Gold Fields Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

Unlock the secrets of the Gold Fields BCG Matrix and understand its strategic positioning within the mining industry. See how its diverse portfolio of assets fits into the Stars, Cash Cows, Dogs, and Question Marks quadrants, revealing critical insights into market share and growth potential.

This glimpse into the Gold Fields BCG Matrix is just the beginning. Purchase the full report for a comprehensive breakdown, including detailed analysis of each asset's performance, actionable recommendations for resource allocation, and a clear roadmap to maximizing profitability and future growth.

Don't miss out on the opportunity to gain a competitive edge. The complete Gold Fields BCG Matrix provides the in-depth analysis and strategic clarity you need to make informed investment decisions and navigate the complexities of the global gold market with confidence.

Stars

The Salares Norte project in Chile is a shining example of a Star in Gold Fields' portfolio. Its production is accelerating quickly, with forecasts showing a jump from 250,000 ounces in 2024 to an impressive 580,000 ounces by 2025.

This new, high-quality mine boasts a low cost structure, positioning it as a crucial engine for Gold Fields' future growth. It is set to deliver significant value and substantially boost the company's total output in an expanding gold market.

The Windfall Project in Canada is Gold Fields' dedicated 'Star' in the making. Currently under development, it's a massive gold deposit recognized for its high-grade ore.

Gold Fields is pouring significant investment into Windfall, anticipating it will become a major contributor. Projections indicate an annual output of 300,000 ounces of gold once production begins, solidifying its role as a crucial future growth driver in a prime mining location.

The Granny Smith mine in Australia showcased impressive results in 2024. Production saw a healthy 1% uptick, underscoring its consistent operational capabilities.

Furthermore, adjusted pre-tax free cash flow surged by a remarkable 74% during the same period. This significant financial growth highlights Granny Smith's strong profitability and its ability to capitalize on favorable market conditions for gold.

These figures solidify Granny Smith's position as a star performer within Gold Fields' Australian operations, demonstrating robust market share and value generation.

Agnew Mine, Australia

The Agnew mine in Australia stands out as a 'Star' in Gold Fields' portfolio. Its financial performance in 2024 was particularly robust, with adjusted pre-tax free cash flow surging by an impressive 48%.

This significant increase in cash flow, directly attributable to the mine's operational efficiency and the prevailing gold market conditions, underscores its strong market position. The Agnew mine consistently contributes to Gold Fields' overall production, reinforcing its status as a high-growth, high-market-share asset.

- Agnew Mine 2024 Performance: 48% increase in adjusted pre-tax free cash flow.

- Market Position: High market share due to consistent production contribution.

- Strategic Importance: Solidified 'Star' status within Gold Fields' BCG Matrix.

- Economic Environment: Benefiting from a buoyant gold price environment.

South Deep Mine, South Africa (Recovery & Long-Term Potential)

South Deep Mine in South Africa is showing significant recovery and long-term potential, positioning it as a strong contender for a 'Star' in Gold Fields' BCG Matrix.

Following substantial operational improvements, the mine achieved a notable 24% year-on-year increase in production during the first quarter of 2025. This performance indicates that South Deep is well on its way to meeting its production targets for the 2025 fiscal year.

The mine boasts an exceptionally long life, underpinned by vast mineral resources, and has regained strong operational momentum. This combination of factors highlights its critical strategic importance for enhancing the overall quality and long-term value of Gold Fields' asset portfolio.

- Production Growth: 24% year-on-year increase in Q1 2025.

- Guidance Attainment: On track to meet 2025 production guidance.

- Asset Characteristics: Very long-life asset with significant mineral resources.

- Strategic Importance: Elevates portfolio quality and long-term potential.

Gold Fields' Stars represent assets with high growth potential and strong market share, demanding significant investment to maintain their leading position. These are the growth engines of the company.

The Salares Norte project is a prime example, with production set to surge from 250,000 ounces in 2024 to 580,000 ounces by 2025, driven by its low-cost structure.

Similarly, the Windfall Project in Canada, a high-grade gold deposit, is projected to yield 300,000 ounces annually upon commencement, solidifying its Star status.

The Granny Smith mine in Australia demonstrated robust performance in 2024, with a 1% production increase and a 74% surge in adjusted pre-tax free cash flow.

| Asset | 2024 Production (koz) | Projected 2025 Production (koz) | Key Metric Growth (2024) | Market Position |

| Salares Norte | 250 | 580 | N/A (New Project) | High Growth Potential |

| Windfall | N/A (Under Development) | 300 (Projected Annual) | N/A | High Growth Potential |

| Granny Smith | N/A | N/A | +1% Production, +74% Adj. Pre-tax FCF | Strong Performer |

| Agnew | N/A | N/A | +48% Adj. Pre-tax FCF | High Market Share |

What is included in the product

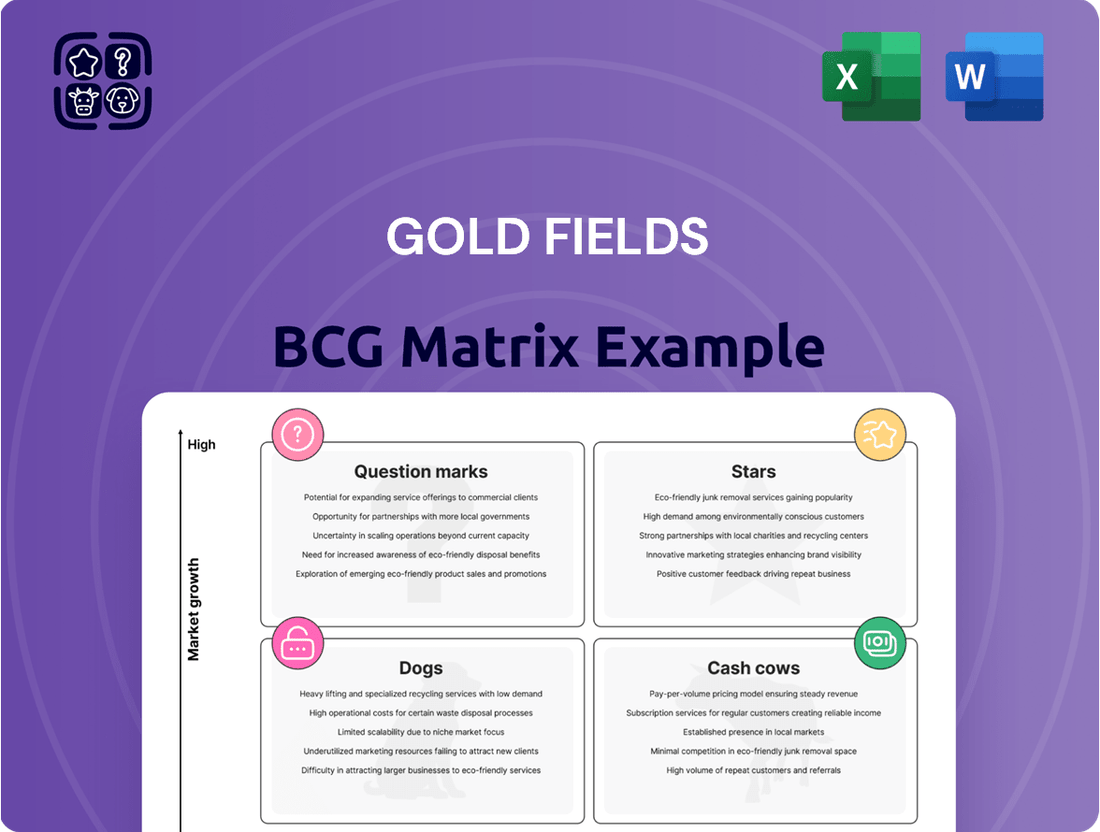

The Gold Fields BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides investment decisions, suggesting divestment of Dogs, milking Cash Cows, investing in Stars, and developing Question Marks.

The Gold Fields BCG Matrix provides a clear, visual roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

The Tarkwa Mine in Ghana stands as a prime example of a Cash Cow within Gold Fields' portfolio. This operation is Ghana's largest open-pit gold mine, a testament to its established position and consistent, significant cash flow generation for the company.

Tarkwa's substantial output, consistently contributing to Gold Fields' financial stability, solidifies its Cash Cow status. While the gold market sees growth, Tarkwa, as a mature asset, prioritizes maintaining high efficiency and output levels, acting as a dependable source of funding for the company's other strategic initiatives.

The St Ives mine in Australia is a cornerstone of Gold Fields' operations, consistently generating substantial cash flow. While 2024 saw some challenges with production and rising costs, its scale as a large asset remains crucial for the company's financial health.

Gold Fields is focusing investments on maintaining St Ives' high productivity and boosting efficiency. A key initiative is the renewable power project, aimed at reducing operational costs and environmental impact.

Gold Fields' consolidated Australian operations represent a quintessential Cash Cow within its portfolio. These mature, high-producing mines consistently generate substantial free cash flow and contribute a significant portion to the company's overall gold output, reflecting a dominant market share in this segment.

In 2023, Gold Fields' Australian assets, including St Ives and Agnew, demonstrated robust performance. St Ives, for instance, produced 235,000 ounces of gold in 2023, while Agnew yielded 224,000 ounces, underscoring their role as reliable cash generators requiring ongoing, but not aggressive, investment to maintain their productive capacity.

Established Global Production Base

Gold Fields' established global production base, characterized by its long-standing and productive mines in various regions, functions as a collective Cash Cow. These operations consistently deliver high volumes of gold, generating robust and reliable cash flows. For instance, in 2023, Gold Fields reported total attributable gold production of 2.4 million ounces, with a significant portion stemming from its mature assets.

These consistent cash inflows are vital for the company's financial health. They serve to fund new exploration and development projects, cover essential administrative overheads, and importantly, provide dividends to shareholders, underscoring their role in maintaining overall financial stability.

- Established Mines: Gold Fields operates mines with proven reserves and ongoing production cycles.

- Consistent Output: These mature operations reliably contribute substantial gold volumes.

- Cash Flow Generation: The consistent production translates into predictable and significant cash flow.

- Financial Support: These cash flows are critical for funding growth initiatives and shareholder returns.

Extensive Mineral Reserves and Resources

Gold Fields' substantial mineral reserves and resources are a key indicator of its Cash Cow status. As of recent reporting, the company holds 44.3 million ounces of proved and probable gold mineral reserves. Additionally, it has 30.4 million ounces in measured and indicated gold mineral resources, separate from reserves. This robust and well-established asset base is foundational to Gold Fields' long-term stability and revenue generation.

This extensive mineral base ensures consistent future production from its existing, well-understood mining operations. The predictability of these operations translates into reliable and steady revenue streams, a hallmark of a Cash Cow. The company's significant reserve and resource figures, which are continuously managed and updated, provide a strong underpinning for its overall valuation and financial outlook.

- Proved and Probable Gold Mineral Reserves: 44.3 million ounces.

- Measured and Indicated Gold Mineral Resources (excluding Reserves): 30.4 million ounces.

- Implication: Long-term production stability and consistent revenue streams.

- Financial Impact: Underpins company valuation and provides foundational stability.

Cash Cows in Gold Fields' portfolio are mature, highly productive mines that consistently generate significant free cash flow. These operations require ongoing investment primarily for maintenance and efficiency improvements rather than aggressive expansion. Their stable output and predictable earnings are crucial for funding the company's growth initiatives and providing shareholder returns.

| Asset | Region | 2023 Production (koz) | 2024 Outlook (koz) | Cash Flow Contribution |

|---|---|---|---|---|

| Tarkwa | Ghana | 632 | 570-630 | High, stable |

| St Ives | Australia | 235 | 210-230 | Significant, requires efficiency focus |

| Agnew | Australia | 224 | 230-250 | Significant, requires efficiency focus |

Preview = Final Product

Gold Fields BCG Matrix

The Gold Fields BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered in its complete, professionally formatted state, ready for your immediate use in business planning and competitive analysis.

Dogs

Gold Fields divested its 45% interest in the Asanko Gold Mine in Ghana in March 2024. This strategic move aligns with the characteristics of a 'Dog' in the BCG Matrix, signifying an asset with low market share and limited future growth potential for Gold Fields.

The decision to exit Asanko underscores Gold Fields' focus on optimizing its asset portfolio and reallocating capital towards ventures offering higher returns and greater strategic alignment. This divestment reflects a deliberate strategy to shed underperforming or non-core assets.

The Damang Mine in Ghana, now processing stockpiled ore after active mining ceased in 2023, exhibits a low growth trajectory and declining returns. This operational shift clearly places it in the 'Dog' category of the BCG Matrix.

With its contribution to Gold Fields' overall production being minimal, and the company actively exploring divestment options, Damang represents an asset with diminishing strategic importance and limited future potential.

The Cerro Corona mine in Peru, with approximately five years of mine life remaining as of 2024, is a prime example of a 'Dog' in Gold Fields' portfolio. While it continues to contribute to production, its limited future operational runway suggests low long-term growth potential for the company.

Gold Fields is actively assessing the future of Cerro Corona, with a potential divestment being a key consideration. This strategic review underscores the company's focus on optimizing its asset base and reallocating capital towards assets with stronger growth prospects.

Rusoro Mining (Divested Interest)

In 2024, Gold Fields completed the divestment of its interest in Rusoro Mining. This strategic move strongly suggests that Rusoro Mining was classified as a 'Dog' within Gold Fields' broader asset portfolio.

The 'Dog' classification in the BCG matrix signifies an asset with low market share and minimal growth potential. Gold Fields' decision to sell aligns with its ongoing efforts to optimize its operational footprint and concentrate on more promising ventures.

The disposal of Rusoro Mining underscores Gold Fields' commitment to portfolio rationalization, aiming to shed non-core and underperforming assets to enhance overall financial performance and strategic focus.

- Divestment Year: 2024

- Asset Classification: Dog (BCG Matrix)

- Reason for Divestment: Low market share, limited growth prospects, non-core asset

- Strategic Implication: Portfolio streamlining and focus on core assets

Far Southeast Project, Philippines (Divested Interest)

Gold Fields divested its interest in the Far Southeast project in the Philippines during 2024. This move aligns with the company's strategy of shedding underperforming assets. The Far Southeast project, by its nature of divestment, is classified as a 'Dog' within the BCG matrix.

Assets categorized as 'Dogs' typically exhibit low market share and low growth potential. Gold Fields' decision to sell indicates the project was not a significant contributor to the company's overall growth or market position. This divestiture allows for the reallocation of capital towards more strategic and profitable ventures.

- Divestment Year: 2024

- Project Location: Philippines

- BCG Matrix Classification: Dog

- Reason for Divestment: Low contribution to growth and market share, capital reallocation.

Gold Fields has strategically divested several assets in 2024, classifying them as 'Dogs' in the BCG Matrix. These divestments, including interests in Asanko Gold Mine, Rusoro Mining, and the Far Southeast project, signify assets with low market share and limited future growth potential.

The company's decision to exit these ventures reflects a clear strategy to optimize its portfolio, shedding non-core and underperforming assets. This allows Gold Fields to reallocate capital towards more promising opportunities, thereby enhancing overall operational efficiency and financial performance.

The Damang Mine in Ghana, currently processing stockpiled ore, and the Cerro Corona mine in Peru, with a limited remaining mine life of approximately five years as of 2024, also exhibit characteristics of 'Dogs'. These assets contribute minimally to overall production and are subject to strategic review, potentially including divestment.

| Asset | Location | BCG Classification | Divestment Year | Reason for Divestment |

|---|---|---|---|---|

| Asanko Gold Mine (45% interest) | Ghana | Dog | 2024 | Low market share, limited growth potential, portfolio optimization |

| Rusoro Mining | N/A | Dog | 2024 | Non-core asset, underperforming |

| Far Southeast project | Philippines | Dog | 2024 | Low contribution to growth, capital reallocation |

| Damang Mine | Ghana | Dog (potential) | Ongoing assessment | Low growth trajectory, declining returns, minimal production contribution |

| Cerro Corona mine | Peru | Dog (potential) | Ongoing assessment | Limited mine life (approx. 5 years remaining as of 2024), low long-term growth potential |

Question Marks

Gold Fields is actively pursuing early-stage exploration near its Salares Norte mine, initiating a 5,000-meter drilling program on its wholly-owned concessions. These targets are prime candidates for the question mark category within the BCG matrix due to their inherent high growth potential, contingent on successful exploration outcomes.

The economic viability of these early-stage targets remains uncertain, necessitating substantial investment in exploration activities before their potential contribution to Gold Fields' asset portfolio can be accurately assessed. This exploration phase is critical for de-risking these prospective areas and understanding their future value.

Edinburgh Park, an early-stage exploration joint venture in Australia, fits the profile of a Question Mark in Gold Fields' BCG Matrix. These ventures are characterized by operating in growing markets, like the Australian mining sector, but currently possess a low market share.

Significant investment is required for continued exploration and evaluation at Edinburgh Park, a hallmark of Question Marks. The success of such ventures is inherently uncertain, with their future potential to become Stars or Cash Cows yet to be determined through ongoing development and discovery.

The East Lachlan Joint Venture in Australia is classified as a Question Mark for Gold Fields. This early-stage exploration project is situated in a promising geological area, but its current contribution to Gold Fields' overall portfolio is minimal.

Significant capital expenditure is necessary for ongoing geological assessments and exploratory drilling. These efforts are crucial to ascertain the project's economic feasibility and its potential to evolve into a high-growth Star asset within Gold Fields' operations.

West Tanami Joint Venture, Australia

The West Tanami joint venture in Australia is classified as a Question Mark within Gold Fields' BCG Matrix. This designation reflects its status as an early-stage exploration asset operating within a burgeoning gold market, yet currently holding a minimal market share.

This venture is a significant cash consumer due to its ongoing exploration activities. Its future trajectory hinges critically on the success of drilling programs and subsequent feasibility studies. These studies must confirm substantial reserves and economic viability to warrant the substantial capital investment required for large-scale development.

- Market Position: Low market share in a growing gold market.

- Cash Flow: Negative cash flow due to exploration expenditure.

- Future Potential: Dependent on successful exploration to prove economic viability.

- Strategic Importance: Represents a potential future growth driver if exploration proves successful.

Uncertain Greenfield Exploration Opportunities

Uncertain greenfield exploration opportunities represent Gold Fields' potential future stars or question marks. These are areas where the company is investing in early-stage geological surveys and initial drilling, aiming to discover new gold deposits. The gold market itself is robust, but Gold Fields' presence in these nascent exploration zones is minuscule, demanding significant ongoing capital allocation with a high degree of uncertainty regarding success.

These ventures are characterized by their high-risk, high-reward profile. While the potential for discovering a significant new gold mine exists, the probability of failure is also substantial. For instance, in 2023, Gold Fields continued its exploration efforts across various prospective regions, with a focus on targets in Australia and the Americas, reflecting the company's commitment to replenishing its resource base through exploration.

- Exploration Expenditure: Gold Fields allocated approximately $133 million to exploration and evaluation activities in 2023, a significant portion of which is directed towards greenfield targets.

- Discovery Potential: These early-stage opportunities are crucial for long-term growth, aiming to identify deposits that could become future mines, similar to how past discoveries have shaped the company's current portfolio.

- Risk Profile: The success rate for greenfield exploration is inherently low, with many targets failing to yield economically viable gold concentrations, necessitating a diversified approach to exploration investment.

- Strategic Importance: Continued investment in greenfield exploration is vital for Gold Fields to maintain its competitive position in the gold mining industry and to ensure a sustainable future pipeline of projects.

Question Marks in Gold Fields' portfolio represent early-stage exploration projects with high growth potential but low current market share. These ventures demand significant investment to assess their viability.

The company is actively exploring promising geological areas, such as the Salares Norte concessions and joint ventures like Edinburgh Park, East Lachlan, and West Tanami. Success in these ventures could lead to future growth drivers.

These projects are characterized by negative cash flow due to ongoing exploration expenditures and a high degree of uncertainty regarding their economic feasibility. Their future as Stars or Cash Cows depends on successful discovery and development.

Gold Fields is committed to replenishing its resource base through exploration, with approximately $133 million allocated to exploration and evaluation activities in 2023, a substantial portion targeting greenfield opportunities. This investment underscores the strategic importance of these high-risk, high-reward ventures for long-term growth.

| Project | BCG Category | Market Growth | Market Share | Cash Flow | Investment Need |

|---|---|---|---|---|---|

| Salares Norte Exploration | Question Mark | High | Low | Negative | High |

| Edinburgh Park JV | Question Mark | High | Low | Negative | High |

| East Lachlan JV | Question Mark | High | Low | Negative | High |

| West Tanami JV | Question Mark | High | Low | Negative | High |

| Greenfield Exploration (General) | Question Mark | High | Low | Negative | High |

BCG Matrix Data Sources

Our Gold Fields BCG Matrix leverages comprehensive data from financial statements, industry reports, and market research to accurately assess business unit performance and market dynamics.