Goldwind Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldwind Bundle

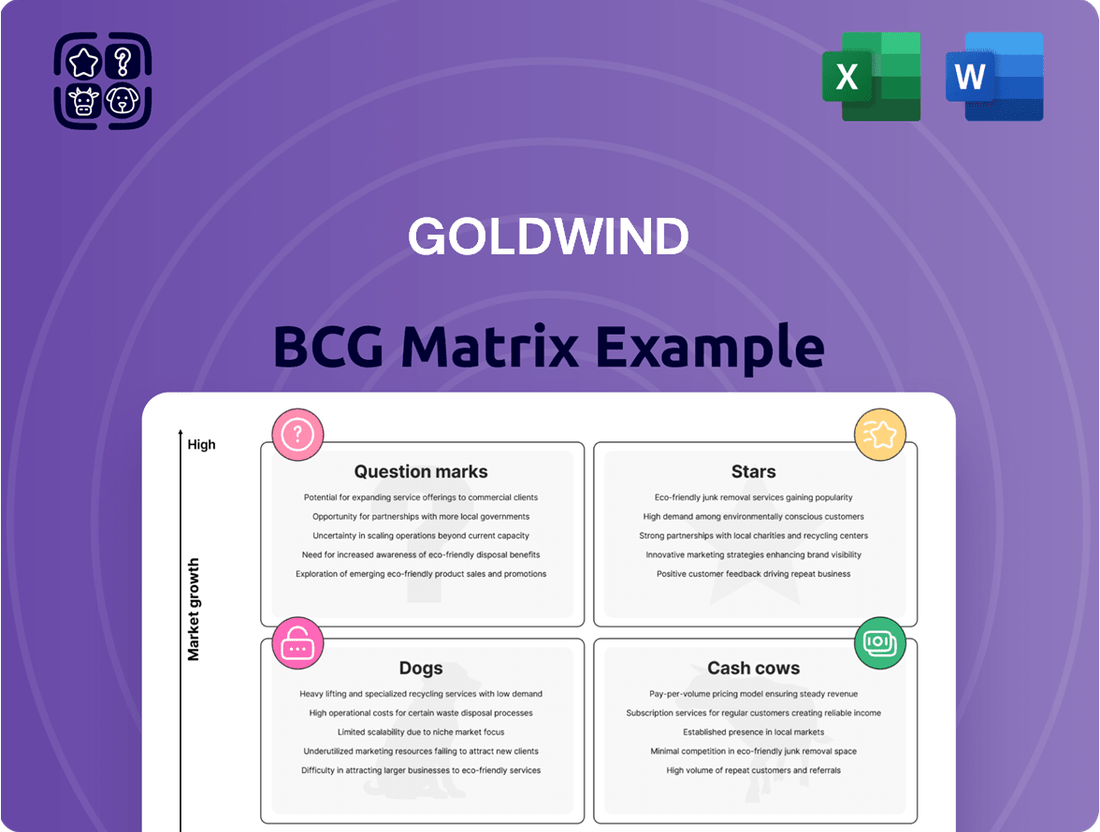

Curious about Goldwind's product portfolio performance? This glimpse into their BCG Matrix highlights key areas, but only a full analysis reveals the complete strategic picture. Understand which of their wind turbine models are market leaders (Stars), consistent revenue generators (Cash Cows), resource drains (Dogs), or potential growth opportunities (Question Marks).

Don't miss out on the critical insights that will shape Goldwind's future. Purchasing the full BCG Matrix report provides a detailed breakdown of each product's position, offering data-backed recommendations for optimizing investments and product development.

This is your opportunity to gain a competitive edge. The complete Goldwind BCG Matrix is more than just a chart; it's a strategic roadmap designed to help you navigate the dynamic renewable energy market with confidence.

Unlock the full potential of this analysis. Buy the full BCG Matrix now to receive a comprehensive Word report alongside a high-level Excel summary, equipping you to evaluate, present, and strategize effectively.

Stars

Goldwind's large-scale onshore wind turbines, specifically those rated at 6MW and above, are clearly a star performer. In the first quarter of 2025, these powerful units made up a dominant 70.47% of their external sales volume, highlighting their importance to the company's strategy.

This strength is amplified by the booming Chinese market. In 2024 alone, China's wind power sector saw substantial growth, expanding by almost 12% year-over-year. This surge means China now accounts for over 60% of the world's newly connected wind capacity annually.

The combination of Goldwind's leading position in its home market and the continued rapid expansion driven by China's aggressive renewable energy goals positions these large-scale turbines firmly in the star category of the BCG matrix. Their high market share within a high-growth environment is a powerful indicator of future success.

The global offshore wind market is booming, projected to grow at an impressive compound annual growth rate of 34.4% between 2024 and 2025. Goldwind is well-positioned in this dynamic sector, particularly with its advanced models like the GWH300-20 (25) MW, engineered for challenging deep-water environments and typhoon resilience.

While 2024 saw some project delays impacting offshore capacity outside of China, the overarching industry trend clearly favors larger, more powerful, and efficient turbines. This shift directly benefits Goldwind's high-capacity offshore wind turbine offerings, including their 16MW models, suggesting a strong future for their technology in this expanding market.

Goldwind's aggressive international expansion, especially in burgeoning economies across South America, Australia, the Middle East, Southeast Asia, and North Africa, highlights its strategic positioning. These markets are characterized by substantial growth potential and well-defined renewable energy agendas, making them prime targets for investment and development.

The company's success in securing key projects within these regions, coupled with its commitment to establishing local operational capabilities, underscores the 'star' status of its emerging market wind farm developments. For instance, Goldwind reported a significant increase in its international revenue share in 2023, with emerging markets contributing a growing percentage to its overall sales.

These emerging market ventures are capitalizing on favorable regulatory environments and increasing demand for clean energy. Goldwind's comprehensive approach, offering end-to-end wind farm solutions, further solidifies these projects as high-growth opportunities with strong potential for market leadership and substantial returns.

Advanced Medium-Speed (Hybrid-Drive) Wind Turbines

Goldwind's advanced medium-speed (hybrid-drive) wind turbines are a clear star in its portfolio, reflecting a significant technological pivot. This new direction saw hybrid-drive systems making up an impressive 89% of Goldwind's total installations in 2024, showcasing their commitment to this technology.

The global market for medium-speed hybrid-drive turbines is experiencing robust growth, with its share climbing from 25.0% in 2023 to 29.1% in 2024. Goldwind is well-positioned to capitalize on this trend, holding a dominant position within this expanding segment.

- Technological Shift: Goldwind transitioned from PMG Direct Drive (DD) to medium-speed (hybrid-drive) systems.

- Dominant 2024 Installations: Hybrid-drive turbines constituted 89% of Goldwind's total installations in 2024.

- Growing Market Share: The global market share for this technology rose from 25.0% in 2023 to 29.1% in 2024.

- Key Growth Driver: This innovation enhances efficiency and aligns with evolving market needs, cementing its star status.

Integrated Smart Energy Solutions (EOD+ENERGY Model)

Integrated Smart Energy Solutions, often represented by Goldwind's Ecology-Oriented Development (EOD)+ENERGY model, is a star performer in the BCG matrix. This segment showcases Goldwind's dedication to advancing sustainable energy globally.

The company's focus on energy storage grid-forming technology and sophisticated power scheduling systems allows it to offer crucial grid auxiliary services and enable more adaptable clean energy distribution. By the close of 2024, Goldwind had successfully promoted over 500 zero-carbon projects, underscoring the significant growth potential and Goldwind's leading position in this expanding market.

- High Growth Potential: The EOD+ENERGY model taps into the rapidly expanding smart energy market.

- Technological Innovation: Goldwind's grid-forming technology and intelligent scheduling are key differentiators.

- Market Leadership: Over 500 zero-carbon projects by year-end 2024 highlight Goldwind's established presence.

- Sustainable Development Focus: The model aligns with global trends towards cleaner energy solutions.

Goldwind's large-scale onshore wind turbines, particularly those 6MW and above, are a clear star. These units accounted for a dominant 70.47% of external sales in Q1 2025, driven by China's 2024 wind market growth of nearly 12% and its over 60% share of global new wind capacity.

The company's advanced medium-speed hybrid-drive turbines are also stars, making up 89% of Goldwind's 2024 installations. This technology's global market share grew from 25.0% in 2023 to 29.1% in 2024, a trend Goldwind leads.

Integrated Smart Energy Solutions, like the EOD+ENERGY model, shine due to Goldwind's 500+ zero-carbon projects by the end of 2024. This segment leverages grid-forming technology and intelligent scheduling in a rapidly expanding smart energy market.

Goldwind's offshore wind turbine offerings, including 16MW models, are stars poised for significant growth. The global offshore wind market is projected to expand at a 34.4% CAGR from 2024-2025, with Goldwind's advanced, resilient designs well-suited for this expansion.

| Product Segment | BCG Category | Key Growth Drivers (2024-2025) | Market Share/Penetration | Key Data Points |

| Large-Scale Onshore Turbines (6MW+) | Stars | China's wind market growth (~12% YoY in 2024), >60% global new capacity in China | 70.47% of Goldwind's external sales (Q1 2025) | Dominant in a high-growth domestic market. |

| Medium-Speed Hybrid-Drive Turbines | Stars | Growing global adoption of hybrid technology | 89% of Goldwind's 2024 installations, Global market share up from 25.0% (2023) to 29.1% (2024) | Technological leadership in an expanding niche. |

| Integrated Smart Energy Solutions (EOD+ENERGY) | Stars | Expansion of smart energy market, demand for zero-carbon projects | Over 500 zero-carbon projects by end of 2024 | Strong innovation in grid auxiliary services and energy storage. |

| Offshore Wind Turbines (e.g., 16MW) | Stars | Global offshore wind market CAGR of 34.4% (2024-2025) | Positioned for growth in a booming sector | Advanced technology for deep-water and typhoon resilience. |

What is included in the product

The Goldwind BCG Matrix analyzes its wind turbine portfolio, identifying Stars for growth and Cash Cows for stable returns.

The Goldwind BCG Matrix provides a clear, visual map to identify and prioritize underperforming business units, relieving the pain of resource misallocation.

Cash Cows

Goldwind's established onshore wind turbine sales in China represent a significant cash cow for the company. They have held the top global spot for three years running, a feat heavily influenced by China's robust domestic market. This segment is characterized by its maturity, with Goldwind consistently capturing 20-25% of the Chinese onshore market for 14 years. This sustained dominance translates into substantial and predictable revenue streams, underscoring its cash cow status.

Goldwind's Wind Power Operations and Maintenance (O&M) Services are a classic Cash Cow. With over two decades of expertise, they offer end-to-end solutions from construction to ongoing maintenance and even transportation.

By the close of 2024, Goldwind's operational capacity had swelled to nearly 40 gigawatts. This substantial installed base necessitates continuous O&M, ensuring consistent demand for their services.

This segment delivers a stable, predictable revenue stream. The essential nature of keeping wind farms running smoothly in a mature market translates to consistently high profit margins.

Goldwind's existing wind farm development and equity transfer model positions its operational assets as strong cash cows. By developing and then selling equity in its self-owned power stations post-construction, Goldwind secures flexible and consistent revenue streams from mature projects.

This dual strategy, encompassing both development and an equity transfer model, underpins its financial stability. With roughly 8 GW of self-operated projects as of mid-2024, these established wind farms are a reliable source of cash flow, funding ongoing investments.

Turbines in the 4MW to 6MW Range for Domestic Projects

Goldwind's 4MW to 6MW turbines, while not the newest technology, remain a vital part of their portfolio as cash cows. These models continue to be a strong performer, especially in the domestic Chinese market. They represent a stable revenue stream due to their established presence and lower ongoing development costs.

In the first quarter of 2025, Goldwind's 4MW to 6MW turbine range accounted for a significant 29.41% of their external sales volume. This demonstrates their sustained market relevance and ability to generate consistent cash flow. The consistent deployment in various projects highlights their reliability and continued demand.

These mature product lines offer a dependable source of income for Goldwind. The reduced investment in research and development, coupled with lower market penetration expenses compared to emerging technologies, allows them to contribute positively to the company's financial health. Their ongoing sales volume underscores their status as a robust cash-generating asset.

- Sustained Domestic Demand: The 4MW-6MW range remains a key player in the stable Chinese market.

- Significant Sales Contribution: These turbines made up 29.41% of external sales volume in Q1 2025.

- Mature Product Line: Benefits from lower R&D and market penetration costs.

- Consistent Cash Flow: Provides a reliable revenue stream for Goldwind.

Component Manufacturing and Supply Chain Services

Goldwind's component manufacturing and supply chain services are a cornerstone of its operations, fitting perfectly into the Cash Cow quadrant of the BCG Matrix. As a leading global wind turbine generator (WTG) manufacturer, Goldwind possesses a highly developed internal and external network for producing and delivering essential components. This segment benefits from economies of scale and established operational efficiencies.

The company's commitment to intelligent manufacturing and green supply chain management systems further solidifies this position. These investments enhance production quality and cost-effectiveness, ensuring a reliable and high-volume revenue stream. For instance, Goldwind's focus on smart manufacturing aims to reduce waste and improve output, contributing to sustained profitability.

This robust infrastructure and deep expertise in component production and logistics generate predictable, consistent revenue. These earnings can then be leveraged to fund research and development for new technologies or support business units with lower market share but high growth potential. The steady cash flow from this segment is crucial for Goldwind's overall financial health.

- Global Market Share: Goldwind consistently ranks among the top global WTG manufacturers, indicating significant production volumes and market penetration.

- Intelligent Manufacturing: Investments in smart factories and automated processes aim to optimize production costs and increase efficiency in component manufacturing.

- Green Supply Chain: Goldwind's focus on sustainable supply chain practices can lead to cost savings through reduced resource consumption and improved logistics.

- Revenue Stability: The high demand for wind turbine components, driven by global renewable energy targets, ensures a steady revenue stream for this segment.

Goldwind's dominance in the Chinese onshore wind market, sustained for over a decade with a 20-25% market share, positions its established sales as a prime cash cow. This segment generates substantial and predictable revenue streams, a hallmark of a mature business with strong market penetration.

The company's Wind Power Operations and Maintenance (O&M) services are a consistent revenue generator, bolstered by nearly 40 gigawatts of operational capacity by the end of 2024. This extensive installed base ensures ongoing demand for their expertise, leading to stable profit margins.

Goldwind's strategy of developing and then transferring equity in its self-owned wind power stations, with approximately 8 GW of self-operated projects by mid-2024, creates reliable cash flow. These mature projects provide a predictable income stream that helps fund new investments.

The 4MW to 6MW turbine range, while mature, continues to be a strong performer, especially in China. Accounting for 29.41% of external sales volume in Q1 2025, these models offer dependable income with lower R&D costs.

Goldwind's component manufacturing and supply chain services are also robust cash cows. Benefiting from economies of scale and intelligent manufacturing, this segment provides a steady revenue stream driven by global renewable energy demand.

| Segment | Market Position | Revenue Stability | Cash Flow Generation |

| Onshore Wind Turbine Sales (China) | Leading (3 years global top, 14 years dominant in China) | High & Predictable | Substantial |

| Wind Power O&M Services | Established (20+ years expertise) | High & Consistent | Strong |

| Wind Farm Development & Equity Transfer | Significant (8 GW self-operated projects) | Stable & Flexible | Reliable |

| 4MW-6MW Turbine Sales | Strong Performer (29.41% of external sales Q1 2025) | Dependable | Consistent |

| Component Manufacturing & Supply Chain | Global Leader | Steady | Robust |

Delivered as Shown

Goldwind BCG Matrix

The Goldwind BCG Matrix preview you are currently viewing is the exact, unwatermarked, and fully formatted document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning, providing clear insights into Goldwind's product portfolio performance.

Dogs

Goldwind's legacy wind turbine models, those rated below 4MW, represented a mere 0.12% of its total external sales volume in the first quarter of 2025. This indicates a significant shift away from these smaller units in the market.

The global wind energy sector is clearly moving towards larger and more powerful turbines. By 2024, the average size of onshore wind turbines had climbed past 5,000 kW, while offshore turbines were averaging an impressive 9,815 kW.

Consequently, these older, smaller turbine models are operating in a market characterized by low growth and declining demand. Their position in the BCG matrix suggests they are likely 'Dogs,' warranting careful consideration for divestiture or at least minimal strategic investment.

Goldwind's international expansion faces headwinds, with installations outside China declining 9% year-over-year in 2024. This contraction points to challenges in saturated or fiercely competitive Western markets, impacting established original equipment manufacturers.

Within this context, small-scale, niche international projects in regions with limited wind energy growth or where Goldwind holds a minimal market share can be categorized as dogs. These ventures may yield negligible profits and demand significant operational resources.

For instance, a minor project securing only 10 MW of capacity in a European market already dominated by established players, where Goldwind's market share is below 2%, would fit this profile. Such a project, contributing minimally to the company's overall global installed capacity, which stood at over 100 GW by the end of 2023, could be a prime example of a dog in the portfolio.

Goldwind's Direct Drive (DD) turbine technology, once a primary offering, now represents a segment with declining market relevance within the company's portfolio. The significant shift towards medium-speed hybrid-drive systems, which comprised 89% of Goldwind's total installations in 2024, underscores this trend. This pivot suggests that DD technology, while potentially still a component in some offerings, is positioned in a low-growth, low-market-share category for Goldwind.

Over-reliance on Chinese Domestic Market for Profitability

Goldwind's substantial presence in the Chinese domestic market, while a volume driver, faces profitability challenges. Intense competition among Chinese OEMs, including Goldwind, led to margin compression in 2024, despite record installation figures. This scenario highlights how high market share in a fiercely competitive environment can lead to declining profitability.

The oversupply of components further exacerbated pricing pressures throughout 2024, impacting margins for all domestic players. For Goldwind, this means that while the sheer volume of Chinese installations provides a strong market share, the profit generated per unit is diminishing. This dynamic risks turning segments of their domestic business into 'dogs' within the BCG matrix if price discipline isn't maintained.

- Fierce Competition: Chinese wind turbine market saw intense price wars in 2024, squeezing margins for leading OEMs like Goldwind.

- Component Oversupply: Excess component inventory contributed to lower average selling prices and reduced profitability for domestic manufacturers.

- Profitability Decline: Despite record installations, profitability for Chinese OEMs, including Goldwind, saw a downturn in 2024 due to margin erosion.

- Potential 'Dog' Status: High volume in the domestic market, if not managed with strict price discipline, could relegate profitable segments to 'dog' status in terms of margin contribution.

Underperforming or Obsolete Wind Farm Assets

Goldwind, like many wind energy operators, manages a portfolio that includes self-operated wind farms. Within this portfolio, older or less efficient wind farms might be categorized as 'dogs' in a BCG matrix analysis. These assets could be characterized by higher-than-average maintenance costs or utilization rates that fall below national benchmarks.

For instance, if a wind farm consistently operates at a capacity factor below the industry average, which for onshore wind in many developed markets hovers around 30-45% (though this varies significantly by location and turbine technology), it might be considered a dog. Such underperformance means it's consuming operational capital without generating the robust returns expected in a sector driven by technological advancement and economies of scale.

- Underperforming Assets: Older wind farms with decreasing efficiency or higher operational expenditures.

- Market Pressure: Constant demand for higher capacity factors and technological upgrades squeezes returns from less efficient assets.

- Cash Consumption: These assets may require significant cash for maintenance and upgrades, diverting funds from more promising investments.

- Obsolescence Risk: As newer, more powerful turbines become standard, older models can become increasingly obsolete and less competitive.

Goldwind's legacy turbine models, especially those below 4MW, represented a minimal 0.12% of external sales in Q1 2025, highlighting their declining market relevance as the industry favors larger turbines. These older units are now in a low-growth, low-demand segment, fitting the 'Dog' profile in the BCG matrix, suggesting a need for strategic reassessment or divestment.

Similarly, niche international projects in markets with limited growth or where Goldwind has a small footprint, such as a 10 MW project in a saturated European market with less than 2% market share, exemplify 'Dogs'. These ventures consume resources with negligible returns.

Goldwind's Direct Drive (DD) technology, now representing a shrinking portion of installations as hybrid-drive systems dominate (89% in 2024), is also moving towards 'Dog' status due to declining market relevance.

Even within Goldwind's strong domestic market share, intense competition and component oversupply in 2024 led to significant margin compression, pushing some profitable segments towards 'Dog' status if price discipline isn't maintained.

Question Marks

Goldwind is actively developing ultra-large capacity offshore wind turbines, with components for a 22 MW model already in production and a prototype slated for 2025. They've also showcased a 20-25 MW platform, signaling a strong commitment to this emerging sector.

This segment represents a high-growth, albeit nascent, market. These advanced turbines, while holding significant future potential, are currently in prototype or early deployment stages, demanding substantial research and development expenditure.

The immense potential for these turbines to become market leaders is clear, but they are not yet generating substantial profits or commanding significant market share. The substantial investment required means they are positioned as question marks in the BCG matrix for now.

Goldwind is strategically exploring new international markets, including recent entries into Georgia and the Philippines, to fuel future growth. These regions represent untapped potential for renewable energy expansion, aligning with Goldwind's global ambitions.

While these emerging markets offer significant upside, Goldwind's current market share within them is minimal, classifying them as question marks in the BCG matrix. Substantial investment will be necessary to build brand recognition and secure large-scale projects in these nascent territories.

The success of these ventures hinges on Goldwind's ability to navigate local regulations, establish strong partnerships, and effectively compete against established players. Proving viability in these new frontiers will be key to transforming them from question marks into stars.

The integration of wind power with green hydrogen production represents a significant emerging opportunity, often categorized as a 'question mark' within strategic frameworks like the BCG Matrix. This sector is characterized by high growth potential, driven by the global push for decarbonization and renewable energy solutions. For instance, the global green hydrogen market is projected to reach substantial figures, with some forecasts placing it in the hundreds of billions by the early 2030s, indicating strong future demand.

While specific Goldwind initiatives aren't detailed, the broader industry trend favors hybrid systems that combine wind or solar with energy storage, including hydrogen electrolyzers. If Goldwind is indeed investing in pilot projects or research and development for these integrated solutions, they would fit the 'question mark' profile. This is because these ventures typically require substantial upfront investment and are in early stages of market penetration, despite their promising growth trajectory.

Advanced Digital Solutions for Wind Farm Management (beyond basic O&M)

Goldwind's advanced digital solutions, exemplified by its Goldwind Oasis Zero-Carbon Platform, are positioned as question marks within the BCG matrix. These offerings, which include sophisticated micro-grid dispatching and energy management systems, are designed to optimize energy utilization and drive carbon reduction. While the potential for growth in smart energy solutions is significant, the market adoption rates and Goldwind's current penetration in these specialized digital areas are still maturing. This necessitates continued investment to solidify its position and capture market share.

The Goldwind Oasis platform is a prime example of these question mark offerings, focusing on intelligent software for comprehensive carbon reduction and smart campus solutions. The market for such integrated digital platforms is expanding rapidly, driven by the global push for sustainability and efficient energy management. For instance, the global smart grid market was valued at approximately USD 35.9 billion in 2023 and is projected to grow significantly in the coming years, indicating a substantial opportunity for Goldwind's digital initiatives.

- Smart Campus Integration: Goldwind's platform allows for intelligent management of energy across a campus, optimizing consumption and reducing waste.

- Micro-grid Dispatching: Advanced algorithms enable efficient control and distribution of power within localized micro-grids, enhancing reliability.

- Carbon Reduction Focus: The software is engineered to facilitate measurable reductions in carbon emissions through optimized energy usage and integration of renewable sources.

- Developing Market Share: While the technology is advanced, Goldwind's share in this specific niche of specialized digital solutions is still in a growth phase, requiring strategic market penetration efforts.

Strategic Partnerships in Highly Competitive Western Markets

For Goldwind, strategic partnerships or acquisitions in highly competitive Western markets like Europe and North America would fall into the question mark category of the BCG matrix. While Chinese OEMs, including Goldwind, have a strong hold on their domestic market, Western OEMs continue to dominate outside of China. This presents a significant hurdle for Chinese expansion into these established territories.

These ventures represent high growth potential, but the path to success is fraught with challenges. Entering these markets often requires substantial capital investment and navigating complex regulatory landscapes. The outcome is uncertain, with a real possibility of failing to gain significant market share, thus demanding careful consideration and robust strategies.

- Market Entry Risk: Western markets are mature and dominated by established players like Vestas and Siemens Gamesa, making it difficult for new entrants to gain traction.

- Capital Intensity: Establishing a presence often necessitates significant upfront investment in manufacturing, supply chains, and distribution networks.

- Technological & Regulatory Hurdles: Western markets may have stringent technical standards and evolving regulatory frameworks that Chinese companies must adapt to.

- Brand Perception: Overcoming potential perceptions of Chinese products versus established Western brands is a critical factor for success.

Question marks in Goldwind's BCG matrix represent areas with high growth potential but low current market share, requiring significant investment to develop. These segments, while not yet profitable, hold the promise of becoming future market leaders if strategic investments yield positive results.

Goldwind's development of ultra-large capacity offshore wind turbines (20-25 MW) and its expansion into new international markets like Georgia and the Philippines exemplify these question marks. These ventures are in their nascent stages, demanding substantial R&D and market penetration efforts.

Similarly, the integration of wind power with green hydrogen production and Goldwind's advanced digital solutions, such as the Oasis Zero-Carbon Platform, also fall into the question mark category. These innovative areas offer considerable growth prospects but are still maturing in terms of market adoption and Goldwind's current market penetration.

Entering competitive Western markets, despite their high growth potential, is another question mark for Goldwind due to established competition and regulatory hurdles.

| BCG Category | Goldwind Segment | Market Growth | Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|---|

| Question Mark | Ultra-large Offshore Turbines (20-25 MW) | High | Low | High | Star or Dog |

| Question Mark | Emerging International Markets (Georgia, Philippines) | High | Low | High | Star or Dog |

| Question Mark | Wind Power & Green Hydrogen Integration | High | Low | High | Star or Dog |

| Question Mark | Advanced Digital Solutions (Oasis Platform) | High | Low | High | Star or Dog |

| Question Mark | Entry into Western Markets | High | Low | High | Star or Dog |

BCG Matrix Data Sources

This Goldwind BCG Matrix is constructed using comprehensive data, including financial reports, market share analysis, and renewable energy sector forecasts, to provide a clear strategic overview.