Goldwind Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldwind Bundle

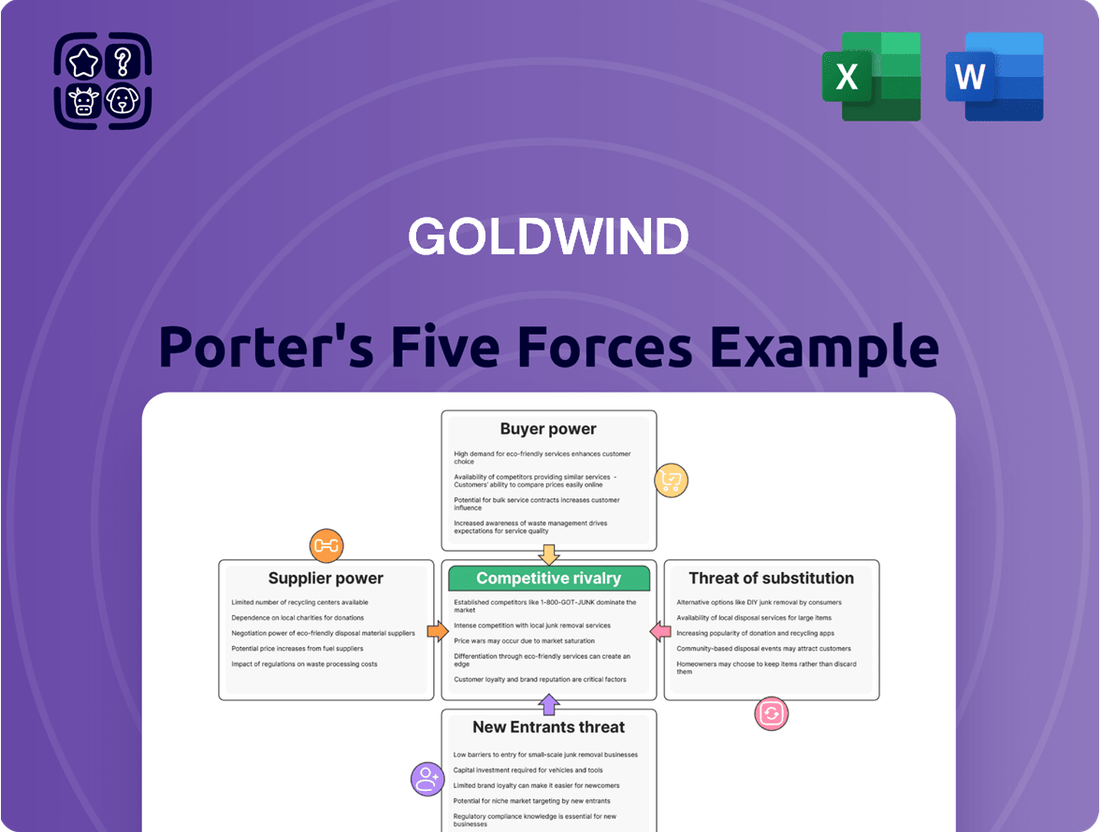

Goldwind's position in the wind turbine industry is shaped by powerful market forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threat of new entrants and substitutes is crucial for strategic planning. This brief overview offers a glimpse into these dynamics.

The complete report reveals the real forces shaping Goldwind’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The wind turbine sector often sees a handful of specialized manufacturers controlling the supply of essential components like advanced blades, high-performance gearboxes, and robust generators. This limited supplier base means these companies can wield considerable influence, especially when their offerings are unique or lack easy alternatives.

For Goldwind, a major Original Equipment Manufacturer (OEM), managing these concentrated supply chains is crucial for negotiating favorable pricing and guaranteeing a steady flow of necessary parts. For instance, in 2023, the global wind turbine market experienced supply chain pressures, with lead times for certain components extending significantly, underscoring the power held by these key suppliers.

The availability of essential raw materials like steel, copper, and particularly rare earth elements, which are critical for Goldwind's direct-drive turbines, significantly impacts supplier leverage. When these materials are scarce or their supply chains are disrupted, suppliers gain more power to dictate terms and prices.

Global commodity prices experienced notable volatility in 2024. For instance, copper prices saw significant upward pressure throughout the year, impacting manufacturing costs across various sectors, including wind turbine production, directly affecting Goldwind's input expenses.

Switching suppliers for Goldwind's critical wind turbine components, such as specialized gearboxes or advanced control systems, can be exceptionally costly. These expenses often encompass significant investments in redesigning existing turbine models, re-tooling manufacturing processes, and undergoing rigorous re-certification procedures for new parts, potentially running into millions of dollars per component change.

These substantial switching costs inherently limit Goldwind's ability to freely change suppliers, thereby strengthening the bargaining leverage of its established and specialized component providers. Suppliers who offer unique or proprietary technologies that are deeply integrated into Goldwind's product lines can command higher prices and more favorable contract terms.

For instance, if a key supplier of rare-earth magnets for Goldwind's direct-drive generators were to increase prices, Goldwind might face a difficult decision due to the extensive R&D and testing required to qualify an alternative supplier, a process that could delay product launches and impact market competitiveness.

Supplier's Product Differentiation

When suppliers offer highly differentiated products, such as specialized components with unique technological advancements or patent protection, their bargaining power significantly increases. Goldwind's need for these innovative parts, crucial for enhancing wind turbine performance and efficiency, can lead to a heightened dependence on its key suppliers. For instance, if a supplier holds a patent for a critical blade material that significantly improves energy capture, Goldwind would have limited alternatives, granting that supplier considerable leverage in price negotiations and supply terms.

This reliance on unique supplier offerings can shape Goldwind's operational costs and procurement strategies. The ability of suppliers to differentiate their products means they can command premium pricing, as finding suitable substitutes becomes more challenging and costly.

- Supplier differentiation creates pricing leverage: Suppliers with patented or technologically superior components can charge higher prices due to limited alternatives.

- Goldwind's dependence on innovation: The company's pursuit of high-performance turbines necessitates reliance on suppliers with cutting-edge technology, increasing supplier power.

- Impact on procurement costs: Differentiated components can drive up Goldwind's raw material and component expenses, affecting overall profitability.

- Strategic sourcing implications: Goldwind must actively manage supplier relationships and potentially invest in R&D or long-term contracts to mitigate the impact of supplier differentiation.

Forward Integration Threat by Suppliers

The threat of suppliers integrating forward into turbine manufacturing, while not a prevalent concern, could theoretically enhance their bargaining power. This would involve suppliers moving beyond component production to assembling and selling complete wind turbines themselves.

However, the substantial capital investment and intricate technical expertise required for turbine manufacturing present significant barriers. These hurdles make it economically unfeasible for most component suppliers to undertake such a strategic shift.

Goldwind's robust in-house manufacturing capabilities for key components and its established assembly processes serve as a crucial defense against this potential threat. By controlling a significant portion of its value chain, Goldwind reduces its reliance on external suppliers and diminishes the likelihood of supplier-driven forward integration.

- Forward Integration Threat: Suppliers moving into turbine assembly is a low-probability, high-impact risk.

- Deterrents: High capital requirements and technical complexity deter suppliers from turbine manufacturing.

- Goldwind's Mitigation: Strong in-house manufacturing reduces vulnerability to this threat.

Suppliers of critical wind turbine components, like specialized blades and advanced generators, hold significant power due to limited competition and the unique nature of their products. For Goldwind, this concentration means these suppliers can dictate terms and prices, especially when essential materials such as rare earth elements, vital for direct-drive turbines, become scarce or experience supply chain disruptions. For example, in 2024, copper price volatility directly impacted manufacturing costs, highlighting how raw material availability strengthens supplier leverage.

Switching costs for Goldwind are substantial, involving redesign, re-tooling, and re-certification, which can run into millions of dollars, reinforcing supplier power. Suppliers offering patented or technologically superior parts, crucial for Goldwind's pursuit of high-performance turbines, can command premium pricing due to Goldwind's dependence on these innovations. This dependence directly affects Goldwind's procurement costs and necessitates strategic sourcing to manage supplier relationships effectively and mitigate the impact of component differentiation.

| Factor | Impact on Goldwind | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Limited suppliers for critical components. | Concentration persists in advanced component markets. |

| Switching Costs | High costs for component changes (millions USD). | High switching costs remain a barrier to supplier diversification. |

| Product Differentiation | Suppliers with unique/patented tech gain leverage. | Innovation in blade and generator tech continues to drive differentiation. |

| Raw Material Availability | Scarcity of materials like rare earths increases supplier power. | Copper price increases in 2024 demonstrated input cost volatility. |

What is included in the product

This analysis details Goldwind's competitive environment, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the wind energy sector.

Simplify complex competitive landscapes with a visual Goldwind Porter's Five Forces analysis, allowing for rapid identification of key pressures and strategic opportunities.

Customers Bargaining Power

Goldwind's customer base is largely comprised of major utility companies, independent power producers, and large-scale project developers. These entities are typically involved in developing wind farms worth billions of dollars, giving them considerable clout.

The sheer magnitude of these wind farm projects significantly amplifies the bargaining power of Goldwind's customers. They can leverage the substantial investment required to negotiate more favorable pricing, contract terms, and after-sales service agreements.

For instance, a single multi-gigawatt wind farm project can represent a significant portion of a customer's annual capital expenditure, making price and contract specifics critical negotiation points. This concentration of purchasing power means customers can often demand customized solutions and competitive terms.

While Goldwind focuses on technological innovation, the wind turbine market, particularly for onshore projects, sees increasing standardization in core functionalities. This means that for many basic needs, turbines from different manufacturers can be seen as interchangeable.

The growing standardization of turbine sizes and power outputs makes it simpler for customers, such as utility companies or independent power producers, to directly compare specifications and pricing across various suppliers. In 2024, the global average capacity of newly installed onshore wind turbines continued to trend upwards, with many models falling within a predictable range of 3-5 MW, facilitating easier cross-manufacturer comparisons.

This ease of comparison directly translates to enhanced bargaining power for customers. They can leverage the availability of comparable products to negotiate better prices and more favorable contract terms, knowing that switching suppliers is less of a technical hurdle than it once was.

Customers in the wind energy sector, including large utilities and independent power producers, are remarkably well-informed. They actively track global market prices for wind turbines, understand the latest technological innovations, and compare the offerings from various manufacturers like Goldwind, Siemens Gamesa, and Vestas. This heightened awareness, often supported by detailed industry analysis from firms like BloombergNEF and Wood Mackenzie, allows them to negotiate effectively.

This transparency directly translates into increased bargaining power for customers. Armed with data on equipment costs, performance metrics, and financing options, they can confidently demand competitive pricing and superior value propositions from Goldwind. For instance, in 2024, the average price for onshore wind power purchase agreements (PPAs) globally continued to reflect intense competition, pushing turbine manufacturers to optimize their cost structures and delivery terms.

Low Switching Costs for Customers

For new wind farm projects, customers have a broad selection of global turbine manufacturers, leading to low switching costs before installation. This accessibility allows buyers to easily compare offerings from established players such as Vestas, Siemens Gamesa, and GE Vernova, alongside significant Chinese original equipment manufacturers (OEMs) like Envision and Mingyang.

The competitive landscape before a purchase decision means customers can readily switch between suppliers based on price, technology, and service agreements. For instance, in 2023, the global wind turbine market saw significant competition, with Vestas leading in market share for onshore installations, indicating that customers have viable alternatives readily available.

- Customer Choice: Access to multiple global manufacturers before project commitment.

- Competitive Pricing: Ability to switch based on cost and technology offerings.

- Market Dynamics: In 2023, Vestas, Siemens Gamesa, and GE Vernova remained key players, alongside growing Chinese OEMs, maintaining customer leverage.

Customer's Threat of Backward Integration

Customers, particularly large utility companies or project developers, possess a potential threat of backward integration into wind turbine manufacturing. This is a highly capital-intensive and complex undertaking, making it a rare occurrence. However, their existing capabilities in developing and operating wind farms provide them with intimate knowledge of operational costs and efficiencies, significantly bolstering their negotiation leverage with manufacturers like Goldwind.

This understanding of the value chain allows these customers to effectively gauge fair pricing and push for more favorable terms. For instance, a utility company that manages its own O&M for existing wind assets can better assess the true cost of turbine production and service, directly impacting their bargaining position during procurement negotiations.

- Customer Insight: Utilities operating their own fleets have a deep understanding of turbine lifecycle costs.

- Integration Rarity: Full backward integration into manufacturing is uncommon due to high capital demands.

- Negotiation Leverage: Knowledge of costs empowers customers in price discussions.

- Market Dynamics: This potential threat influences pricing strategies of turbine manufacturers.

Goldwind's customers, primarily large utilities and independent power producers, wield significant bargaining power due to the substantial scale of their wind farm investments. These buyers can leverage their considerable purchasing volume to negotiate favorable pricing, contract terms, and service agreements, especially as turbine standardization increases, making cross-manufacturer comparisons easier. In 2024, the global average capacity for onshore turbines, often between 3-5 MW, facilitated this price and feature comparison, enhancing customer leverage.

| Customer Segment | Bargaining Power Factor | 2024 Market Insight |

|---|---|---|

| Major Utility Companies | High purchase volume, informed market knowledge | PPAs globally reflected intense competition, pushing manufacturers for better terms. |

| Independent Power Producers | Access to multiple global suppliers, standardization | Onshore turbine market saw a continued trend towards 3-5 MW capacities, simplifying comparisons. |

| Large-Scale Project Developers | Potential for backward integration awareness, understanding of value chain costs | Customer insight into lifecycle costs strengthens negotiation positions. |

What You See Is What You Get

Goldwind Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, offering a comprehensive Goldwind Porter's Five Forces analysis. You'll gain insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the wind energy sector. The analysis presented here is professionally formatted and ready for immediate use, ensuring you get the complete, actionable intelligence you need to understand Goldwind's strategic positioning.

Rivalry Among Competitors

The global wind turbine market is fiercely competitive, populated by both established Western giants like Vestas, Siemens Gamesa, and GE Vernova, alongside increasingly dominant Chinese manufacturers such as Goldwind, Envision, Mingyang, and Windey. Goldwind, while a significant global player, experiences particularly intense rivalry within its home market of China, which is experiencing a substantial surge in new wind power installations.

The global wind power industry is experiencing robust growth, with projections indicating a significant expansion in installed capacity through 2024 and beyond. However, this growth isn't uniform across all regions. While China continues to lead the charge with substantial installations, other markets are seeing a more moderate pace.

This differential growth rate creates a more competitive landscape, particularly in mature markets where capacity additions are more constrained. Companies like Goldwind face intensified rivalry as they vie for a larger share of these developing markets.

Consequently, this heightened competition often translates into aggressive pricing strategies. Players may reduce margins to secure contracts, putting downward pressure on profitability across the industry. This makes differentiating through technology and service crucial for sustained success.

The wind turbine industry is a hotbed of technological innovation, with companies pouring resources into developing larger, more efficient turbines. This race for advancement includes exploring new materials and integrating smart energy solutions to optimize performance. Goldwind stands out with its dedication to research and development, particularly its direct-drive technology, which offers a competitive edge. However, the landscape demands constant evolution as rivals frequently launch novel designs and enhanced features, keeping the pressure on for continuous innovation.

High Fixed Costs and Capacity Utilization

The wind turbine manufacturing sector, including players like Goldwind, operates with substantial fixed costs. These investments span research and development, advanced manufacturing plants, and complex global supply chains. This high cost structure necessitates achieving high production volumes to spread those costs and realize economies of scale.

Companies are thus driven to maintain high capacity utilization. When demand falters and capacity utilization dips, the pressure to sell existing inventory can intensify, potentially sparking aggressive pricing strategies and price wars among competitors. This dynamic directly impacts competitive rivalry.

- High R&D and Capital Expenditures: Setting up and maintaining state-of-the-art manufacturing facilities and investing in ongoing technological innovation requires significant upfront capital.

- Economies of Scale Incentive: Producing more units spreads the high fixed costs over a larger output, lowering the cost per turbine and improving profitability.

- Capacity Utilization Pressure: Underutilized factories lead to higher per-unit costs, creating a strong incentive to secure orders even at lower margins.

- Potential for Price Wars: When multiple manufacturers have excess capacity, they may engage in price competition to capture market share and keep production lines running.

Exit Barriers

High capital investment in manufacturing assets, such as specialized factories and advanced machinery, forms a substantial barrier for wind turbine manufacturers looking to exit the market. For instance, setting up a new wind turbine production facility can cost hundreds of millions of dollars, making it difficult to recoup such investments if market conditions deteriorate. This financial commitment encourages companies to remain operational, even when profitability is low, intensifying competitive rivalry.

The need for specialized knowledge in areas like aerodynamics, materials science, and complex supply chain management also creates significant exit barriers. Training and retaining a skilled workforce capable of designing, manufacturing, and servicing wind turbines requires ongoing investment and expertise. Companies that have cultivated these capabilities find it challenging to divest them easily, often leading them to continue competing rather than abandoning their specialized assets and human capital.

Long-term service contracts, often spanning 10-20 years, further cement companies within the industry. These contracts provide a stable, albeit long-term, revenue stream but also tie manufacturers to ongoing operational and maintenance obligations. As of late 2024, many leading wind turbine manufacturers have substantial backlogs of service agreements, making a swift exit impractical and reinforcing the tendency to compete directly with rivals to secure future service revenue.

- Significant Capital Outlay: The cost of establishing and maintaining wind turbine manufacturing facilities can run into hundreds of millions, deterring potential exits.

- Specialized Expertise: Deep technical knowledge in design, production, and servicing is a critical asset that is difficult to liquidate.

- Long-Term Service Agreements: These contracts create ongoing commitments and revenue streams that discourage premature market departure.

- Industry Interdependence: The complex nature of the wind energy supply chain means that exiting can disrupt relationships with suppliers and component manufacturers, increasing the difficulty of leaving.

The competitive rivalry within the wind turbine sector is intense, driven by a concentrated market with a few dominant players and numerous smaller firms, including Goldwind. This rivalry is amplified by high fixed costs, necessitating high capacity utilization, and significant exit barriers due to specialized assets and long-term service contracts. As of 2024, the global installed wind capacity continues to grow, with China leading, further intensifying competition for market share among major manufacturers like Goldwind, Vestas, and Siemens Gamesa.

| Manufacturer | Global Market Share (Approx. 2024) | Key Markets |

|---|---|---|

| Vestas | ~17% | Europe, North America, Asia |

| Siemens Gamesa | ~12% | Europe, North America |

| GE Vernova | ~10% | North America, Europe |

| Goldwind | ~9% | China, Asia, Emerging Markets |

| Envision Energy | ~7% | China, Asia |

SSubstitutes Threaten

Solar photovoltaic (PV) technology stands as a significant threat of substitution for wind energy, particularly for Goldwind. Solar PV is becoming increasingly cost-competitive, often with lower capital expenditures per megawatt than wind installations. Furthermore, solar projects, especially at the utility scale, can frequently face less complex permitting processes and quicker installation timelines compared to wind farms, which may encounter siting and environmental review challenges.

The rapid expansion of solar capacity additions is a crucial factor. Projections for 2025 indicate that solar could outpace wind in terms of new capacity brought online in several key global markets. This trend directly positions solar as a more attractive or readily available alternative for clean energy investment and deployment by utilities and independent power producers.

Despite the global drive towards decarbonization, traditional fossil fuels like coal and natural gas continue to pose a significant threat of substitution for renewable energy sources. This is largely due to their established infrastructure, inherent dispatchability, and a history of relative price stability, which remain attractive to many energy consumers and grid operators.

Although their market share is gradually shrinking, fossil fuels still represent a substantial portion of worldwide energy consumption, influencing the overall demand dynamics for renewable alternatives. For instance, in 2024, fossil fuels are projected to still account for over 75% of global primary energy consumption, highlighting their persistent relevance.

Advancements in energy storage technologies, particularly improved battery storage, significantly impact the threat of substitutes for wind energy. These advancements make intermittent renewables like solar and wind more reliable and dispatchable, reducing the need for backup power from traditional sources. For instance, by mid-2024, global battery storage capacity continued its rapid expansion, with projections suggesting significant growth in grid-scale deployments to support renewable integration.

This enhanced reliability indirectly boosts the viability of distributed generation and hybrid energy systems. Customers, armed with more flexible energy management options through storage, may find these solutions a compelling alternative to large, centralized wind farm investments. The decreasing cost of battery storage, a trend observed throughout 2024, further strengthens this substitution threat by making localized energy independence more economically attractive.

Nuclear and Hydroelectric Power

Nuclear and hydroelectric power represent significant substitutes for wind energy, especially in providing reliable, low-carbon electricity. These sources can offer baseload power, a capability that intermittent wind power alone struggles to match without substantial storage solutions.

While the development of new large-scale hydroelectric projects faces considerable environmental and siting challenges, the landscape for nuclear power is shifting. Projections indicate increased investment in nuclear energy. For instance, global nuclear power capacity is expected to grow, with some analysts forecasting an addition of over 50 GW by 2030, suggesting a growing role for nuclear as a baseload substitute in various national energy strategies through 2025 and beyond.

- Nuclear Power Growth: Global nuclear capacity is anticipated to expand, with new builds and life extensions planned in several countries.

- Hydroelectric Limitations: New large-scale hydro projects are increasingly difficult to implement due to environmental concerns and site availability.

- Baseload Capacity: Both nuclear and hydro provide dispatchable power, directly competing with wind's need for grid support or storage.

- Energy Mix Impact: The resurgence of nuclear in certain markets by 2025 could influence the long-term demand for other low-carbon sources like wind.

Energy Efficiency and Demand-Side Management

Investments in energy efficiency and demand-side management are increasingly acting as a potent force that can reduce the need for new power generation, including wind energy. These initiatives, which optimize energy consumption through technologies like smart grids and improved building insulation, directly lower overall energy demand. For instance, by 2024, many countries are seeing significant savings from efficiency programs; the International Energy Agency (IEA) reported in its 2024 outlook that energy efficiency improvements could deliver over 40% of the emissions reductions needed to meet climate goals by 2030, implying a substantial dampening effect on new capacity requirements.

This reduction in overall energy demand means that fewer new power plants of any kind are needed. Consequently, the market opportunity for new wind installations, which are capital-intensive and require significant upfront investment, can be diminished. Consider that in 2023, global investment in energy efficiency reached an estimated $567 billion, according to the IEA, a clear signal of the growing trend towards reducing energy consumption rather than solely increasing supply.

- Reduced Demand: Energy efficiency measures directly decrease the total electricity needed, thereby lowering the imperative for new power generation capacity.

- Smart Grid Integration: Technologies that optimize grid operations and consumer usage can further curb peak demand, lessening the need for reserve capacity that might otherwise be met by wind farms.

- Investment Trends: Significant global investment in energy efficiency, such as the projected rise in smart home technology adoption, indicates a growing trend that impacts the long-term demand for traditional power sources.

- Economic Incentives: Government policies and utility programs promoting energy-saving behaviors and upgrades can accelerate the adoption of these demand-reduction strategies, making them a more significant threat to new energy infrastructure projects.

Solar photovoltaic (PV) technology continues to emerge as a potent substitute for wind energy, especially for companies like Goldwind. By mid-2024, solar PV's declining costs and increasingly simpler deployment strategies make it a compelling alternative for new power generation projects.

The global energy landscape in 2024 shows a robust growth in solar capacity additions, often outpacing wind in new installations in key markets. This trend directly positions solar as a more readily available and often more cost-effective choice for utilities and independent power producers seeking clean energy solutions.

Traditional fossil fuels, while facing long-term pressure, remain a significant substitute due to their established infrastructure and dispatchability. However, the increasing integration of battery storage by mid-2024 is making intermittent renewables more competitive, indirectly reducing reliance on fossil fuels and strengthening the substitution threat to wind.

Nuclear power's projected expansion, with new builds and life extensions anticipated through 2030, also presents a strong baseload alternative to wind energy. This growth, alongside continued hydroelectric capacity, means that wind projects must increasingly compete with these more consistent, low-carbon power sources.

| Substitute Technology | Key Factors | 2024/2025 Outlook |

| Solar PV | Cost competitiveness, ease of installation | Continued strong capacity growth, often outpacing wind in new additions. |

| Fossil Fuels | Established infrastructure, dispatchability | Still dominant energy source, but renewables with storage are gaining ground. |

| Nuclear Power | Baseload capability, low-carbon | Projected capacity expansion; new builds and life extensions planned. |

| Hydroelectric Power | Baseload capability, low-carbon | Limited new large-scale project development due to environmental and siting issues. |

| Energy Efficiency | Reduced demand, optimized consumption | Significant contributor to emissions reduction goals; dampens need for new capacity. |

Entrants Threaten

The wind turbine manufacturing sector demands substantial upfront investment. Companies need to allocate significant capital towards research and development for advanced turbine technologies, establish sophisticated manufacturing plants with specialized machinery, and build robust global supply chains for components. For instance, setting up a new, large-scale wind turbine manufacturing facility can easily cost hundreds of millions of dollars.

These high capital requirements act as a formidable barrier, effectively deterring many potential entrants. The sheer scale of investment needed to compete effectively in terms of technological innovation and production capacity makes it challenging for smaller or less capitalized firms to gain a foothold. This financial hurdle is a primary reason why the market remains dominated by a relatively small number of established players.

The wind energy sector is characterized by a substantial barrier to entry due to the immense R&D and technological expertise required. Companies like Goldwind invest heavily in developing advanced turbine designs, aiming for greater efficiency and reliability. For instance, Goldwind’s commitment to innovation is evident in its substantial R&D spending, which enables it to stay at the forefront of turbine technology, including advancements in direct-drive permanent magnet generators.

Newcomers face the daunting task of replicating this deep technological know-how, which is built over years of experience and significant capital outlay. Acquiring or developing the necessary expertise in areas like aerodynamics, materials science, and control systems demands a considerable upfront investment. Without this, potential entrants would struggle to compete with the performance and cost-effectiveness of established players, limiting their ability to gain market share.

The wind energy sector is heavily regulated, with new entrants facing significant challenges in navigating complex permitting processes. These can involve environmental impact assessments, land use permits, and grid connection approvals, often taking years to complete. For instance, securing all necessary permits for a large-scale wind farm in the United States can easily extend beyond 3-5 years, adding substantial time and cost burdens that deter newcomers.

Access to Supply Chains and Distribution Networks

Established players like Goldwind have meticulously developed resilient global supply chains and comprehensive distribution and service networks over years of operation. This deep integration is a significant barrier. For instance, in 2024, Goldwind reported a strong global presence with manufacturing facilities and service centers strategically located to support its extensive customer base, a feat difficult and costly for newcomers to match.

New entrants would face immense challenges in replicating Goldwind's established operational infrastructure, which is fundamental for achieving cost efficiencies in manufacturing, seamless installation processes, and reliable after-sales maintenance. The sheer scale and complexity of these networks, built through strategic partnerships and significant capital investment, represent a formidable hurdle.

The threat of new entrants is therefore mitigated by the substantial capital and time investment required to build comparable supply chain and distribution capabilities. Without access to these established channels, new companies would likely face higher operational costs and slower market penetration, impacting their competitiveness against incumbents like Goldwind.

- Established Global Supply Chains: Goldwind's existing network allows for efficient sourcing of raw materials and components, critical for competitive pricing.

- Extensive Distribution and Service Networks: These networks are vital for timely product delivery, installation, and ongoing maintenance, ensuring customer satisfaction and operational uptime.

- Replication Challenges: New entrants would need substantial financial resources and time to build similar infrastructure, facing difficulties in securing reliable suppliers and establishing widespread service points.

- Cost Disadvantage: Without the economies of scale and established relationships that Goldwind enjoys, new entrants would likely incur higher per-unit costs, hindering their ability to compete on price.

Brand Reputation and Customer Trust

In the wind energy sector, where projects often span decades and require substantial upfront capital, customer trust and a proven track record are absolutely critical. New entrants face a significant hurdle in establishing the credibility that incumbent players have cultivated over time. Goldwind, for instance, leverages its extensive global installed capacity, which translates into a strong, established brand reputation. This reputation is a powerful deterrent, as potential clients are more likely to invest in a supplier with a history of reliable performance and long-term support.

Building this level of trust and recognition is a time-consuming and resource-intensive process. New companies would need to demonstrate not only technological prowess but also a commitment to long-term customer relationships and project success. Goldwind's position in the market, supported by its substantial installed base, creates a formidable barrier for any newcomer aiming to gain significant market share quickly. This established reputation directly impacts the perceived risk for customers, favoring experienced and reputable suppliers.

- Established Global Installed Capacity: Goldwind reported a significant global installed capacity, a key indicator of customer trust and market penetration.

- Long Project Lifecycles: The wind industry's project lifecycles, often exceeding 20 years, emphasize the importance of supplier reliability and long-term commitment.

- Brand Reputation as a Barrier: A strong brand reputation, built on consistent performance and customer satisfaction, presents a substantial challenge for new entrants to overcome.

- Customer Trust in Technology and Support: Customers prioritize proven technology and dependable after-sales support, areas where established players like Goldwind have a distinct advantage.

The wind energy sector presents a high barrier to entry for new companies due to the significant capital required for research and development, manufacturing facilities, and sophisticated technology. For example, establishing a new, large-scale wind turbine manufacturing plant can cost hundreds of millions of dollars, a cost that deters many potential entrants. This financial hurdle, coupled with the need for extensive technological expertise in areas like aerodynamics and materials science, means that only well-funded and technologically advanced firms can realistically compete. Goldwind's substantial R&D investment, for instance, highlights the ongoing need for innovation to maintain market leadership.

Furthermore, established players like Goldwind benefit from robust global supply chains and extensive distribution and service networks. Replicating this infrastructure, which is crucial for cost efficiency and customer support, requires considerable time and financial resources. In 2024, Goldwind's expansive network underscored the difficulty for newcomers to achieve similar economies of scale and market reach. The long project lifecycles in the wind industry, often exceeding 20 years, also emphasize the importance of customer trust and a proven track record, which new entrants struggle to build quickly.

Porter's Five Forces Analysis Data Sources

Our Goldwind Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from the company's annual reports, investor presentations, and industry-specific market research from reputable firms like BloombergNEF and Wood Mackenzie.