Gofore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gofore Bundle

Gofore's market position is strong, leveraging its expertise in digital transformation and cloud solutions. However, understanding the full scope of its competitive advantages and potential threats is crucial for strategic decision-making.

Want the full story behind Gofore's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gofore's diverse service portfolio, encompassing software development, cloud solutions, data and analytics, and cybersecurity, allows them to cater to a wide array of client requirements. This breadth of offerings positions them as a comprehensive partner for digital transformation, enabling them to adapt to shifting market trends and client needs effectively.

Gofore boasts a strong and established presence within the public sector, especially in its home market of Finland. This deep integration translates into a stable and reliable client base, a significant advantage in the often-volatile tech consulting landscape.

This public sector focus allows Gofore to secure large-scale, long-term projects. For instance, in 2023, public administration and defense accounted for a substantial portion of their revenue, demonstrating the sector's importance. Such projects offer predictable revenue streams, insulating the company from some of the cyclicality seen in private sector engagements.

Gofore has a well-established history of successfully guiding businesses through digital transformations, often building strong, strategic alliances with clients. This deep experience translates into a consistent ability to deliver value and foster long-term relationships.

Remarkably, Gofore has managed to sustain or even enhance customer satisfaction levels despite economic headwinds in recent years. For instance, in 2023, their customer satisfaction score remained high, with over 90% of clients indicating they would recommend Gofore's services, a testament to their reliable project execution and client-centric approach.

Strategic Growth through Acquisitions

Gofore's strategic growth is significantly bolstered by its active pursuit of acquisitions. A prime example is the recent acquisition of Huld, which notably expands Gofore's expertise into intelligent industry and security, including the burgeoning space sector. This strategic move not only accelerates entry into new markets but also deepens existing capabilities.

This acquisition strategy allows Gofore to quickly integrate new talent and technologies, enhancing its competitive edge. For instance, Huld's acquisition in 2024 brought in approximately 280 new experts, strengthening Gofore's position in specialized fields and broadening its service portfolio.

- Acquisition of Huld: Expanded into intelligent industry, security, and space sectors.

- Rapid Expansion: Facilitates swift market entry and capability enhancement.

- Expertise Integration: Adds approximately 280 experts from Huld, strengthening specialized knowledge.

- Strengthening Market Position: Enhances Gofore's ability to offer comprehensive solutions.

Commitment to Employee Well-being and Culture

Gofore places a strong emphasis on its human-centered culture and employee well-being, aiming to be a top choice for IT professionals. This commitment is a key factor in attracting and keeping skilled individuals in the fast-paced IT consulting sector.

The company actively cultivates a supportive work environment for its 'Crew,' fostering continuous professional development. This dedication to its people is vital for maintaining a competitive edge in the industry.

- Employee Satisfaction: Gofore's focus on well-being contributes to high employee satisfaction, a critical metric in talent retention.

- Talent Attraction: A strong culture and commitment to development make Gofore an attractive employer, helping to secure top IT talent.

- Retention Rates: Investing in employee well-being and career growth directly impacts retention, reducing costly turnover.

Gofore's broad service offering, covering everything from software development to cybersecurity, makes them a versatile partner for clients undergoing digital transformation. This comprehensive approach allows them to adapt to evolving market demands and client needs effectively.

Their strong foothold in the Finnish public sector provides a stable revenue base, with public administration and defense forming a significant portion of their income in 2023. This sector focus enables Gofore to secure large, long-term projects, offering financial predictability.

Gofore's strategic acquisitions, such as the 2024 addition of Huld, rapidly expand their expertise into new areas like intelligent industry and space technology. This strategy not only accelerates market entry but also integrates valuable talent, exemplified by the 280 new experts from Huld.

The company's commitment to a human-centered culture and employee well-being is a key strength, aiding in the attraction and retention of skilled IT professionals. This focus on their 'Crew' is crucial for maintaining a competitive edge in the dynamic IT consulting landscape.

| Strength Area | Description | Supporting Data/Example |

|---|---|---|

| Diverse Service Portfolio | Offers a wide range of digital transformation services. | Software development, cloud solutions, data & analytics, cybersecurity. |

| Public Sector Dominance | Strong, stable client base in the public sector. | Public administration & defense accounted for a substantial revenue share in 2023. |

| Strategic Acquisitions | Accelerates growth and capability enhancement through M&A. | Acquisition of Huld in 2024 added ~280 experts and new sector capabilities. |

| Employee-Centric Culture | Attracts and retains top IT talent through focus on well-being and development. | High employee satisfaction and retention rates are key competitive advantages. |

What is included in the product

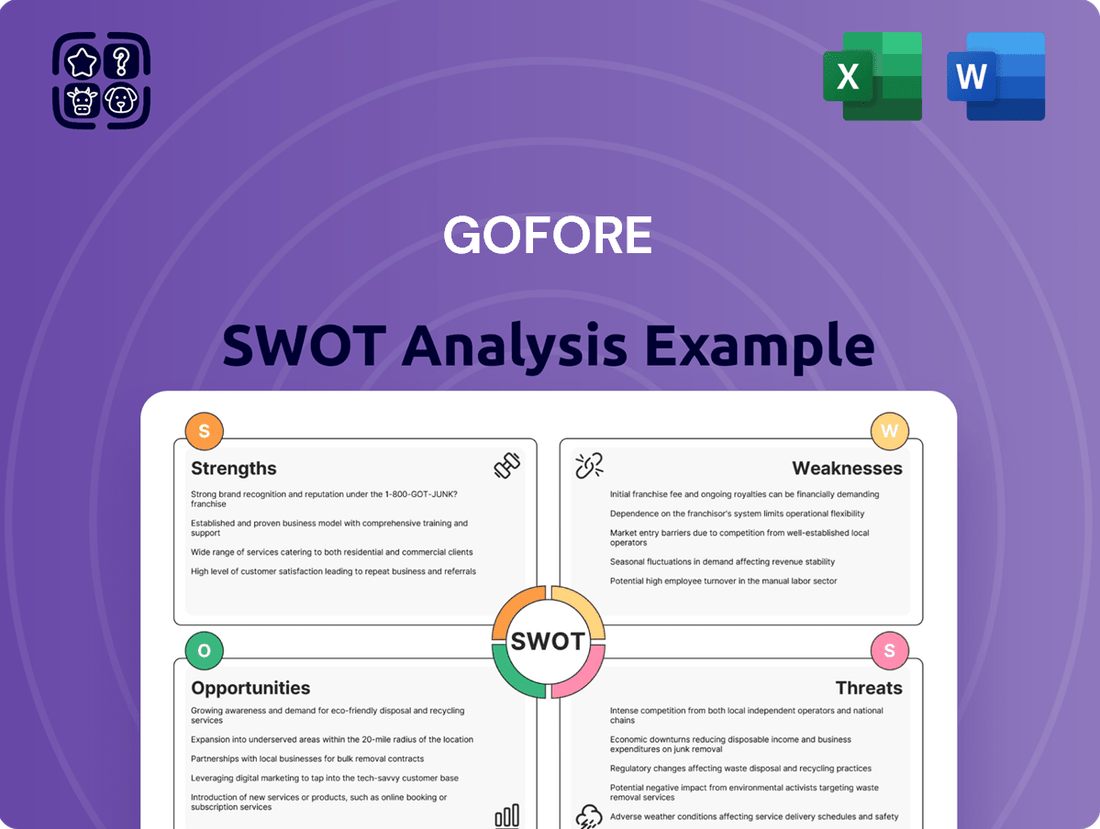

Delivers a strategic overview of Gofore’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

Gofore's reliance on the private sector makes it particularly vulnerable to economic downturns. In 2024, the company experienced its first net sales contraction in over 15 years, a direct consequence of weakened customer demand and hesitant investment amidst a challenging economic climate.

Gofore's significant concentration on Finland and the DACH region, while beneficial for initial growth, presents a key weakness. This strategic focus could hinder overall expansion if these core markets face economic downturns or intensify competitive pressures.

For instance, as of early 2024, Finland and the DACH region represented a substantial majority of Gofore's revenue streams. A prolonged slowdown in either market, perhaps due to regulatory changes or a saturated IT consulting landscape, could disproportionately impact Gofore's financial performance and growth trajectory.

Gofore has encountered significant price competition, particularly within public sector tenders. This intense bidding environment can stifle expansion and exert downward pressure on profit margins. For instance, in 2023, the Finnish public sector IT market saw increased competition, impacting the average project margins for many players.

While Gofore has strategically avoided engaging in the most aggressive price wars to safeguard its profitability, the overall competitive landscape still influences its capacity to secure new engagements at the most favorable terms. This means that even if they win a bid, the profit potential might be less than ideal.

Challenges in Capacity Utilization

In early 2025, Gofore faced significant hurdles with its capacity utilization. The company observed high levels of free capacity, meaning they had more resources available than were actively being used in client projects. This surplus capacity directly impacted profitability, as idle resources don't generate revenue.

Compounding this issue were individual delivery challenges within customer projects. This suggests that even with available capacity, Gofore struggled to efficiently deploy its resources to meet client needs. These delivery issues can lead to project delays, increased costs, and potentially dissatisfied customers, further straining financial performance.

- High Free Capacity: Early 2025 saw Gofore with substantial unused resources.

- Delivery Inefficiencies: Individual customer projects experienced difficulties in execution.

- Profitability Impact: Both free capacity and delivery issues contributed to weakened financial results.

Personnel Adjustments and Associated Costs

Gofore commenced change negotiations in April 2025 to streamline its workforce, a move designed to bolster efficiency. This strategic adjustment, while aimed at long-term competitiveness, carries the immediate consequence of potential restructuring costs and a likely short-term dip in employee morale.

These personnel adjustments, while necessary for operational agility, can lead to tangible financial outlays. For instance, severance packages and outplacement services represent direct expenses that will impact Gofore's financial statements in the near term.

- Restructuring Costs: Direct expenses associated with layoffs, such as severance pay and benefits continuation.

- Morale Impact: Potential decrease in productivity and engagement among remaining staff due to uncertainty.

- Talent Retention Challenges: Risk of losing key talent who may feel insecure about their future with the company.

Gofore's concentrated market presence in Finland and the DACH region, while historically a strength, poses a significant risk. A downturn in these key economies, or intensified competition within them, could disproportionately affect Gofore's financial performance. For example, Finland and the DACH region accounted for a substantial portion of Gofore's revenue in early 2024, making the company susceptible to regional economic shocks or increased competitive pressures in these areas.

Full Version Awaits

Gofore SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Gofore's strategic positioning. This ensures you receive exactly what you see, with no hidden surprises.

Opportunities

The digital transformation market is booming, driven by businesses across all sectors needing to modernize and adopt new digital services. This trend is expected to continue, with the global digital transformation market size projected to reach $2.8 trillion by 2025, up from an estimated $1.3 trillion in 2020, indicating substantial growth. This sustained demand creates a prime opportunity for Gofore to broaden its reach and take on more ambitious projects.

Gofore's strategic pivot towards continuously digitalizing sectors like Digital Society and Intelligent Industry, as outlined in their updated strategy, is a significant opportunity. This move taps into burgeoning markets with high demand for digital transformation services.

The company's active expansion of its security services, notably entering the new space industry domain through acquisitions, presents a substantial growth avenue. This diversification not only broadens Gofore's service portfolio but also positions it to capitalize on emerging technological frontiers and associated security needs.

By strategically entering these new sectors, Gofore is poised to unlock fresh revenue streams and solidify its market standing in high-growth areas. For instance, the global space economy was projected to reach $1.5 trillion by 2040, indicating the potential scale of opportunities in newly entered domains.

Gofore is seeing significant demand for its data and AI services, a trend expected to continue strongly through 2024 and 2025. This presents a prime opportunity for the company to deepen its expertise and offerings in these rapidly expanding fields.

By strategically investing in advanced data analytics and artificial intelligence capabilities, Gofore can solidify its position as a leader in these high-growth sectors. This focus will allow them to develop cutting-edge solutions that address evolving client needs and capture a greater market share.

Geographical Expansion, Especially DACH Region

Gofore is strategically focusing on expanding its footprint within the DACH region (Germany, Austria, and Switzerland), a move poised to significantly broaden its market reach beyond its established Finnish base. This geographical expansion is a key opportunity to tap into a larger, more affluent client pool and leverage the robust digital transformation initiatives prevalent in these economies. By strengthening its organizational structure and operational practices in DACH, Gofore can unlock substantial growth potential.

The DACH market presents a compelling opportunity, with Germany, in particular, demonstrating strong investment in digitalization. For instance, Germany's public sector digitalization spending was projected to reach approximately €27.5 billion in 2024, indicating a substantial market for Gofore's services. This focus allows Gofore to capitalize on this demand.

- Targeting DACH: Gofore's expansion into Germany, Austria, and Switzerland aims to capture a larger share of the European digital transformation market.

- Market Potential: Germany's significant public sector digitalization budget of around €27.5 billion in 2024 highlights the substantial revenue opportunities available.

- Growth Driver: Building a robust presence in DACH is expected to be a primary engine for Gofore's future revenue growth and international diversification.

- Strategic Alignment: This expansion aligns with the increasing demand for digital services across the European Union, particularly in economically strong nations.

Potential for Larger Acquisitions

Gofore's robust financial health, evidenced by its strong cash reserves, positions it favorably for pursuing larger acquisition opportunities. This strategic focus is a key driver in achieving its ambitious net sales target of 500 million euros by 2030.

The company is actively scouting for acquisition targets that align with its growth strategy, aiming for value-accretive deals. Such acquisitions are crucial for accelerating market share expansion and consolidating its position in the digital transformation consulting sector.

For instance, Gofore's acquisition of the IT consulting firm Capgemini's Finnish business in early 2024, a deal valued at approximately 20 million euros, demonstrates its capability and willingness to execute significant M&A activities. This move is expected to bolster its service offerings and client base substantially.

- Strong Cash Position: Gofore maintains significant cash reserves, providing the financial flexibility for substantial M&A.

- Net Sales Target: The company aims for 500 million euros in net sales by 2030, with acquisitions being a primary growth lever.

- Strategic Acquisitions: Focus is on value-accretive targets that enhance market position and service capabilities.

- Recent M&A Activity: The acquisition of Capgemini's Finnish operations in 2024 highlights Gofore's active pursuit of growth through consolidation.

Gofore's expansion into the DACH region presents a significant opportunity, with Germany alone projecting public sector digitalization spending of approximately €27.5 billion in 2024. This strategic move capitalizes on robust digital transformation initiatives across these economies, aiming to broaden its market reach and tap into a larger client base.

The company's focus on data and AI services is well-aligned with market trends, as demand in these areas is expected to remain strong through 2024 and 2025. By investing further in these capabilities, Gofore can solidify its leadership in high-growth sectors and develop innovative solutions for evolving client needs.

Gofore's strong financial position, including substantial cash reserves, enables strategic acquisitions to accelerate growth and achieve its 2030 net sales target of 500 million euros. The recent acquisition of Capgemini's Finnish business for around 20 million euros in early 2024 exemplifies this proactive M&A strategy.

| Opportunity | Description | Supporting Data/Fact |

| DACH Expansion | Entering Germany, Austria, and Switzerland to increase market share. | Germany's public sector digitalization spending projected at €27.5 billion in 2024. |

| Data & AI Growth | Capitalizing on increasing demand for data analytics and AI services. | Strong demand expected to continue through 2024-2025. |

| Strategic Acquisitions | Using strong cash reserves for value-accretive M&A. | Acquisition of Capgemini's Finnish operations for ~€20 million in early 2024. |

| Digital Transformation Market | Leveraging the overall growth of the digital transformation sector. | Global market projected to reach $2.8 trillion by 2025. |

Threats

The IT services market, especially within the public sector, is facing a significant surge in competition, with an oversupply of providers driving down prices. This intensified rivalry directly impacts Gofore, making it more challenging to secure new projects and sustain healthy profit margins.

For instance, in 2024, the Finnish IT consulting market, a key area for Gofore, saw increased consolidation and aggressive bidding, with some contracts awarded at significantly reduced rates compared to previous years. This trend is expected to continue into 2025, putting pressure on Gofore's pricing strategies and profitability.

The ongoing global economic uncertainty, including potential trade disputes and a general sense of caution among customers, poses a significant threat. This environment can directly impact Gofore's business by causing customers to delay or even cancel planned digital transformation projects, which are often discretionary spending. For instance, the International Monetary Fund (IMF) has repeatedly revised down global growth forecasts for 2024 and 2025, citing persistent inflation and geopolitical risks, which directly translates to a more hesitant client base.

This cautious customer sentiment can lead to project discontinuities and extended sales cycles, meaning fewer new projects start and existing ones might be put on hold. Such a prolonged period of weaker demand for digital services would inevitably affect Gofore's revenue streams and overall profitability. Many companies, facing their own economic pressures, are scrutinizing IT budgets, making it harder for service providers like Gofore to secure new, substantial contracts.

Gofore faces a significant hurdle in the highly competitive IT consultancy sector, where attracting and keeping skilled digital professionals is a perpetual challenge. Despite its solid employer reputation, the demand for top talent often outstrips supply.

This intense competition means Gofore must continuously invest in its employee value proposition to combat potential increases in attrition or recruitment slowdowns. For instance, the IT services market in Finland, Gofore's primary operating region, saw average employee turnover rates in the range of 15-20% for specialized roles in 2024, a figure Gofore aims to keep below.

Reliance on Large Customer Accounts

While Gofore is experiencing growth in its large customer base and maintains high satisfaction levels, a significant dependence on a handful of these major accounts presents a potential vulnerability. The loss of even one key client, or a substantial decrease in their project scope, could disproportionately affect Gofore's overall financial results. For instance, if a single large customer were to represent over 10% of Gofore's revenue in 2024, their departure would create a notable revenue gap.

This concentration risk means that Gofore's revenue stream could be significantly impacted by the decisions of a limited number of entities. Diversifying its client portfolio, even with a growing number of large accounts, remains a crucial strategic consideration to mitigate this threat.

- Concentration Risk: Over-reliance on a few large clients can lead to significant revenue volatility.

- Disproportionate Impact: The loss of a major client could have an outsized negative effect on financial performance.

- Client Retention Focus: Maintaining strong relationships and service delivery for key accounts is paramount.

Technological Disruption and Rapid Change

The relentless pace of technological advancement, particularly in areas like artificial intelligence and evolving cybersecurity threats, presents a significant challenge for Gofore. Staying ahead requires substantial and ongoing investment in research and development, as well as a commitment to continuously upskilling the workforce. For instance, the global AI market is projected to reach $1.597 trillion by 2030, underscoring the need for constant innovation.

Failure to adapt swiftly to these rapid shifts could erode Gofore's competitive advantage. This means proactively identifying and integrating emerging technologies to maintain relevance and deliver cutting-edge solutions to clients. The digital transformation market itself is expanding, with projected growth indicating increased demand for adaptable tech partners.

- AI Integration: Keeping pace with AI advancements is crucial for developing next-generation solutions.

- Cybersecurity Evolution: New and sophisticated cyber threats demand continuous investment in robust security measures.

- Talent Development: Upskilling employees to handle new technologies is essential for maintaining a competitive edge.

- Market Agility: The ability to pivot and adopt new technological paradigms quickly is paramount for survival and growth.

Intensified competition within the IT services market, particularly in the public sector, is driving down prices and making it harder for Gofore to secure new projects and maintain profitability. For example, the Finnish IT consulting market in 2024 saw aggressive bidding, with some contracts awarded at significantly reduced rates, a trend expected to persist into 2025.

Global economic uncertainty, including trade disputes and cautious customer spending, poses a threat as clients may delay or cancel digital transformation projects. The IMF's revised global growth forecasts for 2024 and 2025, citing inflation and geopolitical risks, indicate a more hesitant client base, potentially leading to project discontinuities and extended sales cycles.

The rapid pace of technological change, especially in AI and cybersecurity, necessitates substantial ongoing investment in R&D and workforce upskilling. Failure to adapt quickly could erode Gofore's competitive advantage, highlighting the need for continuous innovation and talent development to meet evolving market demands.

SWOT Analysis Data Sources

This Gofore SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial reports, comprehensive market research, and insights from industry experts.