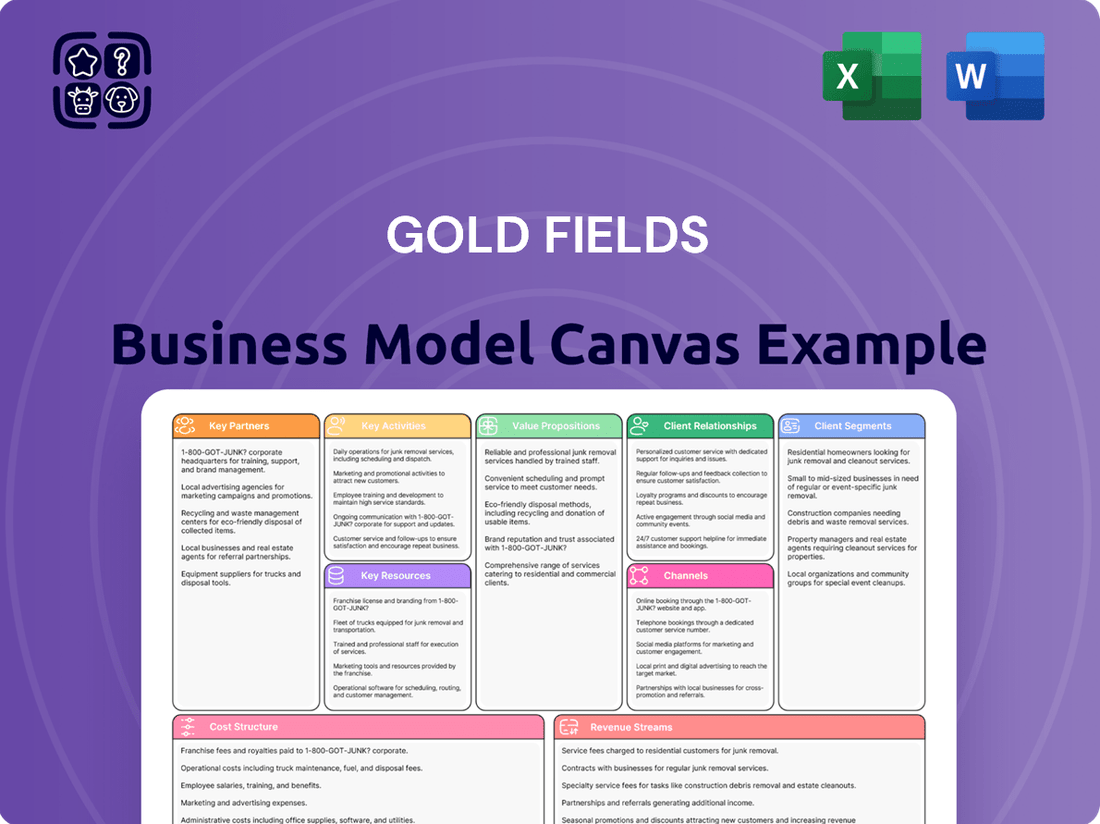

Gold Fields Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gold Fields Bundle

Unlock the core strategies driving Gold Fields's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their operational excellence. Perfect for anyone aiming to understand or replicate industry-leading approaches.

Partnerships

Gold Fields actively collaborates with technology and innovation providers to drive advancements across its operations. These partnerships are crucial for integrating cutting-edge solutions that boost mining efficiency, enhance safety protocols, and improve environmental stewardship. For instance, collaborations focus on deploying advanced automation systems and sophisticated data analytics platforms to optimize ore extraction and processing.

These strategic alliances aim to leverage innovations like AI-driven predictive maintenance to minimize downtime and advanced sensor technologies for real-time monitoring. In 2024, Gold Fields continued to invest in digital transformation initiatives, with a significant portion of capital expenditure allocated to technology upgrades aimed at improving gold recovery rates and reducing overall operational costs.

Gold Fields prioritizes building robust relationships with local communities and Indigenous groups, recognizing this as fundamental to its social license to operate. This engagement is critical for projects like the Windfall mine in Quebec, ensuring collaborative approaches to land use and resource development.

These partnerships involve proactive dialogue on employment prospects, local procurement initiatives, and equitable benefit-sharing agreements. For instance, in 2023, Gold Fields’ South Deep mine in South Africa continued its focus on local economic development, contributing to community upliftment projects and skills development programs aimed at fostering mutual prosperity and mitigating social risks.

Gold Fields relies heavily on partnerships with banks and financial institutions to fund its extensive operations. These relationships are critical for securing the significant capital required for exploration projects, mine development, and ongoing operational expenses. For instance, in 2023, Gold Fields successfully raised $700 million through a sustainability-linked revolving credit facility, demonstrating its ability to leverage financial partnerships for growth while aligning with environmental, social, and governance (ESG) objectives.

Engaging with a diverse base of investors is equally vital. Gold Fields maintains strong communication channels through integrated annual reports and investor presentations, ensuring transparency and fostering confidence. This proactive approach helps attract and retain the necessary funding from institutional investors, private equity firms, and individual shareholders, which is crucial for maintaining a robust financial position and supporting future strategic initiatives.

Government and Regulatory Bodies

Gold Fields actively collaborates with government and regulatory bodies across its operational regions, including Australia, South Africa, Ghana, Chile, Peru, and Canada. This engagement is crucial for securing and retaining mining licenses, obtaining necessary environmental permits, and ensuring strict adherence to local legislation and international benchmarks. In 2023, Gold Fields reported significant progress in its ESG commitments, with initiatives focused on water stewardship and biodiversity management being key areas of engagement with regulatory authorities.

The company's commitment to Environmental, Social, and Governance (ESG) principles is a cornerstone of its relationship with these bodies. This includes transparent reporting against established frameworks, demonstrating responsible resource management and community engagement. For instance, Gold Fields' sustainability reports detail its efforts to meet evolving ESG standards, often in direct response to regulatory expectations and stakeholder dialogue.

- Mining License and Permit Acquisition: Essential for legal operation and expansion, involving adherence to national mining acts and environmental protection laws.

- ESG Compliance and Reporting: Meeting standards for environmental impact, social responsibility, and corporate governance, often aligned with global initiatives like TCFD and GRI.

- Stakeholder Engagement: Building trust and ensuring alignment with government objectives for national development and resource management.

- Regulatory Dialogue: Participating in policy discussions and providing input on mining regulations to foster a stable operating environment.

Suppliers and Contractors

Gold Fields depends on a robust network of suppliers and contractors to keep its mining operations running smoothly. These partners provide essential equipment, raw materials, and specialized services, playing a vital role in ensuring operational continuity.

Strategic relationships with suppliers and contractors are crucial for managing supply chain risks and achieving cost efficiencies. For instance, in 2023, Gold Fields continued its focus on responsible sourcing and supplier diversity, aiming to build resilience and foster economic development in host communities.

The company actively engages with its suppliers to address environmental, social, and governance (ESG) factors, including efforts to reduce Scope 3 emissions. This collaborative approach helps mitigate risks and enhance the sustainability of the entire value chain.

- Operational Continuity: Suppliers provide critical equipment and materials, ensuring uninterrupted mining activities.

- Risk Management: Partnerships help mitigate supply chain disruptions and ensure access to necessary resources.

- Cost Efficiency: Collaborating with contractors for specialized tasks can lead to optimized operational costs.

- ESG Integration: Engagement with suppliers on Scope 3 emissions reduction is a key part of Gold Fields' sustainability strategy.

Gold Fields' key partnerships extend to technology and innovation providers, crucial for operational advancements. These alliances focus on integrating automation and data analytics to boost efficiency and safety. In 2024, significant investment in digital transformation underscored this commitment, aiming for improved gold recovery and cost reduction.

Strong relationships with financial institutions are vital for funding exploration and development. In 2023, Gold Fields secured a $700 million sustainability-linked credit facility, highlighting the importance of these financial partnerships for growth and ESG alignment.

Collaborations with government and regulatory bodies are essential for securing licenses and permits across its global operations. Adherence to ESG principles, such as water stewardship and biodiversity management, forms a key part of these engagements, as seen in ongoing dialogue with authorities in 2023.

Partnerships with suppliers and contractors ensure operational continuity and cost efficiency. Gold Fields' focus on responsible sourcing and supplier diversity in 2023 aimed to build supply chain resilience and integrate ESG factors, including Scope 3 emissions reduction.

What is included in the product

A structured framework detailing Gold Fields' operational strategy, customer relationships, revenue streams, and key resources, all organized within the nine classic Business Model Canvas blocks.

The Gold Fields Business Model Canvas acts as a pain point reliever by providing a clear, visual map of your entire business, allowing you to pinpoint and address inefficiencies or gaps that cause operational friction.

It simplifies complex business strategies into a single, actionable page, effectively reducing the pain of information overload and facilitating targeted problem-solving.

Activities

Gold exploration and resource delineation are fundamental to Gold Fields' long-term success. This involves extensive geological surveys and drilling programs to pinpoint new gold deposits and grow existing reserves. For instance, in the fiscal year ending December 31, 2023, Gold Fields reported total attributable gold equivalent ounces (GEO) of 2,548,000, highlighting the importance of these activities in maintaining and expanding their resource base.

This ongoing process is crucial for ensuring the company's future operational capacity. Gold Fields consistently focuses on reserve replacement at its key mining sites. Their 2023 annual report indicated a total attributable gold mineral reserve of 49.9 million ounces, demonstrating the significant outcomes of their exploration and delineation efforts.

Gold Fields' mine development and construction activities are crucial for future production. This involves substantial investment in projects like the Windfall mine in Canada, which is progressing through its development phase. These endeavors require intricate planning and execution, from initial site preparation to the erection of sophisticated processing facilities.

The company's capital expenditure for growth projects, including Windfall, reflects the scale of these undertakings. In the first half of 2024, Gold Fields reported significant investment in these development pipelines, underscoring the commitment to expanding its asset base and securing long-term operational capacity.

Gold Fields' core activities revolve around the safe and efficient extraction of gold ore from both open-pit and underground mines. This crucial stage involves meticulous planning and execution to ensure operational integrity and cost-effectiveness.

Following extraction, the ore undergoes a rigorous processing phase. This includes crushing and milling to reduce particle size, and then chemical extraction, commonly using cyanide leaching, to separate the gold. The ultimate goal is to produce doré gold, a semi-pure alloy of gold and silver.

In 2023, Gold Fields reported a total gold production of 2.3 million ounces, demonstrating their capacity in these key activities. The company emphasizes a commitment to safety, reliability, and cost management throughout the entire extraction and processing value chain.

Refining and Sales

After processing, the doré gold, a semi-pure alloy, is shipped to specialized refineries. These facilities transform it into high-purity gold bars, meeting stringent international standards. This refining process is crucial for unlocking the full market value of the extracted gold.

Gold Fields then engages in the global sale of this refined gold. This involves cultivating relationships with a diverse range of buyers, including bullion banks, mints, and industrial consumers. Optimizing sales channels and timing is key to maximizing revenue in a volatile market.

In 2024, the global gold market saw continued demand, with central banks remaining net purchasers. For instance, the World Gold Council reported significant central bank buying in early 2024, reflecting a trend that supports stable pricing for producers like Gold Fields. The company's sales strategy aims to capitalize on these market dynamics.

- Refining Process: Doré gold is sent to external or internal refineries to produce 99.5% pure gold.

- Sales Channels: Gold is sold to various global buyers, including financial institutions and industrial users.

- Market Optimization: Strategies focus on timing sales and leveraging market relationships to achieve favorable pricing.

- 2024 Market Context: Central bank demand and investor sentiment continue to influence gold prices, impacting sales revenue.

Environmental, Social, and Governance (ESG) Management

Gold Fields actively manages its environmental, social, and governance (ESG) performance through dedicated programs. This includes ambitious decarbonization targets, aiming for a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2016 baseline. Water stewardship is another key area, with efforts to reduce freshwater abstraction and improve water recycling rates across operations.

Social impact is fostered through substantial investment in host community development. In 2023, Gold Fields invested $31.1 million in community programs, focusing on education, health, and economic empowerment. These initiatives are designed to create shared value and build strong, sustainable relationships with the communities where they operate.

Strong governance underpins these efforts, ensuring ethical conduct and transparency. Gold Fields' commitment to ESG is integrated into its core business strategy and detailed in its annual Sustainability Reports, providing stakeholders with comprehensive data on its performance and progress.

- Environmental Stewardship: Focus on decarbonization (30% Scope 1 & 2 GHG reduction by 2030 vs. 2016) and water management.

- Social Impact: $31.1 million invested in community programs in 2023, targeting education, health, and economic development.

- Governance: Embedded ESG principles into strategy and reporting for transparency and ethical conduct.

Gold Fields' key activities encompass exploration, mine development, ore extraction, and processing. Exploration and resource delineation are vital for identifying and expanding gold deposits, as evidenced by their 49.9 million attributable gold equivalent ounces in reserves as of December 31, 2023. Mine development, including projects like Windfall, requires significant capital investment to ensure future production capacity.

The company then focuses on the safe and efficient extraction and processing of gold ore. In 2023, Gold Fields produced 2.3 million ounces of gold, highlighting their operational capacity in these core activities. The processing involves crushing, milling, and chemical extraction to produce doré gold.

Finally, Gold Fields refines doré gold into high-purity bars and sells them globally. Central bank demand in early 2024, as reported by the World Gold Council, provides a supportive market context for their sales strategies, aiming to optimize revenue in a dynamic environment.

Full Document Unlocks After Purchase

Business Model Canvas

The Gold Fields Business Model Canvas preview you see is not a mockup; it's a direct representation of the actual document you will receive upon purchase. You'll gain full access to this comprehensive and professionally structured Business Model Canvas, ready for immediate use and customization.

Resources

Gold Fields' most crucial asset is its gold mineral reserves and resources, encompassing proven and probable reserves, alongside measured, indicated, and inferred resources. These form the bedrock of their operational sustainability and future growth potential.

As of December 31, 2023, Gold Fields reported attributable gold equivalent mineral reserves of 52.5 million ounces and mineral resources of 126.6 million ounces. These figures highlight the substantial scale of their global mining footprint and the long-term viability of their operations.

Gold Fields' mining infrastructure and equipment are the bedrock of its operations, encompassing everything from open-pit and underground mines to sophisticated processing plants and extensive tailings storage facilities. This includes a vast fleet of heavy machinery essential for the efficient extraction and processing of gold ore.

In 2023, Gold Fields invested approximately $726 million in capital expenditure, a significant portion of which was directed towards maintaining and upgrading these critical assets, ensuring operational capacity and enhancing efficiency across its global portfolio. The company operates mines in South Africa, Australia, Peru, and Ghana, each requiring tailored infrastructure and equipment.

A highly skilled workforce, encompassing geologists, engineers, and operators, alongside a proficient management team, is fundamental to Gold Fields' success in mine exploration, development, and ongoing operations. Their expertise directly impacts efficiency and resource recovery.

Gold Fields has strategically focused on key management appointments to effectively execute its business strategy. This ensures experienced leadership is in place to navigate the complexities of the mining sector.

In 2023, Gold Fields reported a total workforce of approximately 10,500 employees and contractors, highlighting the scale of human capital required. The company's commitment to developing its people through training and development programs underscores the importance of this skilled workforce.

Licenses, Permits, and Social License to Operate

Licenses, permits, and the social license to operate are foundational intangible assets for Gold Fields, enabling their mining activities. These are not just bureaucratic hurdles but represent the company's legal right to explore, develop, and operate within various jurisdictions. Maintaining these requires constant, proactive engagement with governmental bodies and local communities to ensure ongoing acceptance and operational continuity.

In 2024, Gold Fields' commitment to robust social performance is evident in their ongoing stakeholder engagement programs across their global operations. For instance, their South Deep mine in South Africa actively participates in community development initiatives, fostering trust and partnership. This focus on social license is critical, as regulatory approvals and community support are directly tied to the company's ability to conduct business effectively and sustainably.

- Regulatory Compliance: Gold Fields adheres to strict environmental and operational regulations in all jurisdictions, securing necessary permits for exploration, mining, and processing activities.

- Community Engagement: Proactive dialogue and collaboration with local communities, including traditional authorities and residents, are central to maintaining social license, addressing concerns, and creating shared value.

- Government Relations: Building and maintaining strong relationships with national and local governments are essential for navigating the complex permitting processes and ensuring long-term operational stability.

Access to Capital and Financial Strength

Gold Fields maintains robust financial strength, essential for its capital-intensive operations. Sufficient financial resources and a strong balance sheet enable the company to fund significant mining projects, manage ongoing operational expenditures, and effectively navigate market volatility.

The company's ability to generate strong cash flow is a testament to its operational efficiency and strategic management. This consistent cash generation underpins its financial resilience and capacity for investment.

- Gold Fields reported a net profit of $1.1 billion for the fiscal year 2023.

- The company’s net debt to EBITDA ratio stood at approximately 0.5x as of December 31, 2023, indicating a healthy leverage position.

- Free cash flow from operations for 2023 was $1.3 billion, demonstrating strong underlying business performance.

- Gold Fields maintains a diversified funding strategy, including access to revolving credit facilities, ensuring liquidity for its global operations.

Gold Fields' key resources also include its intellectual property and proprietary technologies related to mining and mineral processing. These innovations drive efficiency and cost reduction.

The company's brand reputation and established market position are significant intangible assets. This recognition facilitates access to capital, talent, and favorable partnerships within the mining industry.

Gold Fields' strategic partnerships and joint ventures represent crucial external resources, providing access to new markets, technologies, and capital. These collaborations enhance operational capabilities and risk diversification.

| Key Resource | Description | 2023 Data/Context |

|---|---|---|

| Intellectual Property & Technology | Proprietary mining and processing techniques. | Focus on improving operational efficiency and reducing costs. |

| Brand Reputation & Market Position | Established name and trust in the global mining sector. | Facilitates access to capital, talent, and strategic alliances. |

| Partnerships & Joint Ventures | Collaborations with other entities for mutual benefit. | Provides access to new markets, technologies, and capital. |

Value Propositions

Gold Fields is committed to being a dependable source of gold for the world. In 2024, the company produced approximately 2.3 million ounces of gold, underscoring its role in meeting global demand. This consistent output helps stabilize the market and ensures that industries reliant on gold have a steady supply.

The company's strategic focus is on being a safe, reliable, high-quality, and low-cost gold producer. This approach is crucial for maintaining its value proposition of a reliable supply. By managing operational costs effectively, Gold Fields can continue to deliver substantial volumes of gold to the market, even in fluctuating economic conditions.

Gold Fields' dedication to robust environmental, social, and governance (ESG) practices resonates strongly with investors and consumers who seek ethically sourced gold. This commitment translates into tangible value by ensuring responsible operations and mitigating risks.

The company actively pursues decarbonization initiatives, aiming to reduce its carbon footprint. For instance, in 2023, Gold Fields reported a 6% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to 2022, demonstrating progress towards its climate goals.

Furthermore, Gold Fields prioritizes positive social impact through community development programs and fair labor practices. These efforts enhance the company's reputation and create shared value, appealing to a growing segment of the market that values social responsibility alongside financial returns.

For investors, Gold Fields presents a compelling opportunity to gain exposure to a globally diversified gold producer. Its operations span multiple continents, effectively mitigating single-country risk and showcasing a robust, geographically spread asset base. This diversification is a cornerstone of its strategy to deliver sustainable, superior value to all stakeholders.

In 2024, Gold Fields continued to demonstrate this diversification, with significant production contributions from Australia, South Africa, South America, and North America. The company's commitment to creating value is reflected in its operational performance and strategic capital allocation, aiming to enhance shareholder returns while maintaining a strong balance sheet.

Long-Life Assets and Growth Potential

Gold Fields boasts a robust portfolio featuring foundational assets with operational lives spanning multiple decades, ensuring sustained production. This bedrock of long-life assets is complemented by a promising pipeline of development and exploration projects, such as the recently commissioned Salares Norte in Chile and the advanced Windfall project in Canada, which are poised to drive future growth and replace depleted reserves.

The company's strategic focus on these long-life assets and growth projects underpins its commitment to long-term value creation. For instance, Salares Norte, which commenced production in early 2024, is expected to contribute significantly to Gold Fields' gold output and cash flow over its mine life. Similarly, Windfall is progressing towards its projected production start in 2025, further solidifying the company's growth trajectory.

- Long-Life Foundation Assets: Provides a stable base for production and cash flow.

- Growth Pipeline: Development and exploration projects like Salares Norte and Windfall offer future expansion opportunities.

- Reserve Replacement: Strategic investments ensure the sustainability of operations for decades to come.

- Geographic Diversification: Projects in different regions mitigate operational and political risks.

Shareholder Returns and Financial Performance

Gold Fields is committed to robust financial performance, focusing on profitability and strong free cash flow. This financial strength is directly channeled into delivering attractive returns for shareholders, primarily through dividends.

For the full year 2023, Gold Fields reported a headline earnings per share of $0.53, demonstrating solid profitability. The company’s commitment to shareholder returns was evident with the declaration of a final dividend of $0.25 per share for 2023, in addition to an interim dividend of $0.20 per share, totaling $0.45 per share for the year.

- Profitability: Achieved headline earnings per share of $0.53 in 2023.

- Free Cash Flow: Focus on generating consistent free cash flow to support returns.

- Shareholder Returns: Declared a total dividend of $0.45 per share for 2023.

- Future Outlook: Aiming to maintain and enhance shareholder returns through continued financial discipline.

Gold Fields offers a dependable and consistent supply of gold, underpinned by its 2024 production of approximately 2.3 million ounces. This reliability is further strengthened by a strategic focus on being a low-cost, high-quality producer, ensuring stable delivery even amidst market volatility.

The company's value proposition is amplified by its commitment to robust ESG practices and decarbonization efforts, such as the 6% reduction in GHG emissions intensity in 2023, appealing to ethically-minded investors and consumers.

Shareholders benefit from Gold Fields' strong financial performance, evidenced by $0.53 headline earnings per share in 2023 and a total dividend payout of $0.45 per share for the same year, reflecting a dedication to attractive returns.

| Value Proposition | Key Aspects | Supporting Data (2023/2024) |

| Dependable Gold Supply | Consistent production volumes | Approx. 2.3 million ounces produced in 2024 |

| Low-Cost, High-Quality Production | Operational efficiency and cost management | Focus on maintaining cost leadership |

| Ethical Sourcing & Sustainability | Strong ESG performance, decarbonization | 6% reduction in Scope 1 & 2 GHG intensity (2023 vs 2022) |

| Attractive Shareholder Returns | Profitability and dividend payouts | $0.53 headline EPS (2023), $0.45 total dividend per share (2023) |

Customer Relationships

Gold Fields actively cultivates investor trust through consistent and transparent communication. This includes detailed quarterly and annual financial reports, alongside integrated annual reports that provide a holistic view of their operations and performance. In 2023, for instance, Gold Fields reported attributable gold equivalent production of 2.45 million ounces, underscoring their operational scale and providing a key metric for investor analysis.

Gold Fields prioritizes robust community engagement, actively participating in dialogue with host communities and local stakeholders to address concerns and foster shared value. In 2023, the company reported a total of $100 million invested in community development initiatives across its global operations, demonstrating a tangible commitment to these relationships.

Gold Fields actively engages with governments and regulatory bodies, recognizing this as a cornerstone for operational stability and responsible mining. This collaboration ensures adherence to all legal frameworks, facilitates the acquisition of essential permits, and allows the company to contribute constructively to evolving mining policies. For instance, in 2024, Gold Fields continued its dialogue with various national and regional authorities across its operating regions, aiming to streamline regulatory processes and foster a predictable investment climate.

Supplier and Contractor Partnerships

Gold Fields cultivates strong relationships with its suppliers and contractors, recognizing them as crucial partners for operational success and sustainability. These partnerships are designed for mutual benefit, ensuring a steady flow of necessary resources and the efficient execution of projects. A key focus is aligning on shared sustainability objectives, particularly in addressing Scope 3 emissions, which are critical for the company's overall environmental footprint.

In 2024, Gold Fields continued to emphasize collaborative efforts with its supply chain to drive efficiency and responsible practices. For instance, the company actively engages with key suppliers to implement strategies for reducing indirect greenhouse gas emissions. This collaborative approach extends to ensuring the reliability of critical supplies, from mining equipment and explosives to specialized services, which directly impacts production levels and cost management.

- Supplier Collaboration for Sustainability: Gold Fields actively partners with suppliers to reduce Scope 3 emissions, a key component of their 2024 sustainability targets.

- Reliable Supply Chain Management: Strong relationships ensure the consistent availability of essential mining inputs and services, vital for uninterrupted operations.

- Contractor Performance and Safety: Partnerships with contractors are managed to uphold high standards of safety and operational performance, contributing to project success.

- Mutual Growth and Innovation: The company seeks to foster relationships that encourage innovation and shared growth, benefiting both Gold Fields and its supply chain partners.

Industry Associations and Peer Collaboration

Gold Fields actively engages with industry associations like the World Gold Council and the International Council on Mining and Metals. This participation facilitates the sharing of best practices in areas such as environmental stewardship and community engagement. For instance, in 2024, Gold Fields contributed to discussions on sustainable mining frameworks that aim to standardize responsible practices across the sector, impacting an industry that saw global gold production hover around 3,000 tonnes in 2023.

Collaborating with peer mining companies through these associations allows Gold Fields to collectively address common challenges, such as regulatory changes or supply chain complexities. This cooperative approach strengthens the industry's ability to advocate for responsible mining standards and policies. Such collaboration is vital in an industry where economic factors, like the average gold price in 2024, can significantly influence operational decisions and investment.

- Industry Association Engagement: Participation in groups like the World Gold Council provides a platform for knowledge exchange and setting industry benchmarks.

- Best Practice Sharing: Collaboration enables the dissemination of effective strategies for operational efficiency, safety, and sustainability.

- Addressing Common Challenges: Joint efforts help in navigating complex regulatory landscapes and advocating for favorable industry conditions.

- Reputation and Influence: Active involvement enhances Gold Fields' standing as a responsible and influential player in the global mining community.

Gold Fields maintains strong relationships with its workforce by prioritizing employee well-being, safety, and professional development. This focus is crucial for operational continuity and attracting skilled talent. In 2023, the company invested $55 million in training and development programs for its employees across all operations, aiming to enhance skills and foster career growth.

The company also emphasizes open communication channels with its employees, utilizing regular town hall meetings and internal communication platforms to share updates and gather feedback. This approach builds trust and ensures alignment with company objectives. For instance, in the first half of 2024, Gold Fields reported a 10% increase in employee engagement survey participation, indicating a positive trend in communication effectiveness.

Gold Fields' commitment to its employees extends to robust health and safety protocols. In 2023, the Lost Time Injury Frequency Rate (LTIFR) was 0.38 per million hours worked, reflecting a strong safety culture. This dedication to employee welfare is a cornerstone of their customer relationship strategy, ensuring a stable and motivated workforce.

Channels

Gold Fields primarily sells its refined gold directly to major bullion banks and specialized refiners. These entities act as crucial intermediaries, purchasing large volumes of gold for their own inventory, further processing, or distribution to a wide array of industrial and investment markets.

This direct sales channel is the most efficient way for Gold Fields to get its physical gold to market, ensuring a swift and streamlined transaction for its primary product. In 2024, Gold Fields reported sales of approximately 2.2 million ounces of gold, with a significant portion channeled through these direct relationships.

Gold Fields' listing on the Johannesburg Stock Exchange (JSE) and its American Depositary Shares (ADS) on the New York Stock Exchange (NYSE) are crucial for investor access and liquidity. As of early 2024, Gold Fields had a market capitalization of approximately $8 billion, reflecting investor confidence and the company's significant presence in the global gold mining sector.

The company website acts as the primary digital gateway, providing a comprehensive repository of information for a broad audience including investors, media, employees, and the general public. It's the go-to source for crucial documents like annual reports, investor presentations, and detailed sustainability disclosures, alongside timely news updates.

This digital platform is critical for transparency and communication, offering access to Gold Fields’ latest financial results, such as the reported revenue of $4.1 billion for the fiscal year ending December 31, 2023, and operational highlights. The website ensures all stakeholders can easily find and engage with the company's performance and strategic direction.

Investor Presentations and Conferences

Gold Fields actively engages with the investment community through participation in investor presentations and global conferences. This direct interaction allows the company to communicate its financial performance, strategic direction, and operational updates to a broad audience of current and prospective investors, analysts, and financial media. For instance, in 2023, Gold Fields hosted numerous investor events, including participation in major mining conferences like the Denver Gold Show and the BMO Global Metals & Mining Conference. These engagements are crucial for maintaining transparency and building investor confidence.

These platforms are vital for disseminating key information and fostering relationships. They provide an opportunity to showcase the company's value proposition and address investor queries directly. In the first half of 2024, Gold Fields continued this outreach, presenting at several key industry forums, which helped to reinforce its position in the market and attract new capital. The company's commitment to open communication through these channels is a cornerstone of its investor relations strategy.

Key benefits of this channel include:

- Direct Engagement: Facilitates two-way communication with stakeholders, enabling real-time feedback and clarification.

- Information Dissemination: Effectively communicates financial results, strategic initiatives, and operational highlights to a wide audience.

- Market Visibility: Enhances the company's profile within the investment community, attracting potential investors and analysts.

- Relationship Building: Strengthens ties with existing investors and builds credibility with new ones through consistent and transparent communication.

Sustainability and ESG Reports

Gold Fields utilizes dedicated sustainability and ESG reports as a vital channel to communicate its non-financial performance and commitments. These reports are essential for engaging with a diverse audience, including socially responsible investors, non-governmental organizations (NGOs), and the general public, fostering transparency and accountability in its operations.

These reports provide detailed insights into Gold Fields' environmental stewardship, social impact, and governance practices, which are increasingly critical factors for investors. For instance, in 2023, Gold Fields reported a 7% reduction in greenhouse gas intensity compared to 2019, demonstrating tangible progress in its climate action initiatives.

- Environmental Performance: Detailed data on water usage, waste management, and biodiversity conservation efforts.

- Social Impact: Information on community engagement, employee well-being, and safety statistics.

- Governance: Transparency on board structure, executive compensation, and ethical business practices.

- ESG Ratings: Inclusion of performance against key ESG rating agencies, such as S&P Global ESG Scores.

Gold Fields' channels extend beyond direct sales to include robust investor relations and digital communication platforms. The company leverages its stock exchange listings, primarily the JSE and NYSE, to ensure liquidity and investor access, with a market capitalization around $8 billion in early 2024. Its website serves as a vital hub for transparency, offering financial results like the $4.1 billion revenue in 2023 and operational updates.

Active participation in investor presentations and global conferences, such as the BMO Global Metals & Mining Conference in 2023, further enhances market visibility and stakeholder engagement. These interactions are crucial for communicating strategic direction and performance, reinforcing Gold Fields' market position and attracting capital. The company's commitment to ESG reporting also serves as a key channel, detailing environmental stewardship, social impact, and governance practices, with a reported 7% reduction in greenhouse gas intensity by 2023.

| Channel | Primary Purpose | Key Metrics/Data (2023/Early 2024) |

|---|---|---|

| Direct Sales (Bullion Banks/Refiners) | Physical gold distribution | Approx. 2.2 million ounces sold in 2024 |

| Stock Exchanges (JSE, NYSE) | Investor access & liquidity | Market Cap ~ $8 billion (Early 2024) |

| Company Website | Information dissemination & transparency | Revenue $4.1 billion (FY 2023) |

| Investor Presentations/Conferences | Stakeholder engagement & communication | Participation in major industry forums (2023-2024) |

| Sustainability/ESG Reports | Non-financial performance communication | 7% GHG intensity reduction (vs. 2019) |

Customer Segments

Institutional investors, including major financial institutions, mutual funds, pension funds, and hedge funds, represent a crucial customer segment for Gold Fields. These entities deploy substantial capital, seeking robust financial performance, clear growth trajectories, and strong Environmental, Social, and Governance (ESG) credentials. For instance, as of the first half of 2024, Gold Fields reported a significant portion of its shareholder base comprised of institutional investors, reflecting their confidence in the company's operational and strategic direction.

Individual investors, often referred to as retail investors, are a key customer segment for Gold Fields. They typically purchase shares for a mix of reasons, including diversifying their investment portfolios, seeking capital appreciation over time, and generating income through dividends. For instance, in 2023, Gold Fields declared a final dividend of 30 US cents per share, appealing to income-focused investors.

These investors rely on a variety of channels to stay informed about Gold Fields. This includes following financial news outlets, utilizing services provided by their stockbrokers, and directly accessing the company's publicly released reports and investor relations materials. The company's commitment to transparency in its reporting, such as its annual sustainability reports, helps build trust with this segment.

Gold bullion dealers and refiners are crucial direct purchasers of Gold Fields' refined gold, acting as vital intermediaries who then supply it to a diverse range of end-users, including jewelry manufacturers, industrial consumers, and individual investors. They also maintain significant inventories, reflecting their role in the broader gold market. Their primary focus is on securing a consistent and reliable supply of high-quality gold, with purity and assay certifications being paramount to their operations and subsequent resale value.

In 2024, the global gold market saw continued demand from these segments, with refined gold prices fluctuating. For instance, during the first half of 2024, gold prices averaged around $2,300 per ounce, driven by geopolitical uncertainties and central bank buying. Gold Fields' ability to meet stringent quality standards, such as those required for London Bullion Market Association (LBMA) Good Delivery bars, directly impacts their attractiveness to these key customers.

Central Banks and Sovereign Wealth Funds

Central banks and sovereign wealth funds are significant players in the global gold market, though not direct customers of Gold Fields. They often purchase gold as a means of reserve diversification and as a strategic asset to hedge against economic uncertainty and inflation. Their consistent demand, driven by a focus on market stability and the long-term intrinsic value of gold, plays a crucial role in influencing global gold prices. For instance, in 2023, central banks were net buyers of gold, with reported purchases of 1,037 tonnes, marking the second-highest annual total on record, according to the World Gold Council.

These institutions prioritize the stability and predictability of the gold market, making them indirect stakeholders in the operational efficiency and responsible practices of major gold producers like Gold Fields. Their investment decisions are guided by a long-term perspective, seeking assets that offer capital preservation and a hedge against currency fluctuations. The aggregate gold holdings of central banks globally reached approximately 35,700 tonnes by the end of 2023, underscoring their substantial influence on market dynamics.

- Reserve Diversification: Central banks and sovereign wealth funds utilize gold to diversify their foreign exchange reserves, reducing reliance on any single currency or asset class.

- Strategic Asset Allocation: Gold is viewed as a safe-haven asset, particularly during periods of geopolitical tension or economic downturns, offering a store of value.

- Market Influence: While not direct buyers from producers, their collective buying and selling activities significantly impact global gold prices and market liquidity.

- Long-Term Value Proposition: Their interest lies in gold's historical role as a store of wealth and its ability to retain value over extended periods.

Governments and Regulators in Operating Jurisdictions

Governments and regulators are crucial stakeholders, not typical customers, but their expectations for compliance, economic contribution, and responsible practices are paramount for Gold Fields to maintain its license to operate. Meeting these needs ensures stability and continued operations within various jurisdictions.

In 2024, Gold Fields' commitment to these stakeholders is demonstrated through significant contributions. For instance, the company paid approximately $1.3 billion in taxes and royalties globally in 2023, a figure expected to remain substantial in 2024, directly supporting public services and national economies.

- Compliance: Adhering to all national and local laws, environmental regulations, and labor standards is non-negotiable.

- Economic Contribution: Generating employment, investing in local infrastructure, and contributing through taxes and royalties are key deliverables.

- Responsible Operations: Ensuring safe working environments, minimizing environmental impact, and engaging in community development are vital for social license.

- Stakeholder Engagement: Proactive dialogue and transparency with government bodies and regulators foster trust and facilitate smooth operations.

Gold Fields serves a diverse investor base, from large institutional players like pension funds and mutual funds seeking stable returns and ESG compliance, to individual investors focused on portfolio diversification and dividend income. The company's 2023 dividend payout of 30 US cents per share highlights its appeal to income-seeking shareholders.

Direct customers include gold bullion dealers and refiners who prioritize consistent supply and high purity, such as LBMA Good Delivery bars. These intermediaries then supply the gold to the jewelry and industrial sectors. Global gold prices in early 2024 averaged around $2,300 per ounce, influenced by factors like geopolitical events and central bank activity.

While not direct customers, central banks and sovereign wealth funds are significant market influencers, purchasing gold for reserve diversification and as a hedge against economic instability. Their substantial holdings, totaling around 35,700 tonnes by the end of 2023, underscore their impact on market liquidity and price stability.

Cost Structure

Mining operations costs are the backbone of Gold Fields' extraction process, encompassing direct expenses like labor, energy, and consumables. In 2024, the company continued its emphasis on cost optimization, a strategy that has historically driven efficiency. For instance, their focus on maintaining and upgrading equipment helps reduce downtime and associated repair expenses, contributing to lower overall operational costs.

Gold Fields incurs significant processing and refining costs, crucial for transforming raw ore into marketable gold. These expenses include vital consumables like cyanide for leaching, substantial water usage, and considerable electricity consumption to power milling and extraction equipment. In 2023, Gold Fields reported a total cost of sales of $3,290 million, with processing and refining being a major component of this figure.

Gold Fields invests heavily in exploration to discover new gold deposits and in developing these resources into producing mines. This ongoing capital expenditure is crucial for replenishing reserves and ensuring future production. For instance, the Windfall project in Canada represents a significant development undertaking.

In 2023, Gold Fields reported capital expenditure of approximately $792 million. A substantial portion of this was allocated to growth projects, including the aforementioned Windfall mine, which is progressing towards its initial production target. This investment underscores the company's commitment to expanding its operational footprint and resource base.

Environmental and Social Compliance Costs

Gold Fields incurs significant costs to meet stringent environmental regulations, including managing tailings facilities and treating water, which are crucial for their ESG commitments. In 2023, the company reported approximately $133 million in capital expenditure related to tailings management and water infrastructure, reflecting ongoing investment in compliance and sustainability.

These environmental compliance costs are directly linked to maintaining a social license to operate. Furthermore, Gold Fields allocates resources to social programs aimed at benefiting local communities, fostering positive relationships, and ensuring long-term operational viability. For instance, their community investment in 2023 totaled around $25 million, supporting various socio-economic development initiatives.

- Environmental Compliance: Costs for tailings management, water treatment, and rehabilitation efforts, vital for regulatory adherence and sustainability.

- Social Programs: Investments in community development, education, and healthcare to maintain social license and stakeholder relations.

- ESG Commitment: These expenditures are integral to Gold Fields' broader Environmental, Social, and Governance strategy, aiming for responsible mining practices.

- 2023 Financials: Approximately $133 million in capital expenditure for tailings and water infrastructure, alongside $25 million in community investments highlight the scale of these costs.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Gold Fields encompass a range of overhead costs not directly linked to mining operations. These include executive and corporate salaries, legal and accounting services, office rent and utilities for administrative functions, and investor relations efforts. In 2023, Gold Fields reported G&A expenses of $270 million, reflecting their commitment to efficient operations.

The company has been actively streamlining its organizational structure to improve efficiency and reduce these overheads. This strategic move aims to enhance profitability by ensuring that administrative functions support, rather than burden, the core mining activities. For instance, the integration of operations following acquisitions often presents opportunities for G&A rationalization.

- Corporate Overhead: Includes salaries for non-operational staff and executive management.

- Professional Services: Covers legal, audit, and consulting fees.

- Investor Relations: Costs associated with communicating with shareholders and the financial community.

- Administrative Facilities: Expenses related to maintaining corporate offices and support infrastructure.

Gold Fields' cost structure is dominated by operational expenses, including labor, energy, and consumables for mining and processing. Significant investments in exploration and mine development are also key cost drivers, essential for future production. The company also dedicates substantial resources to environmental compliance and social programs, reflecting its commitment to sustainability and community relations.

| Cost Category | 2023 Actual (USD millions) | Key Components |

|---|---|---|

| Cost of Sales | 3,290 | Mining, processing, refining, royalties, depreciation |

| Exploration & Development | 792 (Capital Expenditure) | New discoveries, mine expansion projects |

| Environmental & Social | 133 (Capital Expenditure for Env.) + 25 (Community Investment) | Tailings management, water treatment, community programs |

| General & Administrative | 270 | Corporate overhead, professional services, investor relations |

Revenue Streams

Gold Fields' primary revenue stream is the sale of refined gold, a core activity that underpins its financial performance. This direct sale of the precious metal to markets is the fundamental way the company generates income from its mining operations.

In 2024, Gold Fields experienced an increase in revenue primarily driven by a higher average gold price. Despite a slight dip in gold-equivalent ounces sold, the improved market price for gold more than compensated, leading to robust top-line growth for the company.

Gold Fields benefits from by-product sales, with copper being a significant contributor. For instance, their Cerro Corona mine in Peru generates copper alongside gold, diversifying revenue.

In 2023, Gold Fields reported that copper sales from Cerro Corona contributed approximately 10% of the mine's total revenue, demonstrating its importance as an additional income source.

Hedging gains or losses can influence revenue, though major gold producers like Gold Fields often prioritize direct exposure to fluctuating spot prices rather than locking in future rates. This means their revenue isn't typically dominated by hedging outcomes, unlike some other commodities.

For instance, in 2023, Gold Fields reported a net debt of $1.78 billion, with a significant portion of its financial instruments being unhedged, reflecting a strategy to benefit from potential upward movements in gold prices.

Investment Income

Gold Fields generates revenue through investment income, primarily from interest earned on its cash reserves and other financial assets. This stream provides a stable, albeit typically smaller, contribution to overall earnings.

In 2024, Gold Fields saw a notable increase in its investment income. This rise was directly attributed to higher prevailing interest rates, which boosted the returns on the company's cash holdings.

- Investment Income Source: Interest earned on cash balances and other financial investments.

- 2024 Performance: Increased due to higher interest rates.

- Impact: Contributes to overall financial stability and profitability.

Asset Sales and Divestments

Gold Fields can unlock value through strategic asset sales. This involves divesting non-core assets or minority stakes in projects, generating immediate cash flow. For instance, in 2024, Gold Fields completed the sale of its 45% interest in the Asanko Gold Mine, realizing $175 million. Such divestments allow the company to streamline its portfolio and focus on core, higher-returning operations.

These transactions are crucial for managing capital allocation and improving financial flexibility. By selling off less strategic holdings, Gold Fields can reduce debt, fund growth initiatives, or return capital to shareholders. The proceeds from these sales directly contribute to revenue, bolstering the company's financial position.

Key aspects of this revenue stream include:

- Strategic Divestments: Selling non-core or underperforming assets to optimize the business portfolio.

- Minority Stake Sales: Monetizing partial ownership in joint ventures or projects.

- Capital Realization: Generating immediate cash inflows from asset disposals.

- Portfolio Optimization: Focusing resources on core, high-potential mining operations.

Gold Fields' revenue is primarily derived from the sale of gold, with by-product sales, notably copper from mines like Cerro Corona, providing a significant secondary income. In 2024, higher average gold prices boosted overall revenue, even with a slight decrease in gold-equivalent ounces sold. The company also generates income from interest on its cash reserves, which saw an increase in 2024 due to higher interest rates.

Furthermore, strategic asset sales contribute to revenue, as seen with the 2024 sale of a 45% interest in the Asanko Gold Mine for $175 million, enhancing financial flexibility and portfolio focus.

| Revenue Stream | Description | 2024 Impact/Notes |

| Gold Sales | Primary revenue from selling refined gold. | Increased revenue due to higher average gold price. |

| By-product Sales (Copper) | Revenue from metals mined alongside gold. | Significant contributor, e.g., Cerro Corona mine. |

| Investment Income | Interest earned on cash reserves and financial assets. | Increased in 2024 due to higher interest rates. |

| Asset Sales | Proceeds from divesting non-core assets or stakes. | e.g., $175 million from Asanko Gold Mine stake sale in 2024. |

Business Model Canvas Data Sources

The Gold Fields Business Model Canvas is informed by a robust combination of internal financial data, comprehensive market research, and strategic operational insights. This multi-faceted approach ensures each component of the canvas is grounded in accurate, actionable information.