Gofore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gofore Bundle

Unlock the strategic power of the Gofore BCG Matrix, revealing how their product portfolio stacks up in the market. Understand which offerings are driving growth and which might need a closer look. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize Gofore's market position.

Stars

Gofore stands as a prominent leader in Finland's public sector digital transformation, evidenced by securing major long-term agreements like the one with the Digital and Population Data Services Agency. The Finnish public sector's ongoing commitment to modernization and digital investment fuels a consistent demand for Gofore's proven expertise and solid market standing.

The company's steady growth within its domestic market, especially with public sector clients, supports its positioning. For example, Gofore reported a revenue of €202.7 million in 2023, with a significant portion attributed to its public sector engagements, highlighting the sector's importance to its financial performance.

Cybersecurity Services represent a strong Star in Gofore's BCG Matrix. The global cybersecurity market is booming, with projections showing it reaching over $300 billion by 2024. Gofore's strategic acquisition of Huld in July 2025 significantly bolsters its cybersecurity offerings, enhancing its competitive edge in this high-growth sector.

The global data analytics market is experiencing explosive growth, projected to reach $136.7 billion by 2024, with AI-driven solutions acting as a primary catalyst for this expansion. Gofore is strategically capitalizing on this trend, demonstrating robust investment in and demand for its advanced data and AI services. These integrated offerings are designed to deliver significant, cutting-edge value to their clientele.

By focusing on these high-demand areas, Gofore is positioning itself to capture substantial market share within the dynamic data and AI landscape. The company’s commitment to developing and deploying these transformative technologies underscores its role as a key player in an industry that is rapidly reshaping business operations and strategic decision-making.

Intelligent Industry Sector (post-Huld acquisition)

Intelligent Industry is a key growth area for Gofore, especially following the Huld acquisition. This strategic move significantly strengthens Gofore's capabilities and market presence within industrial digitalization. The combined entity is well-positioned to capitalize on the increasing demand for smart solutions across manufacturing and automotive sectors.

The integration of Huld's expertise enhances Gofore's offerings in areas such as connected machines, smart production processes, and advanced automotive technologies, particularly in the DACH region. This expansion broadens Gofore's reach and solidifies its competitive standing in a rapidly evolving market. For instance, the industrial automation market in Europe was valued at approximately €150 billion in 2023 and is projected to grow steadily, with digitalization being a primary driver.

- Enhanced Capabilities: Gofore now boasts a more comprehensive suite of services for industrial clients, covering the entire value chain from design to operation.

- Market Expansion: The Huld acquisition provides Gofore with a stronger foothold in the DACH region, a significant hub for industrial innovation and manufacturing.

- Growth Potential: Gofore is targeting the substantial growth opportunities within the industrial digitalization market, driven by trends like Industry 4.0 and IoT adoption.

- Synergistic Benefits: The combination of Gofore's digital transformation expertise and Huld's deep industrial knowledge creates a powerful offering for clients seeking to modernize their operations.

Strategic Partnerships with Large Customers

Gofore's strategic partnerships with large customers are a cornerstone of its business, fostering deep, long-standing relationships. Many of these key clients are now contributing over 1 million euros annually to Gofore's revenue, highlighting the success of this approach. These collaborations, especially within the public sector and with major industrial companies, secure a dominant market share in crucial client segments.

This focus on sustained value delivery through these strategic alliances ensures a steady and substantial revenue stream. For instance, Gofore's significant presence in the Finnish public sector, where it has secured numerous multi-year framework agreements, exemplifies this strategy. These agreements often involve extensive digital transformation projects, demonstrating the depth of the partnerships and the critical role Gofore plays in its clients' operations.

- Gofore's large customer revenue: Over 1 million euros annually per key client.

- Sector focus: Public sector and key industrial players.

- Strategic outcome: High market share within critical client accounts.

- Revenue driver: Consistent value delivery through long-term partnerships.

Stars in Gofore's BCG Matrix represent business areas with high market share in high-growth markets. These are the company's strongest performers, driving significant revenue and requiring continued investment to maintain their leading positions. Gofore's focus on these segments positions it for sustained growth and market leadership.

Cybersecurity and Data & AI are identified as key Star segments for Gofore. The company's strategic acquisitions and investments in these areas, such as the July 2025 acquisition of Huld, significantly bolster its capabilities and market reach in these rapidly expanding sectors. These segments are critical for Gofore's future growth trajectory.

Intelligent Industry, particularly with the integration of Huld's expertise, also emerges as a Star. This segment benefits from the increasing demand for industrial digitalization and smart solutions, with Gofore expanding its presence in key regions like the DACH area. The industrial automation market in Europe, valued around €150 billion in 2023, underscores the substantial opportunity.

| BCG Category | Market Growth | Market Share | Gofore's Position | Key Drivers |

|---|---|---|---|---|

| Stars | High | High | Leading | Digital Transformation, AI, Cybersecurity, Industrial IoT |

| Cybersecurity | High | Strong | Star | Global market over $300 billion by 2024 |

| Data & AI | High | Strong | Star | Global market $136.7 billion by 2024 |

| Intelligent Industry | High | Growing | Emerging Star | Industry 4.0, European market ~€150 billion (2023) |

What is included in the product

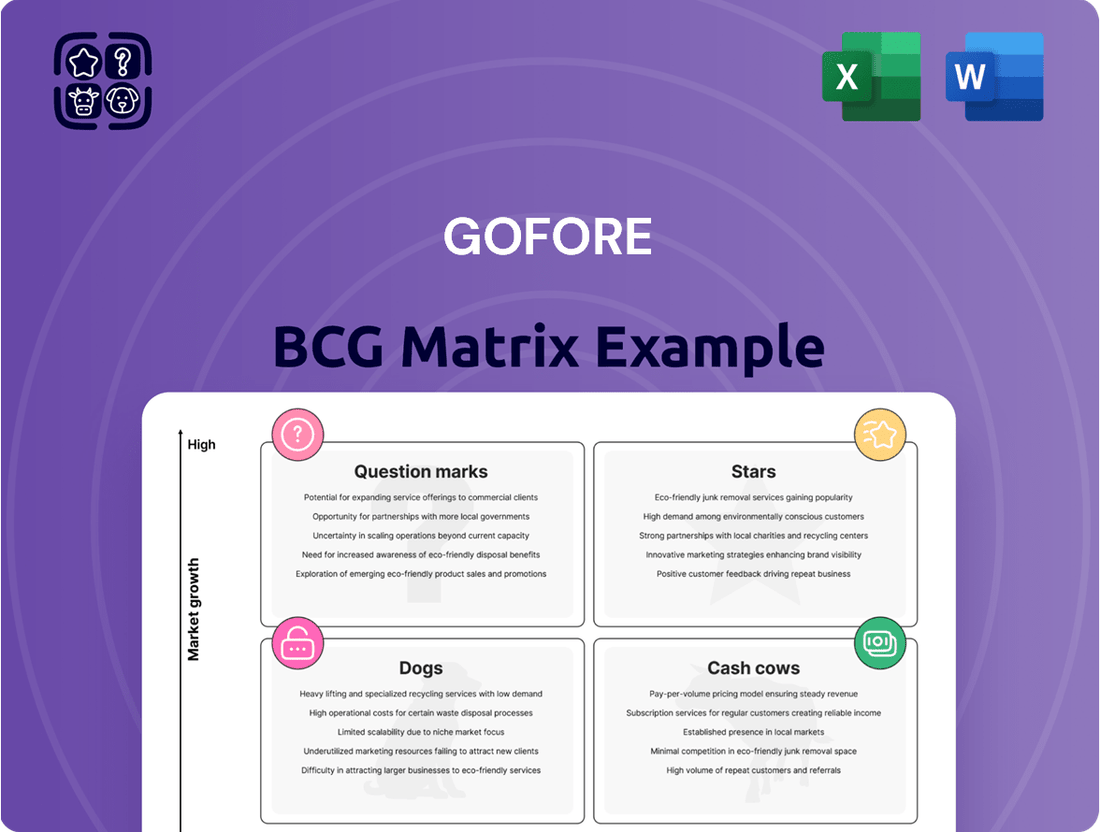

The Gofore BCG Matrix analyzes business units by market share and growth, offering strategic guidance.

Quickly identify underperforming units with a clear, visual Gofore BCG Matrix that pinpoints areas needing strategic attention.

Cash Cows

Gofore's established presence in Finnish public sector digital transformation consulting acts as a classic cash cow. The company benefits from multi-year framework agreements, ensuring a consistent and reliable income. In 2023, Gofore reported a revenue of €343.4 million, with a significant portion likely stemming from these stable public sector contracts.

Gofore's core software development and maintenance for its existing clients form a solid foundation, acting as its cash cows. These services, crucial for client operations, are in a mature market, meaning less need for aggressive marketing once relationships are solid.

This stability translates into strong profit margins and dependable cash flow for Gofore. For instance, in 2023, Gofore reported a notable increase in revenue from its services segment, underscoring the consistent demand and profitability of these established offerings.

Mature Cloud Solutions & Infrastructure Management represents Gofore's established offerings for clients who have successfully navigated their initial cloud journeys. These services focus on the crucial phase of operational efficiency and ongoing optimization, ensuring clients maximize their cloud investments.

Gofore's expertise in this area translates into reliable, high-margin revenue streams by leveraging existing infrastructure and deep technical knowledge. For instance, in 2024, companies increasingly sought to refine their cloud operations, with a significant portion of IT budgets dedicated to managed services and cost optimization, a trend Gofore is well-positioned to capitalize on.

Traditional IT Project Management & Consulting

Traditional IT project management and consulting are Gofore's established strengths, acting as reliable cash cows within their portfolio. These services are fundamental to digital transformation efforts, tapping into a mature IT services market where Gofore's deep expertise and established client trust ensure steady demand.

Gofore leverages its strong reputation and enduring client partnerships to generate consistent revenue from these core offerings. This stability allows for high utilization of their existing skilled workforce, minimizing the need for significant investments in new market development or aggressive expansion strategies.

- Market Position: Gofore operates in a stable, mature segment of the IT services market with its traditional project management and consulting.

- Revenue Generation: Strong reputation and long-term client relationships drive consistent revenue streams.

- Resource Utilization: High utilization of existing expert capacity is a key benefit, reducing the need for extensive new market penetration.

- Financial Contribution: These services provide a predictable and substantial contribution to Gofore's overall financial performance.

Certain Enterprise Resource Planning (ERP) Services

Gofore's enterprise resource planning (ERP) services represent a significant Cash Cow within its portfolio. These services are vital for large organizations needing integrated management of core business processes. The steady, predictable revenue stream comes from ongoing support, customization, and enhancements for existing clients with mature ERP systems.

This segment thrives on Gofore's established client relationships and deep expertise in enterprise systems, ensuring stable cash flow. For example, in 2024, Gofore reported continued strong demand for its ERP modernization and integration services, contributing to its overall service revenue growth.

- Stable Revenue: Ongoing support and maintenance for existing ERP systems provide a predictable income stream.

- Client Retention: Deep expertise and established relationships foster long-term client partnerships.

- Mature Market: Focus on established clients in mature systems ensures consistent demand for enhancements and support.

- Profitability: Efficient delivery of these services leverages Gofore's existing knowledge base, leading to healthy profit margins.

Gofore's established public sector digital transformation consulting acts as a classic cash cow, benefiting from multi-year framework agreements that ensure consistent income. The company's core software development and maintenance for existing clients also form a solid foundation, providing stable, high-margin revenue streams by leveraging deep technical knowledge and client trust.

These mature services, like ERP support and cloud infrastructure management, thrive on established client relationships and a focus on operational efficiency. In 2023, Gofore reported revenue of €343.4 million, with a significant portion likely stemming from these dependable, mature offerings.

| Service Area | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Outlook for 2024 |

|---|---|---|---|---|

| Public Sector Digital Transformation | Cash Cow | Multi-year framework agreements, stable demand | Significant | Continued steady growth |

| Core Software Development & Maintenance | Cash Cow | Existing client base, mature market | Substantial | Reliable revenue stream |

| Mature Cloud Solutions & Infrastructure Management | Cash Cow | Operational efficiency focus, high margins | Growing | Increased demand for optimization |

| Enterprise Resource Planning (ERP) Services | Cash Cow | Ongoing support, established systems | Strong | Continued demand for modernization |

Preview = Final Product

Gofore BCG Matrix

The GoFore BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or placeholder content, ensuring you get a professional, ready-to-use strategic tool immediately. The comprehensive analysis and clear visualization of your business units within the matrix are precisely as you see them now, enabling swift integration into your planning processes. This preview guarantees that the final GoFore BCG Matrix file is delivered directly to you, empowering your strategic decision-making without any surprises or need for further editing.

Dogs

Gofore has acknowledged a contraction in net sales within its newer international markets beyond Finland and the DACH region during 2024. This signals a struggle for market share and negative growth in these territories.

These underperforming international expansions are likely drawing resources without yielding substantial returns, leading Gofore to prioritize its efforts in Finland and the DACH markets.

Continuing to pour capital into these nascent international operations without a clear path to profitability could result in them becoming significant drains on company resources, effectively acting as cash traps.

In 2024, Gofore observed a downturn in net sales from its more cyclical industrial clients. This segment, characterized by its sensitivity to economic shifts, currently holds a low market share and exhibits limited growth potential, particularly when contrasted with Gofore's strategic emphasis on Intelligent Industry expansion.

These cyclical industrial segments, representing a low market share and low growth prospect within Gofore's portfolio, are particularly susceptible to economic downturns. Continued allocation of resources to these areas, especially without a clear path to revitalization, poses a significant risk of becoming a cash drain.

Services focused on extremely old, unchanging legacy IT systems, where modernization or new digital service creation is unlikely, are typically classified as dogs in the Gofore BCG Matrix. These projects often struggle with low profit margins and demand specialized, outdated technical skills.

These engagements can operate at break-even or even consume cash, offering little to no contribution to strategic growth initiatives. For instance, a significant portion of public sector IT spending in 2024 continues to be directed towards maintaining these systems, with estimates suggesting that up to 70% of IT budgets are allocated to legacy maintenance rather than innovation.

Such projects also divert critical resources, including skilled personnel, that could be better utilized in more dynamic and profitable areas of the business, hindering overall development and competitive positioning.

General IT Staff Augmentation in Highly Saturated Markets

General IT staff augmentation in highly saturated markets can be categorized as a 'dog' within the Gofore BCG Matrix. These services often face intense price competition, leading to low margins. For instance, in 2024, the global IT staffing market saw significant growth, but commoditized roles experienced an average margin compression of 5-10% compared to specialized skill sets.

When Gofore engages in pure staff augmentation for basic IT functions in markets with many providers, differentiation becomes a major challenge. This can result in limited market share and profitability, especially if these engagements don't evolve into more strategic partnerships. Many IT firms reported that over 60% of their IT staff augmentation revenue in 2024 came from projects requiring niche skills, highlighting the difficulty in profiting from general IT support.

- Low Profitability: Intense price wars in commoditized IT markets often lead to thin profit margins for general staff augmentation services.

- Limited Differentiation: In saturated markets, it's hard for Gofore to stand out if the service offered is standard IT support without added value.

- Risk of Stagnation: If these 'dog' services don't pave the way for more specialized or strategic engagements, they can drain resources without contributing to overall growth.

- Market Saturation Impact: By 2024, many regions saw a surplus of IT staffing agencies offering similar services, driving down rates for non-specialized roles.

Service Areas with Chronic Excess Capacity

Gofore's experience in April 2025 with initiating change negotiations underscores a critical challenge: service areas suffering from chronic excess capacity. This situation arises when the company has more employees than billable work available, a scenario exacerbated by weak market demand and significant price pressure from competitors.

These specific service areas, characterized by a low market share and minimal growth prospects, are particularly concerning. They risk becoming cash traps, draining resources without generating sufficient returns. This imbalance between the supply of Gofore's services and the actual market demand is a key indicator of strategic underperformance.

- Chronic Excess Capacity: Gofore identified specific service areas with more staff than billable projects in April 2025.

- Market Dynamics: These areas face weak demand and intense price competition, indicating a challenging market environment.

- Low Growth, Low Share: The affected segments represent low market share and low growth potential, fitting the profile of potential cash traps.

- Strategic Mismatch: The situation highlights a disconnect between Gofore's service delivery capacity and the prevailing market demand.

Dogs in Gofore's portfolio represent services with low market share and low growth potential. These segments, such as maintaining very old legacy IT systems or offering general IT staff augmentation in saturated markets, often struggle with thin profit margins due to intense price competition. In 2024, Gofore noted a downturn in net sales from cyclical industrial clients, a segment fitting the 'dog' profile with its low market share and limited growth, especially when compared to their focus on Intelligent Industry expansion.

These underperforming areas can become cash traps, draining resources without contributing to strategic growth. Gofore's experience in April 2025, initiating change negotiations due to chronic excess capacity in certain service areas, highlights this challenge. Weak market demand and significant price pressure further exacerbate the situation for these low-share, low-growth segments.

| Service Category | Market Share | Growth Potential | Profitability Concern | Example Driver (2024/2025) |

| Legacy System Maintenance | Low | Low | Low Margins, High Skill Cost | Public sector IT budgets allocating up to 70% to legacy maintenance. |

| General IT Staff Augmentation | Low | Low | Price Competition, Margin Compression | Commoditized roles saw 5-10% margin compression in the global IT staffing market. |

| Cyclical Industrial IT Services | Low | Low | Economic Sensitivity, Low Demand | Downturn in net sales from these clients observed in 2024. |

Question Marks

Gofore is targeting the DACH automotive industry as a key growth area within its Intelligent Industry segment. This sector is ripe for digital transformation, offering significant opportunities for Gofore's expertise.

The DACH automotive market is highly competitive and specialized, meaning Gofore is currently in the early stages of establishing its presence and market share. Building a strong foothold will require focused effort and resources.

To achieve market leadership in this dynamic environment, Gofore must make substantial investments. These investments are crucial for capitalizing on the digital transformation trends and converting potential into tangible market gains.

Following the acquisition of Huld in July 2025, Gofore is entering the space sector, a market characterized by high specialization and rapid technological advancement. This new venture presents substantial growth prospects, but as a newcomer, Gofore will initially hold a modest market share within this competitive landscape.

The space sector, projected to reach $1 trillion by 2040 according to some analyses, demands significant upfront investment in research, development, and specialized talent. Gofore's strategic focus must be on building expertise and establishing a strong presence to leverage the sector's burgeoning opportunities, aiming to capture a meaningful share of this expanding market.

Gofore is actively developing 'As a Service' ICT partnerships and reusable concepts. These initiatives aim to enhance its consulting capabilities and leverage existing platforms, signaling a move towards subscription-based and scalable solutions. This aligns with a broader market trend favoring recurring revenue models.

While these new offerings represent a significant strategic direction, Gofore's current market share in these emerging areas is minimal. Realizing their potential will necessitate substantial investment in development and targeted marketing campaigns to build brand awareness and customer adoption.

Expansion into Digital Services & Solutions within Finnish Social & Health Industry

Gofore's strategic focus on expanding digital services within Finland's social and health sector positions it as a potential star in the BCG matrix. This sector is ripe for digital transformation, with significant government investment in modernizing healthcare systems. For instance, Finland's Ministry of Social Affairs and Health has been actively promoting digital health solutions, aiming to improve efficiency and patient care.

This push into social and health digital solutions represents a high-growth area for Gofore, even with its established public sector footprint. The market is evolving rapidly, driven by advancements in AI and data analytics, creating opportunities for specialized digital offerings. Gofore is actively building its market share in these targeted areas, requiring dedicated investment to solidify its position.

- High Growth Potential: The Finnish social and health sector is undergoing significant digital transformation, creating substantial growth opportunities.

- Market Development: Gofore is actively developing its market share in specialized digital solutions for this sector.

- Investment Focus: This strategic expansion necessitates focused investment to establish a strong competitive advantage.

- Technological Integration: The sector's adoption of AI and other advanced technologies fuels the demand for Gofore's digital services.

Large-Scale Digital Investments with New Client Accounts

Gofore's strategy to pursue large-scale digital investments with new client accounts positions them squarely in the "Question Marks" category of the BCG matrix. These ventures represent high-growth potential markets, particularly in sectors actively undergoing digital transformation. For instance, in 2024, many public sector organizations and established enterprises are accelerating their digital modernization efforts, creating fertile ground for new partnerships.

While the allure of these large projects is undeniable, Gofore enters these new relationships with a nascent market share. The challenge lies in converting these prospects into significant, ongoing engagements within a market that, as of early 2024, remains cautious and highly competitive. This necessitates significant upfront investment in sales, marketing, and tailored solution development to demonstrate value and build trust.

- High Growth Potential: Targeting sectors with substantial digital transformation needs, such as public administration modernization and industrial digitalization.

- Low Initial Market Share: Entering new, large client engagements means starting from a position of low penetration in these specific accounts.

- Significant Investment Required: Substantial sales, business development, and marketing resources are allocated to secure and nurture these new, large-scale opportunities.

- Strategic Importance: These initiatives are crucial for Gofore's long-term growth and market position, aiming to establish strong footholds in key growth areas.

Gofore's strategic pursuit of new, large-scale digital transformation projects with major clients places it in the Question Marks category of the BCG matrix. These initiatives target high-growth sectors, but Gofore's market share within these specific new engagements is initially low. Significant investment is therefore required to convert these opportunities into sustained business, reflecting their strategic importance for future expansion.

BCG Matrix Data Sources

Our Gofore BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.