Globant Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globant Bundle

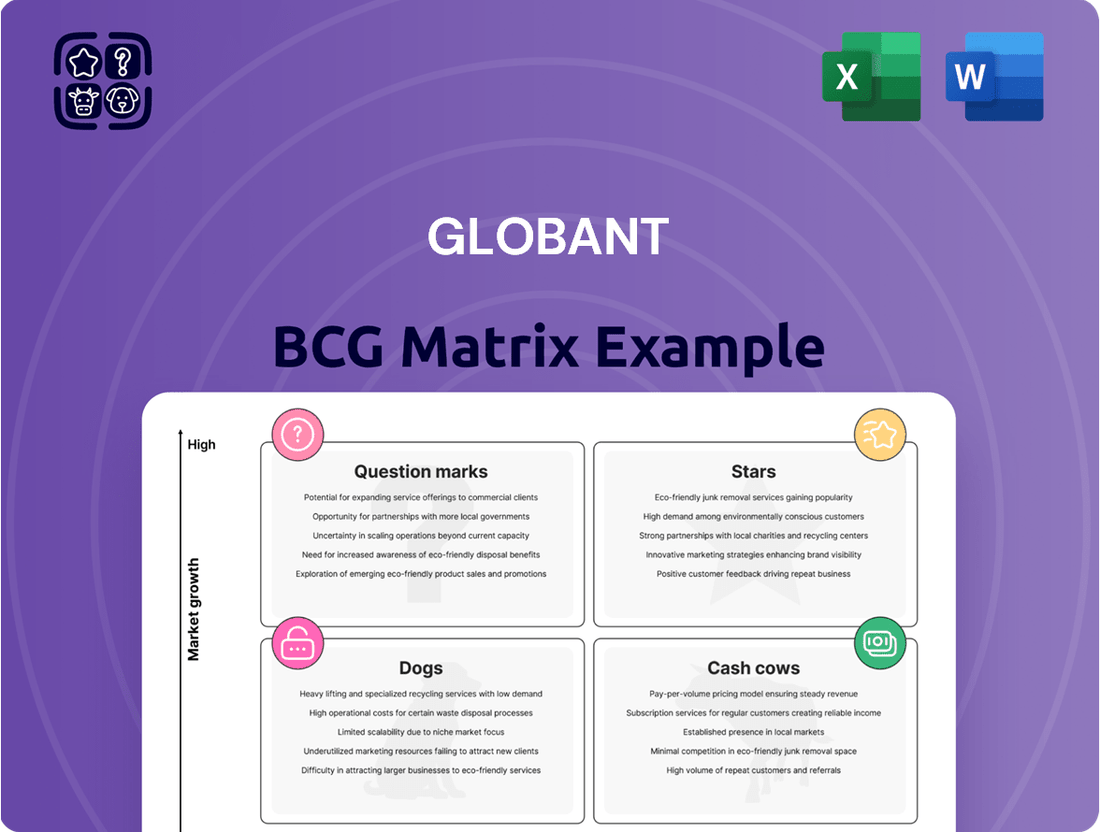

Curious about Globant's strategic positioning? This glimpse into their BCG Matrix reveals where their offerings fall – are they market-leading Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks? Unlock the full potential of this analysis.

Don't miss out on the actionable intelligence within the complete Globant BCG Matrix. Gain a comprehensive understanding of their product portfolio's performance and receive data-driven recommendations to optimize your investment and growth strategies. Purchase the full report for a strategic advantage.

Stars

Globant's AI and Digital Transformation Services are a clear star in its BCG matrix, fueled by substantial, decade-long investments in AI. The company's Enterprise AI Platform and dedicated AI Studios are at the forefront, delivering efficiency and innovation to clients. This strategic emphasis on AI is perfectly timed, as generative AI is expected to see significant market growth, positioning these services as a high-potential, high-growth area for Globant.

Globant's robust cloud solutions, especially its deep partnership with Google Cloud, position it strongly in a rapidly expanding market. The company's 2025 Google Cloud Country Partner of the Year Award for Argentina and Talent Development Partner of the Year for Latin America underscore its significant market presence and dedication to cloud skill development.

Globant's Customer Experience (CX) Improvement Services are a significant star in their business portfolio. IDC MarketScape has consistently named them a Worldwide Leader in this domain, highlighting their prowess in leveraging technology to elevate customer interactions. This focus on enhancing CX is a major driver of their robust revenue growth and solidifies their market leadership.

Geographic Expansion and Global Footprint

Globant's impressive geographic expansion, now spanning 35 countries, is a key indicator of its strong market position. This extensive global footprint, with significant revenue contributions from North America and Europe, alongside growing presence in Latin America and emerging markets like Saudi Arabia, demonstrates their ability to capitalize on the expanding global digital transformation market.

This diversified geographic presence is crucial for sustaining growth, allowing Globant to tap into varied regional demands and mitigate risks associated with over-reliance on any single market. Their strategic entry into new territories, such as Saudi Arabia, further solidifies their ambition to capture a larger share of the global digital services landscape.

- Global Presence: Operates in 35 countries.

- Revenue Diversification: Significant income from North America and Europe, with expansion into Latin America and Saudi Arabia.

- Market Opportunity: Leverages the growing global digital transformation market.

- Growth Sustainability: Broad reach enables capturing diverse regional opportunities.

Strategic Acquisitions for Capability Enhancement

Globant actively pursues strategic acquisitions to bolster its expertise, particularly in data analytics, artificial intelligence, and financial services. This approach is designed to capture market share in rapidly expanding sectors. For instance, the acquisition of Exusia in early 2024 significantly enhanced Globant's capabilities in cloud-native engineering and digital transformation within the financial services industry.

Further strengthening its position, Globant acquired Blankfactor in early 2025, a move that deepens its expertise in financial services technology and digital product engineering. These acquisitions are crucial for Globant's growth, allowing it to offer more comprehensive solutions and stay ahead in competitive, technology-driven markets.

- Acquisition Rationale: Globant's M&A strategy focuses on acquiring companies that offer specialized skills in high-demand areas like AI and data analytics.

- 2024 Acquisition: The acquisition of Exusia in 2024 was a key step in expanding Globant's cloud and digital transformation services, especially for financial clients.

- 2025 Acquisition: Blankfactor, acquired in early 2025, further solidifies Globant's presence and technological depth in the financial services sector.

- Market Impact: These strategic moves are intended to enhance Globant's competitive edge and its ability to serve clients with cutting-edge technological solutions.

Globant's AI and Digital Transformation Services are a prime example of a Star in the BCG matrix, driven by substantial, long-term investments in AI. Their Enterprise AI Platform and dedicated AI Studios are instrumental in delivering enhanced efficiency and innovation to clients, perfectly aligning with the projected market growth of generative AI.

The company's cloud solutions, particularly its strong alliance with Google Cloud, position it favorably in a rapidly expanding market. Globant's recognition as Google Cloud Country Partner of the Year for Argentina and Talent Development Partner of the Year for Latin America in 2024 highlights its significant market influence and commitment to cloud expertise.

Globant's Customer Experience (CX) Improvement Services are a strong Star, consistently recognized by IDC MarketScape as a Worldwide Leader. This leadership in leveraging technology to enhance customer interactions is a significant contributor to their robust revenue growth.

The company's strategic acquisitions, such as Exusia in early 2024 and Blankfactor in early 2025, bolster its capabilities in AI, data analytics, and financial services technology, further cementing its Star status in these high-growth sectors.

| Service Area | BCG Category | Key Differentiators | Market Context | Growth Driver |

|---|---|---|---|---|

| AI & Digital Transformation | Star | Enterprise AI Platform, AI Studios, Generative AI focus | High growth in AI adoption | Client demand for efficiency and innovation |

| Cloud Solutions | Star | Google Cloud partnership, regional awards | Rapid cloud market expansion | Digital transformation initiatives |

| Customer Experience (CX) | Star | IDC MarketScape Leadership, technology integration | Increasing importance of customer engagement | Revenue growth from enhanced CX |

| Strategic Acquisitions | Star | Exusia (2024), Blankfactor (2025) | Consolidation in tech services | Expanding specialized capabilities |

What is included in the product

Globant's BCG Matrix analysis provides a strategic framework for understanding its business units' market share and growth potential.

It guides investment decisions by identifying which units are Stars, Cash Cows, Question Marks, or Dogs.

Globant's BCG Matrix offers a clear, visual breakdown of business units, alleviating the pain of complex strategic analysis.

Cash Cows

Globant's core software development and digital strategy services are its cash cows. These foundational offerings hold a significant market share in a mature but ever-present sector. This translates into consistent, reliable cash flow, bolstered by strong client retention and a history of successful project delivery.

The need for custom software and digital transformation remains robust, ensuring a stable demand for Globant's expertise. This maturity means less reliance on heavy marketing spend, allowing these segments to generate substantial profits that can fund other areas of the business. For example, in 2023, Globant reported a revenue of $1.9 billion, with a significant portion attributed to these established service lines.

Globant's expertise in established enterprise technology platforms like SAP, Salesforce, and Oracle positions these offerings as strong Cash Cows. The company has secured a significant market share within these mature, stable markets, indicating a reliable demand for their services.

These solutions typically involve long-term engagements for implementation, ongoing maintenance, and performance optimization. This structure ensures consistent and predictable revenue generation, a hallmark of a Cash Cow in the BCG Matrix. For instance, in 2024, Globant reported significant growth in its enterprise business, driven by these core platform services, contributing substantially to its overall profitability.

Globant's established client base is a significant strength, with a notable percentage of its customers contributing over $1 million in annual revenue. This concentration of high-value clients underscores the company's ability to secure and retain substantial business.

The consistent growth in wallet share from these existing clients signifies a mature market position where Globant excels at deepening relationships. This strategic advantage allows Globant to effectively leverage its existing client partnerships for sustained and predictable cash flow, characteristic of a cash cow.

Time and Materials Contract Model

The Time and Materials (T&M) contract model represents a significant cash cow for Globant. This model, where clients pay for the actual hours worked by developers and the cost of materials used, generates a substantial portion of Globant's revenue. Despite potentially slower market growth for T&M contracts compared to other models, Globant's established market share and the ongoing demand for its specialized IT talent ensure a steady and profitable cash flow. This stability is a hallmark of a cash cow, providing the financial foundation for other strategic initiatives.

Globant's reliance on T&M contracts is a strategic advantage, especially in the current IT landscape. For instance, in 2023, Globant reported that a substantial percentage of its revenue was derived from these types of engagements, reflecting their continued popularity and effectiveness. The high demand for skilled IT professionals, particularly in areas like digital transformation and cloud services, means that T&M contracts consistently yield high-margin returns for the company. This consistent profitability allows Globant to reinvest in innovation and expand its service offerings.

- Revenue Driver: Time and Materials contracts are a primary source of revenue for Globant, leveraging their expertise and workforce.

- Market Position: Globant holds a strong market share in the T&M segment, benefiting from consistent client demand.

- Profitability: The model offers high-margin cash flow due to the specialized skills and consistent demand for Globant's services.

- Financial Stability: T&M contracts provide a stable financial base, supporting the company's growth and investment strategies.

Financial Services Industry Solutions

Globant's financial services solutions, bolstered by acquisitions like Blankfactor, solidify its position in a mature yet highly profitable market. These offerings, encompassing payments, banking, and capital markets, consistently deliver significant revenue. This is driven by the industry's continuous demand for digital modernization and technological advancements.

The financial services sector, a key area for Globant, benefits from ongoing digital transformation initiatives. For instance, in 2024, the global financial services industry is projected to invest heavily in areas like cloud computing and AI, with cloud spending alone expected to reach over $100 billion annually. Globant's expertise in these domains allows it to capture a substantial share of this spending.

- Payments: Globant offers solutions that streamline payment processing and enhance customer experience, addressing the high transaction volumes and security needs of financial institutions.

- Banking: The company provides digital transformation services for traditional banks, including core banking modernization and the development of new digital banking platforms.

- Capital Markets: Globant supports capital markets firms with technology solutions for trading, risk management, and regulatory compliance, critical for navigating complex financial environments.

Globant's core software development and digital strategy services are its cash cows, holding a significant market share in a mature sector. These foundational offerings generate consistent, reliable cash flow, supported by strong client retention and a history of successful project delivery, as evidenced by Globant's $1.9 billion revenue in 2023.

The ongoing need for custom software and digital transformation ensures stable demand for Globant's expertise, allowing these mature segments to generate substantial profits. For example, in 2024, Globant reported significant growth in its enterprise business, driven by these core platform services, contributing substantially to its overall profitability.

Globant's established client base, with a notable percentage contributing over $1 million annually, signifies a mature market position where the company excels at deepening relationships. This strategic advantage allows Globant to leverage existing client partnerships for sustained and predictable cash flow, characteristic of a cash cow.

Time and Materials (T&M) contracts are a significant cash cow for Globant, generating a substantial portion of its revenue. The high demand for specialized IT talent ensures that T&M contracts consistently yield high-margin returns, providing a stable financial base. In 2023, a substantial percentage of Globant's revenue was derived from these engagements.

| Service Area | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) |

|---|---|---|---|

| Core Software Development & Digital Strategy | Cash Cow | Mature market, high market share, stable demand, strong client retention | Significant portion of $1.9 billion total revenue |

| Enterprise Technology Platforms (SAP, Salesforce, Oracle) | Cash Cow | Established client base, long-term engagements, consistent revenue | Strong contributor to overall profitability |

| Time and Materials (T&M) Contracts | Cash Cow | High demand for IT talent, high-margin returns, stable financial base | Substantial revenue driver |

| Financial Services Solutions | Cash Cow | Mature but profitable market, digital transformation demand, high transaction volumes | Consistent significant revenue |

Delivered as Shown

Globant BCG Matrix

The Globant BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, offering a complete and unwatermarked analysis. This means the strategic insights and formatted data are precisely what you'll utilize for your business planning, with no additional steps or hidden content. You're getting the final, ready-to-deploy Globant BCG Matrix, ensuring immediate application for informed decision-making and competitive strategy development.

Dogs

Legacy Technology Modernization (if not AI-driven) projects at Globant, especially those in highly competitive, commoditized markets with declining returns, would likely fall into the 'Dogs' category of the BCG Matrix. These initiatives, lacking the innovative AI component that drives differentiation, represent low growth and low market share.

For instance, a project focused solely on updating outdated ERP systems without incorporating advanced analytics or AI capabilities would fit this description. Such projects often yield diminishing returns and struggle to command premium pricing in a crowded marketplace, a scenario that characterized a significant portion of IT modernization efforts pre-AI boom.

Highly niche, low-demand legacy software support often represents a Dogs category within the BCG Matrix. This involves providing maintenance and updates for specialized, older software systems that have a very limited and often declining client base. The market for these services is typically characterized by low growth, and Globant's market share in these specific, outdated niches is likely to be small, offering little potential for significant expansion.

Non-strategic, low-profitability projects are those engagements that don't align with Globant's core mission of driving innovation and digital transformation. These can be resource drains, consuming valuable time and capital without delivering substantial returns or strategic advantage.

For instance, if Globant were to take on a project solely focused on legacy system maintenance with limited scope for modernization, and it consistently showed profit margins below its target of, say, 15% for such non-core activities, it would fall into this category. Such projects, if they represent a significant portion of a business unit's portfolio, could negatively impact overall profitability and strategic momentum.

Generic IT Staff Augmentation (without specialized skills)

Generic IT staff augmentation, focusing solely on basic IT roles without specialized expertise in areas like AI or cloud computing, often finds itself in a highly competitive market. This lack of differentiation can lead to significant price pressure, as clients can easily source similar services from multiple providers.

In 2024, the market for undifferentiated IT staffing is characterized by its maturity and intense competition. Companies in this space often struggle with lower profit margins due to the commoditized nature of the services offered. This segment typically exhibits low growth prospects, as businesses increasingly seek specialized skills to drive innovation and efficiency.

- Market Position: Low Market Share due to intense competition and lack of unique value proposition.

- Market Growth: Low growth, as demand shifts towards specialized IT services.

- Profitability: Low profitability driven by price competition and commoditization.

- Strategic Consideration: Businesses in this segment may consider upskilling their workforce or focusing on niche markets to move away from pure commoditization.

Outdated Internal Systems or Processes

Outdated internal systems or processes at Globant, if they are proving inefficient or costly without adding to their competitive edge, would fall into the question mark category of the BCG Matrix. These are areas that require careful evaluation. For instance, if legacy IT infrastructure is significantly hindering project delivery speed or increasing operational expenses, it warrants attention.

Such systems might include manual data entry processes that are prone to errors or slow down client onboarding. Consider that in 2024, many tech companies are investing heavily in automation and AI to streamline operations. If Globant’s internal systems lag behind this trend, they could become a drag on performance.

- Inefficient legacy software: Systems that are no longer supported by vendors or require extensive manual workarounds.

- Manual operational workflows: Processes that could be automated but still rely on human intervention, leading to delays and errors.

- High maintenance costs: Older systems that are expensive to keep running compared to modern, more efficient alternatives.

- Lack of scalability: Internal processes that cannot easily adapt to increased business volume or new service offerings.

Projects focused on maintaining legacy systems without significant modernization or AI integration, especially in commoditized markets, are considered Dogs. These initiatives typically have low market share and low growth potential, often yielding diminishing returns.

For example, providing basic support for outdated enterprise resource planning (ERP) systems, where competition is fierce and innovation is minimal, fits this category. Such services, lacking a unique value proposition, are subject to intense price pressure.

In 2024, the IT services market saw a continued shift towards specialized and AI-driven solutions. Projects that did not align with this trend, such as generic IT staff augmentation or maintenance of non-strategic, low-profitability software, were increasingly categorized as Dogs.

These "Dogs" represent areas where Globant might have low market share and face low market growth, leading to reduced profitability due to commoditization.

Question Marks

Quantum Computing Services, as per Globant's 2025 Tech Trends Report, represents a significant area of future technological advancement. While the report identifies it as a transformative technology, its current market penetration and widespread commercial application are still in their early stages. This positions it as a 'Question Mark' within the BCG matrix framework.

The market for quantum computing is anticipated to experience substantial growth in the coming years. However, Globant's current market share in delivering practical, commercially viable quantum computing solutions is likely minimal. This nascent position reflects its high growth potential but also the inherent uncertainty regarding immediate returns on investment, a hallmark of Question Mark entities.

Globant's focus on 'Synthetic Humans' and 'Invisible Experiences,' like seamless AI integration and smart glasses, positions them in potentially high-growth future markets. These advancements represent a significant shift towards more immersive and integrated technological interactions.

While these areas are promising, their market adoption is still nascent. For instance, the global augmented reality (AR) market, which underpins much of the 'Invisible Experiences' concept, was projected to reach over $100 billion by 2024, indicating substantial future potential but also early-stage development.

Consequently, these offerings fall into the 'Question Mark' category of the BCG matrix for Globant. They demand substantial investment to build capabilities and capture market share in these emerging, but not yet dominant, segments.

Globant views advanced robotics and the Internet of Robotics (IoR) as a significant growth area, driven by increasing automation and interconnectedness. This sector is experiencing rapid expansion, with the global robotics market expected to reach an estimated $268.8 billion by 2030, growing at a CAGR of 17.4% from 2023, according to some projections.

Given Globant's focus on digital transformation and emerging technologies, its current market share in deploying sophisticated robotic solutions is likely nascent. This positions advanced robotics as a 'Question Mark' within the BCG matrix, indicating high market growth potential but currently low relative market share for Globant.

Strategic investment and focused development are crucial for Globant to capitalize on this burgeoning market. The company needs to build expertise and client successes to move this segment towards a 'Star' position, leveraging the projected market surge.

Blockchain and Metaverse Solutions

Globant's investment in blockchain and metaverse solutions reflects their recognition of these technologies' transformative power, particularly in areas like digital identity, enhanced data security, and the creation of immersive customer experiences. These sectors are experiencing rapid growth and possess significant disruptive potential across various industries.

However, the widespread, mature adoption of these technologies across the broader market is still in its nascent stages. Consequently, Globant's current market share within these specific, emerging niches might be relatively modest. This positions these offerings within the Stars category of the BCG matrix, signifying high growth potential but requiring continued strategic investment and market development to solidify leadership.

The metaverse market, for instance, was projected to reach USD 678.8 billion by 2030, growing at a CAGR of 45.3% from 2022 to 2030, according to Grand View Research. Similarly, blockchain technology continues to see increasing enterprise adoption, with reports indicating the global blockchain market size was valued at USD 11.19 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 43.3% from 2024 to 2030, as per Precedence Research.

- High Growth Potential: Blockchain and metaverse technologies are positioned in rapidly expanding markets.

- Evolving Adoption: Broad industry integration is still developing, indicating future market opportunities.

- Strategic Investment Area: Globant's focus here aligns with future technological trends and potential market leadership.

- Market Validation Needed: Continued development and client success stories are crucial to solidify market position.

New AI-Powered Subscription Models (e.g., AI Pods)

Globant's introduction of AI-powered subscription models, like their AI Pods for engineering, positions them in a rapidly expanding sector. These offerings are designed to tap into the burgeoning demand for AI solutions, a market projected to reach hundreds of billions of dollars by the end of the decade. However, as new service lines, their market share and customer penetration are still in the formative stages.

These AI Pods are currently in a high-growth, high-uncertainty phase, characteristic of the Question Mark quadrant in the BCG matrix. Success hinges on significant market adoption and effective customer acquisition strategies. For instance, the global AI market was estimated to be worth over $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 37% through 2030. Globant's ability to capture a substantial portion of this growth with its AI Pods will determine their future trajectory.

- Market Potential: The AI services market is experiencing exponential growth, with significant investment flowing into AI development and implementation across industries.

- New Offerings: AI Pods represent a novel approach to service delivery, requiring substantial marketing efforts and customer education to gain traction.

- Investment Needs: To transition from Question Marks to Stars, these models will require continued investment in R&D, sales, and marketing to build market share and brand recognition.

- Strategic Focus: Globant must strategically focus on demonstrating the value proposition of AI Pods to drive adoption and establish a strong competitive position.

Globant's focus on emerging technologies like Quantum Computing Services, Synthetic Humans, Invisible Experiences, Advanced Robotics, Blockchain, Metaverse, and AI-powered subscription models places them in dynamic, high-growth sectors. These areas, while promising significant future returns, currently represent nascent markets with substantial investment requirements and uncertain market capture for Globant.

Consequently, these initiatives are categorized as Question Marks within the BCG matrix. They exhibit high market growth potential but are characterized by Globant's relatively low current market share. Successful navigation requires strategic investment to build capabilities and gain traction, aiming to transition them into Stars.

The company's strategic allocation of resources to these areas reflects a forward-looking approach, anticipating future market shifts and aiming to establish leadership in transformative technological domains.

| Technology Area | Market Growth Potential | Globant's Current Market Share | BCG Matrix Category | Strategic Implication |

|---|---|---|---|---|

| Quantum Computing Services | Very High | Low | Question Mark | Requires significant R&D and partnership investment. |

| Synthetic Humans & Invisible Experiences | High | Low | Question Mark | Focus on user adoption and platform development. |

| Advanced Robotics & IoR | High | Low | Question Mark | Build expertise in integration and application. |

| Blockchain & Metaverse | Very High | Low to Moderate | Question Mark/Star (Emerging) | Continue investment in platform and use-case development. |

| AI-Powered Subscription Models (AI Pods) | Very High | Low | Question Mark | Drive customer acquisition and demonstrate value. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.