Gold Fields Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

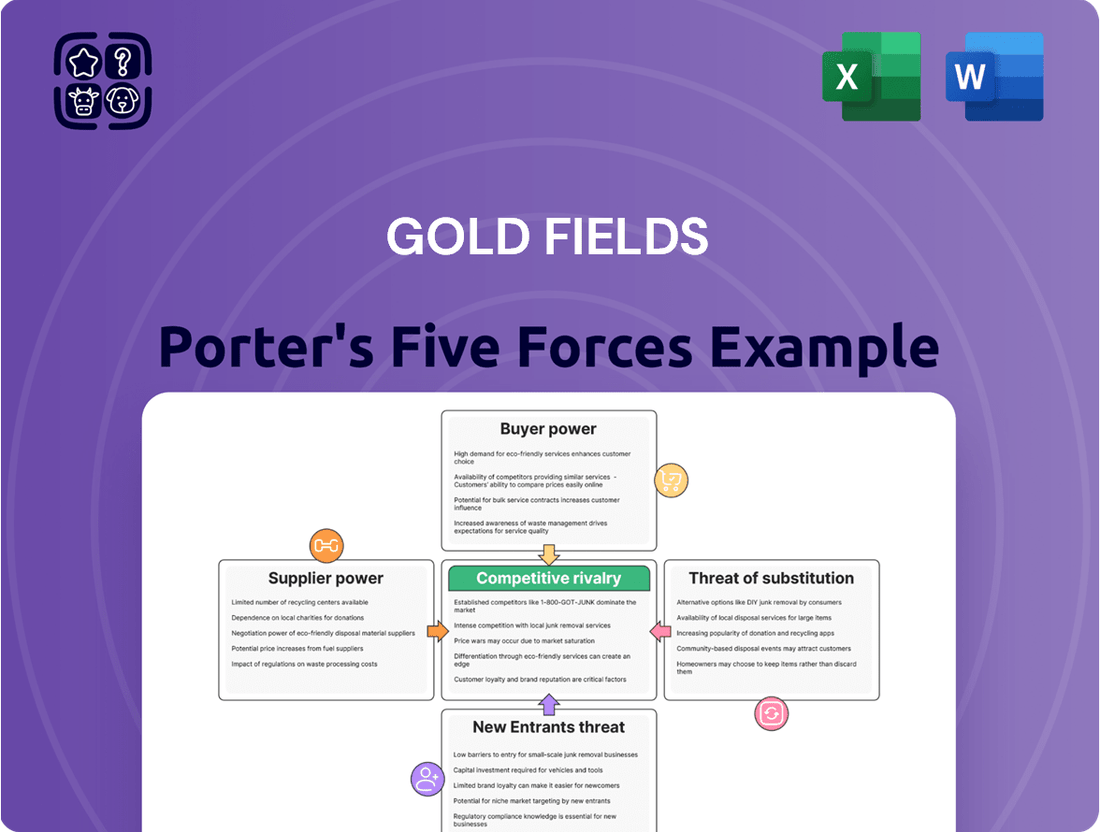

Gold Fields faces significant competitive pressures, from the bargaining power of buyers to the intense rivalry within the global gold mining sector. Understanding these forces is crucial for navigating the volatile commodity market.

The complete report reveals the real forces shaping Gold Fields’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The gold mining sector's dependence on specialized equipment and technology means that if a few dominant suppliers control these essential inputs, they gain substantial bargaining power. This concentration allows them to dictate prices and terms, impacting Gold Fields' operational costs and profitability.

For instance, the market for advanced ore processing chemicals or highly specialized mining machinery is often characterized by a limited number of key players. In 2024, the global mining equipment market was valued at approximately $180 billion, with a significant portion of that attributed to specialized machinery, highlighting the potential leverage of dominant suppliers in these niches.

The uniqueness of inputs significantly influences the bargaining power of suppliers for Gold Fields. If the company relies on specialized raw materials or highly specific technical expertise that few suppliers can provide, those suppliers gain considerable leverage. This scarcity means Gold Fields has fewer alternatives, allowing suppliers to dictate terms and potentially increase prices. For instance, access to rare earth elements used in advanced processing equipment or the availability of highly specialized geologists with expertise in a particular ore body can give suppliers substantial power.

In 2024, the mining industry continued to face challenges in securing specialized labor, particularly for roles requiring advanced technological skills in automation and data analytics. This shortage means that suppliers of such talent, whether recruitment agencies or individual contractors, can command premium rates. Similarly, the supply of certain critical minerals or chemicals essential for gold extraction, which might have limited global producers, can also lead to increased supplier bargaining power. Gold Fields, like its peers, must navigate these supply chain sensitivities to maintain cost control and operational efficiency.

Switching suppliers for critical components or services presents substantial costs and operational disruptions for Gold Fields. These switching costs, such as re-tooling machinery or re-certifying processes, enhance the bargaining power of existing suppliers. For instance, if a key supplier of specialized mining equipment were to increase prices, Gold Fields might face millions in costs to adapt to a new supplier's specifications, making it difficult to switch.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Gold Fields' mining operations is a nuanced consideration. While direct backward integration by traditional raw material suppliers into complex mining processes is uncommon due to high capital requirements and specialized expertise, the landscape is evolving. Technology and equipment providers, for instance, are increasingly offering more comprehensive, integrated solutions that could potentially streamline or even partially encompass aspects of the mining value chain.

This forward integration by suppliers, if it were to materialize significantly, could reduce Gold Fields' bargaining power by creating alternative avenues for resource extraction or processing. Consider the mining equipment sector, where major players are investing heavily in automation and digital solutions. For example, in 2024, companies like Caterpillar and Komatsu are showcasing advanced autonomous mining systems, which represent a step towards more integrated offerings that could, in theory, reduce a miner's direct operational control over certain segments.

- Technological advancements by equipment suppliers can lead to more integrated mining solutions.

- High capital intensity in mining generally limits direct backward integration by traditional suppliers.

- The potential for technology providers to offer end-to-end solutions poses a future threat.

- Increased supplier integration could reduce Gold Fields' operational autonomy and bargaining leverage.

Impact of ESG and Sustainability Requirements on Suppliers

Gold Fields' strong commitment to Environmental, Social, and Governance (ESG) principles means it actively seeks suppliers who align with these high standards. This focus can narrow the selection of potential partners, thereby enhancing the bargaining power of those suppliers who already meet these rigorous ESG requirements, influencing procurement costs and strategies.

The company's ambitious target to achieve a 10% reduction in Scope 3 emissions by 2030 necessitates close collaboration and engagement with its primary suppliers. This drive for sustainability means suppliers with established ESG credentials and demonstrable emission reduction plans are in a stronger position to negotiate terms.

- Supplier Alignment: Gold Fields prioritizes suppliers with robust ESG frameworks, potentially limiting the supplier base.

- Increased Leverage: Suppliers meeting stringent ESG and sustainability criteria gain increased bargaining power.

- Scope 3 Emissions: The 2030 target for a 10% Scope 3 emissions reduction requires active supplier engagement, influencing negotiation dynamics.

- Procurement Impact: Adherence to ESG standards by suppliers can affect procurement costs and strategic sourcing decisions for Gold Fields.

The bargaining power of suppliers for Gold Fields is significant, particularly for specialized equipment, chemicals, and skilled labor. When a few dominant players control essential inputs, they can dictate prices, impacting Gold Fields' costs. The global mining equipment market, valued around $180 billion in 2024, illustrates the leverage of key suppliers in niche areas.

High switching costs for Gold Fields, such as re-tooling machinery, further strengthen suppliers' positions. The company's commitment to ESG standards also empowers suppliers who meet these criteria, potentially affecting procurement costs.

| Factor | Impact on Gold Fields | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Higher prices, less favorable terms | Dominant players in specialized equipment and chemicals |

| Input Uniqueness | Limited alternatives, increased supplier leverage | Rare earth elements, specialized geological expertise |

| Switching Costs | Difficulty in changing suppliers, reinforcing existing relationships | High costs for re-tooling and re-certification |

| ESG Requirements | Empowers suppliers meeting standards, potentially increasing costs | Need for suppliers with strong ESG credentials and emission reduction plans |

What is included in the product

This analysis dissects the competitive forces impacting Gold Fields, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining sector.

Quickly identify and prioritize competitive threats with a visual representation of all five forces, enabling focused strategic action.

Customers Bargaining Power

Gold Fields' customers are quite varied, ranging from jewelry makers to industrial companies using gold in electronics and dentistry. Investors also play a significant role, buying gold in the form of bars, coins, and exchange-traded funds (ETFs). Even central banks are major purchasers of gold.

This wide array of end-users means that no single customer or small group of customers typically holds enough sway to dictate terms to Gold Fields. The fragmented nature of the customer base inherently dilutes the bargaining power of individual buyers, making it harder for them to demand significant price concessions or impose specific conditions on supply.

The bargaining power of customers in the gold market is significant, primarily because gold is a commodity. This means that buyers, whether they are jewelry manufacturers, industrial users, or investors, see little difference between gold sourced from Gold Fields and gold from other producers. In 2024, the price of gold remained a critical factor, with fluctuations impacting purchasing decisions across all segments.

Customer price sensitivity is a key factor for Gold Fields. While gold is a valuable commodity, its market price can swing considerably. For instance, in early 2024, gold prices reached record highs, exceeding $2,300 per ounce, driven by geopolitical uncertainties and central bank purchases. This volatility means that customers, particularly in the jewelry and industrial sectors, may delay purchases or seek alternatives when prices surge, directly impacting Gold Fields' sales volume and revenue.

Availability of Substitutes for Gold Applications

While gold possesses unique properties, certain industrial and investment applications can utilize substitutes, thereby influencing customer bargaining power. The existence of these alternatives, even if not a perfect match, provides customers with more choices.

For instance, in jewelry, while gold's luster is highly valued, platinum and high-quality stainless steel offer alternative luxury options. In electronics, palladium and silver are sometimes used as substitutes for gold in connectors and contacts, although gold's superior conductivity and corrosion resistance often make it the preferred choice. The World Gold Council reported that in 2023, jewelry accounted for approximately 44% of global gold demand, while technology represented around 10%.

- Jewelry: Platinum, palladium, and stainless steel can serve as alternatives, though they may not replicate gold's specific aesthetic or perceived value.

- Electronics: Silver and palladium are sometimes used in place of gold in certain electronic components due to cost considerations, despite gold's superior performance characteristics.

- Investment: While gold is a unique store of value, investors can diversify into other precious metals like silver and platinum, or alternative assets such as bonds and real estate, which can temper gold's pricing power.

- Industrial Uses: In specific industrial applications, materials like copper or nickel alloys might be considered as substitutes if cost or availability becomes a significant factor, though performance trade-offs are common.

Central Bank and Institutional Demand

Central banks and major institutional investors are substantial buyers of gold, frequently acquiring it for reserve diversification or as a safeguard against economic volatility. Their considerable purchasing power allows them to impact market prices and overall demand, thereby exerting a degree of collective bargaining influence.

For instance, in 2023, central banks continued their robust gold accumulation, with net purchases by central banks totaling 1,037 tonnes, marking the second consecutive year of record-breaking demand according to the World Gold Council. This sustained buying activity from these large entities can indeed shape the bargaining power dynamics within the gold market.

- Significant Buyers: Central banks and institutional investors are major purchasers of gold.

- Reserve Diversification: They acquire gold to diversify their reserves and hedge against economic uncertainty.

- Price Influence: Large-scale purchases impact gold prices and market demand.

- Collective Bargaining Power: Their combined buying power gives them leverage in the market.

Gold Fields' customers, including jewelry makers, industrial users, investors, and central banks, face a commodity market where price is paramount. The fragmented nature of many buyers limits individual power, but large institutional purchasers like central banks can collectively influence demand and pricing. The existence of substitutes in some applications also provides customers with leverage.

| Customer Segment | Substitute Options | Bargaining Power Factor |

|---|---|---|

| Jewelry Manufacturers | Platinum, Palladium, Stainless Steel | Price sensitivity, aesthetic preference |

| Industrial Users (Electronics) | Silver, Palladium | Cost considerations, performance trade-offs |

| Investors | Silver, Platinum, Bonds, Real Estate | Portfolio diversification needs |

| Central Banks | N/A (Unique reserve asset) | Large-scale purchasing power, reserve diversification strategy |

Full Version Awaits

Gold Fields Porter's Five Forces Analysis

This preview showcases the complete Gold Fields Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the gold mining industry. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and no hidden content. This professionally formatted analysis is ready for your immediate use, providing valuable strategic insights without any need for further preparation.

Rivalry Among Competitors

The global gold mining arena is populated by a mix of major players and smaller operations. Giants like Newmont and Barrick Gold, along with AngloGold Ashanti, operate on a worldwide scale, meaning Gold Fields faces significant competition for resources and investor attention. For instance, as of early 2024, Newmont was projected to produce around 5.9 million ounces of gold in 2024, while Barrick Gold aimed for 4.7 million ounces, highlighting the sheer scale of these competitors.

The growth rate of gold demand significantly shapes competitive intensity within the industry. While gold's appeal as a safe haven and its industrial applications generally support robust demand, periods of slower growth or market oversupply can escalate competition. In such environments, producers often engage in more aggressive pricing or seek to capture market share from rivals.

Gold is a commodity, meaning products from different companies are largely the same. This makes it tough for Gold Fields to stand out based on the product itself. Instead, the battleground shifts to who can mine and sell gold at the lowest cost. For instance, in 2023, the average all-in sustaining cost for the gold mining industry hovered around $1,200 to $1,300 per ounce, a key metric driving competitive advantage.

This lack of product differentiation forces companies like Gold Fields into intense price competition. To thrive, they must relentlessly focus on operational efficiency and cost management. Companies that can achieve lower production costs gain a significant edge, especially when global gold prices fluctuate. Gold Fields’ focus on improving its South Deep mine in South Africa, for example, aims to reduce its overall cost per ounce.

High Fixed Costs and Exit Barriers

Gold mining is inherently capital-intensive. Companies face substantial upfront investments in exploration, mine development, and processing facilities. For instance, establishing a new gold mine can cost hundreds of millions, even billions, of dollars. This high fixed cost structure means that once operations are underway, companies have a strong incentive to keep producing to spread these costs over a larger output.

The significant investment in infrastructure, such as shafts, processing plants, and transportation networks, creates high exit barriers. Decommissioning a mine and restoring the site also incurs considerable expense. Consequently, even when gold prices are low, mining companies may continue to operate, albeit at reduced capacity, rather than abandoning their investments entirely. This can lead to persistent high supply levels in the market, intensifying competitive rivalry among existing players.

In 2024, the global gold mining industry continues to grapple with these dynamics. Companies are focused on operational efficiency to manage costs, but the fundamental nature of high fixed costs and exit barriers remains a defining characteristic. This environment often forces companies to compete aggressively on price and volume, especially during periods of market uncertainty or lower commodity prices.

- Capital Intensity: Gold mining requires massive upfront capital for exploration, development, and infrastructure.

- Exit Barriers: High costs associated with mine closure and site remediation make exiting the industry difficult.

- Production Persistence: Companies may continue mining even in downturns to cover fixed costs, maintaining supply.

- Intensified Rivalry: The combination of high fixed costs and exit barriers fuels fierce competition among gold producers.

Strategic Acquisitions and Consolidation

The mining sector, including gold, has been marked by significant consolidation. A prime example is Newmont's acquisition of Newcrest Mining, a deal valued at approximately $19 billion, completed in late 2023. This move, aimed at bolstering reserves and unlocking substantial cost synergies, illustrates a broader trend of companies seeking greater scale and efficiency.

These strategic acquisitions can dramatically alter the competitive dynamics for companies like Gold Fields. By combining operations, larger entities can achieve significant economies of scale, potentially giving them a cost advantage. This consolidation can lead to a market with fewer, but more dominant, players.

- Newmont's acquisition of Newcrest Mining for ~$19 billion in late 2023 is a key indicator of industry consolidation.

- Such mergers aim to consolidate mineral reserves and achieve economies of scale, enhancing cost efficiencies.

- This trend can lead to a more concentrated market, with fewer, larger, and more powerful competitors emerging.

- For Gold Fields, this means facing potentially stronger rivals with greater financial and operational leverage.

The gold mining industry is characterized by intense rivalry due to the homogeneous nature of the product, forcing companies to compete primarily on cost efficiency. Global players like Newmont and Barrick Gold, with projected 2024 production of approximately 5.9 million and 4.7 million ounces respectively, set a high bar for operational performance. This cost-centric competition is underscored by average all-in sustaining costs in 2023 ranging from $1,200 to $1,300 per ounce, making efficient production a critical differentiator for Gold Fields.

| Competitor | Estimated 2024 Production (oz) | Approx. 2023 All-in Sustaining Costs (per oz) |

|---|---|---|

| Newmont | ~5.9 million | Data varies by mine, but generally competitive |

| Barrick Gold | ~4.7 million | Data varies by mine, but generally competitive |

| Gold Fields | ~2.4 million (FY23 est.) | Focus on reducing below industry average |

SSubstitutes Threaten

For investors, gold faces significant competition from a diverse array of alternative assets. Stocks, for instance, offered a robust 26.3% return in the S&P 500 in 2023, while bonds saw yields rise, making them more attractive. Real estate markets, though varied, continued to present opportunities, and the volatile yet potentially high-reward landscape of cryptocurrencies also draws capital that might otherwise flow into gold.

Silver, platinum, and palladium present a threat of substitutes for gold, particularly in industrial uses and as investment alternatives. For instance, in electronics, silver's conductivity can sometimes make it a viable substitute for gold. As of mid-2024, silver prices have seen fluctuations, trading around $30 per ounce, while platinum hovered near $950 per ounce, and palladium experienced volatility, trading in the $900-$1000 per ounce range, demonstrating distinct market behaviors that could influence investor choices away from gold.

Technological advancements are increasingly presenting potential substitutes for gold in various industrial applications, which could impact demand. For instance, in the electronics sector, where gold is valued for its conductivity and corrosion resistance, ongoing research is yielding new conductive materials and alloys that offer comparable performance at a lower cost. While gold's unique combination of properties remains difficult to replicate entirely, these innovations can chip away at its market share in specific, high-volume uses. For example, by 2024, the global market for advanced conductive inks and pastes, potential substitutes in some electronic components, was projected to reach billions of dollars, indicating a growing competitive landscape for traditional materials like gold.

Lab-Grown or Synthetic Gold

While lab-grown or synthetic gold is not yet a major commercial threat to the investment or large-scale industrial gold markets, its ongoing development holds potential as a disruptive substitute. Currently, its primary impact is felt within the jewelry sector, offering alternative sourcing options.

The long-term viability of synthetic gold as a substitute hinges on several factors:

- Cost-Effectiveness: The production cost of synthetic gold needs to become competitive with mined gold for widespread adoption.

- Purity and Properties: Ensuring synthetic gold matches the purity and physical properties of natural gold is crucial for industrial applications.

- Consumer Acceptance: Building trust and acceptance among consumers, particularly in the jewelry market, will be key.

- Scalability: The ability to scale production efficiently will determine its market penetration.

As of early 2024, the market for lab-grown gold remains nascent, with research and development focused on refining production processes and exploring niche applications.

Perception of Gold as a Safe Haven

Gold's long-standing reputation as a safe-haven asset is a primary driver of its demand, especially during times of economic or geopolitical uncertainty. However, this perception faces a threat from substitutes that can offer similar perceived security. If alternative assets, such as certain government bonds or even digital currencies, gain traction and are viewed as equally or more reliable hedges against risk, investor demand for gold could soften. This shift would directly impact gold prices and the overall market for the precious metal.

The emergence of new financial instruments or a significant increase in the stability of existing ones could dilute gold's appeal. For instance, a period of sustained global economic growth with low inflation might reduce the perceived need for a traditional safe haven like gold. Investors might then allocate capital to assets offering higher potential returns, seeing less necessity to park funds in a non-yielding asset. This dynamic highlights the competitive landscape gold operates within, even in its role as a store of value.

- Gold's Safe-Haven Status: Historically, gold has been sought after during economic downturns and geopolitical instability.

- Emergence of Substitutes: Other assets like U.S. Treasury bonds or even certain cryptocurrencies can be perceived as alternative safe havens.

- Impact of Economic Stability: Increased global economic stability can reduce the demand for traditional safe-haven assets like gold.

- Investor Behavior Shift: If investors find comparable or superior security in substitutes, their allocation away from gold could increase.

The threat of substitutes for gold is multifaceted, encompassing other precious metals, alternative investments, and technological innovations. While gold's unique properties and safe-haven status are strong differentiators, these substitutes can erode its market share. For example, in 2023, the S&P 500 returned 26.3%, drawing investment away from non-yielding assets like gold, while silver traded around $30 per ounce in mid-2024, offering a lower-cost alternative in some industrial uses.

| Substitute Asset | 2023 Performance (Example) | Mid-2024 Price (Approx.) | Key Threat to Gold |

|---|---|---|---|

| Stocks (S&P 500) | +26.3% | N/A | Higher potential returns |

| Silver | N/A | ~$30/oz | Industrial use, investment alternative |

| Platinum | N/A | ~$950/oz | Industrial use, investment alternative |

| U.S. Treasury Bonds | Yields rose | N/A | Perceived safe-haven alternative |

Entrants Threaten

Establishing a new gold mine demands substantial capital, often running into hundreds of millions or even billions of dollars. These costs cover everything from initial geological surveys and land acquisition to the construction of processing facilities and the purchase of heavy machinery. For instance, the development of a new open-pit gold mine can easily exceed $500 million in upfront investment.

This significant financial hurdle acts as a powerful deterrent for potential new entrants. The sheer scale of investment required means only well-funded corporations or consortiums can realistically consider entering the gold mining sector, thereby limiting the number of new competitors that Gold Fields and similar established players face.

The gold mining sector faces significant regulatory challenges, including extensive environmental impact assessments and social license to operate requirements. For instance, obtaining all necessary permits for a new mine can take several years and involve substantial upfront investment, deterring many potential new players.

These complex and often lengthy permitting processes, covering everything from water usage to waste disposal, act as a formidable barrier to entry. In 2024, the average time to secure mining permits in many jurisdictions continued to extend, with some projects facing delays of up to five years, significantly increasing costs and uncertainty for newcomers.

Securing access to economically viable gold deposits is a significant hurdle for any new player looking to enter the mining industry. Gold Fields, as of their 2023 annual report, operates nine mines and has several development projects, demonstrating substantial established access to proven mineral reserves and resources. This existing infrastructure and resource base presents a formidable barrier, making it exceedingly difficult for new entrants to acquire competitive assets and achieve scale.

Economies of Scale and Experience

Established gold miners like Gold Fields leverage significant economies of scale. This allows them to spread fixed costs like exploration, mine development, and processing over a larger output, resulting in lower per-unit production costs. For instance, in 2023, Gold Fields' all-in sustaining costs (AISC) were reported at $1,072 per ounce, a figure difficult for a new, smaller operation to replicate immediately.

New entrants face a substantial hurdle in achieving comparable cost efficiencies. Without the established infrastructure, extensive operational experience, and high production volumes, they would likely incur higher per-unit costs. This cost disadvantage makes it challenging for newcomers to compete on price with established players like Gold Fields, particularly in a volatile commodity market.

- Economies of Scale: Gold Fields benefits from lower per-unit costs due to large-scale operations in mining, processing, and logistics.

- Experience Curve: Years of operational experience lead to optimized processes, reduced waste, and improved efficiency, which are hard for new entrants to match quickly.

- Capital Intensity: The gold mining industry requires massive upfront capital investment for exploration, mine development, and equipment, creating a high barrier to entry.

- Procurement Power: Large players like Gold Fields can negotiate better prices for essential supplies and services due to their purchasing volume.

Brand Loyalty and Reputation

Established gold mining companies like Gold Fields benefit from strong brand loyalty and a solid reputation, which can be a significant hurdle for new entrants. While gold is a commodity, buyers and investors often value a proven track record of reliable supply, adherence to ethical mining practices, and overall financial stability. Building this kind of trust and recognition is a long, capital-intensive process, effectively deterring newcomers. For instance, Gold Fields’ consistent top rankings in sustainability indices underscore the value placed on its reputation, making it harder for less established firms to compete for the same investor and customer base.

The threat of new entrants in the gold mining sector remains relatively low due to the immense capital requirements, with new mine development often exceeding $500 million. This financial barrier, coupled with the lengthy and complex permitting processes that can take up to five years in 2024, significantly deters potential competitors.

Established players like Gold Fields benefit from economies of scale, achieving lower per-unit production costs, such as their 2023 AISC of $1,072 per ounce, which is difficult for newcomers to match.

Furthermore, securing access to viable gold deposits and building a reputation for reliability and ethical practices are substantial challenges for new entrants, making it difficult to compete with established companies.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing a new gold mine requires hundreds of millions to billions of dollars for exploration, development, and equipment. | High barrier, limiting entry to well-funded entities. |

| Regulatory Hurdles | Extensive environmental assessments and permitting processes, averaging several years for completion in 2024. | Increases costs and uncertainty, deterring many potential entrants. |

| Access to Reserves | Acquiring economically viable gold deposits is difficult for new players compared to established companies with proven reserves. | Limits competitive asset acquisition and scalability. |

| Economies of Scale | Established firms like Gold Fields benefit from lower per-unit costs (e.g., 2023 AISC of $1,072/oz) due to high production volumes. | New entrants face higher costs and struggle to compete on price. |

Porter's Five Forces Analysis Data Sources

Our Gold Fields Porter's Five Forces analysis is built upon a foundation of robust data, including Gold Fields' annual reports, investor presentations, and sustainability reports. We also incorporate industry-specific data from reputable sources like the World Gold Council and S&P Global Market Intelligence to provide a comprehensive view of the competitive landscape.