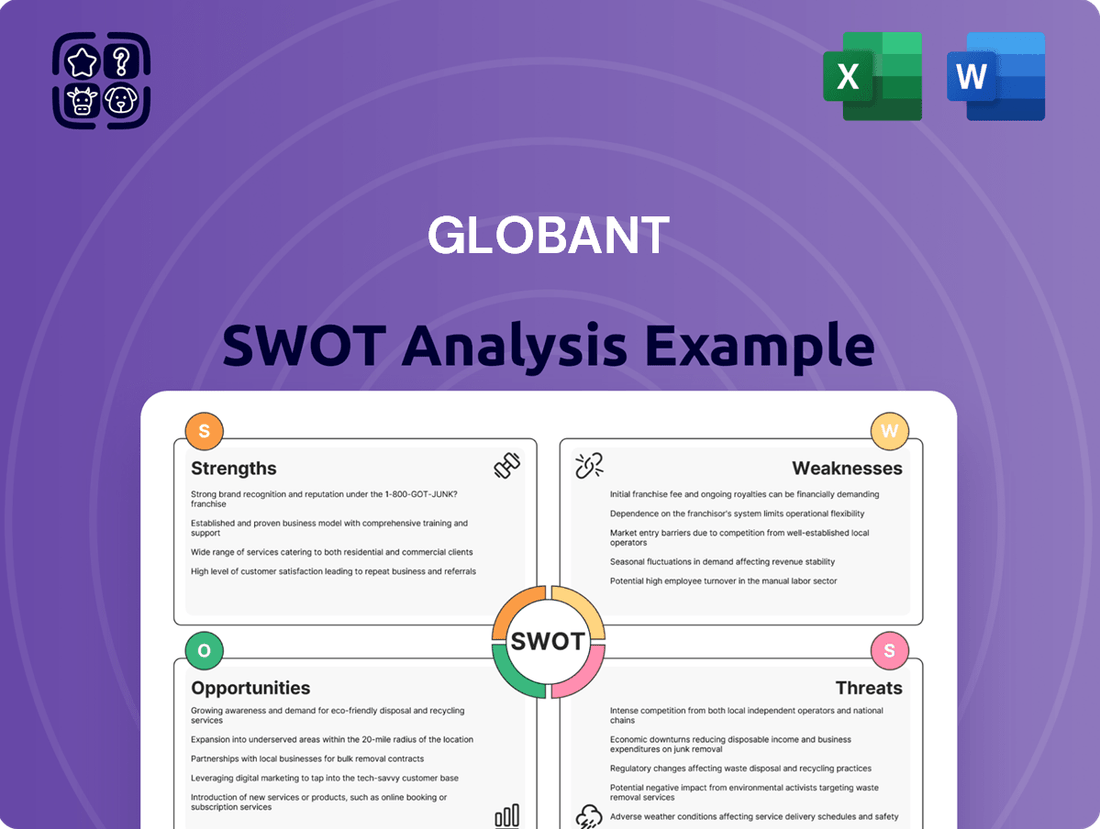

Globant SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globant Bundle

Globant's robust digital transformation capabilities and strong client relationships are significant strengths, but understanding the competitive landscape and potential regulatory shifts is crucial for sustained growth. Our comprehensive SWOT analysis delves into these dynamics, offering actionable insights into their market position and future trajectory.

Want the full story behind Globant’s strengths, opportunities, and potential challenges? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Globant's core identity as a digitally native company positions it to expertly reinvent businesses using cutting-edge technology. This allows clients to significantly improve customer experiences, boost operational efficiency, and unlock new revenue streams. For instance, in 2023, Globant reported revenue of $1.8 billion, demonstrating its capacity to deliver impactful digital transformation solutions.

Globant's robust expertise in Artificial Intelligence is a significant strength. They were recognized as a Worldwide Leader in AI Services in 2023, underscoring their capabilities in this rapidly evolving field.

The company's strategic investments, including the launch of its AI Reinvention Network and the integration of AI agents into software development, highlight a commitment to leveraging AI for enhanced efficiency and innovation.

This focus is translating into substantial financial gains, with AI-related projects contributing over $350 million to Globant's revenue in 2024, a remarkable 110% surge from the previous year.

Globant's financial performance is a significant strength, marked by consistent revenue growth. In 2024, the company achieved $2,415.7 million in revenue, a 15.3% increase from the previous year. This momentum continued into Q1 2025 with revenues reaching $611.1 million, up 7% year-over-year.

The company's profitability remains robust, with a Non-IFRS Adjusted Profit from Operations Margin of 15.7% reported in Q4 2024. This healthy margin, combined with an expanding base of clients contributing over $1 million annually, underscores Globant's capacity for scaling its operations and increasing client value.

Over the past decade, Globant has demonstrated impressive expansion, achieving a compound annual growth rate of 28.3% from 2014 to 2024, highlighting a sustained and strong growth trajectory.

Extensive Global Presence and Diversified Client Base

Globant's extensive global presence, with over 31,100 employees operating in 36 countries as of early 2025, underpins its ability to cater to a wide array of clients worldwide. This geographical reach is crucial for understanding its market penetration and operational capabilities.

The company's diversified client base is a significant asset. In the first quarter of 2025, Globant reported serving 1,004 active customers, a testament to its broad appeal. Furthermore, 341 of these accounts were generating over $1 million in annual revenue, highlighting the depth of its client relationships and the value it delivers.

While North America continues to be a primary revenue generator, Globant is strategically broadening its horizons. Expansion efforts are notably focused on emerging markets like the Middle East and the Asia-Pacific (APAC) region, indicating a forward-looking approach to growth and market diversification.

This combination of a robust global delivery model and a varied client portfolio enhances Globant's resilience against market fluctuations and solidifies its competitive standing in the digital transformation services sector.

Strategic Partnerships and Strong Brand Recognition

Globant's strategic partnerships are a significant strength, notably its April 2025 agreement with Google Cloud to drive AI and cloud transformations. These collaborations are crucial for expanding its technological capabilities and market reach.

The company also benefits from high-profile partnerships with organizations like FIFA and the LA Clippers, which significantly boost its brand visibility and industry credibility. These associations allow Globant to showcase its expertise in dynamic, high-impact environments.

Globant's brand strength is further validated by external recognition. In 2024, Brand Finance named it the fastest-growing IT brand and the fifth strongest IT brand globally. This strong brand recognition, coupled with its strategic alliances, solidifies its competitive position in the market.

- Strategic Alliances: Key partnerships, including the April 2025 Google Cloud agreement, focus on AI and cloud.

- Brand Visibility: Collaborations with FIFA and LA Clippers enhance global recognition.

- Brand Strength: Recognized as the 5th strongest IT brand globally in 2024 by Brand Finance.

- Market Standing: Strong brand and strategic collaborations reinforce its competitive market position.

Globant's deep expertise in digital transformation, particularly in AI, is a core strength. Their recognition as a Worldwide Leader in AI Services in 2023 and strategic AI investments, like their AI Reinvention Network, highlight this. This focus is translating into significant revenue, with AI projects contributing over $350 million in 2024, a 110% year-over-year increase.

The company's financial health is robust, evidenced by consistent revenue growth, reaching $2,415.7 million in 2024, a 15.3% increase. This momentum continued into Q1 2025 with revenues of $611.1 million, up 7% year-over-year, supported by a strong Non-IFRS Adjusted Profit from Operations Margin of 15.7% in Q4 2024.

Globant's extensive global footprint, with over 31,100 employees across 36 countries by early 2025, allows for broad client service. This is complemented by a diversified client base, including 341 accounts generating over $1 million annually in Q1 2025, demonstrating strong client relationships and market penetration.

Strategic partnerships, such as the April 2025 Google Cloud agreement for AI and cloud transformations, significantly enhance Globant's capabilities. Furthermore, high-profile collaborations with entities like FIFA and the LA Clippers bolster brand visibility and industry credibility, reinforced by Brand Finance naming them the 5th strongest IT brand globally in 2024.

| Key Strength | Supporting Data | Impact |

| AI Expertise | Worldwide Leader in AI Services (2023), $350M+ AI revenue (2024) | Drives innovation and revenue growth |

| Financial Performance | $2.4B revenue (2024, +15.3%), 15.7% Q4 2024 Profit Margin | Indicates operational efficiency and scalability |

| Global Presence & Client Base | 31,100+ employees (early 2025), 341 clients >$1M annual revenue (Q1 2025) | Enhances market reach and client value delivery |

| Strategic Partnerships & Brand | Google Cloud (April 2025), FIFA/LA Clippers partnerships, 5th strongest IT brand (2024) | Boosts technological capabilities and market recognition |

What is included in the product

Delivers a strategic overview of Globant’s internal and external business factors, highlighting its strengths in digital transformation and opportunities in emerging markets, while also addressing potential weaknesses in talent retention and threats from increased competition.

Offers a structured framework to identify and address potential market challenges, turning weaknesses into actionable strategies.

Weaknesses

Globant faces a significant weakness in client concentration, with its top clients contributing a substantial portion of its revenue. In Q1 2025, the single largest client accounted for 8.8% of total revenues, and the top five clients collectively represented 20.0%. This heavy reliance on a few major customers introduces a dependency risk, meaning any substantial decrease in spending from one of these key accounts could have a material negative impact on the company's overall financial performance.

This vulnerability was underscored in Q1 2025 when revenue from a top client saw a slight downturn after a period of heightened investment in the latter half of 2024. While Globant is actively pursuing strategies to broaden its customer base and reduce this dependency, the current level of client concentration remains a notable weakness that requires ongoing management and mitigation efforts.

Globant has openly stated that a challenging macroeconomic landscape is affecting client expenditure. This was particularly clear in their Q1 2025 performance, which showed a 7% year-over-year growth, a slowdown compared to earlier periods.

Further compounding these issues, Globant identified specific headwinds in Q1 stemming from economic conditions in Latin America, with Mexico and Brazil being notable examples. This economic uncertainty can prompt clients to shift focus towards shorter-term, less profitable cost-reduction projects, potentially at the expense of more significant, long-term transformation efforts.

Globant's revenue growth in Q1 2025, reaching $611 million, was overshadowed by a notable dip in profitability. The company's IFRS diluted Earnings Per Share (EPS) fell to $0.68 from $1.02 in the same period last year. This trend suggests that while the company is expanding its top line, it's struggling to translate that growth into increased earnings for shareholders, potentially due to rising costs or pricing pressures.

Further illustrating this concern, Globant's non-IFRS adjusted diluted EPS saw a slight decrease from $1.53 to $1.50 in Q1 2025. This persistent decline in per-share earnings, even with increasing sales, raises questions about the efficiency of its operations and its ability to manage expenses effectively. Investors might view this as a weakness, as consistent earnings growth is often a key indicator of a company's financial health and future prospects.

Geographic Revenue Concentration and Regional Headwinds

Globant's revenue is heavily weighted towards North America, representing 55.2% in Q4 2024 and 55.5% in Q1 2025. This significant concentration makes the company vulnerable to regional economic slowdowns or shifts in market demand within this key area.

The reliance on North America as a primary revenue driver creates a risk. Any adverse economic or political developments in this region could disproportionately affect Globant's overall financial performance.

Compounding this, Globant is already seeing the impact of macroeconomic and political challenges in Latin America. These headwinds are dampening demand in those specific markets, further highlighting the risks associated with geographic concentration.

- Geographic Concentration: Over half of Globant's revenue originates from North America.

- Regional Vulnerability: Economic downturns or policy changes in North America pose a significant risk.

- Latin American Challenges: Existing macroeconomic and political issues in Latin America are negatively affecting demand.

Intense Competition and Market Share Challenges

The IT consulting sector is fiercely competitive, with Globant contending against giants like Accenture, Deloitte Consulting, and IBM Consulting. These established players possess significant resources and entrenched market positions, making it challenging for Globant to secure digital transformation projects.

While Globant is lauded for its innovative approach, it faces hurdles in outperforming the average revenue growth rate seen within the broader Information Technology sector. This suggests a demanding market environment where expanding market share requires overcoming substantial competitive pressures.

- Intense Rivalry: Globant competes with industry titans like Accenture and Deloitte, who possess greater scale and brand recognition.

- Market Share Pressure: Gaining significant market share is difficult in a landscape dominated by larger, well-resourced competitors.

- Growth Rate Challenges: Achieving revenue growth significantly above the IT sector average remains a persistent challenge due to this competitive intensity.

Globant's profitability is showing signs of strain, with its IFRS diluted Earnings Per Share (EPS) declining to $0.68 in Q1 2025 from $1.02 in the prior year. This suggests that despite revenue growth, the company is struggling to convert sales into profits, potentially due to rising operational costs or increased pricing pressure from competitors. The non-IFRS adjusted diluted EPS also saw a slight dip from $1.53 to $1.50 in the same period, indicating a persistent challenge in enhancing per-share earnings for investors.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| IFRS Diluted EPS | $1.02 | $0.68 | -33.3% |

| Non-IFRS Adjusted Diluted EPS | $1.53 | $1.50 | -2.0% |

What You See Is What You Get

Globant SWOT Analysis

The preview you see is the actual Globant SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

This is a real excerpt from the complete Globant SWOT analysis. Once purchased, you’ll receive the full, editable version ready for strategic implementation.

You’re viewing a live preview of the actual Globant SWOT analysis file. The complete, in-depth version becomes available immediately after checkout.

Opportunities

The global digital transformation services market is projected to hit $4.8 trillion by 2030, growing at a compound annual growth rate of 28.5% from 2025 to 2030. This massive expansion underscores a fundamental shift across industries towards technology adoption. Globant, with its core focus on reinventing businesses through digital solutions, is ideally situated to benefit from this sustained surge in demand.

As companies worldwide increasingly rely on technology to improve efficiency, customer engagement, and operational agility, the need for specialized digital transformation expertise is paramount. Globant's established capabilities in areas like cloud, data analytics, and artificial intelligence directly address these critical business needs. This creates a substantial opportunity for Globant to broaden its service portfolio and secure new client engagements, further solidifying its market position.

The generative AI market is poised for remarkable expansion, with projections indicating a five-year compound annual growth rate of 73.5% through 2028. This presents a substantial opportunity for Globant, leveraging its established expertise and significant investments in artificial intelligence.

Globant's strategic initiatives, including its AI Reinvention Network and the Globant Enterprise AI platform, are specifically engineered to expedite AI adoption across a wide array of industries. This dedicated focus on AI-powered solutions positions Globant to secure a more significant portion of this rapidly expanding market, thereby fueling accelerated revenue growth.

Globant is actively pursuing expansion into new geographic markets, with a particular focus on the Middle East and the Asia-Pacific (APAC) region. This strategic move is designed to unlock new growth avenues and diversify its revenue streams.

The company anticipates accelerated growth in these emerging markets through 2025 and 2026. This expansion is bolstered by a broadening industry focus, moving beyond its traditional strength in amusement parks to encompass high-potential sectors like financial services and airlines.

By diversifying its geographic revenue base beyond its current concentration in North America, Globant aims to mitigate risks associated with over-reliance on a single region and tap into substantial new pools of customer demand.

Leveraging AI for Enhanced Internal Efficiency and Offerings

Globant is proactively embedding AI within its own operations, not just as a client offering. This internal adoption, exemplified by tools like Magnify and Genexus, aims to streamline software development processes, boosting efficiency and potentially reducing project costs. For instance, by automating code generation and testing, Globant could see a tangible improvement in development cycle times, a key metric for client satisfaction and profitability.

This dual approach—offering AI solutions externally while leveraging them internally—reinforces Globant's expertise and market position. Demonstrating AI's efficacy within their own workflows allows Globant to build stronger credibility with clients. It also opens avenues for developing new, specialized AI-driven services, further expanding their revenue streams and competitive edge.

- AI Integration for Efficiency: Globant is implementing AI agents within its software development lifecycle to enhance productivity and reduce operational costs.

- Internal AI Tools: Platforms like Magnify and Genexus are key to Globant's strategy for improving internal processes and project delivery timelines.

- Enhanced Value Proposition: Successful internal AI adoption strengthens Globant's credibility and ability to deliver cutting-edge AI solutions to its clients.

- New Service Offerings: The internal application of AI can directly translate into the creation of innovative new service lines for Globant's clientele.

Strategic Acquisitions and Partnerships

The IT consulting sector is actively consolidating, with significant merger and acquisition activity. Globant can capitalize on this by acquiring companies that enhance its service portfolio or broaden its market presence and technological expertise. For instance, in 2023, the IT services market saw numerous deals, reflecting this trend.

Strategic alliances offer another avenue for growth. Globant's collaboration with Google Cloud exemplifies this, enabling the co-development of innovative solutions and access to new customer bases. Such partnerships are crucial for maintaining a competitive edge in a rapidly evolving market.

- Acquisition Strategy: Target companies with complementary technologies or market access to accelerate growth.

- Partnership Leverage: Deepen collaborations with major cloud providers like Google Cloud to co-innovate and expand customer reach.

- Market Consolidation: Utilize industry M&A trends to strategically acquire smaller, innovative players.

Globant is well-positioned to capitalize on the booming digital transformation market, projected to reach $4.8 trillion by 2030. The company's expertise in cloud, data analytics, and AI directly addresses the increasing global demand for these services. Furthermore, Globant's strategic expansion into promising regions like the Middle East and APAC, coupled with its focus on high-growth sectors beyond its traditional base, presents significant new revenue opportunities.

Threats

The IT consulting and digital transformation landscape is fiercely competitive, featuring established behemoths like Accenture, Deloitte, and IBM, alongside a growing number of specialized niche players. This crowded market exerts significant pricing pressure, potentially eroding profit margins and complicating the acquisition of new business for companies like Globant. For instance, in Q1 2024, the global IT services market was projected to grow by a modest 4.3%, highlighting the need for differentiation in a slower growth environment.

Globant's global footprint, especially its significant presence in Latin America, exposes it to the volatility of regional economic downturns and political instability. For instance, a slowdown in key Latin American economies in 2024 could directly impact client IT budgets, potentially leading to reduced project pipelines and revenue pressure for Globant.

Macroeconomic headwinds, such as rising inflation and interest rates in major markets during 2024-2025, can further dampen corporate IT investment. This could manifest as delays in client decision-making or outright project cancellations, directly affecting Globant's revenue streams and growth projections.

Geopolitical tensions, including trade disputes or regional conflicts, pose a threat by disrupting global supply chains for technology and impacting the ease of talent mobility, a critical component for Globant's service delivery model. Such disruptions can increase operational costs and complicate the efficient deployment of skilled personnel across its international projects.

Globant faces significant hurdles in acquiring and keeping top IT talent, a necessity for its technology services model. The global competition for skilled professionals, particularly those with expertise in areas like AI, is intense. This demand can drive up salaries and recruitment expenses, impacting profitability.

In 2023, the IT talent market saw continued pressure, with average salaries for software engineers in key tech hubs increasing by an estimated 5-10% year-over-year. Globant's ability to manage employee turnover, which industry benchmarks suggest can range from 15-25% annually for specialized roles, is crucial for maintaining service delivery standards and supporting its expansion plans.

Rapid Technological Advancements and Disruption

Globant faces the challenge of rapidly evolving technologies, especially in artificial intelligence. The company needs to consistently invest in R&D to adapt its offerings and stay competitive. For instance, while Globant reported a revenue increase of 18.7% in 2023 to $2.05 billion, maintaining this growth requires staying ahead of technological shifts.

Failure to adapt to new tech or the rise of disruptive competitors could render Globant's current services outdated. This threat is underscored by the increasing pace of AI adoption across industries, with the global AI market projected to reach $1.59 trillion by 2030, according to Grand View Research.

- Continuous R&D Investment: Essential to integrate emerging AI and machine learning capabilities into service portfolios.

- Agile Service Adaptation: The need to quickly pivot service offerings to align with new technological paradigms.

- Competitive Disruption: Risk of being outpaced by rivals who develop or adopt disruptive technologies faster.

Client Focus on Cost-Takeout Over Transformation Projects

In uncertain economic times, clients often prioritize immediate cost savings over ambitious digital transformation. This means Globant might see a shift towards projects focused on efficiency and cost reduction, which typically yield lower profit margins than large-scale transformation initiatives. For instance, during economic slowdowns, IT spending often gets reallocated from growth-oriented projects to maintenance and cost optimization efforts.

This trend poses a challenge for Globant's revenue mix and profitability. While cost-takeout projects can maintain client engagement, they don't offer the same high-value returns as strategic digital overhauls. Globant needs to effectively articulate the long-term value and demonstrable return on investment (ROI) of its transformation services to counter this client preference.

For example, many companies in 2024 and early 2025 are reporting increased investment in automation and cloud cost optimization, reflecting this cost-centric approach. Globant's strategy must therefore include showcasing how its transformation capabilities can also drive significant, measurable cost efficiencies, thereby aligning with immediate client needs while still positioning for future growth.

- Shift in Client Spending: Economic pressures in 2024-2025 are driving clients to favor cost-reduction projects over large-scale digital transformations.

- Margin Impact: Cost-takeout initiatives generally offer lower profit margins compared to strategic transformation projects.

- Demonstrating ROI: Globant must effectively communicate the tangible and immediate return on investment of its transformation services to retain high-value engagements.

- Market Trend: Increased client focus on automation and cloud cost optimization is a clear indicator of this cost-centric demand.

Intense competition from established players and niche firms creates pricing pressure, potentially squeezing Globant's profit margins. Economic instability in key regions like Latin America can directly impact client IT spending, leading to a reduced project pipeline. Macroeconomic factors such as inflation and rising interest rates throughout 2024 and 2025 are also dampening corporate IT investment, causing project delays or cancellations.

Globant faces a talent war, with high demand for skilled IT professionals driving up recruitment costs and potentially impacting profitability. The rapid evolution of technologies, particularly AI, necessitates continuous R&D investment to remain competitive, posing a risk if the company fails to adapt quickly. Clients prioritizing cost savings in uncertain economic climates may opt for lower-margin efficiency projects over large-scale transformations.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Globant's official financial reports, comprehensive market research, and insights from industry analysts to ensure a well-informed strategic perspective.