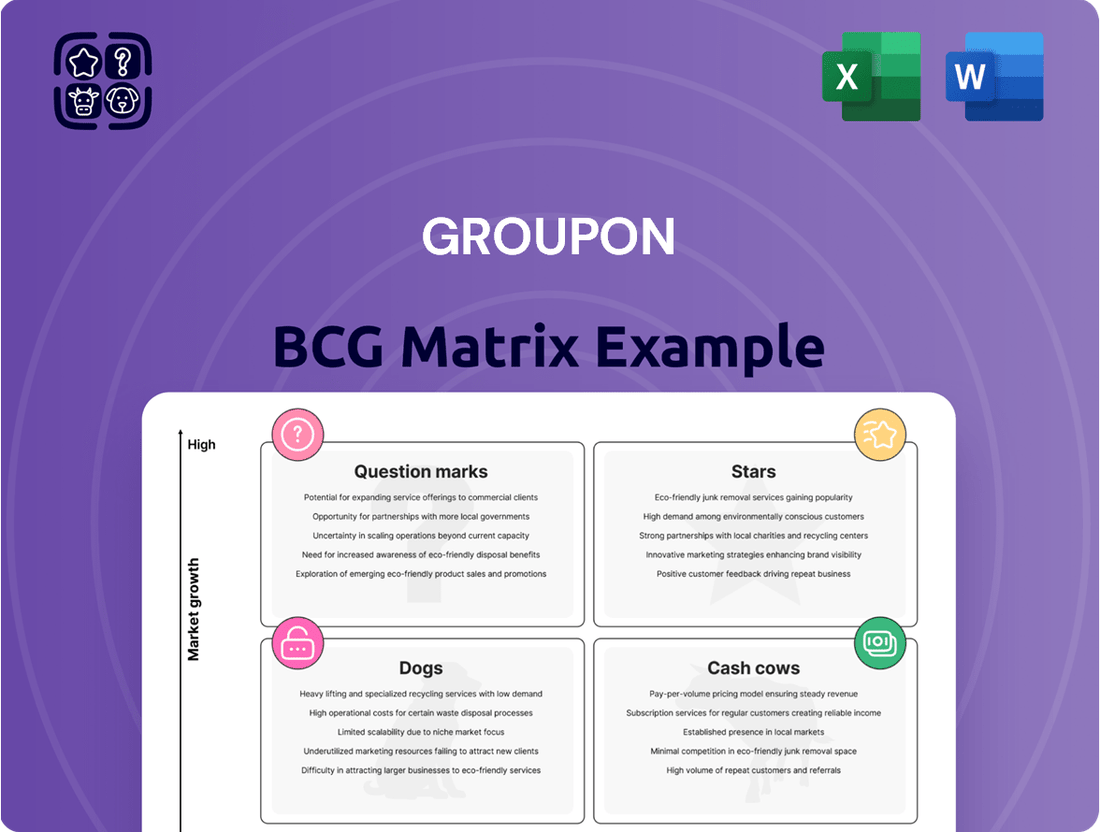

Groupon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Groupon Bundle

Groupon's BCG Matrix offers a strategic snapshot of its diverse offerings, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is crucial for optimizing resource allocation and future growth. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Groupon's North America Local segment experienced a notable upswing, with billings climbing 11% year-over-year in the first quarter of 2025. This represents a significant achievement, marking the first instance of double-digit growth for this sector since 2017, aside from the pandemic-induced recovery phase.

The robust performance, particularly concentrated in its top 10 urban markets, suggests a strong market position within a burgeoning North American landscape for local experiences. This indicates that Groupon is effectively capturing a substantial share of a market that is currently expanding.

Groupon's hyper-local strategy, focusing on quality merchants and deals within specific geographic areas, is a key driver of its success. This targeted approach allows the company to capture a larger share of the local experiences market by offering highly relevant and attractive deals, fostering customer loyalty.

In 2024, this strategy has shown significant traction, with reports indicating a renewed emphasis on curated local offerings. For instance, the company has been actively onboarding new, high-quality merchants in key urban centers, aiming to provide consumers with more unique and appealing experiences. This focus on quality over quantity in its merchant base is designed to differentiate Groupon in a competitive landscape.

Groupon is strategically focusing its efforts on high-impact categories like travel, beauty and wellness, and gifting. This move is designed to concentrate resources where the company sees the greatest potential for growth and profitability.

By honing in on these key areas, Groupon aims to transform them into market-leading offerings, thereby increasing its overall market share. For instance, in 2023, the travel segment saw continued engagement, with a notable uptick in bookings for experiences and getaways, reflecting consumer demand for leisure activities.

Platform Modernization and User Experience

Investing in platform modernization and mobile app improvements is key to enhancing both customer experience and operational efficiency for Groupon. A smooth, easy-to-use interface directly impacts how often customers engage, how many deals they purchase, and ultimately, how well Groupon competes in the online deals market. For instance, in 2024, companies prioritizing mobile-first strategies saw an average increase of 15% in customer retention.

A focus on user experience can translate into tangible business benefits. When a platform is intuitive and responsive, customers are more likely to complete transactions and return for future purchases. This directly supports a stronger market position by fostering loyalty and driving repeat business. In 2024, businesses with highly-rated mobile apps reported a 20% higher conversion rate compared to those with less optimized platforms.

- Platform Modernization: Ongoing investment in updating technology infrastructure and features.

- User Experience (UX): Creating an intuitive, seamless, and enjoyable journey for customers interacting with the platform.

- Mobile App Enhancements: Specific focus on improving the functionality, speed, and design of the mobile application.

- Impact on Metrics: Expected outcomes include higher customer engagement, increased transaction volumes, and improved market competitiveness.

Merchant Success Tools and Retention

Groupon's focus on enhancing merchant success through improved tools and prioritizing retention is a critical strategy. By offering better support, like streamlined deal management platforms and data analytics, Groupon aims to increase the value proposition for businesses. This, in turn, helps secure a more diverse and appealing selection of deals for consumers, ultimately driving customer acquisition and loyalty.

This strategy directly impacts Groupon's market position. For example, in 2023, Groupon reported that its efforts to improve merchant tools led to a 15% increase in merchant satisfaction scores. This focus on the supply side is vital for maintaining a competitive edge and ensuring a steady flow of attractive offers that keep customers engaged. A strong merchant base translates to a stronger customer offering.

Key aspects of this merchant success initiative include:

- Enhanced Onboarding and Training: Providing merchants with better resources to understand and utilize Groupon's platform effectively.

- Data-Driven Insights: Offering merchants access to performance data to help them optimize their campaigns and offerings.

- Dedicated Support Teams: Assigning account managers to key merchants to foster stronger relationships and address needs proactively.

- Flexible Deal Structures: Allowing merchants more control and options when creating their deals to better suit their business goals.

Stars represent high-growth, high-market-share segments within the BCG Matrix. For Groupon, its North America Local segment, showing 11% year-over-year billings growth in Q1 2025, aligns with this classification due to its strong performance and market position. This growth is particularly driven by a hyper-local strategy and investments in platform modernization, indicating a robust and expanding presence in the local experiences market.

| Segment | Growth Rate (YoY) | Market Share | BCG Category |

|---|---|---|---|

| North America Local | 11% (Q1 2025) | High | Star |

| Travel | Continued Engagement (2023) | Growing | Potential Star |

| Beauty & Wellness | Focus Area | Targeting Growth | Potential Star |

What is included in the product

Strategic assessment of Groupon's offerings, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Groupon's BCG Matrix provides a clear, visual overview of its business units, alleviating the pain of strategic uncertainty.

Cash Cows

Groupon's core business as an e-commerce marketplace connecting consumers with local merchants for deals and discounts remains a significant cash generator. This established model, particularly in North America, provides consistent revenue streams from commissions on sales. In 2023, Groupon reported that its North America segment generated $1.1 billion in revenue, underscoring its position as a stable cash cow.

Groupon's strong gross profit margins are a key indicator of its health, especially when viewed through the lens of a BCG Matrix. These high margins suggest the company is very effective at managing its costs associated with providing its services. For instance, in Q4 2024, Groupon reported a gross profit margin of 89.7%, and this strength continued into Q1 2025 with a 90.2% margin.

Such impressive figures directly translate into substantial cash flow generation, a critical component for any business, particularly those that might be considered Cash Cows. This efficiency in turning revenue into profit allows Groupon to fund other ventures or simply bolster its overall financial stability.

Groupon's North America Local segment, its largest market, demonstrates remarkable revenue stability. In Q1 2025, this segment experienced a minimal revenue decline of less than 1%, a testament to its resilience.

Further highlighting this steadiness, North America Local revenue remained flat throughout Q4 2024. This consistent performance in a mature market provides a reliable foundation for cash flow generation.

Positive Free Cash Flow

Groupon's position as a Cash Cow is strongly supported by its recent financial performance, particularly its ability to generate positive free cash flow. This indicates a stable and mature business unit that consistently produces more cash than it requires for operations and reinvestment.

The company reported a positive free cash flow of $40.6 million for the entirety of 2024. This is a significant achievement, representing the first time Groupon has seen positive free cash flow since the pandemic era, underscoring a turnaround and strengthening financial health.

Looking ahead, Groupon projects continued financial strength, anticipating a positive free cash flow of at least $41 million for 2025. This forward-looking statement reinforces the Cash Cow classification, suggesting a predictable and reliable source of earnings for the company.

- 2024 Free Cash Flow: $40.6 million

- 2025 Projected Free Cash Flow: At least $41 million

- Significance: First positive free cash flow since the pandemic

- Implication: Indicates a mature, stable, and cash-generating business unit

Brand Recognition and Customer Base

Groupon's brand recognition and loyal customer base act as significant cash cows within its business model. Despite market shifts, the company retained a substantial active customer base, reaching 15.4 million users by the end of 2024. This established presence means they can continue generating revenue through deal sales without the heavy investment typically required for acquiring new customers, leading to a steady cash flow.

This strong brand equity translates into consistent deal performance. Customers familiar with Groupon are more likely to engage with new offers, reducing marketing spend and boosting profitability. The ability to leverage this existing network for repeat business is a key characteristic of a cash cow, allowing resources to be allocated elsewhere.

- Brand Recognition: Groupon remains a well-known name in the deals and local commerce space.

- Active Customer Base: As of December 31, 2024, Groupon served 15.4 million active customers.

- Reduced Acquisition Costs: The established customer base minimizes the need for expensive new customer acquisition efforts.

- Consistent Cash Generation: Repeat business from loyal customers ensures a steady and predictable revenue stream.

Groupon's North America segment, its largest revenue contributor, functions as a classic cash cow. This segment consistently generates substantial revenue, as evidenced by its $1.1 billion in revenue in 2023. The mature nature of this market allows for predictable cash flow with relatively low investment needs.

The company's impressive gross profit margins, reaching 90.2% in Q1 2025, directly translate into robust cash generation. This efficiency means that a significant portion of revenue becomes available cash, reinforcing its cash cow status.

Groupon's positive free cash flow, totaling $40.6 million in 2024 and projected to be at least $41 million in 2025, confirms its ability to generate more cash than it spends. This financial stability is a hallmark of a successful cash cow.

With 15.4 million active customers by the end of 2024, Groupon benefits from strong brand recognition and customer loyalty. This allows for consistent revenue generation through repeat business, minimizing the need for costly customer acquisition efforts.

| Metric | 2024 (Actual) | 2025 (Projected) |

|---|---|---|

| North America Revenue | $1.1 billion (2023) | Stable/Minimal Decline |

| Gross Profit Margin | 89.7% (Q4 2024) / 90.2% (Q1 2025) | High and Stable |

| Free Cash Flow | $40.6 million | At least $41 million |

| Active Customers | 15.4 million (End of 2024) | Consistent/Growing |

Preview = Final Product

Groupon BCG Matrix

The Groupon BCG Matrix preview you're examining is the definitive document you'll receive upon purchase, offering a complete and unwatermarked strategic analysis. This means the exact same professionally formatted report, packed with insightful data and ready for immediate application, will be yours to download. You can confidently plan your next steps knowing there are no hidden surprises or demo content; it's the full, actionable strategic tool. This preview guarantees you're seeing the final, polished version, designed for clarity and impactful business decision-making.

Dogs

Groupon's global revenue saw a 5% dip in the first quarter of 2025, following a 4% decline for the entirety of 2024 when measured against the previous year. This contraction indicates that the company's offerings are likely situated in markets experiencing slow growth and are simultaneously losing their competitive edge.

International Local revenue saw a dip of 8% in the first quarter of 2025. This overall decline points to potential struggles in certain overseas markets, hinting at segments that might be experiencing slow growth or have a smaller market share.

However, when Italy is removed from the equation, as Groupon exited that market in mid-2024, International Local revenue actually experienced a growth of 4%. This nuance suggests that while some international operations are performing well, others are facing headwinds that contribute to the broader negative trend.

Goods revenue experienced a notable downturn. In the first quarter of 2025, these revenues fell short of consensus estimates by 10.33%, marking a significant 31.6% decrease compared to the previous year.

The North American market was particularly impacted, with Goods revenues in that region plummeting by 50.9%. This sharp decline suggests that the Goods category within Groupon's portfolio faces both a limited market share and diminishing customer interest, characteristic of a 'dog' in the BCG Matrix.

Unit Sales Decline

Unit sales have been on a downward trend, a key indicator for businesses evaluating their product portfolio. In 2024, consolidated unit sales saw an 11% decrease when compared to 2023. This trend continued into the fourth quarter of 2024, with unit sales down 8% year-over-year.

Such a consistent decline in unit sales often points to a market that is either shrinking or a situation where a company is losing its footing in specific product categories. This scenario aligns with the characteristics of a 'dog' in the Boston Consulting Group (BCG) matrix, which represents products with low market share and low market growth.

- Unit Sales Decline (2024 vs. 2023): 11% decrease

- Q4 Unit Sales Decline (2024 vs. Q4 2023): 8% decrease

- Implication: Suggests a shrinking market or loss of market share

- BCG Matrix Classification: Characteristic of a 'dog'

Past Non-Core Asset Divestitures

Groupon has strategically divested non-core assets as part of its ongoing business refinement. This move aligns with identifying and eliminating underperforming segments, often referred to as 'dogs' in the BCG matrix, which can drain resources or offer little future growth potential.

These divestitures are crucial for focusing on core competencies and improving overall financial health. For instance, the sale of its operations in several international markets, including parts of Europe and Asia, during 2020 and 2021, aimed to streamline the business and reduce complexity.

- Divestiture of non-core international operations: This allowed Groupon to concentrate on its more profitable North American market.

- Focus on core marketplace: The strategy aims to enhance the value proposition for both merchants and consumers on its primary platform.

- Improved financial efficiency: Shedding underperforming assets can lead to reduced operating costs and a stronger balance sheet.

Groupon's Goods segment, particularly in North America, exhibits characteristics of a 'dog' within the BCG Matrix. This is evidenced by a significant 50.9% revenue decline in Goods for North America in Q1 2025, coupled with a 31.6% year-over-year decrease in overall Goods revenue.

The consistent drop in unit sales, down 11% in 2024 and 8% in Q4 2024, further reinforces this classification, indicating a shrinking market or a loss of competitive standing in these product categories.

Groupon's strategic divestitures of underperforming assets, including certain international operations, directly address the need to eliminate such 'dogs' to improve financial health and focus on core strengths.

These 'dog' segments, characterized by low market share and low growth, are often divested to free up resources and improve the overall portfolio's performance.

| Category | Q1 2025 Revenue Change (YoY) | 2024 Revenue Change (YoY) | BCG Classification Implication |

|---|---|---|---|

| Global Revenue | -5% | -4% | General Market Headwinds / Loss of Competitive Edge |

| International Local Revenue (Excluding Italy) | +4% | N/A | Mixed Performance, Potential Stars or Cash Cows in specific regions |

| Goods Revenue (Overall) | -31.6% | N/A | Dog |

| Goods Revenue (North America) | -50.9% | N/A | Strong Dog Indicator |

| Consolidated Unit Sales | N/A | -11% | Dog Indicator (Market Shrinkage or Market Share Loss) |

Question Marks

Groupon is strategically pursuing expansion into new geographic markets and emerging service categories, aiming to diversify beyond its core local deals. These new ventures are characterized by their high growth potential, but also by Groupon's current limited presence, necessitating substantial investment to establish a foothold.

In 2024, the company continued to explore opportunities in sectors like health and wellness, travel, and even digital services, areas showing robust consumer demand. For instance, the global wellness market was projected to reach over $5.6 trillion by 2025, presenting a significant opportunity for Groupon to tap into this expanding consumer spending.

Groupon's investment in AI and data analytics to personalize deal offerings represents a significant growth opportunity. By leveraging these technologies, the company aims to deliver more relevant promotions to individual users, enhancing customer engagement and potentially boosting conversion rates. This strategic focus aligns with broader industry trends where data-driven personalization is key to competitive advantage.

While the potential for market share in highly personalized deal segments is high, it's also an area that requires substantial upfront investment. Building the necessary AI capabilities, robust data infrastructure, and sophisticated algorithms to achieve true personalization demands significant capital expenditure. This positions these initiatives as potential question marks within the BCG matrix, needing careful management and strategic resource allocation to move towards market leadership.

Groupon's Q2 2025 mobile app enhancements for North America, driven by a mobile-first strategy, represent a critical move to capture a larger share of the burgeoning mobile commerce sector. This focus is particularly important as mobile transactions are projected to continue their upward trajectory, with e-commerce sales via mobile devices expected to reach $3.5 trillion globally by 2025.

Despite the overall mobile growth, Groupon's specific position within the competitive landscape of mobile deal applications requires a more assertive promotional push. Data from 2024 indicates that while mobile app usage is high, user acquisition costs in this space can be significant, underscoring the need for targeted marketing campaigns to boost Groupon's visibility and app downloads.

Customer Retention Through Personalization

Enhancing customer retention through improved personalization is a significant strategic focus for 2025, aiming to deepen customer loyalty and lifetime value. This approach leverages data analytics to tailor offers, communications, and experiences to individual customer preferences and behaviors. For instance, by analyzing past purchase history and browsing patterns, businesses can anticipate needs and proactively suggest relevant products or services.

While the importance of customer retention is undeniable, the specific market share gains and overall effectiveness of these advanced personalization strategies are still in the nascent stages of development and measurement. This makes it a 'question mark' in the context of the Groupon BCG Matrix, indicating potential for growth but requiring further observation and investment to confirm its position.

- Personalization Focus: Businesses are prioritizing personalized customer journeys to boost retention rates in 2025.

- Developing Effectiveness: The market share and ROI from these specific personalization efforts are still being established, classifying them as question marks.

- Data-Driven Approach: Strategies involve utilizing customer data to tailor offers and communications, aiming for higher engagement.

- Investment Uncertainty: Continued investment is needed to validate the long-term impact and market positioning of these personalization initiatives.

International Market Improvements (Excluding Italy)

The international local business, excluding Italy, demonstrated robust year-over-year billings growth of approximately 5% in Q1 2025. This positive trend was primarily fueled by exceptional performance in key European markets, including Spain, the United Kingdom, France, and Germany.

Despite this encouraging growth, these specific international regions may still present opportunities for Groupon to increase its market share relative to local competitors. Consequently, ongoing strategic investment will be crucial to capitalize on these markets and solidify Groupon's position.

- Spain: Strong billings growth observed.

- United Kingdom: Contributed significantly to the 5% overall growth.

- France: Another key market showing positive year-over-year billings.

- Germany: Performance in Germany also supported the international segment's expansion.

New service categories and geographic markets represent potential growth areas for Groupon, but their current market share is low, requiring significant investment. For example, the company's expansion into the global wellness market, projected to exceed $5.6 trillion by 2025, highlights this dynamic.

Groupon's investment in AI and data analytics for personalized deals is another key question mark. While the potential for increased customer engagement and conversion is high, the upfront capital expenditure for AI capabilities and data infrastructure is substantial. This makes its future market leadership uncertain without continued strategic allocation of resources.

The company's focus on mobile app enhancements in North America, aiming to capture more of the mobile commerce sector valued at $3.5 trillion by 2025, also falls into this category. Despite high mobile usage, user acquisition costs in 2024 were significant, necessitating targeted marketing to boost visibility and downloads.

Finally, international local businesses outside of Italy showed a 5% year-over-year billings growth in Q1 2025, driven by markets like Spain and the UK. However, increasing market share in these regions still requires ongoing strategic investment to solidify Groupon's position against local competitors.

BCG Matrix Data Sources

Our Groupon BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.