Grocery Outlet Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grocery Outlet Bundle

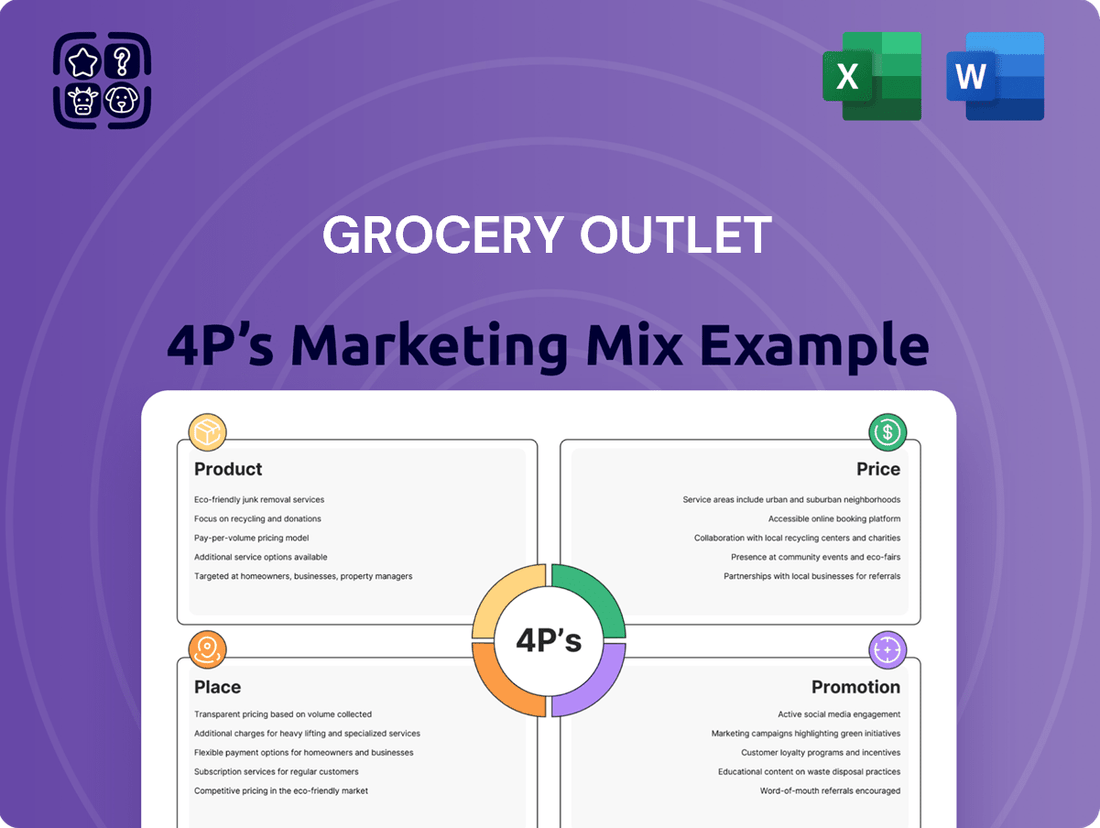

Grocery Outlet's marketing success hinges on its unique approach to the 4Ps, offering incredible value through curated product selections, aggressive pricing, convenient store placement, and targeted promotions. Discover how these elements create a compelling customer proposition.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Grocery Outlet's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into this discount retail giant.

Product

Grocery Outlet's product strategy is built on opportunistic sourcing, acquiring overstock, closeout, and seasonal goods from national brands. This allows them to offer a unique, ever-changing inventory of quality, name-brand items at deeply discounted prices, fostering a treasure hunt shopping experience.

In 2024, Grocery Outlet continued to leverage this model, with approximately 90% of their inventory sourced through opportunistic buying. This strategy directly contributes to their ability to offer savings of 40-60% compared to traditional grocery stores, a key differentiator in the competitive retail landscape.

Grocery Outlet's product strategy hinges on a diverse and constantly shifting inventory. Shoppers can discover a broad spectrum of goods, encompassing everyday staples, gourmet finds, personal care items, frozen goods, and even alcoholic beverages. This unpredictable assortment, often featuring "WOW!" deals, fosters customer excitement and repeat business, as each visit presents the potential for unique discoveries.

Grocery Outlet's introduction of private label brands in 2024, beginning with 'Simply Go' and extending to 'Go Home & Haven' and 'GO Paw & Pamper,' marks a strategic expansion. This move is designed to offer customers greater value on everyday necessities, thereby strengthening customer loyalty and potentially boosting profit margins beyond their opportunistic model.

Focus on Value and Quality

Grocery Outlet, while known for its deep discounts, makes a conscious effort to balance extreme value with consistent quality. This approach is central to their marketing strategy, ensuring customers feel they are getting a great deal without compromising on the products they bring home.

They achieve this by sourcing deeply discounted national brand products that are still considered high-quality consumables and fresh items. This means customers can find premium brands at significantly lower prices, a key differentiator for the retailer. For instance, in 2023, Grocery Outlet reported a net sales increase of 9.3% to $4.0 billion, indicating strong customer reception to their value proposition.

Furthermore, Grocery Outlet's commitment to quality extends to its private label offerings. These products undergo rigorous quality assurance checks and are supported by a satisfaction guarantee. This guarantee is a powerful tool for building and maintaining customer trust, assuring shoppers that even their own-brand items meet high standards. In Q1 2024, the company highlighted continued progress in its private label penetration, aiming to further enhance the quality perception of these offerings.

Key aspects of their value and quality focus include:

- Sourcing high-quality national brands at steep discounts.

- Ensuring private label products meet strict quality assurance standards.

- Offering a satisfaction guarantee on all products to build customer confidence.

- Achieving significant sales growth by effectively communicating this dual focus on value and quality.

Reduced Food Waste through Business Model

Grocery Outlet's business model inherently champions reduced food waste. By strategically acquiring surplus and close-dated inventory that might otherwise be discarded, they effectively divert food from landfills. This opportunistic sourcing directly translates into cost savings for their customers, offering value while simultaneously addressing a significant environmental concern.

This commitment to waste reduction is a core element of their product offering. In 2024 alone, Grocery Outlet reported a remarkable achievement, contributing to the avoidance of over 762 million pounds of food waste. This substantial figure underscores the tangible environmental benefit of their operational strategy.

- Environmental Stewardship: Grocery Outlet's model actively combats food waste, a major environmental issue.

- Consumer Value: The purchase of surplus goods allows them to offer significant discounts to shoppers.

- Quantifiable Impact: In 2024, the company helped prevent over 762 million pounds of food from being wasted.

Grocery Outlet's product strategy is defined by opportunistic sourcing of national brand overstocks and closeouts, delivering significant savings of 40-60% to consumers. This approach, which saw approximately 90% of inventory sourced this way in 2024, creates a dynamic "treasure hunt" shopping experience with a diverse, ever-changing assortment. The company's expansion into private label brands like 'Simply Go' in 2024 aims to further enhance value and customer loyalty.

| Product Strategy Element | Description | 2024/2025 Data/Impact |

|---|---|---|

| Sourcing Model | Opportunistic acquisition of overstock, closeouts, and seasonal goods. | ~90% of inventory sourced opportunistically in 2024. |

| Value Proposition | Offering national brand quality at 40-60% discounts. | Contributes to significant customer savings and competitive advantage. |

| Inventory Mix | Diverse and constantly shifting, including staples, gourmet, and perishables. | Fosters customer excitement and repeat visits through unique discoveries. |

| Private Label Expansion | Introduction of brands like 'Simply Go', 'Go Home & Haven', 'GO Paw & Pamper'. | Aims to increase value on everyday necessities and strengthen loyalty. |

| Quality Assurance | Balancing deep discounts with consistent quality for national and private label brands. | Supported by rigorous QA checks and a satisfaction guarantee. |

| Food Waste Reduction | Acquiring surplus and close-dated inventory. | Helped prevent over 762 million pounds of food waste in 2024. |

What is included in the product

This analysis provides a comprehensive breakdown of Grocery Outlet's marketing strategies, examining how their unique product assortment, deep discount pricing, strategic store placement, and targeted promotions create a compelling value proposition for bargain-conscious consumers.

This analysis distills Grocery Outlet's 4Ps strategy into actionable insights, directly addressing the pain point of budget-conscious shoppers by highlighting how their product, price, place, and promotion strategies deliver exceptional value.

Place

Grocery Outlet's strategic approach to Place centers on aggressive and targeted expansion. The company opened 29 new stores in 2023 and had plans to add around 28 more in 2024, demonstrating a consistent growth trajectory. This expansion is further bolstered by the acquisition of United Grocery Outlet, which brought an additional 40 stores into their portfolio, primarily in the Southeast.

Grocery Outlet's distribution strategy hinges on its network of independently owned and operated stores. These independent operators (IOs) are deeply embedded in their local communities, fostering a strong neighborhood presence and delivering personalized customer service.

This decentralized model empowers IOs to tailor product assortments to local tastes and demands, a key differentiator. For instance, in 2024, Grocery Outlet reported that its IOs were instrumental in adapting inventory, with some stores seeing higher sales of regional specialty items, reflecting the localized approach.

Grocery Outlet has significantly broadened its geographic reach, moving beyond its West Coast origins. By the close of 2024, the company boasted 533 stores spanning 16 states, with a notable expansion into the Southeastern U.S. via the United Grocery Outlet acquisition.

This expansion is strategically focused on clustered growth within key metropolitan areas. Notable markets for this concentrated development include Cleveland, Las Vegas, and Baltimore, aiming to maximize market penetration and operational efficiency.

Optimizing Supply Chain and Distribution

Grocery Outlet is actively enhancing its supply chain and distribution to fuel expansion and boost efficiency. A key initiative is the development of a new 680,000-square-foot ambient distribution center in Vancouver, Washington, slated for full operation by the close of 2025. This strategic investment is designed to streamline operations, lower expenses, and elevate customer service.

These optimizations are critical for managing the increasing volume and ensuring timely product availability across their growing store base. The company's focus on a robust distribution network directly supports its value proposition by enabling cost-effective sourcing and delivery of discounted groceries.

- New Distribution Center: A 680,000-square-foot ambient distribution center in Vancouver, Washington, is scheduled to be fully operational by the end of 2025.

- Efficiency Gains: The goal is to streamline operations, reduce costs, and improve service levels through these supply chain enhancements.

- Strategic Consolidation: Investments in optimizing the distribution network are part of a broader strategy to support the company's growth trajectory.

Small-Box Format and Treasure Hunt Layout

Grocery Outlet embraces a small-box store format, a deliberate choice to foster an engaging 'treasure hunt' shopping atmosphere. This layout, often around 15,000 to 20,000 square feet, is intentionally designed for ease of navigation, encouraging shoppers to explore the ever-changing inventory.

The strategic placement of products within these stores is key to driving sales and promoting impulse buys. By curating a dynamic assortment, Grocery Outlet creates a sense of discovery, making each visit a unique and potentially rewarding experience for customers seeking value.

- Small-Box Format: Stores typically range from 15,000 to 20,000 square feet, facilitating a more intimate and manageable shopping trip.

- Treasure Hunt Experience: The layout encourages exploration and discovery of discounted and unique items.

- Impulse Purchases: Strategic product placement and the thrill of finding deals drive unplanned buying behavior.

- Dynamic Assortment: The constantly rotating inventory ensures repeat visits are met with new opportunities and excitement.

Grocery Outlet's 'Place' strategy is characterized by focused expansion and a community-centric, independent operator model. By the end of 2024, they operated 533 stores across 16 states, with a significant push into the Southeast via the United Grocery Outlet acquisition, adding 40 stores. This expansion, including plans for approximately 28 new stores in 2024, emphasizes clustered growth in key metropolitan areas like Cleveland, Las Vegas, and Baltimore to maximize market penetration and operational efficiency.

| Metric | 2023 | 2024 (Planned/Actual) | 2025 (Outlook) |

|---|---|---|---|

| New Stores Opened | 29 | ~28 | TBD |

| Total Stores (End of 2024) | N/A | 533 | TBD |

| States Operated In | N/A | 16 | TBD |

| Distribution Center Completion | N/A | N/A | End of 2025 (Vancouver, WA) |

Same Document Delivered

Grocery Outlet 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Grocery Outlet's Product, Price, Place, and Promotion strategies. Understand their unique value proposition and how they thrive in the discount grocery sector.

Promotion

The 'treasure hunt' shopping experience is Grocery Outlet's core promotional strategy. This unique approach leverages a constantly rotating inventory of deeply discounted national brand products, fostering excitement and driving repeat visits from value-conscious consumers.

This element of surprise is a significant draw, making every shopping trip an opportunity for discovery and a potential bargain. For instance, in 2024, Grocery Outlet reported a consistent increase in customer traffic, with promotions like these directly contributing to their ability to attract and retain shoppers seeking exceptional value.

Grocery Outlet's marketing prominently features extreme value, consistently emphasizing savings to attract budget-conscious shoppers. Their core message is that prices are typically 40% less than traditional supermarkets.

Further amplifying this, they spotlight 'WOW!' items, which offer even more substantial discounts, often ranging from 40% to 70% off compared to conventional stores. This aggressive pricing strategy directly appeals to consumers looking to maximize their purchasing power, especially during periods of economic uncertainty.

Grocery Outlet is actively boosting its promotional reach through digital avenues, notably its mobile application. This app serves as a central hub for customers to discover exclusive deals and promotions, personalize their shopping journeys, and utilize digital coupons, directly supporting the promotion element of their 4P's strategy.

The mobile app is designed to foster deeper customer engagement, with features allowing users to track their favorite items and receive personalized notifications about sales. This targeted approach is expected to encourage larger purchases and more frequent visits, as evidenced by the company's focus on digital growth in its 2024 strategy updates.

Community Engagement and Local Focus

Grocery Outlet's independently operated stores are a cornerstone of its community engagement strategy. These local operators are often deeply embedded in their neighborhoods, fostering a strong sense of belonging and trust.

This localized approach allows for tailored community initiatives and potential sponsorships, further strengthening the brand's connection to specific areas. For instance, many stores actively participate in local events and support community causes, enhancing their neighborhood presence.

This focus on local engagement is crucial for building customer loyalty, as shoppers often feel a greater connection to businesses that actively contribute to their community. In 2024, Grocery Outlet continued to emphasize this, with many of its over 450 stores actively participating in local food drives and community events.

- Independent Operators: Empower local store owners to act as community liaisons.

- Local Partnerships: Engage in sponsorships and collaborations with local organizations.

- Community Events: Participate in and host neighborhood-specific events.

- Customer Loyalty: Build trust and a sense of belonging through localized efforts.

Public Relations and Impact Reporting

Grocery Outlet actively manages its public image through public relations efforts, notably releasing an annual Impact Report. This report details the company's dedication to increasing affordable food access, minimizing food waste, and fostering entrepreneurship, thereby demonstrating its commitment to societal well-being. For instance, in their 2023 Impact Report, Grocery Outlet highlighted donating over 30 million pounds of food to food banks and community partners, a significant figure underscoring their waste reduction and community support initiatives.

This strategic communication approach directly supports their brand by resonating with an increasingly socially conscious consumer base. By transparently showcasing their positive contributions, such as their partnerships with local growers to reduce spoilage and their programs supporting small businesses in their supply chain, Grocery Outlet aims to build trust and loyalty. This focus on impact reporting is crucial in a market where consumers increasingly align their purchasing decisions with their values, potentially driving sales and enhancing brand equity.

The Impact Report serves as a key tool in their public relations strategy, reinforcing their mission and values. Key areas of focus often include:

- Affordable Food Access: Quantifying the number of customers served and the savings provided compared to traditional grocery stores.

- Waste Reduction: Detailing initiatives like food recovery programs and sustainable packaging efforts, often with metrics on pounds of food diverted from landfills.

- Community Support: Highlighting partnerships with local non-profits and the economic impact of their operations, including job creation and support for local suppliers.

Grocery Outlet's promotional strategy thrives on its unique 'treasure hunt' appeal, offering deeply discounted national brand products with constantly rotating inventory. This fosters excitement and drives repeat visits, with customer traffic consistently increasing in 2024 due to these value-driven promotions. They emphasize savings, often stating prices are 40% less than traditional supermarkets, with 'WOW!' items offering even steeper discounts of 40-70%.

Digital promotion is key, with their mobile app serving as a hub for exclusive deals, personalized shopping, and digital coupons, enhancing customer engagement and encouraging larger, more frequent purchases. Their community engagement is driven by independent store operators who act as local liaisons, fostering trust through tailored initiatives and sponsorships, with over 450 stores actively participating in local events in 2024.

Public relations efforts, like their annual Impact Report, highlight affordable food access, waste reduction, and community support, reinforcing their brand values and resonating with socially conscious consumers. In 2023, they donated over 30 million pounds of food, showcasing their commitment to societal well-being and potentially driving sales.

| Promotional Tactic | Description | 2024/2025 Focus/Data |

|---|---|---|

| Treasure Hunt Experience | Constantly rotating inventory of deeply discounted national brands. | Drives customer traffic and repeat visits; consistent traffic increases reported in 2024. |

| Extreme Value Messaging | Emphasizing savings, typically 40% less than traditional supermarkets. | 'WOW!' items offer 40-70% savings; strong appeal during economic uncertainty. |

| Digital Engagement (Mobile App) | Hub for exclusive deals, personalized shopping, digital coupons. | Aims to increase customer engagement, larger purchases, and frequent visits; focus on digital growth in 2024 strategy. |

| Community Engagement | Independent operators acting as local liaisons, community initiatives, sponsorships. | Over 450 stores actively participating in local events and community causes in 2024. |

| Public Relations (Impact Report) | Showcasing affordable food access, waste reduction, community support. | 2023 Impact Report detailed over 30 million pounds of food donated; reinforces brand values. |

Price

Grocery Outlet's pricing strategy hinges on providing deeply discounted national brand products. This approach is a cornerstone of their value proposition, attracting price-sensitive shoppers. They consistently offer prices that are significantly lower than conventional grocery stores, making national brands accessible to a broader customer base.

Grocery Outlet's pricing is a key differentiator, leveraging its opportunistic buying model to offer dynamic and variable prices. This means deals are not static; they shift constantly based on what the company can acquire from suppliers. For instance, in early 2024, Grocery Outlet continued to highlight significant savings on national brands, often reporting savings of 30-70% compared to traditional supermarkets, a testament to this variable pricing strategy.

The 'treasure hunt' element is directly tied to this pricing. Customers are drawn in by the unpredictable nature of the deals, knowing that specific items and their prices will change frequently as new inventory arrives. This encourages repeat visits, as shoppers want to discover the latest bargains. This strategy has proven effective, with Grocery Outlet reporting a consistent increase in customer traffic, driven by the excitement of finding unexpected savings throughout 2024.

Grocery Outlet distinguishes itself by not only offering extreme value but also by actively competing on price with other discount retailers. This strategy ensures they remain a top choice for budget-conscious shoppers.

Their pricing is remarkably aggressive, typically coming in around 40% lower than conventional supermarkets. Furthermore, compared to other major discount grocers, Grocery Outlet's prices are generally about 20% less, solidifying their powerful value proposition.

Value-Driven Private Label Offerings

Grocery Outlet's introduction of private label brands, such as 'Simply Go,' significantly enhances its value proposition. These store brands offer customers high-quality products at lower prices compared to national brands, directly supporting the company's low-price image and encouraging larger purchases. This strategy is crucial for driving customer loyalty and boosting overall profitability.

The success of private label brands is evident in their contribution to sales. For instance, in 2023, private label penetration at Grocery Outlet reached approximately 35% of total sales, demonstrating a strong customer preference for these value-oriented options. This focus on private labels allows Grocery Outlet to maintain its competitive edge in a challenging retail environment.

- Private Label Penetration: Grocery Outlet's private label brands accounted for around 35% of total sales in 2023.

- Customer Value: 'Simply Go' and other store brands provide affordable, quality alternatives to national brands.

- Profitability Driver: Private labels contribute to larger basket sizes and improved profit margins for the company.

- Brand Image Reinforcement: These offerings solidify Grocery Outlet's reputation for delivering exceptional value.

Pricing Reflecting Perceived Value

Grocery Outlet's pricing strategy is centered on delivering exceptional perceived value, even on deeply discounted items. Their focus remains on offering quality products at prices that resonate with budget-conscious consumers, a strategy that proves particularly effective during inflationary periods. This approach ensures customers feel they are maximizing their purchasing power.

The company's commitment to value is evident in its ability to pass significant savings onto shoppers. For instance, during the first quarter of 2024, Grocery Outlet reported net sales of $1.1 billion, a 1.6% increase compared to the prior year period. This growth, despite economic headwinds, underscores the appeal of their value proposition.

- Deep Discounts, Undiminished Quality: Grocery Outlet maintains a commitment to quality even with its heavily discounted merchandise, ensuring customers receive good value.

- Inflationary Advantage: The pricing strategy is especially attractive to consumers looking to stretch their budgets during times of rising prices.

- Sales Performance: The company's consistent sales growth, such as the 1.6% increase in Q1 2024 net sales to $1.1 billion, reflects the success of its value-driven pricing.

- Customer Perception: By offering low prices without compromising on product quality, Grocery Outlet cultivates a strong perception of value among its customer base.

Grocery Outlet's pricing strategy is fundamentally about delivering extreme value, consistently offering national brands at prices significantly lower than traditional supermarkets. This aggressive pricing, often 40% below conventional stores and 20% less than other discounters, is a core element of their appeal, particularly for budget-conscious consumers. The company’s opportunistic buying model allows for dynamic pricing, creating a 'treasure hunt' experience that drives repeat customer visits.

Private label brands, such as 'Simply Go,' further bolster this value proposition. In 2023, these brands represented about 35% of total sales, demonstrating strong customer acceptance and contributing to larger basket sizes and improved profitability. This focus on private labels reinforces Grocery Outlet's image as a provider of high-quality, affordable goods.

The effectiveness of this value-driven pricing is reflected in the company's financial performance. For instance, in the first quarter of 2024, Grocery Outlet reported net sales of $1.1 billion, a 1.6% increase year-over-year. This growth highlights the enduring appeal of their low-price strategy, especially in an environment marked by inflation.

| Metric | Value | Comparison Point | Time Period |

|---|---|---|---|

| Average Price Savings (vs. Conventional) | ~40% | Conventional Supermarkets | Ongoing |

| Average Price Savings (vs. Other Discounters) | ~20% | Major Discount Grocers | Ongoing |

| Private Label Sales Penetration | ~35% | Total Sales | 2023 |

| Net Sales Growth | 1.6% | Year-over-Year | Q1 2024 |

| Q1 2024 Net Sales | $1.1 billion | Q1 2024 |

4P's Marketing Mix Analysis Data Sources

Our Grocery Outlet 4P's analysis is grounded in comprehensive data, including official company filings, investor relations materials, and direct observation of their store operations and pricing strategies. We also leverage industry reports and competitive benchmarking to provide a well-rounded view of their marketing mix.