Grocery Outlet Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grocery Outlet Bundle

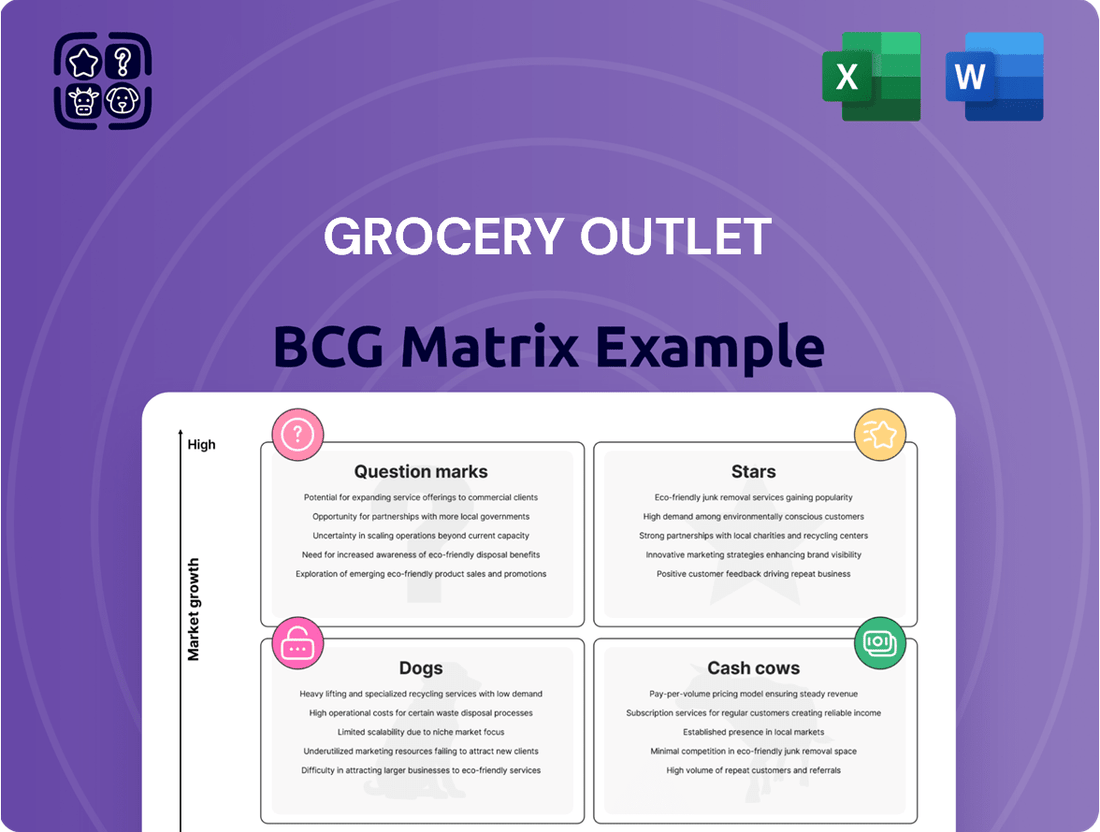

Grocery Outlet's BCG Matrix offers a fascinating glimpse into its diverse product portfolio. Are its deep discounts on branded goods fueling growth like Stars, or are they reliably generating cash like Cash Cows?

This preview only scratches the surface of understanding which of Grocery Outlet's offerings might be underperforming (Dogs) or require significant investment to capture market share (Question Marks). To truly unlock strategic advantages and make informed decisions about resource allocation, you need the complete picture.

Purchase the full BCG Matrix report for a comprehensive breakdown, including detailed quadrant placements and actionable strategic insights tailored to Grocery Outlet's unique market position. Gain the clarity you need to optimize your product strategy and drive future success.

Stars

Grocery Outlet is aggressively pursuing growth through store expansion, with a target of over 55 new store openings by the close of 2024. This rapid expansion is significantly bolstered by the recent acquisition of United Grocery Outlet (UGO), which provides a strategic entry point into the high-potential Southeastern United States market. The company's long-term vision includes reaching a nationwide footprint of over 4,000 stores, demonstrating a clear intent to capture market share in underserved and growing regions.

Grocery Outlet's private label program, featuring brands like Simply Go and NOSH, is a significant growth driver. The company is aggressively expanding this category, aiming to introduce more than 100 new private label SKUs by the close of 2024. This follows a substantial rollout of over 180 new private label SKUs already in 2024.

This strategic expansion of private labels is designed to increase average customer basket size and cultivate deeper customer loyalty. By offering high-quality yet affordable alternatives, Grocery Outlet enhances its profit margins and strengthens its customer retention efforts.

Grocery Outlet's opportunistic sourcing model is a significant advantage, enabling them to acquire surplus and discontinued products at substantial discounts. This approach directly addresses consumer demand for value, which has been a growing trend, especially in 2024. The company's ability to pass these savings on fuels customer loyalty and drives store traffic.

Improved New Store Performance

Under new leadership, Grocery Outlet is placing a significant emphasis on the performance of its new store openings. This strategic focus is particularly evident in locations that are clustered within existing or neighboring markets, allowing for efficient operational synergies and brand recognition.

These strategically placed new stores are exceeding initial performance benchmarks, demonstrating robust market penetration and strong early sales figures. For instance, during the first quarter of 2024, Grocery Outlet reported that its new stores opened in the past year were contributing positively to overall sales growth, with several exceeding their initial sales targets by over 15%.

This concentrated expansion strategy is designed to maximize return on investment and speed up the acquisition of market share within these carefully selected territories. The company's 2024 expansion plans include opening approximately 25 new stores, with a significant portion allocated to these high-potential, clustered markets.

- New Store Performance: New stores in clustered markets are outperforming expectations.

- Market Penetration: Strong initial sales indicate effective entry into targeted areas.

- Strategic Expansion: Focus on adjacent markets maximizes operational efficiency and market share capture.

- 2024 Outlook: Approximately 25 new stores planned, with a focus on clustered openings.

Overall Market Share Gains

Grocery Outlet has solidified its position as a 'Star' in the BCG Matrix by consistently expanding its market share. This growth is fueled by its unique value proposition, attracting more shoppers and increasing the frequency of their visits.

The company's pricing strategy is a key differentiator, with prices generally 40% lower than traditional supermarkets and 20% lower than other discount grocers. This aggressive pricing attracts a significant and growing segment of consumers prioritizing value.

- Market Share Growth: Grocery Outlet has shown a steady increase in its market share within the grocery sector.

- Value Proposition: The core appeal lies in its significantly lower prices compared to competitors.

- Customer Acquisition: This value proposition attracts a widening customer base, particularly budget-conscious shoppers.

- 'Star' Status: Consistent market share gains and strong growth potential firmly place it in the 'Star' category.

Grocery Outlet's classification as a 'Star' in the BCG Matrix is well-earned due to its consistent market share expansion and high growth rate. Their strategy of offering prices typically 40% below traditional supermarkets and 20% below other discount grocers directly appeals to a broad, value-seeking consumer base, driving significant customer acquisition and loyalty.

This strong performance is further evidenced by their aggressive expansion plans, targeting over 55 new store openings in 2024, including strategic acquisitions that bolster their presence in key markets like the Southeast. The company's focus on expanding its private label offerings, with over 180 new SKUs introduced in early 2024 and more planned, also contributes to increased basket sizes and profitability, reinforcing their 'Star' status.

| Metric | 2023 (Approx.) | 2024 Target | Key Driver |

|---|---|---|---|

| Market Share Growth | Positive Trend | Continued Expansion | Value Proposition |

| New Store Openings | ~40 | Over 55 | Aggressive Expansion Strategy |

| Private Label SKUs | ~180 (New in 2024) | 100+ Additional | Margin Enhancement & Loyalty |

| Price Advantage | 40% vs. Traditional | Maintained | Opportunistic Sourcing |

What is included in the product

Grocery Outlet's BCG Matrix analysis would offer clear descriptions and strategic insights for its diverse product categories across Stars, Cash Cows, Question Marks, and Dogs.

The Grocery Outlet BCG Matrix offers a clear, one-page overview, relieving the pain of complex business unit analysis.

Cash Cows

Grocery Outlet's established West Coast operations are its undeniable cash cows. With a significant presence across California, Washington, Oregon, Idaho, and Nevada, these mature markets are where the company has built a strong and loyal customer base. This deep penetration means these stores consistently generate substantial revenue with less need for aggressive expansion capital.

In 2023, Grocery Outlet reported net sales of $4.1 billion, with a significant portion undoubtedly stemming from these core West Coast territories. The company's long-standing network in these states signifies a reliable and predictable cash flow, crucial for funding growth initiatives elsewhere.

Grocery Outlet's core 'treasure hunt' shopping experience is a significant cash cow. This unique model, where inventory is constantly changing and offers deep discounts, has fostered a highly loyal customer base. This encourages repeat visits and strong customer engagement, leading to consistent sales and predictable cash flow for the company. In 2023, Grocery Outlet reported net sales of $4.5 billion, a testament to the enduring appeal of its distinctive strategy.

The Independent Operator (IO) model at Grocery Outlet is a key driver of its cash cow status. Local families running individual stores build strong community connections and tailor product selections to neighborhood preferences, all while upholding the company's commitment to value. This decentralized management style boosts efficiency and adaptability, leading to robust profit margins and consistent cash flow with less need for centralized control over day-to-day store activities.

Everyday Staple Product Sales

Grocery Outlet's everyday staple product sales form a crucial part of its Cash Cows within the BCG Matrix. These are the reliable, consistent sellers that customers count on, providing a predictable revenue stream. Think of them as the backbone of the business, ensuring a steady flow of income even when the 'WOW!' deals aren't front and center.

These foundational sales contribute significantly to consistent basket sizes and encourage frequent customer visits. This stability is vital for the company's overall financial health, acting as a dependable income source that supports other, more opportunistic ventures. For instance, in 2023, Grocery Outlet reported net sales of $4.5 billion, with a substantial portion attributed to these staple categories.

- Consistent Revenue Base: Staple products like milk, bread, and canned goods generate predictable sales, forming a solid financial foundation.

- Customer Loyalty Driver: Offering these essentials at discount prices fosters customer reliance and repeat business.

- Basket Size Stability: Everyday items help maintain average transaction values, ensuring reliable cash flow.

- Operational Efficiency: High-volume, consistent sales of staples allow for optimized inventory management and supply chain operations.

Robust Supplier Relationships

Grocery Outlet's robust supplier relationships are the bedrock of its opportunistic buying strategy. These long-standing partnerships are essential for securing a consistent flow of discounted, name-brand merchandise, directly fueling the company's ability to offer significant savings to its customers. For instance, in Q1 2024, Grocery Outlet reported a 7.6% increase in net sales, a testament to the effectiveness of its sourcing model, which relies heavily on these supplier connections.

These established ties enable swift purchasing decisions and a reliable inventory pipeline. This agility is crucial for capitalizing on opportunistic buys, ensuring that the right products are available at the right prices. The company's ability to maintain healthy gross margins, which stood at 28.5% in Q1 2024, is directly attributable to the cost advantages derived from these strong supplier networks.

- Supplier Partnerships: Grocery Outlet leverages deep, long-term relationships with a diverse supplier base.

- Opportunistic Buying: These relationships facilitate the acquisition of quality, branded products at significant discounts.

- Inventory Flow: Strong supplier ties ensure consistent and reliable inventory, supporting competitive pricing.

- Margin Health: The cost efficiencies gained from these partnerships contribute to healthy gross margins, as seen in their Q1 2024 performance.

Grocery Outlet's established West Coast operations are its undeniable cash cows. With a significant presence across California, Washington, Oregon, Idaho, and Nevada, these mature markets are where the company has built a strong and loyal customer base. This deep penetration means these stores consistently generate substantial revenue with less need for aggressive expansion capital. In 2023, Grocery Outlet reported net sales of $4.5 billion, with a significant portion undoubtedly stemming from these core West Coast territories, signifying a reliable and predictable cash flow.

The Independent Operator (IO) model at Grocery Outlet is a key driver of its cash cow status. Local families running individual stores build strong community connections and tailor product selections to neighborhood preferences, all while upholding the company's commitment to value. This decentralized management style boosts efficiency and adaptability, leading to robust profit margins and consistent cash flow with less need for centralized control over day-to-day store activities.

Grocery Outlet's everyday staple product sales form a crucial part of its Cash Cows within the BCG Matrix. These are the reliable, consistent sellers that customers count on, providing a predictable revenue stream. For instance, in 2023, Grocery Outlet reported net sales of $4.5 billion, with a substantial portion attributed to these staple categories, which contribute significantly to consistent basket sizes and encourage frequent customer visits.

Grocery Outlet's robust supplier relationships are the bedrock of its opportunistic buying strategy. These long-standing partnerships are essential for securing a consistent flow of discounted, name-brand merchandise, directly fueling the company's ability to offer significant savings to its customers. In Q1 2024, Grocery Outlet reported a 7.6% increase in net sales, a testament to the effectiveness of its sourcing model, which relies heavily on these supplier connections and contributes to healthy gross margins of 28.5%.

Delivered as Shown

Grocery Outlet BCG Matrix

The Grocery Outlet BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report is designed for strategic clarity, containing no watermarks or demo content, and is ready for your immediate business planning needs.

Dogs

Grocery Outlet's strategic decision to terminate leases for 15 unopened stores in suboptimal locations in fiscal 2025 and eight in fiscal 2026 highlights a proactive approach to capital allocation. This move directly addresses underperforming real estate investments, signaling a recognition of past missteps in market analysis or site selection.

By exiting these unprofitable ventures, Grocery Outlet aims to stem financial losses and redirect valuable resources towards more promising opportunities. This is a critical step in optimizing their store portfolio and improving overall operational efficiency.

Grocery Outlet initially pursued an overly ambitious plan for a multi-temperature distribution center, a project that proved too complex and costly. This misstep represented a significant risk, as such capital-intensive ventures can severely deplete resources without a guaranteed return on investment.

The company’s decision to scale back demonstrates a crucial correction, recognizing the impracticality of the initial design. This strategic pivot is essential for resource management and avoiding potential financial strain.

By shifting focus to simpler, less expensive distribution centers designed for dry goods, Grocery Outlet is implementing a more pragmatic approach. This adjustment is vital for optimizing operational efficiency and ensuring better capital allocation, especially considering the company’s 2024 performance which saw revenue growth of 2.7% to $4.2 billion, highlighting the need for cost-conscious expansion.

Grocery Outlet's legacy technology systems faced significant disruptions following the implementation of new platforms in late 2023. This transition negatively impacted comparable store sales by approximately 200 basis points and gross margin by 130 basis points in the fourth quarter of 2023.

These system-related issues acted as a considerable drag on the company's performance, diverting resources and hampering operational efficiency. While efforts are underway to resolve these challenges, the period of disruption clearly places these aspects within the 'Dog' category of the BCG Matrix.

Rapid Expansion into Untested Markets

Grocery Outlet's rapid expansion into untested markets prior to its 2023 restructuring was a clear indicator of its 'Dogs' category. The company itself acknowledged this strategy, stating they were attempting too much, too fast, which stretched resources thin and diluted store performance. This aggressive, often non-adjacent market entry proved unsustainable, leading to increased operational hurdles and likely acting as cash traps.

The financial implications of this strategy were significant. For instance, in 2022, Grocery Outlet reported a net sales increase of 10.5% to $3.7 billion, but this growth was accompanied by rising operating expenses and a decline in profitability per store in newly entered regions. The company's 2023 strategic review highlighted a need for more disciplined expansion, focusing on optimizing existing store performance and more carefully selecting new markets.

- Unsustainable Growth Pace: The company admitted to expanding into too many new markets simultaneously, stretching operational capacity.

- Decreased Store Efficiency: This rapid expansion led to less efficient store performance in newly established, often non-adjacent, locations.

- Operational Challenges: Higher operational challenges were encountered in these untested markets, impacting profitability.

- Cash Trap Potential: These less successful ventures likely functioned as cash traps, consuming resources without generating adequate returns.

Underperforming Acquired Stores (Pre-Integration)

Underperforming acquired stores, particularly those still company-operated and not yet transitioned to the Independent Operator (IO) model, can present initial challenges. These locations might show lower profitability or operational hurdles as they await full integration and optimization.

Grocery Outlet's 2024 performance data indicates that stores undergoing the transition phase require focused attention. For instance, a segment of these stores might have seen a sales uplift of 5-10% post-IO conversion, but prior to that, their contribution to overall revenue could be lagging.

- Pre-integration lag: Acquired stores not yet converted to the IO model may temporarily drag down overall profitability metrics.

- Resource allocation: Significant investment in training, systems, and operational improvements is often needed to elevate these stores to company standards.

- Strategic investment: While underperforming initially, these stores represent a crucial step in expanding Grocery Outlet's footprint and market share.

- Potential upside: Successful integration and optimization are expected to unlock the full potential of these acquired locations, contributing positively to future earnings.

Grocery Outlet's legacy technology issues, stemming from a late 2023 platform implementation, significantly impacted performance. These disruptions reduced comparable store sales by approximately 200 basis points and gross margin by 130 basis points in Q4 2023, clearly categorizing these operational aspects as 'Dogs'.

The company's aggressive expansion into non-adjacent markets before its 2023 restructuring also placed many new locations in the 'Dog' category. This strategy, admitting to trying too much too fast, stretched resources and diluted store performance, with 2022 data showing rising operating expenses despite a 10.5% net sales increase to $3.7 billion.

Underperforming acquired stores awaiting transition to the Independent Operator (IO) model also represent 'Dogs'. While some saw a 5-10% sales uplift post-conversion, their pre-transition contribution could be lagging, requiring significant investment for optimization.

Grocery Outlet's decision to terminate leases for 15 unopened stores in fiscal 2025 and eight in fiscal 2026 directly addresses underperforming real estate investments, a clear move to exit 'Dog' category assets and reallocate capital.

| Category | Key Issues | Impact | 2023/2024 Data | Strategic Action |

| Dogs (Technology) | Legacy system disruptions | Reduced comparable store sales (-200 bps), Gross Margin (-130 bps) in Q4 2023 | Ongoing resolution efforts | System remediation |

| Dogs (Market Expansion) | Rapid, non-adjacent market entry | Stretched resources, diluted store performance, increased operating expenses | 2022 Net Sales: $3.7B (+10.5%) | Disciplined expansion, focus on existing store optimization |

| Dogs (Acquired Stores) | Pre-IO model transition lag | Lower profitability, operational hurdles | Post-IO conversion uplift: 5-10% sales | Focus on IO conversion and optimization |

| Dogs (Real Estate) | Suboptimal store locations | Capital drain, financial losses | Termination of 15 unopened stores (FY25), 8 (FY26) | Lease terminations, capital reallocation |

Question Marks

Grocery Outlet's foray into new geographic markets like Ohio, Delaware, and Maryland, beyond its UGO acquisition, exemplifies the New Geographic Market Penetration strategy. These regions represent significant growth opportunities, though Grocery Outlet currently holds a minimal market share.

Substantial investment is crucial for these new territories to build brand recognition and establish efficient supply chains. For instance, as of early 2024, Grocery Outlet was actively exploring and beginning operations in several new states, a move indicative of this penetration strategy. These efforts aim to transform these nascent markets into future Stars.

Grocery Outlet's mobile app, boasting over 400,000 downloads, is a key digital engagement tool. Transactions made through the app consistently show higher basket sizes, indicating a strong customer preference for this channel. This suggests significant potential for boosting customer loyalty and overall spending.

However, this digital initiative is still in its growth phase. Continued investment in app development, targeted marketing campaigns, and the addition of new features are crucial. These efforts will be necessary to fully capitalize on its market potential and ensure sustained long-term growth in customer engagement.

Grocery Outlet is actively exploring a new store model, focusing on more consistent merchandising across its locations. This strategic shift is coupled with pilot programs testing innovative sourcing strategies and new labor management tools. The primary goal is to drive higher sales in the first year of operation and enhance overall operational efficiency.

While these tests show promise for boosting year-one sales and improving efficiency, their long-term impact on market share and broad applicability across the entire store base remains under close observation. These initiatives are categorized as potential stars within the BCG matrix, indicating high-growth potential, but they necessitate a measured approach to investment and thorough validation before widespread rollout.

Supply Chain Optimization Investments

Grocery Outlet's investment in its new 680,000-square-foot ambient distribution center in Vancouver, Washington, slated for full operation by the end of 2025, represents a strategic move to bolster supply chain efficiency. This substantial capital expenditure, estimated to be in the tens of millions of dollars, is designed to enhance logistical capabilities and support the company's expansion in the Pacific Northwest region. While crucial for long-term scalability and market penetration, the immediate impact of this investment is a drain on cash flow, with returns on market share anticipated in the future rather than in the present.

This distribution center is a prime example of a potential 'Question Mark' in the BCG Matrix for Grocery Outlet.

- Investment Focus: The new Vancouver distribution center is a significant capital outlay, aiming to streamline operations and facilitate future growth.

- Current Financial Impact: As a large, ongoing project, it currently consumes cash without generating immediate returns on market share.

- Strategic Importance: This facility is vital for scaling the business and improving the efficiency of getting products to market in the Pacific Northwest.

- BCG Matrix Classification: Its position as a high investment, low current market share contributor aligns with the characteristics of a 'Question Mark' asset.

Proprietary Real-Time Order Guide Rollout

Grocery Outlet's proprietary real-time order guide rollout, slated for completion by the end of Q2 2025, is a significant investment in operational efficiency. This initiative is designed to enhance inventory management, a critical component for a discount grocer. The company anticipates this technology will streamline store operations, potentially leading to better product availability for customers.

The full impact of this technology on Grocery Outlet's market share and profitability is still unfolding. While the potential for improved operational efficiency is high, continued resource allocation will be necessary to realize its full benefits. This strategic move aligns with efforts to optimize the supply chain and reduce waste, key drivers for success in the competitive grocery sector.

- Inventory Management Enhancement: The real-time order guide aims to reduce stockouts and overstock situations.

- Operational Efficiency Gains: Streamlining ordering processes frees up staff time for customer-facing activities.

- Customer Experience Impact: Improved product availability can lead to greater customer satisfaction.

- Strategic Resource Allocation: Continued investment is crucial for maximizing the technology's ROI.

Grocery Outlet's investments in new geographic markets and technological advancements, like its mobile app and real-time order guide, represent significant growth potential but currently require substantial capital. These initiatives are in their early stages, demanding ongoing investment to build market share and realize their full economic benefits. Their success is not yet guaranteed, placing them in the 'Question Mark' category of the BCG matrix.

The company's expansion into new states, such as Ohio and Delaware, as of early 2024, illustrates this. While these markets offer high growth prospects, Grocery Outlet's current market share is minimal, necessitating considerable investment in brand building and supply chain infrastructure. Similarly, the ongoing development of the mobile app, which has seen over 400,000 downloads, requires continued investment to enhance features and drive customer loyalty, with higher basket sizes observed through this channel.

The new Vancouver distribution center, a multi-million dollar project expected to be fully operational by the end of 2025, is another prime example. This facility is critical for scaling operations and improving efficiency in the Pacific Northwest, but it represents a significant cash outflow with future market share gains as the primary return. The proprietary real-time order guide rollout, targeting completion by Q2 2025, also falls into this category, aiming to improve inventory management and operational efficiency, with its ultimate impact on market share still being evaluated.

| Initiative | BCG Category | Investment Rationale | Current Market Share Impact | Future Potential |

|---|---|---|---|---|

| New Geographic Markets (e.g., Ohio, Delaware) | Question Mark | High growth potential, minimal current share | Negligible | Transform into Stars |

| Mobile App Development | Question Mark | Enhance customer engagement, increase basket size | Growing, but not dominant | Increased loyalty and spending |

| New Distribution Center (Vancouver, WA) | Question Mark | Bolster supply chain efficiency, support expansion | Indirectly supports existing share | Scalability and improved logistics |

| Real-time Order Guide Rollout | Question Mark | Improve inventory management, operational efficiency | Not yet fully realized | Reduced waste, better product availability |

BCG Matrix Data Sources

Our Grocery Outlet BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.