Groupon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupon Bundle

Groupon operates in a dynamic digital marketplace, facing significant pressure from rivals and the constant threat of new entrants. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Groupon’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Groupon's core operation hinges on its extensive network of local businesses, essentially its suppliers. These merchants provide the deals and services that form the backbone of Groupon's offerings.

Individually, most of these merchants possess limited bargaining power. Their fragmented nature and reliance on Groupon for significant customer reach often place them in a weaker negotiating position regarding commission rates or deal terms. For instance, in 2023, the vast majority of Groupon's merchant partners were small to medium-sized businesses with limited alternative marketing channels.

However, this dynamic shifts for businesses offering highly unique or in-demand products and services. Such merchants can leverage their distinctiveness to negotiate more favorable terms, effectively increasing their individual bargaining power with Groupon by demanding higher commission shares or more favorable placement on the platform.

Switching costs for merchants looking to leave Groupon are quite low, meaning they can easily shift their marketing efforts elsewhere. This low barrier to exit can empower them if they feel Groupon's value isn't worth the cost or if commission rates become too burdensome. For instance, a local restaurant can simply stop running daily deals on Groupon and focus on social media marketing or loyalty programs instead.

The uniqueness of a merchant's offerings significantly impacts their bargaining power with platforms like Groupon. When a merchant provides a highly sought-after or exclusive experience, they gain considerable leverage. This means they can often negotiate better terms, including more favorable pricing and lower commission rates, as Groupon relies on these unique deals to attract customers.

For instance, consider a popular local restaurant offering a unique tasting menu not available elsewhere. This restaurant can command a higher price point and potentially a smaller commission percentage from Groupon compared to a generic coffee shop. In 2023, the experience economy continued to grow, with consumers increasingly willing to pay a premium for unique activities, further strengthening the bargaining power of merchants providing such offerings.

Merchant Concentration

The concentration of merchants offering similar services directly influences their bargaining power with platforms like Groupon. When a market is saturated with comparable businesses, Groupon benefits from a wider array of choices, diminishing the leverage of any individual merchant. For instance, in a city with numerous restaurants offering similar cuisines, a single restaurant has less power to dictate terms.

Conversely, in niche markets where specialized services are provided by a limited number of merchants, those individual providers gain significant bargaining power. This scarcity allows them to command better terms, as Groupon has fewer alternatives to turn to. This dynamic was evident in early 2024 when certain specialized experience providers found themselves in high demand, allowing them to negotiate more favorable commission rates.

- Merchant Concentration Impact: High merchant density reduces individual supplier leverage, while low density increases it.

- Groupon's Advantage: In competitive service sectors, Groupon can easily substitute one merchant for another, weakening supplier power.

- Niche Market Dynamics: Scarcity in specialized fields grants merchants greater negotiation strength.

- 2024 Trend: Reports indicated increased supplier power in niche leisure activities during early 2024 due to limited providers.

Forward Integration Threat by Merchants

Merchants typically present a low threat of forward integration, meaning they are unlikely to create their own deal platforms to directly challenge Groupon. Their primary focus remains on delivering goods or services rather than managing an e-commerce marketplace.

Despite this, merchants often engage in a form of forward integration by establishing their own direct online presence and marketing channels. This strategy helps them reduce their dependence on third-party platforms like Groupon.

- Reduced Reliance: Merchants building direct online channels diminish their need for deal aggregators, potentially impacting Groupon's customer acquisition costs.

- Market Evolution: As of 2024, the trend towards direct-to-consumer (DTC) models continues to grow across various retail sectors, reinforcing this merchant strategy.

- Strategic Shift: This move allows merchants greater control over customer relationships and data, a critical asset in today's digital economy.

The bargaining power of suppliers, primarily local businesses offering deals on Groupon, is generally moderate to low. Most merchants operate as small to medium-sized entities with limited alternative marketing avenues, making them reliant on Groupon for customer reach. In 2023, the majority of Groupon's merchant partners were in this category, giving Groupon leverage in negotiations over commission rates and deal terms.

However, merchants offering unique or highly in-demand products and services can significantly increase their individual bargaining power. These businesses can command better terms due to their distinctiveness, as Groupon needs such offerings to attract its customer base. For example, specialized experience providers in early 2024 saw increased power due to limited competition.

Switching costs for merchants are low, allowing them to easily cease participation if terms become unfavorable, which provides a degree of leverage. While direct forward integration by merchants into creating their own deal platforms is rare, the growing trend of direct-to-consumer (DTC) models in 2024 allows businesses to reduce dependence on platforms like Groupon, indirectly influencing supplier power.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Merchant Size & Fragmentation | Low to Moderate | Majority of Groupon's 2023 merchant partners were SMBs with limited alternatives. |

| Uniqueness of Offering | Moderate to High | Niche experience providers in early 2024 negotiated better terms due to scarcity. |

| Switching Costs | Low | Merchants can easily stop deals and focus on other marketing channels. |

| Forward Integration (Direct Channels) | Indirectly Increases Power | Growth of DTC models in 2024 reduces reliance on aggregators. |

What is included in the product

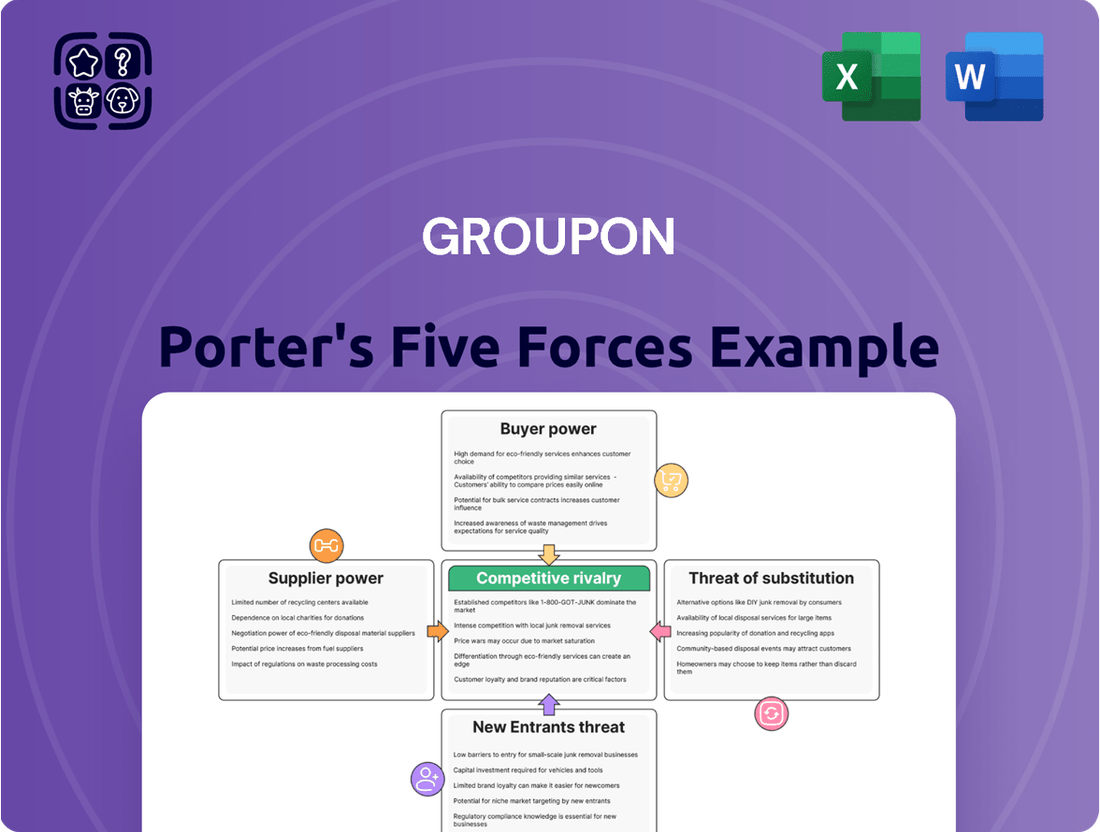

This analysis unpacks the competitive forces shaping Groupon's market, assessing the threat of new entrants, buyer and supplier power, the intensity of rivalry, and the impact of substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Groupon.

Customers Bargaining Power

Groupon's customer base is inherently price-sensitive, as the core value proposition revolves around significant discounts. This means consumers are actively hunting for the best deals, making them less inclined to stick with Groupon if superior offers emerge on competing platforms. For instance, in 2024, the average discount offered on the platform remained a key driver of customer acquisition and retention.

Consumers face very low switching costs when choosing to use or leave Groupon. They can effortlessly explore alternative deal platforms, direct offers from businesses, or opt for full-price purchases through conventional means. This ease of departure significantly enhances their bargaining power, compelling Groupon to continuously offer attractive deals to retain its user base.

The sheer number of substitute products and services available, both online and offline, dramatically boosts the bargaining power of customers. Consumers can easily find comparable deals or alternatives on rival platforms, directly from merchants, through social media, or even using traditional coupons. This vast array of choices prevents Groupon from dictating high prices or offering unappealing deals, as customers can readily switch elsewhere.

Information Availability to Consumers

Consumers today are incredibly well-informed. The internet makes it simple for them to research prices and compare deals from countless businesses and online platforms. This ease of access means they can quickly see what's available and at what cost, making them much savvier shoppers.

This heightened transparency puts significant pressure on companies like Groupon. Consumers can easily spot if a deal isn't as good as it seems or if a competitor offers something better. For Groupon, this means they must consistently offer truly competitive and valuable deals to keep customers engaged and satisfied.

Consider these points regarding information availability:

- Price Comparison Ease: Online tools and review sites allow consumers to compare prices across numerous merchants within seconds, significantly reducing search costs.

- Deal Aggregation Platforms: Websites and apps specifically designed to aggregate deals and discounts empower consumers to find the best offers efficiently.

- Informed Purchasing Decisions: Access to product reviews, merchant ratings, and detailed service comparisons enables customers to make more confident and informed buying choices.

Consumer Volume and Fragmentation

While individual consumers on platforms like Groupon often exhibit high price sensitivity and low switching costs, which typically grants them significant bargaining power, the sheer volume and fragmentation of Groupon's customer base dilute the leverage of any single buyer. In 2023, Groupon reported serving millions of active customers, making it difficult for any one individual to influence terms.

However, the collective power of this vast, deal-seeking consumer base is substantial. This aggregated demand significantly influences Groupon's ability to attract and retain merchants, as businesses rely on the platform to reach a broad audience. The millions of users actively seeking discounts shape the overall market for daily deals and local services.

- Consumer Fragmentation: Groupon's user base is highly dispersed, with no single customer group dominating purchasing power.

- Price Sensitivity: The core appeal of Groupon is discounted offers, highlighting a strong consumer focus on price.

- Low Switching Costs: Consumers can easily move between different deal platforms or direct merchant offerings without significant penalty.

- Collective Demand: The aggregate purchasing power of millions of users creates significant leverage for the platform in negotiating with businesses.

Groupon's customers wield considerable bargaining power due to their inherent price sensitivity and the minimal costs associated with switching platforms. The ease with which consumers can compare deals across numerous online and offline channels, coupled with readily available information on pricing and alternatives, forces Groupon to maintain competitive offers. While individual customers have limited influence, their collective demand as a large, fragmented user base significantly shapes the platform's value proposition.

| Factor | Impact on Groupon | Evidence/Data (2024) |

|---|---|---|

| Price Sensitivity | High | Core value proposition relies on discounts; continued focus on deal attractiveness for acquisition. |

| Switching Costs | Low | Consumers can easily access alternative deal sites or direct merchant offers. |

| Information Availability | High | Online comparison tools and deal aggregators empower informed consumer choices. |

| Customer Volume | Diluted Individual Power, Collective Strength | Millions of active users (as of 2023) mean no single customer dictates terms, but aggregate demand is significant. |

Full Version Awaits

Groupon Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Groupon, detailing the competitive landscape, buyer and supplier power, threat of new entrants and substitutes. The document you see here is precisely the same comprehensive analysis you’ll receive instantly after purchase, ready for immediate use.

Rivalry Among Competitors

Groupon operates in an e-commerce marketplace for local deals and experiences, facing a fierce battle with numerous competitors. This rivalry isn't just from direct daily deal sites; it extends to major e-commerce giants, specialized booking platforms for travel and activities, and even social media channels where businesses actively advertise promotions. The sheer volume and variety of these players make the competitive landscape incredibly crowded.

The competitive landscape for companies like Groupon is intensely aggressive. Rivals constantly engage in price wars and heavy promotions to win over both businesses offering deals and consumers looking for savings. This dynamic means that maintaining market share requires continuous effort and significant investment in marketing and product development.

Competitors are not just competing on price; they are also actively launching new features, creating loyalty programs, and running extensive marketing campaigns. For instance, in 2024, many platforms have focused on personalized recommendations and localized deals to stand out. This relentless pursuit of differentiation forces companies like Groupon to remain highly agile and responsive to market trends.

While Groupon's digital platform doesn't demand massive physical infrastructure, the ongoing investment in technology development, sophisticated marketing campaigns, and a dedicated sales team to onboard new merchants represents significant fixed costs. These operational necessities can create a substantial financial commitment, making it challenging to scale back operations quickly.

Furthermore, exit barriers for companies like Groupon are elevated by factors such as established brand recognition and the valuable, long-term relationships cultivated with a vast network of merchants. These existing ties and brand equity can make it difficult and costly to simply walk away from the market, even when facing profitability challenges, thus fostering a more intense competitive environment.

Market Growth Rate

The daily deals market has largely matured, meaning that growth for companies like Groupon often comes from capturing market share from rivals rather than from the overall market expanding. This dynamic creates a zero-sum game where intense competition for both customers and merchants is the norm. For instance, in 2023, the global deals and coupons market was valued at approximately USD 25.8 billion, with projections suggesting a compound annual growth rate (CAGR) of around 4.5% through 2030. This relatively modest growth rate underscores the importance of competitive positioning.

This environment fosters aggressive competitive tactics as companies vie for a limited pool of participants. Companies must differentiate themselves and offer compelling value propositions to attract and retain both consumers and businesses. The struggle for market share can lead to price wars or increased marketing spend, further intensifying the rivalry.

- Market Maturity: The daily deals sector is no longer in its high-growth phase, shifting the focus to market share acquisition.

- Zero-Sum Dynamics: Growth is primarily achieved by taking customers and merchants from competitors, intensifying rivalry.

- Aggressive Tactics: Slow market growth often prompts companies to employ more aggressive strategies to gain a competitive edge.

- Competitive Landscape: Companies must actively compete for existing demand rather than simply benefiting from overall market expansion.

Differentiation Among Competitors

Differentiation is a significant hurdle in the deals and discounts market, as many platforms essentially offer similar core services. This makes it tough for companies like Groupon to stand out beyond the immediate appeal of a price reduction. For instance, while some competitors might focus on specific niches like travel or beauty services, the fundamental business model of aggregating and selling discounted offers remains largely the same across the board.

This similarity in offerings inevitably leads to intense competition, often centered on who can provide the most attractive deals. Companies are frequently compelled to engage in price wars to capture customer attention and market share. This dynamic is evident in the ongoing promotional activities and flash sales that characterize the sector.

- Limited Differentiation: The core offering of discount aggregation leads to a commoditized market.

- Price Sensitivity: Competition heavily relies on the attractiveness of discounts, driving down margins.

- Niche Specialization: Some platforms attempt differentiation by focusing on specific verticals like travel or local experiences.

- Customer Loyalty: Brand loyalty can be weak when customers are primarily driven by the best available price.

The competitive rivalry within the daily deals and e-commerce marketplace is exceptionally high. Groupon faces intense pressure from a broad spectrum of competitors, ranging from direct daily deal sites to major e-commerce players and specialized booking platforms. This crowded market necessitates constant innovation and aggressive marketing to maintain relevance and market share.

The intensity of this rivalry is further amplified by the mature nature of the deals market, where growth primarily stems from capturing existing market share rather than overall market expansion. This creates a zero-sum environment, driving aggressive tactics like price wars and heavy promotions as companies vie for both consumers and merchants.

Differentiation is a significant challenge, as many platforms offer similar core services, leading to a commoditized market. Consequently, competition often centers on the attractiveness of discounts, impacting profit margins and making customer loyalty a difficult attribute to cultivate.

| Competitor Type | Key Competitive Tactics | Impact on Rivalry |

| Direct Daily Deal Sites | Price wars, flash sales, localized offers | High intensity, margin pressure |

| Major E-commerce Platforms | Bundled deals, loyalty programs, broad reach | Significant threat due to scale and brand recognition |

| Specialized Booking Platforms | Niche focus (travel, activities), curated experiences | Fragmented market, competes for specific consumer segments |

| Social Media Advertisers | Direct promotions, influencer marketing | Disruptive, bypasses traditional deal platforms |

SSubstitutes Threaten

Merchants increasingly leverage their own digital channels, like websites and social media, to offer direct promotions. This trend bypasses third-party platforms, allowing businesses to retain full control over their customer relationships and avoid commission fees. For instance, in 2024, many small to medium-sized businesses reported a significant increase in direct sales through their own e-commerce sites, a trend that continues to grow.

Traditional advertising channels like local newspapers, magazines, and radio still present a substitute threat to Groupon by reaching consumers directly. In 2024, while digital advertising spending continues to grow, traditional media still captures a significant portion of local advertising budgets, particularly for small businesses seeking broad reach.

Physical couponing, whether through direct mail or in-store distribution, also remains a viable alternative for businesses wanting to offer discounts. This direct approach bypasses the need for an online platform like Groupon, allowing businesses to control the discount process and customer interaction entirely.

Consumers can easily find new businesses and deals through organic channels like word-of-mouth, online reviews on platforms such as Yelp and Google Maps, and social media. These organic discovery methods offer valuable information and build trust, directly substituting Groupon's core function of connecting users with local businesses. In 2024, it's estimated that over 80% of consumers rely on online reviews before making a purchase decision, highlighting the strength of these substitutes.

Loyalty Programs and Membership Services

Many businesses, particularly in the restaurant and service sectors, are increasingly using their own loyalty programs and membership services. These initiatives are designed to keep customers coming back by offering exclusive discounts and ongoing value. This directly challenges platforms like Groupon, as it gives customers a reason to stick with a particular business rather than seeking deals elsewhere.

These in-house programs often represent a more cost-effective strategy for merchants compared to paying platform commissions. For instance, a coffee shop offering a 'buy ten, get one free' card incurs minimal cost per redeemed item. This direct customer relationship fosters loyalty and can significantly reduce the perceived need for customers to search for third-party deals.

The threat of substitutes from loyalty programs is substantial because they offer a consistent, predictable benefit to the customer. By building a direct relationship, businesses can gather valuable customer data and tailor offers more effectively. This personalized approach can be more appealing than the often transactional nature of daily deal sites.

- Direct Customer Retention: Loyalty programs build a direct bond, reducing reliance on external deal aggregators.

- Cost Efficiency for Merchants: In-house programs often have lower marginal costs than platform commissions, making them attractive.

- Consistent Value Proposition: Unlike limited-time deals, loyalty programs offer sustained benefits, fostering repeat business.

Alternative E-commerce Marketplaces

Beyond direct competitors in the daily deals space, broader e-commerce marketplaces and booking platforms present a significant threat of substitutes. For instance, OpenTable for restaurant reservations or various travel booking sites allow consumers to find and book services, often with competitive pricing or promotional offers, fulfilling a similar need for convenience and value.

These platforms, while not exclusively deal-focused, increasingly incorporate elements of value and discovery, directly competing for consumer spending that might otherwise go to Groupon. In 2024, the global e-commerce market continued its robust growth, with platforms like Amazon and Alibaba offering vast selections and competitive pricing, acting as strong substitutes for niche deal sites.

The threat is amplified as consumers become more accustomed to the seamless experience of these larger marketplaces. For example, travel booking sites frequently offer dynamic pricing and bundled deals that can rival or surpass traditional daily deals in terms of perceived value and ease of transaction, broadening the scope of substitution beyond direct competitors.

- Broad E-commerce Competition: Platforms like Amazon and Alibaba offer a wide array of goods and services, often with competitive pricing and fast delivery, serving as a substitute for consumers seeking deals on various products.

- Specialized Booking Platforms: Sites such as OpenTable for dining or Expedia for travel provide convenient booking and often feature promotional offers or loyalty programs, directly competing for consumer spending on experiences.

- Shifting Consumer Habits: Consumers increasingly value convenience and integrated experiences, making larger, more versatile platforms more attractive than single-purpose deal sites.

- Price Sensitivity: While Groupon focuses on discounts, substitutes may offer comparable or better value through loyalty programs, bundled packages, or everyday competitive pricing, reducing the unique appeal of deal-based purchases.

The threat of substitutes for Groupon is significant as consumers have numerous alternative avenues to find deals and discover businesses. These substitutes range from direct merchant promotions and traditional advertising to organic discovery channels and loyalty programs.

Businesses are increasingly bypassing third-party platforms to engage customers directly through their own websites and social media, a trend that saw notable growth in 2024. Traditional advertising, while evolving, still captures a substantial portion of local ad spend, offering broad reach. Furthermore, consumers rely heavily on word-of-mouth and online reviews, with over 80% checking reviews before purchases in 2024, directly substituting Groupon's discovery function.

| Substitute Type | Description | 2024 Relevance |

|---|---|---|

| Direct Merchant Promotions | Businesses using their own websites/social media | Increased direct sales reported by SMBs |

| Traditional Advertising | Newspapers, radio, magazines | Still a significant portion of local advertising budgets |

| Organic Discovery | Word-of-mouth, online reviews | Over 80% of consumers rely on reviews |

| Loyalty Programs | In-house customer retention schemes | Cost-effective, build direct customer relationships |

| E-commerce/Booking Platforms | Amazon, OpenTable, Expedia | Growing consumer preference for integrated experiences |

Entrants Threaten

The fundamental technology needed to start a basic online deal platform is quite accessible. This means that the risk of new companies entering the market with simple, functional products is consistently there. For instance, in 2024, the cost to build a functional e-commerce website can range from a few thousand dollars for a template-based solution to tens of thousands for a custom build, making it feasible for many startups.

Launching a new deal platform doesn't require massive capital investment in specialized infrastructure. A basic website, a secure payment processing system, and a handful of initial merchant agreements are often enough to get started. This low technical hurdle significantly reduces the initial challenge for potential competitors looking to enter the space.

While launching a basic daily deal website is relatively straightforward, truly competing with a giant like Groupon demands significant financial muscle. Building a brand that customers trust and a network of merchants that offers compelling deals requires substantial upfront investment. For instance, in 2024, major digital marketing campaigns alone can cost millions, a steep barrier for newcomers.

Groupon's business model thrives on powerful network effects; a larger merchant base draws more consumers, and a growing customer pool, in turn, incentivizes more merchants to join. This creates a virtuous cycle that's difficult for newcomers to replicate.

New entrants grapple with a classic chicken-and-egg dilemma. They must simultaneously attract a critical mass of both merchants and consumers to establish value, a dual-sided market challenge that represents a substantial barrier to entry in the daily deals space.

Established Merchant Relationships and Trust

Groupon's established merchant relationships and the trust built over years present a significant barrier to new entrants. Replicating this extensive network and credibility requires substantial investment and time, making it difficult for newcomers to gain traction.

These deep-seated relationships create implicit switching costs for merchants, as they value the familiarity and proven track record Groupon offers. This loyalty makes it challenging for new platforms to lure away established partners.

- Established Network: Groupon boasts relationships with hundreds of thousands of merchants globally.

- Trust Factor: Merchants rely on Groupon for customer acquisition and marketing, a trust built over time.

- Switching Costs: Re-establishing similar trust and volume with a new platform is a deterrent for merchants.

Regulatory and Legal Landscape

While the daily deals market might seem accessible, new entrants in 2024 face a nuanced regulatory environment. Consumer protection laws, particularly around advertising accuracy and refund policies, can pose challenges. For instance, the Federal Trade Commission (FTC) actively monitors deceptive advertising, which could impact how deals are presented and marketed.

Data privacy regulations, like the California Consumer Privacy Act (CCPA) and similar emerging laws globally, add another layer of complexity. New platforms must invest in robust systems to handle customer data securely and transparently, increasing initial setup costs and ongoing compliance efforts.

- Consumer Protection: Adherence to FTC guidelines on truth in advertising is crucial.

- Data Privacy: Compliance with CCPA and other data protection laws requires significant investment.

- Advertising Standards: Clear terms and conditions for deal redemption and refunds are necessary to avoid legal scrutiny.

While the initial technology for a deal platform is accessible, the threat of new entrants is moderate due to significant barriers like brand building and merchant network establishment. Groupon's established trust and the network effects it enjoys make it difficult for newcomers to gain substantial market share quickly.

Newcomers must overcome the challenge of simultaneously attracting both consumers and merchants, a hurdle that requires considerable marketing investment and time. For example, in 2024, acquiring a new customer in the e-commerce space can cost anywhere from $20 to $100+, a significant upfront expense for startups.

Regulatory compliance, particularly concerning consumer protection and data privacy, adds another layer of difficulty for new entrants. These factors, combined with the need for substantial capital to compete effectively, temper the threat of new entrants in the daily deals market.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Brand Recognition & Trust | Established platforms like Groupon have built consumer and merchant confidence over years. | Replicating the trust that leads to millions of active users requires extensive marketing and a proven track record. |

| Merchant Network & Relationships | Groupon has cultivated deep relationships with a vast number of merchants. | Attracting merchants away from a platform that guarantees customer volume can cost significant incentives, estimated at 10-20% of deal value for initial partnerships. |

| Network Effects | More users attract more merchants, and more merchants attract more users. | New entrants struggle to reach critical mass, making their offerings less appealing to both sides of the market. |

| Capital Requirements | Significant investment is needed for marketing, technology, and operations. | A single major digital marketing campaign in 2024 can cost upwards of $1 million, a substantial hurdle for startups. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Groupon leverages data from investor relations websites, SEC filings, and industry-specific market research reports to assess competitive pressures. We also incorporate insights from financial news outlets and competitor earnings calls to capture real-time market dynamics.