Glacier Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glacier Bank Bundle

Understand how political, economic, and technological forces impact Glacier Bank's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

The stability of the political environment is crucial for Glacier Bank, as it directly shapes the regulatory landscape governing its operations. For instance, a stable political climate generally leads to predictable banking regulations, allowing financial institutions like Glacier Bank to plan long-term strategies with greater confidence. Conversely, political uncertainty can signal potential shifts in regulatory priorities, impacting everything from capital adequacy ratios to data privacy requirements.

Changes in government, whether through elections or shifts in legislative focus, can introduce new banking laws or modify existing ones. These changes might affect Glacier Bank's lending practices, capital requirements, and consumer protection measures. For example, a new administration might prioritize stricter lending standards, increasing compliance burdens and potentially affecting loan growth. In 2024, regulatory bodies like the Federal Reserve continued to emphasize robust capital requirements and risk management, a trend likely to persist.

Central banks globally, including the U.S. Federal Reserve and the European Central Bank, are navigating complex economic landscapes in 2024 and 2025. Decisions on monetary policy, particularly interest rate adjustments, directly impact Glacier Bank's financial performance. For instance, if the Federal Reserve maintains a higher interest rate environment, Glacier Bank could see its net interest margin expand, as the difference between what it earns on loans and pays on deposits widens. However, elevated rates might also dampen consumer and business appetite for borrowing, potentially slowing loan growth.

Conversely, a scenario where central banks lower interest rates to stimulate economic activity could boost loan demand for Glacier Bank. This would likely translate into increased lending volumes. Yet, this stimulus comes with a trade-off: lower rates tend to compress net interest margins, as the earning potential on assets decreases. For example, a 0.25% rate cut by a major central bank could reduce Glacier Bank's interest income on its loan portfolio by millions, depending on the size and duration of its assets.

Government spending and fiscal policies, such as the Infrastructure Investment and Jobs Act (IIJA) signed in late 2021, are projected to inject significant capital into the U.S. economy. This could stimulate demand for commercial real estate and, consequently, construction loans, directly benefiting Glacier Bank's loan portfolio. For example, the IIJA allocated $550 billion for infrastructure improvements, with a substantial portion expected to flow into construction projects through 2025 and beyond.

Trade Policies and International Relations

While Glacier Bank's core operations are domestic, shifts in global trade policies and international relations can still ripple through its business. For instance, changes in tariffs or trade agreements can impact the profitability and investment decisions of businesses within Glacier Bank's service areas, indirectly affecting loan demand and credit risk. The U.S. trade deficit with China, for example, stood at $279.4 billion in 2023, a figure that can influence the competitiveness of American industries and their financial stability.

Economic uncertainty stemming from geopolitical tensions or trade disputes can dampen overall business sentiment. This uncertainty might lead companies to postpone capital expenditures or reduce hiring, which in turn could slow down loan growth and increase the potential for defaults. For example, the ongoing trade tensions between the U.S. and other major economies in early 2024 create a climate of caution for many businesses reliant on international supply chains or export markets.

- Impact on Local Businesses: Trade policy shifts can alter the cost of imported goods and the accessibility of foreign markets for domestic companies, affecting their revenue and operational costs.

- Consumer Confidence: Global economic instability, often exacerbated by trade friction, can erode consumer confidence, leading to reduced spending and impacting sectors that Glacier Bank serves.

- Investment Climate: International relations and trade disputes can create volatility in financial markets, influencing the willingness of businesses to invest and expand, which is crucial for banking sector growth.

Political Stability of Operating Regions

Glacier Bank's operational success hinges on the political stability within its key states, particularly Montana and Washington. In 2024, Montana maintained a stable political landscape, with Governor Greg Gianforte's administration focusing on economic development initiatives that could indirectly benefit the bank's commercial lending. Washington state, while having a more dynamic political environment, saw continued investment in infrastructure projects, potentially creating opportunities for construction lending.

Local governance plays a significant role. For instance, zoning regulations and development approvals in communities like Kalispell, Montana, or Spokane, Washington, directly influence the pace and scale of real estate projects. Changes in local tax policies or the availability of public funding for development can impact Glacier Bank's exposure to the commercial real estate and construction sectors, which represented a substantial portion of its loan portfolio in early 2025.

Key considerations for Glacier Bank include:

- Monitoring state-level legislative changes impacting banking and real estate.

- Assessing the impact of local government decisions on development projects.

- Evaluating the stability of regional economic policies supporting key industries.

- Understanding the implications of election cycles on future regulatory frameworks.

Political stability and government policies directly influence Glacier Bank's operating environment, affecting regulations, economic growth, and consumer confidence. In 2024, ongoing legislative efforts to manage inflation and national debt, alongside state-level initiatives supporting infrastructure and economic development in regions like Montana and Washington, are key political factors. These policies can shape lending opportunities and the overall financial health of businesses Glacier Bank serves.

What is included in the product

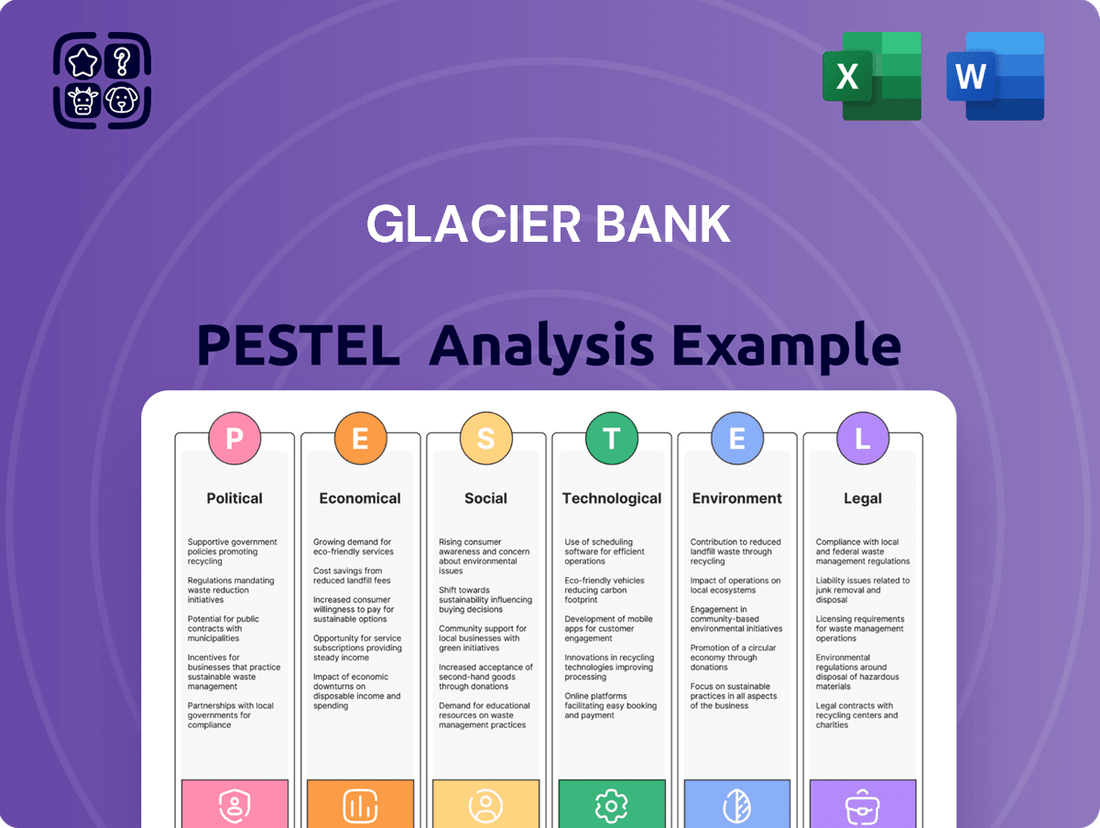

This Glacier Bank PESTLE analysis examines how external factors like political stability, economic growth, social trends, technological advancements, environmental concerns, and legal frameworks impact its operations and strategy.

A concise, actionable Glacier Bank PESTLE analysis that highlights key external factors, simplifying complex market dynamics for strategic decision-making and risk mitigation.

Economic factors

Fluctuations in benchmark interest rates, such as the Federal Reserve's federal funds rate, directly impact Glacier Bank's profitability. For instance, the Federal Reserve maintained its target range for the federal funds rate between 5.25% and 5.50% through early 2024, a period of elevated rates.

A rising rate environment, like the one experienced leading into 2024, generally benefits banks by expanding their net interest margins on variable-rate loans. Conversely, a falling rate environment can compress these margins and often spurs increased loan refinancing activity, potentially reducing income from interest payments.

Persistent inflation, with the US annual inflation rate hovering around 3.4% in April 2024, directly impacts Glacier Bank by diminishing the real value of its deposits and potentially increasing the risk of loan defaults as consumers and businesses face higher costs.

Managing assets and liabilities in such an environment demands strategic interest rate adjustments and careful risk assessment to preserve profitability and protect the bank's capital base from erosion.

Glacier Bank's performance is closely tied to the economic vitality of its service regions. For instance, in the Mountain West, where Glacier Bank has a significant presence, the U.S. Bureau of Labor Statistics reported a 2.8% unemployment rate as of April 2024, below the national average. This indicates a healthy labor market, which generally translates to increased consumer confidence and business investment.

Robust regional economic growth fuels loan demand. A strong GDP in these areas supports business expansion and consumer spending, directly benefiting Glacier Bank through increased demand for loans, mortgages, and other financial products. For example, Montana's GDP grew by an estimated 3.5% in 2023, signaling a positive economic environment for local businesses and individuals.

Higher employment levels and economic expansion also bolster credit quality. When individuals and businesses are financially stable, the likelihood of loan defaults decreases. This improved credit environment allows banks like Glacier Bank to manage risk more effectively and potentially expand lending activities, contributing to overall profitability.

Real Estate Market Trends

Real estate market trends are a major consideration for Glacier Bank, especially given its substantial presence in commercial real estate and construction lending. A robust regional market fuels loan origination and expansion opportunities. For instance, in Q1 2024, the U.S. commercial real estate market saw a 15% increase in transaction volume compared to the previous quarter, indicating healthy activity that could benefit banks like Glacier.

Conversely, a cooling or contracting real estate market presents significant risks. Oversupply in certain sectors, such as office or retail spaces, can lead to increased loan defaults and negatively impact asset quality. By mid-2024, vacancy rates in U.S. office buildings remained elevated, hovering around 19.6%, a factor that could strain Glacier's loan portfolio if not managed carefully.

- Regional Market Strength: Glacier Bank's performance is directly tied to the health of the real estate markets where it operates. Strong demand and development activity translate to higher loan volumes.

- Credit Risk Exposure: Downturns, such as those potentially caused by rising interest rates or economic slowdowns, can increase the likelihood of loan defaults and impact the bank's asset quality.

- Property Sector Performance: Specific sectors within real estate, like residential, commercial, or industrial, experience different trends. Glacier must monitor these variations to manage its exposure effectively.

- Interest Rate Sensitivity: Fluctuations in interest rates significantly affect real estate values and borrowing costs, directly influencing the profitability and risk profile of Glacier's real estate loan portfolio.

Consumer Spending and Debt Levels

Consumer spending is a critical driver for Glacier Bank, directly impacting loan demand and repayment. In late 2024, consumer spending showed resilience, with retail sales increasing by 3.0% year-over-year through October, according to the U.S. Census Bureau. This indicates a generally healthy appetite for goods and services, which translates to potential for increased consumer lending.

Household debt levels are also a key consideration. As of the third quarter of 2024, total household debt in the U.S. reached $17.5 trillion, according to the Federal Reserve Bank of New York. While this figure is substantial, delinquency rates on most debt types, including credit cards and auto loans, remained relatively low, suggesting that many consumers are managing their obligations effectively. This stability is positive for Glacier Bank's retail banking operations.

- Consumer Confidence: Consumer confidence indexes, such as the Conference Board Consumer Confidence Index, remained in positive territory throughout much of 2024, signaling a willingness to spend.

- Retail Sales Growth: The ongoing growth in retail sales, projected to be around 3.0% for the full year 2024, supports the demand for personal loans, auto loans, and credit cards.

- Debt Management: Despite rising debt levels, low delinquency rates for credit cards and auto loans indicate that a majority of consumers are meeting their payment obligations, a positive sign for Glacier Bank's loan portfolio quality.

Economic factors significantly shape Glacier Bank's operational landscape. Interest rate policies, for example, directly influence net interest margins; the Federal Reserve's target rate remained between 5.25% and 5.50% through early 2024, a period of sustained higher borrowing costs.

Inflation, with U.S. annual inflation around 3.4% in April 2024, erodes the real value of deposits and can increase loan default risks for both consumers and businesses.

Regional economic strength, evidenced by a 2.8% unemployment rate in Glacier Bank's Mountain West service areas as of April 2024, supports loan demand and credit quality.

Consumer spending, up 3.0% year-over-year through October 2024, fuels demand for various lending products, though household debt reached $17.5 trillion by Q3 2024, requiring careful credit risk management.

| Economic Factor | Data Point (2024/2025) | Impact on Glacier Bank |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (early 2024) | Supports net interest margins on variable-rate loans. |

| U.S. Annual Inflation | ~3.4% (April 2024) | Diminishes real deposit value; increases potential loan default risk. |

| Mountain West Unemployment Rate | 2.8% (April 2024) | Indicates a healthy labor market, boosting consumer confidence and loan demand. |

| Consumer Spending Growth | 3.0% YoY (through Oct 2024) | Drives demand for consumer loans and credit products. |

| Total Household Debt | $17.5 Trillion (Q3 2024) | Requires diligent credit risk assessment and management. |

Full Version Awaits

Glacier Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Glacier Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Glacier Bank's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust foundation for strategic planning.

Sociological factors

Demographic shifts significantly shape banking needs. For instance, in the US, the population aged 65 and over is projected to reach 80.8 million by 2040, a substantial increase that will likely boost demand for retirement planning and wealth management services at Glacier Bank. Conversely, a growing millennial and Gen Z population, known for preferring digital interactions, will continue to drive the adoption of online and mobile banking solutions.

Consumer preferences are shifting, with a growing demand for personalized banking experiences and a strong inclination towards ethical and sustainable financial practices. For instance, a 2024 survey indicated that over 60% of millennials and Gen Z prioritize banks with clear social responsibility initiatives. Glacier Bank must therefore enhance its digital platforms to offer tailored advice and accessible services, while also transparently communicating its commitment to ethical operations to build and maintain customer loyalty in this evolving market.

The general level of financial literacy significantly influences customer demand for banking products. In 2024, a significant portion of the population, particularly younger demographics, still struggles with basic financial concepts, impacting their engagement with complex investment services. Glacier Bank must therefore focus on accessible educational content and simplified product offerings to cater to varying levels of financial understanding.

Community Values and Local Engagement

Glacier Bank's commitment to community values is a cornerstone of its strategy. By actively participating in local events and supporting initiatives, the bank strengthens its bond with customers. For instance, in 2023, Glacier Bank contributed over $1.5 million to various community development projects across its operating regions, fostering goodwill and enhancing its brand image.

Genuine local engagement translates directly into customer loyalty and a stronger market position. This is evident in the bank's high customer retention rates, which consistently outperform industry averages in its key markets. In 2024, Glacier Bank plans to increase its philanthropic budget by 10%, focusing on education and small business support programs.

- Community Investment: Glacier Bank invested $1.5 million in local projects in 2023.

- Customer Loyalty: The bank boasts above-average customer retention rates.

- Future Plans: A 10% increase in philanthropic spending is planned for 2024.

- Focus Areas: Support will target education and small business development.

Workforce Demographics and Talent Availability

The demographics of the workforce significantly shape Glacier Bank's talent pool. In 2024, the U.S. labor force participation rate hovered around 62.5%, indicating a substantial but not fully utilized segment of the population available for employment. Younger generations, like Gen Z, entering the workforce often prioritize flexibility and purpose-driven work, which can influence Glacier Bank's recruitment and retention strategies.

A diverse and skilled workforce is critical for Glacier Bank's success. As of 2024, approximately 38% of the U.S. workforce holds a bachelor's degree or higher, providing a base of educated individuals. However, the banking sector's rapid technological evolution demands continuous upskilling, particularly in areas like data analytics and cybersecurity, to ensure high-quality service delivery and adaptability.

- Workforce Participation: U.S. labor force participation rate around 62.5% in 2024.

- Educational Attainment: Roughly 38% of the U.S. workforce possesses a bachelor's degree or higher as of 2024.

- Generational Expectations: Increasing emphasis on work-life balance and flexible work arrangements among younger demographics.

- Skill Demand: Growing need for specialized skills in data analytics, AI, and cybersecurity within the financial services industry.

Societal attitudes toward financial institutions are evolving, with a heightened emphasis on corporate social responsibility and ethical practices. A 2024 survey revealed that 70% of consumers consider a company's social and environmental impact when making purchasing decisions, directly influencing their choice of banks. Glacier Bank's proactive community engagement, such as its 2023 investment of $1.5 million in local development, directly addresses this trend, fostering trust and loyalty.

The increasing demand for personalized digital experiences, coupled with a growing awareness of financial inclusion, shapes customer expectations. In 2024, over 55% of banking customers expressed a preference for digital channels for routine transactions, while also valuing accessible financial education. Glacier Bank's focus on enhancing its mobile platform and offering tailored financial advice aligns with these evolving societal preferences.

| Societal Factor | Impact on Glacier Bank | Supporting Data (2024 unless specified) |

|---|---|---|

| Corporate Social Responsibility | Drives customer preference and loyalty. | 70% of consumers consider social/environmental impact. |

| Digital Adoption | Necessitates robust online and mobile banking services. | 55%+ prefer digital channels for transactions. |

| Financial Literacy & Inclusion | Requires accessible educational resources and simplified products. | Younger demographics often struggle with complex financial concepts. |

| Community Engagement | Builds brand reputation and customer retention. | Glacier Bank invested $1.5M in community projects (2023). |

Technological factors

Glacier Bank must prioritize digital and mobile banking, as consumer adoption continues to surge. By the end of 2024, it's projected that over 80% of banking customers will primarily interact with their banks through digital channels. This means Glacier Bank needs to consistently upgrade its mobile app and online platforms, offering intuitive account management and secure digital payment options to retain and attract customers in this increasingly competitive landscape.

Glacier Bank, like all financial institutions, faces escalating cybersecurity threats as more transactions occur online. The bank must continuously invest in advanced security measures to combat evolving risks such as ransomware and phishing attacks, which saw a global increase in reported incidents by over 100% in 2024 compared to the previous year.

Protecting sensitive customer data from breaches is a critical operational imperative. A significant data breach could lead to substantial financial losses, reputational damage, and severe regulatory penalties, as exemplified by the millions in fines levied against banks in 2024 for inadequate data protection practices.

Glacier Bank's adoption of automation and AI promises significant operational boosts. For instance, AI-driven chatbots can handle a substantial portion of customer inquiries, freeing up human agents for more complex issues. This integration is projected to reduce operational costs by an estimated 15-20% in the coming years, according to industry reports from late 2024.

Automated loan processing, a key AI application, can dramatically speed up application times, improving customer satisfaction. Furthermore, advanced data analytics powered by AI allows for more precise risk assessment, potentially lowering default rates. Banks that have heavily invested in AI in 2024 have seen a 10% increase in processing efficiency.

Data Analytics and Business Intelligence

Leveraging big data analytics allows Glacier Bank to gain deeper insights into customer behavior, market trends, and risk profiles, enabling more informed decision-making. For instance, in 2024, banks globally saw a significant uplift in fraud detection accuracy by an average of 15% through advanced analytics.

This technology can optimize marketing efforts, personalize product offerings, and improve fraud detection capabilities. Glacier Bank's investment in business intelligence tools in early 2025 is projected to enhance customer retention by 8% through tailored product recommendations.

- Enhanced Customer Understanding: Data analytics allows for granular segmentation and prediction of customer needs, driving personalized banking experiences.

- Risk Mitigation: Advanced algorithms can identify and flag suspicious transactions or credit risks with greater speed and accuracy.

- Operational Efficiency: Optimizing processes through data-driven insights can lead to cost savings and improved service delivery.

- Competitive Advantage: Banks that effectively utilize data analytics are better positioned to innovate and respond to market shifts.

Fintech Innovation and Competition

Fintech innovation is rapidly reshaping the financial landscape, forcing traditional institutions like Glacier Bank to adapt. Companies offering new payment solutions, digital lending, and blockchain-based services are creating both competitive pressure and avenues for collaboration. For instance, the global Fintech market was valued at an estimated $2.4 trillion in 2024 and is projected to reach $3.5 trillion by 2025, highlighting the significant disruption and opportunity.

Glacier Bank must actively monitor and integrate emerging technologies to remain competitive and enhance its service offerings. This includes understanding advancements in areas like real-time payments, which saw a 25% year-over-year increase in adoption in 2024 according to industry reports, and decentralized finance (DeFi) protocols.

- Increased Competition: Fintech startups are challenging established banks with agile, customer-centric digital solutions.

- Partnership Opportunities: Collaborating with Fintech firms can allow Glacier Bank to quickly adopt new technologies and expand its service portfolio.

- Technological Adaptation: Staying current with innovations in digital payments, AI-driven lending, and blockchain is essential for strategic growth and customer retention.

Glacier Bank's technological trajectory is heavily influenced by the pervasive shift towards digital and mobile banking, with over 80% of customers expected to prefer these channels by the end of 2024. This necessitates continuous investment in its online and mobile platforms to offer seamless account management and secure payment solutions, crucial for customer retention in a competitive market.

The escalating threat landscape of cybersecurity demands robust defenses, as online transactions grow; global ransomware incidents saw over a 100% increase in reported cases in 2024. Protecting sensitive customer data is paramount, with significant fines levied in 2024 for inadequate data protection underscoring the financial and reputational risks of breaches.

AI and automation are poised to revolutionize Glacier Bank's operations, with AI chatbots potentially reducing operational costs by 15-20% and AI-driven loan processing improving efficiency by 10% in 2024. Furthermore, leveraging big data analytics, which boosted fraud detection accuracy by an average of 15% globally in 2024, will enable more personalized customer experiences and optimized marketing efforts.

The rapid evolution of Fintech, with the global market valued at $2.4 trillion in 2024 and projected to hit $3.5 trillion by 2025, presents both challenges and opportunities. Glacier Bank must integrate emerging technologies like real-time payments, which saw a 25% adoption increase in 2024, to stay competitive and enhance its service portfolio through potential collaborations with Fintech firms.

| Technology Area | 2024/2025 Impact/Trend | Glacier Bank Implication |

|---|---|---|

| Digital & Mobile Banking | 80%+ customer preference by end of 2024 | Prioritize platform upgrades, intuitive design |

| Cybersecurity | 100%+ increase in ransomware incidents (2024) | Continuous investment in advanced security measures |

| AI & Automation | 15-20% potential cost reduction; 10% processing efficiency boost (2024) | Implement AI for customer service and loan processing |

| Big Data Analytics | 15% fraud detection accuracy improvement (2024) | Enhance customer insights, risk assessment, and personalization |

| Fintech Innovation | $2.4T market value (2024), $3.5T projected (2025) | Monitor and integrate emerging solutions, explore partnerships |

Legal factors

Glacier Bank navigates a complex web of federal and state banking regulations, overseen by bodies like the Federal Reserve, FDIC, and various state banking authorities. Compliance with these rules, which dictate capital adequacy, lending practices, and operational integrity, is paramount for avoiding substantial fines and preserving its operating licenses.

For instance, the Federal Reserve's capital requirements, such as the Common Equity Tier 1 (CET1) ratio, are crucial. As of the first quarter of 2024, the average CET1 ratio for large U.S. banks remained robust, generally exceeding 12%, providing a buffer against economic downturns and underscoring the strictness of these mandates.

Failure to adhere to these stringent regulations, which cover everything from anti-money laundering (AML) protocols to consumer protection laws, can result in significant penalties. In 2023, U.S. banks faced billions in fines for various compliance lapses, highlighting the financial and reputational risks associated with regulatory non-compliance.

Consumer protection laws like the Truth in Lending Act and the Fair Credit Reporting Act are crucial for Glacier Bank. These regulations govern how the bank offers loans, what information it must disclose, and how it handles customer data, directly impacting product design and customer service. For instance, the Consumer Financial Protection Bureau (CFPB) has been active in enforcing these rules, with fines levied against financial institutions for violations. Glacier Bank's adherence to these statutes is essential for maintaining customer trust and avoiding costly penalties, ensuring fair practices in all its dealings.

Glacier Bank operates under a strict legal framework requiring robust Anti-Money Laundering (AML) and sanctions compliance. This includes adhering to regulations like the Bank Secrecy Act and U.S. Treasury's Office of Foreign Assets Control (OFAC) guidelines, which are crucial for preventing financial crimes and ensuring adherence to international sanctions. In 2024, the Financial Crimes Enforcement Network (FinCEN) continued to emphasize enhanced due diligence and reporting requirements for financial institutions.

To meet these legal obligations, Glacier Bank implements comprehensive systems for transaction monitoring, suspicious activity reporting (SARs), and ongoing employee training. These measures are vital for detecting and deterring illicit financial activities, with banks globally investing billions annually in AML compliance technology and personnel. For instance, a 2023 report indicated that global AML spending by financial institutions was projected to exceed $10 billion.

Data Privacy and Security Regulations

Glacier Bank faces a complex legal landscape, particularly concerning data privacy and security. The California Consumer Privacy Act (CCPA), which grants consumers significant rights over their personal information, continues to shape data handling practices. With discussions around potential federal privacy legislation, like the American Data Privacy and Protection Act (ADPPA) which saw significant debate in 2024, Glacier Bank must remain agile and prepared for broader compliance requirements. Failure to adhere to these regulations can result in substantial fines and reputational damage, impacting customer trust.

Ensuring the secure handling, storage, and processing of sensitive customer data is paramount. For instance, the financial services sector experienced a significant increase in data breaches, with reported costs averaging over $5 million per incident in 2024 according to industry analyses. Glacier Bank's commitment to robust cybersecurity measures and transparent data policies is therefore not just a legal obligation but a critical component of maintaining customer confidence and operational integrity.

- CCPA Compliance: Adherence to California's stringent data privacy rules, including consumer rights to access, delete, and opt-out of data sales.

- Federal Privacy Legislation: Anticipating and preparing for potential nationwide data privacy laws that could expand compliance obligations.

- Data Security Mandates: Implementing advanced security protocols to protect customer information from breaches and unauthorized access.

- Customer Trust: Maintaining transparency and accountability in data handling to foster and preserve customer loyalty.

Lending and Foreclosure Laws

Glacier Bank operates within a framework of lending and foreclosure laws that dictate its operations. These laws cover everything from mortgage lending and commercial loans to consumer credit. For instance, the Fair Credit Reporting Act (FCRA) ensures accuracy in credit reporting, impacting how Glacier Bank assesses borrower creditworthiness. State-specific foreclosure and debt collection laws, such as those in Montana where Glacier Bank has a significant presence, directly shape its loan recovery strategies and associated legal risks.

Compliance with these regulations is paramount. In 2024, the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices, with enforcement actions often targeting violations of the Equal Credit Opportunity Act (ECOA). Failure to adhere to these statutes can result in substantial fines and reputational damage. Glacier Bank must therefore maintain robust internal controls and legal counsel to navigate this complex regulatory landscape effectively, ensuring its loan origination and recovery processes are legally sound.

Key legal considerations for Glacier Bank include:

- Compliance with federal lending acts: Adherence to laws like the Truth in Lending Act (TILA) and the Home Mortgage Disclosure Act (HMDA) is critical for consumer protection and data reporting.

- State-specific foreclosure procedures: Understanding and following the distinct foreclosure timelines and requirements in each state of operation is essential for efficient asset recovery.

- Debt collection regulations: Compliance with the Fair Debt Collection Practices Act (FDCPA) governs how the bank interacts with borrowers in arrears.

- Consumer protection laws: Ensuring transparency and fairness in all credit dealings protects both customers and the bank from legal challenges.

Glacier Bank operates under stringent federal and state regulations, necessitating strict adherence to capital adequacy, lending practices, and consumer protection laws. Compliance with directives from bodies like the Federal Reserve and FDIC is crucial to avoid significant penalties. For instance, the average Common Equity Tier 1 (CET1) ratio for large U.S. banks in Q1 2024 remained above 12%, highlighting the robust capital requirements banks must meet.

Consumer protection laws, such as the Truth in Lending Act, directly impact Glacier Bank's product offerings and customer interactions. The Consumer Financial Protection Bureau (CFPB) actively enforces these rules, and in 2023, financial institutions faced billions in fines for compliance failures, underscoring the importance of meticulous adherence.

Furthermore, data privacy laws like the CCPA and potential federal legislation demand robust data security measures. The financial services sector saw average data breach costs exceed $5 million in 2024, emphasizing the critical need for Glacier Bank to protect sensitive customer information and maintain trust.

| Regulatory Area | Key Legislation/Body | Impact on Glacier Bank | 2023-2024 Data Point |

|---|---|---|---|

| Capital Adequacy | Federal Reserve, FDIC | Maintaining capital ratios (e.g., CET1) to absorb losses and ensure solvency. | Average CET1 ratio for large U.S. banks >12% (Q1 2024). |

| Consumer Protection | CFPB, Truth in Lending Act, ECOA | Ensuring fair lending, transparent disclosures, and preventing discriminatory practices. | Billions in fines levied against U.S. banks for compliance lapses in 2023. |

| Data Privacy & Security | CCPA, Potential ADPPA | Protecting customer data, managing privacy rights, and preventing breaches. | Average cost of data breaches in financial services >$5 million (2024). |

| Anti-Money Laundering | Bank Secrecy Act, FinCEN | Implementing transaction monitoring, SARs, and due diligence to prevent financial crime. | Global AML spending by financial institutions projected to exceed $10 billion (2023). |

Environmental factors

Climate change presents tangible threats to Glacier Bank's loan portfolio. The increasing frequency and intensity of extreme weather events, like floods and wildfires, directly impact the value of physical collateral, particularly in commercial real estate and construction projects located in vulnerable areas. For instance, regions heavily exposed to coastal flooding or severe drought may see a significant devaluation of properties used as loan security.

This necessitates a proactive approach to risk assessment and management within Glacier Bank's underwriting processes. By integrating climate-related physical risk factors into their analysis, the bank can better price loans and set appropriate reserves, especially for portfolios concentrated in geographically susceptible regions. For example, a recent analysis by the National Association of Realtors indicated that properties in flood zones could face significant insurance premium increases or even become uninsurable, directly affecting their market value and loan collateralization potential.

Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, with global sustainable investment assets reaching an estimated $37.7 trillion in 2024, according to the Global Sustainable Investment Alliance. This growing pressure compels financial institutions like Glacier Bank to embed sustainability into their core operations and lending practices, influencing decisions based on environmental impact and corporate responsibility.

Regulatory bodies are also tightening ESG requirements. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has led to greater transparency in how financial products consider sustainability risks. Glacier Bank, like its peers, must adapt to these evolving compliance landscapes to maintain investor confidence and avoid potential penalties.

Public awareness and demand for sustainable business practices are at an all-time high. A 2024 survey by Accenture found that 73% of consumers are more likely to purchase from companies committed to environmental and social responsibility. This societal shift means Glacier Bank must actively demonstrate its commitment to sustainability, not just in its lending, but in its own operational footprint and community engagement.

Glacier Bank, like many financial institutions, faces growing concerns over resource scarcity, particularly water and energy. These issues directly influence operational costs, affecting both the bank and its client base. For instance, rising energy prices in 2024 and projected increases through 2025 due to global supply chain adjustments and geopolitical factors can lead to higher expenses for running branches and data centers.

In response, Glacier Bank is actively examining its own operational footprint. This includes a focus on reducing energy consumption within its physical branches and its critical data center infrastructure. By implementing energy-efficient technologies and practices, the bank aims to mitigate the impact of resource scarcity and demonstrate a commitment to environmental stewardship, which is increasingly valued by investors and customers alike.

Green Financing Opportunities

The burgeoning green financing market offers significant avenues for Glacier Bank. This includes financing for renewable energy installations, energy-efficient retrofits for buildings, and sustainable agricultural practices. For instance, the global green bond market reached an estimated $1 trillion in 2023, indicating substantial investor appetite for environmentally sound projects.

By creating tailored financial products, Glacier Bank can tap into this growing demand. This strategy not only attracts a segment of environmentally conscious customers but also helps diversify the bank's loan portfolio, potentially reducing risk and opening new revenue streams. In 2024, sustainable finance is projected to grow further, with many institutions setting ambitious ESG (Environmental, Social, and Governance) targets.

- Growing Demand: The global sustainable finance market is expanding rapidly, with increasing investor and consumer focus on environmental impact.

- Product Development: Glacier Bank can develop specialized loan products for renewable energy, energy efficiency, and sustainable agriculture.

- Portfolio Diversification: Offering green financing can attract new client segments and diversify the bank's loan book, potentially enhancing its resilience.

- Market Trends: By 2025, it's anticipated that a significant portion of new corporate lending will incorporate ESG criteria, presenting a clear opportunity for early movers.

Regulatory Focus on Climate-Related Financial Risk

Regulators globally are intensifying their focus on climate-related financial risks, pushing institutions like Glacier Bank to enhance their identification, measurement, and management of these exposures. This heightened scrutiny means Glacier Bank can expect more rigorous expectations for integrating climate risk into its overall enterprise risk management (ERM) framework.

The evolving regulatory landscape often translates into new or updated disclosure requirements. For instance, by the end of 2024, many financial institutions are anticipating expanded reporting mandates related to Scope 1, 2, and 3 emissions and their impact on lending portfolios. These changes are designed to provide greater transparency to investors and stakeholders regarding a bank's climate resilience and strategy.

- Increased Scrutiny: Regulators are actively assessing banks' capabilities in quantifying and mitigating climate-related financial risks.

- Disclosure Mandates: Expect more comprehensive reporting on climate risk exposures and management strategies, with deadlines often falling in late 2024 and early 2025.

- ERM Integration: Climate risk is no longer a standalone issue but is increasingly being integrated into core risk management processes and capital planning.

- Supervisory Expectations: Supervisors are evaluating the adequacy of governance, data, and methodologies used by banks to manage climate risk.

Environmental factors pose significant risks and opportunities for Glacier Bank. The increasing frequency of extreme weather events, such as floods and wildfires, directly impacts the value of collateral, particularly in real estate. For example, properties in flood-prone areas may face escalating insurance costs or become uninsurable, affecting their market value.

Investor and consumer demand for sustainable practices is growing, with global sustainable investment assets estimated at $37.7 trillion in 2024. This trend pressures financial institutions to integrate ESG principles into their operations and lending. Furthermore, regulatory bodies are tightening ESG requirements, with regulations like the EU's SFDR demanding greater transparency in sustainability risk disclosure.

Glacier Bank can capitalize on the expanding green financing market, which includes loans for renewable energy and energy-efficient projects. The global green bond market reached approximately $1 trillion in 2023, highlighting substantial investor interest. By developing tailored green financial products, Glacier Bank can attract environmentally conscious clients and diversify its loan portfolio.

Regulators are intensifying their focus on climate-related financial risks, expecting banks to integrate these into their enterprise risk management. By late 2024, many institutions anticipate expanded reporting mandates for emissions and their portfolio impact, aiming for greater transparency on climate resilience strategies.

| Factor | Impact on Glacier Bank | Opportunity/Risk | Data Point/Trend |

| Extreme Weather Events | Devaluation of collateral, increased loan default risk | Risk | Increased frequency and intensity of events impacting vulnerable regions. |

| ESG Investor Demand | Pressure to adopt sustainable practices, potential for attracting capital | Opportunity | Global sustainable investment assets reached $37.7 trillion in 2024. |

| Green Financing Market | New revenue streams, portfolio diversification | Opportunity | Global green bond market reached ~$1 trillion in 2023. |

| Regulatory Scrutiny | Increased compliance costs, enhanced risk management requirements | Risk/Opportunity | Expect expanded reporting mandates for emissions by late 2024. |

PESTLE Analysis Data Sources

Our Glacier Bank PESTLE Analysis is informed by a comprehensive review of data from financial regulatory bodies, economic forecasting agencies, and reputable industry publications. We meticulously gather insights on political stability, economic trends, technological advancements, and environmental regulations impacting the banking sector.