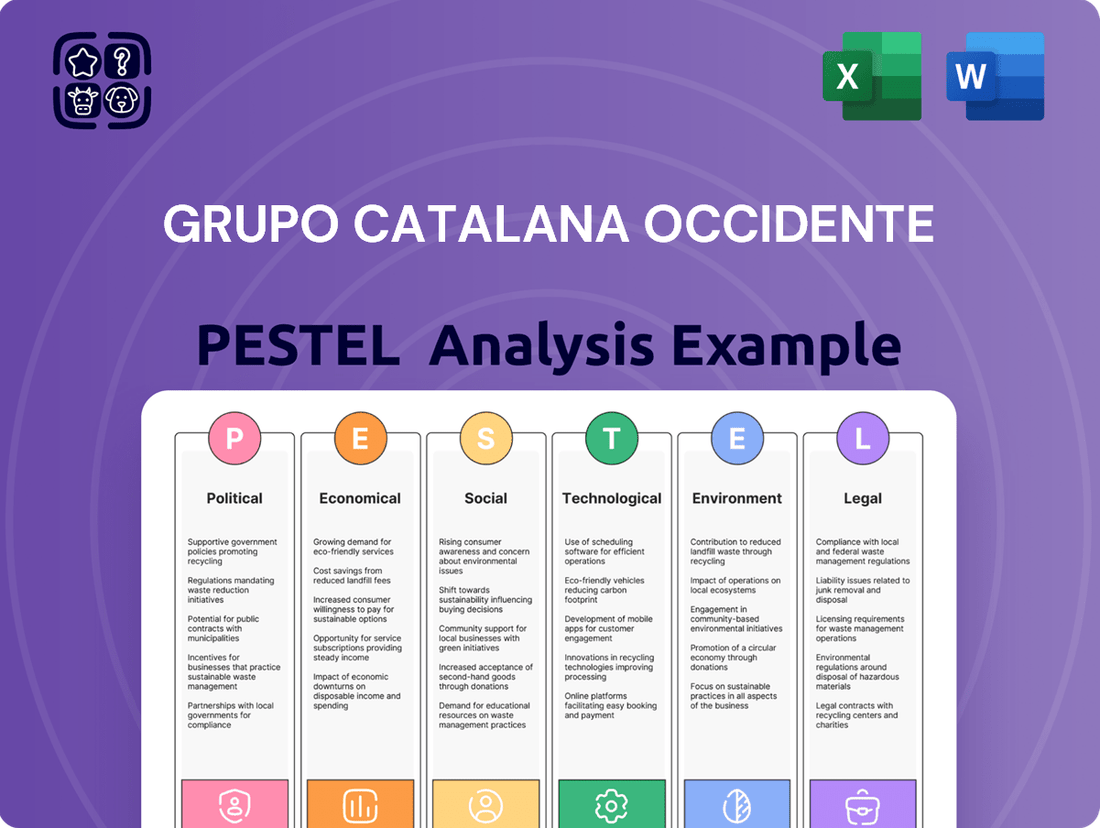

This PESTLE analysis examines the Grupo Catalana Occidente's operating environment, detailing how political, economic, social, technological, environmental, and legal forces present both challenges and strategic advantages.

It offers actionable insights derived from current trends and data, empowering stakeholders to anticipate market shifts and formulate effective business strategies.

A clear, actionable PESTLE analysis for Grupo Catalana Occidente that directly addresses potential disruptions and opportunities, enabling proactive strategic adjustments.

Economic factors

Grupo Catalana Occidente's profitability is directly tied to the prevailing interest rate environment. Fluctuations here significantly affect its investment income, especially for life insurance and long-term savings offerings. For instance, a sustained low-interest-rate scenario, like the ones experienced in recent years leading up to 2025, compresses investment yields, creating pressure on profit margins and potentially impacting how products are priced to remain competitive and profitable.

Conversely, while rising interest rates, a trend observed more prominently in 2024, can boost future investment income over the longer term, they also present challenges. The valuation of existing bond portfolios, a key component of insurer assets, can decline as newer, higher-yielding bonds become available, potentially leading to unrealized losses. This dynamic requires careful management of asset-liability matching to mitigate financial risks.

High inflation, particularly the persistent inflation seen through 2023 and into early 2024, directly impacts Grupo Catalana Occidente by increasing the cost of claims for its property and casualty insurance lines. For instance, rising material and labor costs for vehicle repairs or rebuilding damaged properties can significantly elevate payouts, potentially squeezing underwriting profits if premiums don't keep pace.

Conversely, robust economic growth, a trend anticipated to continue in many of Grupo Catalana Occidente's key markets in 2024 and 2025, generally fuels demand for insurance. As economies expand, businesses invest in new assets and operations, while individuals experience increased disposable income, leading to greater uptake of life, health, and property insurance products.

Furthermore, the economic health of Atradius, a key part of Grupo Catalana Occidente, is closely tied to broader economic performance. Strong economic growth in countries where Atradius operates enhances the financial stability and creditworthiness of its corporate clients, thereby reducing the risk of defaults on trade credit insurance policies. For example, a strong GDP growth rate in Spain, projected to be around 2.0% for 2024, supports the solvency of many businesses insured by Atradius.

Grupo Catalana Occidente, through its subsidiary Atradius, is significantly exposed to fluctuations in global trade volumes. A slowdown in international commerce directly impacts the demand for credit insurance and can increase the likelihood of claims. For instance, the International Monetary Fund (IMF) projected global trade growth to moderate in 2024 after a period of expansion, highlighting the sensitivity of credit insurers to these trends.

An increase in business insolvencies, often a byproduct of declining trade or economic downturns, poses a substantial risk to Grupo Catalana Occidente. Higher insolvency rates translate into more payout obligations for Atradius. In 2023, there was a notable rise in corporate insolvencies across major European economies, a trend that analysts expect to persist into early 2024, directly impacting the credit risk profile of the company.

Consequently, rigorous monitoring of global economic indicators and trade forecasts is paramount for effective risk management within Grupo Catalana Occidente's core credit insurance operations. Staying ahead of potential disruptions, such as supply chain issues or geopolitical tensions affecting trade flows, allows the company to adjust its underwriting strategies and capital reserves accordingly.

Consumer Spending and Disposable Income

Consumer spending and disposable income are key drivers for Grupo Catalana Occidente, directly impacting demand for personal insurance like life, health, and household policies. A strong economy with good employment and growing incomes typically means more people can afford and are willing to purchase these products.

In 2024, the Spanish economy is projected to see continued growth, with forecasts suggesting a GDP increase of around 2.0% to 2.4% by year-end. This economic expansion is expected to support consumer confidence and, consequently, disposable income levels, which is beneficial for the insurance sector.

- Consumer spending in Spain for Q1 2024 showed a year-on-year increase of approximately 2.0%, indicating a positive trend.

- Disposable income per household in Spain is anticipated to rise modestly in 2024, driven by wage growth and employment stability.

- The uptake of non-life insurance products, including household and accident insurance, is closely correlated with consumer confidence and purchasing power.

Financial Market Volatility

Volatility in equity and bond markets directly influences the valuation of Grupo Catalana Occidente's investment holdings. For instance, the MSCI World Index experienced significant fluctuations throughout 2024, with periods of sharp declines impacting broader market valuations.

Substantial market downturns can result in unrealized losses within the group's portfolio, potentially affecting its solvency ratios and overall financial resilience. As of Q3 2024, many institutional investors reported a noticeable dip in the value of their fixed-income portfolios due to rising interest rates.

Grupo Catalana Occidente's strategic approach to diversifying its investment assets is crucial for buffering against these inherent market risks. Effective diversification helps to smooth out returns and reduce the impact of adverse movements in any single asset class.

Key considerations for managing financial market volatility include:

- Asset Allocation: Regularly reviewing and adjusting the mix of equities, bonds, real estate, and alternative investments to align with risk tolerance and market outlook.

- Risk Management Tools: Employing hedging strategies and derivatives to protect against significant downside movements in specific market segments.

- Liquidity Management: Ensuring sufficient liquid assets are available to meet obligations during periods of market stress or unexpected cash needs.

- Long-Term Perspective: Maintaining a focus on long-term investment goals, recognizing that short-term volatility is a normal characteristic of financial markets.

Economic factors significantly shape Grupo Catalana Occidente's performance, with interest rates and inflation being primary drivers. While rising rates in 2024 can boost future income, they also pressure existing bond portfolios. Persistent inflation, evident through 2023 and into early 2024, increases claim costs for property and casualty insurance.

Robust economic growth, expected to continue in 2024 and 2025, generally fuels demand for insurance products across all segments. Atradius, a key subsidiary, benefits from strong economic performance in its operating regions, which enhances client creditworthiness and reduces default risk for credit insurance.

Global trade volumes directly impact Atradius, with a projected moderation in trade growth for 2024 posing a challenge. Increased business insolvencies, a trend observed in 2023 and expected into early 2024, also elevate payout obligations for the credit insurer.

Consumer spending and disposable income are vital for Grupo Catalana Occidente's personal insurance lines. Spain's projected GDP growth of around 2.0%-2.4% in 2024 supports consumer confidence and purchasing power, benefiting the insurance sector.

| Economic Indicator | Period | Value | Impact on Grupo Catalana Occidente |

| Spanish GDP Growth | 2024 Projection | 2.0% - 2.4% | Increased demand for insurance, higher disposable income |

| Global Trade Growth | 2024 Projection | Moderating | Reduced demand for credit insurance, potential increase in claims |

| Consumer Spending (Spain) | Q1 2024 | +2.0% YoY | Positive for personal insurance uptake |

| Business Insolvencies (Europe) | 2023/Early 2024 | Notable Rise | Increased payout obligations for Atradius |

What You See Is What You Get

Grupo Catalana Occidente PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Grupo Catalana Occidente covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

The aging population in key markets like Spain and Portugal, where Grupo Catalana Occidente has a significant presence, is a major demographic trend. For instance, Spain's population aged 65 and over is projected to reach 25% by 2030, up from approximately 20% in 2023. This demographic shift directly impacts insurance demand, boosting the need for health coverage and retirement savings products, which are core offerings for Grupo Catalana Occidente.

While an older demographic generally means higher demand for health and life insurance, it also signals a potential increase in claims payouts. This necessitates careful actuarial analysis and product pricing to ensure long-term profitability for the insurer. Grupo Catalana Occidente must balance offering attractive products to seniors with managing the associated risk exposure.

Understanding the distinct needs and preferences of different generations, from baby boomers to younger millennials, is vital. For example, younger generations may prioritize flexible, digital-first insurance solutions, while older individuals might prefer personalized, face-to-face service. Grupo Catalana Occidente's product development and marketing efforts in 2024 and 2025 will need to cater to these varied generational expectations to remain competitive.

Consumers are increasingly demanding personalized, flexible, and digitally integrated insurance services. Grupo Catalana Occidente needs to respond by enhancing its online presence and mobile capabilities, offering tailored product packages that meet individual needs. For instance, in 2023, digital sales channels for insurance products saw a significant uptick across Europe, with mobile app usage for policy management growing by an estimated 15% year-over-year, highlighting this shift.

The emphasis on transparency and exceptional customer service is paramount for retaining clients in today's competitive insurance landscape. By providing clear policy information and responsive support, Grupo Catalana Occidente can build trust and foster long-term customer loyalty. Surveys from late 2024 indicate that over 70% of insurance customers prioritize ease of communication and clarity of terms when choosing or remaining with a provider.

Growing awareness of health and wellness is a significant sociological factor influencing the insurance market. For instance, in 2023, a significant portion of the Spanish population, around 60%, reported actively trying to maintain a healthy lifestyle, which directly impacts demand for preventative health and life insurance products. This trend suggests a shift towards policies that reward healthy habits.

Changing lifestyles, including the rise of remote work and increased participation in leisure activities, also reshape insurance needs. These shifts can alter risk profiles, for example, by potentially reducing accident-related claims for commuters but increasing those related to sedentary lifestyles or new recreational pursuits. Grupo Catalana Occidente can capitalize on this by developing specialized coverage options that align with these evolving life patterns.

Social Responsibility and Ethical Considerations

Grupo Catalana Occidente's commitment to social responsibility is increasingly scrutinized by a public demanding ethical business conduct. Consumers and investors alike are favoring companies that demonstrate genuine care for societal well-being and operate with integrity. For instance, in 2023, the company continued its focus on sustainable development, aligning with growing expectations for environmental and social governance (ESG) performance.

Adherence to high ethical standards directly impacts brand perception and stakeholder attraction. Grupo Catalana Occidente's efforts to invest responsibly and contribute to community initiatives are vital for building trust. Transparency in their operations, from financial reporting to supply chain management, is paramount in meeting these evolving societal expectations.

- Enhanced Brand Reputation: Companies with strong CSR often see improved customer loyalty and a more positive public image.

- Attracting Socially Conscious Investors: A growing segment of the investment community prioritizes ESG factors, seeking to align their capital with ethical businesses. In 2024, sustainable investment funds continued to see significant inflows globally.

- Employee Engagement and Retention: Employees are more likely to be motivated and committed to organizations that demonstrate a clear commitment to social good.

- Operational Transparency: Open communication about business practices builds trust and mitigates reputational risks.

Public Trust in Financial Institutions

Public trust is the bedrock of any financial institution, and for Grupo Catalana Occidente, maintaining this is crucial for customer acquisition and retention. Recent surveys in 2024 indicate that while trust levels in the insurance sector are generally higher than in banking, past incidents of misconduct can still significantly impact consumer confidence. For instance, a 2023 study revealed that over 40% of consumers consider an insurer's reputation for honesty as a primary factor when choosing a policy.

Grupo Catalana Occidente needs to consistently showcase its reliability and ethical practices to build and sustain strong customer relationships. Demonstrating a clear commitment to policyholder interests, especially during challenging economic periods like the current inflation environment, is key. For example, swift and fair claims processing, a hallmark of trusted insurers, can significantly bolster public perception.

- Reputation Management: Proactive communication about financial stability and ethical conduct is essential.

- Customer Experience: Positive interactions, particularly during claims, directly influence trust.

- Transparency: Clear policy terms and conditions build confidence and reduce uncertainty.

- Social Responsibility: Engagement in community initiatives can enhance brand image and public goodwill.

Societal attitudes towards health and financial security are evolving, directly influencing demand for insurance products. Increased awareness of preventative health measures, for example, is driving interest in policies that reward healthy lifestyles, a trend observed in 2023 and expected to continue through 2025. This shift necessitates insurers like Grupo Catalana Occidente to adapt their offerings to align with these changing consumer priorities.

The increasing demand for personalized and digitally accessible services is a critical sociological factor. Consumers in 2024 and 2025 expect seamless online interactions and tailored product solutions, pushing insurers to enhance their digital platforms. For instance, mobile app usage for insurance policy management saw a notable increase, with estimates suggesting a 15% year-over-year growth in Europe during 2023.

Public trust and the emphasis on ethical business practices are paramount for retaining customers. Surveys from late 2024 indicate that over 70% of insurance customers prioritize clear communication and transparency from their providers. Grupo Catalana Occidente's commitment to social responsibility and transparent operations is therefore crucial for building and maintaining strong customer relationships and attracting socially conscious investors.

Technological factors

Grupo Catalana Occidente must invest heavily in digital transformation to modernize its operations, impacting everything from how claims are handled to how policies are managed. This is crucial given the accelerating digital shift across the financial services sector.

Automation, particularly through Robotic Process Automation (RPA), offers a significant opportunity to boost efficiency and cut costs. For instance, the insurance industry globally saw automation projects deliver an average cost saving of 20-30% in 2024, a trend Grupo Catalana Occidente can leverage.

Expanding digital channels is vital for reaching new customers and making interactions smoother. In 2024, digital sales channels accounted for over 50% of new insurance policies in many European markets, highlighting the necessity for Grupo Catalana Occidente to strengthen its online presence.

Grupo Catalana Occidente is increasingly leveraging data analytics and artificial intelligence to sharpen its competitive edge. By harnessing big data, the company can significantly improve its risk assessment processes and bolster fraud detection capabilities across its diverse insurance portfolio, including credit insurance offered by Atradius. This allows for more precise underwriting, especially vital in volatile markets.

The integration of AI is also pivotal for creating more personalized product offerings and refining customer segmentation. For instance, predictive analytics, a key component of AI, can anticipate emerging market trends, enabling more informed and optimized investment strategies. This proactive approach is essential for maintaining profitability and adapting to the rapidly evolving financial landscape, with the insurance sector seeing significant AI investment globally.

Grupo Catalana Occidente's increasing reliance on digital platforms necessitates robust cybersecurity. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the financial risks associated with data breaches.

Protecting sensitive customer data is crucial for maintaining trust and complying with regulations like GDPR. Failure to do so can result in significant fines; for instance, regulatory bodies issued over €2.7 billion in GDPR fines in 2023 alone.

Continuous investment in advanced cybersecurity infrastructure and comprehensive employee training is therefore essential for Grupo Catalana Occidente to mitigate these threats and ensure data privacy.

InsurTech Innovations and Competition

The insurance landscape is being reshaped by InsurTech startups, introducing novel competitive dynamics and business models. For Grupo Catalana Occidente, staying ahead means strategic engagement with these innovators, whether through partnerships, acquisitions, or internal development of cutting-edge solutions. This proactive approach is crucial for maintaining market relevance and capturing new opportunities in a rapidly evolving sector.

Emerging InsurTechs are challenging traditional insurance models with agile operations and customer-centric digital platforms. For instance, by mid-2024, the global InsurTech market was projected to reach over $10 billion, signaling significant disruption. Grupo Catalana Occidente's strategy must address this by integrating advanced technologies.

- Blockchain for Smart Contracts: Enhancing efficiency and transparency in claims processing and policy management.

- Telematics for Usage-Based Insurance (UBI): Offering personalized premiums based on driving behavior, a trend gaining traction in the automotive sector.

- Artificial Intelligence (AI) and Machine Learning (ML): Improving risk assessment, fraud detection, and customer service through data analytics.

- Digital Distribution Channels: Leveraging online platforms and mobile apps to reach a wider customer base and streamline sales processes.

Cloud Computing and Infrastructure Modernization

Grupo Catalana Occidente's adoption of cloud computing is a significant technological driver, enhancing scalability and flexibility. This move allows for more efficient IT operations and cost savings, crucial in the competitive insurance sector. By 2024, the global cloud computing market was projected to reach over $600 billion, highlighting its widespread adoption and the potential for significant operational improvements.

Migrating core insurance systems to the cloud can accelerate the launch of new digital products and services, a key strategy for customer acquisition and retention. Improved data accessibility from cloud platforms is vital for advanced analytics, enabling better risk assessment and personalized offerings. For instance, insurers leveraging cloud-based analytics saw a 15% increase in customer satisfaction in 2024 according to industry reports.

Modernizing legacy IT infrastructure is paramount for Grupo Catalana Occidente to support emerging technological capabilities. This includes AI-driven underwriting, enhanced cybersecurity measures, and seamless integration with insurtech partners. Companies that prioritize infrastructure modernization are better positioned to adapt to evolving market demands and competitive pressures.

- Scalability and Flexibility: Cloud adoption offers dynamic resource allocation, adapting to fluctuating business needs.

- Cost Efficiency: Reduced capital expenditure on hardware and optimized operational costs through pay-as-you-go models.

- Faster Service Deployment: Streamlined processes for launching new insurance products and digital customer interfaces.

- Enhanced Data Analytics: Centralized and accessible data for improved insights into customer behavior and risk management.

Grupo Catalana Occidente's technological strategy involves embracing automation, particularly Robotic Process Automation (RPA), to boost efficiency and cut costs, with the insurance industry globally achieving average cost savings of 20-30% in 2024 through such initiatives. Expanding digital channels is critical, as over 50% of new insurance policies in many European markets were sold via digital channels in 2024, underscoring the need for a strong online presence.

The company is leveraging data analytics and AI for improved risk assessment and fraud detection, vital for its diverse insurance portfolio. Personalized product offerings and predictive analytics are also key, with AI investments in the insurance sector showing significant global growth. Cybersecurity is paramount, especially given the projected $10.5 trillion annual global cost of cybercrime in 2024 and the €2.7 billion in GDPR fines issued in 2023, highlighting the financial risks of data breaches.

Grupo Catalana Occidente must also contend with InsurTech startups, which are reshaping the industry with agile, customer-centric digital platforms. The global InsurTech market was projected to exceed $10 billion by mid-2024, indicating substantial disruption. Key technologies being adopted include blockchain for smart contracts, telematics for usage-based insurance, AI/ML for enhanced analytics, and digital distribution channels.

Cloud computing is a core enabler, offering scalability and flexibility with the global cloud market projected to surpass $600 billion in 2024. This facilitates faster deployment of new digital products and improved customer satisfaction, with cloud-based analytics users seeing a 15% increase in satisfaction in 2024. Modernizing legacy IT is essential to support AI underwriting, cybersecurity, and insurtech integration.

| Technology Area | Key Impact for GCO | Industry Trend/Data (2024/2025) |

|---|---|---|

| Digital Transformation & Automation | Modernize operations, increase efficiency, reduce costs | RPA projects yield 20-30% cost savings; Digital sales >50% of new policies in EU markets |

| Data Analytics & AI | Sharpen competitive edge, improve risk assessment, fraud detection, personalize offerings | Significant global AI investment in insurance; predictive analytics anticipates market trends |

| Cybersecurity | Protect sensitive data, maintain trust, comply with regulations | Global cybercrime cost projected at $10.5T annually; €2.7B+ in GDPR fines in 2023 |

| InsurTech Integration | Stay competitive, capture new opportunities, adopt novel business models | Global InsurTech market projected >$10B by mid-2024 |

| Cloud Computing | Enhance scalability, flexibility, cost efficiency, accelerate service deployment | Global cloud market projected >$600B in 2024; Cloud analytics users see 15% higher customer satisfaction |

Legal factors

Grupo Catalana Occidente navigates a stringent regulatory landscape, particularly with the European Union's Solvency II framework governing insurance operations. This directive mandates robust capital requirements and risk management practices, directly impacting how the company manages its solvency and operational resilience.

Maintaining compliance with these intricate regulations is paramount for Grupo Catalana Occidente to retain its operating licenses and ensure financial stability. The company's ability to meet capital adequacy ratios, such as the Solvency Capital Requirement (SCR) and Minimum Capital Requirement (MCR), is continuously monitored.

Failure to adhere to these legal stipulations can lead to severe repercussions. For instance, in 2023, the European Insurance and Occupational Pensions Authority (EIOPA) reported that non-compliance issues across the EU insurance sector resulted in an aggregate of €50 million in fines, underscoring the financial and reputational risks involved.

Grupo Catalana Occidente must navigate a complex web of data protection laws, with the General Data Protection Regulation (GDPR) being a prime example. These regulations dictate how the company handles customer information, from collection to processing. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher, a substantial risk for any financial institution.

Maintaining robust data governance is crucial for Grupo Catalana Occidente to ensure compliance and safeguard customer trust. This involves implementing strong internal policies and conducting regular audits to verify adherence to privacy standards. In 2024, many companies are investing heavily in cybersecurity and data privacy training for their employees to mitigate risks associated with data breaches and non-compliance.

Consumer protection laws significantly shape Grupo Catalana Occidente's operations in the financial services sector, particularly in insurance. These regulations mandate fair marketing practices, clear policy disclosures, and robust customer service protocols. For instance, the EU's Insurance Distribution Directive (IDD) requires insurers to act honestly, professionally, and in the best interests of their clients, impacting product design and sales processes.

Adherence to these consumer protection frameworks is crucial for Grupo Catalana Occidente to prevent costly legal challenges and safeguard its reputation. In 2023, the European consumer protection authorities reported a notable increase in investigations related to unfair commercial practices in financial services, highlighting the heightened scrutiny on companies in this domain. Ensuring transparent terms and effective complaint resolution is therefore paramount.

Anti-Money Laundering (AML) and Sanctions Regulations

Grupo Catalana Occidente, like other financial institutions, must adhere to strict Anti-Money Laundering (AML) and sanctions regulations. This necessitates comprehensive internal controls and thorough customer due diligence to combat financial crime. For instance, in 2024, regulators worldwide continued to emphasize enhanced scrutiny of transactions and customer onboarding processes, impacting operational costs for compliance.

Failure to comply with these evolving legal frameworks can lead to severe penalties, including substantial fines and reputational damage. Atradius, as a credit insurer, must ensure its partners and clients also meet these standards, reinforcing the importance of robust compliance programs to maintain international business operations and avoid legal entanglements.

- Regulatory Scrutiny: Financial regulators globally, including those in the EU and US, are increasing oversight of AML and sanctions compliance in 2024-2025, demanding more sophisticated detection and reporting systems.

- Due Diligence Costs: Implementing and maintaining effective Know Your Customer (KYC) and Customer Due Diligence (CDD) processes represent a significant operational expense, with ongoing investments in technology and training.

- International Impact: Sanctions regulations, particularly those imposed by major economies, directly affect cross-border transactions and partnerships, requiring constant monitoring and adaptation by Grupo Catalana Occidente and its subsidiaries like Atradius.

Contract Law and Dispute Resolution

The legal framework surrounding insurance contracts is paramount for Grupo Catalana Occidente. In 2024, regulatory bodies continue to emphasize clarity and fairness in policy language, directly impacting how claims are processed and disputes are handled. Ambiguous contract terms can lead to increased litigation, as seen in the growing number of consumer protection cases filed annually across Europe, impacting the insurance sector.

Efficient and impartial dispute resolution mechanisms are critical for maintaining customer trust and operational efficiency. For instance, in Spain, where much of Grupo Catalana Occidente's business is concentrated, the Directorate-General for Insurance and Pension Funds (DGSFP) oversees consumer complaints. In 2023, the DGSFP reported a significant volume of insurance-related claims, highlighting the importance of robust internal and external resolution processes to manage these effectively and minimize reputational damage.

- Contract Clarity: Ensuring policy wording adheres to evolving legal standards, such as those reinforced by the European Insurance Distribution Directive (IDD), is crucial for preventing disputes and litigation.

- Dispute Resolution Efficiency: Streamlined internal claims handling and accessible external arbitration or mediation services are vital for customer satisfaction and cost management, especially given the increasing complexity of insurance claims.

- Regulatory Compliance: Adherence to national and supranational legal frameworks, including data protection laws like GDPR, directly influences operational procedures and risk management strategies for Grupo Catalana Occidente.

- Litigation Trends: Monitoring legal precedents and consumer protection trends in key markets, such as Spain and Portugal, allows for proactive adjustments to contract terms and dispute resolution protocols.

Grupo Catalana Occidente operates within a highly regulated environment, with directives like Solvency II and the Insurance Distribution Directive (IDD) setting stringent capital, risk management, and consumer protection standards.

Compliance with data protection laws such as GDPR is critical, with potential fines reaching up to 4% of global annual turnover, emphasizing the need for robust data governance. In 2024, companies are increasing investment in cybersecurity and privacy training to mitigate these risks.

The company must also navigate Anti-Money Laundering (AML) and sanctions regulations, with increased global scrutiny in 2024-2025 demanding sophisticated compliance systems and significant investment in Know Your Customer (KYC) processes.

Clear and fair insurance contract terms are legally mandated, with dispute resolution efficiency being key to customer trust and operational costs, especially given the volume of claims handled by bodies like Spain's DGSFP.

| Legal Factor | Impact on Grupo Catalana Occidente | 2023-2025 Data/Trend |

|---|---|---|

| Solvency II & Capital Requirements | Mandates robust capital and risk management, affecting operational flexibility. | EIOPA reported aggregate fines of €50 million for non-compliance in the EU insurance sector in 2023. |

| Data Protection (GDPR) | Dictates handling of customer information, with severe penalties for breaches. | Penalties can reach up to 4% of global annual turnover or €20 million. Increased investment in privacy training observed in 2024. |

| Consumer Protection (IDD) | Requires fair marketing, clear disclosures, and acting in clients' best interests. | European consumer protection authorities noted increased investigations into unfair commercial practices in financial services in 2023. |

| AML & Sanctions Compliance | Necessitates strong internal controls and customer due diligence to combat financial crime. | Global regulators increased oversight in 2024-2025, driving demand for advanced detection systems and higher KYC/CDD costs. |

Environmental factors

The escalating frequency and intensity of extreme weather events, driven by climate change, pose a significant threat to Grupo Catalana Occidente's property and casualty insurance business. In 2023, global insured losses from natural catastrophes reached an estimated $100 billion, according to Swiss Re, directly increasing claims costs for insurers like GCO. Accurately pricing these evolving risks is paramount for maintaining underwriting profitability.

Furthermore, Grupo Catalana Occidente must diligently assess its investment portfolio for exposure to both physical climate risks, such as rising sea levels impacting coastal properties, and transition risks, like policy changes affecting carbon-intensive industries. This proactive risk management is essential for safeguarding the group's long-term financial stability in a changing climate.

Grupo Catalana Occidente faces increasing demands for transparent ESG reporting from regulators and investors. This includes detailing its environmental footprint, social contributions, and governance structures. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) is expanding reporting obligations significantly for companies like GCO, with initial reporting periods beginning in 2024 for some entities.

Meeting these evolving reporting standards is crucial for maintaining investor confidence and tapping into the growing sustainable finance market. In 2023, sustainable investment funds globally saw continued inflows, underscoring investor preference for companies with strong ESG credentials.

Conversely, failing to meet these expectations could harm Grupo Catalana Occidente's reputation and limit its access to capital. Companies with poor ESG ratings often face higher borrowing costs and reduced investor interest, potentially impacting long-term growth and profitability.

The financial world is seeing a major move towards sustainable and green investments. This trend means Grupo Catalana Occidente needs to weave ESG (Environmental, Social, and Governance) factors into how it invests. By focusing on eco-friendly assets and moving away from carbon-intensive businesses, the company can tap into growing investor demand and build a more resilient financial future.

Resource Scarcity and Pollution Concerns

Concerns about resource scarcity and pollution are increasingly shaping the insurance landscape for Grupo Catalana Occidente. Industries heavily reliant on natural resources or those with significant environmental impacts face evolving risk profiles. For example, sectors with large carbon footprints might experience rising operational costs due to carbon taxes or stricter emissions standards, directly influencing their ability to meet financial obligations, a key consideration for Atradius's credit assessments.

Grupo Catalana Occidente must therefore conduct thorough assessments of these sector-specific environmental risks. The increasing global focus on sustainability, evidenced by initiatives like the EU's Green Deal aiming for climate neutrality by 2050, means that industries contributing to pollution or resource depletion could face greater regulatory pressure. This could translate into higher insurance premiums or even reduced insurability for certain activities, impacting the group's portfolio and underwriting strategies.

The financial implications are tangible. A report from the World Economic Forum in early 2024 highlighted that environmental risks, including water scarcity and biodiversity loss, are among the top global threats. For insurers like Grupo Catalana Occidente, this translates to a need to understand how these macro-level environmental challenges affect the financial health and long-term viability of the businesses they insure. For instance, a manufacturing client facing water usage restrictions due to scarcity could see production curtailed, impacting their revenue and creditworthiness.

- Increased operational costs for polluting industries due to potential carbon pricing mechanisms.

- Potential for higher insurance premiums or reduced coverage for sectors with significant environmental footprints.

- Impact of water scarcity on manufacturing and agricultural clients' financial stability.

- Growing regulatory scrutiny on industries with high emissions, affecting their creditworthiness.

Public Awareness and Green Consumerism

Growing public awareness of environmental issues is significantly shaping consumer behavior, particularly in the insurance sector. This trend is evident in the increasing demand for 'green' products and services, pushing companies like Grupo Catalana Occidente to adapt their offerings. For instance, a 2024 report indicated that over 60% of consumers consider environmental impact when making purchasing decisions, a figure expected to rise.

Grupo Catalana Occidente can leverage this shift by developing and promoting eco-friendly insurance products, such as those covering renewable energy installations or offering discounts for sustainable practices. Demonstrating a genuine commitment to environmental sustainability in its core operations, from reducing its carbon footprint to investing in green initiatives, will further enhance its brand appeal. By mid-2025, companies with strong ESG (Environmental, Social, and Governance) credentials are projected to see a 15% higher customer retention rate.

- Increased demand for sustainable products: Over 60% of consumers consider environmental impact in purchasing decisions as of 2024.

- Brand differentiation: Offering eco-friendly insurance and demonstrating operational sustainability can attract environmentally conscious customers.

- Customer retention: Companies with strong ESG credentials are expected to achieve up to 15% higher customer retention by mid-2025.

- Market opportunity: The growing green consumerism presents a significant opportunity for Grupo Catalana Occidente to innovate and capture market share.

Grupo Catalana Occidente must navigate increasing regulatory demands for environmental transparency, exemplified by the EU's CSRD, which expanded reporting obligations for companies starting in 2024. This focus on ESG reporting is crucial for investor confidence and accessing the growing sustainable finance market, with sustainable investment funds seeing continued inflows in 2023.

The company faces heightened risks from climate change, as evidenced by global insured losses from natural catastrophes reaching an estimated $100 billion in 2023. This necessitates accurate risk pricing and careful assessment of investment portfolios for physical and transition climate risks to ensure long-term financial stability.

Growing public awareness of environmental issues is driving demand for sustainable products, with over 60% of consumers considering environmental impact in purchasing decisions as of 2024. Grupo Catalana Occidente can capitalize on this by offering eco-friendly insurance and demonstrating operational sustainability, aiming for up to 15% higher customer retention by mid-2025 for companies with strong ESG credentials.

| Environmental Factor | Impact on GCO | Supporting Data/Trend |

| Climate Change & Extreme Weather | Increased claims costs, risk pricing challenges | Global insured losses from natural catastrophes ~$100 billion in 2023 (Swiss Re) |

| Regulatory Reporting (ESG) | Need for enhanced transparency, compliance costs | EU's CSRD expanding reporting obligations from 2024 |

| Sustainable Finance & Investment | Opportunity for capital and investor appeal | Continued inflows into sustainable investment funds in 2023 |

| Consumer Demand for Green Products | Market opportunity for eco-friendly offerings | Over 60% of consumers consider environmental impact in purchasing (2024) |

| Resource Scarcity & Pollution | Higher operational costs for clients, potential for increased premiums | EU Green Deal aiming for climate neutrality by 2050 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grupo Catalana Occidente is built on a robust foundation of data from official regulatory bodies, leading financial institutions, and reputable market research firms. We meticulously gather insights from economic reports, environmental impact assessments, technological advancements, and legal frameworks relevant to the insurance and financial services sectors.