Groupon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupon Bundle

Groupon's unique business model presents significant strengths in customer acquisition and merchant partnerships, but also faces challenges from intense competition and evolving consumer habits. Understanding these dynamics is crucial for navigating its market position.

Want the full story behind Groupon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Groupon benefits from significant brand recognition, a valuable asset cultivated over more than ten years in operation. This established presence continues to draw in a steady stream of consumers actively seeking deals and businesses eager for increased visibility.

The company's enduring brand familiarity plays a crucial role in retaining a substantial customer base, even when facing market volatility and intense competition. As of early 2024, Groupon's brand remains a recognized name in the e-commerce sector, attracting users searching for discounted goods and services.

Groupon boasts a significant customer base, with around 15.4 million active customers worldwide as of the fourth quarter of 2024. This large audience, especially concentrated in North America, is a major asset for attracting new merchants and boosting sales volume.

Having millions of engaged users means Groupon can offer merchants access to a broad market, making it an attractive platform for advertising and promotions. This extensive reach is a key competitive advantage in the crowded local deals sector.

Groupon boasts an extensive network of merchant partnerships, a key strength cultivated over its history. This vast web of relationships allows the company to offer a wide array of deals across numerous categories, catering to diverse consumer interests.

As of the fourth quarter of 2024, Groupon's platform showcased more than 250,000 active deals. This sheer volume is crucial for drawing in a substantial customer base and guaranteeing a consistent flow of attractive, discounted offerings.

These deep-rooted merchant relationships are the bedrock of Groupon's deal sourcing capabilities and its overall market standing. They are fundamental to maintaining its competitive edge in the dynamic deals and discounts sector.

Focus on High-Margin Local Experiences

Groupon's strategic focus on high-margin local experiences, such as 'Things to Do,' travel, and beauty services, is a key strength. This specialization allows the company to differentiate itself from general e-commerce giants and cater to consumer demand for unique, localized activities.

This emphasis has demonstrably driven growth, evidenced by an 11% acceleration in North America Local billings during the first quarter of 2025. Such targeted efforts enable Groupon to capture value in growing market segments.

- Focus on High-Margin Local Experiences: Prioritizing deals in categories like 'Things to Do,' travel, and beauty/wellness.

- Recent Growth Acceleration: North America Local billings saw an 11% increase in Q1 2025.

- Differentiation: Sets Groupon apart from broad e-commerce platforms.

- Market Tap: Allows access to growing consumer spending segments.

Improved Financial Performance and Debt Restructuring

Groupon has shown a marked improvement in its financial health, reporting positive adjusted EBITDA and free cash flow for 2024. Projections indicate this upward trend is set to continue into 2025, signaling a more robust operational performance.

A key factor in this strengthening is the successful debt restructuring undertaken in early 2025. This initiative effectively reduced net debt from approximately $500 million down to $300 million.

The reduction in debt directly translates to lower interest expenses, freeing up capital and significantly enhancing Groupon's financial flexibility. This healthier balance sheet and increased operational efficiency are critical strengths.

- Improved Profitability: Achieved positive adjusted EBITDA in 2024, with expectations for continued growth in 2025.

- Enhanced Cash Flow: Generated positive free cash flow in 2024, indicating strong operational cash generation.

- Debt Reduction: Successfully lowered net debt from $500 million to $300 million in early 2025.

- Increased Financial Flexibility: Reduced interest expenses due to debt restructuring, allowing for greater strategic maneuverability.

Groupon's significant brand recognition, built over a decade, continues to attract both consumers seeking deals and businesses aiming for visibility. As of early 2024, this established presence remains a draw in the e-commerce landscape.

The company maintains a substantial customer base, with approximately 15.4 million active customers globally as of Q4 2024, particularly strong in North America. This large audience provides a significant advantage for merchant acquisition and sales volume.

Groupon leverages an extensive network of merchant partnerships, enabling it to offer a diverse range of deals across many categories. This broad selection, featuring over 250,000 active deals in Q4 2024, is key to attracting and retaining its customer base.

A strategic focus on high-margin local experiences, such as 'Things to Do' and beauty services, differentiates Groupon from broader e-commerce platforms. This specialization fueled an 11% acceleration in North America Local billings in Q1 2025.

Groupon's financial health has improved, achieving positive adjusted EBITDA and free cash flow in 2024, with continued positive trends expected for 2025. A successful debt restructuring in early 2025 reduced net debt from $500 million to $300 million, enhancing financial flexibility.

| Metric | 2024 (Approx.) | 2025 (Projected) |

|---|---|---|

| Active Customers (Millions) | 15.4 (Q4 2024) | N/A |

| Active Deals | >250,000 (Q4 2024) | N/A |

| North America Local Billings Growth | N/A | +11% (Q1 2025) |

| Net Debt (Millions USD) | ~$500M (Early 2025 - Pre-restructure) | ~$300M (Early 2025 - Post-restructure) |

| Profitability | Positive Adjusted EBITDA | Continued Growth Expected |

| Cash Flow | Positive Free Cash Flow | Continued Growth Expected |

What is included in the product

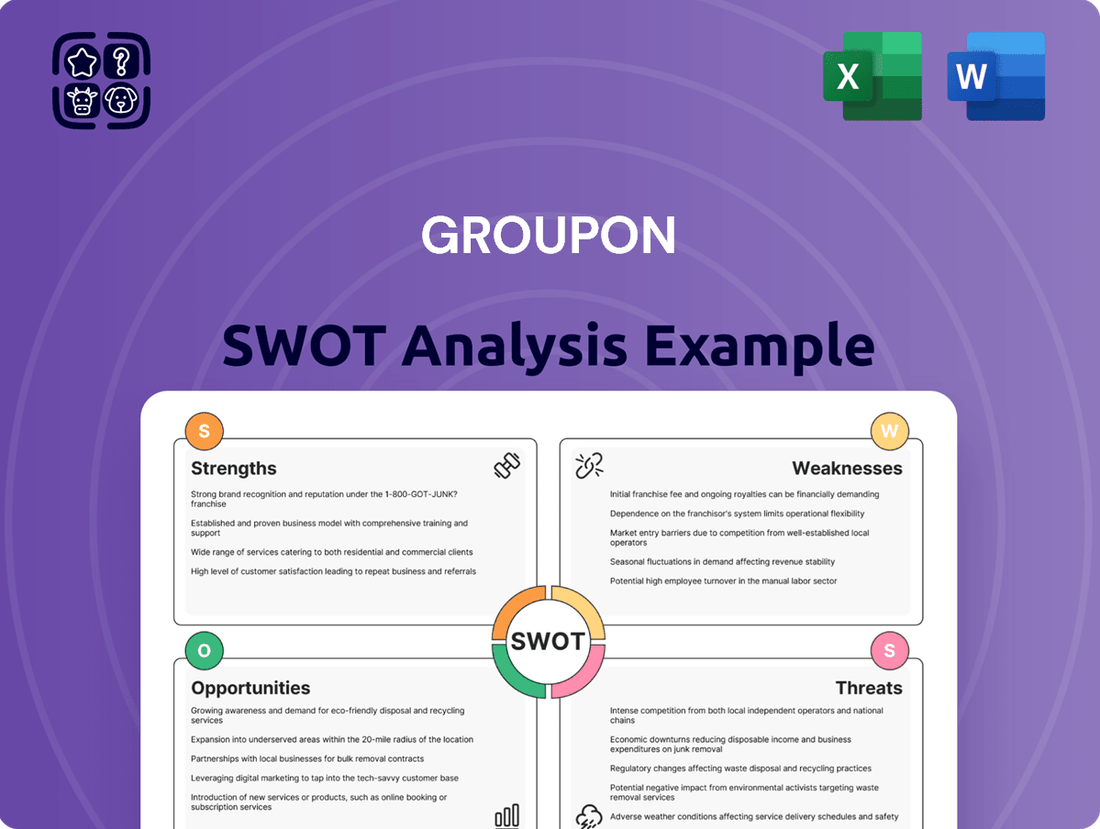

Delivers a strategic overview of Groupon’s internal and external business factors, highlighting its brand recognition and customer base as strengths, while acknowledging challenges like declining revenue and increasing competition.

Offers a clear breakdown of Groupon's competitive landscape, highlighting areas for strategic improvement and risk mitigation.

Weaknesses

Groupon faces significant headwinds with its customer base, experiencing a 6% year-over-year decline in active customers as of December 31, 2024. This persistent high churn rate indicates a struggle to keep users engaged beyond initial deal-seeking behavior.

A key issue is that many customers acquired through heavily discounted offers don't convert into repeat purchasers. Merchants often find these deal-driven customers are less likely to return for full-price transactions, undermining efforts to build a loyal customer cohort.

This cycle of acquisition and churn directly impacts the long-term viability of Groupon's customer base and negatively affects merchant satisfaction. The focus on attracting new users via discounts, rather than fostering sustained engagement, presents a fundamental challenge to the business model.

Groupon's core strategy of offering deep discounts presents a significant weakness, raising questions about its long-term financial viability. This reliance on steep price reductions can erode profit margins for both Groupon and the participating merchants.

While these deals attract customers, they often fail to foster sustained loyalty or encourage repeat business for merchants, potentially leading to higher churn rates. This cycle makes it difficult to build a stable, profitable customer base.

The financial performance underscores these concerns. For instance, despite some revenue beats, Groupon reported a significant net loss in the fourth quarter of 2024, indicating persistent challenges in translating sales volume into consistent profitability.

Groupon's appeal to merchants can be inconsistent, with many businesses finding that the deep discounts offered aren't profitable and don't foster lasting customer relationships. This has led some merchants to withdraw from the platform, forcing Groupon to invest more in attracting new partners and ensuring a steady supply of attractive deals.

Execution Risks with Platform Migrations and Innovation

Groupon has encountered significant operational hurdles, particularly with its platform migrations. These backend shifts have led to performance degradation, negatively affecting customer retention. For instance, in Q3 2023, the company reported a continued decline in active customers, partly attributed to these technical disruptions.

The company is actively working on modernizing its technology and improving its mobile application. However, these ambitious projects carry substantial execution risks. A smooth transition is critical for enhancing customer experience and streamlining operations, which are key to its recovery strategy.

- Platform Migration Challenges: Past backend migrations have resulted in performance issues, impacting user experience and customer loyalty.

- Innovation Execution Risk: Modernizing the platform and mobile app, while necessary, presents inherent risks in successful implementation.

- Customer Retention Impact: Technical glitches and performance problems have directly correlated with a decrease in active customer accounts.

- Strategic Importance: Successful execution of these tech initiatives is paramount for improving user engagement and operational efficiency.

Intense Competition and Limited Differentiation

Groupon faces a crowded marketplace, contending with a multitude of online discount providers and major e-commerce players such as Amazon and Google. This fierce competition often leads to pressure on profit margins and makes it difficult for Groupon to stand out from its rivals.

The constant need to offer discounts to attract customers can erode profitability and hinder the development of unique value propositions.

- Market Saturation: The daily deals sector is highly saturated, with many platforms offering similar services.

- Price Wars: Intense competition often forces businesses to engage in price wars, reducing profit margins for both Groupon and its merchants.

- Lack of Unique Selling Proposition: In 2023, a significant portion of Groupon's offerings were commoditized, making it hard to differentiate from competitors who could easily replicate deals.

Groupon's core weakness lies in its inability to cultivate lasting customer loyalty, evidenced by a 6% year-over-year decline in active customers by the end of 2024. This high churn rate stems from a business model heavily reliant on deep discounts, which attracts deal-seekers rather than repeat, full-price customers, impacting merchant satisfaction and long-term viability.

The company's reliance on aggressive discounting erodes profit margins for both Groupon and its partners, creating a cycle where customers acquired through deals are less likely to return for full-price purchases. This makes building a stable, profitable customer base a significant challenge.

Operational issues, including past platform migration challenges that led to performance degradation and negatively impacted customer retention, further exacerbate these weaknesses. For example, Q3 2023 saw a continued decline in active customers, partly attributed to these technical disruptions.

Groupon also faces intense competition in a saturated market, forcing it into price wars that compress profit margins and make differentiation difficult. The lack of a strong unique selling proposition in 2023 meant many offerings were easily replicable by competitors.

Full Version Awaits

Groupon SWOT Analysis

This is the same Groupon SWOT analysis document included in your download. The full content, detailing strengths, weaknesses, opportunities, and threats, is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, offering a comprehensive look at Groupon's strategic position, becomes available after checkout.

The file shown below is not a sample—it’s the real Groupon SWOT analysis you'll download post-purchase, in full detail, providing actionable insights.

Opportunities

Groupon can capitalize on its strength in local markets by expanding high-margin deals in sectors like travel, beauty, and gifting. This focus helps decrease reliance on unpredictable national promotions.

The company's 'Things to Do' segment showed strong growth, with North America Local billings also accelerating. This momentum suggests a clear path for increasing profitability and market share by prioritizing these lucrative areas.

Groupon can seize a significant opportunity by embracing technological advancements, particularly in mobile and artificial intelligence (AI). This allows for a more optimized platform, enhancing the overall user experience and enabling the delivery of highly targeted deals. For instance, by mid-2024, mobile commerce continued its upward trajectory, with a significant portion of Groupon's transactions already occurring on mobile devices, highlighting the importance of this channel.

Integrating AI offers a powerful avenue for improvement. AI can significantly boost deal matching accuracy and personalize recommendations, leading to a better customer journey. Furthermore, AI-powered chatbots can streamline customer service, potentially lowering customer acquisition costs and increasing conversion rates. Early reports from 2024 indicated that companies leveraging AI for personalized marketing saw an average increase of 10-15% in engagement metrics.

Focusing on keeping existing customers and merchants is a significant chance for Groupon to grow. By making things more personal and offering better tools for businesses, especially with their 'Wow Deals,' they can encourage more frequent buying and build stronger customer loyalty. This focus on retention is crucial for a stable user base and solidifying partnerships with local businesses.

Strategic Partnerships and Market Expansion

Groupon can significantly boost its market presence by forging strategic alliances with major e-commerce and technology players. These collaborations could unlock new customer segments and integrate Groupon's offerings into broader digital ecosystems, thereby diversifying revenue. For instance, a partnership with a leading travel booking site could present localized deals to a captive audience of travelers, a market where Groupon has historically seen strong engagement.

Expanding into new geographic regions and emerging market verticals presents a substantial growth avenue. Identifying underserved areas with a burgeoning middle class and a strong appetite for local deals can fuel expansion. Groupon's strategy in 2024 and 2025 is likely to focus on markets where digital adoption is rapidly increasing, allowing for efficient penetration and scaling of its local commerce model.

Key opportunities for strategic expansion include:

- Forging partnerships with established e-commerce platforms to reach new customer bases.

- Expanding into high-growth international markets, leveraging local market insights.

- Developing new service verticals, such as health and wellness or home services, to cater to evolving consumer needs.

- Acquiring or partnering with complementary technology companies to enhance user experience and operational efficiency.

Optimizing Marketing Spend and Customer Acquisition

Groupon has a significant opportunity to refine its marketing strategies, particularly by emphasizing performance marketing channels and leveraging social media influencers. This focus can lead to more cost-effective customer acquisition. For instance, in 2024, companies that heavily invested in influencer marketing saw an average ROI of $5.20 for every dollar spent, demonstrating the potential for improved marketing spend efficiency.

By enhancing its data analytics capabilities, Groupon can gain deeper insights into customer behavior and preferences. This allows for the creation of highly targeted email campaigns and personalized offers, which are crucial for maximizing conversion rates. Data suggests that segmented email campaigns can achieve open rates up to 40% higher than non-segmented ones, indicating a strong potential for engagement.

- Focus on performance marketing: Shift budget towards channels with measurable conversion rates.

- Leverage social media influencers: Partner with influencers to reach new, engaged audiences.

- Implement targeted email campaigns: Utilize data analytics for personalized customer communication.

- Improve marketing ROI: Measure and optimize campaigns for maximum efficiency and customer acquisition.

Groupon can leverage its existing customer base and merchant network by focusing on customer retention and loyalty programs. By offering more personalized experiences and exclusive deals, the company can encourage repeat business and strengthen merchant relationships.

The company has a clear opportunity to expand its offerings into new service categories that align with current consumer trends, such as health and wellness or home services. This diversification can attract new customer segments and reduce reliance on traditional deal categories.

Strategic partnerships with larger e-commerce platforms or technology providers could significantly broaden Groupon's reach and customer acquisition channels. Integrating its local deals into broader digital ecosystems offers a pathway to new markets and enhanced brand visibility.

Further investment in AI and mobile technology presents a chance to optimize the user experience, improve deal targeting, and streamline operations. By mid-2024, mobile commerce continued its strong growth, with a substantial portion of Groupon's transactions already happening on mobile, underscoring the importance of this channel.

| Opportunity Area | Description | Potential Impact | Relevant Data Point (2024/2025 Focus) |

|---|---|---|---|

| Customer Retention & Loyalty | Enhance personalization and loyalty programs for repeat business. | Increased customer lifetime value and reduced churn. | Companies focusing on retention can see up to a 5x increase in profitability compared to new customer acquisition. |

| Service Vertical Expansion | Introduce new categories like health, wellness, and home services. | Attract new demographics and diversify revenue streams. | The global wellness market is projected to reach $7 trillion by 2025, indicating strong consumer demand. |

| Strategic Partnerships | Collaborate with e-commerce and tech giants. | Expand market reach and access new customer segments. | Partnerships can drive an average of 10-20% revenue growth for participating businesses. |

| Technology Advancement (AI/Mobile) | Optimize platform with AI for personalization and mobile-first experience. | Improved user engagement, conversion rates, and operational efficiency. | AI in marketing can boost engagement by 10-15%; mobile transactions continue to dominate e-commerce. |

Threats

Groupon confronts formidable competition from e-commerce behemoths like Amazon and Google, who are actively expanding into the deals sector. This intense rivalry, coupled with the proliferation of specialized niche platforms, puts significant pressure on Groupon's profit margins and complicates efforts to stand out.

Consumers are increasingly seeking personalized digital deals, a trend that directly challenges Groupon's traditional daily deal model. This shift means platforms need to offer more tailored experiences rather than one-size-fits-all discounts.

The decline in daily deal platform usage since 2022, with many consumers migrating to mobile apps for spontaneous discount hunting, highlights a significant threat. For instance, a 2023 report indicated a 15% year-over-year decrease in engagement with traditional deal sites among a key demographic.

To stay relevant, Groupon must continuously adapt its offerings and user experience, focusing on mobile-first strategies and personalized recommendations. Failure to do so risks further alienation of a consumer base that now expects seamless, individualized digital interactions for savings.

Economic uncertainties, such as persistent inflation and potential job market slowdowns, are a significant threat to Groupon. These factors directly impact consumers' ability to spend on non-essential items, which includes the discounted deals Groupon offers.

For instance, rising inflation in 2024 has already squeezed household budgets, leading many to cut back on discretionary purchases. This cautious consumer behavior can cause fluctuations in demand for Groupon's services, impacting its billings and overall revenue streams.

The macroeconomic volatility creates a direct risk to Groupon's financial performance, as a reduction in discretionary spending by consumers translates to fewer transactions and lower revenue for the company.

Merchant Churn and Difficulty in Attracting Quality Supply

Groupon faces a significant threat from merchant churn, where businesses leave the platform due to perceived unprofitability or a lack of long-term value. This difficulty in retaining quality merchants directly impacts the platform's appeal, as a reduced variety and quality of deals can deter consumers.

The ongoing challenge of attracting new, high-value supply exacerbates this issue, creating a detrimental cycle. If merchants don't see a clear benefit, they'll seek alternatives, leaving Groupon with fewer compelling offers. For instance, in Q1 2024, while revenue saw a slight uptick, the core challenge of merchant engagement and retention remained a key focus area for the company's strategic planning.

- Merchant Retention Challenges: Businesses may leave if deal economics don't meet expectations or if they don't see sustained customer acquisition.

- Supply Quality Impact: A decline in high-quality merchant participation directly reduces the attractiveness and diversity of deals for consumers.

- Vicious Cycle: Reduced supply can lead to lower consumer demand, further discouraging new merchants from joining.

- Competitive Landscape: In 2024, the market for local deals and services remains competitive, with many platforms vying for merchant attention.

Regulatory Scrutiny and Cybersecurity Risks

Groupon faces increasing regulatory attention concerning its dynamic pricing models and the nature of its merchant agreements, potentially triggering compliance hurdles and legal challenges. For instance, in 2024, several e-commerce platforms experienced heightened scrutiny regarding data privacy practices, underscoring the evolving regulatory landscape.

The company's global e-commerce operations inherently expose it to substantial and ongoing cybersecurity threats. These risks encompass potential data breaches, unauthorized access to sensitive customer information, and vulnerabilities within its platform infrastructure, which could have severe financial and reputational consequences.

- Regulatory Scrutiny: Concerns around pricing algorithms and merchant partnerships could lead to investigations and potential fines, impacting operational flexibility.

- Cybersecurity Risks: A data breach could result in significant financial penalties, estimated to cost companies millions in recovery and legal fees, as seen in past incidents affecting major online retailers.

- Data Protection: Maintaining robust data security measures and adhering to global privacy regulations like GDPR and CCPA is crucial for customer trust and avoiding substantial financial penalties.

Groupon's core business model is threatened by evolving consumer preferences and a highly competitive digital landscape. The shift towards personalized mobile deals and the rise of niche platforms challenge Groupon's traditional daily deal approach, as evidenced by a reported 15% year-over-year decline in engagement with traditional deal sites among a key demographic in 2023.

Economic headwinds, including persistent inflation in 2024, directly impact consumer discretionary spending, a critical factor for Groupon's revenue. This macroeconomic volatility can lead to reduced transaction volumes and fluctuating demand for its services.

Merchant retention remains a significant hurdle, with businesses exiting the platform if deal economics are unfavorable or long-term value is not perceived. In Q1 2024, merchant engagement was a key strategic focus, highlighting the ongoing challenge of attracting and keeping quality supply.

Increased regulatory scrutiny on pricing and merchant agreements, coupled with substantial cybersecurity risks like data breaches, present further threats. These issues could lead to compliance costs, legal challenges, and severe reputational damage, impacting customer trust and financial stability.

SWOT Analysis Data Sources

This Groupon SWOT analysis is built upon a robust foundation of data, including its official financial statements, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of the company's internal capabilities and external market positioning.