Gofore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gofore Bundle

Gofore's competitive landscape is shaped by powerful forces, from the bargaining power of its clients to the intensity of rivalry within the IT consulting sector. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Gofore’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gofore, a digital transformation consultancy, is significantly impacted by talent scarcity. The company's core operations depend on specialized IT professionals like data engineers and cloud architects. This reliance is amplified by a persistent global shortage in these critical fields.

In 2025, a staggering 76% of IT employers reported difficulties in finding qualified talent. This widespread scarcity directly elevates the bargaining power of highly skilled individuals and niche recruitment agencies. Consequently, Gofore faces increased pressure to attract and retain top-tier talent, potentially impacting project costs and delivery timelines.

Gofore relies heavily on specialized technology and software from external vendors for its core operations. Key cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) hold substantial market power. This is driven by their extensive service portfolios and the broad adoption of their platforms across the industry, which can influence pricing and terms for Gofore.

For highly specialized tools or proprietary technologies crucial for digital transformation projects, the limited number of niche vendors can significantly increase their bargaining power. If Gofore relies on specific cybersecurity solutions or advanced data analytics platforms, and only a few companies offer these, those suppliers hold more sway. This is particularly true if these tools are indispensable for Gofore's service delivery, meaning Gofore has fewer alternatives if prices rise or terms change.

Open-Source vs. Proprietary Solutions

Gofore's use of open-source technologies can mitigate supplier power, as these solutions often have lower licensing costs and greater flexibility. However, reliance on proprietary software, particularly for core business functions or specialized platforms, can significantly increase supplier bargaining power. For instance, if Gofore depends on a specific cloud provider or a unique software suite, switching costs can be substantial, making it difficult to negotiate favorable terms.

The switching costs associated with proprietary solutions are a key driver of supplier power. These costs can include not only direct financial outlays for new software and migration services but also the indirect costs of retraining staff, reconfiguring existing systems, and potential disruptions to operations. In 2024, many companies found themselves locked into long-term contracts for proprietary enterprise resource planning (ERP) systems, illustrating this challenge.

- Open-Source Benefits: Reduced licensing fees and increased flexibility through community-driven development.

- Proprietary Risks: Higher switching costs, potential vendor lock-in, and reliance on vendor roadmaps.

- Switching Cost Factors: Financial outlay for new systems, employee retraining, system integration, and operational downtime.

- Supplier Leverage: Vendors of critical proprietary software can command higher prices or dictate terms due to the difficulty of finding viable alternatives.

Impact of AI and Automation Tools

The increasing integration of AI and automation tools into digital transformation services, like those Gofore provides, means the company could become more dependent on the suppliers of these advanced technologies. This reliance can shift power towards those suppliers.

If a few dominant players emerge in the market for AI-powered development tools or specialized automation platforms, their bargaining power over consultancies like Gofore could significantly increase. This is particularly true if these tools become essential for delivering competitive digital transformation projects.

- Increased Dependency: As AI and automation become core to digital transformation, consultancies like Gofore may find their ability to operate effectively hinges on specific technology providers.

- Market Concentration: In 2024, the AI tooling market saw continued consolidation. For instance, major cloud providers expanded their AI services, potentially creating fewer, more powerful suppliers.

- Vendor Lock-in Risk: Reliance on proprietary AI platforms could lead to vendor lock-in, making it costly and difficult for Gofore to switch providers if terms become unfavorable.

- Cost Implications: Greater supplier power often translates to higher costs for software licenses, subscriptions, and support, impacting Gofore's project profitability.

Gofore's reliance on specialized software and cloud services from a limited number of vendors grants these suppliers significant bargaining power. High switching costs, often associated with proprietary technologies, further solidify this power, as seen with enterprise resource planning systems in 2024. This dependence can lead to increased costs and less favorable terms for Gofore.

The growing importance of AI and automation tools in digital transformation elevates the bargaining power of their suppliers. Market concentration in AI tooling, observed in 2024 with major cloud providers expanding their offerings, means fewer, more powerful vendors can dictate terms. This creates a risk of vendor lock-in and higher operational expenses for Gofore.

| Supplier Type | Impact on Gofore | Example Scenario | 2024 Data Point |

|---|---|---|---|

| Cloud Service Providers (AWS, Azure, GCP) | High bargaining power due to market dominance and broad adoption. | Increased pricing for cloud infrastructure or premium services. | Cloud computing spending grew by approximately 20% in 2024 globally. |

| Niche Technology Vendors (Cybersecurity, AI Tools) | Significant power when solutions are critical and few alternatives exist. | Higher licensing fees for specialized development platforms. | The global AI market was valued at over $200 billion in 2024. |

| Proprietary Software Providers (ERP, CRM) | Strong leverage due to high switching costs and vendor lock-in. | Unfavorable contract renewals or mandatory upgrade costs. | Companies reported average switching costs for enterprise software between 15-30% of initial implementation cost. |

What is included in the product

Analyzes the competitive intensity and profitability potential within the IT consulting sector, focusing on Gofore's strategic positioning.

Gofore's Porter's Five Forces Analysis provides a clear, actionable framework, instantly highlighting competitive pressures to guide strategic decisions and alleviate uncertainty.

Customers Bargaining Power

Gofore operates within a highly competitive landscape for digital transformation consulting. Many of its engagements are structured as distinct projects, which inherently allows clients to seek proposals from a variety of firms. This project-based nature, especially prevalent in the public sector, directly amplifies customer bargaining power.

In 2023, the digital transformation market saw significant activity, with European governments investing heavily in modernization. For instance, the EU's digital decade targets aim for widespread digital adoption, creating numerous project opportunities. However, this also means Gofore, like its peers, faces intense scrutiny on pricing and contract terms as clients can easily compare offerings and negotiate favorable conditions, knowing alternatives exist.

Gofore's strategic aim to cultivate large clients, those billing over 1 million euros annually, while fostering recurring revenue, inherently raises concerns about customer concentration. If a substantial portion of Gofore's revenue originates from a limited number of these major clients, their individual bargaining power intensifies. This is particularly true if a single client's business represents a significant percentage of Gofore's overall sales, potentially allowing them to negotiate more favorable terms.

Customers developing in-house capabilities directly weakens the bargaining power of external consultants. For instance, if a company builds a robust internal data analytics team, it might no longer need outside help for complex data modeling, a significant shift from previous years where such expertise was often outsourced.

The trend of 'embedded IT' and 'shadow AI' further empowers customers. By 2024, many business units are leveraging readily available, user-friendly tools to manage IT needs, bypassing traditional IT departments and external vendors. This internal self-sufficiency means fewer projects are handed off to consultants, impacting their revenue streams.

Economic Sensitivity and Budget Constraints

Customer demand for digital transformation services, like those Gofore offers, is notably sensitive to economic shifts. When the economy slows, both businesses and government entities tend to tighten their belts. This often means delaying or scaling back significant investments, directly impacting the market for these services.

In weaker economic periods, customers become more cost-conscious, actively seeking ways to reduce spending. This can manifest as implementing savings programs, cutting non-essential projects, or postponing initiatives altogether. This heightened focus on cost efficiency significantly amplifies the bargaining power of customers.

For instance, during economic downturns, clients may negotiate harder on pricing or demand more favorable payment terms. This increased leverage allows them to secure services at lower costs, directly affecting Gofore's pricing power and profitability.

- Economic Downturn Impact: During 2023, global IT spending growth was projected to slow down, with many companies re-evaluating their digital transformation budgets.

- Customer Hesitation: A survey in late 2023 indicated that over 60% of businesses were delaying or reducing their planned technology investments due to economic uncertainty.

- Focus on ROI: Customers increasingly demand clear and immediate return on investment for digital transformation projects, putting pressure on service providers to demonstrate tangible value quickly.

Standardization and Commoditization of Services

When digital transformation services become more standardized, customers naturally gain leverage to push for lower prices. This is particularly true for services that are easily replicated or where multiple providers offer similar capabilities. For instance, basic software development or routine cloud infrastructure setup are areas where price competition can intensify.

While Gofore distinguishes itself with specialized offerings, it's important to acknowledge that certain segments of the digital services market are indeed commoditizing. In 2024, the demand for readily available, off-the-shelf solutions in areas like cloud migration and basic application development has increased, leading to a more competitive pricing landscape for these particular services.

- Increased Price Sensitivity: As services become commoditized, customers are more likely to compare providers based on price rather than unique value propositions.

- Market Saturation: A growing number of providers entering the market for standardized digital services can lead to oversupply and further price erosion.

- Gofore's Differentiation: Gofore's strategy to focus on highly specialized, strategic consulting and complex transformation projects helps mitigate the impact of commoditization on its core business.

Gofore's customers possess significant bargaining power, particularly due to the project-based nature of digital transformation consulting, which allows for easy comparison of multiple providers. This power is amplified when clients develop in-house capabilities or leverage readily available tools, reducing reliance on external expertise. Economic downturns further enhance customer leverage as they become more cost-conscious, leading to tougher negotiations on pricing and terms.

| Factor | Impact on Gofore | Supporting Data (2023-2024 Trends) |

| Project-Based Engagements | Increases customer ability to switch providers and negotiate terms. | Digital transformation market saw continued project opportunities, especially in public sector modernization, but also intense price scrutiny. |

| In-house Capabilities & Self-Sufficiency | Reduces demand for external consulting services. | Growth in user-friendly IT tools and 'embedded IT' trends empower business units to manage needs internally. |

| Economic Sensitivity & Cost Consciousness | Customers demand lower prices and more favorable payment terms. | Global IT spending growth projected to slow in 2023; over 60% of businesses delayed tech investments due to economic uncertainty in late 2023. |

| Service Commoditization | Customers can push for lower prices on standardized services. | Increased demand for off-the-shelf solutions in cloud migration and basic app development intensified price competition in 2024. |

Preview Before You Purchase

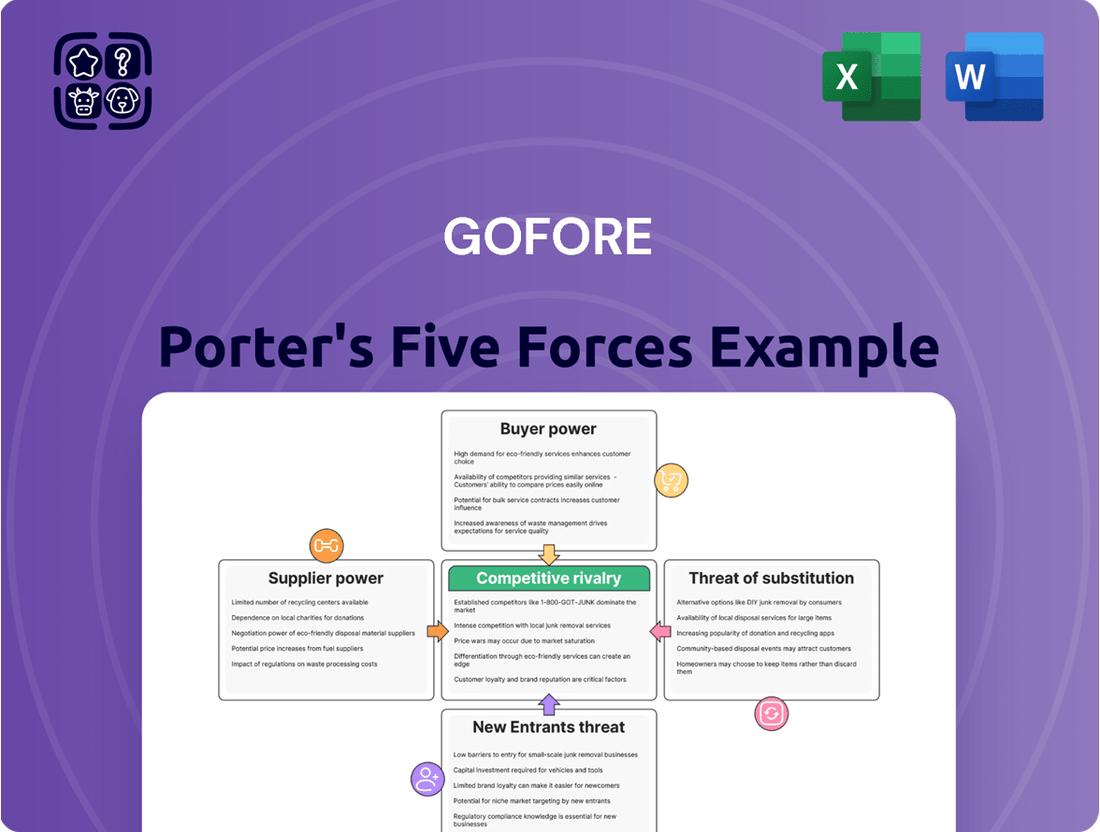

Gofore Porter's Five Forces Analysis

This preview showcases the complete Gofore Porter's Five Forces Analysis, offering a detailed examination of competitive pressures within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently expect to download this comprehensive analysis, ready for immediate use and strategic application.

Rivalry Among Competitors

The digital transformation consulting market is vast and expanding, yet it's characterized by significant fragmentation, hosting a multitude of global and local competitors. Gofore navigates this landscape, facing off against major multinational consultancies like Accenture, Deloitte, and Capgemini, as well as numerous smaller, highly specialized boutique firms.

Price competition is a significant factor, especially within the public sector. This is largely driven by the open nature of government procurement processes, which often attract numerous bids. When market conditions are less robust, leading to an oversupply of services, this competitive pressure intensifies.

Gofore strategically navigated this landscape in 2024. The company deliberately avoided engaging in the most aggressive price wars. While this approach may have somewhat constrained its growth trajectory, it proved effective in safeguarding the company's profitability during a period of heightened price sensitivity.

Competitors actively differentiate through specialized offerings such as advanced AI integration, robust cybersecurity solutions, and deep industry-specific expertise. These specialized capabilities allow them to carve out distinct market positions and appeal to particular client needs.

Gofore itself employs a strategy of niche specialization, concentrating on critical areas like the digital product life-cycle, user-centric digital services, and the convergence of Information Technology (IT), Operational Technology (OT), and Engineering Technology (ET). This focused approach is key to establishing a competitive advantage.

For instance, in 2024, the demand for specialized IT consulting services, particularly in AI and cybersecurity, saw significant growth. Reports indicated a 15% year-over-year increase in projects focused on AI-driven automation and a 12% rise in cybersecurity transformation initiatives, highlighting the market’s receptiveness to differentiated expertise.

Talent Acquisition and Retention

The competition for skilled IT professionals is fierce, with consultancies actively seeking the top talent to bolster their service offerings. This intense rivalry directly impacts a firm's capacity to deliver high-quality projects and maintain client satisfaction.

Gofore, like its peers, recognizes that attracting and retaining exceptional individuals is paramount. This isn't just about filling roles; it's about securing the expertise that drives innovation and ensures project success, making talent a critical battleground.

- Talent is the core asset: In the IT consulting sector, human capital is the primary differentiator.

- High demand, limited supply: The scarcity of specialized IT skills, particularly in areas like cloud, AI, and cybersecurity, intensifies competition.

- Retention as a competitive edge: Companies with strong retention rates demonstrate an ability to foster employee growth and satisfaction, which translates to consistent service delivery.

- Impact on service quality: A stable, skilled workforce directly correlates with the quality and efficiency of consultancy services provided to clients.

Mergers and Acquisitions as a Growth Strategy

Mergers and acquisitions are a significant driver of competitive rivalry in the consulting sector, and Gofore actively leverages this strategy to enhance its market standing. By integrating new entities, Gofore can broaden its service portfolio and absorb specialized expertise, thereby increasing its overall competitive advantage.

Gofore's acquisition of Huld in 2023, for instance, was a strategic move designed to bolster its presence in critical areas such as Intelligent Industry and Security. This consolidation allows Gofore to offer more comprehensive solutions to its clients, directly impacting its competitive positioning.

- Acquisition of Huld: Completed in 2023, this move significantly expanded Gofore's capabilities in Intelligent Industry and Security.

- Market Share Expansion: M&A activities are crucial for Gofore to gain a larger slice of the consulting market.

- Capability Enhancement: Acquisitions provide access to new technologies and specialized talent, sharpening Gofore's competitive edge.

Competitive rivalry in the digital transformation consulting market is intense, with Gofore facing established global players and specialized boutiques. Price competition, especially in the public sector, is a constant factor, though Gofore strategically focuses on value over aggressive pricing. Differentiation through specialized expertise, particularly in AI and cybersecurity, is key, with Gofore concentrating on areas like digital product lifecycle and IT/OT/ET convergence.

The fierce competition for skilled IT professionals directly impacts service quality and client satisfaction, making talent acquisition and retention a critical battleground for all firms. Mergers and acquisitions are also a significant driver, with companies like Gofore using them to expand capabilities and market share, as seen with the Huld acquisition in 2023.

| Competitor Type | Key Differentiators | Gofore's Strategy |

|---|---|---|

| Global Consultancies (e.g., Accenture, Deloitte) | Broad service offerings, established client relationships, large workforce | Niche specialization, focus on value, strategic acquisitions |

| Boutique Firms | Deep industry-specific expertise, agility, specialized technology focus | Concentration on digital product lifecycle, IT/OT/ET convergence |

| Internal IT Departments | Direct control, cost savings (potential), deep understanding of internal processes | Offering specialized external expertise, efficiency, and innovation |

SSubstitutes Threaten

Organizations increasingly opt to build in-house digital capabilities, a direct substitute for external consultancies. This 'build vs. buy' approach involves hiring dedicated IT staff, data scientists, and cloud architects internally. For instance, in 2024, many companies are investing heavily in upskilling existing employees or recruiting specialized digital talent to gain greater control and cost-efficiency.

The rise of off-the-shelf software and SaaS solutions presents a significant threat of substitution for custom development and consulting services. Businesses can increasingly find pre-built, configurable platforms that address many operational needs, reducing reliance on bespoke solutions. For example, the global SaaS market was projected to reach over $200 billion in 2024, indicating a vast array of readily available options.

The proliferation of low-code/no-code (LCNC) platforms presents a significant threat of substitutes for traditional software development services. These platforms allow businesses to build applications and automate workflows with minimal to no coding expertise, directly impacting the demand for external development consultants.

By 2024, the LCNC market is projected to reach $65 billion, demonstrating a substantial shift towards more accessible development tools. This growth means companies can bypass specialized development firms for many tasks, reducing the need for custom-coded solutions and thereby diminishing the bargaining power of those service providers.

Artificial Intelligence and Automation Tools

The rise of artificial intelligence and automation tools poses a significant threat of substitution for consulting firms like Gofore. Clients may increasingly turn to sophisticated AI platforms and software that can automate tasks historically handled by human consultants, potentially reducing the need for external expertise.

For example, AI-powered coding assistants are already transforming software development, enabling quicker and more efficient code generation. This trend suggests that companies might rely more on these tools internally, diminishing the demand for consulting services focused on these areas. By 2024, the global AI market was valued at over $200 billion, showcasing the rapid adoption and increasing capabilities of these technologies.

- AI-driven platforms can automate data analysis and reporting, services often provided by consultants.

- AI coding assistants can accelerate software development cycles, potentially reducing the need for specialized development consultants.

- Clients may find cost-effective and scalable solutions through AI tools, directly substituting traditional consulting engagements.

- The increasing sophistication of AI means it can handle more complex tasks, broadening its substitutive potential across various consulting domains.

Freelance Consultants and Gig Economy Platforms

The rise of freelance consultants and gig economy platforms presents a significant threat of substitutes for traditional consultancies like Gofore. Businesses can now tap into a vast pool of specialized talent for specific projects, often at a lower cost than engaging a full-service firm. This trend is amplified by the increasing acceptance and sophistication of remote work models.

For instance, platforms like Upwork and Fiverr have seen substantial growth, with the global freelance platform market projected to reach $9.1 billion by 2026, up from $2.4 billion in 2021. This accessibility to on-demand expertise means companies might bypass longer-term consultancy engagements for discrete tasks, thereby reducing the need for Gofore's comprehensive service offerings.

- Growing Gig Economy: The global gig economy is expanding rapidly, offering businesses flexible access to specialized skills.

- Cost-Effectiveness: Freelancers and platforms often provide a more budget-friendly alternative for specific project needs.

- Platform Growth: Online platforms are facilitating easier connections between businesses and independent consultants, increasing the threat.

- Impact on Traditional Models: This shift challenges the traditional consultancy model by offering viable, agile alternatives for talent acquisition.

The increasing availability of powerful AI tools, capable of automating complex tasks like data analysis and code generation, directly substitutes for many services offered by traditional consultancies. Companies are leveraging these AI platforms to achieve greater efficiency and cost savings internally. For example, the global AI market was valued at over $200 billion in 2024, highlighting the widespread adoption of these powerful technologies.

Furthermore, the booming gig economy and specialized freelance platforms offer businesses agile and often more cost-effective alternatives for specific project needs. This trend allows companies to bypass larger consultancies for discrete tasks, as evidenced by the projected growth of the freelance platform market to $9.1 billion by 2026.

The proliferation of low-code/no-code (LCNC) platforms also presents a significant substitute, enabling companies to build applications and automate workflows with minimal external expertise. The LCNC market's projected reach of $65 billion by 2024 underscores the growing capability for businesses to develop solutions independently.

| Substitute Type | Description | 2024 Market Relevance/Data |

|---|---|---|

| In-house Capabilities | Companies building internal digital teams. | Increased investment in upskilling and hiring specialized digital talent. |

| Off-the-Shelf Software/SaaS | Pre-built, configurable platforms. | Global SaaS market projected to exceed $200 billion. |

| Low-Code/No-Code (LCNC) | Platforms for minimal-to-no coding development. | LCNC market projected to reach $65 billion. |

| AI & Automation Tools | AI platforms automating analysis, reporting, and coding. | Global AI market valued over $200 billion; AI coding assistants accelerating development. |

| Freelance Platforms | Gig economy platforms offering specialized talent. | Freelance platform market projected to reach $9.1 billion by 2026. |

Entrants Threaten

The digital transformation consulting market demands substantial upfront investment. This includes securing top-tier talent, cultivating a robust service offering, and establishing market credibility. Gofore's deep industry experience and existing client network significantly raise the barrier to entry for newcomers.

Gofore's established brand reputation, built on decades of successful project delivery and a deep understanding of client needs, particularly within the public sector, presents a significant barrier to new entrants. The company's emphasis on cultivating strategic, long-term partnerships, rather than transactional relationships, fosters a high degree of client trust and loyalty. This ingrained credibility means newcomers would face a substantial uphill battle in replicating Gofore's market standing and securing the same level of confidence from potential clients.

For Gofore, the threat of new entrants is significantly mitigated by the deep regulatory and compliance knowledge required, particularly when serving public sector clients. New companies entering this space must invest heavily in understanding and adhering to intricate government regulations, data privacy laws like GDPR, and sector-specific compliance standards. This steep learning curve and the associated costs act as a substantial barrier.

Talent Scarcity and Recruitment Challenges

The global shortage of specialized IT talent is a significant barrier for new entrants. Companies struggle to quickly assemble experienced teams, as demand for skilled professionals, particularly in areas like cloud computing and cybersecurity, continues to outstrip supply. For instance, in 2024, the cybersecurity talent gap was estimated to be 3.4 million professionals worldwide, highlighting the intensity of this challenge.

Established companies, including Gofore, possess a distinct advantage in talent acquisition and retention. Their strong brand reputation, established employee development programs, and competitive compensation packages make them more attractive to top-tier IT professionals. This existing talent pool makes it harder for newcomers to build the necessary expertise to compete effectively.

- Global IT Talent Shortage: The ongoing scarcity of skilled IT professionals worldwide acts as a substantial deterrent for new companies aiming to enter the market.

- Recruitment Hurdles: New entrants face significant difficulties in rapidly building a competent workforce due to intense competition for specialized IT skills.

- Established Firm Advantage: Companies like Gofore benefit from their established employer branding and robust talent management strategies, enabling them to attract and retain key personnel more effectively.

- Impact on Competition: The difficulty in acquiring talent directly limits the ability of new entrants to scale operations and challenge incumbents.

Acquisition Strategy by Established Players

Established players like Gofore are actively acquiring smaller companies to bolster their market position and capabilities. This consolidation can significantly raise the barrier to entry for newcomers.

For instance, in 2024, the IT consulting sector saw numerous mergers and acquisitions as firms sought to scale and integrate new technologies. This trend suggests that new entrants face a market where established entities are increasingly dominant through strategic acquisitions.

- Market Consolidation: Acquisitions by Gofore and peers reduce the number of independent players.

- Increased Capital Requirements: New entrants need more capital to compete against larger, integrated entities.

- Talent Acquisition Challenges: Established firms can attract talent through acquisitions, making it harder for startups to recruit.

- Service Offering Expansion: Acquirers gain broader service portfolios, presenting a more comprehensive alternative to new entrants.

The threat of new entrants in the digital transformation consulting market is significantly dampened by high capital requirements and the need for specialized expertise. Building a reputable brand and securing client trust, especially in sectors like public administration, demands substantial time and investment, making it difficult for newcomers to gain traction quickly.

The intense competition for skilled IT professionals, exacerbated by a global talent shortage, further erects barriers. For example, in 2024, the cybersecurity talent gap alone was estimated at 3.4 million globally, making it challenging for new firms to assemble experienced teams. Established players like Gofore leverage their strong employer branding and existing talent pools to attract and retain key personnel, a significant hurdle for startups.

Market consolidation through mergers and acquisitions by established firms also raises the bar for new entrants. These strategic moves by companies like Gofore create larger, more integrated entities with broader service offerings, requiring new competitors to possess greater capital and a more comprehensive value proposition to compete effectively.

| Factor | Impact on New Entrants | Gofore's Advantage |

|---|---|---|

| Capital Requirements | High investment needed for talent, technology, and brand building. | Established financial resources and operational scale. |

| Talent Acquisition | Difficult due to global shortages and competition. | Strong employer brand, development programs, and existing talent pool. |

| Brand Reputation & Trust | Challenging to build credibility, especially with public sector clients. | Decades of successful project delivery and client loyalty. |

| Regulatory Knowledge | Significant investment required for compliance with complex regulations. | Deep understanding and experience in public sector compliance. |

| Market Consolidation | Increased competition from larger, acquired entities. | Ability to participate in or lead market consolidation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, industry-specific market research, and government economic indicators. This comprehensive approach ensures an accurate assessment of competitive intensity and strategic positioning.