Goldwind SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldwind Bundle

Goldwind, a global leader in wind turbine manufacturing, boasts significant strengths in its technological innovation and expansive market reach, particularly within China. However, understanding the full scope of its operational efficiencies and potential supply chain vulnerabilities is crucial for any investor or strategist. Our comprehensive SWOT analysis delves into these aspects, revealing key opportunities for market expansion and potential threats from evolving regulatory landscapes.

Want the full story behind Goldwind's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Goldwind has cemented its status as a global frontrunner in wind turbine manufacturing. The company consistently ranks among the top players in market share and installation volume year after year. This sustained leadership is particularly evident in China, a powerhouse for global wind energy deployment, where Goldwind holds a commanding presence.

Goldwind's strength lies in its complete control over the wind power value chain. This means they handle everything from designing and building wind turbines and their parts to investing in, developing, constructing, and even operating wind farms. This end-to-end capability is a significant advantage.

By managing the entire process, Goldwind can offer customers truly comprehensive smart energy solutions. They aren't just selling a product; they're providing an integrated service that covers all aspects of wind energy generation.

This integrated model also provides Goldwind with invaluable, in-depth knowledge. They gain a clearer understanding of what customers truly need and how the market is evolving, allowing them to adapt and innovate more effectively.

For example, in 2023, Goldwind's order backlog for wind turbine components and services was substantial, reflecting the demand for their integrated offerings and their ability to manage complex projects from start to finish.

Goldwind's robust research and development (R&D) and commitment to technological innovation are key strengths. The company consistently pushes the boundaries of wind turbine technology, evident in their development of specialized designs like typhoon-resistant turbines and advanced grid-forming capabilities. This dedication to innovation allows Goldwind to offer more efficient, reliable, and cost-effective solutions.

Their focus on larger megawatt turbines, such as the GWH252-16MW model, showcases their drive for enhanced performance and a greater share of the market. These advancements in turbine size and sophisticated control systems directly translate into improved energy capture and operational stability, solidifying their competitive position in the global wind energy sector.

Commitment to Sustainability and ESG Practices

Goldwind's dedication to sustainability is a significant strength, with the company embedding green principles across its operations. For instance, Goldwind has set targets for substantial greenhouse gas emission reductions and aims to boost its reliance on green electricity for manufacturing processes. This proactive approach to environmental stewardship resonates strongly in today's market.

The company's commitment extends to fostering a circular economy model and ensuring responsible practices throughout its supply chain, alongside active community engagement. These ESG-focused initiatives not only bolster Goldwind's reputation but also align with increasing investor and regulatory demands for sustainable business operations. As of the latest reporting, Goldwind has been a consistent leader in renewable energy installations, further underscoring its practical application of these principles.

- Green Electricity Usage: Goldwind is actively increasing its use of green electricity in production, a key metric for operational sustainability.

- Emission Reduction Targets: The company has established ambitious goals for reducing greenhouse gas emissions, demonstrating a commitment to climate action.

- Circular Economy Integration: Goldwind is working to integrate circular economy principles, focusing on resource efficiency and waste reduction.

- Supply Chain Responsibility: A strong emphasis on responsible supply chain management ensures that sustainability efforts extend beyond direct operations.

Growing International Presence and Localization Strategy

Goldwind is steadily growing its international presence, a key strength that diversifies its revenue beyond its strong Chinese base. By establishing overseas manufacturing facilities and actively entering new markets, the company is building a more resilient business model. This global expansion is supported by localization strategies, which include developing local talent and strengthening supply chains within those regions. For example, by the end of 2023, Goldwind had already secured significant market share in regions like Europe and South America, demonstrating tangible success in its international endeavors.

This strategic move to localize operations is crucial for reducing dependence on any single market and for better serving diverse customer needs. It allows Goldwind to adapt its offerings and operations to local regulations and preferences, fostering stronger relationships and greater market penetration. This approach is vital for long-term sustainable growth in the competitive global wind energy sector.

- Expanding Global Footprint: Goldwind is actively establishing a presence in key international markets, moving beyond its strong domestic position.

- Localization Initiatives: The company focuses on developing local talent and enhancing supply chains in overseas markets to better integrate and compete.

- Revenue Diversification: This international expansion directly contributes to diversifying revenue streams, mitigating risks associated with reliance on a single region.

- Market Penetration: Goldwind's success in securing international projects demonstrates the effectiveness of its global strategy in gaining traction in new territories.

Goldwind's comprehensive control over the entire wind power value chain, from design to operation, is a significant strength. This integrated approach allows them to offer complete smart energy solutions, fostering deep market understanding and enabling effective innovation. Their commitment to R&D, particularly in advanced turbine technologies like GWH252-16MW models and grid-forming capabilities, ensures they remain at the forefront of efficiency and reliability. Furthermore, Goldwind's dedication to sustainability, evidenced by ambitious emission reduction targets and green electricity usage, aligns with global demand for environmentally conscious energy solutions.

What is included in the product

Delivers a strategic overview of Goldwind’s internal and external business factors, highlighting its strengths in technology and market share, weaknesses in supply chain reliance, opportunities in emerging markets, and threats from global competition and policy changes.

Offers a clear breakdown of Goldwind's competitive landscape, helping address market uncertainty and inform strategic responses.

Weaknesses

Goldwind's substantial dependence on the Chinese domestic market remains a key vulnerability. While the company has been actively pursuing international expansion, its installations and revenue streams are still overwhelmingly concentrated within mainland China. This significant reliance makes Goldwind susceptible to shifts in domestic policies, economic downturns, and the highly competitive landscape prevalent in its home market.

For instance, in the first half of 2024, Goldwind's domestic market accounted for a vast majority of its wind turbine sales, underscoring this persistent reliance. Any adverse changes in Chinese renewable energy policies or a slowdown in the Chinese economy could disproportionately impact Goldwind's financial performance compared to more diversified global competitors.

Goldwind, like many Chinese wind turbine manufacturers, is grappling with significant profitability challenges. This is largely driven by intense competition and a substantial oversupply of components, especially within its home market. Despite a booming demand, evidenced by record installations and orders in 2023 and projected for 2024, this competitive environment forces price reductions.

The resulting price pressure directly squeezes profit margins for Goldwind and its peers. For instance, while the global installed capacity for wind power surged, with China leading the charge, the sheer number of domestic original equipment manufacturers (OEMs) competing for market share has created a difficult pricing landscape. This dynamic can negatively impact the company's overall financial performance and its ability to invest in research and development or expand into new markets.

As a prominent Chinese wind turbine manufacturer, Goldwind faces significant headwinds from escalating geopolitical risks and ongoing trade tensions. These international frictions can directly impede its ambitions for global expansion, particularly in Western markets. For instance, in 2024, several Western nations continued to express concerns over supply chain security, potentially leading to stricter import regulations or outright bans on Chinese renewable energy equipment.

Such protectionist measures translate into tangible barriers for Goldwind, limiting its access to crucial overseas markets and disrupting established global supply chains. This vulnerability was underscored by the increasing frequency of trade investigations and tariffs imposed on Chinese manufactured goods throughout 2023 and early 2024, creating an unpredictable operating environment for international sales and component sourcing.

Supply Chain Vulnerabilities and Rising Costs

The wind energy sector, including Goldwind, is susceptible to supply chain snags and escalating expenses. This can affect their ability to produce turbines efficiently and meet project deadlines. For example, while some Chinese original equipment manufacturers (OEMs) experienced a price recovery in the final quarter of 2024, the underlying issues of rising commodity prices and increased capital costs persist, potentially squeezing profit margins.

These persistent vulnerabilities translate into tangible impacts:

- Increased Production Costs: Higher prices for raw materials like steel and rare earth elements directly inflate manufacturing expenses for wind turbines.

- Extended Project Timelines: Delays in component delivery due to supply chain disruptions can push back the commissioning of new wind farms, impacting revenue streams.

- Pressure on Profitability: The combination of rising costs and potential pricing pressures in a competitive market can erode the profitability of wind turbine manufacturers like Goldwind.

Challenges in Offshore Wind Market Outside China

While the global offshore wind market expanded significantly, with total installed capacity reaching new heights, installations outside of China experienced a slowdown in 2024. This downturn was largely attributed to inconsistent government policies and project execution delays in key international markets. Goldwind’s robust performance might be more heavily concentrated within its domestic market, suggesting that its global offshore expansion could be hampered by the distinct financial and regulatory complexities inherent in these foreign markets.

Expanding Goldwind's offshore wind footprint internationally presents considerable challenges. For instance, in 2024, European offshore wind installations saw a dip compared to previous years, a trend influenced by permitting backlogs and rising capital costs. These external factors create a less predictable environment for international growth.

- Global offshore wind capacity saw strong growth, but installations outside China slowed in 2024 due to policy inconsistencies and project delays.

- Goldwind's international offshore market expansion faces hurdles related to unique financing structures and evolving regulatory landscapes.

- The European offshore wind sector, a key international market, experienced a contraction in installations in 2024, impacting potential growth for companies like Goldwind.

- Navigating diverse international permitting processes and securing stable long-term project financing remain significant weaknesses for broad global offshore market penetration.

Goldwind's profitability is under pressure due to intense domestic competition and an oversupply of components, leading to price reductions. For example, while the global wind power market saw record installations in 2023 and 2024, the sheer number of Chinese OEMs competing for market share has created a challenging pricing environment that squeezes profit margins.

Geopolitical tensions and trade disputes pose a significant threat to Goldwind's international expansion, particularly in Western markets. Concerns over supply chain security in 2024 led to potential import restrictions on Chinese renewable energy equipment, creating barriers to market access and disrupting global supply chains.

Rising production costs, driven by increased prices for raw materials like steel and rare earth elements, directly impact Goldwind's manufacturing expenses. Furthermore, supply chain disruptions can cause project delays, affecting revenue streams and potentially eroding profitability even with strong market demand.

Preview Before You Purchase

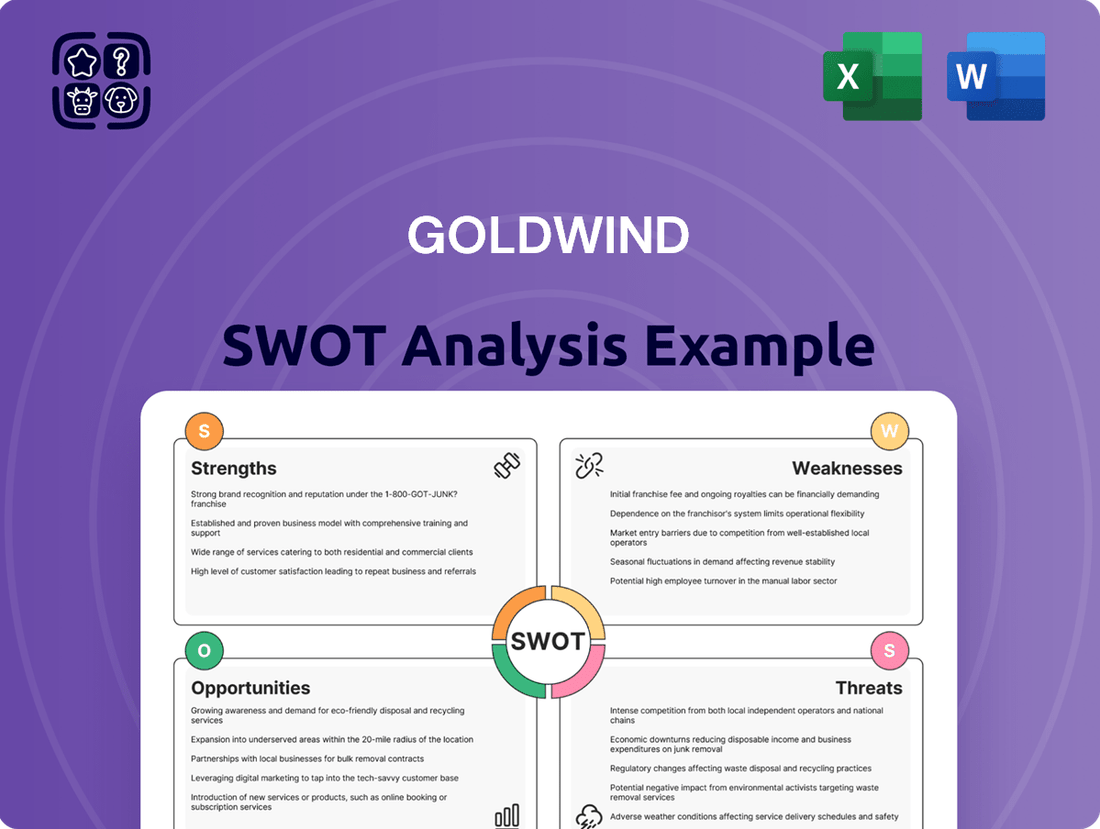

Goldwind SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. You're viewing a live preview of the actual SWOT analysis file, showcasing key insights into Goldwind's market position. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout. This ensures you receive exactly what you see, with no hidden surprises.

Opportunities

The global push to reduce carbon emissions and hit net-zero targets is a major tailwind for the renewable energy sector. This translates directly into increased investment and a surge in demand for wind power solutions, which Goldwind is well-positioned to capitalize on.

The ambitious goal set by the International Energy Agency (IEA) and other bodies to triple global renewable energy capacity by 2030 creates a vast and expanding market. For Goldwind, this means a substantial opportunity to grow its market share and revenue streams as countries worldwide accelerate their clean energy deployment.

Emerging and developing markets represent significant strategic opportunities for wind energy expansion, driven by growing energy needs and often less stringent regulations compared to mature markets. These regions are actively seeking renewable energy solutions to power their economic growth.

Goldwind is well-positioned to capitalize on this trend, leveraging its existing international footprint and successful localization strategies. For instance, the company has already made inroads into key emerging markets such as Brazil, Turkey, and various African nations, demonstrating its capability to adapt and thrive in diverse operating environments.

By 2024, the global wind energy market in emerging economies was projected to see substantial growth, with countries in Asia, Latin America, and Africa leading the charge. Goldwind's continued investment in these regions is expected to yield considerable market share gains, supported by its competitive technology and localized supply chains.

The offshore wind market is experiencing rapid expansion, driven by innovations in turbine technology and installation techniques. Floating wind turbines, in particular, are opening up new possibilities in deeper waters, a segment expected to grow substantially. For example, the global floating offshore wind market is projected to reach USD 30 billion by 2030, according to some industry forecasts.

Goldwind's strategic investment in developing larger megawatt turbines and its ongoing research and development in offshore wind, including floating solutions, positions it well to capture market share in this high-value sector. By focusing on these advanced technologies, Goldwind can tap into projects that require more powerful and versatile wind turbines, thereby enhancing its competitive edge.

Integration of Wind Power with Energy Storage and Hydrogen Production

Goldwind is strategically positioning itself to be a leading provider of integrated new-type power system solutions, combining wind power with energy storage and green hydrogen production. This approach unlocks substantial growth opportunities in emerging markets.

The company's focus on hybrid energy solutions addresses the increasing demand for reliable and flexible renewable energy. By integrating wind power with battery storage, Goldwind can offer more consistent power output, overcoming the intermittency challenges inherent in wind generation. This synergy is crucial for grid stability and meeting the evolving energy needs of various sectors.

The burgeoning green hydrogen economy presents another significant avenue for Goldwind. By utilizing surplus wind power to produce green hydrogen through electrolysis, Goldwind can tap into a rapidly expanding market for clean fuels and industrial feedstocks. This aligns with global decarbonization efforts and creates a new revenue stream.

Key opportunities include:

- Expanding market share in integrated renewable energy solutions, which are projected to grow significantly as grid flexibility becomes paramount.

- Capitalizing on the global push for green hydrogen, with the International Energy Agency forecasting a substantial increase in hydrogen production capacity by 2030.

- Developing innovative hybrid power plant models that combine wind, storage, and hydrogen to offer comprehensive energy services to utilities and industrial clients.

- Securing partnerships and pilot projects in regions with strong renewable energy targets and hydrogen development strategies.

Supportive Government Policies and Incentives for Renewables

Governments globally are actively promoting renewable energy, creating a fertile ground for companies like Goldwind. These initiatives often include direct subsidies, tax credits, and favorable power purchase agreements that significantly reduce the financial risk for renewable projects. For instance, the United States' Inflation Reduction Act of 2022 offers substantial tax incentives for clean energy, including wind power, which is expected to drive significant investment through 2030 and beyond. This policy-driven demand directly benefits turbine manufacturers by ensuring a steady pipeline of orders and supporting higher project development rates.

The trend of supportive government policies is not limited to a single region. China, Goldwind's home market, has consistently prioritized renewable energy development, setting ambitious targets for wind power capacity. By the end of 2023, China's installed wind power capacity surpassed 400 GW, a testament to the effectiveness of its policy framework. These global and regional policy tailwinds translate into increased market opportunities and a more predictable revenue stream for Goldwind.

The impact of these policies extends to de-risking investments, making renewable energy projects more attractive to a broader range of investors. This increased capital availability fuels market expansion and encourages the adoption of new technologies. Specifically, policies designed to streamline permitting processes and grid connection further accelerate project deployment.

- Policy Support: Many nations are offering tax credits, subsidies, and feed-in tariffs to boost renewable energy adoption.

- Market Demand: Favorable policies directly translate into increased demand for wind turbines, creating a robust order pipeline.

- Investment Climate: Government incentives reduce project risk, attracting more private capital into the renewable sector.

- Global Trends: Countries like China and the US are setting aggressive renewable energy targets, signaling sustained market growth.

Goldwind is strategically positioned to benefit from the global energy transition, with a strong focus on integrated renewable energy solutions. The company can leverage the growing demand for green hydrogen, a market the IEA expects to see significant expansion in by 2030, by combining wind power with electrolysis. Developing hybrid power plants that integrate wind, storage, and hydrogen offers comprehensive energy services, creating new revenue streams and enhancing grid stability.

These integrated solutions are crucial as grid flexibility becomes paramount. Goldwind's ability to secure partnerships and pilot projects in regions with aggressive renewable energy and hydrogen development targets, like those seen in the US and China, will be key to capturing market share. The company's investment in larger megawatt turbines and offshore solutions further strengthens its competitive position in high-growth segments.

Threats

The wind turbine manufacturing industry, especially among Chinese original equipment manufacturers (OEMs) like Goldwind, is grappling with persistent price wars and an overabundance of components. While some stabilization hints emerged in late 2023 and early 2024, the underlying pressures remain, forcing companies to constantly find ways to cut costs to protect their profit margins.

This oversupply situation directly impacts profitability, as increased competition drives down unit prices. For instance, reports from early 2024 indicated that average selling prices for onshore wind turbines in key markets were still significantly lower than in previous years, squeezing margins for all players, including Goldwind.

Sustained pressure on profitability necessitates a relentless focus on cost optimization across the entire value chain, from raw materials to manufacturing and logistics. Goldwind's ability to navigate this threat hinges on its efficiency in production and its capacity to innovate in cost-saving technologies.

The wind energy sector, including companies like Goldwind, continues to grapple with significant supply chain vulnerabilities. These disruptions, exacerbated by geopolitical events and lingering pandemic effects, directly translate into increased costs and extended delivery times for essential components.

Rising commodity prices, particularly for steel and rare earth metals crucial for turbine manufacturing, present a persistent threat. For instance, the price of steel, a primary input for wind turbines, saw significant volatility in 2023, impacting the cost base for manufacturers.

Logistical hurdles, from shipping container shortages to port congestion, further complicate the timely delivery of finished turbines and parts. This can delay project timelines and increase overall project expenses for Goldwind and its clients.

These external pressures on raw material sourcing and transportation directly affect Goldwind's production efficiency and its ability to meet market demand reliably, potentially squeezing profit margins.

Policy instability in key markets presents a significant threat to Goldwind. For instance, the volatile nature of renewable energy subsidies in some European nations, including the phasing out or alteration of feed-in tariffs, can directly impact project economics and Goldwind's order pipeline. The company has observed stop-and-go policy implementations leading to project delays and uncertainty in markets where it seeks to expand its presence.

Changes in governmental incentives, such as tax credits or renewable portfolio standards, can swiftly alter the attractiveness of wind power projects. Furthermore, shifts in permitting processes or evolving trade regulations, like increased tariffs on imported components, could hinder market access and inflate operational costs for Goldwind. In 2024, several emerging markets saw unexpected revisions to their renewable energy frameworks, creating apprehension among investors and manufacturers alike.

Technological Disruption and Rapid Innovation by Competitors

The wind energy sector is a hotbed of technological advancement, meaning competitors could quickly launch more efficient or cheaper wind turbine designs. For Goldwind, this poses a significant threat as a market leader. For instance, the industry saw turbine capacities grow substantially, with some manufacturers in 2024 and early 2025 showcasing models exceeding 15 MW, a leap from earlier generations. This rapid innovation cycle demands continuous, substantial investment in research and development to avoid being outpaced.

Competitors are not just focusing on size but also on improving drivetrains, control systems, and blade aerodynamics. These advancements can lead to higher capacity factors and lower levelized cost of energy (LCOE), directly challenging Goldwind's existing product offerings. Staying ahead requires not only replicating but also pioneering these technological leaps. The pressure to invest in R&D is immense, with industry reports in late 2024 highlighting increased R&D spending by major players to secure future market share.

- Technological Obsolescence: Competitors’ faster innovation cycles could render Goldwind’s current turbine technology less competitive.

- Increased R&D Costs: To counter this, Goldwind must allocate significant capital to R&D, impacting profitability.

- Market Share Erosion: New, superior technologies from rivals could lead to a loss of market share if Goldwind cannot match them.

- Price Competition: More efficient turbines from competitors may drive down prices, squeezing Goldwind's margins.

Grid Constraints and Infrastructure Limitations

Outdated or insufficient electrical grid infrastructure presents a major obstacle for integrating renewable energy sources like wind power. This lack of modern grid capacity, especially in developing regions, can significantly slow down the deployment of new wind farms. For instance, in some parts of the United States, grid interconnection queues for renewable projects numbered over 2,000 GW by early 2024, highlighting the sheer scale of the challenge.

Prolonged permitting processes for grid upgrades and new transmission lines further exacerbate these limitations. Goldwind, like other turbine manufacturers, faces delays in project timelines due to these infrastructure bottlenecks. The need for substantial investment in grid modernization, estimated to be hundreds of billions of dollars globally, is critical to unlocking the full potential of wind energy.

- Grid Capacity Issues: Many regions lack the necessary electrical grid capacity to absorb large influxes of wind power.

- Interconnection Queues: Renewable energy projects often face lengthy waits to connect to the grid, with queues extending for years.

- Infrastructure Investment Needs: Significant capital is required to upgrade and expand existing grid infrastructure to accommodate renewables.

- Permitting Delays: Bureaucratic hurdles and lengthy approval processes for grid enhancements and new transmission lines hinder progress.

Intense price competition within the wind turbine market continues to pressure Goldwind's profitability, with average selling prices remaining subdued into early 2024. Supply chain disruptions, including rising commodity prices for steel and logistical challenges, further inflate costs and delay deliveries, impacting efficiency and market responsiveness.

Policy shifts and regulatory uncertainty in key international markets create significant headwinds, potentially altering project economics and impacting Goldwind's order pipeline. Rapid technological advancements by competitors necessitate substantial and ongoing R&D investment, risking market share erosion if Goldwind cannot keep pace with innovations in turbine capacity and efficiency.

Inadequate electrical grid infrastructure and lengthy permitting processes for grid upgrades worldwide create substantial bottlenecks for wind project deployment, delaying timelines and increasing overall project costs for Goldwind and its clients.

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, including Goldwind's official financial reports, detailed market research, and insights from industry experts and verified news sources, ensuring a robust understanding of the company's strategic landscape.