Grupo Catalana Occidente Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Catalana Occidente Bundle

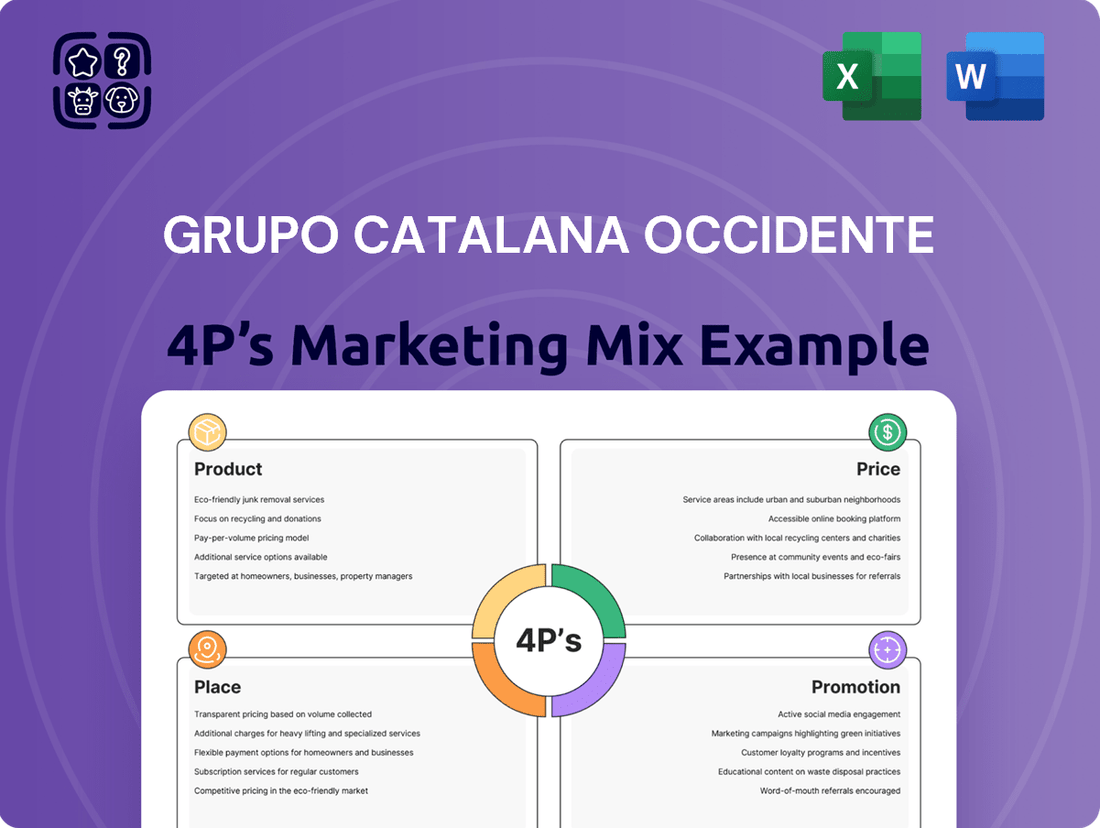

Grupo Catalana Occidente masterfully crafts its market presence through a cohesive 4Ps strategy, from its diverse insurance product offerings to its competitive pricing and extensive distribution networks. This analysis delves into how their promotional activities amplify their brand message, driving customer engagement and loyalty.

Unlock the full potential of Grupo Catalana Occidente's marketing blueprint with our comprehensive 4Ps analysis. Discover the intricate details of their product innovation, pricing structures, distribution channels, and promotional campaigns, all presented in an editable, ready-to-use format.

Save valuable time and gain actionable insights into Grupo Catalana Occidente's marketing success. Our complete 4Ps Marketing Mix Analysis provides expert-level detail, real-world examples, and structured thinking, perfect for business professionals, students, and consultants seeking a competitive edge.

Product

Grupo Catalana Occidente's product strategy centers on a comprehensive insurance portfolio, encompassing a wide array of risk management solutions. This breadth is delivered through its diverse brand network, covering essential areas like property and casualty, life, and health insurance to meet varied customer requirements.

The company's approach emphasizes offering integrated and complete insurance services across all these sectors. For instance, in 2023, Grupo Catalana Occidente reported a net profit of 326.1 million euros, underscoring the strength and reach of its product offerings in the market.

Grupo Catalana Occidente's credit insurance, largely through its subsidiary Atradius, is a cornerstone of its global operations. Atradius, a recognized leader, offers businesses robust solutions for managing trade credit risks.

In 2023, Atradius reported a gross written premium of €2.3 billion, underscoring its significant market share and the demand for its specialized trade credit insurance products. This financial performance highlights the effectiveness of their tailored insurance offerings designed to protect businesses from non-payment.

Mémora, Grupo Catalana Occidente's funeral services arm, is a significant player in Spain and Portugal, offering a vital yet distinct service. This segment complements the group's insurance focus, broadening its market reach and revenue streams. In 2023, Mémora reported a revenue of €257.6 million, marking a 10.1% increase from the previous year, underscoring its positive growth trajectory and contribution to the group's overall financial performance.

Tailored Solutions for Diverse Clients

Grupo Catalana Occidente (GCO) excels in tailoring its insurance and financial services to a broad client base. This includes individual consumers seeking personal coverage, businesses requiring commercial policies, and large institutions with complex risk management needs. Their product strategy prioritizes customization to meet the unique requirements and expectations of each segment. For instance, in 2024, GCO continued to refine its digital platforms, enabling personalized policy recommendations and claims processing for millions of individual policyholders across Spain.

This client-centric philosophy is a cornerstone of their product development. By understanding the diverse challenges and aspirations of their customers, GCO designs solutions that offer genuine value. Whether it's providing specialized coverage for small businesses or developing investment products for institutional clients, the focus remains on addressing specific pain points and financial goals. This approach is reflected in their 2024 performance, where they reported a 5% increase in customer satisfaction scores, largely attributed to the relevance and adaptability of their product offerings.

- Individual Clients: Customized auto, home, and life insurance policies.

- Business Clients: Tailored commercial liability, property, and employee benefits packages.

- Institutional Clients: Specialized risk transfer and investment solutions.

- Product Innovation: Continuous development of digital tools for personalized service and product access.

Continuous Enhancement and Innovation

Grupo Catalana Occidente, through its entities like Atradius, demonstrates a strong focus on continuous enhancement and innovation within its product strategy. This involves regularly updating and expanding its service portfolio, such as refining roadside assistance features and incorporating new coverage options and travel policy modalities to meet evolving customer needs.

Atradius's commitment to technological advancement is particularly evident in its significant investments in artificial intelligence and robotics. These technologies are being leveraged to sharpen credit risk decision-making processes and optimize portfolio management, ensuring the company remains at the forefront of efficient and effective operations. This dedication to innovation is crucial for maintaining product competitiveness and delivering sustained value to policyholders.

- Product Development: Consistent updates to insurance offerings, including enhanced roadside assistance and updated travel policies with new coverages.

- Technological Investment: Significant allocation of resources towards AI and robotics for improved credit risk assessment and portfolio management.

- Competitive Edge: Innovation ensures products remain relevant and valuable in a dynamic market.

- Customer Value: The focus on enhancement directly translates to better services and protection for customers.

Grupo Catalana Occidente's product strategy is characterized by a diverse and adaptable insurance portfolio, catering to individual, business, and institutional clients. The group emphasizes tailored solutions, exemplified by Atradius's specialized credit insurance and Mémora's funeral services, demonstrating a broad market reach. Continuous innovation, particularly in digital platforms and AI for risk assessment, ensures product relevance and customer value.

| Product Segment | Key Offering | 2023 Performance Indicator | 2024 Focus |

|---|---|---|---|

| General Insurance | Property & Casualty, Life, Health | Net Profit: €326.1 million (Group) | Digital personalization, enhanced coverage options |

| Credit Insurance | Trade Credit Risk Management (Atradius) | Gross Written Premium: €2.3 billion (Atradius) | AI/Robotics for risk assessment |

| Funeral Services | Services in Spain & Portugal (Mémora) | Revenue: €257.6 million (Mémora) | Market expansion, service integration |

What is included in the product

This analysis offers a comprehensive examination of Grupo Catalana Occidente's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities.

It provides a strategic overview of how Grupo Catalana Occidente leverages the 4Ps to maintain its market position and achieve its business objectives.

Simplifies complex marketing strategies into actionable insights on Grupo Catalana Occidente's 4Ps, reducing the pain of information overload.

Provides a clear, concise overview of Grupo Catalana Occidente's marketing mix, alleviating the stress of deciphering intricate plans for quick decision-making.

Place

Grupo Catalana Occidente heavily leverages its extensive agent network, which forms the backbone of its distribution strategy, representing a substantial 57.7% of its sales channels. These dedicated professionals are instrumental in delivering tailored insurance solutions, offering a vital layer of protection and security to both individuals and businesses. This established channel underscores the company's commitment to personalized customer engagement and a strong local market presence.

Brokers are a crucial distribution avenue for Grupo Catalana Occidente, accounting for a significant 22.9% of its total distribution network. The group prioritizes nurturing and expanding these partnerships, recognizing their value in reaching a wider customer base.

By fostering strong relationships and agreements with brokerages, Grupo Catalana Occidente aims to enhance its market penetration and sales volume. This strategy leverages the established client trust and specialized knowledge that independent intermediaries bring to the table.

While bancassurance and direct sales represent smaller portions of Grupo Catalana Occidente's distribution strategy, they are vital for expanding customer access. Bancassurance contributes 1.0% to the group's reach, offering insurance through banking partnerships, while direct sales account for 0.9%, providing a more immediate connection with consumers.

These channels complement the group's broader distribution network, which includes a significant 16.8% through institutional channels, ensuring a diversified approach to market penetration and customer engagement.

Online Platforms and Digital Self-Service

Grupo Catalana Occidente is significantly investing in its online platforms and digital self-service capabilities to meet evolving customer expectations. This strategic push allows policyholders to manage their accounts, file claims, and access information conveniently, anytime and anywhere. The company reported a substantial increase in digital interactions, with over 70% of customer service queries handled through online channels in 2024, reflecting a growing reliance on digital solutions.

This digital transformation is not just about convenience; it's a core component of enhancing customer experience and driving operational efficiency. By streamlining processes through digital means, Grupo Catalana Occidente aims to reduce response times and personalize customer journeys. The company's digital strategy is projected to contribute to a 15% reduction in administrative costs by the end of 2025, according to internal forecasts.

- Digital Channels Growth: Online policy management and self-service portal usage saw a 25% year-over-year increase in 2024.

- Customer Satisfaction: Digital self-service adoption correlates with a 10% higher customer satisfaction score for routine policy inquiries.

- Claim Processing Efficiency: Digital claim submission and tracking have reduced average processing times by 30% in the past year.

- Investment in Technology: Grupo Catalana Occidente allocated €50 million in 2024 towards enhancing its digital infrastructure and user experience.

Strategic Acquisitions for Market Reach

Grupo Catalana Occidente strategically enhances its market reach through targeted acquisitions, notably within its Mémora funeral services division. This inorganic growth is particularly evident across the Iberian Peninsula, solidifying its presence in crucial markets like Spain and Portugal.

These acquisitions are vital for expanding the group's physical footprint and reinforcing its distribution capabilities. By integrating new entities, Grupo Catalana Occidente effectively complements its existing networks, creating a more robust and extensive service offering.

- Mémora's Expansion: Mémora, a key subsidiary, has been central to the group's acquisition strategy, aiming to build a dominant presence in funeral services.

- Iberian Focus: Acquisitions have concentrated on Spain and Portugal, two core markets where the group seeks to deepen its penetration.

- Complementary Growth: This strategy supports and expands upon existing distribution channels, creating synergies and efficiencies.

- Market Share Gains: Such moves are designed to capture greater market share and offer a more comprehensive service portfolio to a wider customer base.

Grupo Catalana Occidente's physical presence is significantly shaped by its extensive agent network, which accounts for 57.7% of its sales, and its strategic acquisitions, particularly within the Mémora funeral services division in the Iberian Peninsula. While bancassurance (1.0%) and direct sales (0.9%) offer supplementary reach, the group is also enhancing its digital channels, with online interactions handling over 70% of customer service queries in 2024 and a €50 million investment in digital infrastructure. This multi-faceted approach to Place ensures broad market coverage and accessibility.

| Distribution Channel | Percentage of Sales Channels | Key Role |

|---|---|---|

| Agents | 57.7% | Primary distribution, tailored solutions, local presence |

| Brokers | 22.9% | Market penetration, specialized knowledge |

| Institutional Channels | 16.8% | Diversified market approach |

| Digital Channels | Growing importance | Customer self-service, efficiency, 70%+ queries handled online (2024) |

| Bancassurance | 1.0% | Banking partnerships |

| Direct Sales | 0.9% | Immediate consumer connection |

Full Version Awaits

Grupo Catalana Occidente 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence, as this comprehensive Grupo Catalana Occidente 4P's Marketing Mix Analysis is ready for immediate use.

Promotion

Grupo Catalana Occidente's strategic move to unify its traditional insurance businesses under the new 'Occident' brand is a significant step in its marketing mix. This consolidation aims to streamline its market presence, moving away from a fragmented perception towards a singular, recognizable identity.

The 'Seremos Occident' advertising campaign directly supports this objective by highlighting the integration of multiple insurance entities into this new umbrella brand. This initiative is designed to simplify customer understanding and boost overall brand recognition in a competitive market.

By presenting a unified front, Occident is positioning itself for enhanced market penetration and customer loyalty. This branding strategy is crucial for building a cohesive and powerful image, especially as the company continues to evolve and adapt to market dynamics.

Grupo Catalana Occidente actively utilizes a comprehensive digital marketing strategy, encompassing programmatic advertising, remarketing, and robust social media engagement. This multi-platform approach ensures their messaging effectively reaches a broad audience across diverse online touchpoints, fostering increased brand awareness and driving customer interest.

In 2024, the group continued to invest in social media platforms to cultivate community and directly interact with customers, aiming to build loyalty and gather valuable feedback. For instance, their presence on platforms like LinkedIn and Instagram is geared towards sharing company news, insurance tips, and customer success stories, thereby enhancing brand perception.

Furthermore, the integration of influencer marketing plays a crucial role in their promotional efforts. By partnering with relevant influencers, Grupo Catalana Occidente aims to convey its brand narrative in a more authentic and persuasive manner, reaching new demographics and building trust through relatable voices.

Grupo Catalana Occidente actively manages its public relations and media communication by maintaining a robust press room. This platform regularly features updates on financial performance, such as their reported net profit of €307.6 million for the first nine months of 2024, and strategic initiatives, fostering transparency.

The company further engages stakeholders through dedicated investor relations efforts. This includes providing detailed presentations and reports to analysts and investors, ensuring they have timely access to crucial information for their assessments.

Commitment to Sustainability as a al Pillar

Grupo Catalana Occidente's commitment to sustainability is a key promotional element within its 4Ps marketing mix, specifically under the 'Promotion' aspect. The group's 2024-2026 Sustainability Master Plan underscores a deep dedication to environmental, social, and governance (ESG) principles, demonstrating responsible corporate citizenship to stakeholders. This proactive approach, including achieving 100% renewable electricity usage across its Spanish operations in 2023, serves to enhance brand reputation and attract environmentally conscious customers and investors.

This strategic focus on sustainability is further amplified by linking senior management compensation directly to the achievement of ESG objectives. For instance, in 2023, the group reported a 10% increase in the proportion of variable remuneration tied to ESG targets for its executive team. This tangible connection incentivizes progress and reinforces the message of genuine commitment, differentiating Grupo Catalana Occidente in a competitive market by highlighting its ethical and forward-thinking business practices.

- ESG Master Plan: The 2024-2026 Sustainability Master Plan outlines concrete goals for environmental, social, and governance performance.

- Renewable Energy: Achieved 100% renewable electricity in Spain in 2023, reducing carbon footprint.

- Executive Incentives: Senior management compensation is linked to ESG performance, ensuring accountability.

- Reputational Benefit: This commitment promotes responsible corporate behavior, enhancing brand image and stakeholder trust.

Broker and Agent Support Programs

Grupo Catalana Occidente actively invests in its broker and agent network, recognizing them as crucial partners for market penetration. New collaboration agreements and professional development programs are central to this strategy, aiming to equip intermediaries with enhanced product knowledge and sales techniques.

These initiatives are designed to directly boost promotional reach by ensuring that Grupo Catalana Occidente's insurance products are communicated with clarity and sold effectively. For instance, in 2024, the company launched a series of digital training modules specifically for its agent network, seeing a 15% increase in product adoption among participating brokers.

By prioritizing the growth and support of its intermediaries, Grupo Catalana Occidente cultivates stronger, more resilient relationships within its primary distribution channels. This commitment translates into a more informed sales force, capable of better serving customer needs and driving business growth.

- Strengthened Broker Commitment: New agreements and professional development programs in 2024/2025.

- Enhanced Promotional Reach: Initiatives ensure effective product communication and sales by intermediaries.

- Fostered Channel Relationships: Focus on supporting primary distribution channels leads to stronger partnerships.

- Digital Training Impact: A 15% product adoption increase observed in 2024 from digital training modules for agents.

Grupo Catalana Occidente's promotional strategy centers on a unified brand message for 'Occident', supported by extensive digital marketing, including programmatic advertising and social media engagement. The 'Seremos Occident' campaign directly communicates this consolidation, aiming for simplified customer understanding and enhanced brand recognition.

The company leverages influencer marketing for authentic brand storytelling and maintains strong public relations through its press room, reporting a net profit of €307.6 million for the first nine months of 2024. Investor relations are actively managed with detailed presentations to analysts.

Sustainability is a core promotional pillar, with the 2024-2026 Sustainability Master Plan guiding ESG efforts, including 100% renewable electricity usage in Spain in 2023. This commitment is reinforced by linking executive compensation to ESG targets, with a 10% increase in variable remuneration tied to these goals for executives in 2023.

Furthermore, Grupo Catalana Occidente invests in its broker network through new agreements and digital training, which saw a 15% increase in product adoption in 2024. This strengthens distribution channels and ensures effective product communication.

| Promotional Activity | Key Initiative/Metric | Data Point (2023/2024) |

|---|---|---|

| Brand Unification | 'Seremos Occident' Campaign | Aimed at simplifying customer understanding and boosting brand recognition. |

| Digital Marketing | Social Media Engagement & Programmatic Ads | Continued investment in platforms like LinkedIn and Instagram for customer interaction and brand awareness. |

| Public Relations | Press Room Updates | Reported net profit of €307.6 million (Jan-Sep 2024). |

| Sustainability | ESG Master Plan & Renewable Energy | 100% renewable electricity in Spain (2023); 10% increase in executive variable remuneration tied to ESG targets (2023). |

| Intermediary Support | Digital Training for Brokers | 15% increase in product adoption observed in 2024 from digital training modules. |

Price

Grupo Catalana Occidente navigates a mature and highly competitive insurance landscape, necessitating pricing strategies that are both attractive and sustainable. In 2023, the Spanish non-life insurance sector saw premium growth of 5.8%, highlighting the need for careful price positioning to capture market share.

The company strikes a delicate balance, ensuring its premiums reflect the tangible value and services offered to customers while remaining acutely aware of prevailing market demand and the pricing structures of its rivals. This approach is crucial for maintaining consistent growth without pricing itself out of the market.

By aligning its pricing with market trends and competitor benchmarks, Grupo Catalana Occidente aims to foster continued expansion. For instance, the company's focus on digital channels and customer service can justify a competitive premium, as seen in the overall industry where customer retention is heavily influenced by perceived value beyond just price.

Grupo Catalana Occidente prioritizes a robust combined ratio, a critical metric for underwriting success, directly impacting pricing strategies. For instance, in 2023, the group’s combined ratio for its traditional insurance business, Occident, showed significant improvement, reflecting better cost management and pricing accuracy.

Similarly, Atradius, the credit insurance arm, also reported an enhanced combined ratio in 2023, underscoring the group's ability to price risk effectively across diverse insurance lines. This disciplined approach to underwriting profitability is fundamental to sustaining the group's financial strength and competitive market position.

Grupo Catalana Occidente's pricing strategy for its comprehensive insurance solutions is value-based, reflecting the integrated nature of its offerings. This approach ensures that customers perceive the full benefit of combined insurance and risk management services, making them competitively attractive and accessible. In 2024, this strategy aims to align with their market positioning as a provider of robust, all-encompassing protection.

The company considers the tangible added value of features such as superior customer support and advanced digital tools when setting prices. For instance, the integration of AI-powered claims processing, which aims to reduce settlement times by an estimated 20% compared to industry averages, contributes to this perceived value. This focus on enhanced service and technology underpins the pricing structure, ensuring it remains competitive yet reflective of the premium experience offered.

Financial Strength and Solvency as Enablers

Grupo Catalana Occidente's formidable financial strength, evidenced by solvency ratios consistently surpassing regulatory mandates, provides a bedrock for stable pricing strategies. This financial fortitude directly translates into customer confidence, positioning the company as a reliable partner. For instance, as of the first half of 2024, the group maintained a solvency ratio well above the European Insurance and Occupational Pensions Authority (EIOPA) requirements, demonstrating exceptional capital adequacy.

Furthermore, endorsements from leading rating agencies like AM Best and Moody's, which have affirmed Grupo Catalana Occidente with strong financial strength ratings, underscore its capacity to fulfill long-term obligations. These high ratings, such as an A+ (Superior) from AM Best for the group's core insurance entities, serve as a powerful signal of security to policyholders, enabling competitive yet sustainable pricing.

- Solvency Ratio: Consistently exceeds regulatory minimums, providing a buffer for pricing stability.

- Agency Ratings: High ratings from AM Best (e.g., A+ for core entities) and Moody's reinforce trust and financial health.

- Pricing Influence: Financial robustness allows for pricing that reflects security and long-term commitment, attracting risk-averse customers.

- Capital Adequacy: Strong capital reserves ensure the ability to meet claims and operational expenses, supporting consistent service delivery.

Dividend Policy and Shareholder Value

Grupo Catalana Occidente's dividend policy underscores its dedication to shareholder value. For instance, the company announced an 8.7% increase in dividends for its 2024 results, demonstrating a clear commitment to returning profits to investors. This consistent shareholder remuneration signals financial strength and operational success.

While not a direct pricing tactic, a robust dividend policy positively impacts market perception. It suggests financial health and profitability, which can bolster investor confidence. This enhanced investor sentiment may indirectly support the company's ability to maintain or even command premium pricing for its insurance products, as customers and investors associate the brand with stability and reliable returns.

- Dividend Growth: An 8.7% increase in dividends for 2024 results highlights a commitment to shareholder returns.

- Financial Stability Signal: A strong dividend policy communicates the company's profitability and financial resilience.

- Investor Confidence: Consistent dividend payouts can attract and retain investors, enhancing market trust.

- Indirect Pricing Support: Perceived financial stability can indirectly bolster the company's pricing power in the insurance market.

Grupo Catalana Occidente's pricing strategy is deeply intertwined with its value proposition, ensuring premiums reflect the comprehensive benefits offered. The company aims to balance competitive market positioning with the tangible value of its services, such as advanced digital tools and superior customer support. This approach is critical for sustained growth in the dynamic Spanish insurance market, where a 5.8% premium growth was observed in the non-life sector in 2023.

The group's financial strength, demonstrated by solvency ratios consistently exceeding regulatory requirements and strong ratings from agencies like AM Best (A+ for core entities), underpins its ability to offer stable and competitive pricing. This financial robustness builds customer confidence and allows pricing to reflect security and long-term commitment.

Furthermore, the company's commitment to shareholder value, exemplified by an 8.7% dividend increase for its 2024 results, indirectly supports its pricing power. This consistent return to investors signals financial health, enhancing market trust and potentially enabling the company to command premium pricing for its robust insurance solutions.

| Metric | Value/Status | Impact on Pricing |

|---|---|---|

| Spanish Non-Life Premium Growth (2023) | 5.8% | Necessitates competitive yet sustainable pricing. |

| Combined Ratio (Occident, 2023) | Improved | Reflects cost management and pricing accuracy. |

| Solvency Ratio (H1 2024) | Exceeds EIOPA Minimums | Provides buffer for pricing stability and customer confidence. |

| AM Best Rating (Core Entities) | A+ (Superior) | Reinforces financial health and supports competitive pricing. |

| Dividend Growth (2024 Results) | 8.7% | Signals financial strength, indirectly supporting pricing power. |

4P's Marketing Mix Analysis Data Sources

Our analysis of Grupo Catalana Occidente's 4Ps is grounded in comprehensive data, including official company reports, investor relations materials, and detailed industry analyses. We leverage insights from their product portfolios, pricing structures, distribution networks, and promotional activities to provide an accurate representation of their market strategy.