Grammer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grammer Bundle

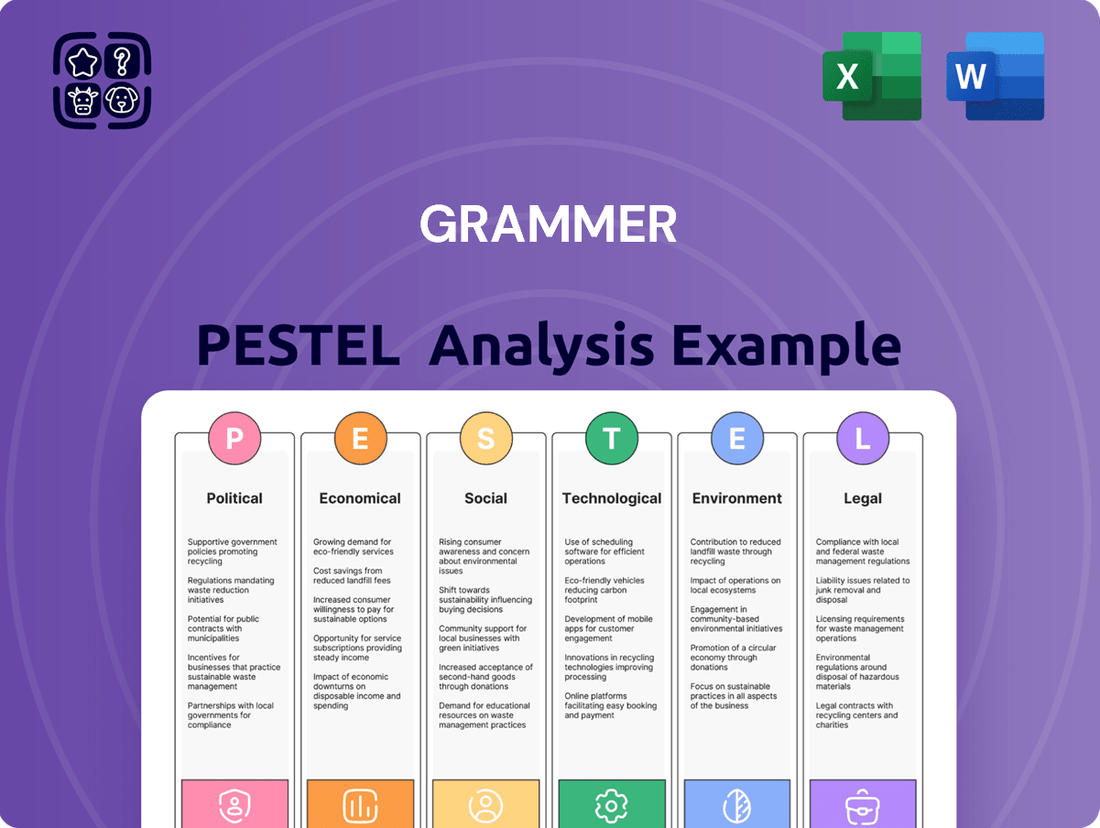

Navigate the complex external forces impacting Grammer with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the company's trajectory. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full analysis now for immediate insights.

Political factors

Government bodies worldwide, including agencies like Euro NCAP and the NHTSA, are continually updating vehicle safety regulations. These evolving standards cover critical components such as headrests, armrests, and child booster seats, directly impacting companies like Grammer AG. For instance, Euro NCAP's 2025 roadmap emphasizes advanced driver-assistance systems and pedestrian protection, necessitating ongoing R&D investment for compliance.

Grammer AG's ability to meet these stringent, ever-changing safety mandates is paramount. Compliance ensures market access, as demonstrated by the fact that vehicles failing to meet NHTSA's Federal Motor Vehicle Safety Standards (FMVSS) cannot be sold in the US. This adherence also builds consumer confidence, a vital asset for Grammer's safety-centric product portfolio, which generated approximately €2.0 billion in revenue in 2023.

Grammer AG's reliance on a global supply chain makes it vulnerable to shifts in international trade policies. For instance, the ongoing trade tensions between major economies in 2024 and 2025 could lead to unexpected increases in import duties on raw materials or finished goods, directly impacting Grammer's cost of production. This necessitates agile strategies to mitigate potential disruptions and maintain competitive pricing.

Grammer AG's operations are significantly influenced by the political stability of its key markets, including Germany, the Czech Republic, and China. Geopolitical tensions, such as those seen in Eastern Europe impacting supply chains in 2024, can directly disrupt production and logistics. For instance, disruptions in the automotive sector due to regional conflicts can lead to reduced demand for Grammer's interior and acoustic components. Maintaining a diversified manufacturing footprint across multiple regions is crucial for mitigating these risks and ensuring business continuity.

Government Incentives for Electric Vehicles (EVs)

Governments worldwide are actively promoting electric vehicle (EV) adoption through various incentives, directly influencing the automotive sector's electrification trajectory. For Grammer AG, this translates into potential shifts in demand for traditional internal combustion engine (ICE) vehicle components and emerging opportunities in specialized EV interior solutions.

These government policies are designed to accelerate the transition to cleaner transportation. For instance, in 2024, the United States continued its Inflation Reduction Act (IRA) tax credits, offering up to $7,500 for qualifying new EVs and $4,000 for used EVs, stimulating consumer purchases. Similarly, many European nations provide purchase subsidies and tax exemptions for EVs.

- Government EV Purchase Subsidies: Many countries offer direct financial incentives to consumers buying EVs, making them more affordable and boosting demand.

- Production Incentives: Governments are also incentivizing EV manufacturing through grants and tax breaks to encourage domestic production and job creation.

- Charging Infrastructure Investment: Public funding is being directed towards expanding EV charging networks, addressing range anxiety and further supporting EV uptake.

- Regulatory Mandates: Some regions are setting targets for EV sales or phasing out ICE vehicle sales, creating a regulatory push for electrification.

Grammer must strategically adapt its product development and manufacturing processes to align with the evolving EV ecosystem, focusing on lightweight materials, integrated battery component housings, and advanced interior features tailored for electric mobility.

Industrial and Labor Policies

Grammer AG, headquartered in Germany, operates within a framework shaped by robust industrial and labor policies. These regulations directly impact manufacturing costs and the company's ability to adapt its operations. For instance, Germany's strong labor laws, including those governing working hours and employee rights, necessitate careful human resource planning and can influence wage structures.

Union negotiations are a significant aspect of these policies. In 2023, Germany saw continued discussions around collective bargaining agreements across various sectors, which can set benchmarks for wages and working conditions. Grammer's engagement with labor representatives is therefore crucial for maintaining stable production and positive employee relations, directly affecting its operational flexibility and cost competitiveness.

Industrial policies, such as those promoting sustainability and digitalization in manufacturing, also play a role. Germany's focus on Industry 4.0 initiatives, for example, encourages investment in advanced technologies. Grammer's compliance with and adaptation to these evolving policies are essential for long-term stability and market positioning.

- German Labor Laws: Strict regulations on working hours, minimum wage, and employee protections directly influence Grammer's HR strategy.

- Union Influence: Collective bargaining agreements in Germany can impact wage levels and operational flexibility, as seen in ongoing negotiations across industries.

- Industrial Policy Alignment: Germany's push for Industry 4.0 and sustainability requires Grammer to invest in technological advancements and compliant manufacturing processes.

Government regulations, particularly those concerning vehicle safety and emissions, directly shape the automotive industry landscape for companies like Grammer AG. For instance, evolving safety standards from bodies like Euro NCAP and NHTSA necessitate continuous investment in research and development, impacting product design and compliance costs. Furthermore, global political stability and trade policies significantly influence supply chain operations and production costs, as demonstrated by ongoing trade tensions in 2024 and 2025.

What is included in the product

Grammer's PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive understanding of its external operating landscape.

The Grammer PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of uncertainty by offering clarity on potential opportunities and threats.

Economic factors

Global economic growth is a key driver for Grammer AG, directly influencing demand for its automotive and commercial vehicle components. When economies are expanding, consumers and businesses tend to spend more on vehicles, boosting Grammer's sales. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years but still indicating a generally positive environment for vehicle demand.

Conversely, economic slowdowns or recessions pose a significant risk. During these periods, both individual consumers and fleet operators cut back on discretionary spending, including new vehicle purchases. This reduction in demand directly impacts Grammer's sales volumes and overall revenue, as seen in historical downturns where automotive production and sales experienced sharp declines.

Consumer spending, a major component of economic health, directly translates into vehicle purchasing power. Higher disposable incomes and consumer confidence generally lead to increased demand for new cars and trucks, which in turn benefits suppliers like Grammer. As of early 2024, consumer sentiment indicators in major automotive markets showed mixed signals, suggesting a cautious approach to spending that could moderate vehicle sales growth.

Grammer AG's manufacturing process relies heavily on raw materials like steel, plastics, foams, and textiles. The prices of these commodities are subject to significant global fluctuations, directly impacting Grammer's production expenses and, consequently, its profitability. For instance, steel prices saw considerable swings in late 2023 and early 2024, influenced by supply chain disruptions and demand shifts in the automotive and construction sectors, which are key end markets for Grammer.

To navigate these uncertainties, Grammer must employ robust procurement strategies, including forward contracts and strategic supplier relationships, to mitigate the financial risks tied to volatile material costs. Hedging mechanisms, such as commodity futures, can also be utilized to lock in prices and provide greater cost predictability. The company's ability to effectively manage these fluctuating input costs is crucial for maintaining competitive pricing and healthy profit margins in its highly competitive industry.

Interest rate fluctuations directly impact Grammer AG's cost of capital and the affordability of its products for customers. For instance, a rise in the European Central Bank's key interest rates, which stood at 4.50% as of early 2024, can make financing more expensive for automotive manufacturers and individual buyers, potentially softening demand for Grammer's interior and exterior components.

Higher borrowing costs also affect Grammer AG's own investment decisions. Increased interest expenses on loans can reduce profitability and limit the company's capacity for crucial investments in research and development, facility upgrades, or strategic mergers and acquisitions needed to maintain its competitive edge in the automotive supply chain.

Supply Chain Disruptions and Logistics Costs

Grammer AG, like many global manufacturers, faces significant risks from supply chain disruptions. Geopolitical tensions and the lingering effects of the COVID-19 pandemic have exposed vulnerabilities in the international flow of components and finished goods. For instance, in 2023, disruptions in key automotive component markets continued to impact production schedules across the industry.

Rising logistics costs present another substantial challenge. Factors such as elevated fuel prices and persistent shortages of shipping containers directly increase Grammer's operational expenses. In early 2024, freight rates, though fluctuating, remained a significant cost consideration for companies reliant on global shipping.

To mitigate these pressures, Grammer must prioritize building a resilient and diversified supply chain. This involves strategies such as:

- Supplier Diversification: Reducing reliance on single-source suppliers, especially in politically unstable regions.

- Regionalization: Exploring near-shoring or on-shoring options for critical components to shorten lead times and reduce transportation costs.

- Inventory Management: Optimizing inventory levels to buffer against short-term disruptions without incurring excessive holding costs.

- Logistics Partnerships: Securing reliable partnerships with logistics providers to ensure stable and cost-effective transportation.

Currency Exchange Rate Fluctuations

Grammer AG, operating globally with international sales and production, faces significant exposure to currency exchange rate fluctuations. These shifts directly affect the reported value of international revenues and the cost of raw materials sourced from abroad. For instance, a strengthening Euro against the US Dollar in early 2024 could reduce the dollar-denominated profits when converted back to Euros, impacting Grammer's consolidated financial statements.

Such volatility can also influence Grammer's export competitiveness. If the Euro strengthens considerably, Grammer's products become more expensive for buyers in countries with weaker currencies, potentially leading to reduced sales volumes. Conversely, a weaker Euro can boost export sales by making Grammer's offerings more attractive internationally.

To navigate these risks, Grammer employs strategic financial management. This often involves hedging strategies, such as forward contracts or currency options, to lock in exchange rates for future transactions. For example, if Grammer anticipates a large revenue stream in USD in the coming months, they might use financial instruments to secure a specific Euro-USD exchange rate, thereby protecting their profit margins from adverse currency movements.

- Impact on Revenue: A 5% appreciation of the Euro against the USD could reduce the Euro value of USD-denominated sales by approximately 5% before hedging.

- Cost of Goods Sold: Fluctuations in the Chinese Yuan (CNY) can impact the cost of components sourced from China, affecting Grammer's production expenses.

- Competitive Pricing: Exchange rate shifts can alter the price competitiveness of Grammer's products in key markets like North America and Asia.

- Hedging Effectiveness: The success of Grammer's hedging strategies is crucial in mitigating the financial impact of currency volatility, with effectiveness often measured by the reduction in earnings per share volatility attributed to currency movements.

Economic factors significantly shape Grammer AG's performance, influencing demand, material costs, and financing. Global economic expansion generally boosts vehicle sales, benefiting Grammer. Conversely, recessions or slowdowns reduce consumer and business spending on vehicles, impacting revenue. Fluctuations in commodity prices, such as steel and plastics, directly affect Grammer's production costs and profitability.

Interest rate changes influence Grammer's cost of capital and customer purchasing power. Higher rates can increase borrowing costs for the company and make vehicle financing more expensive for buyers. Currency exchange rate volatility also presents a challenge, affecting the value of international sales and the cost of imported materials. Hedging strategies are crucial for mitigating these currency risks.

The global economic outlook for 2024, projected around 3.2% growth by the IMF, suggests a generally supportive environment, though with some moderation. Consumer spending confidence, a key indicator, showed mixed signals in early 2024, suggesting a cautious market. Steel prices experienced notable swings in late 2023 and early 2024, impacting manufacturing inputs.

Interest rates in major economies, like the European Central Bank's 4.50% in early 2024, directly affect borrowing costs. Currency markets saw the Euro fluctuate against the US Dollar, with potential impacts on Grammer's revenue translation and export competitiveness. For instance, a 5% Euro appreciation could reduce USD sales value by that percentage before hedging.

| Economic Factor | 2024 Projection/Data | Impact on Grammer AG | Mitigation Strategies |

|---|---|---|---|

| Global Economic Growth | IMF projected ~3.2% for 2024 | Drives vehicle demand; slowdowns reduce sales | Diversification of markets |

| Commodity Prices (e.g., Steel) | Volatile late 2023/early 2024 | Affects production costs and profitability | Forward contracts, supplier relationships |

| Interest Rates (e.g., ECB) | ECB at 4.50% (early 2024) | Influences cost of capital and buyer financing | Efficient capital management |

| Currency Exchange Rates (EUR/USD) | Fluctuating | Impacts international revenue and costs | Currency hedging (forward contracts, options) |

What You See Is What You Get

Grammer PESTLE Analysis

The preview shown here is the exact Grammer PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Grammer, providing valuable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a complete and actionable PESTLE breakdown for Grammer.

Sociological factors

Modern car buyers are looking for more than just a way to get around; they want a comfortable, personalized space that’s packed with the latest tech. This means vehicle interiors are becoming a major selling point, influencing purchasing decisions significantly. For companies like Grammer AG, this shift means a constant need to upgrade their offerings to keep pace with these desires.

Grammer AG’s focus on ergonomic seating and advanced interior components directly addresses this trend. For instance, the demand for customizable ambient lighting and integrated charging ports is soaring. In 2024, reports indicated that over 60% of new car buyers considered interior comfort and technology features as highly important, a figure expected to climb.

This evolving preference is pushing the automotive industry towards more sophisticated and user-friendly cabin designs. Companies are investing heavily in research and development for smart materials, advanced infotainment integration, and modular interior systems that can be tailored to individual needs, impacting Grammer’s product pipeline and strategic direction.

Many developed countries are seeing their populations age. This trend means more people are getting older, and this directly impacts what consumers want in vehicles. For instance, car interiors and seating need to be easier to get into and out of, and more comfortable for older drivers and passengers.

In the commercial vehicle sector, this demographic shift is also important. As more older individuals may remain in the workforce, ensuring driver comfort and health is crucial for productivity and well-being. This means seats and cabins need to be designed with long-term comfort and reduced strain in mind.

Grammer AG's commitment to developing ergonomic and comfortable interior solutions, like advanced seating systems, positions them well to meet these evolving demands. Their focus on user-centric design directly addresses the needs of an aging demographic in both passenger and commercial vehicle markets, a trend that is only expected to grow.

As cities grow, more people are relying on public transport like buses and trains. This trend directly affects the demand for seating systems, as manufacturers like Grammer need to supply these growing transit networks. For instance, by 2025, it's projected that over 65% of the world's population will live in urban areas, highlighting the increasing importance of efficient public transportation solutions.

While individual car ownership might see changes due to urbanization, the shift creates significant opportunities in the mass transit sector. Grammer's established presence in providing seating for buses and trains positions them well to benefit from this expansion. The company's ability to innovate in areas like lightweight materials and passenger comfort will be crucial in securing contracts for these expanding urban mobility projects.

Health and Wellness Consciousness

The increasing focus on health and wellness is significantly shaping how vehicles are designed, particularly their interiors. Consumers are actively seeking features that contribute to a healthier and more comfortable experience, such as advanced air filtration systems for better cabin air quality, ergonomically designed seating to support posture and reduce strain, and materials that create a more calming, stress-reducing atmosphere. This trend is particularly pronounced in the commercial vehicle sector, where drivers spend extended periods behind the wheel. For them, seating solutions that actively combat fatigue and promote overall well-being are not just a luxury but a necessity for performance and health. Grammer AG's strategic alignment with this societal shift is evident in their product development, with a strong emphasis on comfort and advanced ergonomics directly catering to the growing demand for health-conscious living. For instance, Grammer's suspension seating systems are designed to absorb vibrations and shocks, reducing driver fatigue by up to 30% on long hauls, a critical factor for driver health and safety in the 2024/2025 period.

This societal trend translates into tangible market opportunities for companies like Grammer. The demand for premium seating solutions that prioritize driver health and comfort is on the rise, influencing purchasing decisions and OEM specifications.

- Increased demand for advanced air filtration systems in vehicle cabins.

- Growing preference for ergonomically designed seats to improve posture and reduce physical strain.

- Higher value placed on seating that minimizes driver fatigue and enhances overall well-being, especially in commercial vehicles.

- Grammer AG's focus on comfort and ergonomics aligns with the societal shift towards health-conscious lifestyles, impacting vehicle interior design choices.

Sustainability and Ethical Consumption

Consumers are increasingly prioritizing sustainability and ethical sourcing, directly impacting the automotive industry. For Grammer AG, this means a growing demand for vehicle interiors crafted from recycled, renewable, or ethically sourced materials. This trend is not just a niche concern; a 2024 survey indicated that over 60% of car buyers consider a brand's environmental commitment when making a purchase decision.

Grammer AG must actively showcase its dedication to these principles. This involves transparent reporting on their material sourcing and manufacturing processes. For instance, Grammer's 2024 sustainability report highlighted a 15% increase in the use of recycled plastics in their components compared to the previous year, a move designed to resonate with environmentally conscious consumers and bolster brand reputation in a competitive market.

- Consumer Demand: A significant majority of consumers now factor environmental impact into their purchasing decisions.

- Material Innovation: There's a clear push for interiors using sustainable, recycled, and ethically sourced materials.

- Brand Reputation: Demonstrating commitment to sustainability is crucial for maintaining and enhancing Grammer AG's brand image.

- Market Alignment: Grammer's focus on eco-friendly materials aligns with broader industry shifts and consumer values.

Societal attitudes toward health and wellness are increasingly influencing automotive interiors. Consumers are actively seeking features that promote well-being, such as improved air quality and ergonomic seating. This focus extends to commercial vehicles, where driver comfort is paramount for productivity and health.

Grammer AG's emphasis on advanced ergonomics, like their vibration-dampening suspension seating, directly addresses this trend. For instance, their systems aim to reduce driver fatigue by up to 30% on long routes, a critical factor for driver health and safety in 2024/2025.

The growing demand for sustainable and ethically sourced materials is also a significant sociological factor. Consumers are factoring environmental impact into their purchasing decisions, with over 60% of car buyers considering a brand's environmental commitment in 2024. Grammer AG reported a 15% increase in recycled plastics usage in 2024, aligning with this consumer preference.

| Sociological Factor | Consumer Impact | Grammer AG Relevance |

|---|---|---|

| Health & Wellness | Demand for ergonomic seating, better air quality | Focus on comfort, fatigue reduction (e.g., suspension seating) |

| Sustainability & Ethics | Preference for recycled/ethical materials, brand commitment | Increased use of recycled plastics (15% in 2024), transparent reporting |

| Urbanization | Increased reliance on public transport | Opportunity in bus/train seating, lightweight materials |

| Aging Population | Need for easier access, comfortable seating | Development of user-friendly interior solutions |

Technological factors

Grammer AG benefits from ongoing material science research, enabling lighter and stronger interior components. For instance, the automotive industry's push for lighter materials saw the average weight of new vehicles in the US decrease by approximately 2% in 2024 compared to 2023, a trend Grammer's innovations in advanced polymers and composites directly support.

The development of advanced polymers and composites is key to Grammer's strategy for more sustainable and efficient products. These materials allow for a significant reduction in component weight, which is critical for improving vehicle fuel efficiency. For example, a 10% reduction in vehicle weight can lead to a 6-8% improvement in fuel economy, a crucial metric for automakers in 2024 and beyond.

Lightweighting is not just about fuel efficiency; it's also about reducing environmental impact. Bio-based materials are increasingly integrated into automotive interiors, aligning with Grammer's sustainability goals. The global market for bio-based plastics is projected to grow substantially, reaching an estimated $11.7 billion by 2027, indicating a strong demand for Grammer's eco-friendly material solutions.

Grammer AG must embrace the integration of smart interior technologies to meet the evolving demands of connected and intelligent vehicles. This involves embedding advanced electronics, sensors, and haptic feedback systems directly into seating and interior components, a trend that saw significant investment from automotive suppliers in 2024 as they prepared for new model year releases featuring enhanced digital cockpits and driver assistance systems.

The company needs to develop expertise in creating smart surfaces, intuitive integrated controls, and personalized comfort settings. For instance, the global market for automotive interior electronics, including these smart features, was projected to reach over $70 billion in 2025, highlighting a substantial opportunity for Grammer to innovate and capture market share by offering these cutting-edge solutions that elevate both user experience and vehicle functionality.

Autonomous driving is transforming car interiors from driver-focused spaces to versatile living areas. This shift requires Grammer to innovate seating, modularity, and integrated tech solutions to meet new passenger needs. For example, by 2025, it's projected that over 10 million vehicles globally will feature advanced driver-assistance systems (ADAS), a stepping stone to full autonomy, highlighting the urgency for interior redesign.

Electrification of Vehicles and Battery Integration

The automotive industry's rapid shift towards electrification presents a significant technological factor for Grammer AG. As electric vehicles (EVs) become more prevalent, their unique architecture, often featuring large underfloor battery packs, necessitates a redesign of interior spaces and seating. Grammer must innovate its seating solutions and interior components to seamlessly integrate with these new vehicle layouts, ensuring optimal space utilization and passenger comfort.

This transition also brings new thermal management considerations. Battery packs require precise temperature control, which can influence interior climate control systems and potentially lead to the integration of heating and cooling elements directly into seating. Grammer's engineering teams are challenged to develop adaptable seating systems that can accommodate these evolving requirements, enhancing passenger experience in the EV era.

Real-world data underscores this trend. By the end of 2024, global EV sales were projected to exceed 15 million units, a substantial increase from previous years. This growing market share demands that suppliers like Grammer proactively develop solutions tailored for EV platforms. For instance, the integration of advanced thermal management in seating could become a key differentiator.

- EV sales growth: Global EV sales are expected to continue their upward trajectory, creating a sustained demand for specialized interior components.

- Architectural changes: The placement of batteries in EVs alters vehicle floor structures, requiring new approaches to seat mounting and interior design.

- Thermal integration: The need for efficient battery cooling and passenger cabin heating/cooling in EVs opens opportunities for integrating advanced climate control within seating systems.

- Material innovation: Lighter, more durable, and potentially flame-retardant materials may be required for EV interiors to meet safety and efficiency standards.

Advanced Manufacturing and Industry 4.0

Grammer AG's embrace of Industry 4.0 technologies, including robotics and data analytics, is set to boost production efficiency and quality. This digital transformation aims to streamline operations, leading to more cost-effective manufacturing processes. For instance, Grammer's investment in automated solutions in their production facilities, such as those in Germany and the Czech Republic, is a testament to this strategy.

The integration of smart factory concepts allows Grammer to achieve greater agility in production. This means they can respond more quickly to market demands and offer a higher degree of product customization. This flexibility is crucial in the automotive sector, where evolving customer preferences and shorter product lifecycles are common.

Grammer's commitment to advanced manufacturing is reflected in its ongoing capital expenditures. In 2023, the company allocated significant resources towards modernizing its production capabilities, with a focus on digital integration and automation. This strategic investment is designed to enhance Grammer's competitive edge by reducing lead times and improving the overall quality of its interior and seating systems.

Key advancements Grammer is leveraging include:

- Robotics and Automation: Implementing advanced robotic systems for assembly and material handling to increase precision and speed.

- Data Analytics: Utilizing real-time data from production lines to monitor performance, identify bottlenecks, and optimize processes.

- Connected Production: Establishing interconnected systems that allow for seamless data flow between machines, enabling predictive maintenance and enhanced quality control.

- Digital Twin Technology: Exploring the use of digital twins for virtual simulation and testing of production processes before physical implementation, reducing risks and costs.

Grammer AG's technological advancements are heavily influenced by the automotive industry's drive towards electrification and autonomous driving. The increasing prevalence of electric vehicles (EVs) necessitates innovative seating and interior designs to accommodate new architectures, like underfloor battery packs. This shift also introduces new thermal management challenges, potentially integrating climate control directly into seating systems, a trend supported by the projected over 15 million global EV sales by the end of 2024.

Legal factors

Grammer AG operates within a stringent legal framework governing vehicle safety. Compliance with international standards like ECE R17 for seats and FMVSS 207/210 in the US is paramount for its automotive components. Failure to meet these rigorous crashworthiness and occupant protection requirements can result in costly product recalls and significant financial penalties, impacting market access and profitability.

Grammer AG operates within a framework of increasingly strict environmental legislation. For instance, the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation dictates the use of specific substances in manufacturing, directly impacting material sourcing and product composition.

Furthermore, directives concerning vehicle emissions and the end-of-life treatment of vehicles (ELV) necessitate that Grammer design components with recyclability and reduced environmental impact in mind. Non-compliance can lead to significant fines and reputational damage, as seen with various automotive suppliers facing penalties for environmental violations in recent years.

Grammer AG's global operations necessitate strict adherence to varying labor laws concerning wages, working conditions, and employee rights across different nations. For example, in 2023, Germany's minimum wage stood at €12 per hour, a significant factor impacting operational costs and employee relations within the country.

Failure to comply with these diverse regulations can lead to costly legal battles, disruptive strikes, and damage to the company's reputation, underscoring the importance of robust compliance strategies. In 2024, the automotive sector, where Grammer is active, has seen increased scrutiny on fair labor practices and supply chain transparency.

Product Liability and Consumer Protection Laws

Grammer AG operates within a legal framework that includes significant product liability and consumer protection statutes. The company faces potential legal responsibility for damages arising from product defects, necessitating stringent quality control measures and comprehensive product warnings. For instance, in 2023, the automotive industry saw a rise in recall costs, with manufacturers spending billions globally to address safety concerns, highlighting the financial implications of product liability for companies like Grammer.

Consumer protection laws are also critical, mandating adherence to warranty obligations and fair trading practices. These regulations ensure that customers receive products that meet advertised standards and have recourse in case of non-compliance. Grammer AG must ensure its sales and service agreements align with these consumer rights to maintain trust and avoid penalties, a challenge amplified as global consumer advocacy groups become more vocal and organized.

- Product Liability Exposure: Grammer AG is susceptible to lawsuits for damages caused by faulty products, requiring robust risk mitigation strategies.

- Mitigation Strategies: Emphasis on rigorous quality assurance, thorough product testing, and clear, informative product labeling and warnings are paramount.

- Consumer Protection Compliance: Adherence to warranty terms and fair business practices mandated by consumer protection laws is essential.

- Industry Context: The automotive sector, a key market for Grammer, faces increasing scrutiny regarding product safety and consumer rights, as evidenced by rising recall expenditures across the industry.

Intellectual Property Rights and Patents

Grammer AG's ability to protect its innovative designs, manufacturing processes, and technologies through patents and other intellectual property (IP) rights is fundamental to maintaining its competitive edge in the automotive and commercial vehicle interiors market. This legal framework safeguards their significant investments in research and development. For instance, in 2023, Grammer continued to actively manage its patent portfolio, filing new applications to cover advancements in seating technology and lightweight construction materials, crucial for meeting evolving industry demands for sustainability and efficiency.

Conversely, Grammer must remain acutely aware of and vigilant against potential infringement of competitors' IP rights. This legal due diligence is essential to avoid costly litigation and protect its market position. The company's legal and R&D departments collaborate closely to conduct thorough freedom-to-operate analyses before launching new products or technologies, ensuring compliance with global IP regulations.

The importance of IP protection is underscored by the industry's increasing focus on technological differentiation. As of mid-2024, the automotive sector is seeing a surge in patent filings related to advanced driver-assistance systems (ADAS) integration and sustainable material usage, areas where Grammer is actively innovating. Maintaining a robust IP strategy is therefore not just about defense, but also about securing future growth and market leadership.

Key considerations for Grammer regarding IP and patents include:

- Patent Portfolio Management: Continuously evaluating and updating its patent portfolio to reflect ongoing R&D and market trends.

- Freedom-to-Operate Analysis: Ensuring new product developments do not infringe on existing third-party patents.

- Enforcement and Defense: Actively protecting its IP rights against infringement and defending against claims from competitors.

- Global IP Strategy: Navigating and complying with diverse IP laws across key operating regions to maximize protection.

Grammer AG must navigate a complex web of antitrust and competition laws to ensure fair market practices. Violations can result in substantial fines and restrictions on business activities. For instance, regulatory bodies worldwide, including the European Commission, actively monitor and investigate potential anti-competitive behavior in the automotive supply chain, imposing penalties on companies found to be engaging in price-fixing or market allocation. Adherence to these regulations is crucial for maintaining market access and operational integrity.

Environmental factors

Grammer AG, like many automotive suppliers, faces growing demands to prioritize sustainable material sourcing. This means a significant push towards using recycled, renewable, or materials with a reduced environmental impact in their product lines.

The company is actively exploring options like bio-based plastics and recycled foams and textiles, seeking out suppliers who demonstrate a strong commitment to eco-friendly practices. For instance, the automotive industry's overall use of recycled plastics in new vehicles saw a notable increase in 2024, with projections for continued growth.

By embracing sustainable sourcing, Grammer not only aims to lessen its own environmental footprint but also to align with the evolving expectations of its automotive clients, who are increasingly incorporating sustainability metrics into their supplier evaluations.

Grammer AG is actively pursuing initiatives to lower its carbon footprint throughout its operations. This involves adopting energy-saving technologies in manufacturing and increasing the use of renewable energy sources. For instance, by the end of 2024, Grammer aims to power 50% of its European production sites with renewable electricity, a notable increase from 30% in 2023.

Optimizing logistics and supply chain routes is another key strategy. By implementing more efficient transport planning, Grammer seeks to reduce emissions associated with moving raw materials and finished goods. This focus on sustainability not only addresses environmental concerns but also strengthens the company's reputation for corporate responsibility, a factor increasingly valued by investors and customers alike.

Grammer AG's commitment to robust waste management and circular economy principles is key to reducing its environmental footprint. By designing products for easier disassembly and maximizing the use of recycled materials, the company can significantly decrease landfill waste. For instance, Grammer's focus on lightweight construction, which inherently reduces material usage, aligns with these goals. In 2023, the automotive industry, a key sector for Grammer, saw a growing emphasis on sustainable materials, with many manufacturers setting ambitious targets for recycled content in their vehicles, a trend Grammer is well-positioned to support.

Water Usage and Pollution Control

Grammer AG's manufacturing operations, like many in the automotive supply sector, are inherently water-intensive, with processes such as parts washing and cooling systems requiring significant water volumes. The company must navigate a complex web of environmental regulations governing both water consumption efficiency and the treatment of wastewater discharged from its facilities. Failure to comply can result in substantial fines and reputational damage, impacting its operational license and market standing. For instance, in 2023, the European Union continued to strengthen its Water Framework Directive, with member states implementing stricter effluent discharge limits for industrial pollutants.

To mitigate these risks and demonstrate responsible resource management, Grammer AG is actively investing in technologies aimed at reducing its water footprint. This includes implementing closed-loop water systems where feasible and upgrading wastewater treatment facilities to meet or exceed regulatory standards. These investments are not only crucial for environmental stewardship but also contribute to long-term cost savings through reduced water intake and lower treatment expenses. For example, many companies in the manufacturing sector are reporting a 10-15% reduction in water costs after implementing advanced water recycling technologies.

Key considerations for Grammer AG regarding water usage and pollution control include:

- Water Footprint Reduction: Implementing water-saving technologies and optimizing manufacturing processes to minimize overall water consumption.

- Wastewater Treatment: Ensuring all discharged wastewater meets stringent regulatory standards for pollutants, often requiring advanced filtration and chemical treatment.

- Regulatory Compliance: Staying abreast of and adhering to evolving national and international water usage and pollution control legislation.

- Resource Stewardship: Proactively managing water resources as a critical component of sustainable business operations and corporate social responsibility.

Customer and Regulatory Demand for Eco-Friendly Products

Automotive manufacturers and consumers are increasingly prioritizing eco-friendly vehicle interiors. This trend is pushing Grammer AG to develop innovative solutions using low-VOC materials and substances free from harmful chemicals. For instance, Grammer's focus on sustainable materials aligns with the growing market for electric vehicles, where environmental considerations are paramount.

Meeting these evolving customer and regulatory demands is crucial for Grammer's market position. The company's commitment to reducing the lifecycle environmental impact of its components directly addresses this need. By 2024, a significant portion of new vehicle sales are expected to incorporate sustainability features, making Grammer's efforts in this area a key competitive advantage.

- Growing Market Share: The global market for sustainable automotive materials is projected to reach over $10 billion by 2025, indicating a substantial opportunity for Grammer.

- Regulatory Push: Stricter regulations on emissions and material safety, such as those implemented in the EU, are compelling OEMs to demand greener components.

- Consumer Preference: Surveys in 2024 show that over 60% of car buyers consider environmental impact when making a purchase decision.

Grammer AG faces increasing pressure to adopt sustainable material sourcing, focusing on recycled and renewable options to reduce environmental impact. The automotive industry's use of recycled plastics in new vehicles saw significant growth in 2024, with projections indicating continued expansion, a trend Grammer is actively supporting.

The company is committed to lowering its carbon footprint by investing in energy-saving technologies and renewable energy sources, aiming to power 50% of its European production sites with renewables by the end of 2024. Grammer also optimizes logistics to minimize emissions, enhancing its reputation for corporate responsibility.

Grammer's waste management and circular economy initiatives, including designing for disassembly and maximizing recycled material use, are crucial for reducing its environmental footprint. The automotive sector's growing emphasis on sustainable materials in 2023 positions Grammer to capitalize on this trend.

Grammer AG's operations are water-intensive, necessitating strict adherence to water consumption and wastewater discharge regulations. Investments in water-saving technologies and upgraded wastewater treatment facilities are essential for compliance and cost savings, with manufacturers reporting 10-15% reductions in water costs after implementing advanced recycling.

| Environmental Factor | Grammer's Focus/Initiatives | Industry Trend/Data (2024/2025) |

|---|---|---|

| Sustainable Material Sourcing | Using recycled, renewable, bio-based plastics, recycled foams/textiles | Automotive recycled plastics use increased in 2024; projected growth continues. |

| Carbon Footprint Reduction | Energy-saving tech, renewable energy (50% EU sites by end 2024), logistics optimization | Growing demand for EVs emphasizes environmental considerations. |

| Waste Management & Circular Economy | Product design for disassembly, maximizing recycled content, lightweight construction | Automakers setting ambitious recycled content targets for vehicles. |

| Water Usage & Pollution Control | Closed-loop systems, upgraded wastewater treatment, regulatory compliance | Stricter EU Water Framework Directive effluent limits implemented. |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a robust blend of official government publications, reputable academic research, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscapes.